Global Biofuel From Sugar Crops Market Size, Share, And Industry Analysis Report By Type (Ethanol, Butanol, Biodiesel), By Pathways (Bioprocessing, Catalytic Upgrading), By Feedstock Type (First Generation, Second Generation), By Source (Sugarcane, Sugar Beets, Corn), By Production Technology (Fermentation, Transesterification, Hydrolysis), By Application (Automotive, Aviation, Marine, Power Sector), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177854

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Pathways Analysis

- Feedstock Type Analysis

- Source Analysis

- Production Technology Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

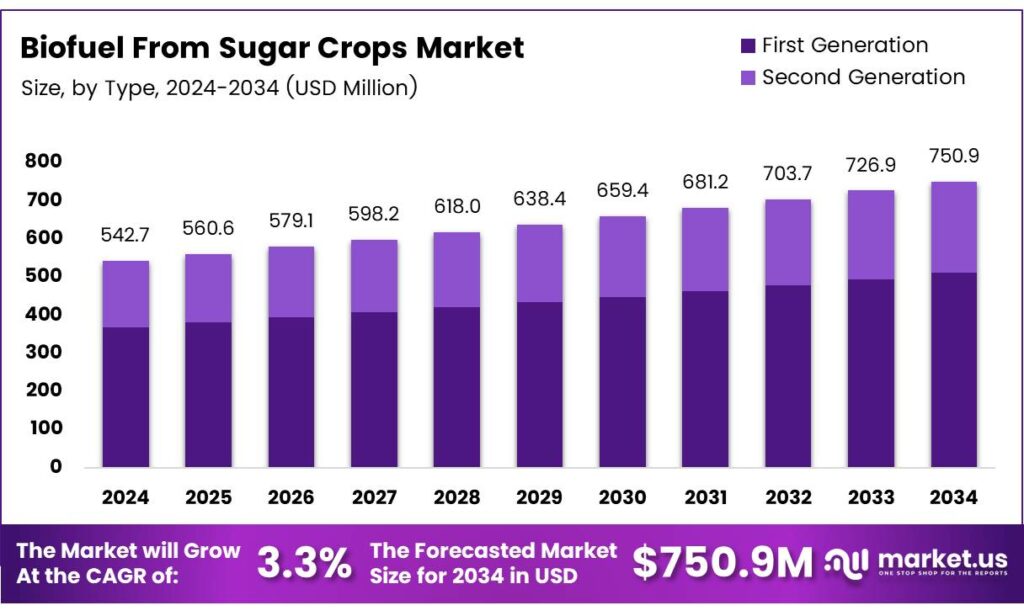

The Global Biofuel From Sugar Crops Market size is expected to be worth around USD 750.9 million by 2034 from USD 542.7 million in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034.

Biofuels derived from sugar crops represent renewable energy alternatives produced through bioprocessing and catalytic upgrading pathways. Sugarcane, sugar beets, and corn serve as primary feedstock sources. These sustainable fuels support global decarbonization efforts across transportation and power generation sectors.

Market expansion reflects growing adoption of ethanol blending mandates worldwide. Governments implement policies encouraging low-carbon fuel alternatives. Moreover, automotive manufacturers are increasing flexible-fuel vehicle production. Consequently, demand for sugar-based biofuels accelerates across developed and emerging economies.

- Brazil produced 51 million litres of cellulosic ethanol in 2024, highlighting steady progress in second-generation biofuel production and the commercial use of agricultural waste as feedstock. At the same time, corn ethanol output in the Centre-South region reached 8.19 billion litres during the 2024/25 production cycle, demonstrating significant diversification beyond traditional sugarcane and strengthening overall supply security through multiple crop sources.

Carbon credit trading mechanisms provide additional revenue opportunities for producers. Net-zero emission commitments drive corporate procurement of sustainable fuels. Additionally, strategic partnerships between agribusiness and energy sectors accelerate market development. Therefore, industry collaboration supports long-term growth trajectories.

