Global Beta-Glucan Market By Source (Cereal, Mushroom, Yeasts, and Seaweed), By Type (Soluble and Insoluble), By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Animal Feed, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 34421

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

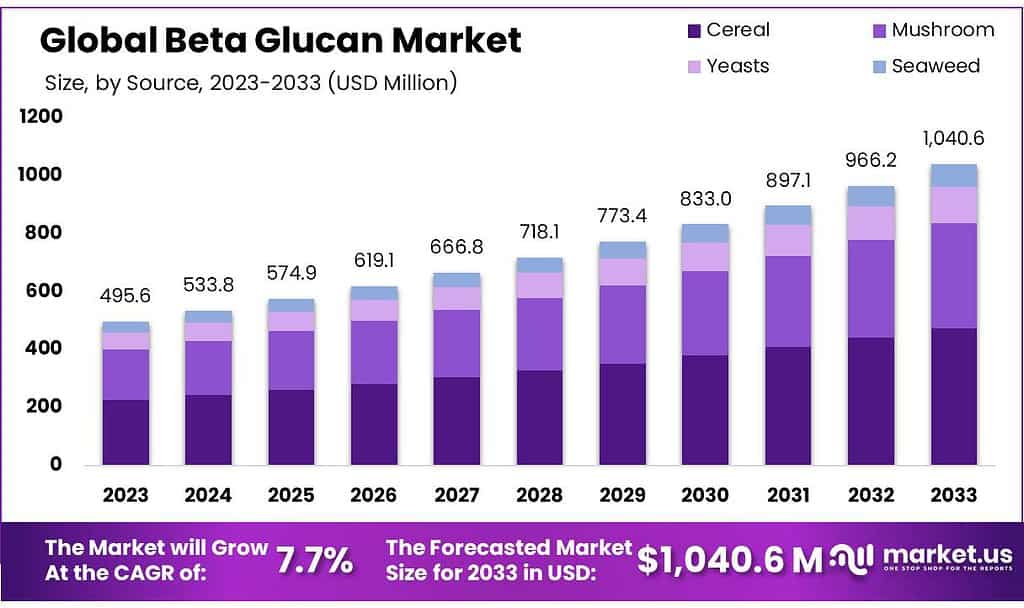

The global beta-glucan market size is expected to be worth around USD 1040.6 Million by 2033, from USD 495.6 Million in 2023, growing at a CAGR of 7.7% during the forecast period from 2023 to 2033.

Growth is expected to be driven by the increasing use of beta-glucan as an immune booster medicine in the pharmaceutical industry and the nutraceutical sector. The growth is likely to be driven by changing consumer preferences towards nutritious food supplements instead of synthetic ingredients.

The increasing awareness of manufacturers about multiple sources, harvesting and processing, as well as extraction methods, will drive the industry to expand. Manufacturers are using innovative, patented technologies to increase market share and overall sales.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth Projection: By 2033, the Beta-Glucan market is anticipated to soar to a value of around USD 1040.6 Million from the 2023 valuation of USD 495.6 Million, growing at a CAGR of 7.7%.

- Driving Factors: Increased utilization in pharmaceuticals and nutraceuticals, especially as an immune booster, propels market growth. Growing preference for nutritious food supplements over synthetic ingredients is influencing consumer choices.

- Diverse Sources & Utilization: Cereals, mushrooms, yeasts, and seaweed stand as primary sources for Beta-Glucan extraction. Applications span across food and beverages, personal care products, pharmaceuticals, and animal feed.

- Source & Type Dominance: Cereals emerged as the leading source, notably oats, barley, and wheat, holding a significant share of 45.6% in 2023. Soluble and insoluble Beta-Glucan jointly dominated, accounting for over 88% of the market.

