Global Books Market Size, Share, Growth Analysis By Category (Fiction, Non-fiction), By Type (Educational, Romance, Comic, Science, Historical, Literary, Realistic, Mystery, Fantasy, Others), By Format (Hard Copy, E-book, Audiobook), By Distribution Channel (Local Book Shops, Online, Mass Merchandisers, Specialty Bookstores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144577

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

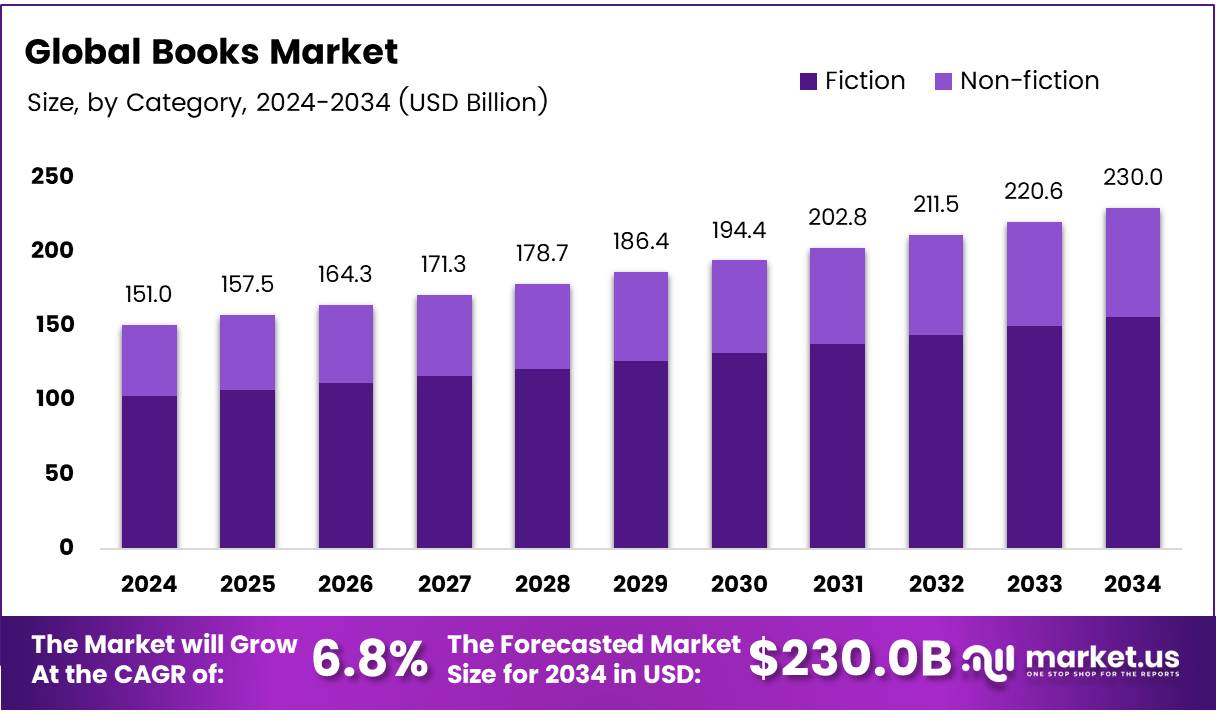

The Global Books Market size is expected to be worth around USD 230.0 Billion by 2034, from USD 151.0 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The books market encompasses the production, distribution, and sale of printed books, e-books, audiobooks, and other literary content. This market involves publishers, authors, distributors, retailers, and consumers.

The books market is an essential part of the broader media and entertainment industry, which includes genres such as fiction, non-fiction, textbooks, and professional publications. With a growing demand for diverse content and formats, the market is continuously evolving in response to changing consumer preferences, technological advancements, and the rise of digital platforms.

The books market has witnessed consistent growth over recent years, with unit sales of printed books in the United States totaling 782.7 million in the year ended Dec. 28, 2024, up from 778.3 million in 2023, according to Publishers Weekly. This growth reflects a steady demand for books despite the growing influence of digital media.

