Global Blue Economy Market Share Analysis Report By Type (Offshore Oil & Gas, Marine Fisheries, Aquaculture (Marine and Freshwater), Marine Renewable Energy, Shipping and Maritime Transport, Desalination and Water Treatment, Ports and Harbors Infrastructure, and Others), By Sector (Public Sector, Private Sector, and Public-Private Partnerships), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153405

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

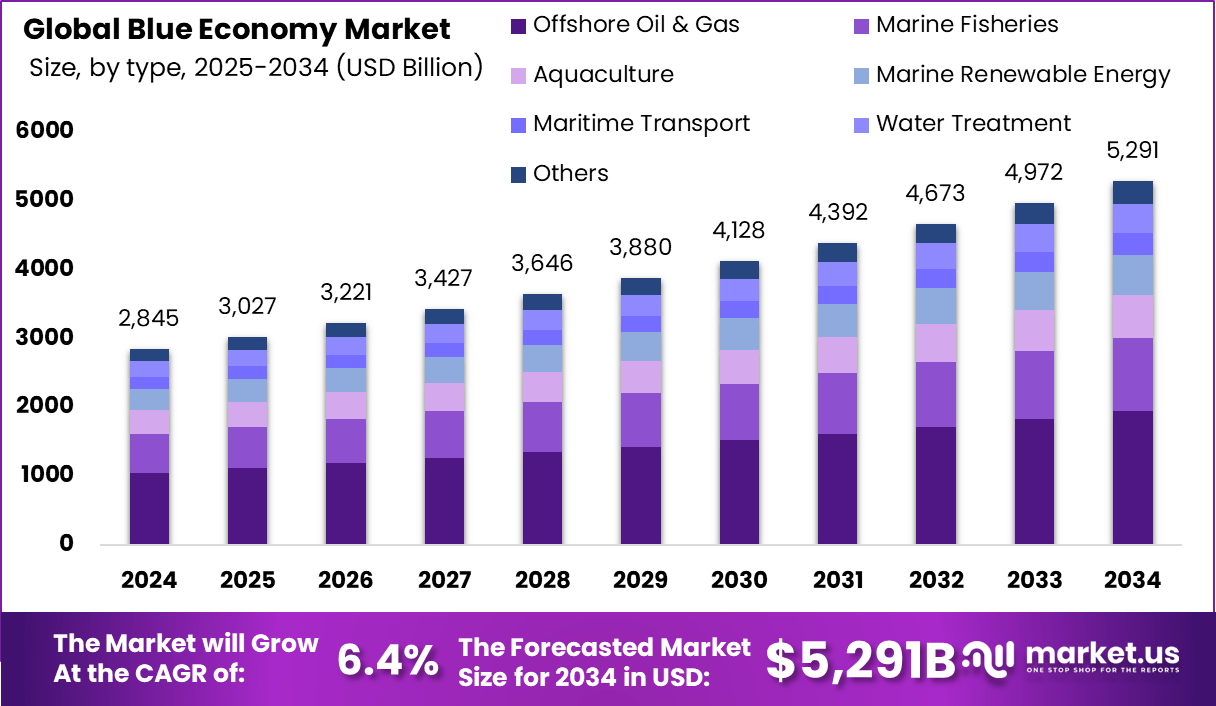

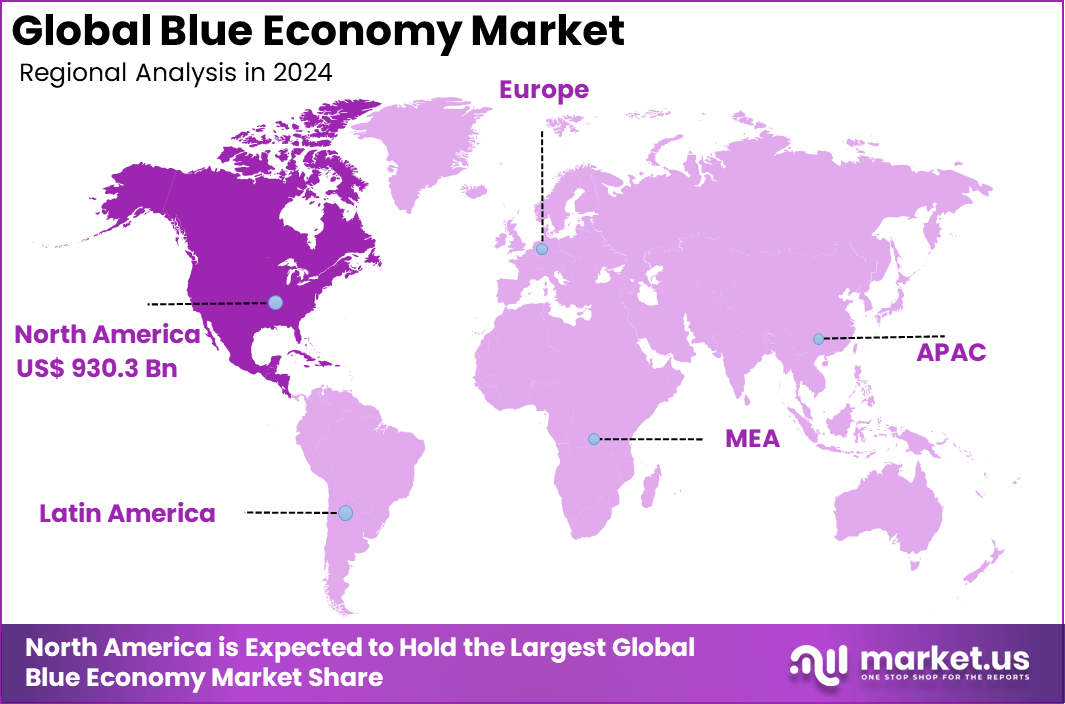

The Global Blue Economy Market size is expected to be worth around USD 5,291 Billion By 2034, from USD 2,845 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.7% share, holding USD 930.3 Billion revenue.

The Blue Economy Market refers to the sustainable development and use of oceanic and coastal resources to drive inclusive economic growth while ensuring long‑term ecosystem health. It encompasses traditional sectors like fisheries, shipping, tourism, alongside emerging areas such as offshore renewable energy, marine biotechnology, and aquaculture, all framed within environmental stewardship and social equity.

The Top Driving Factors behind its expansion include scientific and technological advancements, policy reforms, and rising awareness of oceanic significance. Investors are motivated by environmental, social, and governance (ESG) impact, innovation prospects, and favorable growth potential. Subnational interest is driven by job creation and regional economic gains.

There is strong and growing demand for Blue Economy sectors, especially as populations rise in coastal regions and people everywhere become more aware of how ocean health links to food security, climate regulation, and economic stability. Industries such as maritime transport, aquaculture, and eco-tourism are seeing rising interest. Policy modeling shows that even small growth in sustainable coastal tourism can boost related sectors and strengthen national economies.

