Global Smart Contracts in Parametric Insurance Market Size, Share Analysis Report By Solution (Parametric Insurance Software (Cloud-Based ,on-Premises), Services (Implementation & Integration Services, Consulting & Training Services, Support & Maintenance Services), By Type of Parametric Insurance (Natural Catastrophe Insurance, Specialty Insurance, Other), By Technology (Blockchain-based Smart Contracts, AI/ML-integrated Smart Contracts, IoT-enabled Smart Contracts, Others), By End User (Individuals, Corporations, Government & Public Sector), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142278

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Market Size

- Solution Analysis

- Type of Parametric Insurance Analysis

- Technology Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

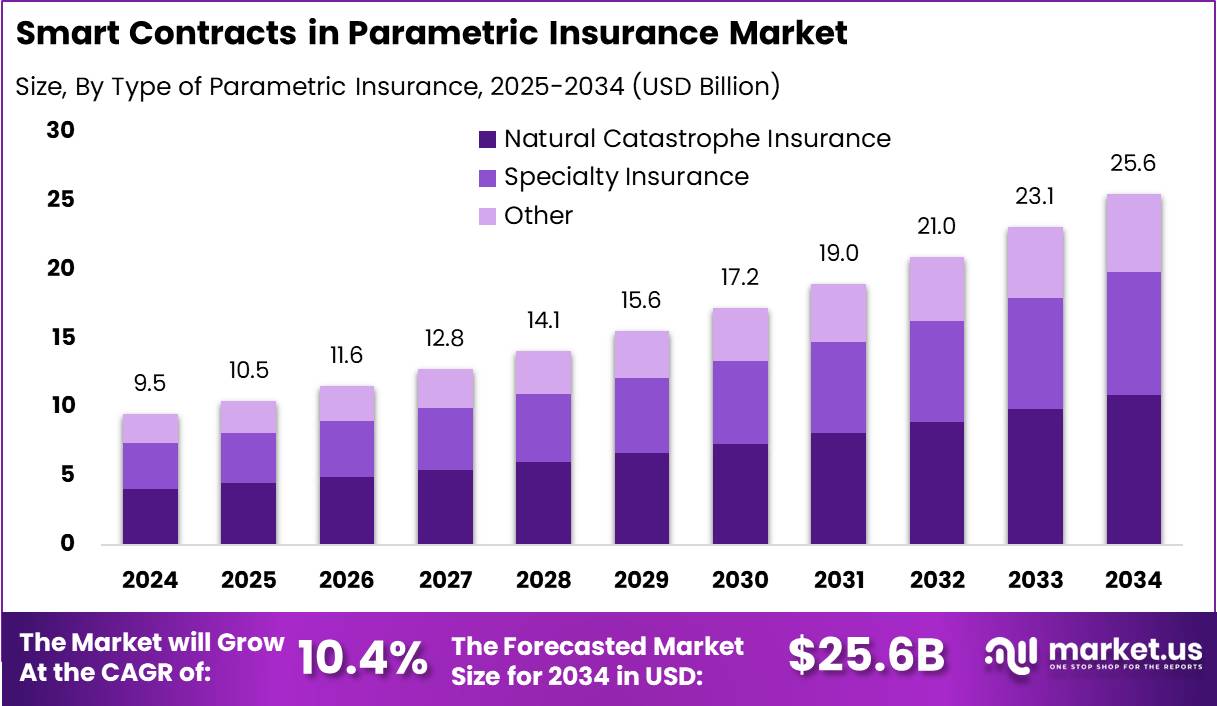

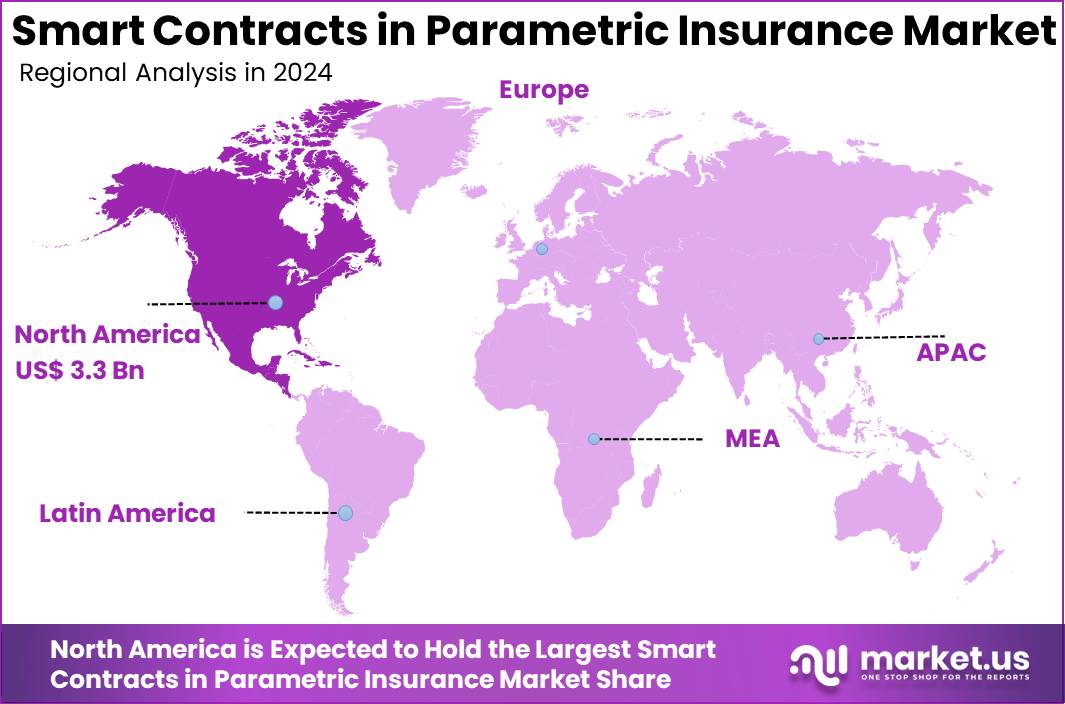

The Smart Contracts in Parametric Insurance Market size is expected to be worth around USD 25.6 Billion By 2034, from USD 9.5 billion in 2024, growing at a CAGR of 10.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.6% share, holding USD 3.3 Million revenue.

Smart contracts in parametric insurance represent a specialized application of blockchain technology, designed to automate the insurance payout process based on predefined conditions. This technology enables the execution of contracts that are both transparent and immune to tampering, ensuring trust and efficiency. Essentially, smart contracts facilitate parametric insurance by automating claims and payouts, eliminating the need for manual claims processing.

