Global Bedside and Table Top Pulse Oximeters Market Analysis By Product (Equipment, Sensor), By Technology (Conventional, Connected), By Age Group (Adult, Pediatric, Infant, Neonatal), By End-Use (Hospitals, Ambulatory Care Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 84680

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

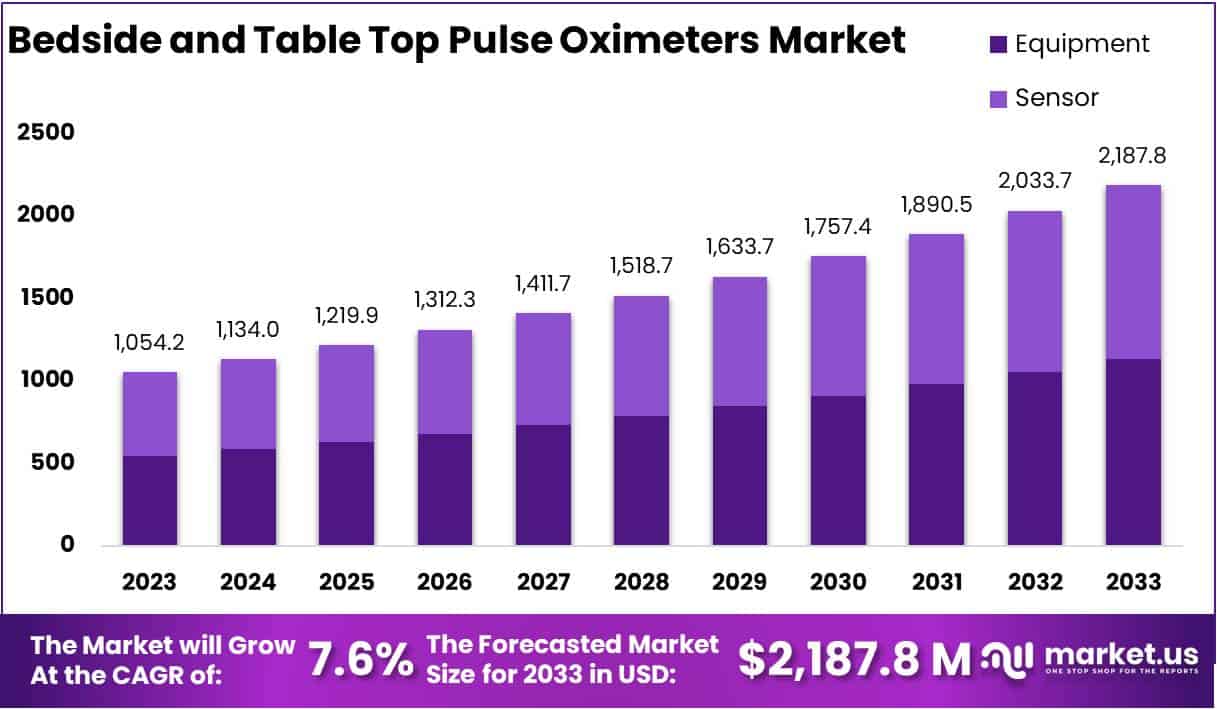

The Global Bedside and Table Top Pulse Oximeters Market size is expected to be worth around USD 2187.8 Million by 2033, from USD 1054.2 Million in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

Bedside and table top pulse oximeters are medical devices used to measure oxygen saturation levels in a patient’s blood and pulse rate. These devices are essential in various healthcare settings, including hospitals, clinics, and home care, for monitoring patients with respiratory or cardiac conditions. They provide continuous monitoring with real-time feedback, which is crucial for timely intervention by healthcare professionals.

The Bedside and Table Top Pulse Oximeters market is currently witnessing substantial growth, largely driven by global telehealth initiatives. For example, in the United States, the Health Resources and Services Administration (HRSA) through its Office for the Advancement of Telehealth (OAT) has been pivotal in promoting telehealth services. This office has supported over 22,000 patients and facilitated more than 6,000 requests for telehealth technical assistance. Moreover, the Federal Communications Commission (FCC) has initiated the Rural Telehealth Initiative to enhance broadband access, thereby improving telehealth services in underserved areas.