The professional-book sector has also seen substantial revenue, with year-to-date figures reaching $385.7 million, as reported by Publishing Perspectives. Furthermore, over 788 million copies of print books were sold in the U.S. within a year, according to Rare Book Hub.

Opportunities for market expansion exist in both print and digital formats. The surge in e-books and audiobooks presents new growth avenues, with significant demand for educational and professional content. Technological advancements, such as improved digital reading devices, continue to drive adoption of these formats.

Additionally, governments are increasingly recognizing the importance of literacy and cultural heritage, offering investments in the form of grants, subsidies, and regulations to support book publishing. These regulations help ensure copyright protection, access to content, and the sustainability of local publishing industries.

Governments worldwide are also placing greater emphasis on promoting reading, especially among younger generations, which is expected to foster a more vibrant and sustainable book market. This trend, combined with technological innovations, creates an environment conducive to sustained growth and new opportunities within the books market.

Key Takeaways

- The global books market is projected to reach USD 230.0 billion by 2034, growing at a CAGR of 4.3%.

- Fiction dominates the books market by category, holding a 62.1% share in 2024.

- The educational segment leads the market by type, accounting for 18.9% of the market in 2024.

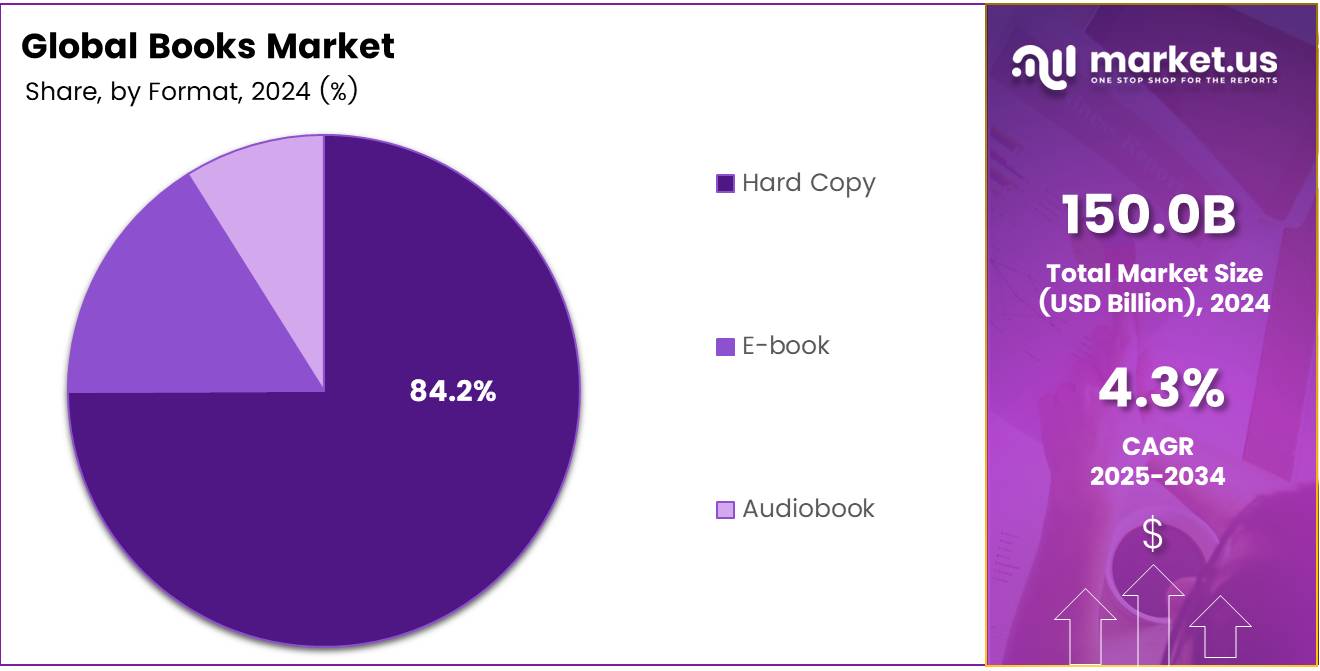

- Hard copy books continue to dominate the market, with an 84.2% share in 2024.