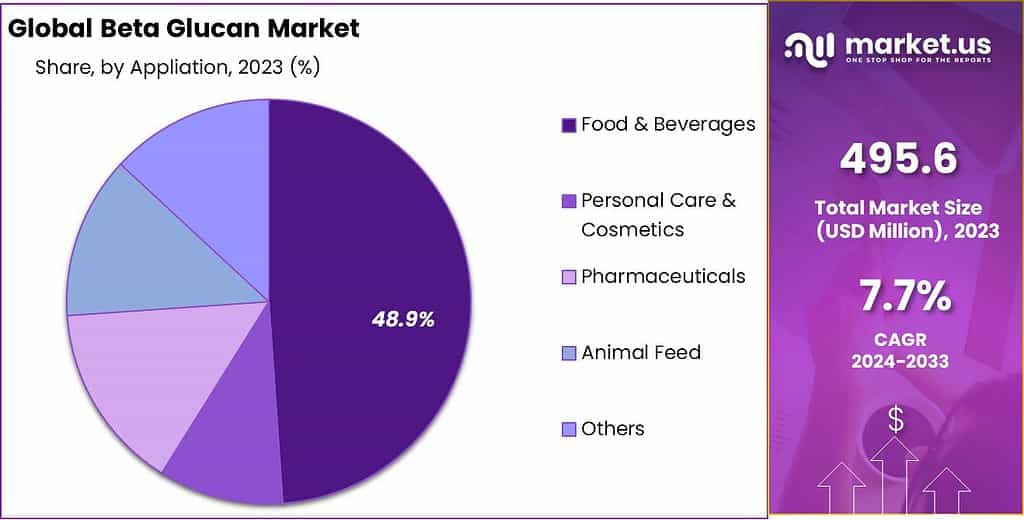

- Applications & Impact: Food and beverages constitute the major application segment (48.9%), with Beta-Glucan enhancing nutritional value. Personal care & cosmetics also utilize Beta-Glucan for moisturizing and skin-soothing properties.

- Global Impact & Regions: North America secured a dominant market share (44.4%), primarily driven by pharmaceutical demand. Europe stands out with major players focusing on innovative manufacturing techniques.

- Key Market Players: Tate & Lyle PLC, Kerry Group PLC, Koninklijke DSM NV are among the significant players shaping the market landscape.

- Future Opportunities & Challenges: Beta-Glucan’s potential in managing blood sugar levels presents growth opportunities. Challenges include awareness gaps, cost, competition, need for more research, and navigating complex regulations.

Source Analysis

In 2023, Cereal emerged as the leading source in the Beta Glucan market, securing over a dominant 45.6% market share. Cereals, including oats, barley, and wheat, stand out as significant sources of beta-glucan, prominently used in various food and supplement products.

Cereals have been proven to have positive effects on human bodily functions, making them a major source of raw material to extract the product.

The highest number of industries where mushroom-based products will be used. In the manufacture of beta-glucan from specific mushrooms or fungi such as shiitakes, reshis, maitakes, and turkey tails are used in cosmetics formulations.

Because of its low cost, Baker’s yeast is one of the most popular sources of this product. It is used extensively in the food and beverage industries as well as an inexpensive animal feed. It has higher active links than mushroom-sourced yeast, which is why it is used in the pharmaceutical industry for cancer treatment.

Seaweed-derived products are mainly used in the production and sale of dietary supplements for food and beverages. This is expected to fuel industry growth in the coming years. The market is expected to grow as major manufacturers adopt advanced algae-based technology for extracting beta-glucan.

Type Analysis

In 2023, Soluble Beta Glucan and Insoluble Beta Glucan jointly dominated the market, capturing an impressive share of over 88%. Soluble Beta Glucan, known for its ability to dissolve in water, is widely utilized in various food and beverage products, supplements, and pharmaceuticals. Its capacity to form gels and viscous solutions makes it a sought-after ingredient in functional foods.

Soluble fibres dissolve easily in water and travel through the digestive system becoming gelatinous. This helps to remove cholesterol and balance blood glucose. The market for soluble products is expected to grow due to the rising demand for pharmaceutical formulations.

