Global Bio Plasticizers Market By Type (Epoxides, Sebacates, Succinic Acid, Citrates, and Glycerol Esters), By Application (Flooring & Wall, Film & Sheet Coverings, Wires & Cables, Coated Fabrics, and Consumer Goods), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 24013

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

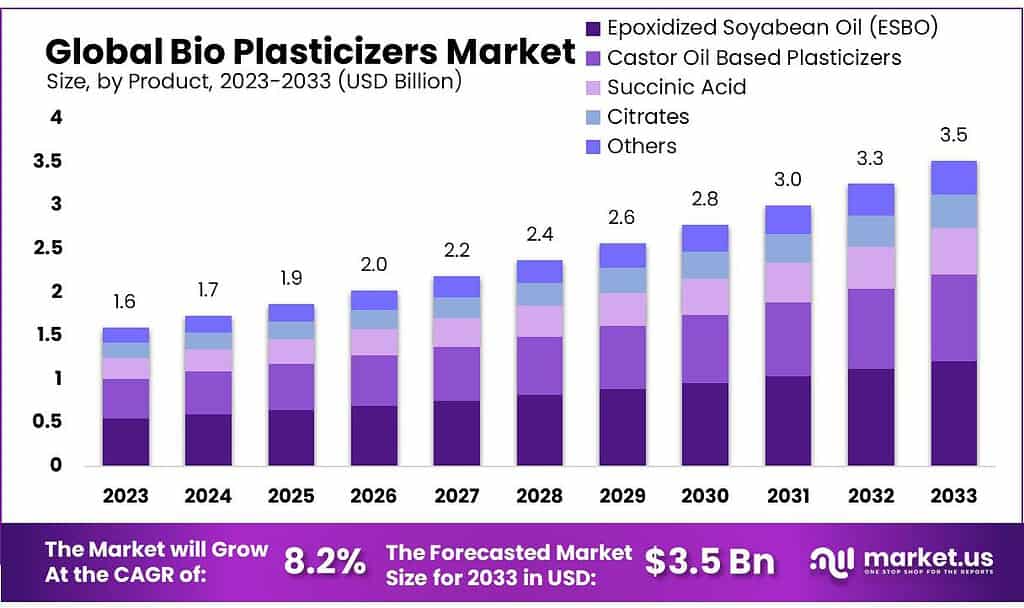

The global bio plasticizers market size is expected to be worth around USD 3.5 billion by 2033, from USD 1.6 billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2023 to 2033.

Bio-plasticizers are made from vegetable materials. They can also be used to replace petroleum-based plasticizers. These additives can be made from ESBO or succinic acid, two of the most common raw materials. ESBO is a preferred additive for food packaging.

It is especially used in PVC gaskets. BioAmber and Myriant are two of the largest succinic acid producers in North America. These are the main suppliers of raw materials for product manufacturers throughout the region. Bio-plasticizers can be used as additives to synthetic chemicals with low side effects, high safety, and high biodegradability.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Size: The bio plasticizers market is set to surge, with its worth expected to reach around USD 3.5 billion by 2033 from USD 1.6 billion in 2023, boasting a promising CAGR of 8.2% over the forecast period. Here are key takeaways distilled from the comprehensive report:

- Product Dynamics: ESBO Dominance: Epoxidized Soyabean Oil (ESBO) claimed over 34.5% of the market share in 2023 due to its versatility and eco-friendly nature.