According to UNRIC, 40% of the global population lives near coastal areas, with over 3 billion people relying on oceans for their livelihood. Around 80% of global trade is carried by sea, highlighting the critical role of oceans in food security and poverty reduction. Based on EU data, shipping contributes 13% of transport-related greenhouse gas emissions, prompting nations like Norway to target a 40% emissions reduction by 2030 and full climate neutrality for its fleet by 2050.

The EU blue economy has shown strong growth. In 2022, it employed 4.82 mn people, marking a 16% rise from 2021. Turnover reached nearly EUR 890 bn (a 29% increase), while Gross Value Added (GVA) stood at EUR 250.7 bn, up 33% year-over-year. Coastal tourism led the sector, contributing 33% to GVA and employing 54% of the workforce. Despite a major setback in 2020 due to COVID-19, the sector fully recovered by 2022, reaffirming its importance within the blue economy

Scope and Forecast

Report Features Description Market Value (2024) USD 2,845 Bn Forecast Revenue (2034) USD 5,291 Bn CAGR (2025-2034) 6.4% Largest Segment Public Sector Largest Market North America (32.7% Market Share) Largest Country U.S. (USD 846.6 Bn Market Revenue) Technological innovation is reshaping the Blue Economy in remarkable ways. Emerging tech like autonomous underwater vehicles, marine robotics, remote sensing for real-time ocean monitoring, and offshore renewable energy systems are becoming increasingly mainstream. Desalination, advanced waste treatment, and next-generation aquaculture systems are rapidly gaining traction as well. These breakthroughs boost efficiency, improve resource use, and aid the shift to sustainability.