The market for smart contracts in parametric insurance is evolving rapidly due to its potential to enhance efficiency and reduce costs in the insurance industry. These contracts are particularly beneficial in areas with high risks, such as agriculture or natural disaster-prone regions, where they can provide quick financial relief based on objective data triggers.

The adoption of smart contracts in the insurance sector is driven by their ability to lower transaction costs, reduce fraud, and provide transparency, which in turn attracts investment and encourages innovation in insurance products.

The primary drivers of the smart contracts in parametric insurance market include the increasing prevalence of blockchain technology, the demand for more efficient and transparent insurance processes, and the growing need for insurance in volatile environments like those affected by climate change.

Based on insights provided by Market.us, the Global Smart Contracts Market is positioned for substantial expansion, with an estimated valuation of USD 1.9 billion in 2024. The demand for smart contracts is projected to grow at a CAGR of 25.8% from 2024 to 2033, driven by increasing adoption in financial services, supply chain automation, and decentralized applications.

Similarly, the Parametric Insurance Market is experiencing steady growth, with its valuation projected to reach USD 40.6 billion by 2033, up from USD 15.8 billion in 2023. This reflects a CAGR of 9.9% during the forecast period. In 2023, North America dominated the market, holding a 35% share with USD 5.5 billion in revenue, largely due to a strong insurance infrastructure and widespread adoption of parametric policies.