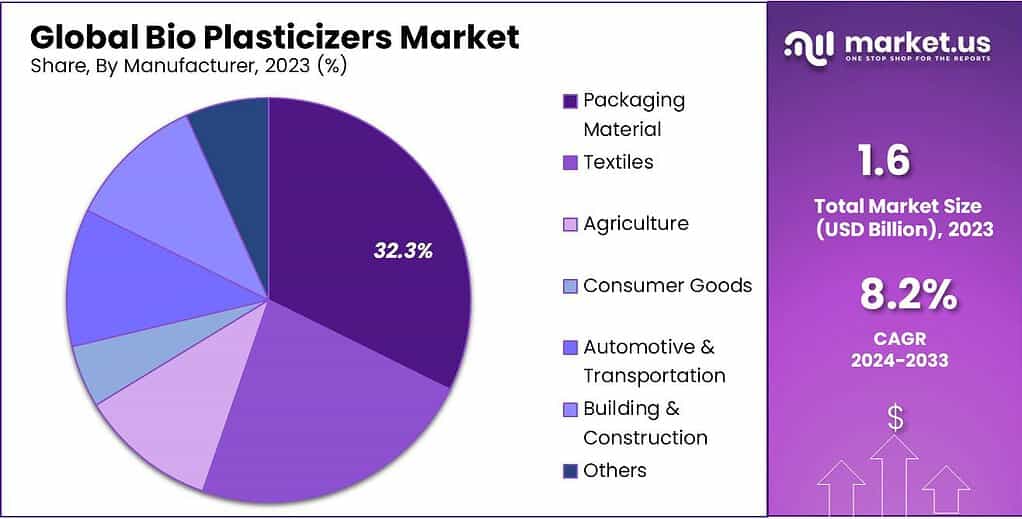

- Application Insights: Packaging Primacy: Packaging Materials secured over 32.3% of the market share in 2023, driven by the demand for sustainable packaging solutions across industries like food and beverages.

- Market Drivers: Industry Growth: Diverse sectors like automotive, construction, textiles, and agriculture are adopting bio plasticizers derived from castor oil, soybean oil, etc., fueling market expansion.

- Challenges Faced: Cost Volatility: Fluctuations in raw material availability and pricing, especially for soybean oil and castor oil, pose challenges in maintaining steady costs.

- Opportunities Ahead: Automotive and Packaging Focus: Bio plasticizers offer substantial opportunities in automotive and transportation sectors as alternatives to metals, particularly in packaging solutions for food, pharmaceuticals, and beverages.

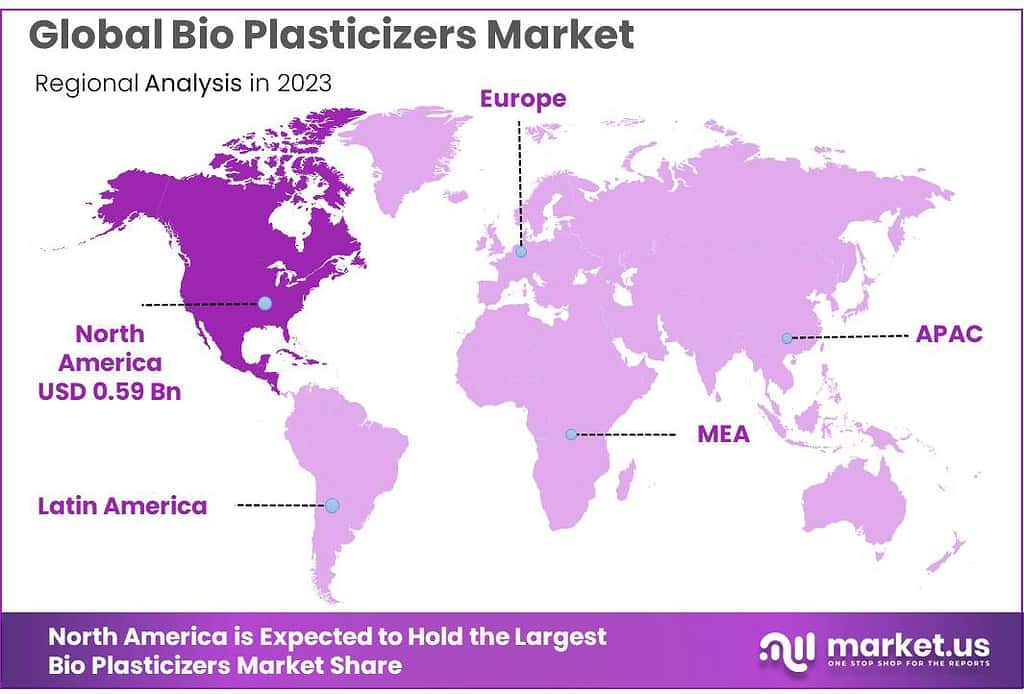

- Regional Impact: North America’s Lead: North America led the market in 2023, driven by advancements in packaging, consumer goods, and the booming auto & transport industry.