Blue Economy Statistics

- The Blue Economy Market is estimated to reach USD 5,291 billion by 2034, up from USD 2,845 billion in 2024, growing at a CAGR of 6.4% during 2025–2034.

- In 2024, North America led with over 32.7% market share, generating around USD 930.3 billion in revenue.

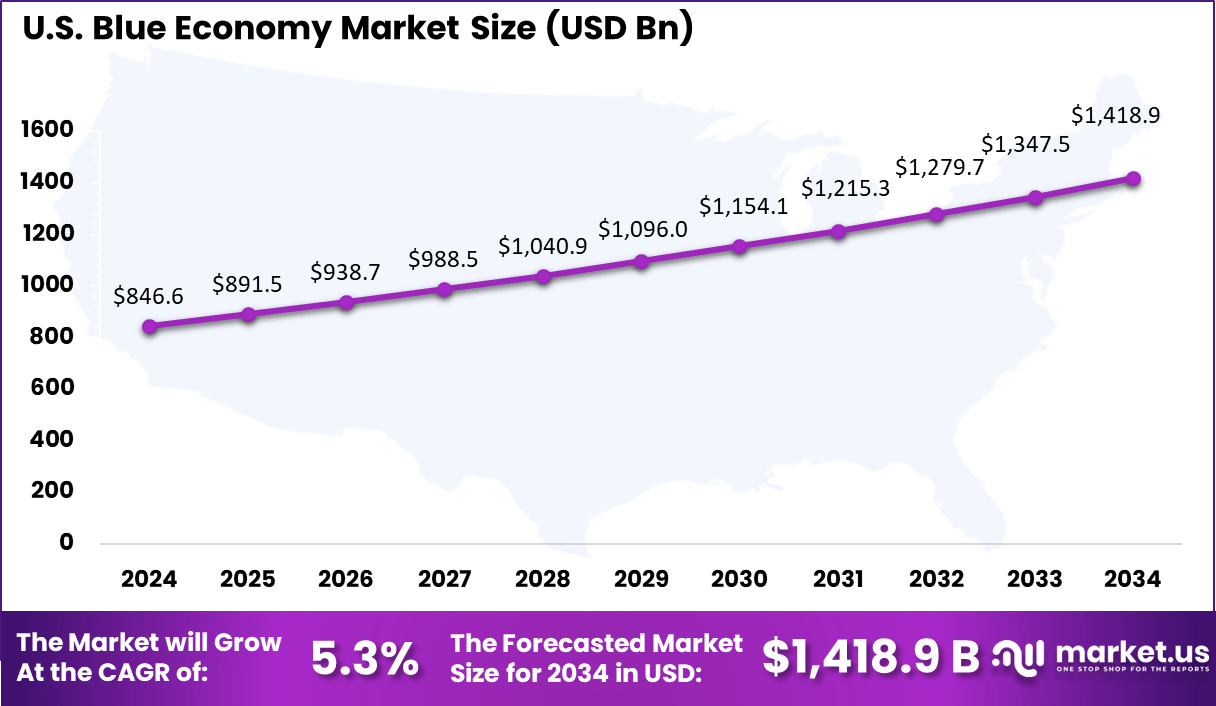

- The United States contributed approximately USD 846.6 billion in 2024, expanding at a CAGR of 5.3%.

- By type, Offshore Oil & Gas dominated with a share of nearly 36.8%, driven by continued offshore production activities.

