Biologics Market By Product Type (Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense & RNAi Therapeutics, Others), By Manufacturing (Outsourced, In-house), By Application (Oncology, Immunology, Infectiuos Disease, Cardiovascular Disorders, Others), By Source (Microbial, Mammalian, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 64874

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

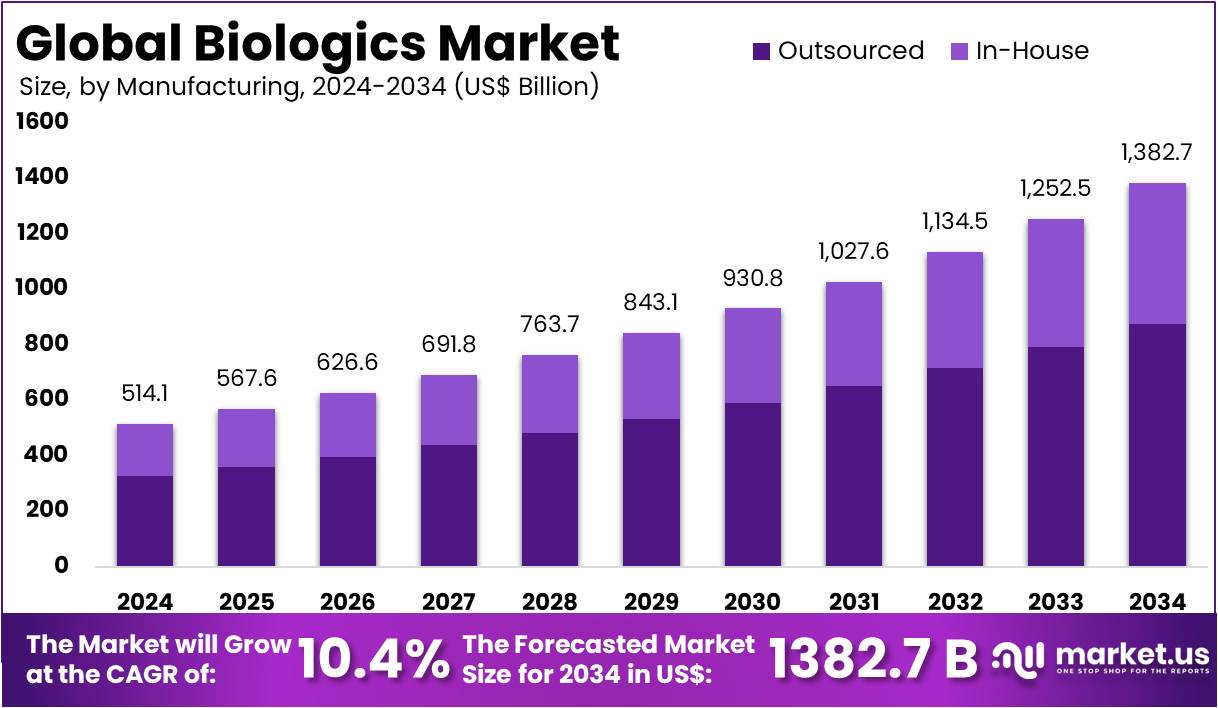

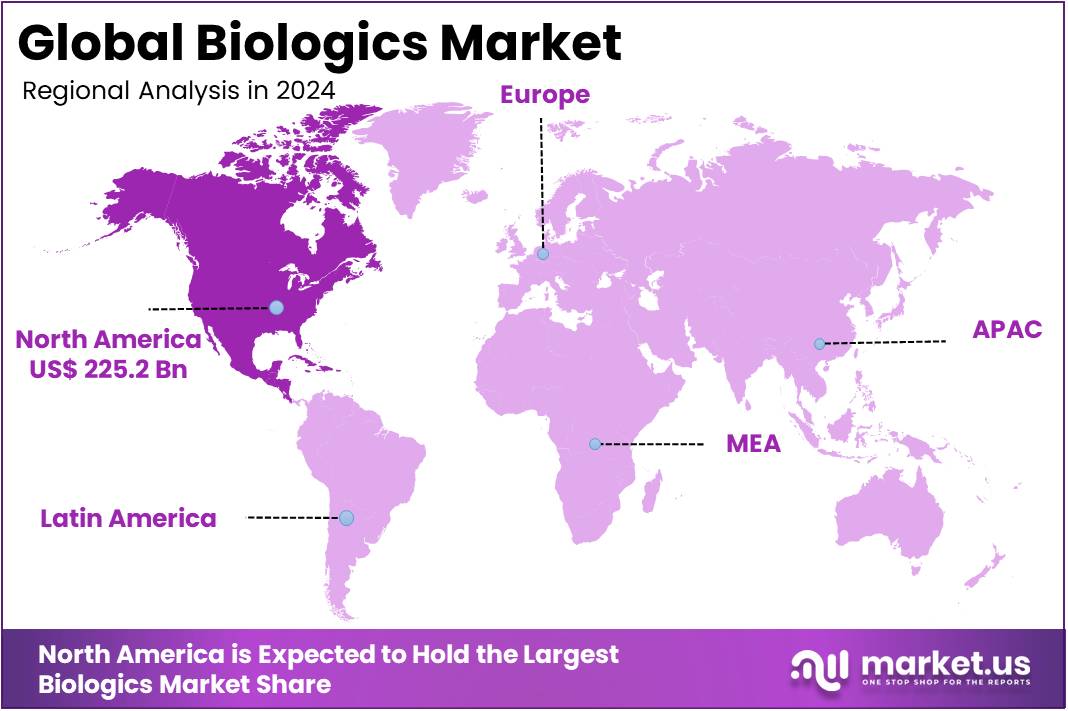

The Biologics Market Size is expected to be worth around US$ 1382.7 billion by 2034 from US$ 514.1 billion in 2024, growing at a CAGR of 10.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.8% share and holds US$ 225.2 Billion market value for the year.

The biologics market is undergoing a period of dynamic expansion, driven by a confluence of factors including the rise of chronic and complex diseases, rapid advancements in targeted therapies, and a robust innovation pipeline. The increasing global burden of chronic illnesses, such as cancer, autoimmune disorders, and neurological conditions, is creating a critical demand for more effective treatment options.

This trend is a key driver for the biologics industry, as these therapies offer a more precise approach to disease management compared to traditional small-molecule drugs. The development of personalized medicine and companion diagnostics further fuels this growth, enabling physicians to tailor treatments to a patient’s specific genetic and disease profile, thereby increasing efficacy.