- Key Players and Developments: Industry Participants: Major players like Evonik Industries, BASF SE, and others engage in product innovation and collaborations to expand market share.

Product Analysis

In 2023, Epoxidized Soyabean Oil (ESBO) stood out as the top choice in the bio plasticizers market, claiming over 34.5% of the market share. Its popularity stemmed from its versatility and eco-friendly nature, appealing to various industries seeking sustainable alternatives to traditional plasticizers.

Soybean oil is a light yellow vegetable oil that is made from soybeans. It is widely used in plasticizers as a stabilizer. ESBO is an additive that increases the reactivity in plasticizers. It works by oxidizing carbon-carbon double bonds found in vegetable oils.

The use of succinic acid to make plastic additives produces flexible PVC with comparable mechanical properties to DOA. They can be used to make bio-based additions that are phthalate-free and have a higher renewal rate than their synthetic counterparts.

Castor oil and its derivatives can be used to create flexible, semi-rigid, or rigid Bio-plasticizers. It resists hydrolysis and pigment dispersion. It is compatible with polyether polyols. The biodegradable and bio-based citrates can be used to make PVC, PHA, or other biopolymers.

Global players are shifting their focus to sustainability in manufacturing and supply chains, which helps reduce carbon emissions, waste, energy, and other environmental impacts. Because it has lower adverse environmental impacts and offers high profits, recycled bio-based plastics are quickly gaining popularity.

Application Analysis

In 2023, Packaging Material took the lead in the bio plasticizers market, securing over 32.3% of the market share. Its dominance was driven by the rising demand for sustainable packaging solutions across various industries, including food, beverages, and personal care products.

Bio plasticizers reduce fuel consumption and emissions by decreasing vehicle weight. The fabrics of automotive interiors are also made from plant-based plasticizers that have comparable mechanical properties to their synthetic counterparts. The additional benefits include improved stiffness, electrical properties, and dimensional stability as well as a higher gloss level and resistance to thermal shock.

The average growth rate of the market during the forecast period for the ‘Packaging Materials’ segment is expected to be around 8.5% over the forecast period. An important role is played by these specialty additives in protective packaging, rigid and flexible food contact packaging industries, etc., as well as many other packaging options that can be used for different industries.

Global packaging companies use sophisticated manufacturing techniques and flexible processes to tailor their products to customers’ specific needs, especially when it comes to food packaging. Bio-based materials can be used to preserve food and prolong its shelf-life. They also have higher barrier properties, such as oxygen resistance, antimicrobial, and moisture resistance.

Eco-friendly plastics can be used in agriculture and horticulture to produce eco-friendly tarpaulins. The rise in environmental constraints due to increasing carbon footprints, combined with better durability and improved finished product properties will lend synthetic plastics an edge.

The availability of abundant and easy-to-access renewable feedstock provides stable raw materials that support the transition from traditional PVC plastics into organic polymers. Countries in Europe and the U.S. are both mature economies that have been focusing on the use of eco-friendly products and fabrics in their textile and packaging industries.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

-

By Product

- Castor Oil-Based Plasticizers

- Epoxidized Soybean Oil (ESBO)

- Succinic Acid

- Citrates

- Other Products

-

By Application

- Consumer Goods

- Packaging Materials

- Building & Construction

- Automotive & Transport

- Other Applications

Drivers

The growth of various industries like automotive, construction, packaging, textiles, transportation, and agriculture is set to boost the bio plasticizers market. These industries are increasingly adopting bio plasticizers derived from raw materials like castor oil, soybean oil, and linseed oil, driving the market’s expansion in the coming years.

Consumer Goods stands out as one of the fastest-growing segments in the bio plasticizer market. With rising per capita incomes in both developed and certain developing countries like those in Central America and the Asia-Pacific region, the demand for consumer goods and fast-moving consumer products is on the rise.

Strict regulations on conventional plasticizers are also playing a pivotal role in propelling the global bio plasticizers market. Governments are favoring the use of bio-based alternatives in industries such as automotive, textiles, and consumer goods, fueling market growth. These eco-friendly organic fabric softeners made from renewable natural sources are quickly gaining a foothold among consumers.

