Global Bitcoin Market By Application (Exchanges, Remittance Services, Payment & Wallet), By End-use (BFSI, E-commerce, Media & Entertainment), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 65855

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

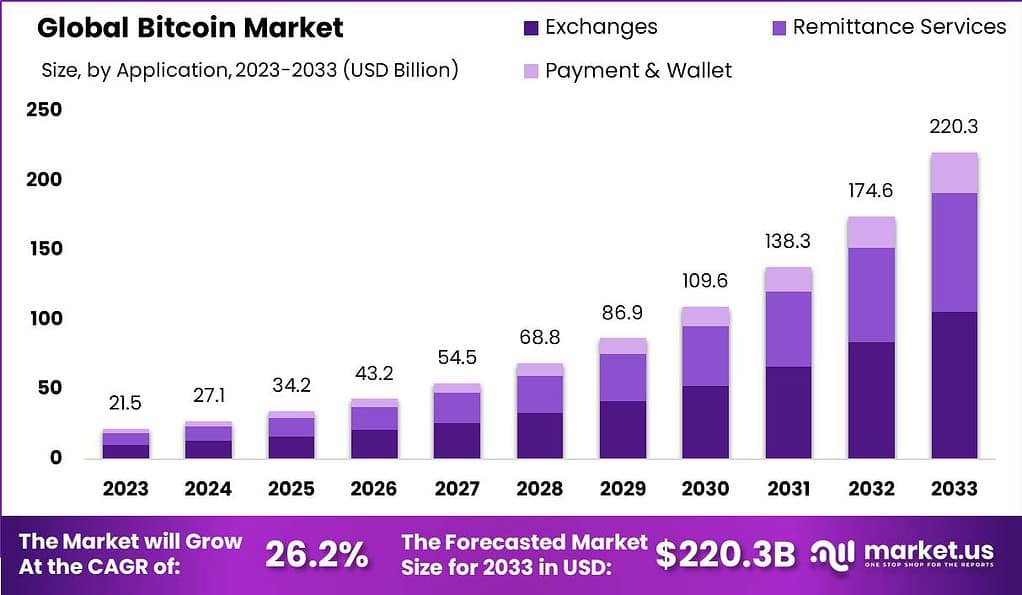

The Global Bitcoin Market size is poised to cross USD 27.1 Billion in 2024 and is likely to attain a valuation of USD 220.3 Billion by 2033. The bitcoin Industry share is projected to develop at a CAGR of 26.2% from 2024 to 2033.

Bitcoin is a type of cryptocurrency. It is a centralized digital currency without a single administrator or a central bank, and the bitcoin can be transferred from user to user on the bitcoin peer-to-peer network without any intermediaries. Network nodes certify the Bitcoin transactions through cryptography, and these transactions are recorded in a public distributed ledger called a blockchain.

The Bitcoin market refers to the ecosystem around Bitcoin, including the platforms and exchanges where people can buy, sell and trade Bitcoin. Bitcoin can be obtained through various means, such as mining (a process where powerful computers solve complex mathematical problems to validate transactions and add them to the blockchain) or by purchasing them on cryptocurrency exchanges using traditional fiat currencies.

Note: Actual Numbers Might Vary In Final Report

Analyst Viewpoint

The Bitcoin market, as observed in recent times, has exhibited notable dynamics, underscoring its growing relevance in the global financial landscape. Primarily, the driving factors behind Bitcoin’s growth can be attributed to its increasing acceptance as a legitimate form of currency and an investment asset.

The decentralized nature of Bitcoin, providing autonomy from traditional banking systems, has significantly contributed to its appeal. Additionally, the growing interest and investment from institutional investors have lent credibility and stability to the market. The enhanced security features and underlying blockchain technology also play a crucial role in attracting users seeking transparent and secure transaction methods.

Opportunities within the Bitcoin market are abundant, particularly as it paves the way for innovative financial products and services. The potential for high returns attracts a diverse range of investors, from individuals to large financial institutions. Furthermore, Bitcoin’s integration into digital payment systems is expanding its use in everyday transactions, thus broadening its market reach. The technology underpinning Bitcoin is also opening avenues in various sectors, including supply chain management and digital identity verification, offering extensive growth prospects.

