Global Beef Grower Market Size, Share, And Industry Analysis Report By Product Type (Medicated, Non-Medicated), By Form (Pellets, Crumbles, Mash, Textured), By Animal Age Group (Calves, Growers, Finishers), By Ingredient Type (Grains, Oilseed Meals, Additives, Forage-Based Blends), By Sales Channel (Feed Stores and Co-ops, Direct Sales, Online Retail, Distributors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172709

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

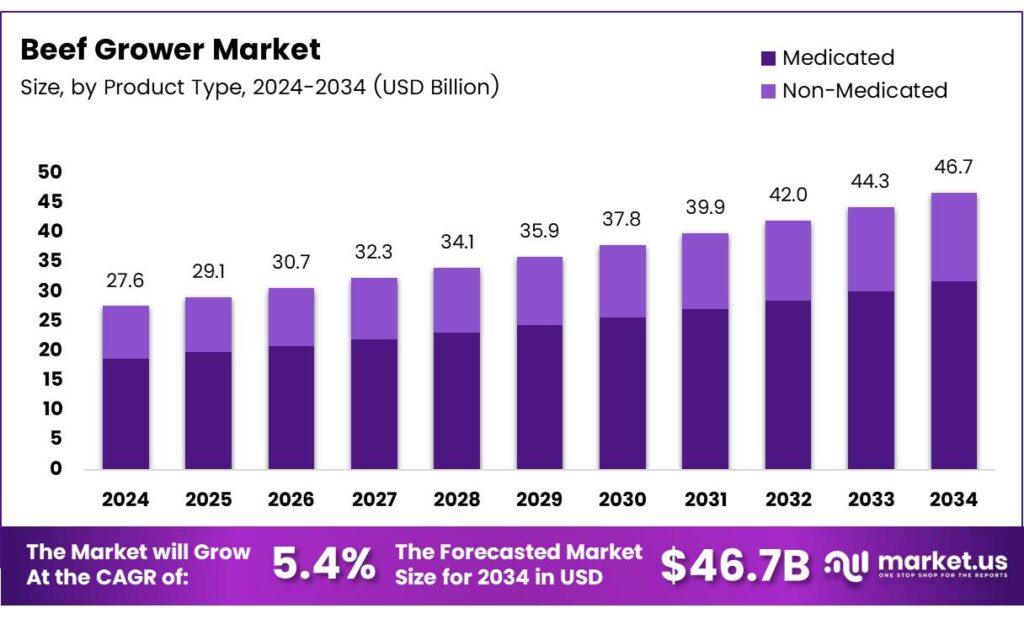

The Global Beef Grower Market size is expected to be worth around USD 46.7 billion by 2034, from USD 27.6 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Beef Grower Market refers to the commercial stage focused on raising weaned calves efficiently before final finishing. It bridges cow-calf operations and finishing systems by improving weight, health, and feed efficiency. This market supports beef supply stability by optimizing growth performance, cost control, and on-farm feeding strategies using structured grower diets.

Beef grower operations play a strategic role in value creation across the beef production chain. They reduce pressure on finishing systems while improving animal uniformity and feed conversion outcomes. As beef demand rises steadily, grower-focused feeding programs help producers manage volatility in feed costs and improve return predictability.

- Feeding programs in beef production are structured around two clear stages, growing and finishing, to support efficient and healthy weight gain. During the grower phase, calves aged 7–9 months, typically weighing 550–675 pounds, are developed toward 800 pounds with targeted daily gains of 2.0–2.25 pounds. This stage focuses on controlled energy intake, balanced nutrition, and maintaining rumen health, ensuring calves develop strong frames without excessive fat deposition while optimizing feed utilization.

The Beef Grower Market is expanding due to rising global protein demand and efficiency-driven livestock management. Producers increasingly adopt structured grower-finisher transitions to shorten production cycles and stabilize margins. Moreover, digital ration planning, precision feeding, and on-farm feed optimization tools are accelerating adoption across both developed and emerging beef-producing regions.

Key Takeaways

- The Global Beef Grower Market is projected to reach USD 46.7 billion by 2034, rising from USD 27.6 billion in 2024 at a 5.4% CAGR.