Initiatives underway in Asia-Pacific countries, like Japan’s collaboration between National Institute of Advanced Industrial Science and Technology (AIST) to introduce biodegradable, eco-friendly, hypoallergenic, non-toxic bio-softening products are showing progress.

Efforts such as ‘Made in India’ are also expected to enhance domestic bio plasticizer production, contributing to market growth during the forecast period. These initiatives and collaborations aim to bolster the production and adoption of bio plasticizers, aligning with global sustainability goals.

Restraints

The soaring cost of bio plasticizers poses a significant challenge to the market. The pricing of these bio-based alternatives is intricately tied to the availability and cost of key raw materials like soybean oil epoxidized (ESBO), succinic acid, and castor oil, which serve as primary inputs for bio plasticizer production.

Factors influencing the prices of these oilseed-derived materials include global supply and demand dynamics, fluctuations in inventories, escalating demand for castor oil across various sectors, competition from other major crops, and the unpredictable impact of weather conditions. The intricate interplay of these elements contributes to the volatility in oilseed prices, thus directly impacting the cost of bio plasticizers.

These raw materials, pivotal for bio plasticizer manufacturing, find application in a diverse array of industries such as plastics, paints, lubricants, and pharmaceuticals. However, the sluggish production of these plant sources on a global scale, particularly in regions like China, Brazil, and India, is anticipated to further escalate the prices of castor oil-based derivatives and seeds in the global market.

The escalating global demand for castor oil as an alternative to petroleum-derived products across industries like paper, plastics, and nylon amplifies the sensitivity of prices to any decline in crop production, particularly in India. Any shortfall in crop yield in this major production region invariably affects prices, potentially causing ripple effects across industries reliant on these bio-based materials.

In essence, the volatile nature of oilseed prices, coupled with the growing demand for these materials across various sectors, poses a challenge to the cost-effectiveness of bio plasticizers. The market faces the uphill task of balancing the demand for sustainable alternatives with the economic feasibility of their production, especially amidst fluctuations in raw material availability and pricing.

Opportunity

The expanding utilization of bio-based plastics in automotive and transportation as alternatives to metals and alloys is a prime catalyst driving the global demand for bio plasticizers. Within the realm of bio-plasticizers, packaging materials stand as a ubiquitous application.

The rise of bio-based plastics is significantly reshaping packaging solutions, particularly in food, pharmaceuticals, and beverages. Traditional composite plastics like PET and PC are progressively being supplanted by bio plasticizer polymers in packaging across beverages, consumer goods, electronics, toys, and clothing.

The surge in consumption, both in developing and developed nations, serves as a major impetus for the application of bio plasticizers, especially in packaging. This presents promising opportunities, particularly in the packaging of beverages, where bio plastics require relatively smaller quantities compared to conventional materials, offering significant advantages.

The prospects for bio plasticizers in packaging applications are notably lucrative, tapping into the growing demand for sustainable solutions. As bio-based plastics continue to gain traction as viable alternatives, they pave the way for innovation and market expansion, particularly in the packaging industry across diverse sectors.

Challenges

Prices of materials used in bio plasticizers can change a lot, making it hard to keep costs steady. Sometimes, it’s tough to get enough of the materials needed, like soybean oil or castor oil, which can affect making bio plasticizers. Making sure that bio plasticizers work well and can be used with different materials can be tricky.

Rules regarding bioplasticizers vary between states, making it hard to adhere to all the different regulations regarding their use. Furthermore, not everyone knows much about them or finds them too expensive.

Bioplasticizer production can be challenging without compromising quality or becoming too costly. Other types of plasticizers are already well-known and cheaper, so convincing people to switch to bio-based ones can be hard.

Some industries might be unsure about using new bio-based options without knowing for sure if they’ll work as well or be compatible with their current materials.

Regional Analysis

North America was responsible for the largest Market Share Analysis of 36.4% in 2023 and is expected to continue growing in the years ahead. The highest contribution was made by China. China’s rapid industrialization combined with high levels of urbanization will likely boost the major countries’ market growth trajectory.