Key Takeaways

- The Global Bitcoin Market is expected to surpass USD 27.1 Billion in 2024 and is projected to reach a valuation of USD 220.3 Billion by 2033, with a Compound Annual Growth Rate (CAGR) of 26.2% from 2024 to 2033.

- In 2023, the Exchanges segment held a dominant market position, capturing more than a 48% share, driven by ease of access, liquidity, and growth in trading volumes.

- The BFSI sector dominated the market in 2023, capturing more than a 35% share, driven by increasing integration of Bitcoin into traditional banking and financial systems.

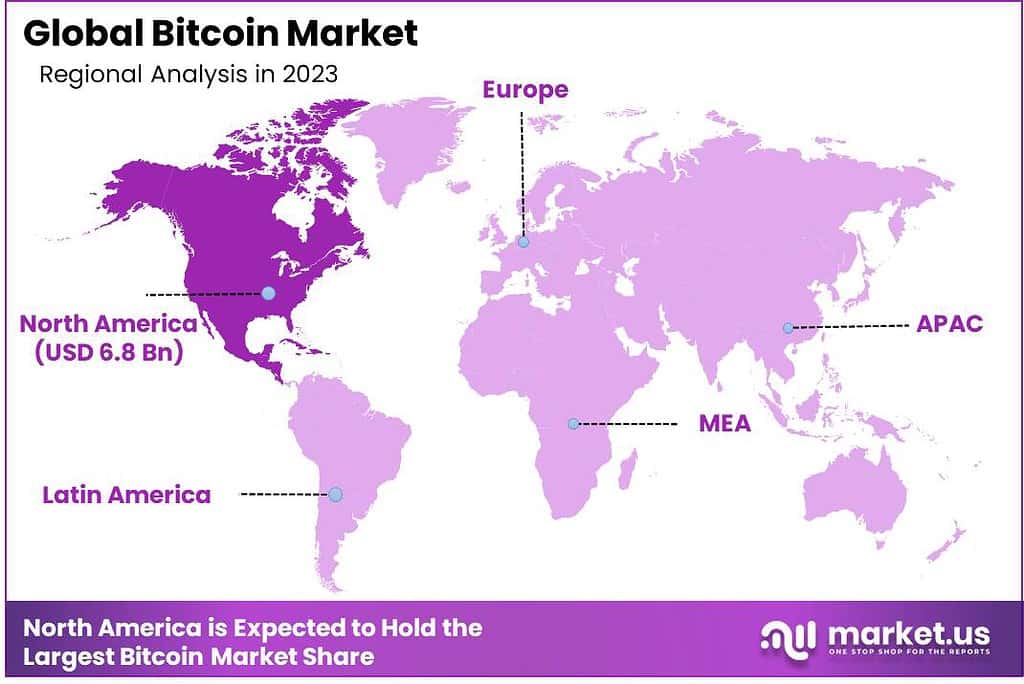

- In 2023, North America held a dominant market position, capturing more than a 32% share, driven by technological adoption, regulatory favorability, and strong infrastructure.

By Application Analysis

In 2023, the Exchanges segment held a dominant market position in the Bitcoin market, capturing more than a 48% share. This leading position can be attributed to several key factors. Primarily, the ease of access and liquidity provided by exchanges have significantly boosted their popularity among both individual and institutional investors. Exchanges serve as the primary gateway for Bitcoin trading, offering a platform for buying, selling, and holding cryptocurrencies. The robust growth in this segment is also driven by the increasing acceptance of Bitcoin as a legitimate investment asset, leading to a surge in trading volumes.

Furthermore, the proliferation of advanced trading features, such as futures and options, along with improved regulatory compliance by leading exchanges, has enhanced investor confidence. This has resulted in a higher rate of adoption among new users, contributing to market growth. The integration of user-friendly interfaces and mobile applications has also played a crucial role in making exchanges more accessible to a wider audience.

By End-use Analysis

In 2023, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position in the Bitcoin market, capturing more than a 35% share. This leadership is primarily due to the increasing integration of Bitcoin and other cryptocurrencies into traditional banking and financial systems.

Financial institutions have been progressively adopting Bitcoin for various purposes, including investment, trading, and as a hedge against currency fluctuation and inflation. The recognition of Bitcoin as a potential store of value and an asset class has further fueled its adoption in the BFSI sector. Additionally, the growing interest of institutional investors in Bitcoin has significantly contributed to the segment’s market share.