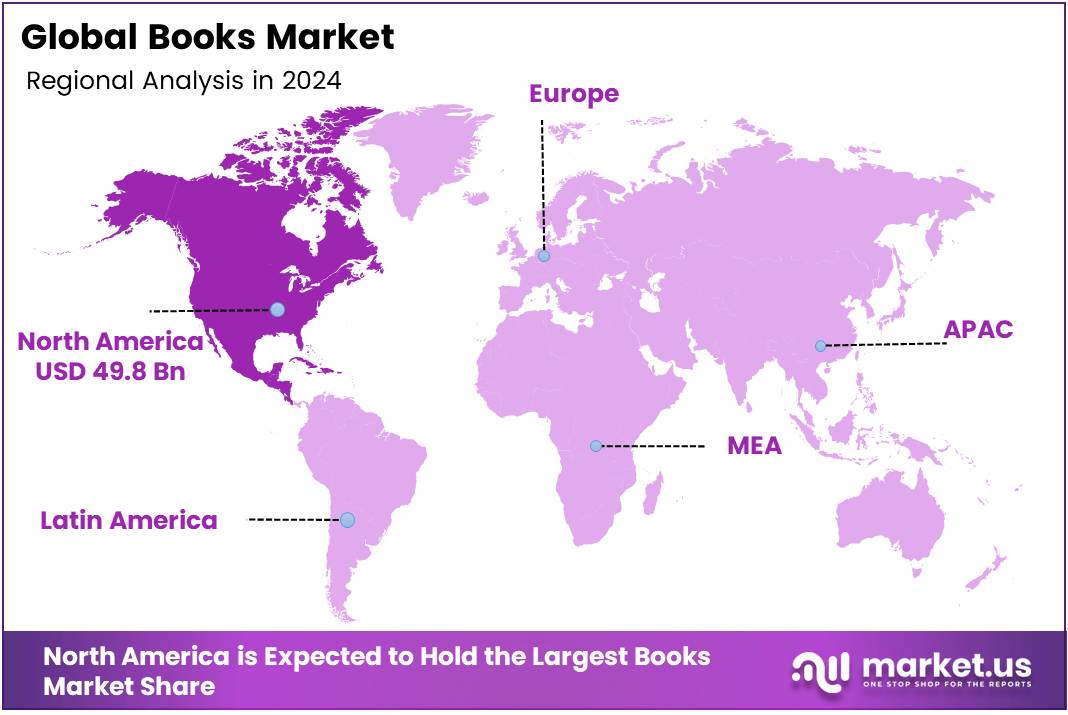

- North America is the leading region, contributing 33.2% to the global books market, or USD 49.8 billion in 2024.

Category Analysis

Fiction dominates the Books Market with a 62.1% share, driven by strong reader preference and genre diversity.

In 2024, Fiction held a dominant market position in the By Category Analysis segment of the Books Market, capturing a 62.1% share. This substantial market presence is attributed to the genre’s broad appeal across various demographics and its ability to cater to diverse interests.

Fiction encompasses a wide range of subgenres, from literary fiction to fantasy, science fiction, and romance, allowing it to capture the attention of a global audience. Its continuous innovation and the rise of digital platforms have also contributed to its consistent growth, as readers seek out both physical and e-book formats.

On the other hand, Non-fiction, while significant, holds a smaller portion of the market. Non-fiction books, including biographies, self-help, and educational texts, cater to a more niche but steadily growing audience.

As consumers increasingly turn to non-fiction for educational purposes, the segment’s share is expected to continue growing. However, Fiction’s broad narrative appeal and cultural influence ensure its dominant position in the market for the foreseeable future.

Type Analysis

Educational Books Lead the Market with 18.9% Share in 2024 Due to Increased Demand for Learning Materials

In 2024, the Educational segment held a dominant position in the By Type Analysis segment of the Books Market, commanding a 18.9% share. This strong performance is attributed to the increasing demand for textbooks, study guides, and educational resources, driven by both formal education systems and the rise of self-learning trends. The push for enhanced learning outcomes and the growth of e-learning platforms have significantly contributed to the widespread consumption of educational books.

