Global Blood Volume Analyzer Market By Product Type (Automated and Manual), By Test Type (Blood Clotting Test, Blood Enzyme Test, and Blood Chemistry Test), By End-user (Diagnostic Centers, Hospitals, Specialty Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169906

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

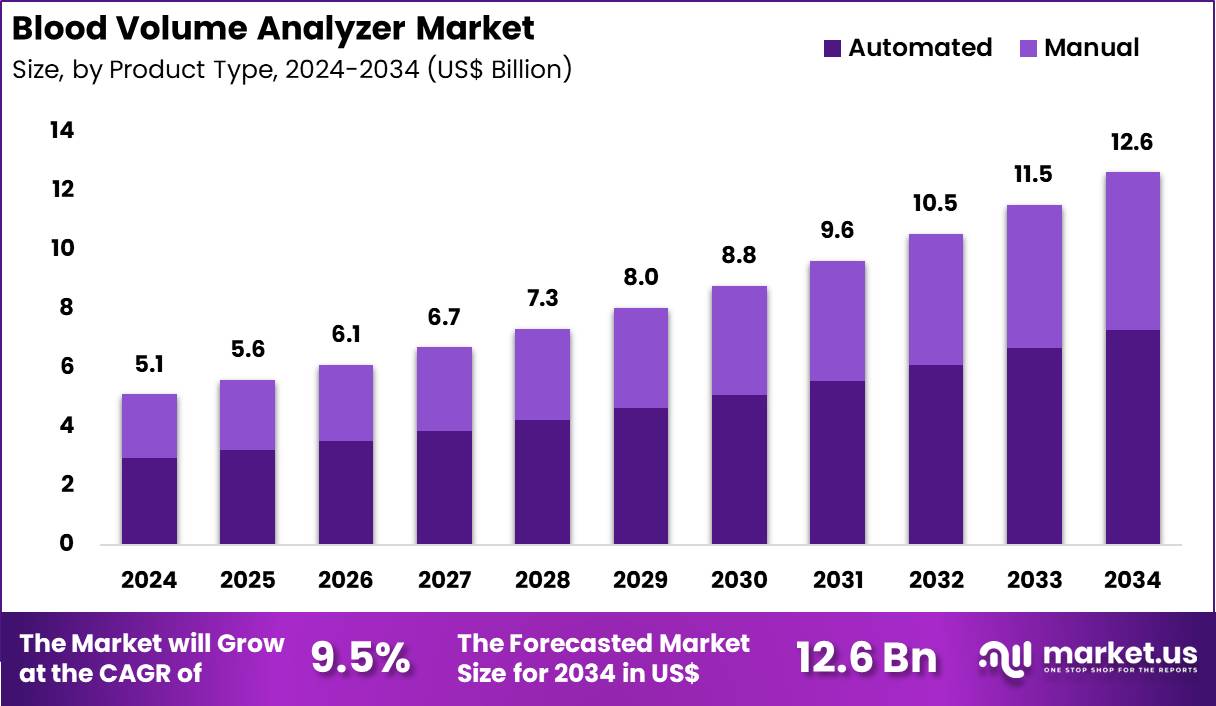

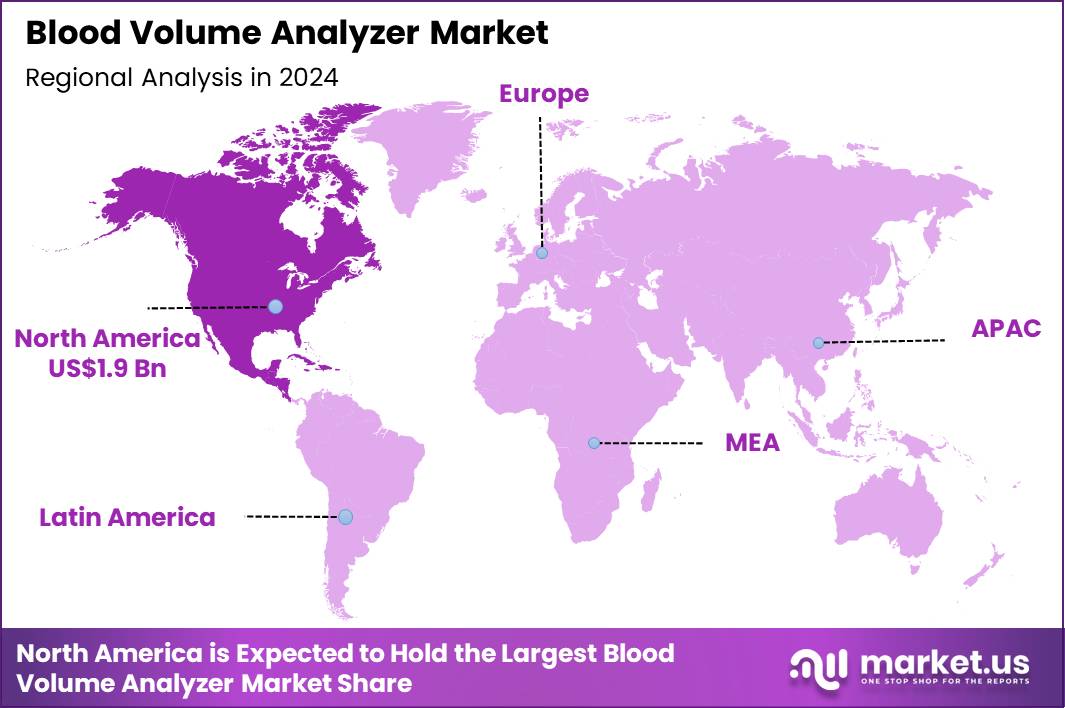

Global Blood Volume Analyzer Market size is expected to be worth around US$ 12.6 Billion by 2034 from US$ 5.1 Billion in 2024, growing at a CAGR of 9.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.3% share with a revenue of US$ 1.9 Billion.

Increasing demand for precise fluid management in critical care settings propels the Blood Volume Analyzer market, as clinicians seek accurate measurements to optimize resuscitation and prevent complications from volume overload or deficit. Manufacturers advance indicator dilution techniques using radiolabeled albumin or chromium-51 for direct quantification of plasma and red cell volumes in real time.

These analyzers enable hypervolemia assessment in heart failure exacerbations to guide diuretic dosing, hypovolemia detection during sepsis-induced distributive shock for timely vasopressor initiation, preoperative optimization in major orthopedic surgeries to reduce transfusion needs, and postoperative monitoring in burn patients to maintain hemodynamic stability.

Strong revenue growth underscores expanding clinical adoption and user base for established platforms. Daxor Corporation announced on March 4, 2025, that revenue from its blood volume measurement technology surged by 116.5% in 2024, driven by heightened demand for the BVA-100® system and a notable influx of new adopters. This financial momentum highlights the technology’s proven value and accelerates market penetration in high-acuity environments.