- Medicated Feed leads the product type segment with a dominant share of 56.3% in 2024.

- Pelleted feed dominates the form segment, accounting for 39.5% of the Beef Grower Market in 2024.

- The Growers’ age group holds the largest share at 54.7%, reflecting focus on accelerated weight gain stages.

- Grains remain the primary ingredient type with a market share of 44.9% in 2024.

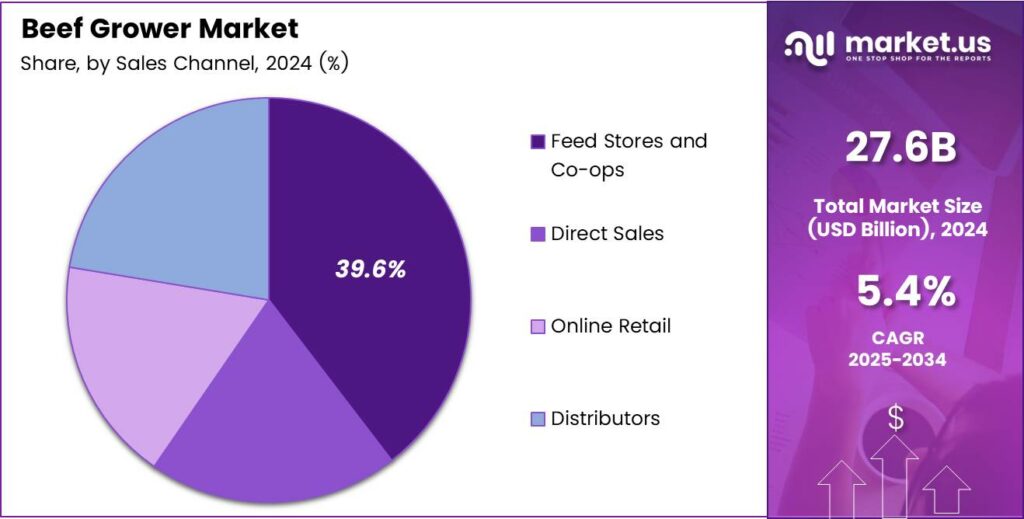

- Feed stores and co-ops lead sales channels, capturing 39.6% of total market demand.