The prevalence of these diseases is both a challenge and a market opportunity. For instance, the American Cancer Society projects that in 2025, there will be over 2 million new cancer cases diagnosed in the U.S. alone, underscoring the constant need for innovative cancer treatments. Concurrently, the National Institutes of Health (NIH) has documented the rising prevalence of autoimmune diseases, which affect a significant portion of the population, often with a disproportionate impact on women.

In a similar vein, the Alzheimer’s Association estimates that in 2025, an estimated 7.2 million Americans aged 65 and older will be living with Alzheimer’s dementia, a figure that highlights the urgency for disease-modifying therapies. The approval of biologics like Leqembi (lecanemab-irmb) for Alzheimer’s disease serves as a powerful example of how these therapies are addressing critical unmet medical needs.

The commercial success of novel products has also been a significant market accelerator. The rapid and effective development of mRNA-based vaccines, such as Pfizer’s Comirnaty, has not only transformed the public health landscape but has also paved the way for new applications targeting other infectious diseases like the flu and respiratory syncytial virus (RSV). This demonstrates the vast potential of these platforms beyond their initial use.

Government agencies are actively supporting this sector; for example, the FDA’s Center for Biologics Evaluation and Research (CBER) has a dedicated office for approving cellular and gene therapies, as well as a fast-track process for promising new treatments. This regulatory support, combined with a decline in the productivity of traditional small-molecule drug R&D, is positioning biologics for dramatic growth. The increased efficacy and safety profiles of these new compounds are driving a shift in patient care, as individuals who have failed to respond to conventional treatments are now finding new hope in these advanced therapies.

