Global Body Firming Creams Market By Product (Non-Plant Based, Plant Based), By Distribution Channel (Offline, Online), By Application (Oil Skin, Dry Skin, All Use), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133628

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

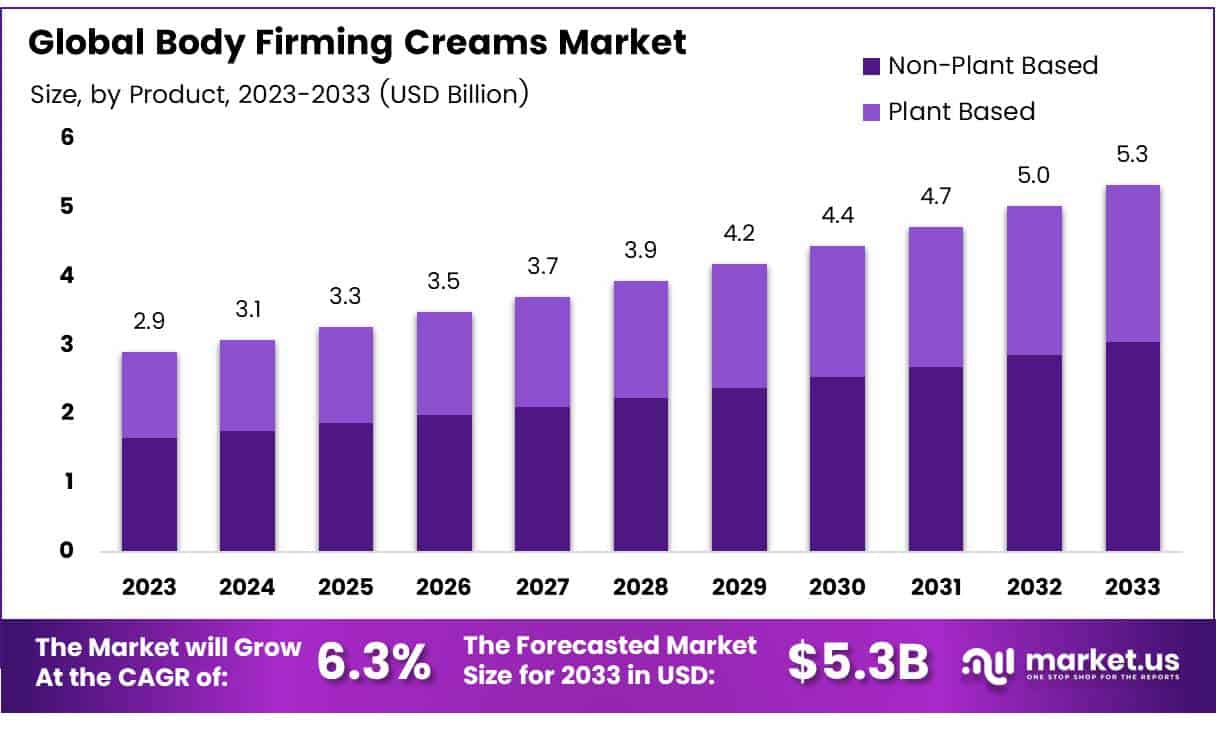

The Global Body Firming Creams Market size is expected to be worth around USD 5.3 Billion by 2033, from USD 2.9 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Body firming creams are topical products designed to enhance skin elasticity and appearance, incorporating ingredients like collagen, caffeine, and botanical extracts to tighten skin and reduce signs of aging like cellulite.

These creams are part of the larger cosmetics and personal care industry, appealing to a wide range of health-conscious consumers. With an aging global population and a general rise in wellness interest, the demand for these anti-aging products is growing.

Market growth is fueled by advancements in skincare technology, which help create more effective products. Additionally, the rising trend in fitness and wellness supports this growth, as consumers look for beauty solutions that complement their healthy lifestyles.

Regulatory oversight from governments in the U.S., Europe, and Asia ensures the safety and efficacy of these creams, mandating that claims made by such products are substantiated. This oversight is crucial in regions like Asia, where skincare is a key part of daily life, prompting governments to promote safe skincare practices and innovation.

According to Shiseido, their product, Vital Perfection Uplifting and Firming Cream, exemplifies the industry’s ability to deliver high-performance products, with claims of visible skin lifting within just one week of use.