The BFSI sector’s interest in blockchain technology, which underpins Bitcoin, for improving security, transparency, and efficiency in transactions has also played a crucial role in this growth. Banks and financial institutions are exploring the use of Bitcoin and blockchain to streamline payment processes and reduce transaction costs, especially in cross-border transactions.

In July 2022, NYDIG, a well-known bitcoin enterprise, joined forces with Southland Credit Union. This collaboration positions Southland as the second credit union in Southern California to offer bitcoin trading services. Members of Southland Credit Union can now engage in the buying, selling, and secure storage of bitcoin through a fully integrated mobile banking feature.

Key Market Segments

By Application

- Exchanges

- Remittance Services

- Payment & Wallet

By End-use

- BFSI

- E-commerce

- Media & Entertainment

Driving Factors

Increasing Acceptance as a Mainstream Financial Asset

One of the primary drivers of the Bitcoin market is its increasing acceptance as a mainstream financial asset. This trend is highlighted by Bitcoin’s growing integration into the portfolios of individual and institutional investors, as well as its acceptance by various businesses and retailers as a form of payment. The perception of Bitcoin as a hedge against inflation and a potential safe haven asset, akin to gold, has further boosted its appeal. This broader acceptance has led to enhanced liquidity, increased trading volumes, and a more diverse investor base, which collectively contribute to the market’s growth and stability.

Restraining Factors

Regulatory Challenges and Legal Uncertainty

A significant restraint facing the Bitcoin market is the ongoing regulatory challenges and legal uncertainty in various countries. The decentralized nature of Bitcoin poses a complex challenge for regulatory bodies attempting to establish control or oversight. Concerns about use in illicit activities, lack of consumer protections, and potential financial instability are leading to divergent and sometimes restrictive regulatory responses. This uncertainty can create market volatility, discourage institutional investment, and hinder the development of Bitcoin-related financial services and products.

Opportunity

Technological Advancements and Integration with Financial Services

The Bitcoin market has a substantial opportunity in leveraging technological advancements and integrating with traditional financial services. The development of more efficient and scalable blockchain technologies can address current limitations in transaction speeds and costs.

There is also potential for Bitcoin to play a pivotal role in emerging areas like decentralized finance (DeFi), which seeks to recreate traditional financial systems, such as banks and exchanges, with cryptocurrency at the core. This integration can lead to innovative financial products and services, opening up new markets and customer segments. Additionally, the growing interest in Central Bank Digital Currencies (CBDCs) could indirectly benefit Bitcoin by normalizing digital currencies and blockchain technology in the mainstream financial sector.

Challenges

Scalability and Environmental Concerns

The Bitcoin market is grappling with two main challenges: scalability and environmental impact. Scalability refers to Bitcoin’s struggle to efficiently process a growing number of transactions. The core issue here is the Bitcoin network’s limited capacity. Unlike traditional payment systems that handle thousands of transactions per second, Bitcoin’s structure allows for a much smaller number, often leading to delays and higher transaction fees when there’s a surge in activity. This limitation poses a significant barrier to Bitcoin’s adoption as an everyday currency.

On the environmental front, Bitcoin mining, the process of creating new bitcoins, is extremely energy-intensive. It’s estimated that the Bitcoin network consumes more electricity annually than some countries. This heavy energy use largely relies on non-renewable sources, raising serious environmental concerns. The carbon footprint of Bitcoin mining has become a hot topic, especially as the world increasingly focuses on sustainability and reducing emissions. The debate continues on how to reconcile Bitcoin’s growing popularity with its environmental impact, highlighting a key challenge for its future.

Key Market Trend

Digitalization and the Rise of Alternative Payment Systems

The key trend shaping the Bitcoin market is the rapid digitalization of financial systems and the growing acceptance of alternative payment methods. The rise of digital and mobile banking, along with an increasing willingness among consumers and businesses to embrace non-traditional payment options, has created a fertile ground for cryptocurrencies like Bitcoin. This trend is partly driven by the younger, tech-savvy generation who are comfortable with digital technologies and are looking for quick, borderless, and innovative ways to transact.