Additionally, the ability of smart contracts to significantly reduce administrative costs and eliminate the need for intermediaries contributes to their adoption. Demand for smart contracts in parametric insurance is expected to grow as more industries recognize their potential benefits.

Key Takeaways

- The smart contracts in parametric insurance market is projected to experience significant growth in the coming years. The market size is expected to reach USD 25.6 billion by 2034, increasing from USD 9.5 billion in 2024, at a CAGR of 10.4% during the forecast period from 2025 to 2034.

- North America continues to dominate the global market. In 2024, the region held a 35.6% market share, generating USD 3.3 billion in revenue.

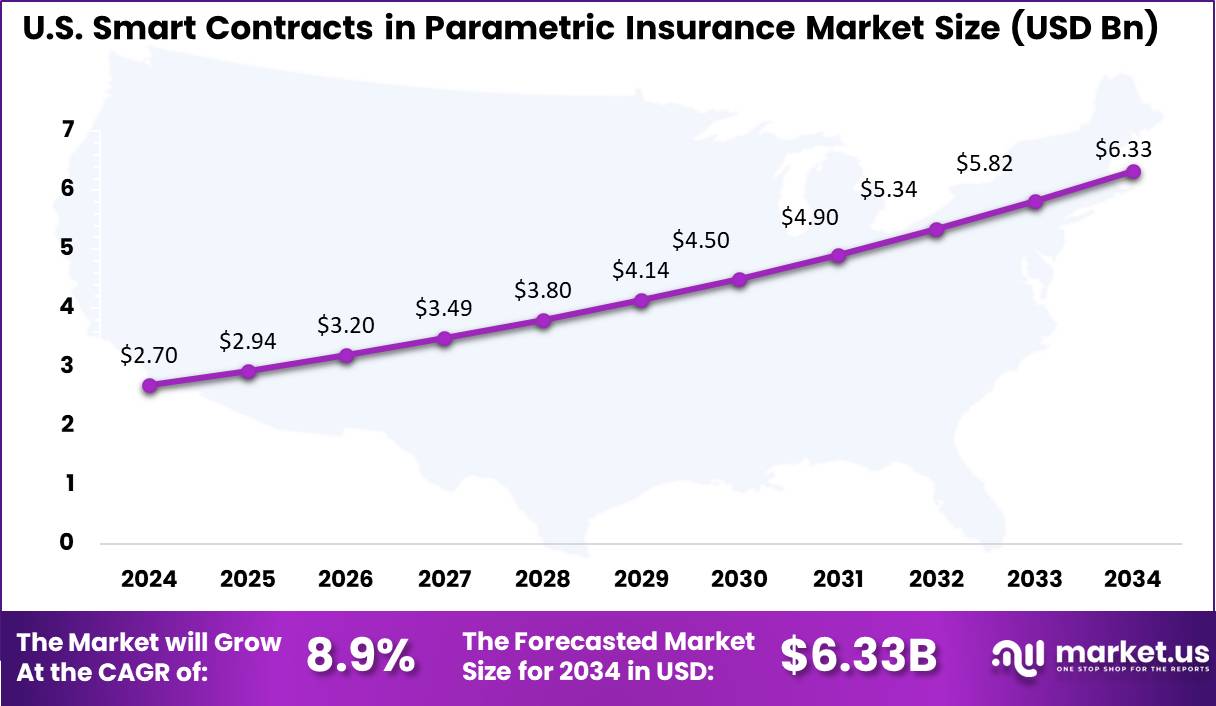

- The United States plays a major role in this growth, with its market valued at USD 2.7 billion in 2024 and projected to grow at a CAGR of 8.9%.

- Parametric Insurance Software accounted for the largest portion of the market in 2024, holding a 78.4% share.

- Natural Catastrophe Insurance led among application segments, securing a 42.7% market share in 2024.

- Blockchain-based Smart Contracts emerged as the most preferred type, commanding a 55.6% share in 2024.