This claim not only highlights the advancements in product formulation but also sets a benchmark for consumer expectations in the efficacy of anti-aging and skin firming products. Such developments are crucial in driving consumer trust and market growth, as they reflect the industry’s commitment to innovation and quality.

Further underpinning the market’s expansion are demographic insights provided by sources like Progno health, which indicate a surprising prevalence of skin disorders 40.1% among males and 23.7% among females. These statistics not only highlight the widespread need for corrective skincare solutions but also open up avenues for targeted products catering to specific demographic needs.

Additionally, the statistic that approximately 90% of Chinese women engage in anti-aging practices points to significant cultural and regional factors that influence market trends. This high level of engagement with anti-aging and skincare routines in China exemplifies the vast potential for market penetration and expansion in Asia, prompting companies to tailor their strategies and product offerings to align with regional consumer behaviors and preferences.

Key Takeaways

- The Global Body Firming Creams Market is projected to grow from USD 2.9 billion in 2023 to USD 5.3 billion by 2033 at a CAGR of 6.3%.

- The Non-Plant Based segment led with a 58.3% share in 2023, driven by consumer trust in traditional formulations offering immediate results.

- Offline distribution channels dominated in 2023 due to consumer preference for verifying product quality and texture before purchase.

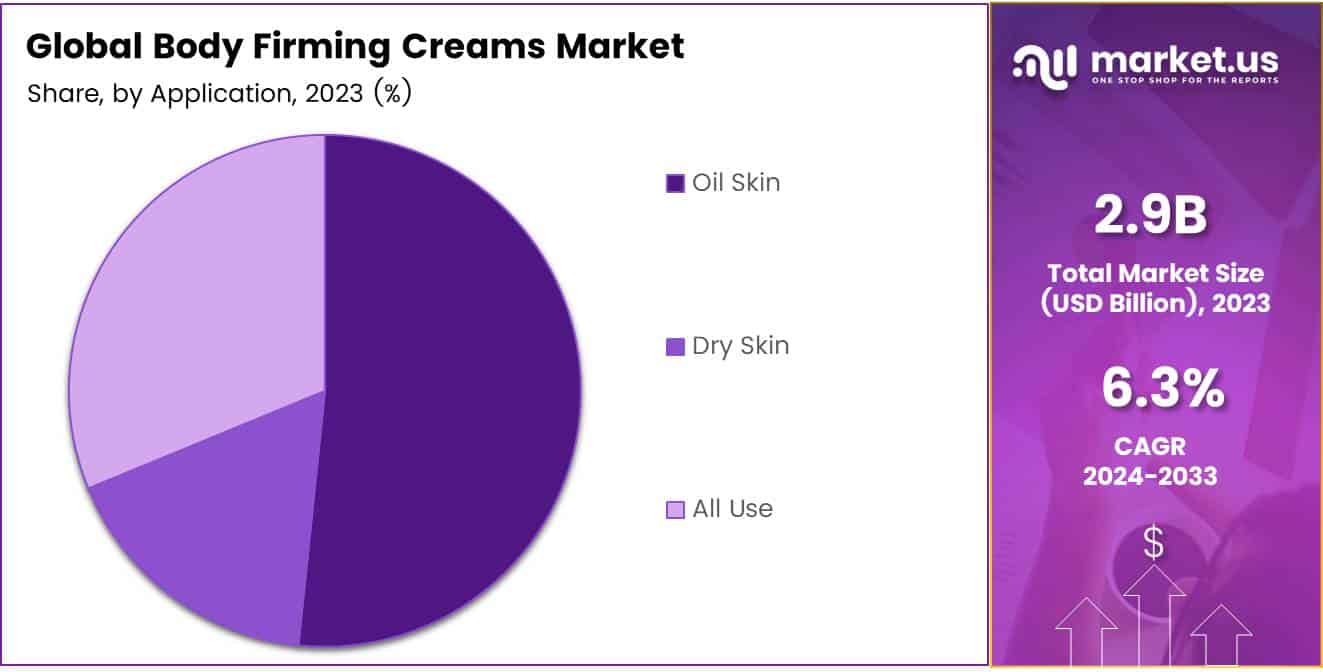

- The Oily Skin segment was the top application segment in 2023, reflecting rising awareness of tailored skincare routines.

