Blood Gas and Electrolyte Analyzers Market By Product Type (Instruments (Bench-top and Portable) and Consumables), By End-user (Point-of-care, Clinical Laboratory, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 143713

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

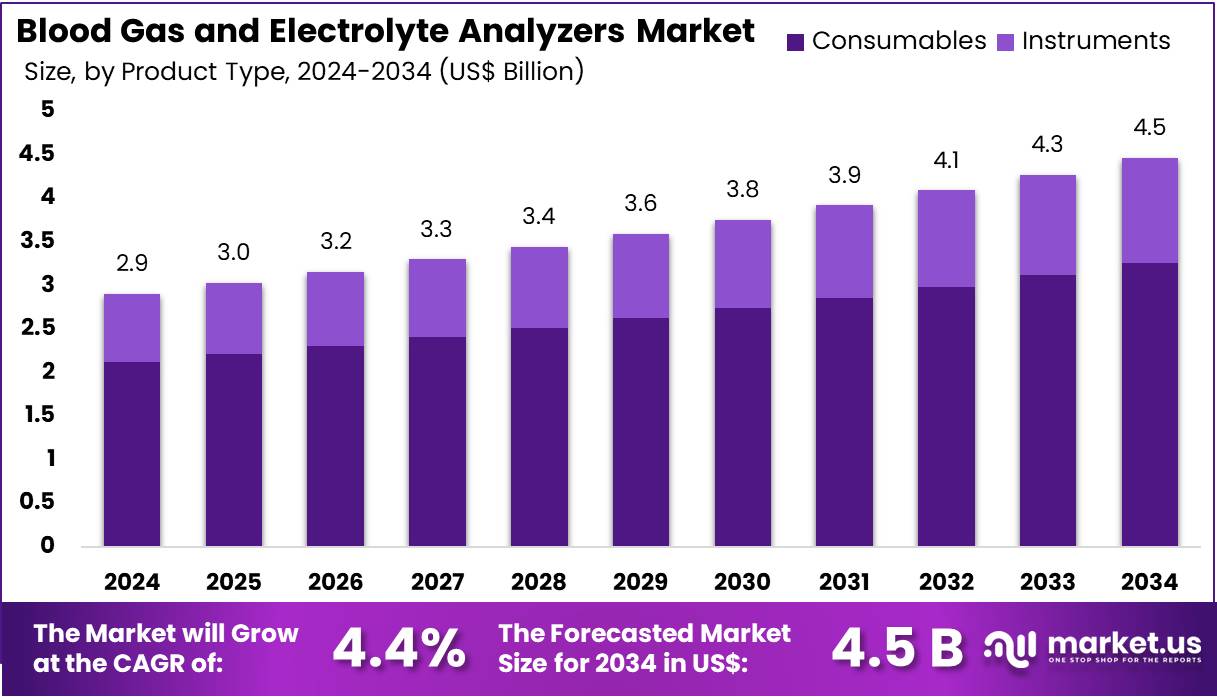

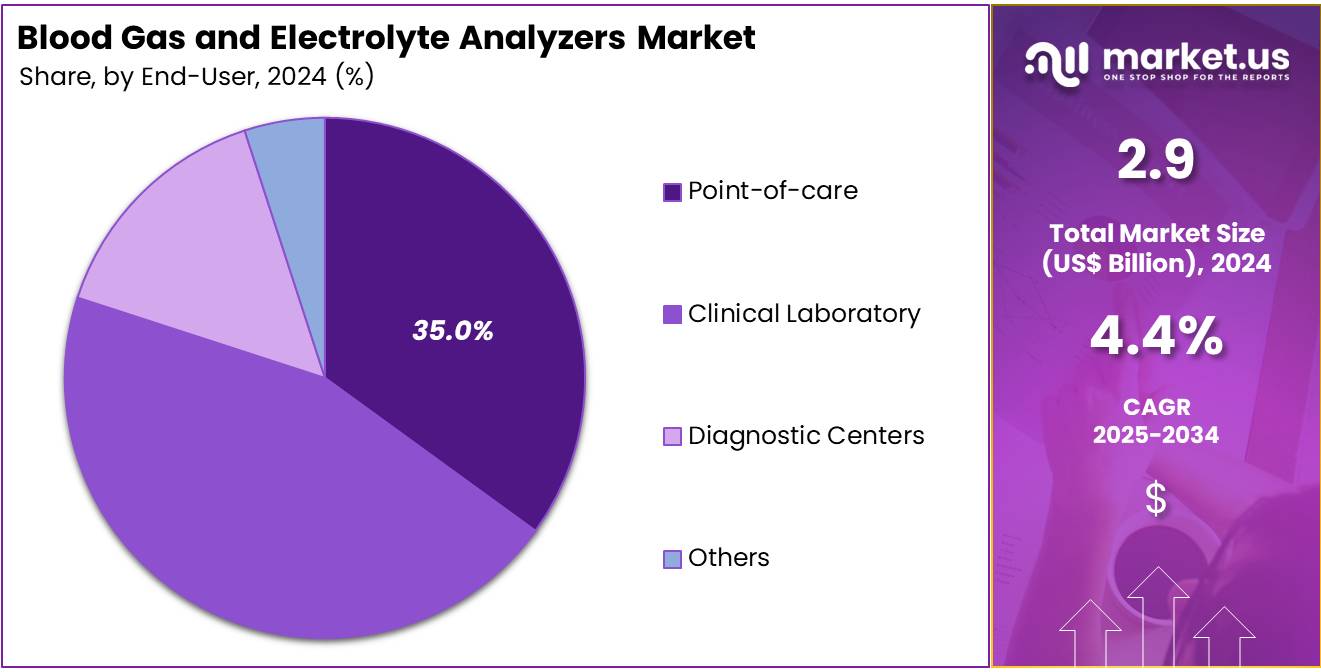

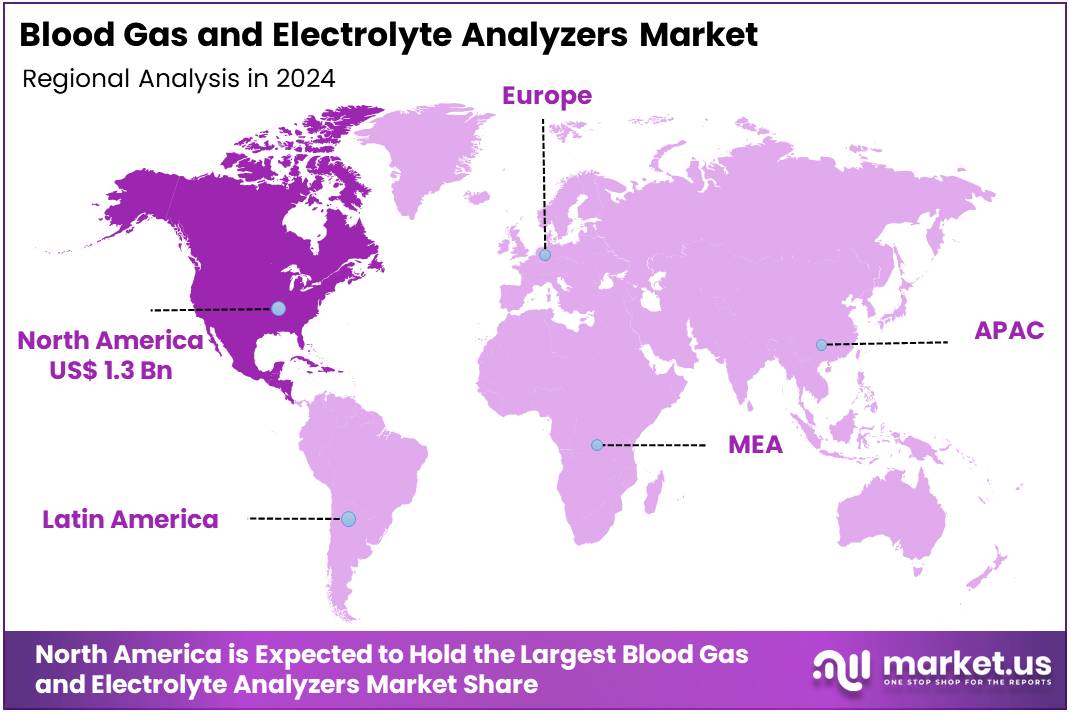

The Global Blood Gas and Electrolyte Analyzers Market size is expected to be worth around US$ 4.5 Billion by 2034, from US$ 2.9 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43% share and holds US$ 1.3 Billion market value for the year.

Increasing demand for accurate and rapid diagnostic tools in critical care settings drives the growth of the blood gas and electrolyte analyzers market. These analyzers play a vital role in measuring parameters such as pH, oxygen, carbon dioxide, and electrolytes, which are essential for assessing a patient’s respiratory, metabolic, and acid-base balance.

