Global Black Beauty Market Size, Share, Growth Analysis By Product Type (Skincare Products, Haircare Products, Makeup Products, Fragrances), By Ingredient Insights (Activated Charcoal, Black Seed Oil, Black Tea Extract, Others), By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Beauty Specialty Stores, Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152466

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

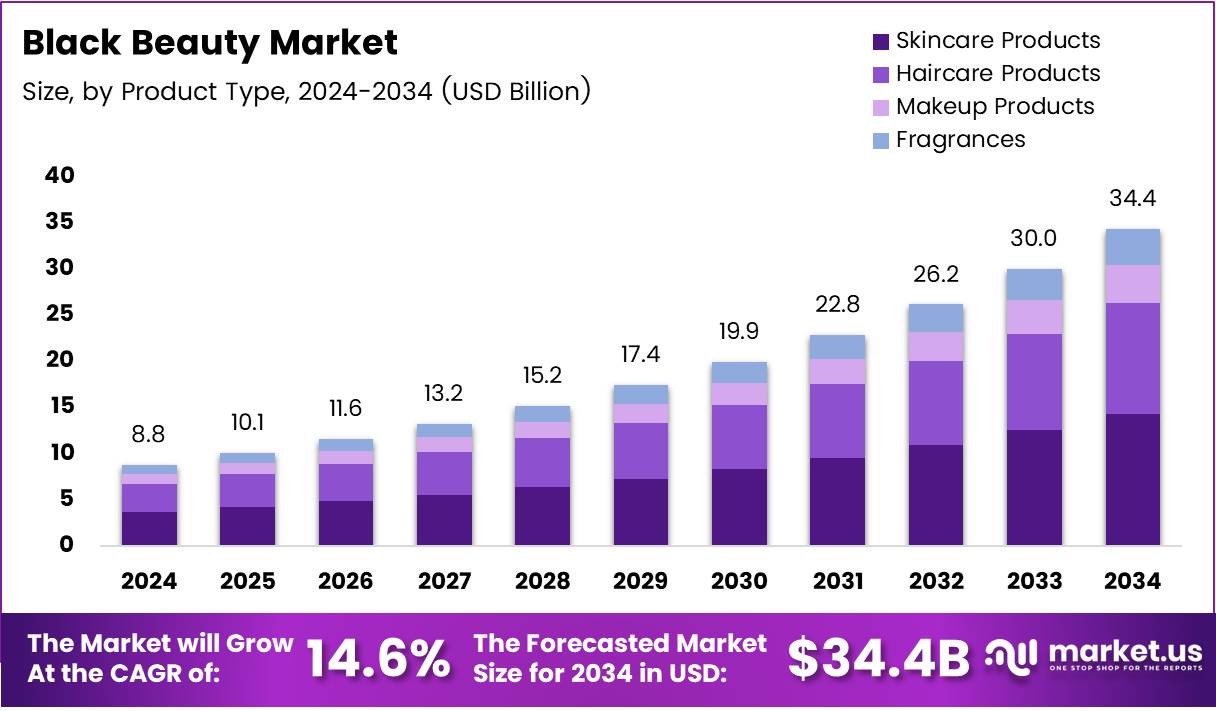

The Global Black Beauty Market size is expected to be worth around USD 34.4 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 14.6% during the forecast period from 2025 to 2034.

The Black beauty market represents a dynamic and evolving segment of the global beauty industry, focused on products tailored specifically for Black consumers’ hair, skin, and cosmetic needs. As cultural identity and inclusivity gain traction, this market is no longer niche—it is a rising force, driven by both demand and innovation.

Notably, the demographic makeup fuels this momentum. Nearly half of Black Americans are under 30, with a median age of 32, according to U.S. Census data. This younger audience actively influences beauty trends and seeks brands that align with their identity and values. Consequently, brands that authentically connect with this audience gain a competitive edge.

Moving forward, sales data further highlight the opportunity. According to gcimagazine, Black beauty brands in the prestige segment grew 19% in dollar sales in February 2023, almost twice the rate of the total prestige beauty market. This reflects a high level of consumer loyalty and increasing purchasing power among Black consumers.