Investment flows into integrated biorefinery infrastructure enhance production efficiency. Companies develop co-product revenue streams from biomass residues. Furthermore, precision agriculture technologies optimise crop yields. These advancements reduce production costs and improve commercial viability.

Key Takeaways

- The Global Biofuel From Sugar Crops Market is valued at USD 542.7 million in 2024, projected to reach USD 750.9 million by 2034, at 3.3% CAGR during the forecast period 2025-2034.

- The Ethanol segment dominates with 73.5% market share, driven by transportation fuel demand.

- The Bioprocessing pathway leads with 69.2% share through advanced fermentation technologies.

- First-generation feedstock holds 74.6% share due to established production infrastructure.

- Sugarcane source commands 68.4% market share from Latin American production capacity.

- Fermentation Technology accounts for 71.9% share in production processes.

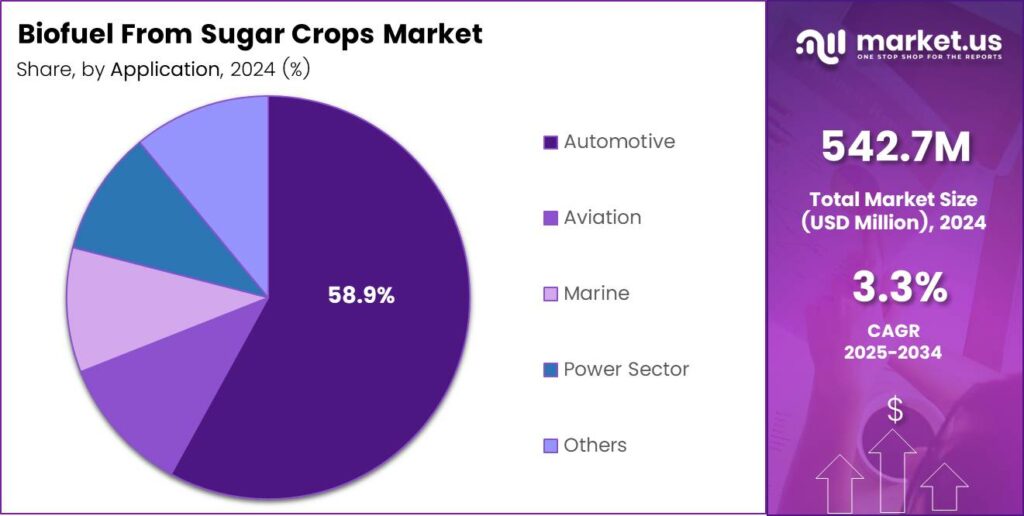

- Automotive application represents 58.9% of the market, driven by ethanol blending mandates.