The rising prevalence of chronic diseases, including diabetes and cardiovascular conditions, and the growing need for advanced diagnostics in emergency medicine create ample opportunities for market expansion. Technological advancements in portable and point-of-care devices have made blood gas and electrolyte testing more accessible and efficient.

In September 2021, Sensa Core Medical Instrumentation launched the ST-200CC Blood Gas Analyzer, a state-of-the-art device designed to enhance diagnostic accuracy and efficiency in hospitals, clinics, and diagnostic centers. This innovation reflects the trend toward improving healthcare delivery by providing faster and more reliable results, ultimately contributing to better patient outcomes in critical care settings.

Key Takeaways

- In 2023, the market for blood gas and electrolyte analyzers generated a revenue of US$ 2.9 billion, with a CAGR of 4.4%, and is expected to reach US$ 4.5 billion by the year 2033.

- The product type segment is divided into instruments and consumables, with consumables taking the lead in 2023 with a market share of 73%.

- Considering end-user, the market is divided into point-of-care, clinical laboratory, diagnostic centers, and others. Among these, clinical laboratory held a significant share of 35%.

- North America led the market by securing a market share of 43.2% in 2023.

Product Type Analysis

The consumables segment led in 2023, claiming a market share of 73% as healthcare providers increasingly rely on these devices for routine diagnostics and monitoring. Consumables, such as reagents, electrodes, and calibration solutions, are critical for the accurate functioning of blood gas and electrolyte analyzers.

The growing prevalence of chronic diseases, such as respiratory disorders, diabetes, and kidney diseases, which require frequent monitoring of blood gas and electrolyte levels, is likely to drive the demand for consumables. Additionally, as healthcare systems focus on improving diagnostic accuracy, reducing errors, and enhancing patient care, the demand for high-quality consumables is anticipated to increase, contributing to the growth of this segment.

End-User Analysis

The clinical laboratory held a significant share of 35% due to the critical role clinical laboratories play in diagnosing and monitoring various health conditions. Clinical laboratories are expected to remain the primary users of blood gas and electrolyte analyzers, as these devices are essential for assessing acid-base balance, electrolyte imbalances, and respiratory function in patients.

The increasing incidence of chronic diseases, such as cardiovascular diseases and kidney dysfunction, which require regular monitoring of blood gases and electrolytes, is likely to drive the demand for analyzers in clinical laboratories. Additionally, advancements in automation and the push for faster, more accurate test results are expected to further enhance the growth of this segment, as laboratories seek to improve efficiency and diagnostic precision.

Key Market Segments

By Product Type

- Instruments

- Bench-top

- Portable

- Consumables

By End-user

- Point-of-care

- Clinical Laboratory

- Diagnostic Centers

- Others

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market

The increasing prevalence of chronic diseases such as diabetes, kidney disorders, and respiratory illnesses is a major factor driving the blood gas and electrolyte analyzers market. According to the World Health Organization (WHO), chronic diseases caused approximately 74% of global deaths in 2022. Cardiovascular diseases and diabetes were among the leading contributors. The Centers for Disease Control and Prevention (CDC) reported that in 2023, over 37 million Americans had diabetes, while 96 million had prediabetes. This growing patient population has fueled the demand for frequent monitoring of blood gases and electrolytes.

The rising need for accurate and rapid diagnostic tools has led healthcare facilities to adopt advanced analyzers. These devices help in efficient disease management by providing real-time results. Companies such as Siemens Healthineers and Abbott Laboratories reported a 12-15% increase in sales of these devices in 2023. This growth reflects the rising demand for better diagnostic solutions. The integration of these analyzers into point-of-care settings has further boosted adoption, enabling timely clinical decisions.

The global demand for blood gas and electrolyte analyzers is expected to rise steadily. Government initiatives to combat chronic diseases support this trend. The shift toward point-of-care testing has improved patient outcomes by reducing diagnostic delays. Healthcare providers increasingly prefer these analyzers due to their efficiency and reliability. Advancements in technology continue to enhance their accuracy and ease of use. With chronic disease cases rising worldwide, the market for these diagnostic devices is likely to expand further in the coming years.

Restraints

High Costs of Advanced Analyzers are Restraining the Market

The high costs associated with advanced blood gas and electrolyte analyzers are a major restraint for market growth. These devices, especially those equipped with cutting-edge technology, can cost upwards of US$ 20,000, making them unaffordable for smaller healthcare facilities and clinics. A 2023 report by the Indian Council of Medical Research (ICMR) highlighted that nearly 40% of hospitals in tier-2 and tier-3 cities in India lacked access to such devices due to the high costs.

