Global Blockchain Distributed Ledger Market Size, Share Report By Components (Solution, Service), By Deployment (Private, Public, Hybrid), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Applications (Payments, Smart Contracts, Supply Chain Management, Compliance Management, Trade Finance, Others), By End Use Industries (Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Manufacturing, Retail and E-Commerce, Media and Entertainment, Transportation and Logistics, Healthcare, Energy and Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153681

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- Growth Factors

- By Components

- By Deployment

- By Enterprise Size

- By Applications

- By End-Use Industry

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

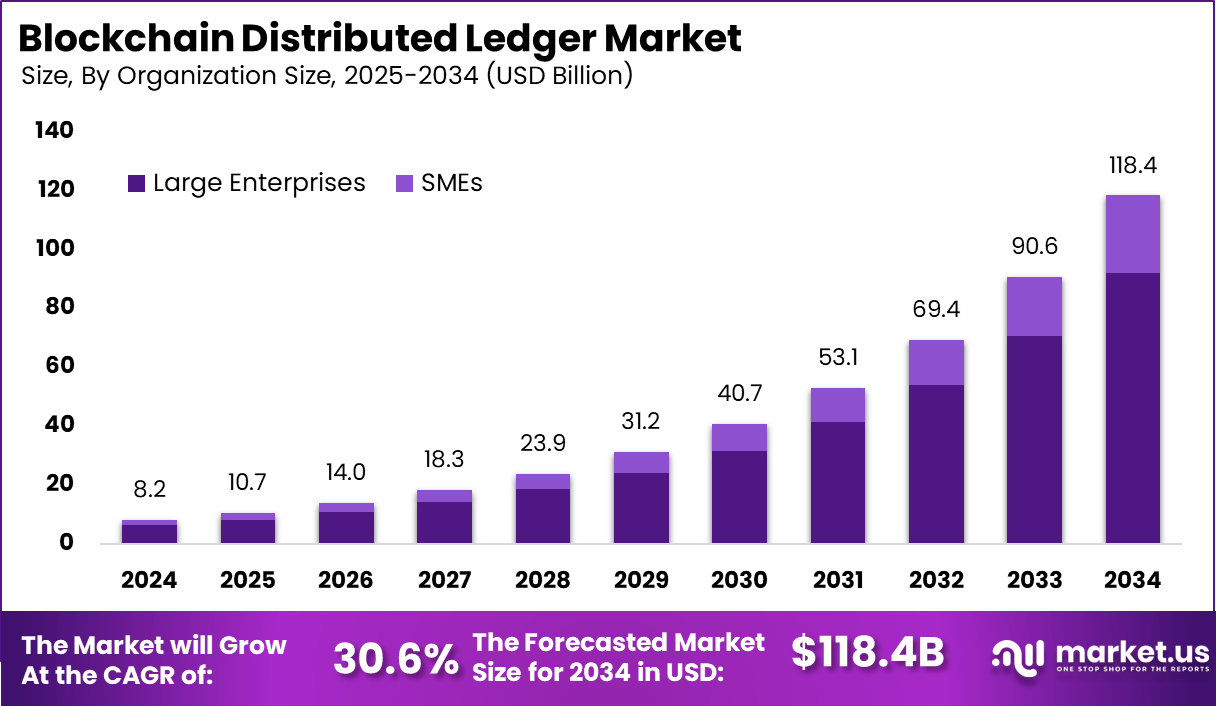

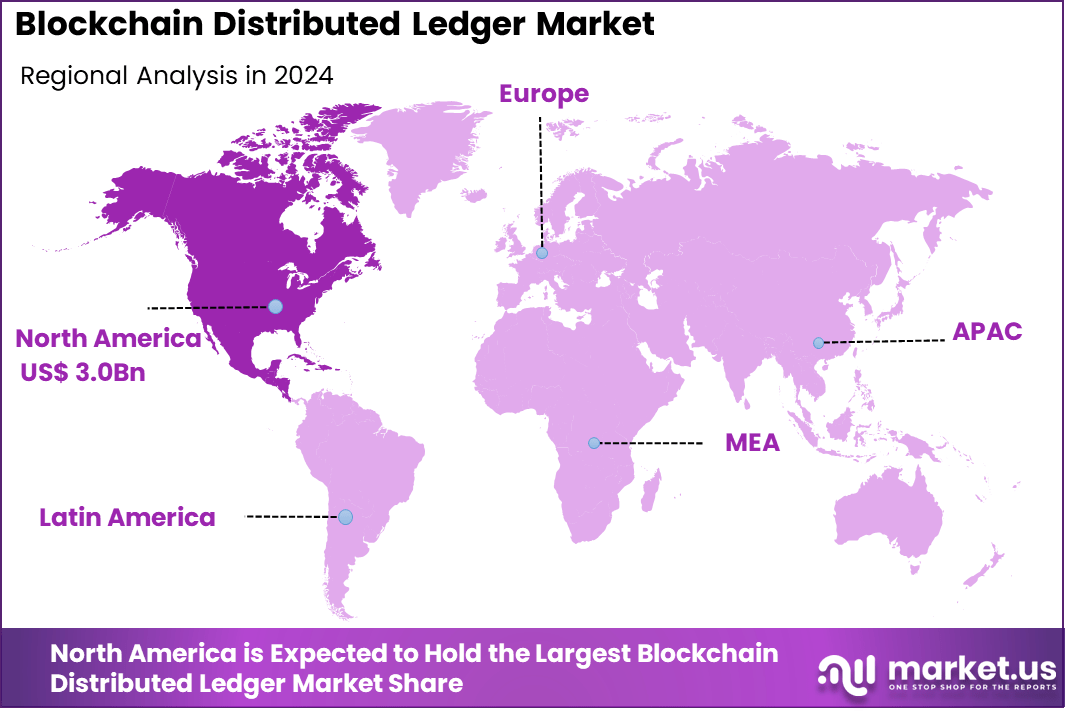

The Global Blockchain Distributed Ledger Market size is expected to be worth around USD 118.4 Billion By 2034, from USD 8.2 billion in 2024, growing at a CAGR of 30.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.3% share, holding USD 3.0 Billion revenue.

The Blockchain Distributed Ledger Market encompasses the provision of infrastructure, platforms, and consultancy that enable organizations to deploy and manage distributed ledger systems. These services span architecture design, system integration, governance frameworks, consensus mechanism configuration, and operational support to enterprise and consortium networks.

The market is characterized by adoption across financial services, supply chains, identity systems, and government initiatives. It supports permissioned, public, and hybrid blockchain models tailored to use‑case and compliance needs. Top driving factors include the growing need for secure and transparent data recordation, the rise of decentralized finance (DeFi) and cross-border payment solutions, and the demand for enhanced traceability in supply chains.

DeFi expands usage by enabling financial services via smart contracts without intermediaries, and blockchain reduces transaction costs and increases trust in workflows. Technologies increasingly adopted include smart contract platforms, scalable consensus models (such as energy‑efficient proof of stake), interoperable ledgers, and tokenization frameworks. Asset tokenization – representing securities, real estate, or commodities as digital tokens – is gaining attention as it promises improved liquidity and market access.

Scope and Forecast

Report Features Description Market Value (2024) USD 8.2 Bn Forecast Revenue (2034) USD 118.4 Bn CAGR (2025-2034) 30.6% Largest Segment Large Enterprises (77.8%) Largest Market North America [37.3% Market Share] Largest Country U.S. [USD 2.44 Bn Market Revenue] Key Insight Summary

- The global market is projected to grow at a 30.6% CAGR from 2025 to 2034. Rising demand for secure and transparent transactions is driving growth.