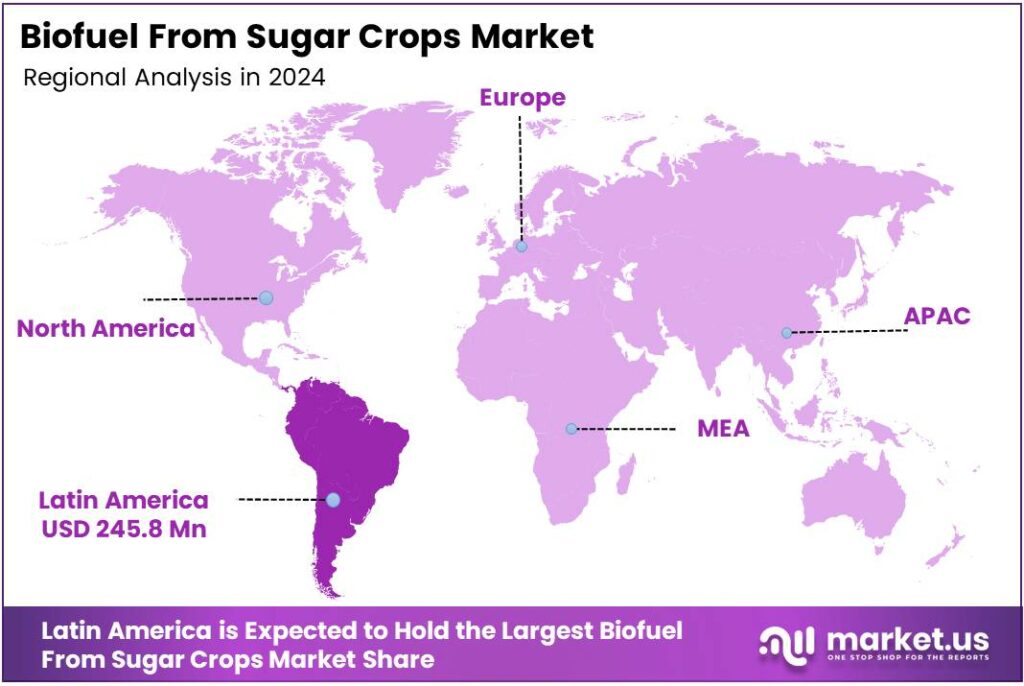

- Latin America dominates with 45.3% regional share, valued at USD 245.8 million.

Type Analysis

Ethanol dominates with 73.5% due to established infrastructure and government blending mandates.

In 2025, Ethanol held a dominant market position in the By Type segment of the Biofuel From Sugar Crops Market, with a 73.5% share. Transportation fuel mandates drive ethanol consumption globally. Flexible-fuel vehicles utilise ethanol-gasoline blends efficiently. Moreover, fermentation technologies enable cost-effective production from sugar feedstocks. Consequently, ethanol remains the primary sugar-based biofuel product.

Butanol emerges as an advanced biofuel alternative with superior energy density. Aviation and marine sectors explore butanol applications. Additionally, butanol blends with gasoline without engine modifications. However, production costs currently exceed ethanol manufacturing expenses. Therefore, commercial adoption progresses gradually through pilot projects.

Biodiesel production from sugar crops remains limited compared to oil-based feedstocks. Catalytic upgrading pathways convert sugars into diesel-range hydrocarbons. Furthermore, biodiesel offers compatibility with existing diesel engines. Nevertheless, economic viability challenges restrict widespread sugar-to-biodiesel conversion. Consequently, market share remains modest within the sugar crop biofuel sector.

Pathways Analysis

Bioprocessing dominates with 69.2% through proven fermentation and enzymatic conversion technologies.

In 2025, Bioprocessing held a dominant market position in the By Pathways segment of the Biofuel From Sugar Crops Market, with a 69.2% share. Fermentation processes efficiently convert sugars into ethanol and butanol. Enzymatic technologies enable cellulosic biomass utilisation. Moreover, bioprocessing offers scalability for commercial production facilities. Therefore, this pathway dominates current market operations.

Catalytic Upgrading represents emerging technology for advanced biofuel production. Chemical catalysts transform sugars into drop-in fuels. Additionally, catalytic pathways produce diesel-range hydrocarbons and jet fuels. However, capital investment requirements exceed bioprocessing infrastructure costs. Consequently, adoption is concentrated in research facilities and demonstration plants currently.

Feedstock Type Analysis

First Generation dominates with 74.6% through established sugarcane and corn processing infrastructure.

In 2025, First Generation held a dominant market position in the By Feedstock Type segment of the Biofuel From Sugar Crops Market, with a 74.6% share. Food crops provide readily fermentable sugars for ethanol production. Existing agricultural systems support a large-scale feedstock supply. Moreover, processing technologies demonstrate proven commercial viability.

Second-generation feedstocks utilise agricultural residues and cellulosic biomass. Bagasse, corn stover, and crop waste offer sustainable alternatives. Additionally, second-generation pathways reduce food-versus-fuel concerns. However, enzymatic pretreatment increases production complexity and costs. Therefore, commercial deployment progresses through pilot-scale demonstration projects.

Source Analysis

Sugarcane dominates with 68.4% due to high sugar content and established production ecosystems.

In 2025, Sugarcane held a dominant market position in the by-source segment of the Biofuel From Sugar Crops Market, with a 68.4% share. Tropical climates support year-round sugarcane cultivation cycles. Brazil leads global production with integrated mill-refinery operations. Moreover, sugarcane bagasse enables cogeneration of electricity and heat. Therefore, sugarcane remains the preferred feedstock source.