The surging product demand in this major region is also due to the increasing use of bio-based packaging solutions from emerging economies such as India, Japan, and Taiwan. Market growth in the region is expected to increase due to a spike in construction activities and the increased demand for bio-plasticizers.

India, China, South Korea, and Japan are major industrial nations that use bio-plasticizers to treat water, bleach their homes, and for chemical purposes. Growing population figures, combined with an increase in incomes and purchasing power parity have resulted in a strong

demand for consumer goods such as toys and household items. These factors are expected to drive the demand for bio-plasticizers in this region over the forecast period.

North America was the market leader due to its continued expansion and technological advances in the packaging, and consumer goods industries. The continued growth in North America’s bio-plasticizers market sector is also due to the booming auto & transport industry.

Europe is dominated by significant industrial economies like the UK and France. This has led to a growing number of market suppliers, as well as manufacturers of personal care products and pharmaceutical products. Bio plasticizers can be used as an additive in the production of cosmetic products, including lipsticks, shampoos, and soaps. European countries are expected to register a high demand for bio-plasticizers because of the large number of cosmetic and personal care manufacturing units.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Players Analysis

Evonik Industries is one of many industry participants in the bioplasticizers market. Global Market Major Players such as Solvay SA, BASF SE, and Emery Oleochemicals LLC engage in product innovation, industrial collaborations, R&D initiatives, and technology & product innovation to expand their product portfolios.

Industry players are likely to expand their market share analysis in emerging countries like India, Japan, and China over the forecast period. This industry is well-consolidated, with only a few companies accounting for significant market size and market share analysis. Many manufacturers are sensitive to commodity and energy prices.

They also need to pay for raw material costs. This creates problems in earning high-profit margins due to the volatility of material prices in the global market sectors. Many companies have the ability to respond to signs of a larger turndown or inventory buildup by portfolio consolidation, restructuring, and temporary production process shutdowns.

Маrkеt Plауеrѕ

- Evonik Industries AG

- DuPont

- Dow Chemical Company

- Emery Oleochemicals

- Lanxess AG

- MATRCA S.P.A.

- Myriant Corporation

- PolyOne Corporation

- Vertellus Holdings LLC

- Cargill, Inc.

- BASF SE

- DIC CORPORATION

Recent Developments

November 2022: Evonik Industries is centralizing and expanding its reach. It launched its first digital platform, ‘myFLEXINO,’ for plasticizers to effectively and efficiently extend its products and services to consumers.

August 2022: The Hallstar Company, a specialty chemicals company acquired an ester manufacturing facility in Greensboro, North Carolina, from German specialty chemicals maker Lanxess. This site has significant assets that produce environmentally friendly phthalate-free plasticizers which will help to expand the product portfolio of Hallstar Company.

Report Scope

Report Features Description Market Value (2023) USD 41.7 Billion Forecast Revenue (2033) USD 68.6 Billion CAGR (2023-2032) 8.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dyes, Pigments), By Application (Textile, Paints & coatings, Plastics, Leather, Paper, Printing ink, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Clariant AG, DIC Corporation, Sudarshan Chemical Industries Ltd., Atul Ltd., Huntsman Corp., Kronos Worldwide, Inc., Lanxess AG, Kiri Industries Ltd., Archroma, Nippon Kayaku, Kyung-In Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are plasticizers?Plasticizers are additives used in plastics to improve flexibility, durability, and workability by increasing the polymer's plasticity or reducing its viscosity.

What are bio plasticizers?Bio plasticizers are a type of plasticizer derived from renewable sources such as vegetable oils, bio-based acids, and other natural materials, as opposed to traditional plasticizers that are petroleum-based.

How does research and development impact the bio plasticizers market?Ongoing research focuses on developing innovative bio-based plasticizers with improved performance, compatibility, and cost-effectiveness, thereby expanding the application potential of these additives.

-

-

- BASF SE

- Evonik Industries AG

- Solvay SA

- Dow Chemical Company

- PolyOne Corporation

- Emery Oleochemicals LLC

- Danisco US Inc.

- BioAmber Inc.

- vertellus holdings LLC

- Other Key Players