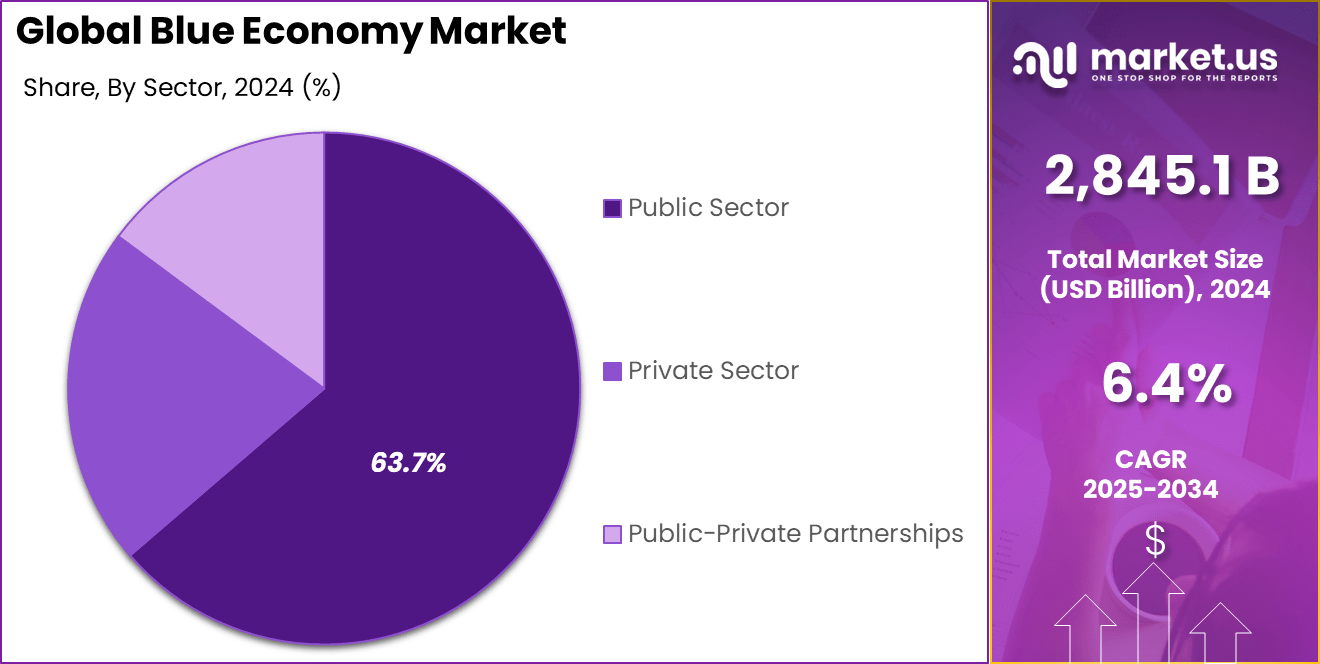

- By sector, the Public Sector held the largest share at about 63.7%, reflecting significant government-led investments in ocean-based industries.

Analysts’ Viewpoint

Investment interest in the Blue Economy has soared. Over the past decade, the volume of disclosed investment in this area has grown by more than three times, showing investors’ faith in the future of sustainable ocean industries. Opportunities abound in early-stage tech, ocean observation platforms, blue renewable energy, and sustainable aquaculture.

Meanwhile, specialized investment instruments and public-private partnerships, as well as blue bonds and blended finance models, are providing fresh ways to inject capital into sustainable marine sectors. The business case for the Blue Economy is compelling. Besides straightforward profitability, participating organizations build resilience against climate shocks, tap into entirely new market segments, and often cut costs thanks to improved resource efficiency.

Engaging with the Blue Economy also enhances a company’s social license to operate, helps meet the rising expectations of consumers and investors, and puts businesses on the right side of tightening environmental regulation. A robust and shifting regulatory landscape influences every aspect of the Blue Economy Market. Globally recognized frameworks, such as the United Nations Sustainable Development Goals, specifically target oceans sustainability.

Many governments are putting in place stricter marine spatial planning, fisheries regulation, and measures to combat marine pollution and illegal practices. Companies operating in the Blue Economy are required to actively demonstrate compliance with these layers of regulations, which is driving a cultural shift throughout maritime sectors.

U.S. Blue Economy Market

The US Blue Economy is one of the most advanced and diversified in the world, valued at approximately USD 846.6 bn in 2024, and contributing significantly to national GDP, employment, and innovation. According to NOAA, the U.S. marine economy supported over 2.3 mn jobs and generated $361 bn in gross domestic product in 2022, with key sectors including offshore oil and gas, shipping, tourism, marine construction, and living marine resources.

The Gulf of Mexico remains a critical hub for offshore oil production, while the Pacific Northwest and Atlantic coasts are investing heavily in offshore wind energy notably, the Vineyard Wind project in Massachusetts is among the first large-scale U.S. offshore wind farms. Major ports like Los Angeles, Long Beach, and Houston handle significant cargo volumes, driving maritime logistics and innovation in port automation and sustainability.

The U.S. is also a leader in marine biotechnology, autonomous underwater vehicles (AUVs), and oceanographic research, with institutions like Woods Hole Oceanographic Institution and companies like Ocean Infinity at the forefront. Additionally, blue carbon initiatives in states like California and Florida are integrating coastal ecosystem preservation with carbon offset markets.