Key Takeaways

- In 2024, the market for biologics generated a revenue of US$ 514.1 billion, with a CAGR of 10.4%, and is expected to reach US$ 1382.7 billion by the year 2034.

- The product type segment is divided into monoclonal antibodies, vaccines, recombinant proteins, antisense & RNAi therapeutics, and others, with monoclonal antibodies taking the lead in 2023 with a market share of 47.6%.

- Considering manufacturing, the market is divided into outsourced and in-house. Among these, outsourced held a significant share of 63.2%.

- Furthermore, concerning the application segment, the market is segregated into oncology, immunology, infectious disease, cardiovascular disorders, and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 45.5% in the biologics market.

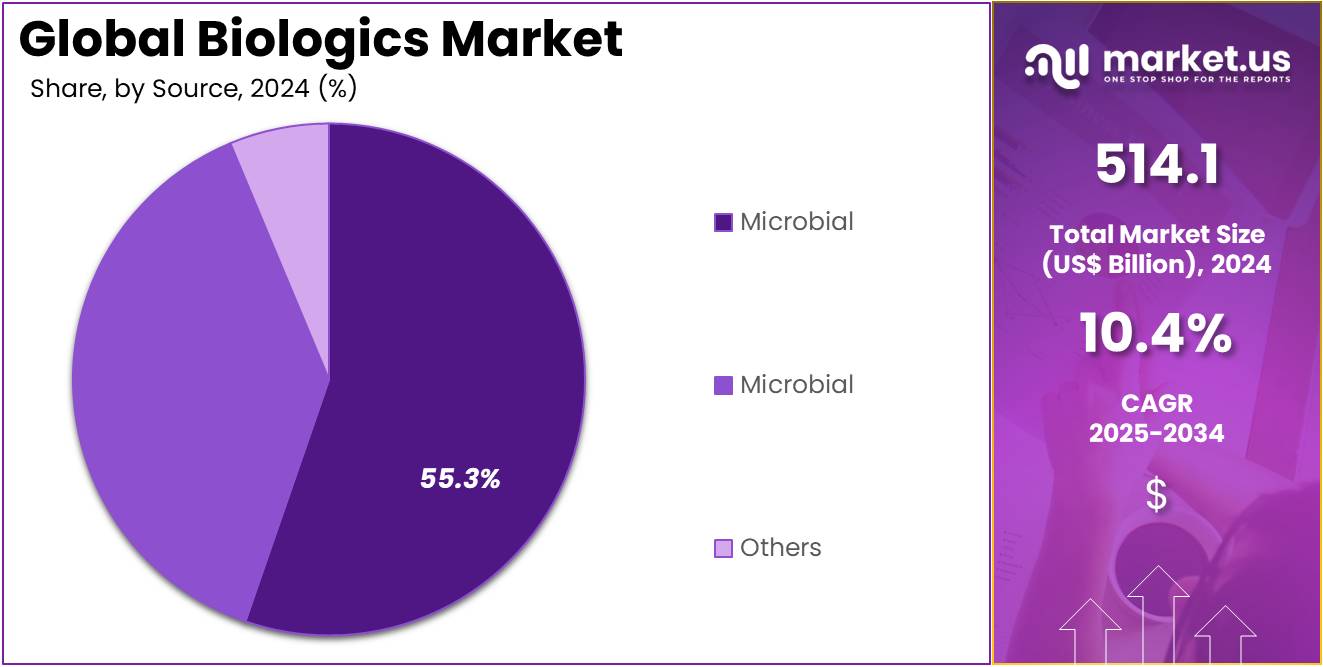

- The source segment is segregated into microbial, mammalian, and others, with the microbial segment leading the market, holding a revenue share of 38.4%.

- North America led the market by securing a market share of 43.8% in 2023.