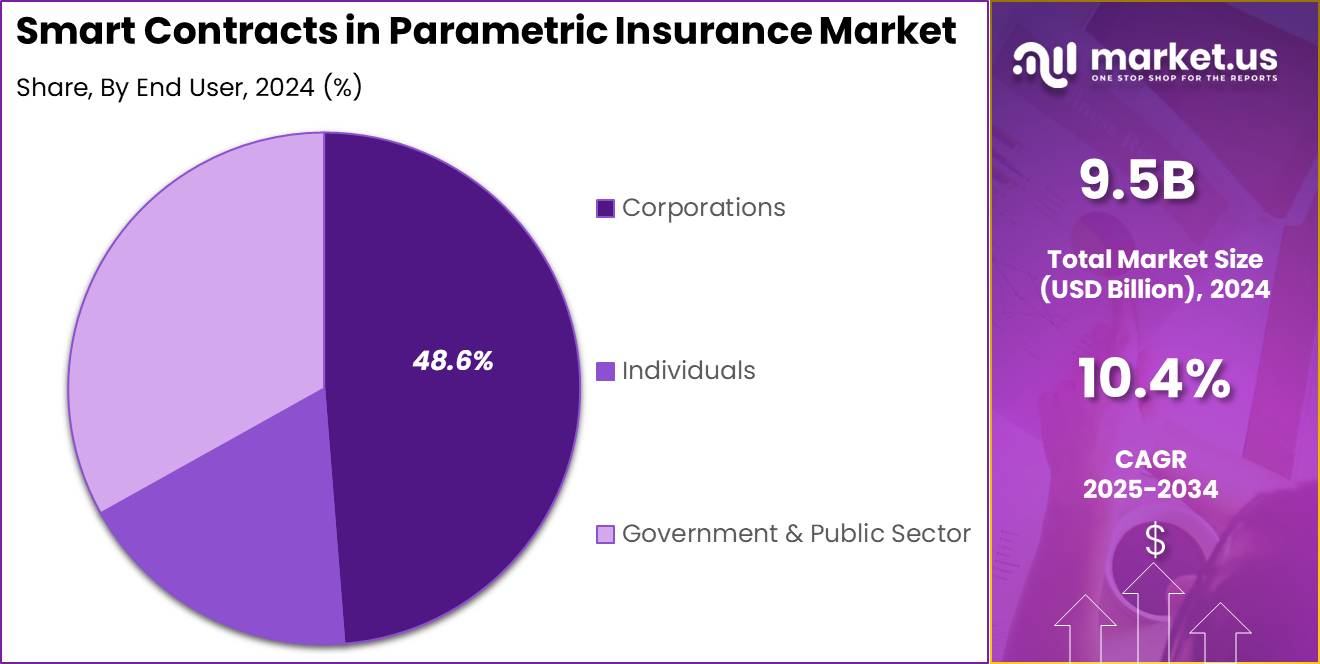

- Corporations represented the largest end-user segment, with a 48.6% market share in 2024.

Analysts’ Viewpoint

Investment opportunities in the parametric insurance market are robust, particularly in developing technology that enhances the accuracy and reliability of data used to trigger claims. Investments in IoT devices, satellite imagery, and advanced data analytics tools are critical for insurers looking to offer innovative and competitive parametric insurance products.

Recent technological advancements in blockchain and smart contract protocols have made it feasible to implement complex parametric insurance models. These advancements include improvements in data security, contract flexibility, and the integration of real-time data feeds, which ensure that contract conditions are met transparently and efficiently.

The regulatory environment for smart contracts in parametric insurance is still developing, as governments and regulatory bodies work to understand and address the implications of blockchain technology. Regulations are being formulated to ensure that these contracts are both secure and compliant with existing insurance and financial laws, which is crucial for widespread adoption and market growth.

U.S. Market Size

The US Smart Contracts in Parametric Insurance Market size was exhibited at USD 2.7 Billion in 2024 with CAGR of 8.9%. The United States is leading in the adoption of smart contracts for parametric insurance for several reasons that underscore the region’s unique position in leveraging innovative technology to drive insurance practices.