In 2024, North America held a dominant market position, capturing more than 32.7% share and generating over USD 930.3 billion in revenue. This leadership can be attributed to strong federal and regional investment in ocean-based industries, including offshore renewable energy, sustainable fisheries, and marine biotechnology.

The United States and Canada have advanced port infrastructure, robust maritime logistics systems, and a well-established regulatory framework that supports marine conservation and economic activities simultaneously. Public-private partnerships have accelerated technology adoption across ocean monitoring, ship decarbonization, and aquaculture automation, further enhancing market maturity.

Geographic Relevance

Europe follows closely, known for its leadership in marine renewable energy especially offshore wind farms like Dogger Bank (UK) and Hornsea (Denmark) along with strong regulatory frameworks supporting ocean sustainability through the EU Blue Economy Strategy.

The Asia-Pacific region is witnessing rapid expansion, fueled by industrial fishing, shipping, and aquaculture dominance from countries like China, Japan, and India. China alone accounts for more than 35% of global fish production, and it is investing heavily in port development and marine technology.

Latin America, led by Brazil and Chile, is focusing on sustainable fisheries and offshore oil. Meanwhile, the Middle East & Africa region is gaining traction with growing investments in desalination (e.g., in Saudi Arabia) and maritime trade along strategic corridors like the Red Sea and Suez Canal. Each region contributes uniquely to shaping the global blue economy’s future.

By Type Analysis

The Type segment of the Global Blue Economy Market is highly diverse, encompassing a broad range of ocean-based industries that contribute to economic development and environmental sustainability. Offshore oil and gas remains the dominant segment, accounting for 36.8% of the market share in 2024, driven by continued global energy demand and extensive offshore exploration in regions such as the Gulf of Mexico, North Sea, and West Africa.

However, as nations pivot toward clean energy, marine renewable energy is rapidly gaining momentum particularly offshore wind, which is seeing large-scale deployment in Europe, the U.S., and China. For example, the Dogger Bank Wind Farm in the UK, once fully operational, will be the world’s largest offshore wind facility, powering millions of homes.

Meanwhile, marine fisheries and aquaculture, including both freshwater and marine farming, are critical for global food security, contributing to over 50% of seafood consumed globally. Shipping and maritime transport, another key component, supports more than 80% of global trade by volume, driving demand for smart port infrastructure and decarbonized vessels.

Other segments include desalination, crucial for freshwater generation in arid regions, and ports and harbors infrastructure, which underpins global logistics. Each of these segments plays a unique role in shaping a resilient and sustainable blue economy.

By Sector Analysis

The Sector segment of the Global Blue Economy Market is primarily divided into the Public Sector, Private Sector, and Public-Private Partnerships (PPPs), with the Public Sector dominating at 63.7% of the market share in 2024. Government bodies play a crucial role in managing marine resources, funding oceanographic research, building maritime infrastructure, and enforcing regulations for sustainable practices.

For instance, the U.S. National Oceanic and Atmospheric Administration (NOAA) and the European Maritime Safety Agency (EMSA) are instrumental in providing marine data, ecosystem monitoring, and maritime safety enforcement. Massive public investment is evident in offshore wind, like the Biden Administration’s USD 3 bn pledge, while China’s Belt and Road shows large-scale funding in ports and trade routes.

The Private Sector, while smaller in share, is rapidly growing, driven by innovation in marine biotechnology, smart shipping, aquaculture, and renewable energy. Companies like Orsted, Maersk, and Cargill are leading advancements in decarbonized vessels, offshore wind farms, and sustainable seafood. Public-Private Partnerships (PPPs) are particularly crucial for high-capital projects like desalination plants, port modernization, and coastal protection infrastructure.

Driving Factor

Expansion of global trade and shipping activities

With more than 80% of world trade by volume and over 70% by value transported by sea, the shipping industry continues to be the cornerstone of global commerce, according to the UNCTAD. The growing demand for goods, energy, and raw materials, especially from emerging economies in Asia and Africa, is intensifying the need for efficient maritime logistics and port infrastructure.

