Global Blockchain Technology in Energy Market By Technology (Public Blockchain, Private Blockchain, Consortium/Hybrid Blockchain), By Application (Energy Trading and Peer-to-Peer (P2P) Transactions, Grid Management and Optimization, Supply Chain Management, Billing and Settlement, Asset Financing and Tokenization), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119682

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

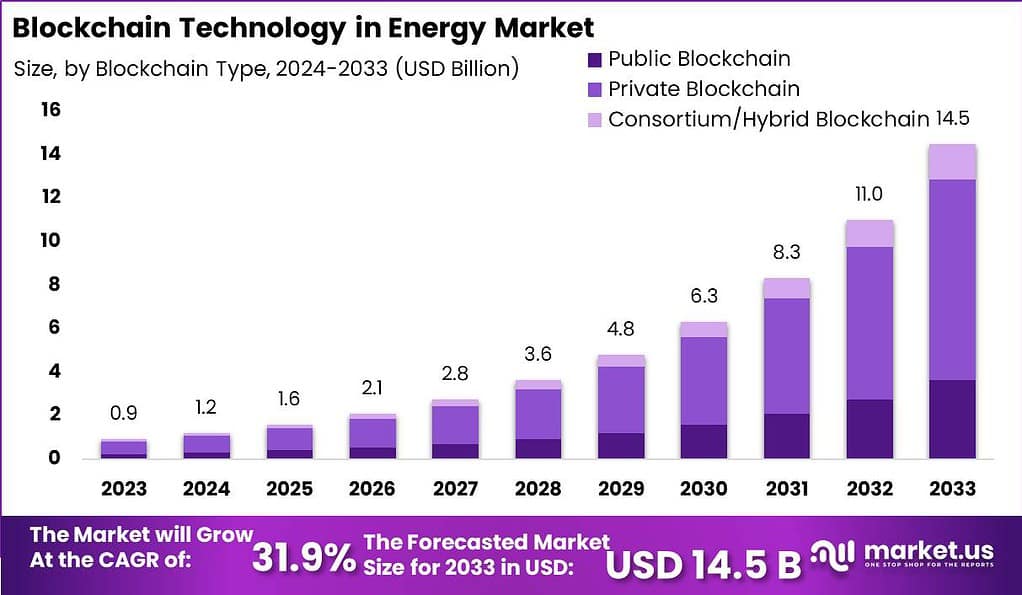

The Global Blockchain Technology in Energy Market size is expected to be worth around USD 14.5 Billion By 2033, from USD 0.9 Billion in 2023, growing at a CAGR of 31.9% during the forecast period from 2024 to 2033.

Blockchain technology in the energy sector involves the use of a decentralized and digital ledger that records all transactions across a network of computers. This technology provides a transparent, efficient, and secure way of managing data, which can be particularly beneficial in areas such as renewable energy distribution, smart grids, and energy trading.

The market for blockchain technology in the energy sector is growing rapidly due to the increasing demand for grid management, supply chain efficiency, and the integration of renewable energy sources. Key factors driving this market include the need for improved security in transactions, the decentralization of energy systems, and the potential for blockchain to reduce operational costs.

Companies and startups are investing in blockchain applications that can handle energy trading, manage renewable energy credits, and optimize utility operations. The market is also supported by governmental policies encouraging digitalization and sustainability in energy systems, suggesting a positive growth outlook for blockchain technology in this field.

Key Takeaways

- Blockchain technology in the energy market was valued at USD 0.91 billion in the year 2023. The market is estimated to reach USD 14.5 billion in the year 2033 with a CAGR of 31.9% during the forecast period 2024-2033.

- Based on its application, the blockchain technology in energy market is divided into Energy Trading and Peer-to-Peer (P2P) Transactions, Grid Management and Optimization, Supply Chain Management, Billing and Settlement, and Asset Financing and Tokenization segment where the Energy Trading and Peer-to-Peer (P2P) Transactions segment has dominated the market with a share of 35.1% in the year 2023.

- On segmenting based on the blockchain type, the market is segmented into Public Blockchain, Private Blockchain, and Consortium/Hybrid Blockchain segments. The private blockchain segment dominated the market with a share of 63.7% in the year 2023.

- In 2023, North America held a dominant market position in the blockchain technology in the energy market, capturing more than a 32.8% share.

Blockchain Type Analysis

On segmenting by blockchain type, the blockchain technology in energy market is divided into Public Blockchain, Private Blockchain, and Consortium/Hybrid Blockchain segments. Amongst these, the private blockchain segment has the largest market share of 63.7% in the year 2023.