Insoluble compounds are usually mixed with methyl sulfuride and urea, or partially sulphated by sulfuric acid. This product is used extensively in the manufacturing of pharmaceutical biofuels, which will be a benefit to the market.

The insoluble beta-glucan powder can be used to make cosmetics. It is inert in its natural state and compatible with many ingredients. Cosmetics manufacturers use an insoluble version of an antifungal cream, antimicrobial crème, and other oral care products. This is expected to fuel the industry’s growth.

Application Analysis

In 2023, Food & Beverages emerged as the leading application segment in the Beta Glucan market, securing over a dominant 48.9% share. Beta Glucan finds extensive use in this sector due to its functional properties, often added to various food products like bread, cereals, and beverages to enhance nutritional value and health benefits.

Personal Care & Cosmetics followed suit with a considerable market share, utilizing Beta Glucan in skincare and cosmetic formulations for its moisturizing and skin-soothing properties.

Beta-glucan is found in cosmetics and personal care products made from oats. Oat-based products have been shown to stimulate and promote macrophages in skin layers, which in turn encourages the protective qualities of keratinocytes. This aids in skin texture repair. This is due to the increased demand for cosmetics.

It is expected that the pharmaceutical industry will be a large consumer of beta-glucan. The product is sourced from yeast as it is cheaply coupled. The market for beta-glucan-containing drugs has seen steady growth since the ban on antibiotics in animal food. This is expected to drive demand.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

By Source

- Cereal

- Mushroom

- Yeasts

- Seaweed

By Type

- Soluble

- Insoluble

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Animal Feed

- Other Applications

Drivers

Emergence of Beta-Glucan Application in Different Industries Beta-glucan has long been studied for its health benefits, such as immunity enhancement, anti-inflammatory effects and cholesterol reduction properties. Recently however, there has been increased interest in its application beyond food and supplement sectors – such as studies into its uses as an adhesive filling material or carpet backing material.

Studies of beta-glucan films demonstrate their potential use as biodegradable and renewable alternatives to petroleumbased plastics in food packaging, according to research published in 2020 in Journal of Applied Polymer Science.

According to this research, beta-glucan films featured superior mechanical properties as edible coatings for fruits and vegetables; European Commission Joint Research Centre also investigated its use as coating material on paper-based packaging to increase water resistance and durability, with commercial launch by

Food Packaging company Biopack in 2021 a beta-glucan coating to further improve these aspects while making it more environmentally sustainable while improving water resistance/durability and durability whilst creating sustainable packaging from paper materials in 2021 – commercialized through Biopack. This coating promises both improvements in terms of water resistance/durability while making packaging more sustainable. Eco-friendly.

Restarints

Diabetes’ increasing global prevalence can be traced back to inadequate diets, nutritional guidance gaps, and inadequate insulin production within individuals’ bodies. To combat this problem, it’s critical to regulate Beta Glucan consumption among an expanding population.

Diabetes manifests itself primarily through hypoglycemia (low blood sugar levels) or hyperglycemia (increased ones), and Beta Glucan has long been recognized for its ability to lower those blood sugar levels; making it particularly appealing to those suffering from hypoglycemia – yet its use remains limited within this demographic group.

Beta Glucan can offer significant relief to individuals suffering from low blood sugar by helping to stabilize their levels without creating adverse side effects. According to estimates from the Global Diabetes Community U.K., approximately 415 million people worldwide were living with diabetes in 2018.

This number is projected to escalate, reaching approximately 642 million individuals by the year 2040. Effective regulation of Beta Glucan consumption among those affected by low blood sugar due to diabetes is imperative to ensure proper management and control of the condition.

Opportunities

The Beta Glucan market has great potential because it helps lower blood sugar levels. With more people dealing with diabetes, there’s a growing need for solutions like Beta Glucan that can manage low blood sugar without causing harm.

People who care about their health are interested in natural foods that offer benefits, and Beta Glucan fits into this trend. It’s found in different products like food, drinks, supplements, and medicines, making it appealing to a wide range of people.