Sugar Beets thrive in temperate climate regions across Europe and North America. Beet processing facilities convert roots into crystalline sugar and molasses. Additionally, beet pulp serves as a livestock feed co-product. However, seasonal harvest patterns limit continuous ethanol production. Consequently, market share remains concentrated in specific geographic regions.

Corn provides fermentable sugars through starch-to-glucose conversion processes. The United States and Brazil expand corn-based ethanol capacity. Furthermore, corn cultivation utilises existing grain farming infrastructure. Nevertheless, food security debates influence policy decisions regarding corn ethanol. Therefore, production growth varies by regional regulatory frameworks.

Production Technology Analysis

Fermentation dominates with 71.9% through proven biochemical conversion of sugars into ethanol.

In 2025, Fermentation held a dominant market position in the By Production Technology segment of the Biofuel From Sugar Crops Market, with a 71.9% share. Yeast-based fermentation processes efficiently convert glucose into ethanol. Industrial-scale distilleries operate globally with optimised production parameters. Moreover, fermentation technology requires moderate capital investment compared to alternatives.

Transesterification converts oils and fats into biodiesel through chemical reactions. Sugar crops provide limited oil content for transesterification processes. Additionally, this technology primarily utilises vegetable oils and animal fats. However, integrated biorefineries explore combined fermentation-transesterification pathways. Therefore, market adoption remains specialised within the sugar crop biofuel sector.

Hydrolysis breaks down cellulosic materials into fermentable sugars. Enzymatic and acid hydrolysis enable second-generation biofuel production. Furthermore, hydrolysis pretreatment enhances sugar recovery from agricultural residues. Nevertheless, enzyme costs and process complexity challenge commercial scalability. Consequently, technology deployment concentrates in advanced biorefinery facilities.

Application Analysis

Automotive dominates with 58.9% through ethanol-gasoline blending mandates and flexible-fuel vehicle adoption.

In 2025, Automotive held a dominant market position in the By Application segment of the Biofuel From Sugar Crops Market, with a 58.9% share. Transportation sectors implement renewable fuel standards globally. Ethanol blends reduce greenhouse gas emissions from passenger vehicles. Moreover, flex-fuel engines accommodate high ethanol concentrations. Therefore, automotive applications drive primary market demand.

Aviation explores sustainable aviation fuels from sugar-based feedstocks. Airlines commit to carbon reduction targets through biofuel procurement. Additionally, drop-in jet fuel compatibility eliminates infrastructure modifications. However, production costs exceed conventional jet fuel pricing. Consequently, market penetration progresses through government incentives and corporate sustainability programs.

Marine shipping investigates biofuel alternatives for vessel propulsion. International regulations mandate emission reductions from maritime transport. Furthermore, biofuel blends demonstrate compatibility with existing marine engines. Nevertheless, fuel availability and port infrastructure limit widespread adoption. Therefore, pilot programs evaluate commercial viability across shipping routes.

Power Sector utilises biofuels for electricity generation and distributed energy. Sugar mills generate surplus power from bagasse combustion. Additionally, ethanol powers backup generators and remote installations. However, renewable electricity sources often provide lower-cost alternatives. Consequently, power sector applications remain concentrated in cogeneration facilities.

Key Market Segments

By Type

- Ethanol

- Butanol

- Biodiesel

By Pathways

- Bioprocessing

- Catalytic Upgrading

By Feedstock Type

- First Generation

- Second Generation

By Source

- Sugarcane

- Sugar Beets

- Corn

By Production Technology

- Fermentation

- Transesterification

- Hydrolysis

By Application

- Automotive

- Aviation

- Marine

- Power Sector

- Others

Drivers

Government Mandates Supporting Ethanol Blending Targets Accelerate Market Growth

Governments worldwide implement renewable fuel standards requiring ethanol blending. Brazil mandates 27% anhydrous ethanol in gasoline nationwide. Moreover, India targets 20% ethanol blending by 2025 through the national biofuel policy. Indian oil marketing companies received 904.84 crore litres of ethanol during ESY 2024-25. These policy frameworks create a stable demand for sugar-based biofuels.