Simultaneously, innovation is reshaping the product landscape. Indie and heritage Black-owned brands are gaining visibility, while major corporations are investing in culturally relevant R&D. Skin tone-inclusive foundations, textured hair care, and protective styles are driving shelf space expansion. These innovations address long-overlooked consumer needs.

Meanwhile, the regulatory environment is tightening, particularly around product safety. A study by North Carolina Health News reported that 80% of cosmetics marketed to Black women contain hazardous chemicals. This insight is prompting greater scrutiny and calls for ingredient transparency across the sector, opening space for clean beauty alternatives.

Additionally, government and public sector investments are catalyzing change. Initiatives supporting minority-owned businesses and supplier diversity programs are boosting access to capital for Black-owned beauty brands. These steps are expanding the commercial footprint and enhancing brand resilience in a competitive market.

Moreover, social media and digital platforms continue to level the playing field. Influencers and creators from the Black community are shaping brand narratives, driving virality, and fostering direct-to-consumer success stories. As a result, consumer discovery and engagement have become faster and more authentic.

Looking ahead, the Black beauty market offers strong growth potential. With cultural representation, younger demographics, and rising digital engagement, brands that invest in inclusivity, transparency, and innovation are positioned to win. The momentum is clear—the Black beauty industry is not only growing, it’s leading a new beauty standard.

Key Takeaways

- The Global Black Beauty Market is expected to reach USD 34.4 Billion by 2034, growing at a CAGR of 14.6% from 2025 to 2034.

- Skincare Products dominated the By Product Type Analysis segment in 2024, holding a 43.8% market share.

- Activated Charcoal led the By Ingredient Insights Analysis segment in 2024, with a 39.6% market share.

