Global Biopolymer Market By Type [Biodegradable (PLA, Starch Blends, PHA, PBS and Others) Non-Biodegradable/Biobased (BIO-PET, BIO-PABIO-PE, BIO-PTT and Others)] By Application (Films, Bottles, Fibers, Seed Coating, Vehicle Components, Medical Implants and Others) By End User [Packaging (Rigid Packaging and Flexible Packaging) Consumer Goods (Electrical Appliances, Domestic Appliances and Others) Automotive & Transportation (Interior, Exterior and Under Hood) Textiles (Medical & Healthcare Textile, Personal care, clothes and other textiles, Agriculture & Horticulture, Tapes & Mulch Films and Others) Others] By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Jan 2024

- Report ID: 112340

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

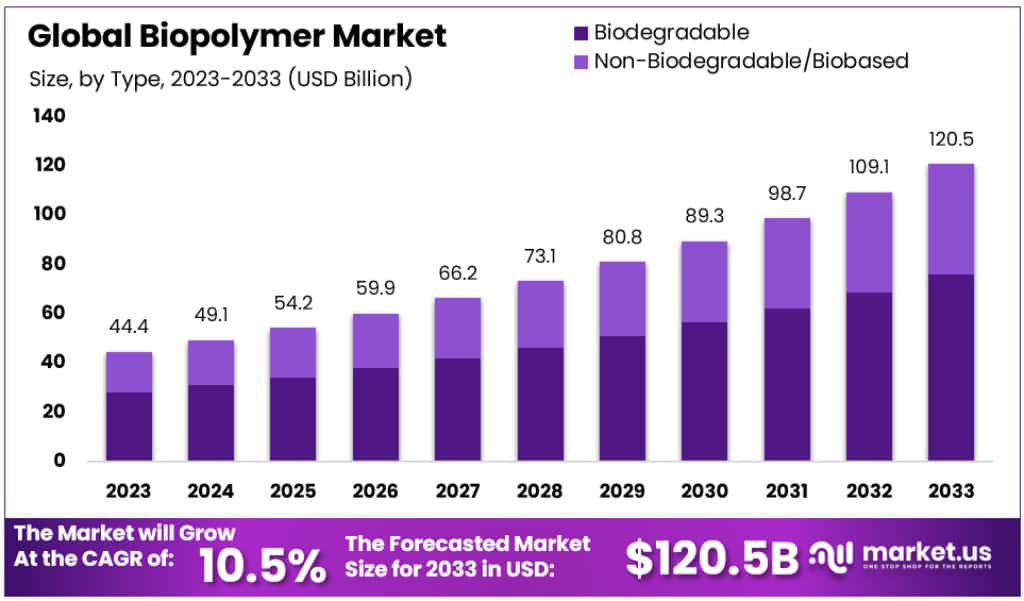

The Global Biopolymer Market size is expected to be worth around USD 120.5 Billion by 2033, from USD 44.4 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2023 to 2033.

Biopolymers are natural polymers produced by living organisms. They consist of monomeric units that are covalently bonded in chains to form larger molecules. There are three main classes of biopolymers: polynucleotides, polypeptides, and polysaccharides.

Polynucleotides, RNA, and DNA, are long polymers of nucleotides. Polypeptides are polymers of amino acids, and polysaccharides are polymers of monosaccharides. Biopolymers are sustainable materials that are fully biodegradable and are used in various applications such as tissue engineering, medical devices, drug delivery, and food packaging.

Key Takeaways

- The Global Biopolymer Market is projected to reach approximately USD 120.5 billion by 2033, showing significant growth from USD 44.4 billion in 2023.

- The market is expected to experience a CAGR of 10.5% during the forecast period from 2024 to 2033.

- In 2023, the Biodegradable segment held a dominant market position, capturing over 63.1% market share.