Crude oil price volatility encourages nations to reduce petroleum import dependence. Biofuels provide domestic energy security through agricultural feedstock utilisation. Additionally, renewable fuel standards support rural agricultural economies. Therefore, government mandates establish predictable market conditions that attract production investment.

Flexible-fuel vehicle deployment expands consumer access to higher ethanol blends. Automotive manufacturers increase FFV production across global markets. Furthermore, fueling infrastructure adapts to accommodate E85 and higher concentrations. Consequently, vehicle fleet compatibility strengthens long-term ethanol demand trajectories.

Restraints

Competition Between Fuel Production and Food Security Concerns Limits Market Expansion

First-generation biofuels utilise food crops, creating agricultural resource allocation debates. Sugarcane and corn diversion to ethanol production affects sugar and food prices. Moreover, critics argue that fuel crops compete with food production on arable land. Therefore, policymakers balance renewable energy goals against food security priorities.

Water-intensive sugarcane cultivation strains resources in drought-prone regions. Irrigation requirements conflict with drinking water and agricultural needs. Additionally, climate variability affects crop yields and feedstock supply consistency. Consequently, water scarcity challenges threaten production sustainability in key growing areas.

Environmental organisations scrutinise land-use changes from biofuel crop expansion. Deforestation concerns arise when agricultural frontiers extend into natural ecosystems. Furthermore, monoculture farming practices reduce biodiversity and soil health. These sustainability questions constrain social acceptance and regulatory approval for capacity expansion.

Growth Factors

Technological Advancements Accelerate Market Expansion Through Innovation

Second-generation biofuel technologies enable cellulosic ethanol production from agricultural waste. Enzymatic hydrolysis converts bagasse, corn stover, and crop residues into fermentable sugars. India supplied 598.14 crore litres of grain-based ethanol during ESY 2024-25. These advancements reduce food-versus-fuel conflicts while utilising abundant biomass resources.

Integrated biorefineries generate revenue from multiple co-products beyond fuel production. Sugar mills produce electricity from bagasse cogeneration systems. Moreover, facilities extract high-value chemicals and animal feed from processing residues. Therefore, diversified revenue streams improve economic viability and financial resilience.

Emerging economies expand biofuel export capabilities through production capacity investments. Brazil develops international ethanol trade partnerships across Asia-Pacific markets. Additionally, Caribbean nations explore renewable fuel manufacturing for regional supply. Consequently, global trade networks strengthen market access and commercial opportunities.

Emerging Trends

Carbon Credit Trading Mechanisms Reshape Market Economics

Ethanol producers participate in carbon offset programs, generating additional revenue streams. Renewable fuel credits provide financial incentives for low-carbon fuel production. Moreover, corporate sustainability commitments drive voluntary biofuel procurement agreements. Therefore, carbon markets enhance the commercial attractiveness of sugar-based biofuels.

Net-zero emission pledges accelerate adoption across transportation and logistics sectors. Airlines purchase sustainable aviation fuel to meet climate targets. Additionally, shipping companies pilot biofuel blends for maritime decarbonization. Consequently, demand expands beyond traditional automotive applications into new market segments.

Strategic alliances between agribusiness companies and energy corporations advance market development. Joint ventures combine agricultural expertise with fuel distribution networks. Furthermore, technology partnerships accelerate the commercialisation of advanced biofuel pathways. These collaborations optimise value chains from feedstock cultivation through end-user delivery.

Regional Analysis

Latin America Dominates the Biofuel From Sugar Crops Market with a Market Share of 45.3%, Valued at USD 245.8 Million

Latin America leads global production through Brazil’s established sugarcane ethanol industry. The region accounts for 45.3% market share, valued at USD 245.8 million. Favourable climate conditions enable year-round cultivation and processing operations. Moreover, government policies mandate high ethanol blending rates, supporting consistent demand. Therefore, Latin America maintains a dominant regional position.