Following the Educational segment, Romance and Comic genres also demonstrated strong market presence, capturing the interest of diverse reader demographics. Romance books continue to enjoy steady demand, fueled by both print and digital formats. Comic books, especially graphic novels, are gaining momentum due to their broad appeal across age groups and growing acceptance in mainstream media.

Science, Historical, Literary, Realistic, Mystery, and Fantasy genres each hold niche segments of the market, with Fantasy particularly appealing to younger generations through multimedia adaptations. Other genres continue to fill specific preferences, but their share is comparatively smaller. The diverse offerings across these genres highlight the rich variety in consumer preferences within the global books market, supporting sustained growth across different segments.

Format Analysis

Hard Copy Dominates Books Market Format Segmentation with 84.2% Share in 2024

In 2024, the Hard Copy segment of the Books Market maintained a dominant position, capturing a significant 84.2% share. This continued dominance can be attributed to the traditional appeal of physical books, which offer tactile engagement and are preferred by a large demographic of readers.

Hard copy books, particularly print editions, remain the go-to format for many consumers due to their collectible nature, ability to be gifted, and the convenience of no reliance on electronic devices or power sources. Moreover, physical bookstores continue to be a hub for discovery, adding to the enduring popularity of hard copies.

In contrast, the E-book segment holds a much smaller share, driven by the convenience of digital platforms and portability, but still struggles to rival the widespread preference for physical books. Audiobooks, while growing in popularity, especially among busy professionals and commuters, represent an even smaller portion of the market.

Both E-books and Audiobooks face challenges in surpassing the deeply ingrained preference for hard copy books, which offer unique sensory experiences and are perceived as valuable for long-term storage.

Distribution Channel Analysis

Local Book Shops Lead Distribution Channels with a 48.3% Market Share in 2024

In 2024, Local Book Shops held a dominant position in the By Distribution Channel segment of the Books Market, commanding a 48.3% share. Their popularity can be attributed to the personalized shopping experience they offer, with knowledgeable staff and a curated selection of titles that attract book lovers seeking a tangible, community-centered shopping environment. Furthermore, local stores often play a key role in fostering relationships with readers, which enhances customer loyalty.

While Local Book Shops maintain their strong presence, Online channels continue to grow, contributing significantly to the market share. Convenience, the ability to purchase books anytime, and the wider selection of titles available online are driving factors behind this shift. Online retailers are benefiting from ease of delivery and cost efficiency, making them a compelling alternative for many consumers.

Mass Merchandisers and Specialty Bookstores hold smaller but notable shares. Mass Merchandisers have leveraged their wide reach and competitive pricing, while Specialty Bookstores offer niche genres that cater to specific reader preferences, maintaining a loyal customer base. Despite the rise of digital shopping trends, Local Book Shops remain resilient, bolstered by their strong community engagement and a commitment to providing a unique, in-store experience.

Key Market Segments

By Category

- Fiction

- Non-fiction

By Type

- Educational

- Romance

- Comic

- Science

- Historical

- Literary

- Realistic

- Mystery

- Fantasy

- Others

By Format

- Hard Copy

- E-book

- Audiobook

By Distribution Channel

- Local Book Shops

- Online

- Mass Merchandisers

- Specialty Bookstores

Drivers

Rising Digital Adoption Fuels the Growth of the Books Market

The books market is seeing significant growth due to the increasing digital adoption across the globe. With the widespread use of e-readers, smartphones, and tablets, people are embracing digital books like never before.

The convenience of being able to instantly access books online and listen to audiobooks has made reading more accessible. This trend is especially popular among tech-savvy readers who prefer digital formats for their ease of use and portability.

As more consumers adopt digital devices, the demand for e-books and audiobooks is expected to continue rising, reshaping how people consume literature. Moreover, the shift toward digital media has made it easier for publishers to reach a wider audience and for readers to explore various genres without the limitations of physical bookstores. With this growing preference for digital books, publishers and authors are investing more in creating content in digital formats, contributing to the market’s expansion.