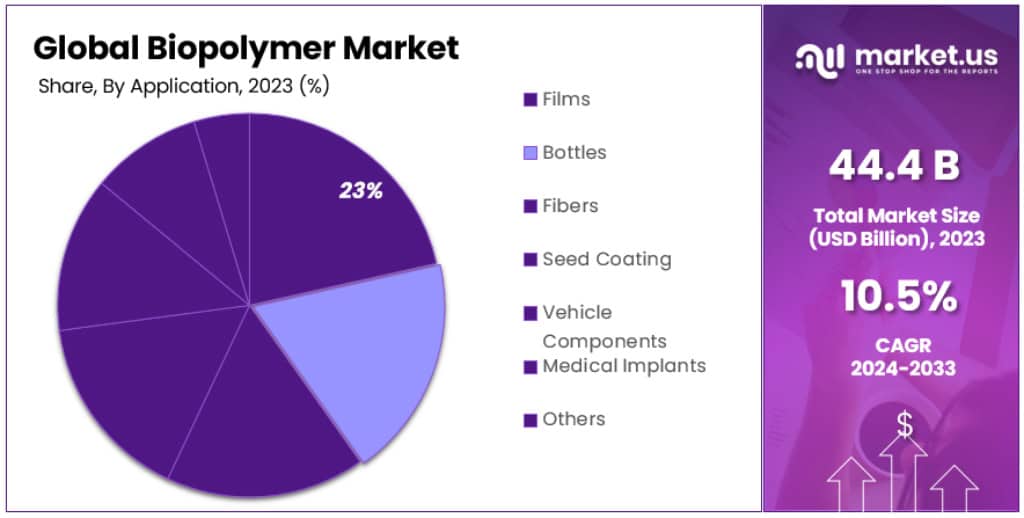

- Films, made from biopolymers, held a dominant market position in 2023, with over 23.3% market share.

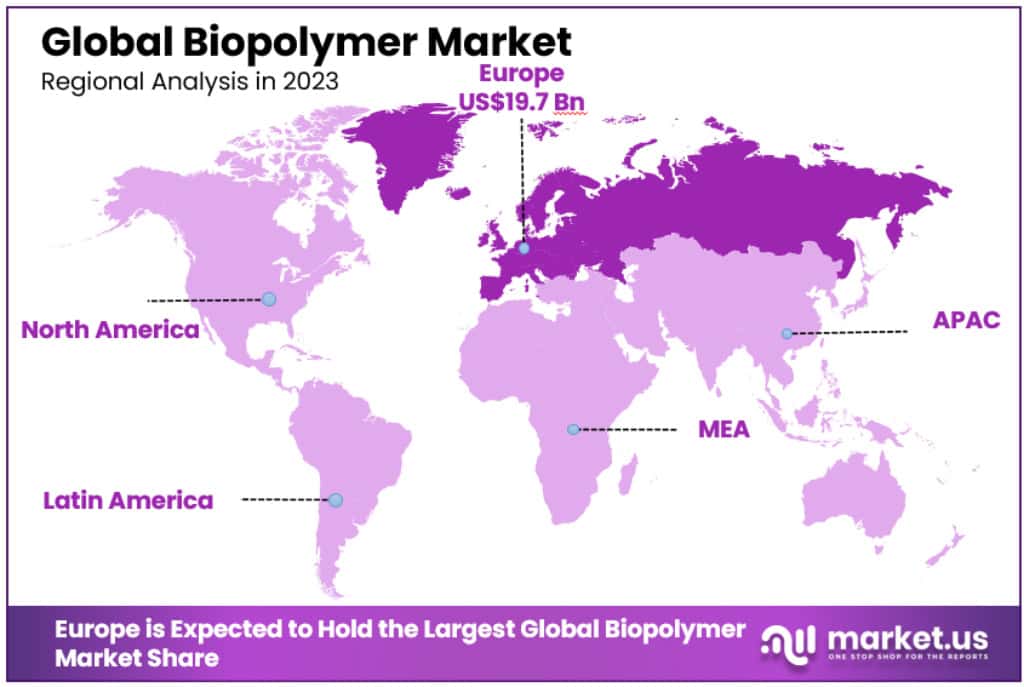

- Europe maintained its dominance in the Biopolymer Market in 2023, accounting for a significant 44.5% share, with USD 19.7 Billion, while the Asia-Pacific region is expected to register the highest CAGR during the forecast period.

Type Analysis

In 2023, the Biodegradable segment held a dominant market position in the Biopolymer Market, capturing more than a significant 63.1% share. This segment encompasses a variety of materials, including Polylactic Acid (PLA), Starch Blends, Polyhydroxyalkanoates (PHA), Polybutylene Succinate (PBS), and others. These materials are primarily favored for their environmentally friendly attributes, as they break down naturally and reduce dependence on fossil fuels.

PLA, a leading biodegradable polymer derived from renewable resources like corn starch or sugarcane, is notable for its wide application in packaging, agriculture, textile, and biomedical sectors. Its market prominence is underlined by its substantial share, attributed to its biocompatibility and ease of processing. Starch blends, another significant segment, are lauded for their cost-effectiveness and extensive use in food packaging and agricultural applications.

PHA, recognized for its biocompatibility and biodegradability, is gaining traction in medical applications, including sutures and drug delivery systems. PBS, known for its excellent mechanical properties and processability, is increasingly utilized in packaging, disposable goods, and agricultural films.