For instance, the Port of Shanghai, the world’s busiest container port, handled over 47 million TEUs (twenty-foot equivalent units) in 2023, showcasing the scale and growth of maritime trade. This boom has led to significant investments in smart port technologies, automated container handling, and green shipping corridors, aiming to optimize efficiency and reduce emissions.

Additionally, companies like Maersk and CMA CGM are investing in methanol-powered and LNG-fueled vessels to align with sustainability goals. The surge in e-commerce, global supply chain integration, and energy exports (including LNG) are further propelling the maritime sector. This rapid growth boosts the Blue Economy and supports sectors like shipbuilding, marine engineering, coastal infrastructure, and digital maritime services.

Restraining Factor

Geopolitical tensions and maritime territorial disputes

Geopolitical tensions and maritime territorial disputes pose a significant restraint on the growth of the Global Blue Economy Market. Conflicts over ocean boundaries, resource ownership, and strategic waterways often disrupt investment, hinder international cooperation, and create uncertainty for marine industries.

A prime example is the South China Sea, where overlapping claims by China, Vietnam, the Philippines, Malaysia, Brunei, and Taiwan have led to ongoing disputes. This region, which handles one-third of global shipping traffic and is rich in oil, gas, and fisheries, has become a flashpoint for naval build-up and economic tension.

China’s creation of artificial islands and militarization of disputed zones have intensified concerns, prompting the U.S. and allied nations to conduct freedom of navigation operations, escalating geopolitical friction. Similar disputes are seen in the Arctic, where melting ice is opening new shipping routes and resource access, leading to competing claims between Russia, Canada, and others.

These tensions not only deter foreign investments in offshore projects but also delay infrastructure development and complicate joint ventures. Additionally, piracy risks in regions like the Horn of Africa and Strait of Malacca further threaten shipping security.

Growth Opportunity

Integration of digital technologies

The integration of digital technologies represents a major opportunity for accelerating growth in the Global Blue Economy Market by enhancing efficiency, sustainability, and safety across marine sectors. Emerging technologies such as Artificial Intelligence (AI), Internet of Things (IoT), blockchain, digital twins, and autonomous systems are transforming traditional maritime operations.

For instance, smart ports like the Port of Rotterdam and Singapore Port use AI-driven analytics, real-time IoT sensors, and digital platforms to optimize cargo flow, reduce downtime, and lower emissions. Similarly, autonomous ships, such as Yara Birkeland in Norway, the world’s first zero-emission autonomous container vessel are revolutionizing logistics by minimizing human error and fuel consumption.

Predictive maintenance powered by IoT-enabled sensors in offshore oil rigs and wind farms reduces costly equipment failures and downtime. Blockchain technology is also being used to ensure transparent and tamper-proof tracking of seafood supply chains, enhancing traceability and combating illegal fishing.

According to a World Economic Forum report, digital technologies could unlock over USD 300 billion in value for the ocean economy by 2030. These innovations not only improve operational efficiency but also support environmental monitoring, marine conservation, and data-driven governance making digital integration a vital enabler of a smarter, more resilient blue economy.

Challenge Analysis

Governance Gaps and Complex Stakeholder Needs

One of the greatest challenges in realizing a successful Blue Economy is the complexity of governance. Coordinating the interests of various stakeholders – such as fishermen, shipping companies, conservationists, and local communities – is difficult.

Weak institutional capacity, fragmented policy frameworks, and a lack of clear marine spatial planning lead to overlapping uses of ocean resources and conflict among user groups. As multiple ministries and agencies take charge of different maritime activities, efforts to manage cumulative impacts often fall short.

To overcome these hurdles, countries need to invest in stronger institutions, clearer legal frameworks, and participatory decision-making processes that include all relevant voices. Only by integrating diverse stakeholder needs and adopting ecosystem-based management can the Blue Economy realize its full potential, balancing economic growth with protection of the ocean’s health for generations to come.

Latest Trends

Growth of ocean-based carbon sequestration and blue carbon projects

The growth of ocean-based carbon sequestration and blue carbon projects is emerging as a transformative trend in the Global Blue Economy Market, aligning economic development with climate action. Blue carbon is the carbon sequestration potential of coastal and marine ecosystems, which include mangroves, seagrasses and salt marshes and can sequester carbon up to 10 times faster than terrestrial forests.