Product Type Analysis

Monoclonal antibodies (mAbs) hold a dominant position in the biologics market with a commanding 47.6% share, and they are poised to maintain this lead. Their success stems from their exceptional versatility and efficacy, particularly in the fields of oncology and immunology. These targeted therapies are a primary growth driver, offering precise treatment with a lower risk of off-target side effects compared to conventional small-molecule drugs. The continuous stream of regulatory approvals for mAbs across a wide range of conditions, including rheumatoid arthritis, various cancers, and infectious diseases, further fuels this market.

The ability to engineer and customize mAbs for personalized medicine is set to enhance their therapeutic effectiveness and increase demand. As companies continue to invest heavily in R&D for next-generation antibody platforms, this segment’s market dominance is secure. This trend is further supported by the U.S. Food and Drug Administration (FDA), which has consistently approved a high number of biologics, with monoclonal antibodies accounting for a significant portion of these approvals. In fact, a recent analysis of FDA approvals in 2024 revealed a record number of monoclonal antibodies, underscoring their growing importance in the pharmaceutical landscape.

Manufacturing Analysis

The outsourced manufacturing segment holds a significant 63.2% of the biologics market, driven by the critical need for companies to reduce costs, enhance operational efficiency, and expedite time-to-market. By leveraging specialized contract manufacturing organizations (CMOs), pharmaceutical and biotech firms can access state-of-the-art facilities and expertise without the substantial capital expenditure required for in-house development. This strategic shift has been particularly pronounced with the rising demand for biologics in complex therapeutic areas like oncology and immunology.

Outsourcing also provides a crucial level of scalability, allowing companies to respond flexibly to growing global demand. As biologics developers increasingly navigate the complexities of global distribution and diverse regulatory landscapes, outsourcing remains a cost-effective and efficient solution for maintaining a competitive edge. This is a trend that extends beyond just biologics, as research from the National Center for Health Statistics (NCHS) consistently shows that a significant percentage of pharmaceutical companies utilize outsourcing to some degree in their research and development processes.

Application Analysis

Oncology represents a significant and growing application segment in the biologics market, accounting for a 45.5% share. This growth is directly linked to the rising global incidence of cancer, which creates a pressing need for innovative and effective therapies. Biologics, particularly monoclonal antibodies and other targeted therapies, have fundamentally transformed cancer treatment by offering more potent and less toxic options compared to traditional chemotherapy. The rapid progress in immuno-oncology, which harnesses the body’s own immune system to combat cancer, is a key driver for this segment.

The success of biologics in treating a broad spectrum of cancers is expected to attract continued investment. As of 2025, the American Cancer Society projects there will be over 2 million new cancer cases in the U.S., highlighting the immense and ongoing need for these advanced treatments. This increasing burden of disease ensures that oncology will remain one of the most dynamic and critical applications within the biologics market.

Source Analysis

Microbial-derived biologics currently hold a 38.4% share of the source segment in the biologics market. The growth of this segment is driven by the clear advantages of using microbial systems, such as bacteria and yeast, for producing biologic drugs. These systems offer cost-effectiveness, superior scalability, and accelerated production timelines.

Microbial fermentation is a cornerstone technology for producing a wide range of biologic products, including vaccines, monoclonal antibodies, and recombinant proteins. The increasing use of microbial-based systems in vaccine production, especially for infectious diseases, is expected to fuel further expansion.

As companies continue to innovate in microbial production to improve yield and reduce costs, the demand for biologics will rise, solidifying the role of microbial-derived biologics in meeting global healthcare needs. According to the CDC, microbial fermentation is a critical process for a wide range of vaccines and drugs, with a significant percentage of all antibiotics and a majority of all vaccines produced using these microbial systems, showcasing the foundational role this source plays in modern medicine.