Conversely, the Non-Biodegradable/Biobased segment, though smaller, represents an essential part of the Biopolymer Market. This segment includes BIO-PET, BIO-PA, BIO-PE, and BIO-PTT, among others. BIO-PET, primarily used in packaging, is renowned for its durability and similarity to conventional PET. BIO-PA, used in automotive and electronics, offers advantages like high strength and thermal stability. BIO-PE and BIO-PTT, although holding smaller market shares, are noteworthy for their potential in reducing carbon footprints and are gradually being adopted in various industries.

Application Analysis

In 2023, the Films segment held a dominant market position in the Biopolymer Market, capturing more than a significant 23.3% share. Films, made from biopolymers, are increasingly favored for their reduced environmental impact and are prominently used in packaging, agriculture, and consumer goods. Their market dominance is attributed to their versatility, biodegradability, and the growing demand for sustainable packaging solutions.

Bottles, another key application segment, are gaining traction due to their renewable nature and lower carbon footprint compared to traditional plastic bottles. Used extensively in the beverage industry, biopolymer bottles represent a significant move towards more sustainable consumer goods.

Fibers, derived from biopolymers, are utilized in textiles, automotive, and industrial applications. Their market share is bolstered by the demand for eco-friendly and sustainable materials in the fashion industry and beyond. These fibers are celebrated for their reduced environmental impact and are becoming a material of choice for conscious consumers and manufacturers.

Seed Coating is an innovative application of biopolymers, designed to enhance seed performance and protection. The use of biopolymers in seed coatings is a growing trend, driven by the agricultural sector’s need for sustainable and efficient cultivation methods.

Vehicle Components made from biopolymers are rising in demand due to their potential to reduce vehicle weight and overall environmental impact. As the automotive industry seeks more sustainable solutions, biopolymer-based components are being integrated into vehicles for various applications, from interior parts to exterior panels.

Medical Implants represent a critical application of biopolymers, particularly in biodegradable polymers used for temporary implants and drug delivery systems. The use of biopolymers in medical applications is driven by their biocompatibility and ability to reduce the risk of post-operative complications.

The Biopolymer Market, by application segment, attained a total market valuation of USD 44.4 billion in 2023. Looking forward, this segment is growing at a CAGR of 10.5% during the forecast period 2024 to 2033.

End User Analysis

In 2023, the Packaging end-user segment in the Biopolymer Market held a dominant position, capturing more than a significant 53.3% share. This segment’s prominence is further underscored by the fact that in 2022, it constituted ~60% of the global bioplastics and biopolymers market. The growing demand in this sector is primarily driven by increasing environmental regulations and changing consumer lifestyles, which have amplified the need for bioplastics and biopolymers in various packaging applications including food, healthcare, cosmetics, personal care, and shopping bags.

The Packaging industry’s reliance on bioplastics and biopolymers stems from their high strength and water impermeability, making them ideal for safeguarding products during storage and transportation. The industry is moving towards biopolymers due to their eco-friendly nature and as a response to stringent governmental environmental regulations. However, it’s important to note that the product quality in this industry may be lower compared to traditional plastic product manufacturing industries.

Among the specific areas within Packaging, food and beverage packaging is a major segment, holding a significant share. Biopolymers are frequently used in this sector due to their high strength, lightweight, heat resistance, and are seen as an ideal replacement for single-use plastic packaging. The surging growth of the food & beverage industry, supported by governmental initiatives, is a key driver for the demand for biopolymers.

The Automotive and transportation segment, encompassing applications in interior, exterior, and under-hood components, is also a noteworthy user of biopolymers. This sector is gradually incorporating biopolymers for their advantages in reducing vehicle weight and environmental impact.

Textiles, another key segment, utilizes biopolymers in medical & healthcare textiles, personal care products, and clothing. The adoption of biopolymers in textiles is driven by the increasing demand for sustainable and biodegradable materials.

Agriculture and horticulture is also embracing biopolymers, especially in applications like tapes and mulch films, reflecting the agricultural sector’s shift towards sustainable practices.

Key Market Segments

By Type

Biodegradable- PLA

- Starch Blends

- PHA

- PBS

- Others

Non-Biodegradable/Biobased- BIO-PET

- BIO-PABIO-PE

- BIO-PTT

- Others

By Application

- Films

- Bottles

- Fibers

- Seed Coating

- Vehicle Components

- Medical Implants

- Others

By End User

Packaging- Rigid Packaging

- Flexible Packaging

Consumer Goods- Electrical Appliances

- Domestic Appliances

- Others

Automotive & Transportation- Interior

- Exterior

- Under Hood

Textiles- Medical & Healthcare Textile

- Personal care, clothes and other textiles

- Agriculture & Horticulture

- Tapes & Mulch Films

- Others

Others

Drivers

- Environmental Awareness: The increasing awareness of the harmful effects of traditional petrochemical-based plastics on the environment is a significant driver. These plastics contain harmful compounds that may leach into food and beverages, posing health risks. In contrast, biopolymers, made from natural and safe ingredients, present no such risks. Their demand is rising due to consumer and commercial preference for safer, healthier alternatives.