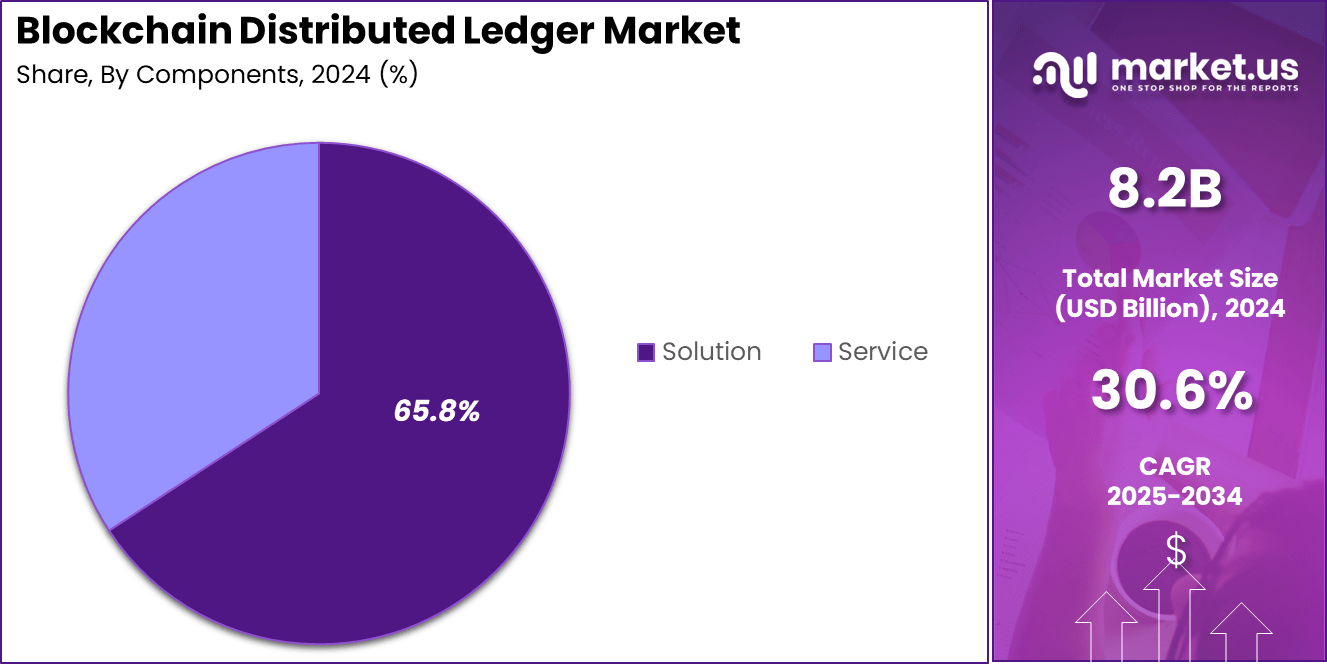

- The solution segment dominated by components, holding 65.8% share. Businesses prefer ready-to-deploy blockchain platforms.

- Public deployment held 45.8% share. Open blockchain networks are gaining traction for financial and identity verification use cases.

- Large enterprises made up 77.8% of users. These firms are leading in blockchain adoption due to large-scale operations and data security needs.

- By application, payments led with 28.6% share. Cross-border payments and real-time settlements are key drivers.

- The BFSI sector was the top end-user, holding 30.4% share. This industry invests heavily in blockchain for fraud reduction and transaction efficiency.