Key Market Segments

By Product Type

- Monoclonal Antibodies

- MABs by Application

- Diagnostic

- Biochemical Analysis

- Diagnostic Imaging

- Therapeutic

- Direct MAB Agents

- Targeting MAB Agents

- Protein Purification

- Others

- Diagnostic

- MABs by Type

- Murine

- Chimeric

- Humanized

- Human

- Others

- MABs by Application

- Vaccines

- Recombinant Proteins

- Antisense & RNAi Therapeutics

- Others

By Manufacturing

- Outsourced

- In-house

By Application

- Oncology

- Immunology

- Infectiuos Disease

- Cardiovascular Disorders

- Others

By Source

- Microbial

- Mammalian

- Others

Drivers

The increasing prevalence of chronic diseases is driving the market

The rising global incidence of chronic diseases, such as cancer, autoimmune disorders, and diabetes, is a primary driver for the biologics market. These complex conditions often require targeted therapies that biologics can provide more effectively than traditional small-molecule drugs.

Biologic therapies, including monoclonal antibodies and gene therapies, are designed to interact with specific molecular targets, offering a more precise and often more potent treatment option. According to a 2023 report by the CDC, 76.4% of US adults reported having at least one chronic condition, a number that continues to rise. This represents a significant and expanding patient population in need of advanced treatments.

Furthermore, the FDA’s Center for Drug Evaluation and Research (CDER) approved 37 novel drugs in 2022, with a substantial portion of these being biologics aimed at treating chronic and rare diseases. This trend of approving new and innovative biologic therapies in response to the growing disease burden underscores the market’s strong growth trajectory. The effectiveness and specificity of these treatments are making them the preferred course of action for a wide range of debilitating conditions, ensuring a steady demand.

Restraints

The high cost of research and development is restraining the market

A significant restraint on the market is the substantial cost and complexity associated with the research, development, and manufacturing of biologics. Unlike small-molecule drugs, biologics are produced from living organisms, requiring intricate and highly specialized manufacturing processes. This complexity leads to extensive development timelines and high capital expenditures.

A 2024 analysis of drug development costs found that the mean capitalized cost of developing a new drug, including failures, was approximately $879.3 million, with biologics often sitting at the higher end of this spectrum. This enormous financial outlay creates a high barrier to entry for new players and concentrates market power among a few large pharmaceutical companies.

Furthermore, the final price of these treatments reflects these high costs, as well as the unique nature of the products. A 2022 report from the HHS ASPE highlighted that US prices for brand-name drugs were 422% of prices in other comparison countries, with biologics being a major contributor to this disparity. These high costs limit patient access and put significant pressure on healthcare systems, hindering broader market penetration.

Opportunities

The rise of biosimilars is creating growth opportunities

The emergence and increasing acceptance of biosimilars present a major growth opportunity for the market. Biosimilars are highly similar versions of approved biologics, offering a more affordable alternative while maintaining comparable safety and efficacy profiles. As key patents for blockbuster biologics expire, the pathway for biosimilars opens, introducing price competition and expanding patient access to essential treatments. The FDA has been actively approving biosimilars, with a total of 127 innovator and biosimilar drugs approved in 2024.

The introduction of these products creates significant cost savings for healthcare systems. A 2024 study on inpatient biosimilar use found a mean 35% reduction in wholesale acquisition costs for biosimilars compared to their reference products. This cost-saving potential is a powerful incentive for payers, healthcare providers, and patients to adopt biosimilars, thereby broadening the overall market. The steady increase in biosimilar adoption, particularly in therapeutic areas like oncology and supportive care, is democratizing access to advanced treatments and creating a new segment of growth within the market.

Impact of Macroeconomic / Geopolitical Factors

The operational landscape for companies involved in the development and supply of biologics is currently being redefined by significant economic and geopolitical trends. Global inflationary pressures are causing an escalation in the costs associated with raw materials, energy, and labor, which in turn raises the price of intricate manufacturing components. This trend is evident in a recent medical trends report from 2025, which projects the average medical trend rate to be 10.0%, marking the second consecutive year of a double-digit increase. This situation is reducing corporate profit margins and increasing expenses for healthcare providers, which could potentially curb their investment in new biologic therapies.