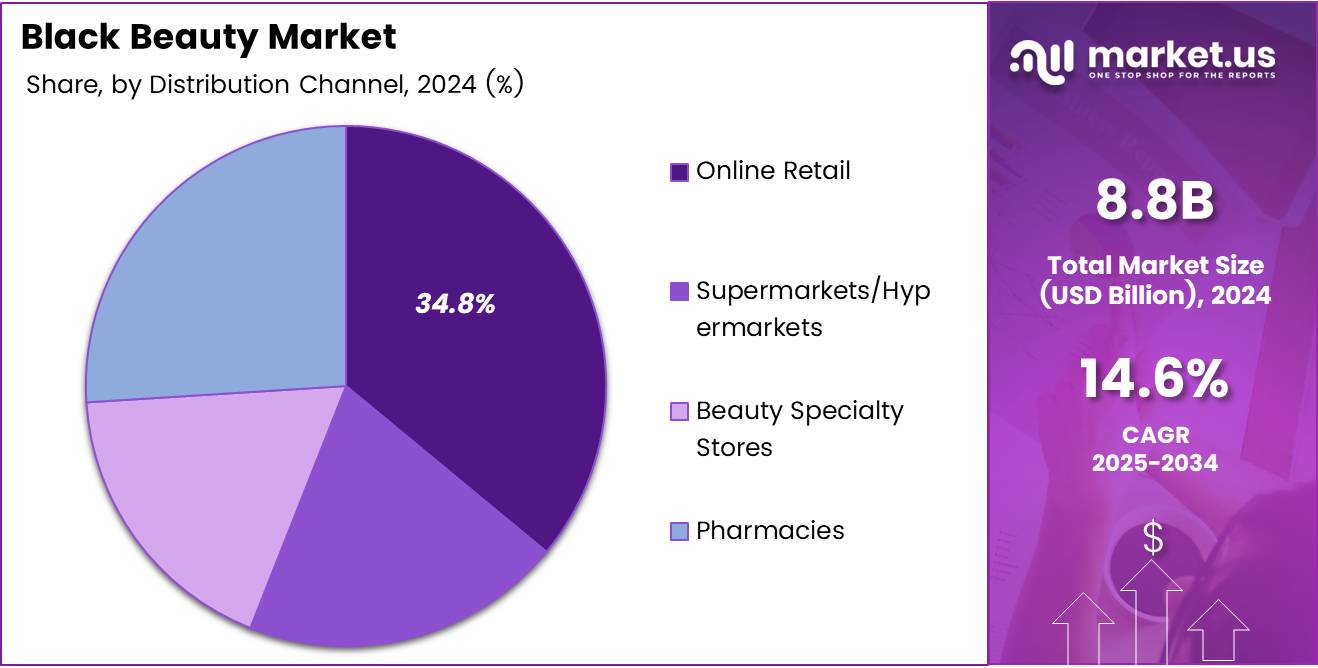

- Online Retail captured the largest share in the By Distribution Channel Analysis segment in 2024, with 34.8% of the market.

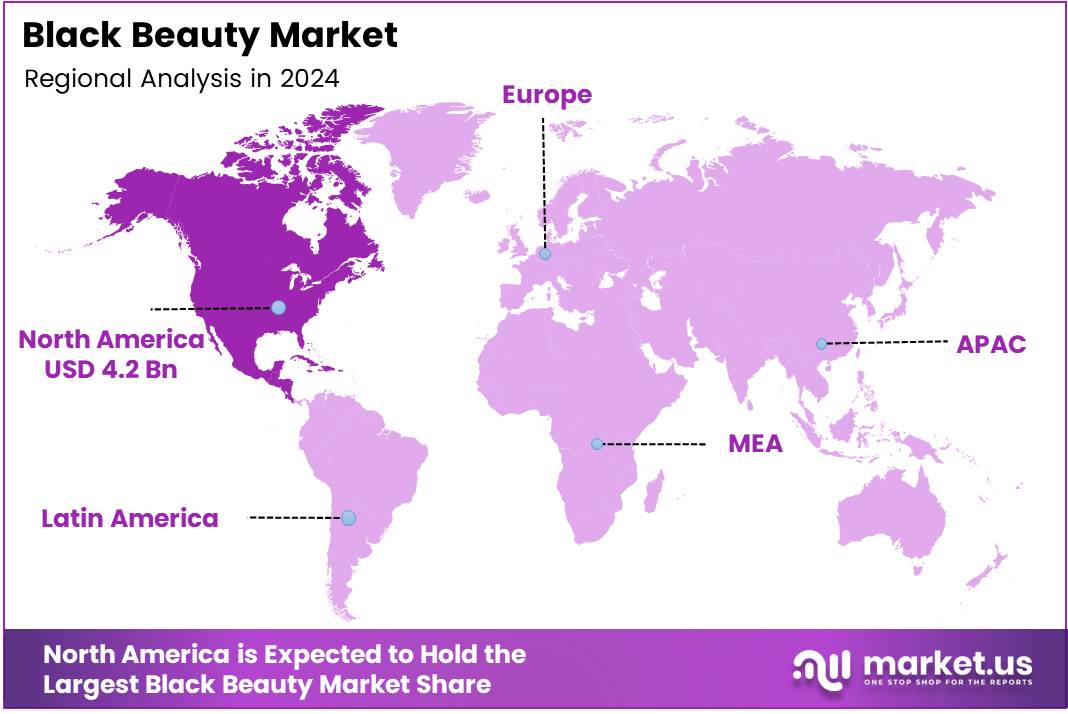

- North America held the largest market share in 2024, with 47.9%, valued at USD 4.2 billion.

Product Type Analysis

Skincare Products lead with 43.8% share, driven by growing demand for melanin-focused care routines.

In 2024, Skincare Products held a dominant market position in the By Product Type Analysis segment of the Black Beauty Market, with a 43.8% share. The rising focus on personalized skincare solutions for melanin-rich skin, along with the demand for products that address hyperpigmentation and uneven skin tone, continues to push this segment forward.

Haircare Products followed closely, benefiting from increased consumer interest in natural curls, protective styles, and scalp health. The surge in awareness around sulfate-free, paraben-free, and moisturizing formulas tailored for textured hair has kept this category competitive.