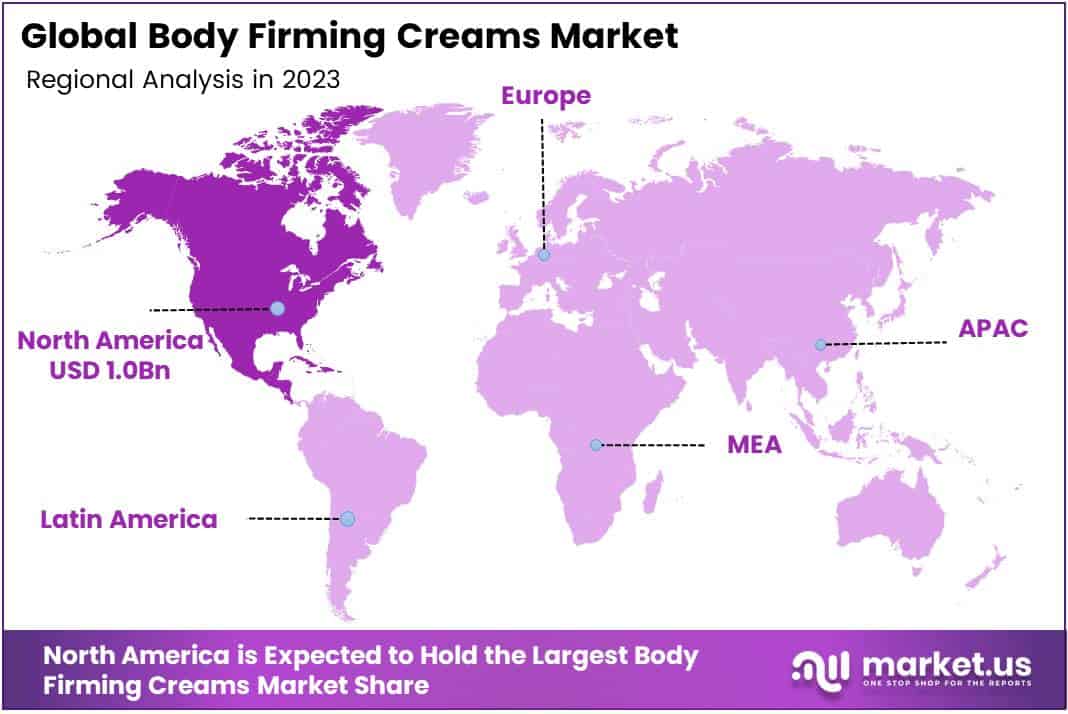

- North America held the largest regional market share of 32.1% valued USD 1 billion in 2023, fueled by consumer awareness and a wide range of skincare products.

Product Analysis

Non-Plant Based Dominates Body Firming Creams Market with 58.3% Share

In 2023, Non-Plant Based held a dominant market position in the By Product Analysis segment of the Body Firming Creams Market, capturing a 58.3% share. This segment’s strong performance can be attributed to consumer trust in traditional formulations, which are perceived to offer immediate and effective results.

Non-plant based creams often incorporate well-researched, synthetic active ingredients that promise to enhance skin elasticity and firmness more reliably than their natural counterparts.

On the other hand, the Plant-Based segment, while smaller, is gaining traction due to rising consumer awareness about the environmental impact and potential health benefits of natural ingredients. These plant-based products appeal particularly to the growing demographic of eco-conscious consumers, who are motivated by sustainable living values.

However, despite this growing interest, the efficacy of plant-based formulations in delivering comparable results to their non-plant based counterparts remains a significant factor influencing consumer choices, thereby slowing its market penetration compared to the non-plant based segment.

This distinction highlights a pivotal consumer trend within the body firming creams market, where efficacy is often weighed against ethical and environmental considerations.

Distribution Channel Analysis

Offline Distribution Channel Leads with Dominant Share in Body Firming Creams Market

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Body Firming Creams Market. This segment thrived primarily because consumers prefer personal verification of product quality and texture before purchase, a critical factor when choosing body firming products.

Physical stores offer the advantage of immediate product testing and access to expert advice, leading to higher consumer confidence and satisfaction.

Moreover, the tactile experience allows for a better assessment of the cream’s feel and scent, aspects that are often pivotal in skincare product selection. Retail outlets also benefit from impulse purchases, where consumers are more likely to buy additional products after experiencing them firsthand.

Conversely, the online segment is growing rapidly due to the convenience of home shopping and the increasing reliability of product reviews. Online platforms cater to a tech-savvy demographic that values the ease of comparing multiple products and brands.