US Market Size

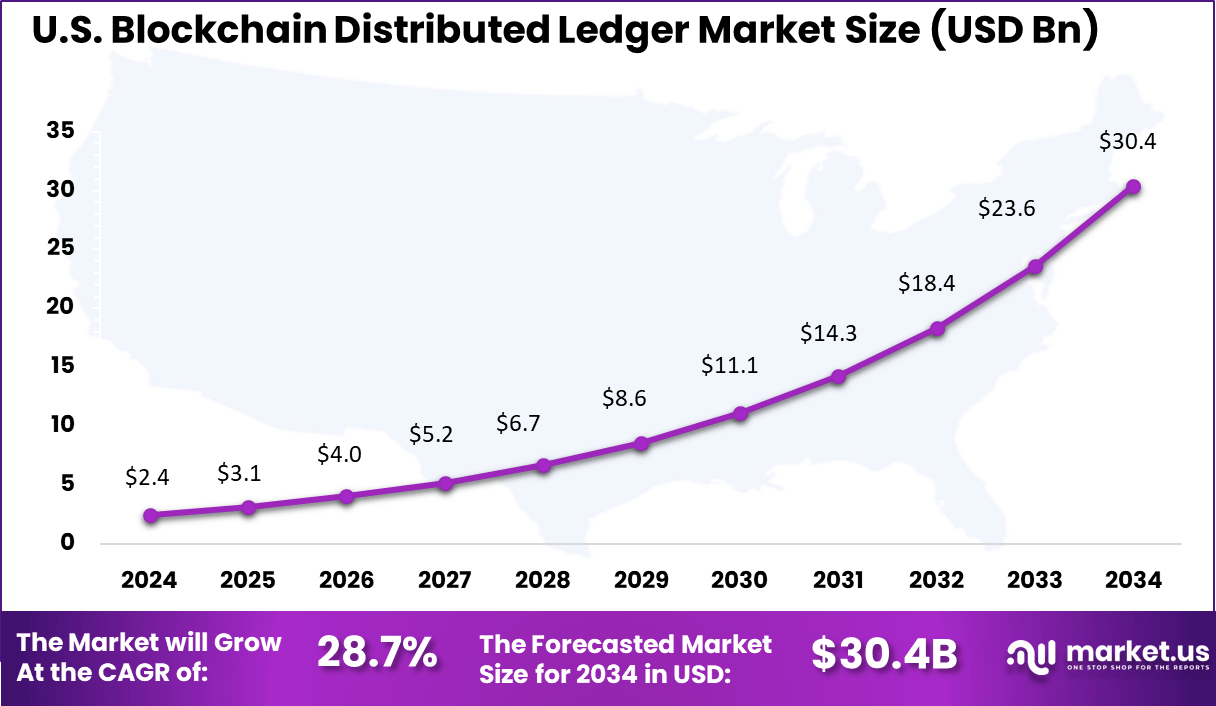

The U.S. Blockchain Distributed Ledger Market was valued at USD 2.4 Billion in 2024 and is anticipated to reach approximately USD 30.4 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 28.7% during the forecast period from 2025 to 2034.

The U.S. leads the Blockchain Distributed Ledger Market due to its robust innovation ecosystem, strong regulatory groundwork, and high enterprise adoption across critical sectors. A significant driver of this leadership is the early integration of blockchain technology by financial institutions, government agencies, and large corporations, aiming to improve transparency, reduce operational friction, and enhance transaction security.

In 2024, North America held a dominant market position, capturing more than a 37.3% share, holding USD 3 Billion in revenue. This regional leadership is primarily driven by the widespread adoption of blockchain across financial services, government operations, healthcare systems, and logistics networks in the United States and Canada.

Major institutions are integrating distributed ledger technology (DLT) to streamline data verification, increase operational transparency, and reduce transaction costs. In particular, U.S. banks and fintechs have been early movers in piloting blockchain for digital asset custody, cross-border settlement, and decentralized finance (DeFi) initiatives.

The region’s advantage also stems from a combination of policy support, mature digital infrastructure, and active investment. North America is home to a dense concentration of blockchain development companies, academic research hubs, and venture capital networks that continue to fund innovation at scale.

Regulatory agencies, including the SEC and CFTC, have laid foundational rules to legitimize and guide blockchain use while safeguarding against misuse. This blend of innovation, funding, and regulatory clarity gives North America a stable environment for blockchain deployment, making it the largest and most influential contributor to the global blockchain distributed ledger market.

Growth Factors

Growth Factor Description Demand for Transparent and Secure Transactions Increasing need for tamper-evident, transparent ledgers that reduce fraud and build trust in industries such as finance and healthcare. Digital Transformation Across Industries Adoption driven by organizations digitizing operations, automating workflows, and seeking streamlined, fraud-resistant processes. Growth in Decentralized Finance (DeFi) and Tokenization Expansion of decentralized finance platforms and asset tokenization enabling new models for investment and ownership. Regulatory Support and Industry Adoption Evolving regulatory frameworks and endorsements by enterprises provide confidence and accelerate blockchain implementation. Enhanced Supply Chain and Data Traceability Use of blockchain to improve end-to-end visibility, quality assurance, and counterfeiting prevention in supply chain management. By Components

In 2024, solutions dominate the blockchain distributed ledger market, accounting for 65.8% of the segment. Organizations are increasingly adopting comprehensive blockchain solutions that integrate various functionalities, enabling secure, transparent, and efficient digital transactions. These solutions play a crucial role in simplifying complex workflows, ensuring data integrity, and reducing operational costs.

Businesses favor ready-to-deploy blockchain solutions that facilitate easier implementation and faster returns on investment. Consulting firms and technology vendors are focusing on delivering customizable, scalable blockchain platforms that support diverse enterprise needs, making solutions the cornerstone of blockchain adoption.

By Deployment

Public blockchain deployments hold a significant 45.8% share in 2024, reflecting the growing preference for decentralized and open-access networks. Public blockchains provide transparency and trust by allowing multiple participants to interact without centralized control, which is particularly appealing for industries requiring auditability and broad collaboration.

Organizations use public blockchain networks to enhance transparency across supply chains and financial transactions, benefiting from the security and immutability inherent to these networks. The increasing maturity of public blockchain platforms is encouraging more enterprises to explore this deployment model.