Growing emphasis on non-invasive and portable diagnostics accelerates the Blood Volume Analyzer market, as healthcare providers integrate point-of-care devices to facilitate bedside decisions and reduce reliance on invasive catheterization. Technology firms develop bioimpedance spectroscopy and ultrasound-based analyzers that estimate total circulating volume with minimal patient disruption.

Applications encompass ambulatory heart failure management through serial volume tracking to avert hospitalizations, emergency trauma evaluations for rapid hemorrhage quantification, dialysis optimization in chronic kidney disease patients via ultrafiltration guidance, and athletic performance enhancement by assessing hydration status during endurance training. Portable innovations open avenues for home-based monitoring in chronic conditions and integration with wearable biosensors. Leading developers capitalize on these trends to launch battery-operated systems that deliver results in under 30 minutes, enhancing workflow efficiency across diverse care continuums.

Rising incorporation of artificial intelligence for predictive analytics invigorates the Blood Volume Analyzer market, as laboratories leverage algorithms to forecast volume shifts based on integrated hemodynamic data. Instrument providers embed machine learning models into analyzers that correlate blood volume metrics with vital signs for proactive interventions.

These enhanced tools support critical care research by validating fluid responsiveness in vasodilatory shock trials, oncology applications through volume correction for chemotherapeutic dosing in cachectic patients, transfusion medicine via precise red cell mass determination in polycythemia vera, and geriatric assessments to differentiate dehydration from heart failure in frail elderly cohorts.