These are ecosystems that will serve as natural carbon sinks, while offering other co-benefits such as biodiversity protection, flood mitigation, and coastal resilience. For example, countries such as Australia, Kenya and Indonesia are pioneering efforts to conserve and restore blue carbon habitats through climate finance and policy integration.

The Mikoko Pamoja project in Kenya, is the world’s first community-led blue carbon initiative, receiving verified carbon credits from mangrove conservation. Meanwhile, private players like Ocean-Based Climate Solutions Inc. are testing deep-ocean carbon removal technologies, such as artificial upwelling, to optimize marine carbon uptake.

According to the UNEP, protecting and restoring blue carbon ecosystems could reduce global greenhouse gas emissions by up to 1.4 billion tonnes of CO₂ annually. As carbon markets expand and regulatory frameworks mature, blue carbon projects offer dual value: they serve as viable investment opportunities and critical tools in achieving global net-zero goals firmly positioning oceans at the heart of climate strategy.

Key Market Segments

By Type

- Offshore Oil & Gas

- Marine Fisheries

- Aquaculture (Marine and Freshwater)

- Marine Renewable Energy

- Offshore Wind Energy

- Tidal and Wave Energy

- Ocean Thermal Energy Conversion (OTEC)

- Shipping and Maritime Transport

- Commercial Shipping

- Freight and Logistics

- Desalination and Water Treatment

- Ports and Harbors Infrastructure

- Others

By Sector

-

- Public Sector

- Private Sector

- Public-Private Partnerships

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Key Player Analysis

Key players in the Blue Economy include Orsted A/S, Vestas Wind Systems, and Siemens Gamesa Renewable Energy, who lead offshore wind development with a focus on renewable energy transition. Maersk Line and Royal Dutch Shell are advancing low-emission maritime logistics, aligning with global decarbonization goals.

Firms like DNV GL, ABB Ltd., and Wärtsilä Corporation are driving innovation in marine systems, offering hybrid engines, smart grids, and safety solutions. Bluewater Energy Services supports offshore operations with advanced energy infrastructure technologies.

In ocean-based food and resource sectors, Marine Harvest (Mowi) and Cargill Aqua Nutrition are improving sustainable aquaculture practices. Utilities such as Iberdrola and E.ON SE are investing in marine renewables. Innovation from Deep Green, Sibelco, and other major players reflects growing support for sustainable marine resource extraction

Top Key Players in Blue Economy Market

- Orsted A/S

- Maersk Line

- Vestas Wind Systems

- Siemens Gamesa Renewable Energy

- Royal Dutch Shell

- DNV GL

- Bluewater Energy Services

- ABB Ltd.

- Wärtsilä Corporation

- Marine Harvest (Mowi)

- Cargill Aqua Nutrition

- Iberdrola

- ON SE

- Deep Green

- Sibelco

- Other Major Players

Recent Developments

- January 2025: Orsted completed the sale of 12.45% minority stakes in four UK offshore wind farms to Brookfield for GBP 1.745 billion (about DKK 15.7 billion), reinforcing financial strength for future renewable projects.

- DP World made headlines in December 2024 as it launched the world’s first MENA Blue Bond. This $100 million financial product aims to accelerate sustainable marine transport, port infrastructure, and ocean-positive initiatives – marking a pioneering move in capital markets dedicated to ocean sustainability

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Offshore Oil & Gas, Marine Fisheries, Aquaculture (Marine and Freshwater), Marine Renewable Energy, Shipping and Maritime Transport, Desalination and Water Treatment, Ports and Harbors Infrastructure, and Others), By Sector (Public Sector, Private Sector, and Public-Private Partnerships) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Orsted A/S, Maersk Line, Vestas Wind Systems, Siemens Gamesa Renewable Energy, Royal Dutch Shell, DNV GL, Bluewater Energy Services, ABB Ltd., Wärtsilä Corporation, Marine Harvest (Mowi), Cargill Aqua Nutrition, Iberdrola, E.ON SE, Deep Green, Sibelco, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Orsted A/S

- Maersk Line

- Vestas Wind Systems

- Siemens Gamesa Renewable Energy

- Royal Dutch Shell

- DNV GL

- Bluewater Energy Services

- ABB Ltd.

- Wärtsilä Corporation

- Marine Harvest (Mowi)

- Cargill Aqua Nutrition

- Iberdrola

- ON SE

- Deep Green

- Sibelco

- Other Major Players