These government-led efforts are crucial for the increased adoption of monitoring technologies such as pulse oximeters, especially in remote and underserved regions. Integrating these technologies into telehealth systems is essential for continuous patient monitoring and for enhancing overall healthcare outcomes. Such initiatives not only improve access to healthcare services but also drive growth in markets associated with remote health monitoring devices.

The demand for Bedside and Table Top Pulse Oximeters is also bolstered by the growing global need for continuous monitoring devices. This is partly due to the increasing elderly population, which is expected to reach 1.4 billion by 2030. Additionally, the prevalence of respiratory conditions like COPD and asthma is on the rise, further fueling the market demand. China, as a leading exporter, supplies over 40% of the global pulse oximeters, while the U.S. is the largest importer, accounting for about a quarter of the global imports.

The market’s expansion is significantly supported by advancements in healthcare technology that enable remote patient monitoring, thereby increasing the demand for connected pulse oximetry devices. These devices are vital for managing chronic diseases such as COPD and asthma.

The growth is also supported by strategic mergers and acquisitions among key players, which enhance their product offerings and technological capabilities. For instance, Medtronic’s acquisition of Covidien for $42.9 billion has expanded its medical device portfolio, including pulse oximeters. Furthermore, collaborations like Philips Healthcare’s partnership with the University of California are advancing oximetry technology for home care, aligning with the trend towards healthcare digitization and patient-centered care.

Key Takeaways

- The market is projected to grow from USD 1054.2 million in 2023 to USD 2187.8 million by 2033, at a CAGR of 7.6%.

- COPD, a leading cause of death, emphasizes the need for pulse oximeters; it caused about 3.23 million deaths globally in 2019.

- Technological enhancements in pulse oximeters, such as better connectivity, support their increasing use in clinical and home care settings.

- The FDA’s strict approval processes can delay new product launches and increase costs, slowing down market innovation and expansion.

- In 2023, equipment for pulse oximeters dominated the product segment, holding over 52% of the market share due to critical care demand.

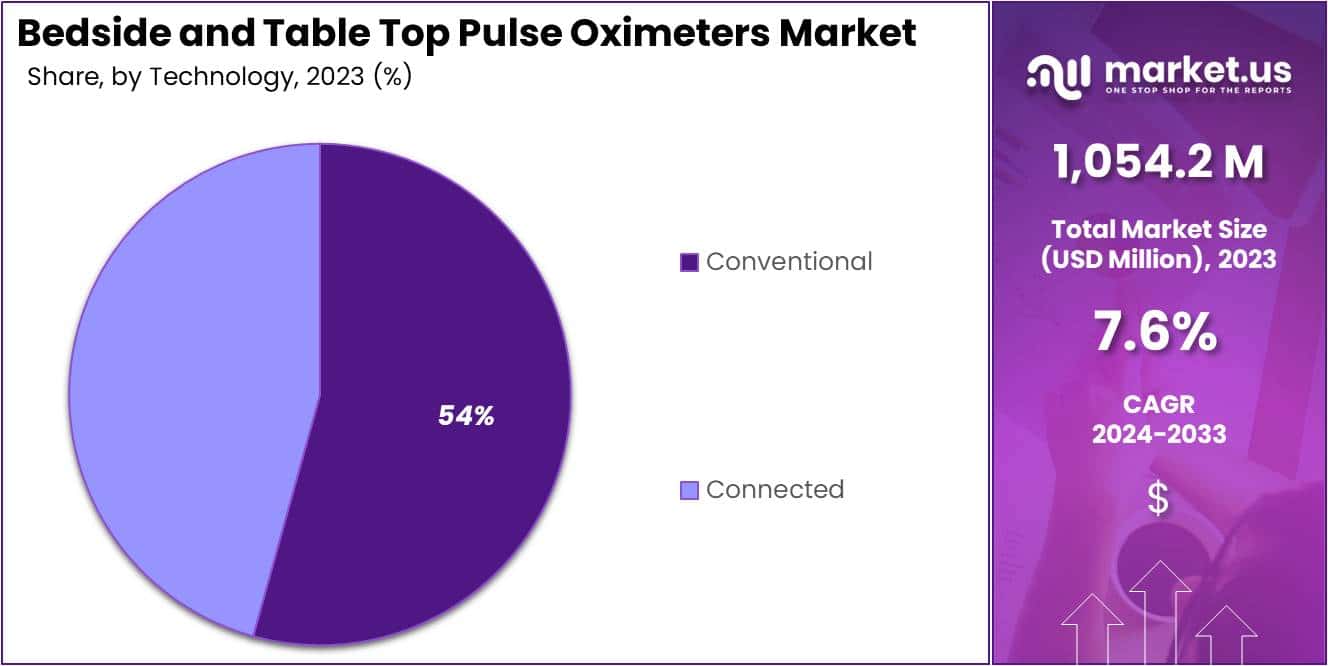

- Connected pulse oximeters led the technology segment with a 54% share in 2023, favored for their advanced patient management capabilities.