Scientists are studying Beta Glucan to see if it has more benefits besides managing blood sugar. It might help with things like keeping your immune system strong, maintaining heart health, and even improving skin.

Companies working together, like food and medicine companies, might create new products using Beta Glucan that could appeal to more people.

More and more folks are interested in natural ways to stay healthy, and that’s where Beta Glucan shines. It has lots of potential to help different types of people with their health.

Challenges

Not Enough Awareness: Many people don’t know about Beta Glucan and how it helps. They might miss out on its benefits because they haven’t heard of it.

Cost and Availability: Sometimes, products with Beta Glucan can be expensive or hard to find. This makes it tough for everyone to get hold of them.

More Research Needed: Scientists are still studying Beta Glucan, so we don’t know all the good things it can do yet. This makes some people unsure about using it.

Lots of Competition: There are many other health products out there, so Beta Glucan needs to work hard to stand out and show why it’s special.

Complex Rules: The rules about what can be said on labels or in advertisements about Beta Glucan can be hard to understand. This makes it tricky for companies to tell people how good it is.

In short, getting the word out, making it affordable and available, learning more about its benefits, standing out in a busy market, and dealing with rules are the main challenges for Beta Glucan.

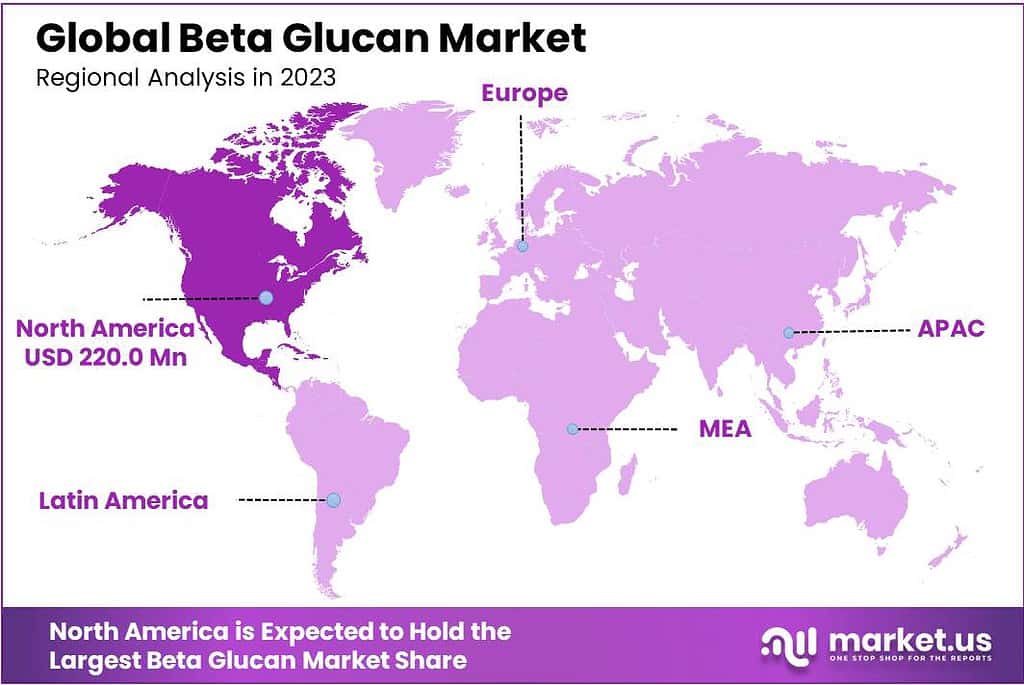

Regional Analysis

In 2023, the North American region secured a dominant market share exceeding 44.4% within the Beta Glucan market. This ascendancy stemmed from amplified demand propelled by the regional pharmaceutical sector.

Product growth is expected to be driven by the presence of several major European players, high disposable income, and changing consumer preferences regarding nutraceutical supplement consumption over the next eight-year. Many companies are investing in innovative manufacturing techniques that can be tailored to the needs of the end-user industries. This is expected to fuel the growth.