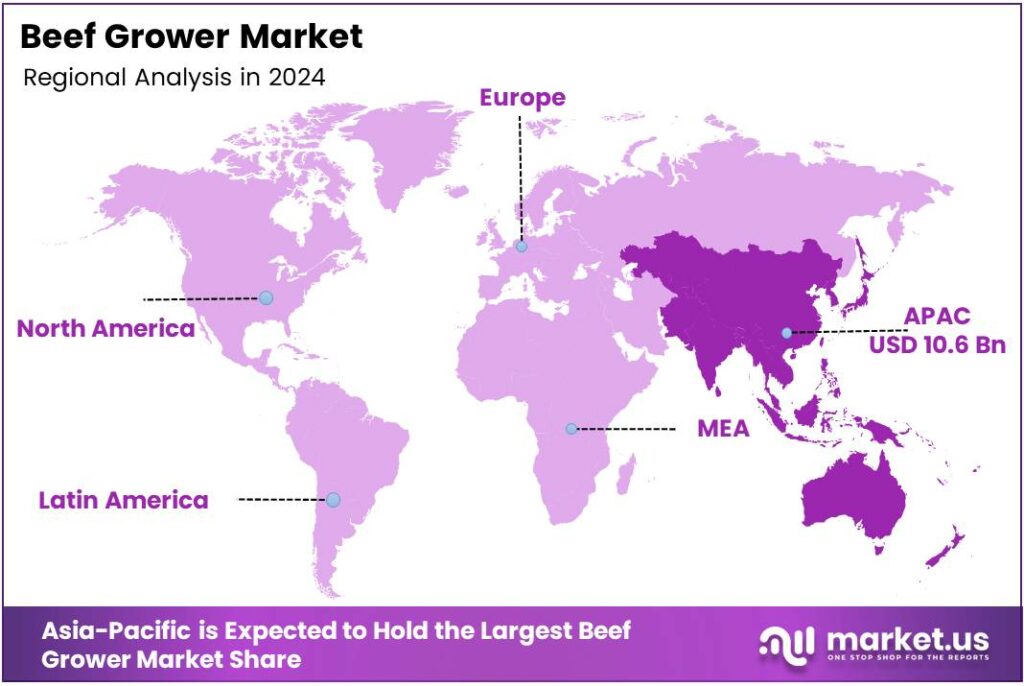

- Asia Pacific is the leading region with a 39.2% market share, valued at USD 10.6 billion in 2024.

By Product Type Analysis

Medicated dominates with 56.3% due to its role in herd health and productivity management.

In 2024, Medicated held a dominant market position in the By Product Type Analysis segment of the Beef Grower Market, with a 56.3% share. This leadership reflects its ability to support disease prevention and stress reduction during growth stages. Consequently, producers rely on medicated feeds to maintain consistent weight gain and operational stability.

Non-medicated feed represents a significant alternative, especially for producers focused on natural and antibiotic-free beef programs. Gradually, demand is increasing due to changing consumer preferences and regulatory scrutiny. However, adoption remains selective, as producers balance health risks with cost efficiency and market positioning.

By Form Analysis

Pellets dominate with 39.5% driven by handling ease and uniform nutrient delivery.

In 2024, Pellets held a dominant market position in the By Form Analysis segment of the eef Grower Market, with a 39.5% share. Pelleted feed improves intake consistency and minimizes feed wastage. As a result, it supports efficient feed conversion and simplifies large-scale feeding operations.

Crumbles are widely used for younger cattle transitioning from starter feeds. They offer better palatability and easier digestion. Consequently, crumbles play a supportive role in early growth stages, particularly where gradual feed adaptation is required. Mash feed remains cost-effective and flexible for on-farm mixing.

Nutrient segregation can occur during handling. Therefore, mash is often preferred by smaller operations prioritizing formulation control over convenience. Textured feed combines grains and supplements for visual appeal and intake stimulation. It gains attention where feeding behavior management is critical. Still, higher handling requirements limit broader adoption.

By Animal Age Group Analysis

Growers dominate with 54.7% reflecting focus on accelerated weight gain phases.

In 2024, Growers held a dominant market position in the By Animal Age Group Analysis segment of the Beef Grower Market, with a 54.7% share. This stage demands optimized nutrition to achieve rapid skeletal and muscle development. Hence, feed programs are designed to balance energy and rumen health.

Calves represent an essential foundational segment requiring nutrient-dense formulations. Early-stage feeding emphasizes immunity and digestive development. Consequently, tailored feeds support smoother transitions into grower programs. Finishers rely on high-energy diets to maximize final weight before market readiness.

By Ingredient Type Analysis

Grains dominate with 44.9% due to energy density and availability.

In 2024, Grains held a dominant market position in the By Ingredient Type Analysis segment of the Beef Grower Market, with a 44.9% share. Corn and similar grains provide efficient energy for weight gain. As a result, they remain central to commercial feeding strategies.

Oilseed Meals contribute protein essential for muscle development. They are frequently blended with grains to improve amino acid balance. Consequently, they play a complementary yet vital nutritional role. Additives enhance digestion, feed efficiency, and health performance. Gradually, their use expands as producers seek optimized outcomes.

However, inclusion levels remain carefully managed to control costs. Forage-Based Blends support rumen function and fiber intake. They are especially relevant in balanced diets. Still, lower energy density limits their dominance in intensive growth systems.

By Sales Channel Analysis

Feed Stores and Co-ops dominate with 39.6% due to accessibility and advisory support.

In 2024, Feed Stores and Co-ops held a dominant market position in the By Sales Channel Analysis segment of the Beef Grower Market, with a 39.6% share. These channels provide immediate availability and localized technical guidance. Therefore, they remain preferred by small and mid-sized producers.