Firstly, the prevalence and integration of advanced technology in the insurance sector play a crucial role. The U.S. has a robust technological infrastructure and a strong presence of tech giants and startups that pioneer the development and application of blockchain and smart contracts. This technological ecosystem not only fosters innovation but also accelerates the practical application of smart contracts in real-world insurance scenarios.

Furthermore, the regulatory landscape in the U.S. is progressively adapting to accommodate new technologies like blockchain, which is essential for the widespread adoption of smart contracts in insurance. U.S. regulators are increasingly recognizing the potential of blockchain to enhance transparency and efficiency in the insurance market, thereby providing a conducive environment for the growth of smart contracts in parametric insurance.

In 2024, North America held a dominant market position in the smart contracts in parametric insurance market, capturing more than a 40% share with revenues reaching USD 3.3 billion. This substantial market share can be attributed to several pivotal factors that uniquely position North America at the forefront of this innovative insurance technology landscape.

Firstly, the region’s advanced technological infrastructure and the rapid adoption of blockchain technologies have been fundamental in driving the growth of smart contracts in parametric insurance. North American companies are at the vanguard, leveraging robust IT systems and cutting-edge blockchain solutions that facilitate the seamless execution of smart contracts.

These technological advancements not only enhance the efficiency of contract execution but also ensure transparency and reduce the likelihood of disputes, which are crucial in the insurance sector. Moreover, the presence of a mature financial services sector in North America, coupled with a regulatory environment that is increasingly supportive of financial innovations, has provided a fertile ground for the growth of smart contracts in parametric insurance.

Regulatory bodies in the U.S. and Canada have been proactive in refining regulations that govern digital transactions and blockchain applications, which has encouraged more insurers to adopt these technologies. Additionally, the high incidence of natural disasters such as hurricanes, wildfires, and floods in regions like the U.S. Gulf Coast and California has spurred demand for parametric insurance solutions.

Solution Analysis

In 2024, the Parametric Insurance Software segment held a dominant market position, capturing more than a 78.4% share of the overall smart contracts in the parametric insurance market. This substantial market share can be attributed to the increasing demand for automated and accurate risk assessment tools in the insurance industry, facilitated primarily by cloud-based and on-premises software solutions.

The leading role of Parametric Insurance Software is underpinned by its capability to leverage real-time data and automate payouts, which significantly reduces the need for manual claims processing and decreases the likelihood of disputes. Cloud-based solutions, in particular, have gained prominence due to their scalability, cost-effectiveness, and ease of integration with existing insurance platforms.

These systems provide insurers with the agility to respond to dynamic market conditions and cater to the evolving needs of policyholders. Furthermore, the integration of advanced analytics and machine learning technologies within these software solutions enhances their appeal. They enable insurers to refine risk assessments and pricing models, which is critical in the context of parametric insurance where payouts are triggered by predefined parameters related to measurable events.

This technological edge contributes to the segment’s dominance by improving the accuracy and reliability of parametric insurance products. Services associated with Parametric Insurance Software, including implementation and integration, consulting and training, and support and maintenance, also play a crucial role in the segment’s growth. These services help ensure that the software solutions are effectively tailored to meet the specific needs of insurers, thereby enhancing operational efficiencies and customer satisfaction.

Type of Parametric Insurance Analysis

In 2024, the Natural Catastrophe Insurance segment held a dominant market position within the smart contracts in parametric insurance, capturing more than a 42.7% share. This significant market share is primarily driven by the increasing frequency and severity of natural disasters globally, spurred by climate change and environmental degradation.

This type of insurance offers a rapid disbursement of funds following events such as hurricanes, earthquakes, and floods, which are quantifiable and can be immediately verified by data. Natural Catastrophe Insurance leverages smart contracts to streamline claims processes, significantly reducing the time and complexity typically involved in traditional claims verification and payout procedures.