Energy firms focus on security and privacy which increases the demand for private blockchain solutions. It keeps the sensitive information inside reliable networks due to the presence of restricted access features. Energy transactions require scalability and higher performance, and thus private blockchains are highly demanded by businesses.

In a private setting, regulatory compliance is simpler to maintain, ensuring adherence to rules and industry norms. Furthermore, private blockchain save expenses by enabling smooth interaction with current infrastructure. The demand for private blockchain in the energy sector is further strengthened by their capacity to be tailored in terms of functionality and governance structures to satisfy industry-specific requirements.

Application Analysis

Based on application, the Blockchain technology in the energy market is segmented into Energy Trading and Peer-to-Peer (P2P) Transactions, Grid Management and Optimization, Supply Chain Management, Billing and Settlement, and Asset Financing and Tokenization segment. Among these, the Energy Trading and Peer-to-Peer (P2P) Transactions segment has dominated the market with a share of 35.1% in the year 2023.

Emphasis on the generation of renewable energy, such as wind, solar, and ocean energy will greatly aid in the system’s development and promote the production and availability of renewable energy. Apart from the high degree of standardization generated, pre-transaction visibility helps in improving the state of the market.

Further Grid Management and Optimization segment is expected to register a rapid growth in the market during the forecast period as cost-effective transactions are possible by shared grid transactions. The use of smart grid technologies, rising energy consumption, and legislative reforms that promote cheaper energy access contribute to enhancing the market environment.

Key Market Segments

By Blockchain Type

- Public Blockchain

- Private Blockchain

- Consortium/Hybrid Blockchain

By Application type

- Energy Trading and Peer-to-Peer (P2P) Transactions

- Grid Management and Optimization

- Supply Chain Management

- Billing and Settlement

- Asset Financing and Tokenization

Drivers

Increasing demand for decentralized and sustainable energy resources to fuel the market growth

The increasing utilization of decentralized and sustainable energy resources, such as microgrids, solar panels, and wind turbines, is a significant driving force behind the advancement of blockchain technology in the energy industry. These sources have excess energy that can be used on the blockchain platform to trade with other users or network operators.

Blockchain technology allows for decentralized energy trade, thus enabling direct consumer-to-consumer transactions free from middlemen. This encourages an energy economy that is more democratic and efficient. By tracking and validating carbon credits and renewable energy certificates, blockchain technology can lower greenhouse gas emissions and promote the growth of sustainable energy sources.

Restrains

Laws and regulations concerning energy utilization in the energy sector are a restraining the market growth

Blockchain is an innovative and rapidly developing technology, however, it presents different legal and regulatory challenges to the energy sector faces. The energy laws and policies are created specifically for conventional and centralized energy systems. They might not be compatible with the decentralized energy solutions that blockchain technology enables.

Moreover, the scalability and acceptance of blockchain technology in the energy sector may be hampered by the lack of consistency and balance among various blockchain platforms and protocols. To safeguard consumer rights, data privacy, and network security, it is crucial to create transparent and consistent regulations and standards that encourage the development and application of blockchain technology in the energy industry.

Opportunities

Decentralization of the energy market presents a huge opportunity for the market to grow

Energy market decentralization is one of the main opportunities for Blockchain technology in the energy market. Energy markets used to be centralized, with a few companies in charge of producing, distributing, and selling electricity. However, by enabling peer-to-peer energy trading and the development of microgrids, blockchain technology has the potential to decentralize the energy markets.

Without depending on a centralized power company, businesses, and people can buy and sell electricity directly with one another through peer-to-peer energy trading. Blockchain-based platforms enable the exchange of energy and settlement of payments between these parties safely and transparently. By facilitating peer-to-peer energy trade, blockchain technology can boost the resilience and dependability of energy networks and open up new revenue streams for both producers and consumers.

Challenges

Scalability constraints of the technology is hampering the market growth

There are several challenges faced by blockchain technology in the energy market. One of the main challenges is scalability, as the current blockchain systems are not able to manage the volume of transactions needed for energy trading on a big scale. Furthermore, many blockchain networks are unable to handle energy transactions at high speeds.

It ensuring the balance between various blockchain platforms and current systems is also challenging since the energy sector has several participants using a wide range of technologies. Furthermore, there are challenges in the implementation of this technology due to differing rules across jurisdictions, compliance issues, and regulatory ambiguity. To integrate blockchain technology in the energy markets, addressing these issues with creative solutions, cooperative efforts from players, and well-defined rules is crucial.

Latest Trends

Increasing automation

Organizations are adopting infrastructure changes to lower the total capital requirement and are switching to blockchain-based software due to the growing automation of energy utilities. Energy companies can potentially benefit from the use of blockchain-based infrastructure and solutions to enhance their overall production processes.