The expense of the devices, coupled with the additional costs for maintenance and consumables, makes it difficult for low- and middle-income countries, where healthcare budgets are already strained, to adopt these technologies. For example, in India, many public hospitals and smaller private clinics are unable to afford these advanced analyzers, which limits access to critical diagnostics.

While manufacturers are working on more cost-effective solutions, the high initial investment remains a significant barrier, particularly in resource-limited settings. As a result, there is a pressing need for affordable, scalable alternatives to ensure that a wider range of healthcare facilities can access these essential diagnostic tools.

Opportunities

Technological Advancements are Creating Growth Opportunities

Technological advancements in the field of blood gas and electrolyte analyzers are creating significant growth opportunities for the market. Innovations such as portable devices, wireless connectivity, and integration with electronic health records (EHRs) have enhanced the usability and efficiency of these analyzers. For example, in 2023, Radiometer launched the ABL90 FLEX PLUS, a compact analyzer with wireless capabilities, which saw a 20% increase in sales within the first year of its release.

Similarly, the introduction of artificial intelligence (AI)-enabled analyzers by companies like Roche Diagnostics has improved diagnostic accuracy and reduced turnaround times. The US Food and Drug Administration (FDA) has approved several AI-based diagnostic devices in recent years, reflecting the growing acceptance of these technologies. These advancements are particularly beneficial for emergency and critical care settings, where rapid and accurate results are crucial. Furthermore, the increasing adoption of telehealth and remote monitoring solutions has opened new avenues for the integration of these analyzers into digital healthcare ecosystems, driving market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have significantly influenced the blood gas and electrolyte analyzers market. Economic growth in emerging markets, such as India and China, has increased healthcare spending, enabling greater adoption of advanced diagnostic tools. For instance, China’s healthcare expenditure grew by 8.5% in 2023, according to the National Bureau of Statistics.

However, geopolitical tensions, such as the Russia-Ukraine conflict, have disrupted supply chains, leading to increased costs and delays in the delivery of critical components. Inflation and currency fluctuations have also impacted pricing strategies, with companies like Roche and Abbott adjusting their product costs by 5-7% in 2023.

On the positive side, government initiatives and funding for healthcare infrastructure development, particularly in developing regions, have created new opportunities. For example, the Indian government allocated US$ 10 billion to healthcare infrastructure in its 2023 budget, boosting the adoption of advanced diagnostic devices. Despite challenges, the market remains resilient, driven by technological advancements and the growing demand for efficient diagnostic solutions. The focus on improving healthcare access and outcomes in underserved regions will continue to propel market growth in the coming years.

Latest Trends

Rising Adoption of Point-of-Care Testing is a Recent Trend

A recent trend in the blood gas and electrolyte analyzers market is the increasing adoption of point-of-care testing (POCT) devices. These devices offer the advantage of providing immediate results at the patient’s bedside, reducing the need for sample transportation and minimizing delays in diagnosis. According to the National Health Service (NHS) in the UK, the POCT segment accounted for over 35% of the total market share in 2022, with a significant increase in usage in emergency departments.

Companies like Abbott and Siemens have been at the forefront of this trend, with Abbott’s i-STAT system witnessing a 25% increase in sales in 2023. The COVID-19 pandemic further accelerated the adoption of POCT devices, as healthcare providers sought to reduce hospital stays and improve patient outcomes. In 2023, the NHS reported a 30% increase in the use of POCT devices in emergency departments. This trend is expected to continue, driven by the growing emphasis on decentralized testing and the need for faster diagnostic solutions in critical care settings.

Regional Analysis

North America is leading the Blood Gas and Electrolyte Analyzers Market

North America dominated the market with the highest revenue share of 43.2% owing to advancements in healthcare infrastructure, increasing prevalence of chronic diseases, and rising demand for point-of-care testing. According to the Centers for Disease Control and Prevention (CDC), the prevalence of chronic respiratory diseases, such as COPD, has risen by 8% in the U.S. between 2022 and 2024, necessitating frequent monitoring of blood gases and electrolytes.