Additionally, in some regions, the instability of local currencies has led people to explore digital currencies like Bitcoin as a more stable store of value. The global pandemic has further accelerated this shift towards digital payments, with an increasing number of businesses and consumers opting for contactless, digital payment options over traditional cash transactions. This evolving landscape presents a significant growth opportunity for the Bitcoin market.

Regional Analysis

In 2023, North America held a dominant market position in the Bitcoin market, capturing more than a 32% share. The demand for Bitcoin in North America reached US$ 6.8 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. In February 2021, Mastercard collaborated with Island Pay to launch the world’s inaugural Central Bank Digital Currency (CBDC)-linked card.

This significant market dominance can be attributed to several key factors. Firstly, the high level of technological adoption and integration in financial systems within this region provides a robust infrastructure for Bitcoin transactions and investments. North America, particularly the United States, is home to a large number of cryptocurrency exchanges and fintech companies, contributing to the region’s substantial market share.

Furthermore, the regulatory environment in North America, while still evolving, has been relatively favorable towards cryptocurrencies, especially when compared to other regions. This has encouraged both individual and institutional investors to engage more actively in the Bitcoin market. The United States and Canada have seen a surge in Bitcoin ATMs, facilitating easier access to the cryptocurrency for the general public.

Additionally, the presence of a highly developed financial sector and a growing awareness and acceptance of digital currencies among the population have played a crucial role. A considerable portion of venture capital investments in blockchain and cryptocurrency startups has been concentrated in this region, indicating a strong future growth potential.

Moreover, the high internet penetration rate and the widespread use of smartphones in North America further support the accessibility and popularity of Bitcoin, making it a leading region in the global Bitcoin market. As per the latest data, the number of Bitcoin wallet users in North America has seen a consistent upward trajectory, reflecting the increasing mainstream adoption of Bitcoin in the region.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Bitcoin market encompasses a diverse array of key players, each contributing uniquely to the ecosystem. These players range from cryptocurrency exchanges and wallet providers to mining companies and financial technology firms.

Some prominent players in the Bitcoin market include:

- Coinbase

- Binance

- Kraken

- Bitstamp

- Ledger

- Trezor

- Blockchain.info

- Antpool

- F2Pool

- Slush Pool

- BitPay

- CoinGate

- OpenNode

- Other Key Players

Recent Developments

- In 2023, Coinbase, Launched Coinbase Prime in April 2023, catering to hedge funds and other institutional investors with advanced trading tools and custody solutions.

-

In 2023, Blockchain.info, Launched Blockstream Satellite API for secure and offline access to the Bitcoin network, and partnered with Chainalysis for enhanced transaction monitoring.

Report Scope

Report Features Description Market Value (2023) US$ 21.5 Bn Forecast Revenue (2033) US$ 220.3 Bn CAGR (2024-2033) 26.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Exchanges, Remittance Services, Payment & Wallet), By End-use (BFSI, E-commerce, Media & Entertainment) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Coinbase, Binance, Kraken, Bitstamp, Ledger, Trezor, Blockchain.info, Antpool, F2Pool, Slush Pool, BitPay, CoinGate, OpenNode, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Bitcoin and how does it work?Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, utilizing blockchain technology to secure transactions and control the creation of new units. It allows for secure, borderless, and pseudonymous transactions.

How big is the bitcoin market?The Global Bitcoin Market size is poised to cross USD 27.1 Billion in 2024 and is likely to attain a valuation of USD 220.3 Billion by 2033. The bitcoin Industry share is projected to develop at a CAGR of 26.2% from 2024 to 2033.

Which segment accounted for the largest bitcoin market share?North America dominated the bitcoin market with a share of 32% in 2023. The presence of several prominent players in the region stimulates market growth.

Who are the key players in the bitcoin market?Some key players operating in the bitcoin market include Coinbase, Binance, Kraken, Bitstamp, Ledger, Trezor, Blockchain.info, Antpool, F2Pool, Slush Pool, BitPay, CoinGate, OpenNode, Other Key Players

What are the factors driving the bitcoin market?The growth of the Bitcoin market is propelled by key factors, including the expanding community of Bitcoin holders and a growing acceptance of digital currencies.

-

-

- Coinbase

- Binance

- Kraken

- Bitstamp

- Ledger

- Trezor

- Blockchain.info

- Antpool

- F2Pool

- Slush Pool

- BitPay

- CoinGate

- OpenNode

- Other Key Players