Enhanced e-commerce user interfaces and targeted marketing strategies are expected to further boost online sales, although they still lag behind offline channels in terms of total revenue generation in the body firming creams market.

Application Analysis

Oily Skin Leads Application Segment in 2023 Body Firming Creams Market

In 2023, Oil Skin held a dominant market position in the By Application Analysis segment of the Body Firming Creams Market. This segment’s prominence is attributed to the increasing consumer awareness regarding the benefits of specialized skin care routines tailored for oily skin types.

Oily skin types require specific formulations that help in managing excess sebum production while providing adequate hydration and firming benefits without exacerbating oiliness. As consumers become more knowledgeable about the ingredients that benefit oily skin, such as hyaluronic acid, niacinamide, and retinol, the demand for body firming creams catering specifically to this skin type has surged.

Manufacturers have responded by developing advanced formulations that not only firm the skin but also ensure that the skin’s natural oil balance is maintained. These products often include mattifying agents that help in reducing the appearance of shine, making them highly desirable in markets with warmer climates where oily skin is a common concern.

The targeted benefits of these creams, combined with aggressive marketing strategies and consumer education on skin health, have solidified Oil Skin’s leading position in the market segment.

Key Market Segments

By Product

- Non-Plant Based

- Plant Based

By Distribution Channel

- Offline

- Online

By Application

- Oil Skin

- Dry Skin

- All Use

Drivers

Increasing Demand for Anti-Aging Products

The body firming creams market is seeing significant growth, driven primarily by the increasing demand for anti-aging products. As the global population ages, more consumers are seeking solutions to reduce visible signs of aging.

Body firming creams, known for their ability to enhance skin elasticity and improve overall skin tone, are becoming a popular choice among those looking to maintain a youthful appearance. This trend is supported by a rising awareness of skin care routines and the benefits of specific products like body firming creams.

Additionally, the expansion of e-commerce platforms and online retailing has made these creams readily available to a broader audience, further fueling the market’s growth. This accessibility allows consumers from various regions to explore and purchase a wide range of products tailored to their skin care needs.

Restraints

Restraints of the Body Firming Creams Market

One of the main challenges in the body firming creams market is the high cost of premium products. These creams often come with a hefty price tag, which can deter budget-conscious consumers from purchasing them.

Additionally, there’s the risk of side effects or allergic reactions, such as skin irritation or rashes, which can further discourage consumers, especially those with sensitive skin. This sensitivity to ingredients can make it hard for some people to find a product that works for them without causing discomfort or harm, limiting the market to those who can either afford the high-end products or tolerate their effects.

Growth Factors

Growth Opportunities in the Body Firming Creams Market

The body firming creams market is poised for expansion, particularly in emerging markets where there’s a noticeable increase in the middle-class population and disposable income. This growth is not only about increasing sales but also about adapting to regional preferences and skincare needs, which vary widely across different climates and cultural backgrounds.

Furthermore, the trend towards personalized skincare solutions presents a significant opportunity. By developing customized body firming creams that cater to individual skin types and specific concerns, companies can enhance customer satisfaction and loyalty.

Additionally, the potential integration of smart beauty technologies, like skin analysis tools or connected beauty devices, could transform the way consumers interact with body firming products. This technology can provide more targeted skincare routines, improve product effectiveness, and ultimately, boost user engagement and market growth.

Emerging Trends

Natural and Organic Ingredients Drive Body Firming Cream Market

In today’s market, consumers are becoming more conscious of the ingredients in their skincare products, particularly body firming creams. This shift towards natural and organic ingredients highlights a broader trend in consumer behavior.

People now prefer products made from sustainable and organic sources, reflecting a growing awareness of both environmental impacts and personal health benefits. This trend is intertwined with the holistic beauty movement, where skincare is seen as part of an overall wellness routine, pushing demand for firming creams that offer additional health benefits.

Furthermore, there is a significant push for clean and transparent labeling, ensuring that consumers understand what they are applying to their skin and can trust the claims of safety and effectiveness made by brands. This drive for clarity and quality in ingredients and labeling is reshaping the body firming cream market, aligning it more closely with today’s consumer expectations for authenticity and efficacy.

Regional Analysis

North America Leads with 32.1% Share and USD 1 Billion in Revenue

The global market for body firming creams is experiencing significant growth, with regional dynamics playing a crucial role in shaping the industry landscape.

North America emerges as the dominant region, holding a substantial 32.1% market share valued at USD 1 billion. This dominance is driven by a heightened consumer awareness regarding skincare and the availability of diverse products catering to different skin types and concerns.