Makeup Products also saw consistent demand, particularly foundations and concealers catering to diverse undertones. Though not the leading category, this segment showed strong traction due to inclusive branding and expansion in shade ranges.

Fragrances represented a smaller portion of the market, but still carved a niche with culturally resonant scents and artisanal blends. While it held a lesser share compared to other segments, its emotional appeal and gifting value kept it relevant.

Ingredient Insights Analysis

Activated Charcoal takes the lead with 39.6% share due to its detoxifying properties and popularity in skincare.

In 2024, Activated Charcoal held a dominant market position in the By Ingredient Insights Analysis segment of the Black Beauty Market, with a 39.6% share. Its purifying qualities and ability to draw out impurities made it a top choice in cleansers, masks, and scrubs tailored to oily or acne-prone skin types.

Black Seed Oil followed, appreciated for its deep hydration and anti-inflammatory benefits. This natural oil continues to gain ground in both skincare and haircare formulations, particularly for soothing irritation and promoting scalp health.

Black Tea Extract secured a notable place thanks to its antioxidant richness. Often used in anti-aging and soothing products, its presence in toners and moisturizers aligned with the market’s clean beauty trends.

The Others category included a range of botanicals and niche actives. While each individual ingredient had a smaller footprint, together they reflected the growing consumer interest in plant-based and culturally rooted beauty components.

Distribution Channel Analysis

Online Retail leads with 34.8% share, reflecting a shift toward digital-first beauty shopping habits.

In 2024, Online Retail held a dominant market position in the By Distribution Channel Analysis segment of the Black Beauty Market, with a 34.8% share. This growth was propelled by the convenience of home delivery, access to a wide range of niche brands, and digital marketing targeting underrepresented communities.

Supermarkets/Hypermarkets held a strong secondary position. Their advantage lay in high foot traffic and the ability to offer competitive pricing and bundled deals, appealing to value-conscious shoppers seeking mainstream Black beauty brands.

Beauty Specialty Stores remained influential, especially for consumers looking for curated selections and personalized consultations. These stores often featured indie brands and exclusive collaborations, drawing loyalty from trend-aware shoppers.

Pharmacies maintained a modest share but were important for their trusted positioning in skincare and personal care. Their role in providing dermatologist-recommended and therapeutic beauty solutions kept them relevant in the evolving market landscape.

Key Market Segments

By Product Type

- Skincare Products

- Haircare Products

- Makeup Products

- Fragrances

By Ingredient Insights

- Activated Charcoal

- Black Seed Oil

- Black Tea Extract

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Beauty Specialty Stores

- Pharmacies

Drivers

Growing Demand for Organic and Natural Beauty Products Drives Market Growth

The Black beauty market is seeing strong growth as more consumers prefer organic and natural beauty products. People are becoming more aware of what they put on their skin and are choosing items that are free from harsh chemicals. This shift in consumer behavior is pushing brands to develop more plant-based and clean products.

Social media and beauty influencers are also playing a big role in promoting Black beauty brands. Influencers often share skincare and haircare routines tailored for melanin-rich skin and natural hair textures, which helps boost brand visibility and trust. Platforms like Instagram and TikTok have become powerful tools for product discovery and marketing.

Rising disposable income is another important factor. As Black consumers have more spending power, they are more willing to invest in premium beauty products. Additionally, there is a growing focus on self-care and wellness, driving demand for quality beauty solutions designed specifically for Black skin and hair types.

Lifestyle changes, especially among younger consumers, are increasing interest in beauty products that are both ethical and effective. Products that reflect cultural identity and support representation are becoming more desirable. This growing awareness is leading to greater demand and innovation in the Black beauty market.

Restraints

Intense Competition from Established Beauty Brands Limits Market Potential

One of the main challenges for Black beauty brands is the limited shelf life of some products, especially natural and organic ones. These products often contain fewer preservatives, which can affect storage and transport. Retailers may hesitate to stock items with shorter expiration dates, impacting market reach.