North America is expected to be a major consumer of the product in cosmetic applications, functional foods and ready-to-drink beverages. Due to the high demand for organic cosmetic formulations as well as pharmaceutical preparations for the treatment of cancer.

Note: Actual Numbers Might Vary In Final Report

Кеу Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

With the presence of both domestic and global players, Europe is the dominant market. The industry’s major players include Biotec Pharmacon ASA and Biothera Pharmaceuticals Inc. Ceapro Inc. Super Beta Glucan Inc., DSM NV. Tate & Lyle Plc. AIT Ingredients are also important.

A large number of European-based companies are involved in product manufacturing. Norway is the main manufacturing country, supplying the domestic market and exporting to the global markets. Due to the continuous demand for the product, the industry’s production volume has been increasing over the years. The main end-user of the industry is the global healthcare industry.

Key Market Players

- Tate & Lyle PLC

- Kerry Group PLC

- Koninklijke DSM NV

- International Flavors & Fragrances Inc.

- Merck KGaA

- Lantmannen

- Ceapro Inc.

- Lesaffre

- Garuda International Inc.

- Cargill Inc.

- Biotec BetaGlucans AS

- Super Beta Glucan Inc.

- Biothera Pharmaceuticals, Inc.

- AIT Ingredients

- Ohly

Recent Development

In November 2022, Ceapro Inc. initiated an advanced phase aimed at expanding its revolutionary Pressurized Gas eXpanded (PGX) technology for the creation of pharmaceutical and nutraceutical offerings. Within the framework of this technology, Alginate and yeast beta-glucan stand as the pioneering bio-actives undergoing processing. This endeavor is poised to enhance the company’s portfolio of innovative products

In July 2023, BENEO announced the launch of the company’s first barley beta-glucan ingredient, the Orafti β-Fit, for heart health and blood sugar management. This new launch is expected to improve BENEO’s global market reach in the fiber and cardio-metabolic health markets

Report Scope

Report Features Description Market Value (2023) USD 495.6 Million Forecast Revenue (2033) USD 1040.6 Million CAGR (2023-2032) 7.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Cereal, Mushroom, Yeasts, and Seaweed), By Type (Soluble and Insoluble), By Application (Food and beverages, Personal Care and cosmetics, Pharmaceuticals, Animal Feed, and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tate & Lyle PLC, Kerry Group PLC, Koninklijke DSM NV, International Flavors & Fragrances Inc., Merck KGaA, Lantmannen, Ceapro Inc., Lesaffre, Garuda International Inc., Cargill Inc., Biotec BetaGlucans AS, Super Beta Glucan Inc., Biothera Pharmaceuticals, Inc., AIT Ingredients, Ohly Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Beta-Glucan?Beta-Glucan is a type of soluble fiber found in foods such as oats, barley, yeast, and certain mushrooms. It's known for its potential health benefits, including immune system support and cholesterol-lowering properties.

What are the key sources of Beta-Glucan?Beta-Glucan can be found in various natural sources, with oats and barley being among the most common sources. It's also present in certain types of yeast, mushrooms like reishi and shiitake, and some seaweeds.

What is the outlook for the future of the Beta-Glucan market?The Beta-Glucan market is anticipated to grow steadily, driven by increasing consumer demand for natural and functional ingredients, ongoing research uncovering new health benefits, and the incorporation of Beta-Glucan into a wider array of products across industries.

-

-

- Tate & Lyle PLC

- Kerry Group PLC

- Koninklijke DSM NV

- International Flavors & Fragrances Inc.

- Merck KGaA

- Lantmannen

- Ceapro Inc.

- Lesaffre

- Garuda International Inc.

- Cargill Inc.

- Biotec BetaGlucans AS

- Super Beta Glucan Inc.

- Biothera Pharmaceuticals, Inc.

- AIT Ingredients

- Ohly