Direct Sales enable customized formulations and bulk purchasing. Gradually, large-scale operators favor this channel to improve cost efficiency. However, it requires stronger supplier relationships and logistics planning. Online Retail is emerging as a convenient procurement option. Digital platforms improve price transparency and ordering flexibility.

Still, trust and delivery limitations constrain rapid expansion. Distributors serve as critical intermediaries for regional supply coverage. They support consistent availability across diverse geographies. Consequently, distributors maintain steady relevance within the overall market structure.

Key Market Segments

By Product Type

- Medicated

- Non-Medicated

By Form

- Pellets

- Crumbles

- Mash

- Textured

By Animal Age Group

- Calves

- Growers

- Finishers

By Ingredient Type

- Grains

- Oilseed Meals

- Additives

- Forage-Based Blends

By Sales Channel

- Feed Stores and Co-ops

- Direct Sales

- Online Retail

- Distributors

Emerging Trends

Adoption of Precision Nutrition Shapes Market Trends

The beef grower market is a growing focus on precision nutrition. Farmers are moving toward diets that match animal age, weight, and growth stage. This improves feed efficiency and supports healthier growth during the grower phase. Sustainability is also influencing market trends. There is a rising interest in feeds that reduce waste and improve nutrient utilization.

- Efficient grower feeds help lower environmental impact by optimizing resource use. In 2024, beef cattle production accounted for about 22% of the total $515 billion in cash receipts from all agricultural commodities, making it one of the largest earning sectors within farming.

Demand for quality assurance is shaping the market. Buyers and processors prefer cattle raised under controlled feeding programs. This encourages farmers to adopt grower feeds that support uniform growth, better meat quality, and stronger market acceptance.

Drivers

Rising Global Demand for High-Quality Beef Drives Market Growth

The beef grower market is mainly driven by the steady rise in global beef consumption. Growing populations and increasing income levels are encouraging higher demand for protein-rich diets. Beef remains a preferred source of animal protein in many regions, supporting consistent demand for efficient grower feed programs.

The shift toward structured feeding practices. Farmers are increasingly adopting scientifically balanced grower diets to improve daily weight gain and feed efficiency. Controlled nutrition during the grower phase helps reduce overall production time and improves carcass quality.

Government support for livestock productivity also supports market growth. Many countries promote improved animal nutrition through extension services, training programs, and subsidies. These initiatives encourage farmers to adopt formulated grower feeds instead of traditional feeding methods.

Restraints

High Feed Costs Limit Adoption of Advanced Grower Programs

One major restraint in the beef grower market is the rising cost of raw materials. Ingredients such as grains, oilseed meals, and additives are subject to price volatility. This increases the overall cost of grower feed, making it less affordable for small and medium farmers.

- Limited awareness in rural regions also restricts market expansion. Many farmers still rely on traditional feeding practices due to a lack of technical knowledge. Beef producers can reduce greenhouse gas emissions by up to 30% across the production cycle by adopting improved practices and technologies, such as better grazing management, feed additives, and manure handling systems.

Infrastructure challenges further constrain growth. Inadequate storage facilities and limited access to organized feed distribution networks affect product availability. This is particularly common in remote livestock-producing regions. Concerns around overfeeding and animal health also act as a restraint. Improper use of grower feeds can lead to digestive issues or uneven growth.

Growth Factors

Expansion of Commercial Cattle Farming Creates New Opportunities

The increasing commercialization of cattle farming presents strong growth opportunities for the beef grower market. Large-scale and contract-based beef operations are focusing on faster weight gain and predictable output. This creates demand for standardized grower feeding solutions.

Emerging markets offer significant potential as meat consumption rises. Urbanization and changing food habits are increasing the demand for beef in developing regions. This encourages investment in modern feeding systems, including grower feeds.

Innovation in feed formulations is another opportunity. Customized grower feeds designed for specific breeds, climates, and growth targets improve performance. Such tailored products attract progressive farmers seeking higher productivity. Digital advisory tools and farm management services are also opening new avenues. When combined with grower feeds, these tools help farmers track growth performance and optimize feeding strategies.