Another key restraint is the tough competition from large, well-established beauty companies. Many mainstream brands are now entering the inclusive beauty space, offering products for darker skin tones and textured hair. These brands have bigger marketing budgets, established customer bases, and wider distribution networks, making it difficult for smaller Black-owned businesses to compete.

Because of these challenges, many Black beauty startups struggle to scale or maintain visibility in a saturated market. Without strong brand recognition or access to major retail channels, it can be hard to grow, even with high-quality offerings.

Despite rising interest in diverse beauty, these obstacles slow down progress and make it harder for smaller or independent Black beauty brands to thrive in the long term.

Growth Factors

Expansion into Emerging Markets with Growing Beauty Consciousness Creates Growth Opportunities

The Black beauty market has major opportunities in emerging regions where beauty awareness is growing. Countries in Africa, the Caribbean, and parts of Latin America have large populations with diverse skin tones and hair types, but limited product availability. Expanding into these markets can open up new revenue streams.

There’s also a strong opportunity in developing eco-friendly and vegan beauty lines. Consumers are looking for sustainable and cruelty-free products that align with their values. Black beauty brands that focus on clean ingredients and environmentally friendly packaging can attract a loyal customer base.

Partnering with e-commerce platforms offers another growth path. Online sales make it easier for small and mid-size brands to reach wider audiences without needing physical stores. Collaborations with popular e-commerce retailers can increase visibility and boost sales.

The rise of DIY beauty routines and at-home treatments also presents a unique opportunity. Many consumers now prefer skincare and haircare solutions they can use at home. Brands that offer kits or easy-to-use products designed for personal use can tap into this growing demand and further diversify their product lines.

Emerging Trends

Surge in Personalized and Customizable Beauty Products Influences Market Trends

Personalization is becoming a key trend in the Black beauty market. Consumers are looking for products that suit their specific skin tones, hair textures, and beauty needs. Brands that offer customizable options, such as foundation shades or haircare treatments, are gaining attention and building stronger customer loyalty.

Another major trend is the adoption of clean beauty standards. Consumers are demanding safer, non-toxic ingredients, and many Black beauty brands are responding by offering cleaner formulas. This shift not only meets health-conscious preferences but also aligns with growing interest in sustainable beauty.

The men’s grooming segment is also expanding within the Black beauty market. More men are now investing in skincare, beard care, and haircare products. Brands that cater specifically to Black male consumers with targeted solutions are seeing increased demand.

Lastly, technology is becoming a powerful tool in the beauty industry. AR and AI are helping customers try products virtually before buying. These digital tools offer better shopping experiences and reduce the chances of mismatched products, especially for melanin-rich skin tones.

Regional Analysis

North America Dominates the Black Beauty Market with a Market Share of 47.9%, Valued at USD 4.2 Billion

In 2024, North America held the dominant position in the Black Beauty market, capturing 47.9% of the market share, valued at USD 4.2 billion. The region’s growth is driven by a younger consumer base, increased demand for inclusive beauty products, and growing brand engagement. Furthermore, North America’s well-established retail infrastructure and heightened awareness around product safety contribute significantly to its market leadership.

Europe Black Beauty Market Trends

Europe holds a significant portion of the Black Beauty market, with a growing focus on product formulations that cater to diverse skin tones. The region is seeing a rise in demand for ethically sourced ingredients and a shift toward clean beauty. Regulatory frameworks supporting inclusivity in the beauty sector further drive growth. Increased awareness around product safety also influences consumer choices in European markets.

Asia Pacific Black Beauty Market Trends

Asia Pacific is experiencing rapid growth in the Black Beauty market, spurred by an expanding middle class and increasing disposable income. The region’s diverse beauty preferences, especially in countries like India and Japan, provide substantial opportunities for niche products. The demand for skin care and hair care solutions tailored to different ethnicities is also on the rise, driving market expansion.