The use of blockchain technology ensures transparency and trust in the payout process, as the terms are pre-agreed and encoded into the smart contract. This automation not only enhances efficiency but also improves customer satisfaction by providing timely financial support in the aftermath of disasters.

Moreover, the reliability and objectivity of smart contracts in assessing claims based on predefined parameters attract more policyholders who seek straightforward and quick compensation methods. This is particularly pertinent in regions prone to natural disasters, where traditional insurance models often struggle with high volumes of claims and delayed processing.

As technological advancements continue to refine the accuracy of data used to trigger payouts, the appeal of Natural Catastrophe Insurance is expected to grow. This growth is bolstered by the increasing awareness among individuals and businesses about the importance of quick financial recovery following catastrophic events, ensuring the ongoing dominance of this segment in the parametric insurance market.

Technology Analysis

In 2024, the Blockchain-based Smart Contracts segment held a dominant market position in the smart contracts in parametric insurance market, capturing more than a 55.6% share. This leadership is predominantly due to the inherent characteristics of blockchain technology, which offers unparalleled security, transparency, and efficiency in contract execution, qualities that are crucial in the insurance sector.

Blockchain-based smart contracts enhance the trustworthiness and efficiency of parametric insurance by automating the claims process and eliminating the need for manual intervention, which can often lead to delays and disputes. The technology facilitates immediate verification and execution of claims based on predetermined triggers that, once met, ensure swift payout without the possibility of tampering or error.

This capability is particularly valuable in parametric insurance, where the assurance of prompt and accurate claims settlement is critical. Moreover, the adoption of blockchain technology in parametric insurance enables a significant reduction in administrative costs and resources traditionally required to handle claims processing.

By automating these processes and reducing the scope for fraud or errors, insurers can offer more competitive premiums and expand their customer base. The decentralized nature of blockchain further ensures that all parties – insurers, policyholders, and intermediaries – have access to an immutable and transparent record of transactions, enhancing accountability across the sector.

End User Analysis

In 2024, the Corporations segment held a dominant market position in the smart contracts in parametric insurance market, capturing more than a 48.6% share. This notable dominance is largely attributed to the growing recognition among businesses of the need for efficient risk management tools that can provide swift financial recourse in the event of predefined and quantifiable risks.

Corporations are increasingly leveraging smart contracts in parametric insurance due to their ability to offer rapid payout solutions, which is crucial for maintaining operational continuity. This is especially pertinent in industries prone to disruptions from environmental, political, or other measurable risks.

Smart contracts automate the claims process, significantly reducing the time from claim trigger to payout. This efficiency is highly valued by corporate entities that need to quickly recover from losses and mitigate downtime in production or services. Furthermore, the transparency and immutable nature of smart contracts build greater trust between insurers and corporate policyholders.

Each contract execution is recorded on a blockchain, ensuring that all conditions and transactions are visible and verifiable by all parties involved, reducing the likelihood of disputes and fostering a more cooperative relationship. The adoption of smart contracts in parametric insurance by corporations is also driven by the potential for cost savings.

Key Market Segments

By Solution

- Parametric Insurance Software

- Cloud-Based

- On Premises

- Services

- Implementation & Integration Services

- Consulting & Training Services

- Support & Maintenance Services

By Type of Parametric Insurance

- Natural Catastrophe Insurance

- Specialty Insurance

- Other

By Technology

- Blockchain-based Smart Contracts

- AI/ML-integrated Smart Contracts

- IoT-enabled Smart Contracts

- Others

By End User

- Corporations

- Individuals

- Government & Public Sector

Driver

Increasing Need for Efficient and Transparent Claims Processes

The adoption of smart contracts in parametric insurance is largely driven by the need for more efficient and transparent claims processes. Traditional insurance claims can be time-consuming and often require extensive documentation and adjustments. Smart contracts automate these processes by executing the terms of the insurance contract automatically when predefined conditions are met, such as specific weather events or other measurable triggers.