By Enterprise Size

Large enterprises command a dominant 77.8% share in blockchain distributed ledger adoption in 2024. These organizations leverage blockchain to address complex business challenges, such as cross-border payments, regulatory compliance, and fraud prevention, capitalizing on the technology’s ability to foster trust and efficiency at scale.

With extensive resources and a global footprint, large enterprises are implementing blockchain networks that integrate with existing systems to streamline processes and enhance transparency. Their early adoption and investment act as a catalyst, accelerating blockchain maturity and adoption across industries.

By Applications

Payments remain the leading application for blockchain distributed ledger technology in 2024, capturing 28.6% of the market. Blockchain’s ability to facilitate faster, secure, and cost-effective transactions is driving its adoption in payment processing, remittances, and digital wallets.

Financial institutions and payment providers are harnessing blockchain to reduce settlement times, lower transaction fees, and improve transparency. This application not only addresses traditional payment inefficiencies but also opens avenues for innovative financial services.

By End-Use Industry

The BFSI sector represents the largest end-use industry for blockchain distributed ledger technology with a 30.4% share in 2024. Driven by the need for secure transactions, fraud reduction, and regulatory compliance, BFSI institutions are investing heavily in blockchain to transform operations.

Blockchain helps the sector improve cross-border payments, secure data sharing, and streamline policy management. The technology’s transparency and immutability align well with BFSI’s stringent security and governance demands, driving widespread adoption across banks, insurance companies, and financial service providers.

Emerging Trend Analysis

Blockchain Interoperability and Expansion of DeFi

Blockchain distributed ledger technology is seeing a powerful trend toward enhanced interoperability between different blockchain networks. Cross-chain bridges and protocols are being developed to make it easier for assets and data to move seamlessly across various decentralized systems.

This development is fueling the rise of decentralized finance, which is also branching out into new financial tools beyond what was previously possible. Decentralized autonomous organizations are helping make governance more open, enabling users to participate directly in decision-making.

The shift toward interoperability is making the digital landscape more connected and responsive. Developers can now create applications that draw resources from multiple blockchains at once, leading to richer and more versatile user experiences. This new level of connection not only speeds up innovation but helps lower the barriers to entry for businesses and individuals looking to leverage blockchain technology.

Driver Analysis

Growing Need for Transparency and Security

The main driver powering the adoption of distributed ledger technology is the growing need for transparency and improved security in digital transactions. Many organizations want ways to share records and process payments without risking fraud or errors.

Blockchain ledgers store every transaction with a secure cryptographic hash, and all participating network members can instantly verify these records. This kind of setup gives users more confidence in the integrity of their data, reducing the risk of manipulation.

With data breaches and digital fraud continuing to challenge traditional systems, blockchain’s distributed nature offers a reassuring solution. By allowing multiple independent participants to check and validate data simultaneously, the technology limits single points of failure and helps businesses establish more trustworthy relationships with partners and clients.

Restraint Analysis

Regulatory Uncertainty and Fragmentation

Despite its promise, blockchain distributed ledger technology faces a significant restraint in the form of regulatory uncertainty across jurisdictions. Rules about digital asset types, smart contract validity, and data privacy vary sharply from one country to another. This fragmented environment makes it hard for organizations to build global solutions, as they must spend considerable resources navigating different regulatory frameworks.

As regulators continue to figure out standards for blockchain’s many uses, businesses are often left in limbo, delaying investments or rolling out services in limited regions. This lack of clarity not only slows down product development but also introduces risk, as companies may inadvertently step into legal traps or face compliance challenges down the road.

Opportunity Analysis

Tokenization of Real-World and Digital Assets

One of the most exciting opportunities emerging from blockchain distributed ledgers is the ability to tokenize ownership of both real-world and digital assets. Tokenization allows assets such as property, art, or intellectual property to be issued as unique digital tokens on a blockchain.

This process opens fresh possibilities for fractional ownership, secure transfer, and transparent proof of ownership, all recorded in real time and viewable by any authorized party. The use of tokenization is making ownership more accessible for ordinary investors.

It is also helping streamline how assets are bought, sold, and managed, cutting out many of the traditional intermediaries. Whether it’s someone investing in a fraction of a valuable painting or a business managing digital rights, tokenization is a forward-thinking solution that can unlock new forms of value.