AI-driven features create opportunities for real-time alerts and personalized treatment protocols in value-based care models. Collaborative studies actively refine these analytics to improve diagnostic thresholds and expand clinical guidelines for routine blood volume profiling.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.1 Billion, with a CAGR of 9.5%, and is expected to reach US$ 12.6 billion by the year 2034.

- The product type segment is divided into automated, manual, with automated taking the lead in 2024 with a market share of 57.8%.

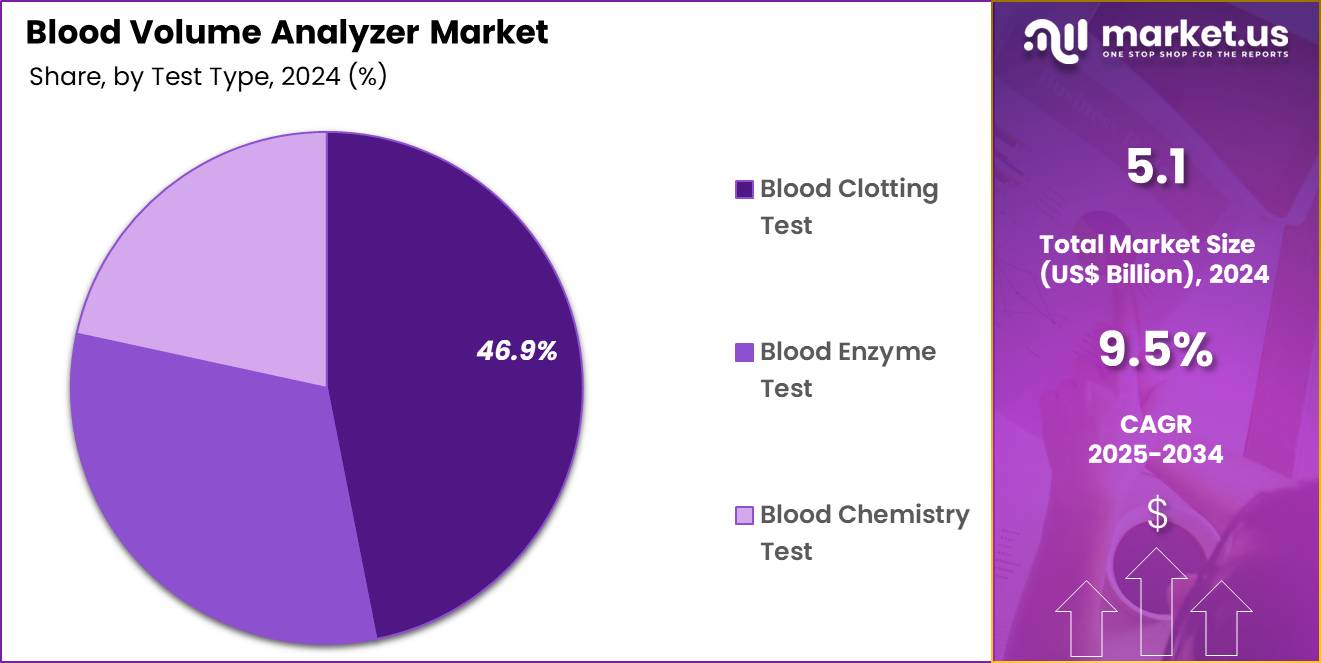

- Considering test type, the market is divided into blood clotting test, blood enzyme test, blood chemistry test. Among these, blood clotting test held a significant share of 46.9%.

- Furthermore, concerning the end-user segment, the market is segregated into diagnostic centers, hospitals, specialty clinics, others. The diagnostic centers sector stands out as the dominant player, holding the largest revenue share of 44.7% in the market.

- North America led the market by securing a market share of 37.3% in 2024.

Product Type Analysis

Automated systems, holding 57.8%, are expected to dominate as laboratories prioritize fast, accurate, and standardized blood-volume analysis. Automated analyzers reduce manual errors and deliver consistent results, improving diagnostic reliability. Growth in chronic disease monitoring increases test volumes across outpatient and inpatient settings. Manufacturers introduce systems with advanced sensors and integrated software that streamline workflow and minimize technician intervention.