Middle East and Africa Black Beauty Market Trends

The Middle East and Africa Black Beauty market is gradually expanding as urbanization increases, and consumers seek beauty products tailored to their specific needs. The region is witnessing an increased focus on skincare and hair care products formulated for darker skin tones. The growing trend of online beauty retail platforms is expected to further boost market growth, especially in the more urbanized areas.

Latin America Black Beauty Market Trends

Latin America, though still developing in the Black Beauty segment, is beginning to see a steady rise in demand for beauty products catering to a diverse consumer base. Local brands are gaining popularity by creating products that suit a variety of skin tones, alongside increased distribution through e-commerce. The region’s evolving beauty culture and greater focus on inclusivity are driving this segment’s growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Black Beauty Company Insights

In 2024, the global Black Beauty Market continues to experience significant growth, driven by rising consumer demand for inclusive and diverse beauty products.

L’Oréal S.A. is maintaining a dominant position through its expansive range of beauty products tailored to various ethnic groups. The company’s commitment to inclusivity has allowed it to strengthen its presence in the Black beauty market with specialized products targeting Black consumers.

Estée Lauder Companies Inc. has capitalized on its strong brand portfolio to cater to the needs of Black consumers. By focusing on product innovation and increasing diversity within its product lines, the company continues to expand its reach in this lucrative segment.

Procter & Gamble Co. has established itself as a key player by investing in research and development to create products that specifically address the unique beauty needs of Black women. The company’s Olay brand remains a strong performer in this market, offering products designed for melanin-rich skin.

Unilever PLC has also seen substantial success through its diverse product range, especially with its SheaMoisture brand, which is rooted in the heritage of Black beauty and skincare. The brand’s commitment to natural ingredients and sustainable sourcing resonates strongly with consumers, further solidifying Unilever’s position in the market.

These companies are not only innovating but also building stronger connections with Black consumers by embracing diversity, inclusivity, and the cultural nuances that drive purchasing decisions. Their continued investments are expected to further enhance market growth.

Top Key Players in the Market

- L’Oréal S.A.

- Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Unilever PLC

- Revlon Inc.

- E.l.f. Beauty, Inc.

- Black Opal Beauty

- Fenty Beauty

- SheaMoisture

- Olay (Procter & Gamble)

- Nubian Heritage

- Carol’s Daughter

- Cantu Beauty

- TGIN

- Burt’s Bees

Recent Developments

- In April 2024, Mented Cosmetics, a pioneering Black woman-owned beauty brand, was acquired by West Lane Capital Partners. This acquisition highlights West Lane’s focus on expanding its portfolio with diverse and inclusive beauty brands.

- In June 2025, L’Oréal acquired the British skincare brand Medik8. The acquisition is expected to strengthen L’Oréal’s position in the premium skincare market, particularly in anti-aging solutions.

- In December 2024, L’Oréal Groupe acquired the Korean skincare brand, Dr.G. This move aligns with L’Oréal’s strategy to enhance its Asian market presence and expand its offerings in the skincare sector.

Report Scope

Report Features Description Market Value (2024) USD 8.8 Billion Forecast Revenue (2034) USD 34.4 Billion CAGR (2025-2034) 14.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Skincare Products, Haircare Products, Makeup Products, Fragrances), By Ingredient Insights (Activated Charcoal, Black Seed Oil, Black Tea Extract, Others), By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Beauty Specialty Stores, Pharmacies) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape L’Oréal S.A., Estée Lauder Companies Inc., Procter & Gamble Co., Unilever PLC, Revlon Inc., E.l.f. Beauty, Inc., Black Opal Beauty, Fenty Beauty, SheaMoisture, Olay (Procter & Gamble), Nubian Heritage, Carol’s Daughter, Cantu Beauty, TGIN, Burt’s Bees Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Procter & Gamble Co.

- Unilever PLC

- Revlon Inc.

- E.l.f. Beauty, Inc.

- Black Opal Beauty

- Fenty Beauty

- SheaMoisture

- Olay (Procter & Gamble)

- Nubian Heritage

- Carol's Daughter

- Cantu Beauty

- TGIN

- Burt's Bees