Restraints

Decline in Physical Book Sales Impacts Traditional Book Market

The books market is facing challenges due to a significant decline in physical book sales, as more consumers turn to digital alternatives like e-books and audiobooks. This shift towards digital media has changed how people consume literature, leading to fewer visits to traditional bookstores and a reduction in demand for physical copies of books.

Publishers and booksellers are feeling the effects, as they are required to adapt to this changing consumer behavior. Moreover, the rising production and distribution costs are further intensifying these issues. The prices of paper, printing, and logistics have been increasing, which affects the overall profitability of publishing physical books. These additional costs create a financial burden for publishers, particularly smaller independent publishers who already struggle with tight margins.

As a result, they may need to increase book prices or limit the number of physical books produced, both of which could deter potential buyers. This combination of shifting consumer preferences and rising operational costs is putting pressure on the traditional book market, forcing businesses to rethink their strategies to remain competitive and profitable in an increasingly digital world.

Growth Factors

Expansion of Online Bookstores Opens New Avenues for Authors and Publishers

The book market is experiencing substantial growth due to the rise of online bookstores like Amazon, Audible, and other digital platforms. This shift has created new opportunities for both traditional and self-published authors to reach a global audience. With the convenience of online purchasing and the ability to access a wide variety of books instantly, readers are more inclined to buy books digitally.

For authors, this means greater exposure and the ability to self-publish with ease, often bypassing traditional publishing routes. Additionally, the digital format allows for niche markets to thrive, as readers can access specialized books that may not be found in physical stores. This trend has also led to the rise of audiobooks and e-books, which cater to the growing preference for digital content.

Beyond just books, this boom in digital platforms also extends to educational content, where e-learning and digital classrooms are integrating books into their curriculums, creating opportunities for publishers to expand their reach into the education sector.

Furthermore, the growing demand for audiobooks and educational podcasts opens additional revenue streams, enabling publishers to diversify their offerings and cater to the increasing preference for audio content. With these trends, the book market has a wealth of opportunities to explore and capitalize on.

Emerging Trends

Personalized Reading Experiences Enhance Book Discovery and Engagement

The books market is seeing significant transformation driven by several key factors. One major trend is the rise of personalized reading experiences, where artificial intelligence (AI) and machine learning (ML) algorithms help recommend books tailored to individual preferences. These AI-powered systems analyze past reading habits, genres, and user ratings to suggest new titles, enhancing discovery and engagement for readers.

Additionally, interactive and enhanced e-books are becoming increasingly popular, incorporating multimedia elements like videos, sound, and interactive features that offer a more dynamic and immersive reading experience. This shift is reshaping the traditional reading process, especially in digital formats. Furthermore, book-to-screen adaptations are also fueling market interest, as more books are being transformed into movies, TV series, or streaming content.

This trend not only brings books into the spotlight but also sparks renewed interest in the original works, leading to increased sales and a broader fan base. These developments are contributing to the evolution of the book market, making reading experiences more personalized, interactive, and integrated with other media. With these trends in place, the future of books is evolving to meet the changing preferences and habits of modern readers.

Regional Analysis

North America Leads Global Books Market with 33.2% Share Worth USD 49.8 Billion

North America dominates the global books market, contributing approximately 33.2% to total market revenues, equivalent to USD 49.8 billion in 2024. The region’s leading position can be attributed to a high literacy rate, robust publishing industry infrastructure, and significant consumer spending on books.

Additionally, digital formats such as e-books and audiobooks have witnessed substantial adoption, facilitated by advanced digital infrastructure, widespread availability of smart devices, and a cultural shift towards convenience and accessibility.

Regional Mentions:

Europe holds a considerable share of the global market, driven by significant contributions from countries such as Germany, France, and the United Kingdom. Europe’s mature book industry benefits from established publishing houses, a strong literary culture, and consistent consumer demand across diverse genres including fiction, academic texts, and children’s literature.

The Asia Pacific region represents a rapidly expanding market segment, driven by increasing literacy rates, economic development, and a growing middle-class population. Countries such as China, India, and Japan are significant contributors, showcasing rising demand for educational materials, leisure reading, and localized content.