Challenge Analysis

Scalability and Performance Limitations

A major challenge facing blockchain distributed ledger systems is the ongoing struggle with scalability and transaction speed. While some blockchains are able to process several dozen transactions per second, conventional payment systems can handle thousands. This limitation often makes blockchain solutions less practical for high-volume, time-sensitive applications.

Industry leaders are hard at work on solutions, such as optimizing consensus algorithms and creating new Layer-2 technologies to speed up transactions. While progress is being made, truly solving scalability remains a tough problem for developers and businesses alike. Until these challenges are overcome, it may take longer for blockchain to become the backbone of mainstream digital infrastructure.

Key Market Segments

By Components

- Solution

- Service

By Deployment

- Private

- Public

- Hybrid

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SME’s)

By Applications

- Payments

- Smart Contracts

- Supply Chain Management

- Compliance Management

- Trade Finance

- Others

By End Use Industries

- Banking, Financial Services and Insurance (BFSI)

- Government and Public Sector

- Manufacturing

- Retail and E-Commerce

- Media and Entertainment

- Transportation and Logistics

- Healthcare

- Energy and Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Blockchain Distributed Ledger Market, Accenture PLC, AlphaPoint, and Amazon Web Services Inc. are recognized for their strong presence and advanced technology offerings. These firms have integrated blockchain into enterprise-level platforms, enabling businesses to enhance transparency and reduce transaction friction. Their blockchain infrastructure supports use cases across finance, identity management, and supply chain.

Companies such as Auxesis Services & Technologies Ltd., Digital Asset Holdings LLC, and Huawei Technologies Co. Ltd. are steadily increasing their blockchain capabilities. Their strategies focus on industry-specific applications, particularly in insurance, banking, and government sectors. These players contribute to expanding decentralized ecosystems by offering permissioned ledger solutions tailored to sensitive data environments.

Global technology leaders like Intel Corporation, IBM Corporation, iXLedger, NTT DATA Corporation, and Visa Inc. are enhancing blockchain solutions with a focus on security, scalability, and interoperability. Their blockchain offerings are often embedded into broader digital transformation services, making adoption easier for large organizations. These firms leverage existing infrastructure and industry trust to lead innovation in distributed ledger applications.

Top Key Players Covered

- Accenture PLC

- AlphaPoint

- Amazon Web Services Inc.(Amazon.com Inc.)

- Auxesis Services & Technologies Ltd.

- Digital Asset Holdings LLC

- Huawei Technologies Co. Ltd.

- Intel Corporation

- International Business Machines Corporation

- iXLedger

- NTT DATA Corporation (The Nippon Telegraph and Telephone Corporation)

- Visa Inc.

- Others

Recent Developments

- March 2025: Digital Asset Holdings pushed innovation in post-trade and settlement, using distributed ledgers and smart contracts to simplify the life cycle of digital securities and cut the need for intermediaries.

- January 2025: The Auxesis Services & Technologies Ltd. company gained visibility as one of the top blockchain leaders in retail and enterprise solutions, with large pilots for decentralized supply chain management in India and Southeast Asia.

- August 2024: Accenture was named a leader in enterprise blockchain services in the IDC MarketScape 2024 vendor assessment. Their ongoing investments in blockchain and partnership ecosystems place them at the heart of large-scale digital ledger deployments for global businesses.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Components (Solution, Service), By Deployment (Private, Public, Hybrid), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Applications (Payments, Smart Contracts, Supply Chain Management, Compliance Management, Trade Finance, Others), By End Use Industries (Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Manufacturing, Retail and E-Commerce, Media and Entertainment, Transportation and Logistics, Healthcare, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture PLC, AlphaPoint, Amazon Web Services Inc. (Amazon.com Inc.), Auxesis Services & Technologies Ltd., Digital Asset Holdings LLC, Huawei Technologies Co. Ltd., Intel Corporation, International Business Machines Corporation, iXLedger, NTT DATA Corporation (The Nippon Telegraph and Telephone Corporation), Visa Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blockchain Distributed Ledger MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Blockchain Distributed Ledger MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture PLC

- AlphaPoint

- Amazon Web Services Inc.(Amazon.com Inc.)

- Auxesis Services & Technologies Ltd.

- Digital Asset Holdings LLC

- Huawei Technologies Co. Ltd.

- Intel Corporation

- International Business Machines Corporation

- iXLedger

- NTT DATA Corporation (The Nippon Telegraph and Telephone Corporation)

- Visa Inc.

- Others