High-throughput capabilities make automated analyzers suitable for centralized labs handling large sample loads. Diagnostic centers and hospitals adopt automation to improve turnaround times. Rising demand for point-of-care compatible automated solutions expands adoption. These factors keep automated systems anticipated to remain the leading product type.

Test Type Analysis

Blood clotting tests, holding 46.9%, are anticipated to dominate due to their clinical importance in evaluating coagulation disorders, cardiovascular risk, and response to anticoagulant therapy. Clinicians rely on clotting tests such as PT, aPTT, and INR to guide treatment decisions for patients with bleeding or thrombotic conditions. Rising prevalence of liver disease, hemophilia, and DVT increases testing frequency.

Surgical and trauma-care settings require frequent clotting assessments to manage perioperative risk. Diagnostic laboratories expand coagulation panels to support personalized treatment. Automation technologies improve accuracy and efficiency of clotting test processing. Public-health awareness about clotting abnormalities increases demand for routine screening. These drivers keep blood clotting tests projected to remain the most influential test type.

End-User Analysis

Diagnostic centers, holding 44.7%, are expected to dominate end-user adoption due to their high testing throughput and specialization in routine blood analysis. These centers manage large sample volumes from hospitals, clinics, and community health programs. Automated blood-volume analyzers enhance operational efficiency and reduce result turnaround time. Diagnostic centers expand services to include comprehensive coagulation, enzyme, and chemistry testing, strengthening analyzer utilization.

Increasing patient preference for fast, affordable testing boosts footfall. Partnerships with healthcare networks improve test-volume consistency. Investment in advanced equipment supports accurate, reliable output across large populations. These factors keep diagnostic centers anticipated to remain the dominant end-user segment in the blood volume analyzer market.

Key Market Segments

By Product Type

- Automated

- Manual

By Test Type

- Blood Clotting Test

- Blood Enzyme Test

- Blood Chemistry Test

By End-user

- Diagnostic Centers

- Hospitals

- Specialty Clinics

- Others

Drivers

The Increasing Prevalence of Anemia Is Driving the Market

The increasing prevalence of anemia has emerged as a key driver for the blood volume analyzer market, given the critical role these devices play in distinguishing between true anemia and conditions involving plasma volume expansion. Accurate blood volume assessment enables clinicians to tailor treatments, such as distinguishing hypovolemic from normovolemic states, thereby optimizing transfusion decisions and reducing unnecessary interventions. This is particularly relevant in chronic kidney disease and heart failure patients, where anemia often complicates volume status management.

Healthcare providers are turning to analyzers like the BVA-100 to measure red cell and plasma volumes precisely, improving diagnostic accuracy in hematology and critical care settings. The Centers for Disease Control and Prevention reported a prevalence of anemia at 9.3% among individuals aged 2 years and older during August 2021–August 2023, with higher rates among females at 13.0%. Such widespread occurrence underscores the need for reliable tools to address misdiagnoses that could lead to inappropriate therapies.

Hospitals are incorporating these analyzers into protocols for preoperative evaluations, where anemia screening has become standard to mitigate surgical risks. The economic implications of untreated anemia, including prolonged hospital stays, further incentivize adoption of efficient diagnostic systems. As population aging accelerates, the demand for precise volume measurements intensifies, positioning analyzers as essential for integrated care pathways. This driver ultimately enhances patient safety and resource allocation in high-volume clinical environments.

Restraints

The High Cost of Advanced Analyzers Is Restraining the Market

The high cost of advanced blood volume analyzers continues to restrain market growth by limiting accessibility in resource-constrained healthcare facilities. These devices require significant upfront investment for equipment, along with ongoing expenses for reagents and maintenance, deterring smaller hospitals from integration. Budget limitations in public health systems exacerbate this issue, prioritizing essential over specialized diagnostics. Even in larger institutions, competing funding needs for broad-spectrum technologies sideline volume analyzers despite their clinical value.