- The adult age group was the largest market segment in 2023, holding a 62% share, driven by high rates of chronic respiratory diseases.

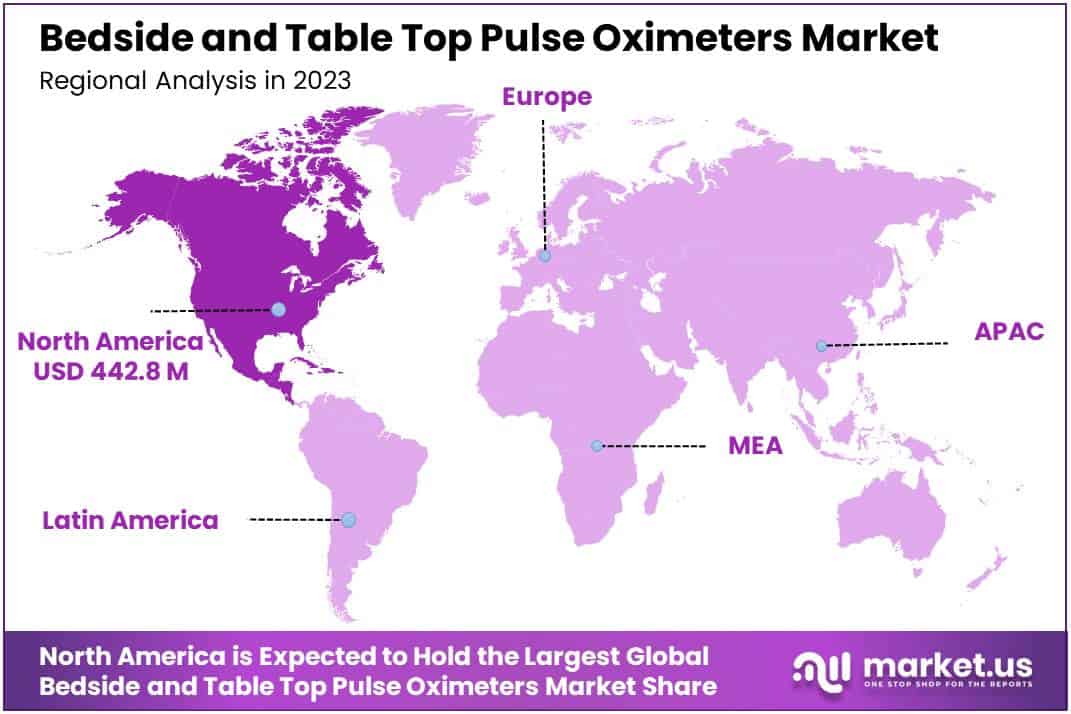

- North America led the regional market with a 42% share in 2023, supported by advanced healthcare infrastructure and high chronic disease prevalence.

- Asia-Pacific is expected to be the fastest-growing region, driven by healthcare improvements and significant investments in health technology.

Product Analysis

In 2023, the Equipment segment maintained a dominant position in the Product Segment of the Bedside and Table Top Pulse Oximeters Market, accounting for over 52% of the market share. This substantial market share is primarily due to the increased integration of these devices in clinical environments, driven by heightened awareness of conditions that require constant monitoring such as respiratory and cardiac diseases. Additionally, advancements in technology have significantly improved the functionalities and accuracy of these devices, making them essential in critical care settings.

On the other hand, the Sensor segment, although smaller, has exhibited notable growth. This increase is driven by the continuous demand for replacement sensors and their integration with various medical devices. Sensors are crucial for maintaining consistent operation and accuracy, which are vital in medical monitoring and diagnostics. As healthcare spending increases worldwide and there is a shift towards preventive care, both the Equipment and Sensor segments are anticipated to see continued growth, underlining the expanding dependence on advanced monitoring technologies in healthcare.