Simultaneously, international supply chains are experiencing instability due to ongoing geopolitical tensions. An update from April 2024 on global events noted how conflicts and natural disasters have caused minor to moderate shipping delays for essential materials such as electronic components and laboratory supplies. These disruptions are affecting medical device production and leading to higher prices. To address these challenges, the industry is focusing on strategies to improve operational efficiency and implement more strategic sourcing of materials. Companies that have strong supply networks and the ability to absorb these cost increases are in a better position to maintain both market stability and profitability.

The US tariff policy is also introducing new challenges for supply chains. The recent imposition of duties on imported components and finished goods from key trading partners has increased their cost. In 2025, these tariffs included a 10% baseline on many products, along with a 25% duty on specific medical devices. The financial impact of these tariffs is passed through the distribution channel, which affects profit margins and ultimately results in higher costs for healthcare providers. This can make the adoption of new biologic solutions less financially viable and may raise consumer costs, potentially limiting patient access to care and slowing the adoption of new technologies.

However, these tariffs are also providing a competitive edge to US-based manufacturers. Consequently, some healthcare providers are beginning to favor domestically produced goods to ensure a more dependable supply and predictable pricing. This shift is stimulating local manufacturing and encouraging companies to invest in domestic production capabilities to bypass the tariff burden and strengthen their market standing.

Latest Trends

Personalized medicine and targeted therapies are a recent trend

A notable trend observed in 2024 and 2025 is the increasing focus on personalized medicine and targeted therapies. This approach involves tailoring medical treatment to the individual characteristics of each patient, with biologics being central to this paradigm. By analyzing a patient’s genetic makeup and disease biomarkers, clinicians can select the most effective biologic therapy, leading to better outcomes and reduced side effects. This trend is driven by advancements in genomic sequencing and diagnostics.

A 2024 report on new FDA and European Medicines Agency (EMA) oncology drug approvals highlighted that a majority of the new agents were biologics focused on specific molecular targets. For instance, several new antibody-drug conjugates and bispecific antibodies were approved for various solid and hematologic malignancies. This trend extends to novel cell and gene therapies as well.

In 2024, the FDA approved seven new cell and gene therapy products, including the first cellular therapy for a solid tumor. These “first-of-a-kind” approvals for highly targeted treatments demonstrate the industry’s shift toward creating bespoke therapies, moving beyond a one-size-fits-all approach.

Regional Analysis

North America is leading the Biologics Market

The biologics market in North America held a commanding position in 2024, representing a 43.8% share of the global market. This growth is primarily fueled by a well-developed healthcare infrastructure, significant investment in research and development, and a favorable regulatory environment. The high prevalence of chronic and complex diseases, such as cancer and autoimmune disorders, is a major driver of demand for advanced biological therapies.

For example, the American Cancer Society estimated 1.95 million new cancer cases in the United States in 2023, underscoring the critical need for new oncology treatments, many of which are biologics. The US Food and Drug Administration (FDA) is also a key enabler, having approved a total of 63 biosimilars as of the end of 2024, which increases patient access and competition. This regulatory support, coupled with the availability of advanced medical facilities, solidifies the region’s leadership in the biologics market.

The market’s expansion is further supported by significant innovation and investment. The pharmaceutical industry is increasingly focusing on biologics, with the FDA reporting that in 2024, biologics accounted for 32% of all new drug approvals, a notable increase from the 28% average over the prior six years. This trend highlights the growing importance of these therapies in modern medicine.

In Canada, drug purchases have seen accelerated growth, with total estimated drug purchases increasing by 13.7% in 2023 to reach $43.5 billion, far exceeding the previously forecasted rate. This growth is heavily influenced by the increasing use of complex therapies, including biologics and biosimilars, which are now key contributors to pharmaceutical spending. These factors collectively indicate a robust and expanding biologics market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The biologics market in Asia Pacific is anticipated to grow at the fastest rate during the forecast period. This growth is a result of increasing healthcare expenditures, a rising prevalence of chronic diseases, and a concerted push by governments to develop and adopt advanced biopharmaceutical technologies. The region’s large and aging population is a major catalyst.