This automation not only speeds up the claims process but also reduces the potential for disputes and enhances transparency for all parties involved. The integration of real-time data processing capabilities, from sources like IoT devices and satellite imagery, further supports the accuracy and efficiency of these automated systems.

Restraint

Complexity in Understanding and Trust

A significant restraint in the adoption of smart contracts in parametric insurance is the complexity of the technology and a general lack of understanding and trust among potential users. The concept of smart contracts and the underlying blockchain technology can be difficult for many to grasp, especially in terms of how claims are processed and payouts are triggered.

This complexity can lead to skepticism and reluctance among insurers and policyholders, who may prefer more traditional methods with which they are familiar. Moreover, the perceived opacity of how data is managed and the fear of relinquishing control over the claims process can deter stakeholders from adopting this innovative approach.

Opportunity

Expansion into New Markets and Product Lines

Smart contracts in parametric insurance offer significant opportunities to expand into new markets and product lines, particularly in areas prone to specific types of risks that can be clearly quantified and parameterized, such as natural disasters or agricultural outputs.

By utilizing smart contracts, insurers can offer products that are not only tailored to the unique needs of these markets but also provide quicker payout solutions, which is a crucial advantage in regions where timely financial assistance can make a substantial difference in recovery efforts.

The ability to customize and scale these products to various needs and conditions without extensive manual intervention opens up a broad array of new business opportunities for insurers.

Challenge

Regulatory and Legal Frameworks

The implementation of smart contracts in parametric insurance faces challenges related to regulatory and legal frameworks. As these technologies are relatively new, many existing laws and regulations may not directly apply or may need significant modifications to accommodate the novel features of smart contracts.

This includes issues related to the legal recognition of blockchain transactions, data security standards, and the enforceability of automated contracts. Insurers and regulators need to work closely to develop standards and frameworks that support the innovative aspects of smart contracts while ensuring compliance, consumer protection, and market stability.

Growth Factors

The adoption of smart contracts in parametric insurance is being driven by several compelling growth factors that address both efficiency and cost-effectiveness in the insurance sector. One of the primary growth drivers is the increasing capability of technology to handle complex datasets and provide real-time, accurate risk assessments.

Technologies such as IoT, AI, and blockchain are pivotal, as they allow for the swift gathering and processing of data points necessary to trigger insurance payouts. For instance, IoT devices can continuously monitor and report on parameters like weather conditions or agricultural outputs, which are crucial for parametric insurance triggers.

Furthermore, the demand for more transparent and customer-friendly insurance solutions is pushing the market towards smart contracts. These contracts offer a clear, predetermined set of conditions under which payouts are made, eliminating the often lengthy and opaque traditional claims processes. This transparency is not only attractive to customers but also reduces the likelihood of disputes between insurers and policyholders, thereby enhancing trust and satisfaction.

Another significant growth factor is the global increase in the frequency and severity of natural disasters due to climate change. As traditional insurance models struggle to cope with the volume and complexity of related claims, smart contracts in parametric insurance present a viable alternative that can provide immediate relief to those affected by disasters.

Emerging Trends

Emerging trends in the use of smart contracts for parametric insurance are largely influenced by advancements in technology and shifts in consumer expectations. One of the key trends is the integration of advanced data analytics and machine learning techniques, which improve the precision of risk assessments and the responsiveness of insurance products.

For instance, AI algorithms can analyze vast datasets to identify patterns and predict outcomes, which can be used to refine trigger mechanisms in smart contracts, making them more aligned with actual risk scenarios. Another trend is the increasing use of blockchain technology to enhance the security and integrity of insurance contracts.

Blockchain’s decentralized nature ensures that contract terms and data are immutable once entered into the system, which significantly reduces the risk of fraud and tampering. This technology also facilitates the automation of payouts, which can be executed without the need for manual intervention, thereby speeding up the claims process and reducing administrative costs.

Moreover, there is a growing focus on customizing parametric insurance products to cater to specific industries and geographies, particularly those more prone to certain types of risks. For example, agricultural sectors in regions vulnerable to climate variability are seeing tailored products that use local weather data to trigger payouts for drought or flood conditions.