- Sustainable Packaging Initiatives: Governments worldwide are implementing measures to reduce plastic waste, banning single-use plastics and advocating for eco-friendly packaging solutions. This regulatory environment, coupled with consumer awareness, is propelling the shift towards biopolymers.

- Consumer Preference for Biodegradable Plastics: The biodegradable nature of biopolymers is attracting consumers. Unlike conventional plastics, which linger in landfills for decades, biopolymers decompose much faster, aligning with growing environmental concerns.

Challenges

- High Cost of Biopolymers: The cost disparity between biopolymers and traditional polymers continues to be a significant barrier. Biodegradable plastics currently range from USD 2/kg to USD 6/kg, compared to USD 1/kg to USD 2/kg for conventional plastics. This cost difference, stemming from higher R&D and production expenses, limits biopolymers’ market penetration.

Opportunities

- New Applications in Packaging and Agriculture: There’s a growing demand for biopolymers in consumer goods, influenced by governmental sustainability initiatives. In packaging, applications like food packaging trays, cutlery, and cups are becoming more prevalent. In agriculture, biodegradable mulch films represent a significant opportunity.

- Potential in Emerging APAC Markets: Strategic developments in APAC, like Total Corbion’s PLA Plant in Thailand and Indonesia’s exploration of seaweed-based bioplastics, highlight the potential in these markets. The abundance of bio-based feedstock and evolving environmental regulations in these regions present significant opportunities for market expansion.

Trends

- Innovation and Development: The biopolymers market is witnessing innovation, particularly in combining biopolymers with other materials to create eco-friendly products. An example is the development of ‘eco-alloys’, a blend of biopolymers and traditional polymers, offering 100% biodegradable solutions.

- Government Initiatives and Circular Economy: National and international legislation is transforming the material system into a circular economy. The European Commission’s action plan and the EFSA’s ongoing research demonstrate a focused effort towards sustainable practices, boosting the biopolymer market.

- Growth in the Medical Devices Industry: Biopolymers are increasingly used in medical devices. For instance, the Canadian medical device market, valued at around USD 8.6 billion in 2020, indicates a rising demand for biopolymers in this sector.

- Thermoplastic Starch Innovation: Thermoplastic starch, derived from various carbohydrates and mixed with polymers like PLA, represents a key innovation in the biopolymers market, leading to fully biodegradable products.

Regional Analysis

In 2023, Europe maintained its dominance in the Biopolymer Market, accounting for a significant 44.5% share, translating to USD 19.7 billion. This dominance is underpinned by the region’s stringent environmental regulations and a growing consumer preference for bio-based and biodegradable products.

The European market’s expansion is driven by the rapid use of plastics and heightened consumer awareness about the benefits of bio-based alternatives. Notably, the region’s food and beverage industry, a major consumer of biopolymers, has shown robust growth. For example, Food Drink Europe reported an 8.2% increase in the production index of this industry in 2020.

In contrast, the Asia-Pacific region is expected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is primarily driven by government regulations regarding plastic bag bans, global warming initiatives, and a rising consumer preference for eco-friendly products. Despite higher prices of bioplastics & biopolymers compared to conventional resins, increasing regulations and focus on sustainable development are creating substantial opportunities for bioplastics in the Asia Pacific.

The region, including key markets like China, Japan, and India, is rapidly adopting biopolymers for applications in packaging, textiles, automotive, and construction materials. The growth in this region is also fueled by increasing consumer purchasing power, which is boosting various end-use industries.

Europe’s market strength is expected to continue throughout the forecast period, with the European Union implementing directives against plastic bags and promoting recyclable and reusable packaging by 2028. These initiatives are expected to further propel the demand for biopolymers in Europe. France’s ban on standard plastic bags for packing fruits and vegetables under the Energy Transition for Green Growth law exemplifies such measures.

Overall, the global biopolymers market is influenced by factors like environmental concerns, government initiatives, and technological innovations. Key players in this market include Plantic Technologies Ltd, BASF SE, Novamont SpA, and others, who are contributing to the market growth through innovations and expansions. Europe’s stringent environmental laws and the Asia Pacific’s rapid industrial growth and sustainability focus are pivotal in shaping the global biopolymers market dynamics.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

-

-

- Nature Works

- Braskem

- BASF

- Total Corbion

- Novamont

- Biome Bioplastics

- Mitsubishi Chemical Holding Corporation

- Biotec

- Toray Industries

- Plantic Technologies

- Other Market Players