The complexity of these systems also demands specialized training, adding to indirect costs that strain departmental budgets. Without favorable reimbursement structures, providers hesitate to expand usage beyond targeted applications like critical care. This financial barrier perpetuates reliance on less accurate, indirect methods such as central venous pressure monitoring.

Rural and community hospitals, serving underserved populations, face amplified challenges in justifying expenditures. Consequently, disparities in diagnostic capabilities widen, affecting equitable patient outcomes. Overcoming this restraint necessitates innovative financing models and cost-reduction strategies to broaden deployment.

Opportunities

Advancements in Non-Invasive Hemodynamic Monitoring Are Creating Growth Opportunities

Advancements in non-invasive hemodynamic monitoring technologies are creating substantial growth opportunities by offering alternatives to traditional invasive blood volume assessments. Techniques such as bioreactance and plethysmography enable real-time evaluation of cardiac output and fluid status without catheterization risks, appealing to perioperative and ICU settings. These innovations reduce patient discomfort and procedural complications, facilitating broader screening in ambulatory care.

Integration with wearable sensors allows continuous monitoring, supporting proactive management in chronic conditions like heart failure. Key developments include echocardiography-based tools that estimate volume shifts with high correlation to gold-standard methods, enhancing usability across specialties. Opportunities lie in collaborations between developers and hospitals to validate these modalities against invasive benchmarks, potentially accelerating regulatory approvals.

Emerging markets in home health could further expand reach, empowering remote volume assessments for high-risk patients. As accuracy improves through algorithmic refinements, adoption in emergency departments rises, streamlining triage processes. These technologies also align with value-based care by lowering complication rates and hospital readmissions. Overall, they herald a shift toward safer, scalable solutions that democratize advanced diagnostics.

Impact of Macroeconomic / Geopolitical Factors

Economic expansion and rising healthcare spending fuel the blood volume analyzer market, as hospitals and clinics prioritize accurate tools to manage critical conditions in trauma, surgery, and chronic disease care. Inflation, however, drives up costs for precision components and reagents, which forces manufacturers to raise prices and slows purchases in budget-constrained facilities. Geopolitical tensions, especially ongoing U.S.-China trade disputes, interrupt shipments of specialized electronics and sensors from Asia, which creates delays and higher freight expenses for global suppliers.

These same tensions, on the positive side, encourage Europe, India, and Southeast Asia to build their own production capabilities, which sparks fresh innovation and reduces dependence on any single region. Current U.S. tariffs add significant duties on imported medical diagnostic equipment, which increases landing costs and pressures smaller distributors serving American hospitals.

Yet, these measures strongly motivate U.S. companies to invest in domestic manufacturing lines, which creates local jobs and strengthens supply security. Despite short-term challenges, growing clinical demand and continuous technological improvement keep the blood volume analyzer market on a clear upward path with greater reliability and broader access ahead.

Latest Trends

The FDA Clearance of the BVA-200 Blood Volume Analyzer Is a Recent Trend

The FDA clearance of the BVA-200 Blood Volume Analyzer by Daxor Corporation on August 4, 2025, represents a significant recent trend toward automated, precise blood volume diagnostics. This device provides quantitative measurements of total blood and plasma volumes through an automated system, streamlining workflows in clinical laboratories. Classified under product code JWO for hematology applications, it builds on prior models by enhancing efficiency in sample processing and result generation.

The clearance confirms substantial equivalence to predicate devices, ensuring reliability for uses in anemia, heart failure, and surgical planning. Deployments in major hospitals have demonstrated reduced turnaround times, aiding faster therapeutic adjustments. This innovation addresses longstanding needs for objectivity in volume status evaluation, minimizing subjective estimations. Market analysts note its potential to integrate with electronic health records, fostering data-driven decisions.

The trend reflects broader momentum in diagnostic automation, with similar clearances anticipated for companion software. Early user feedback highlights improved accuracy in complex cases, such as polycythemia differentiation. In summary, the BVA-200 underscores 2025’s emphasis on technology-enhanced precision in blood volume analysis.