The U.S. leads within this region, thanks to robust marketing by leading skincare brands and a high consumer propensity to invest in premium body care products.

Regional Mentions:

In Europe, the market is propelled by a strong inclination towards natural and organic skincare solutions, coupled with stringent EU regulations that promote the use of safe and sustainable ingredients. The region’s rich heritage in cosmetic science also supports the development of innovative formulations that are highly effective in skin firming and toning.

The Asia Pacific market is rapidly expanding, fueled by increasing disposable incomes and a growing middle-class population that is becoming more conscious of personal grooming and skincare. Countries like South Korea, Japan, and China are at the forefront, offering a wide range of products from luxury to affordable options, focusing on both traditional herbal ingredients and advanced cosmetic technology.

The Middle East & Africa region shows promising growth due to the rising demand for personal care products among affluent consumers and an expanding retail landscape. The market in this region benefits from the luxurious spending habits of the population in Gulf countries, where premium body care products are highly favored.

Latin America’s market is driven by a young demographic with a keen interest in appearance and fitness, which supports the demand for body firming creams. The region’s tropical climate and the resulting skin care concerns, such as skin elasticity and moisture retention, further propel the market growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Body Firming Creams Market, several prominent players are defining the competitive landscape in 2023.

L’Oréal S.A., a longstanding leader in the beauty industry, continues to innovate with its extensive portfolio of skin firming products, which are well-received for their efficacy and ingredient safety. The company leverages its strong R&D capabilities to enhance product formulations, meeting consumer demands for organic and natural ingredients.

ET Browne Drug Co., Inc., known for its Palmer’s brand, remains a favorite for consumers seeking cost-effective and reliable options in body firming. Their products, which often feature cocoa butter and vitamin E, appeal to a broad demographic looking for proven results without a high price tag.

The Procter & Gamble Company leverages its vast distribution networks to ensure widespread availability of its body firming creams. Their marketing strategies focus heavily on demonstrating clinical results, which helps in instilling consumer trust.

Beiersdorf AG, with its Nivea brand, maintains a strong presence in the market through continuous product innovation and sustainability initiatives, which resonate well with environmentally conscious consumers.

Kao Corporation and Clarins Group both focus on tailoring their offerings to meet specific skin care needs, utilizing unique formulations and premium ingredients that justify their higher price points.

Shiseido Company, Limited and The Estée Lauder Companies Inc. cater to the luxury segment, emphasizing superior product feel and advanced formulation technology. Their products often incorporate exotic ingredients and claim advanced anti-aging benefits, attracting a niche market willing to invest in high-end skin care solutions.

Johnson & Johnson and Sol de Janeiro target different market segments with their distinctive branding and product offerings, emphasizing safety and sensory experience, respectively, which helps in maintaining their strong market positions.

Top Key Players in the Market

- L’Oréal S.A.

- ET Browne Drug Co. Inc.

- The Procter & Gamble Company

- Beiersdorf AG

- Kao Corporation

- Clarins Group

- Johnson & Johnson

- Sol de Janeiro

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

Recent Developments

- In March 2024, premium skincare brand Allies of Skin announced a $20 million funding round, focusing on expanding its presence across the US market to cater to a growing demand for high-performance skincare solutions.

- In February 2023, UK-based Skin + Me secured over €11 million in funding to further enhance its personalized, prescription-based skincare approach, helping customers address unique skin concerns with tailored solutions.

- In August 2024, L’Oréal announced its acquisition of a 10% stake in the Swiss skincare company Galderma. This move aims to strengthen its premium dermatological offerings.

Report Scope

Report Features Description Market Value (2023) USD 2.9 Billion Forecast Revenue (2033) USD 5.3 Billion CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Non-Plant Based, Plant Based), By Distribution Channel (Offline, Online), By Application (Oil Skin, Dry Skin, All Use) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L’Oréal S.A., ET Browne Drug Co. Inc., The Procter & Gamble Company, Beiersdorf AG, Kao Corporation, Clarins Group, Johnson & Johnson, Sol de Janeiro, Shiseido Company, Limited, The Estée Lauder Companies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L'Oréal S.A.

- ET Browne Drug Co. Inc.

- The Procter & Gamble Company

- Beiersdorf AG

- Kao Corporation

- Clarins Group

- Johnson & Johnson

- Sol de Janeiro

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.