Middle East & Africa display moderate but improving market performance, influenced by rising educational initiatives, increasing literacy levels, and growing governmental support for publishing activities. Demand predominantly centers around educational and religious publications. However, challenges remain, including underdeveloped distribution channels and limited access in rural areas.

Latin America demonstrates steady growth potential, driven by countries such as Brazil and Mexico. The region’s vibrant literary culture and increasing adoption of digital reading formats offer notable opportunities. Nevertheless, economic instability, limited access to quality publishing resources, and piracy issues represent ongoing constraints within this regional market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global books market of 2024, Scholastic Inc. maintains a prominent position, distinguished by its strategic focus on children’s publishing and education. The company’s targeted approach leverages its established series and educational resources to meet evolving educational standards and reading preferences. Scholastic’s strength lies in its capacity to integrate educational content with entertainment, making it a vital player in fostering early literacy.

Penguin Random House, known for its extensive catalog and global reach, continues to dominate across multiple genres. Its strategic mergers and acquisitions have broadened its demographic reach and diversified its portfolio, reinforcing its market leadership. The company excels in both print and digital formats, responding adeptly to changing consumer reading habits.

Simon & Schuster, Inc., with its strong focus on bestsellers and new titles, remains influential in the general and literary fiction categories. The company’s aggressive marketing strategies and partnerships with prominent authors help maintain its market share and visibility.

IDW Publishing and Marvel Comics stand out in the graphic novel and comic book segments. Their ability to capitalize on the crossover between popular media and publishing has driven their success, particularly through franchising and multimedia adaptations.

Pearson leads in the educational sector, providing comprehensive learning solutions globally. Its emphasis on digital transformation and adaptive learning technologies addresses the growing demand for personalized education.

Hachette Book Group and HarperCollins Publishers continue to excel in trade publishing, with robust catalogues that include bestsellers in both fiction and non-fiction. Their focused expansion in digital audiobooks and e-books aligns with shifting consumer preferences.

Macmillan Publishers, through strategic niche targeting and investment in quality content, strengthens its presence in both academic and professional markets, demonstrating adaptability and innovation in its publishing approaches.

Top Key Players in the Market

- Scholastic Inc.

- Penguin Random House

- Simon & Schuster, Inc.

- IDW Publishing

- Pearson

- Hachette Book Group

- HarperCollins Publishers

- Morris Publishing

- Marvel Comics

- Macmillan Publishers

Recent Developments

- In January 2025, Denmark’s WeDoBooks, a leading bookkeeping software provider, acquired Germany-based Libreka, a digital book distribution platform. The acquisition strengthens WeDoBooks’ footprint in the European market, expanding its service offerings in the book industry.

- In February 2025, FE International, a global mergers and acquisitions advisory firm, facilitated the acquisition of Link My Books by Visma, a prominent European software company. The acquisition enhances Visma’s capabilities in automating bookkeeping and accounting services for small and medium-sized businesses.

- In February 2025, FactSet, a global financial data and analytics firm, acquired LiquidityBook, a cloud-based trading and portfolio management solutions provider. This acquisition allows FactSet to expand its offerings in the investment management sector with advanced trading tools and real-time market data.

Report Scope

Report Features Description Market Value (2024) USD 151.0 Billion Forecast Revenue (2034) USD 230.0 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (Fiction, Non-fiction), By Type (Educational, Romance, Comic, Science, Historical, Literary, Realistic, Mystery, Fantasy, Others), By Format (Hard Copy, E-book, Audiobook), By Distribution Channel (Local Book Shops, Online, Mass Merchandisers, Specialty Bookstores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Scholastic Inc., Penguin Random House, Simon & Schuster, Inc., IDW Publishing, Pearson, Hachette Book Group, HarperCollins Publishers, Morris Publishing, Marvel Comics, Macmillan Publishers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Scholastic Inc.

- Penguin Random House

- Simon & Schuster, Inc.

- IDW Publishing

- Pearson

- Hachette Book Group

- HarperCollins Publishers

- Morris Publishing

- Marvel Comics

- Macmillan Publishers