Regional Analysis

Asia Pacific Dominates the Beef Grower Market with a Market Share of 39.2%, Valued at USD 10.6 billion

Asia Pacific leads the Beef Grower Market due to rising meat consumption, population growth, and expanding middle-class incomes. Countries across the region are investing in feed efficiency, structured grower–finisher programs, and modern cattle management practices. In 2024, Asia Pacific accounted for a dominant 39.2% share, with the market valued at USD 10.6 billion, supported by large-scale cattle farming and improving cold-chain infrastructure.

North America shows steady growth driven by advanced feeding systems, data-driven herd management, and strong demand for high-quality beef. Producers focus on optimized grower diets to improve weight gain and feed conversion efficiency. Government-supported extension services and sustainability-focused practices further strengthen regional productivity and long-term market stability.

Europe’s Beef Grower Market is shaped by strict animal welfare regulations and sustainability standards. Farmers increasingly adopt balanced grower rations and controlled feeding programs to meet environmental and quality requirements. Demand for traceable and premium beef products supports consistent growth across both Western and Eastern European countries.

The U.S. market benefits from large-scale commercial cattle operations and well-established feedlot systems. Grower-phase optimization remains a priority to reduce costs and improve finishing performance. Strong domestic consumption and export demand continue to support investments in nutrition research and cattle health management.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Beef Grower Market remained shaped by strategic scale, supply-chain integration, and product innovation among leading agribusiness firms.

Cargill Inc. continued to leverage its expansive global footprint and diversified feed portfolios to support beef producers with tailored nutrition solutions and risk-management services. Its focus on sustainable practices and traceable sourcing bolstered producer confidence amid rising input costs and evolving regulatory expectations.

Archer Daniels Midland maintained a strong position through its extensive crop processing capabilities and advanced feed ingredient formulations. By optimizing coarse-grain and protein meal supplies, ADM helped beef grower operations improve feed conversion efficiency and herd health outcomes. Its investments in biotechnology and data analytics further enhanced predictive nutrition models relevant to large-scale producers seeking performance gains.

Land O’Lakes Inc. strengthened its market influence via cooperative-driven support structures and integrated advisory services, combining feed solutions with animal health and farm management expertise. Through its focus on producer profitability and local supply resilience, Land O’Lakes reinforced loyalty among mid-tier beef grower segments, particularly in North America, while piloting regenerative practices that align with buyer demands.

Alltech sustained its reputation as a science-led innovator in animal nutrition and gut health. By advancing precision supplementation and microbiome-targeted additives, Alltech helped beef operations enhance feed efficiency, reduce waste, and mitigate environmental footprints. Its collaboration with research institutions and commitment to field-based evidence supported the adoption of performance solutions across diverse climatic and production systems.

Top Key Players in the Market

- Cargill Inc.

- Archer Daniels Midland

- Land O’Lakes Inc.

- Alltech

- Ridley Corporation

- Others

Recent Developments

- In 2025, Cargill will focus on sustainability and operational investments in its beef operations amid industry challenges. Cargill announced investments in its beef business, in automation and technology at its Fort Morgan, Colorado beef plant, to improve efficiency and preserve more meat per cow, amid a declining U.S. cattle supply.

- In 2025, ADM has emphasized partnerships in animal nutrition and regenerative agriculture, while navigating trade and operational adjustments. ADM and Alltech announced a new joint venture in North American animal feed, combining expertise to enhance production and innovation.

Report Scope

Report Features Description Market Value (2024) USD 27.6 Billion Forecast Revenue (2034) USD 46.7 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Medicated, Non-Medicated), By Form (Pellets, Crumbles, Mash, Textured), By Animal Age Group (Calves, Growers, Finishers), By Ingredient Type (Grains, Oilseed Meals, Additives, Forage-Based Blends), By Sales Channel (Feed Stores and Co-ops, Direct Sales, Online Retail, Distributors) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cargill Inc., Archer Daniels Midland, Land O’Lakes Inc., Alltech, Ridley Corporation, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Cargill Inc.

- Archer Daniels Midland

- Land O'Lakes Inc.

- Alltech

- Ridley Corporation

- Others