North America produces biofuels primarily from corn-based feedstocks. The United States ethanol industry supplies domestic transportation fuel requirements. Additionally, Canada develops renewable fuel standards encouraging biofuel adoption. However, sugar beet utilisation remains limited compared to corn ethanol production volumes.

Europe utilises sugar beets for ethanol production in temperate climate regions. The Renewable Energy Directive establishes sustainability criteria for biofuel certification. Moreover, European Union members implement national blending mandates supporting market growth. Consequently, regional production balances domestic agricultural capacity with import requirements.

Asia Pacific markets expand rapidly through government-backed renewable energy programs. India accelerates ethanol blending initiatives utilising sugarcane and grain feedstocks. Additionally, Thailand develops cassava and molasses-based biofuel production. Therefore, regional demand growth creates significant commercial opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BP Plc operates integrated biofuel production facilities across multiple continents. The company invests in advanced biorefinery technologies and sustainable feedstock sourcing. Moreover, BP develops strategic partnerships with agricultural suppliers, ensuring reliable feedstock access. Consequently, the company maintains significant market presence through a diversified biofuel portfolio and global distribution networks.

Royal Dutch Shell Plc advances renewable fuel capabilities through research and commercial-scale production investments. The energy corporation pursues second-generation biofuel technologies utilising cellulosic feedstocks. Additionally, Shell collaborates with the aviation and shipping sectors, supplying sustainable fuel alternatives. Therefore, the company positions itself as a leading provider across transportation biofuel applications.

Wilmar International Limited leverages agricultural processing expertise in the sugar and oilseed sectors. The company operates refineries producing ethanol from sugarcane and molasses feedstocks. Furthermore, Wilmar expands production capacity across Asia-Pacific markets, meeting regional demand growth. Consequently, integrated operations from cultivation through processing strengthen competitive positioning.

GranBio LLC pioneers commercial-scale cellulosic ethanol production in Latin America. The company develops proprietary enzyme technologies enabling cost-effective biomass conversion. Moreover, GranBio demonstrates second-generation biofuel viability through operational demonstration facilities. Therefore, technological innovation establishes company leadership in advanced biofuel development.

Top Key Players in the Market

- BP Plc

- Royal Dutch Shell Plc

- Wilmar International Limited

- GranBio LLC

- CropEnergies AG

- Bunge Limited

- Greenfield Global, Inc.

Recent Developments

- In 2025, BP expanded its biofuels operations in Brazil, focusing on sugarcane-based bioethanol production. BP acquired full ownership of its joint venture BP Bunge Bioenergia, rebranding it as BP Bioenergy. This entity is one of Brazil’s top-three sugarcane bioethanol producers, with 11 agro-industrial units capable of crushing around 32 million tonnes of sugarcane annually and producing approximately 50,000 barrels per day of ethanol equivalent.

- In 2025, Shell continues to invest in biofuels as part of its low-carbon energy portfolio, including blending and trading activities. The company paused construction on its biofuels facility in Rotterdam, Netherlands, to evaluate more commercial pathways forward. Shell also maintains ambitions for sustainable aviation fuel (SAF) production, which could incorporate feedstocks like those from sugar crops in broader biofuel strategies.

Report Scope

Report Features Description Market Value (2024) USD 542.7 Million Forecast Revenue (2034) USD 750.9 Million CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ethanol, Butanol, Biodiesel), By Pathways (Bioprocessing, Catalytic Upgrading), By Feedstock Type (First Generation, Second Generation), By Source (Sugarcane, Sugar Beets, Corn), By Production Technology (Fermentation, Transesterification, Hydrolysis), By Application (Automotive, Aviation, Marine, Power Sector, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BP Plc, Royal Dutch Shell Plc, Wilmar International Limited, GranBio LLC, CropEnergies AG, Bunge Limited, Greenfield Global, Inc. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Biofuel From Sugar Crops MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Biofuel From Sugar Crops MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BP Plc

- Royal Dutch Shell Plc

- Wilmar International Limited

- GranBio LLC

- CropEnergies AG

- Bunge Limited

- Greenfield Global, Inc.