For example, the World Health Organization estimates that a significant portion of the global burden of chronic diseases affects Asia Pacific, creating a substantial patient pool for biological drugs. Countries like China are central to this growth, with the National Health Commission of China projecting that the country’s elderly population will reach 487 million by 2050 and chronic diseases will account for over 85% of total health expenditures.

The market’s rapid expansion is also a result of supportive policies and a growing focus on innovation. Governments across the region are implementing favorable policies, such as China’s “Made in China 2025” strategy, which prioritizes the development of a strong biopharmaceutical industry. In South Korea, for instance, a pricing cap on biosimilars was enforced in 2023 to increase affordability and patient access.

India’s biopharmaceutical market is also experiencing strong growth, fueled by the rising demand for biosimilars due to their cost-effectiveness. In 2023, India produced 50% of the 8 billion vaccine doses distributed globally, demonstrating its robust manufacturing capabilities. These advancements and strategic investments are positioning Asia Pacific as a critical growth engine in the global biologics market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major players in the biologics market are driving growth through a combination of innovation, strategic alliances, and global expansion. They’re investing significantly in research and development to create advanced biologic drugs that address critical medical needs. By forming strategic partnerships with academic institutions, healthcare providers, and other industry leaders, these companies can speed up product development and get into new markets faster.

Many also use mergers and acquisitions to quickly grow their product offerings and access new customers. They also leverage their regulatory expertise to navigate complex approval processes, ensuring their products meet global standards. A focus on creating patient-centric solutions further strengthens brand loyalty and ensures long-term growth.

Amgen Inc. is a leading company in the biologics market. It focuses on developing groundbreaking therapies for a variety of diseases, including cancer and cardiovascular conditions. Amgen maintains a strong pipeline of products, backed by extensive research and advanced manufacturing techniques. Through strategic acquisitions and partnerships, the company continues to broaden its portfolio and global reach, keeping it at the forefront of the industry.

Top Key Players in the Biologics Market

- Sanofi

- Samsung Biologics

- Novo Nordisk A/S

- Johnson & Johnson Services, Inc

- Hoffmann La-Roche Ltd

- Eli Lilly and Company

- Celltrion Healthcare Co., Ltd

- Bristol-Myers Squibb Company

- Amgen Inc

- AbbVie Inc

Recent Developments

- In January 2023: The US FDA granted accelerated approval to Lecanemab for treating Alzheimer’s Disease.

- In March 2023: Novartis disclosed plans by its division Sandoz to invest about USD 400 million into the creation of a biologics manufacturing facility in Slovenia.

- In March 2023: Eli Lilly announced an additional USD 500 million investment to expand its 500,000 sq. ft. biologics manufacturing site in Limerick. This follows an initial USD 500 million investment announced in January 2022 for the same facility.

Report Scope

Report Features Description Market Value (2024) US$ 514.1 billion Forecast Revenue (2034) US$ 1382.7 billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies (MABs by Application (Diagnostic (Biochemical Analysis, Diagnostic Imaging) and Therapeutic (Direct MAB Agents, Targeting MAB Agents)) and MABs by Type (Murine, Chimeric, Humanized, Human, and Others)), Vaccines, Recombinant Proteins, Antisense & RNAi Therapeutics, and Others), By Manufacturing (Outsourced and In-house), By Application (Oncology, Immunology, Infectious Disease, Cardiovascular Disorders, and Others), By Source (Microbial, Mammalian, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sanofi, Samsung Biologics, Novo Nordisk A/S, Johnson & Johnson Services, Inc, F. Hoffmann La-Roche Ltd, Eli Lilly and Company, Celltrion Healthcare Co., Ltd, Bristol-Myers Squibb Company, Amgen Inc, AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sanofi

- Samsung Biologics

- Novo Nordisk A/S

- Johnson & Johnson Services, Inc

- Hoffmann La-Roche Ltd

- Eli Lilly and Company

- Celltrion Healthcare Co., Ltd

- Bristol-Myers Squibb Company

- Amgen Inc

- AbbVie Inc