Business Benefits

The implementation of smart contracts in parametric insurance offers several business benefits that enhance the operational efficiency and competitiveness of insurers. One of the most significant benefits is the reduction in claims processing time and costs. Since payouts are automated and based on predefined conditions, there is no need for the manual processing of claims or extensive investigations, which typically incur high costs and can be time-consuming.

Additionally, smart contracts provide enhanced accuracy in claims handling, which helps in minimizing disputes and fraud. The conditions for payout are transparently coded into the contract, and data used to trigger claims is obtained from reliable and tamper-proof sources, facilitated by technologies like blockchain and IoT. This transparency and accuracy build trust among policyholders and can lead to higher retention rates.

Furthermore, smart contracts enable insurers to tap into new customer segments and markets, particularly those that are underserved by traditional insurance products. By offering innovative, flexible, and responsive insurance solutions that meet the specific needs of different sectors, insurers can expand their market presence and explore new revenue streams.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the evolving landscape of parametric insurance, several companies have made notable strides by integrating smart contracts into their offerings. Here is an overview of three prominent firms:

CelsiusPro, a Swiss-based company specializing in parametric solutions, expanded its capabilities by acquiring Global Parametrics in September 2023. This strategic move combined the strengths of both firms in weather risk and natural catastrophe coverage, aiming to enhance resilience in vulnerable communities.

Arbol has been at the forefront of integrating blockchain technology with parametric insurance. In 2020, Arbol acquired eWeatherRisk, a move that strengthened its position in the market. The company utilizes smart contracts to automate and expedite payouts, offering innovative weather risk solutions to clients.

Etherisc is known for its decentralized insurance protocol, leveraging blockchain to create transparent and efficient parametric insurance products. The company has developed various solutions, including flight delay and crop insurance, using smart contracts to automate claims and reduce administrative overhead.

Top Key Players in the Market

- Swiss Re

- Munich Reinsurance America, Inc.

- AXA SA

- Zurich American Insurance Company

- Allianz

- QBE Insurance Group Ltd.

- Sompo Holdings, Inc.

- Beazley Group

- Arbol

- Raincoat

- Others

Recent Developments

- In February 2025, CatX launched ‘Catamaran Parametric,’ an AI-driven platform designed to simplify parametric protection. The platform employs artificial intelligence to guide users through a comprehensive risk management process, transforming traditional methods in the industry.

- In February 2025, Aon, in collaboration with Floodbase and Swiss Re, unveiled a parametric insurance solution targeting hurricane-related storm surges along the U.S. coast. This product aims to mitigate commercial losses by providing rapid payouts based on predefined parameters.

- In January 2025, Descartes Underwriting introduced a parametric insurance product to protect utility-scale solar farms against tornado damage. The coverage utilizes satellite data and analytics to offer swift financial support following tornado events.

Report Scope

Report Features Description Market Value (2024) USD 9.5 Bn Forecast Revenue (2034) USD 25.6 Bn CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Parametric Insurance Software (Cloud-Based ,on-Premises), Services (Implementation & Integration Services, Consulting & Training Services, Support & Maintenance Services), By Type of Parametric Insurance (Natural Catastrophe Insurance, Specialty Insurance, Other), By Technology (Blockchain-based Smart Contracts, AI/ML-integrated Smart Contracts, IoT-enabled Smart Contracts, Others), By End User (Individuals, Corporations, Government & Public Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Swiss Re, Munich Reinsurance America Inc., AXA SA , Zurich American Insurance Company, Allianz, QBE Insurance Group Ltd. , Sompo Holdings Inc., Beazley Group , Arbol, Raincoat, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Contracts in Parametric Insurance MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Contracts in Parametric Insurance MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Swiss Re

- Munich Reinsurance America, Inc.

- AXA SA

- Zurich American Insurance Company

- Allianz

- QBE Insurance Group Ltd.

- Sompo Holdings, Inc.

- Beazley Group

- Arbol

- Raincoat

- Others