Regional Analysis

North America is leading the Blood Volume Analyzer Market

North America accounted for 37.3% of the overall market in 2024, and the region saw meaningful growth as hospitals expanded use of blood-volume assessment technologies to improve diagnosis of heart-failure–related congestion, unexplained hypotension, and perioperative fluid-management challenges. Cardiologists increased reliance on quantitative volume measurements to optimize diuretic therapy and strengthen precision-cardiology protocols.

Critical-care units adopted these systems to manage patients with sepsis, renal impairment, and hemodynamic instability. Growth accelerated as outpatient heart-failure clinics integrated volume-status testing to reduce avoidable hospital readmissions.

The American Heart Association reported 6.7 million adults living with heart failure in the United States in 2022 (AHA – “Heart Disease and Stroke Statistics 2023 Update”), and this expanding patient base significantly increased demand for accurate blood-volume assessment. Diagnostic manufacturers enhanced device portability and usability, driving broader clinical adoption. These combined factors reinforced the region’s strong market performance in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to observe strong growth during the forecast period as cardiovascular disease rises across rapidly urbanizing populations and clinicians prioritize early assessment of fluid imbalance in heart-failure and renal-disease patients. Hospitals expand hemodynamic-monitoring capabilities by integrating quantitative volume-analysis tools in cardiology, nephrology, and intensive-care departments. Government initiatives to reduce heart-failure mortality encourage adoption of diagnostic workflows that enable precise volume-management decisions.

Private diagnostic networks increase availability of advanced monitoring technologies across India, China, Japan, and Southeast Asia. Medical universities strengthen cardiovascular-research programs, increasing institutional demand for accurate measurement systems. The Japan Circulation Society reports approximately 1.2 million heart-failure patients nationally as of 2023 (JCS – Heart Failure Data Overview), underscoring a growing need for improved volume-status evaluation. Manufacturers enhance regional distribution channels, enabling wider clinical access. These developments collectively position Asia Pacific for sustained market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors boost growth in the blood-volume analysis sector by launching next-generation devices that deliver fast, accurate measurement of plasma, red-cell and total blood volume, thereby supporting fluid-management decisions in critical care and cardiology. They expand geographic coverage by forging distribution and service networks across emerging and established healthcare markets, tailoring supply-chain logistics and regulatory compliance to local needs.

They integrate blood-volume tools into broader hemodynamic monitoring systems and hospital ICU workflows to increase adoption beyond niche cardiology units into general critical-care settings. They emphasise improvements in ease-of-use and throughput, reducing operator burden and enabling frequent volume assessments even in resource-constrained settings. They pursue acquisition or partnership strategies with firms that offer complementary monitoring technologies or informatics tools, enabling bundled solutions to healthcare providers.

One leading company, Daxor Corporation, markets its FDA-cleared BVA-100 analyzer and capitalises on its precision radioisotope-dilution technology, global sales strategy and growing clinical adoption in cardiology, nephrology and critical-care environments to consolidate its position and support ongoing market expansion.

Top Key Players

- Sysmex Corporation

- Beckman Coulter, Inc.

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers AG

- Danaher Corporation

- HORIBA Ltd.

Recent Developments

- On January 3, 2025, Siemens Healthineers introduced the epoc blood analysis system, a portable device capable of generating a wide range of blood chemistry and physiological measurements in less than half a minute. The system allows clinicians to quickly assess fluid balance and blood volume status directly at the bedside.

- On March 4, 2025, Daxor Corporation revealed that it will introduce a new generation of its Blood Volume Analyzer later in 2025. The upcoming system is being developed to offer even more precise and objective insights into fluid management, supporting better care for patients in critical clinical situations.

Report Scope

Report Features Description Market Value (2024) US$ 5.1 Billion Forecast Revenue (2034) US$ 12.6 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Automated and Manual), By Test Type (Blood Clotting Test, Blood Enzyme Test, and Blood Chemistry Test), By End-user (Diagnostic Centers, Hospitals, Specialty Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Beckman Coulter, Inc., Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Inc., Siemens Healthineers AG, Danaher Corporation, HORIBA Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blood Volume Analyzer MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Blood Volume Analyzer MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- Beckman Coulter, Inc.

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers AG

- Danaher Corporation

- HORIBA Ltd.