Additionally, the National Institutes of Health (NIH) reported a 12% increase in emergency room visits related to acute kidney injury during this period, further boosting the demand for rapid diagnostic tools. Technological innovations, such as the integration of artificial intelligence in analyzers by companies like Siemens Healthineers and Abbott Laboratories, have enhanced diagnostic accuracy and efficiency.

The U.S. Food and Drug Administration (FDA) approved over 15 new analyzer models in 2023 alone, reflecting the rapid pace of innovation. Government initiatives, such as the Medicare expansion for diagnostic testing coverage, have also played a pivotal role in market growth. For instance, the Centers for Medicare & Medicaid Services (CMS) reported a 10% increase in reimbursements for blood gas and electrolyte tests in 2023 compared to 2022. These factors, combined with the growing adoption of portable analyzers in home healthcare settings, have solidified North America’s position as a leading market for these devices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding healthcare access, rising healthcare expenditure, and increasing awareness of early disease diagnosis. The World Health Organization (WHO) reported a 15% increase in government healthcare spending across Southeast Asia between 2022 and 2024, with countries like India and China leading the way. The Indian Ministry of Health and Family Welfare highlighted a 20% rise in the adoption of advanced diagnostic tools in public hospitals during this period.

Similarly, the National Health Commission of China announced the installation of over 5,000 new analyzers in rural healthcare facilities in 2023, addressing the growing demand for critical care diagnostics. The region is also expected to benefit from the increasing burden of lifestyle-related diseases, such as diabetes and hypertension.

Additionally, collaborations between global players like Roche Diagnostics and local manufacturers have facilitated the introduction of cost-effective analyzers tailored to regional needs. The Japanese Ministry of Health, Labour, and Welfare reported a 12% increase in the use of point-of-care testing devices in 2023, reflecting the shift towards decentralized diagnostics. These trends, coupled with ongoing investments in healthcare infrastructure, are projected to propel the market’s growth in the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the blood gas and electrolyte analyzers market focus on technological innovation, product differentiation, and expanding their global presence to drive growth. They invest in the development of advanced analyzers with enhanced accuracy, faster results, and improved ease of use to meet the evolving needs of healthcare providers.

Companies also expand their service offerings to include integrated solutions that streamline testing processes and improve clinical decision-making. Strategic partnerships with hospitals and diagnostic centers help enhance product adoption. Additionally, they target emerging markets with growing healthcare infrastructure to increase their market share and reach new customer bases.

Abbott Laboratories, headquartered in Abbott Park, Illinois, is a global leader in healthcare and diagnostic solutions. The company offers a range of blood gas and electrolyte analyzers, including the i-STAT system, which provides rapid and accurate results at the point of care.

Abbott focuses on innovation by integrating advanced technologies, such as handheld devices and cloud-based data analytics, to improve clinical outcomes. The company continues to expand its global footprint, focusing on emerging markets and offering comprehensive solutions to healthcare providers worldwide. Through strategic acquisitions and partnerships, Abbott maintains its leadership in the diagnostics sector.

Top Key Players in the Blood Gas and Electrolyte Analyzers Market

- Werfen

- Radiometer Medical

- Medica Corporation

- LifeHealth

- Hoffmann-La Roche Ltd

- Erba Mannheim

- B&E BIO-TECHNOLOGY CO., LTD

- Abbott

Recent Developments

- In May 2024, Radiometer formed a collaboration with Etiometry to improve clinical decision-making and streamline workflows in healthcare settings. By integrating Radiometer’s acute care diagnostic tools with the Etiometry platform, the partnership aims to enhance blood gas analysis in critical care environments.

- In June 2023, B&E BIO-TECHNOLOGY CO., LTD. introduced the i-Check handheld blood gas electrolyte analyzer, designed to advance point-of-care testing capabilities, making it easier to perform critical blood gas analysis in various healthcare settings.

Report Scope

Report Features Description Market Value (2024) US$ 2.9 billion Forecast Revenue (2034) US$ 4.5 billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments (Bench-top and Portable) and Consumables), By End-user (Point-of-care, Clinical Laboratory, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Werfen, Radiometer Medical, Medica Corporation, LifeHealth, F. Hoffmann-La Roche Ltd, Erba Mannheim, B&E BIO-TECHNOLOGY CO., LTD, and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blood Gas and Electrolyte Analyzers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Blood Gas and Electrolyte Analyzers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Werfen

- Radiometer Medical

- Medica Corporation

- LifeHealth

- Hoffmann-La Roche Ltd

- Erba Mannheim

- B&E BIO-TECHNOLOGY CO., LTD

- Abbott