Energy businesses can evaluate and make decisions based on vast volumes of data generated by new electricity customers, such as connected houses and electric vehicles, as well as new communication devices, like smart meters, sensors, and remote control devices. In an ever-changing energy market, blockchain technology can also assist electric utilities in achieving higher efficiency and dependability while preserving a balance between production and consumption.

Regional Analysis

In 2023, North America held a dominant market position in the blockchain technology in the energy market, capturing more than a 32.8% share. This substantial market share can be attributed to several key factors. Primarily, the region has a robust technological infrastructure and a high degree of digitalization within its energy sectors. These conditions are conducive for the adoption and integration of blockchain technology.

Furthermore, significant investments and supportive government policies regarding renewable energy and technology innovation have spurred the deployment of blockchain solutions across various energy operations. The presence of major technology players and startups focused on blockchain applications in energy management and trading significantly contributes to the market’s growth in this region.

For instance, initiatives aimed at improving grid management and facilitating transparent and efficient energy trading using blockchain platforms are more prevalent in North America compared to other regions. This proactive approach not only enhances operational efficiencies but also promotes sustainability through better integration of renewable energy sources.

Additionally, North America’s drive towards achieving energy independence and reducing carbon footprints has led to an increased adoption of blockchain to ensure traceability and reliability in renewable energy distribution. The trend towards decentralized energy systems in the U.S. and Canada further boosts the demand for blockchain applications, enabling peer-to-peer energy transactions and enhancing consumer engagement in the energy market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the evolving landscape of the global energy market, blockchain technology is emerging as a pivotal innovation, offering transformative solutions for enhancing efficiency, transparency, and reliability in various energy-related transactions. Key players in this market are actively exploring blockchain applications to revolutionize energy trading, grid management, and renewable energy sourcing.

Prominent among these players is Power Ledger, an Australian technology company that has pioneered the use of blockchain for energy and environmental commodity trading. The platform enables the buying and selling of electricity in real-time and has been successfully implemented in several countries. Another significant player, WePower, based in Europe, leverages blockchain technology to connect energy producers directly with consumers, facilitating the purchase of renewable energy through smart contracts.

Top Key Players in the Market

- IBM Corporation

- Microsoft

- Accenture

- ConsenSys

- Infosys

- Drift

- Electron

- LO3 Energy

- Power Ledger

- Siemens

- Yuanguang Software

- WePower

- Other Key Players

Recent Developments

- In August 2023, Powerledger launched a public blockchain for the energy sector application with effective scalability, security, and energy efficiency for the public.

- In July 2023, Fujitsu and IHI, one of the well known Japanese engineering corporation, collaboratively launched a joint blockchain project that was intended for the future development of the environmental value exchange market.

Report Scope

Report Features Description Market Value (2023) USD 0.9 Bn Forecast Revenue (2033) USD 14.5 Bn CAGR (2024-2033) 31.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Public Blockchain, Private Blockchain, Consortium/Hybrid Blockchain), By Application (Energy Trading and Peer-to-Peer (P2P) Transactions, Grid Management and Optimization, Supply Chain Management, Billing and Settlement, Asset Financing and Tokenization) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Microsoft, Accenture, ConsenSys, Infosys, Drift , Electron, LO3 Energy, Power Ledger , Siemens , Yuanguang Software, WePower, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is blockchain technology?Blockchain is a decentralized digital ledger technology that enables secure, transparent, and tamper-proof recording of transactions across a network of computers.

How big is Blockchain Technology in Energy Market?The Global Blockchain Technology in Energy Market size is expected to be worth around USD 14.5 Billion By 2033, from USD 0.9 Billion in 2023, growing at a CAGR of 31.9% during the forecast period from 2024 to 2033.

Who are the prominent players operating in the blockchain in energy market?The major players operating in the blockchain in energy market are IBM, Microsoft, Accenture, ConsenSys, Infosys, Drift , Electron, LO3 Energy, Power Ledger , Siemens , Yuanguang Software, WePower, Other Key Players

Which are the driving factors of the blockchain in energy market?The driving factors of blockchain in the energy market include increased decentralization, improved transparency, enhanced security, cost reduction, and the facilitation of peer-to-peer energy trading.

How does blockchain technology apply to the energy market?In the energy market, blockchain technology can be used to create transparent, secure, and efficient systems for various processes such as energy trading, supply chain management, peer-to-peer energy trading, grid management, and renewable energy certificate (REC) tracking.

Blockchain Technology In Energy MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Blockchain Technology In Energy MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft

- Accenture

- ConsenSys

- Infosys

- Drift

- Electron

- LO3 Energy

- Power Ledger

- Siemens

- Yuanguang Software

- WePower

- Other Key Players