Technology Analysis

In 2023, the Connected segment held a dominant market position in the Technology Segment of the Bedside and Table Top Pulse Oximeters Market, capturing more than a 54% share. This leadership can be attributed to the increasing integration of IoT and wireless communication technologies in medical devices, which enhances remote monitoring capabilities and data accuracy. The conventional technology segment, while substantial, has seen slower growth due to its limited data management features and lack of connectivity options.

The connected pulse oximeters offer significant advantages, including real-time data tracking, alerts for abnormal readings, and integration with electronic health records (EHRs), which are highly valued in clinical settings for efficient patient management. This segment is anticipated to maintain its growth trajectory, driven by ongoing advancements in technology and the rising demand for sophisticated healthcare solutions. As healthcare providers continue to prioritize patient safety and improved clinical outcomes, the adoption of connected bedside and table top pulse oximeters is expected to further increase, reinforcing its preeminence in the market.

Age Group Analysis

In 2023, the Adult segment emerged as the predominant category within the Age Group Segment of the Bedside and Table Top Pulse Oximeters Market, securing over a 62% share. This dominance is primarily driven by the increased incidence of respiratory ailments like COPD and asthma among adults, as well as a growing elderly population requiring consistent monitoring of blood oxygen levels. The surge in preventive healthcare measures and the adoption of advanced pulse oximetry technology in clinical environments have also significantly contributed to the expansion of this segment.

Meanwhile, the Pediatric segment maintains a significant stance in the market due to the escalating utilization of pulse oximeters for monitoring oxygen saturation in newborns and children with respiratory conditions. Innovations targeting safety enhancements and the introduction of devices designed specifically for pediatric use are facilitating their uptake in both hospital and home settings. Additionally, the Infant and Neonatal segments, although smaller, are poised for substantial growth.

The imperative for precise, continuous monitoring in neonatal care to prevent conditions like hypoxemia and congenital heart defects is propelling demand for these specialized devices. This growth is supported by advancements in sensor technology and the increased availability of oximeters suited for premature and low birth weight infants.

End-Use Analysis

In 2023, the Hospitals segment maintained a leading position in the Bedside and Table Top Pulse Oximeters Market’s End-Use Segment, securing over a 41% share. This dominant share is largely due to the essential requirement for continuous monitoring of oxygen saturation in patients within hospital environments, particularly in critical care units and during surgeries. The heightened focus on monitoring in hospitals is driven by the rising incidences of respiratory illnesses and an increase in surgical procedures, necessitating the widespread adoption of these devices.

Meanwhile, the Ambulatory Care Centers segment captured a substantial market share, propelled by the shift towards outpatient services and the escalating demand for portable medical devices that allow for quick health assessments. These centers are adopting pulse oximeters extensively to improve patient monitoring capabilities without the need for extended hospital stays. Additionally, other end-use areas like home healthcare and specialized clinics are integrating these oximeters more frequently. The growth in these segments is fueled by increasing health awareness and the need for regular monitoring among patients with chronic conditions, promoting the use of advanced, user-friendly pulse oximeters outside traditional clinical settings.

Key Market Segments

Product

- Equipment

- Sensor

Technology

- Conventional

- Connected

Age Group

- Adult

- Pediatric

- Infant

- Neonatal

End-Use

- Hospitals

- Ambulatory Care Centers

- Others

Drivers

Increasing Prevalence of Respiratory Diseases

The increasing prevalence of respiratory diseases such as COPD and asthma significantly drives the demand for bedside and tabletop pulse oximeters, essential tools for monitoring oxygen saturation in patients. According to the World Health Organization, COPD was the third leading cause of death globally in 2019, causing approximately 3.23 million deaths, particularly prevalent in low- and middle-income countries where over 90% of these deaths occur under the age of 70.

Additionally, asthma affects an estimated 262 million people worldwide and was responsible for around 455,000 deaths in 2019. The rising number of individuals affected by these conditions necessitates robust monitoring and management, boosting the market for pulse oximeters used to ensure adequate oxygenation and timely medical response in these patient populations. This trend underscores the critical need for advanced respiratory monitoring technologies in healthcare settings globally.

Restraints

Regulatory Challenges

Regulatory challenges significantly restrain the growth of the bedside and table top pulse oximeters market. For instance, the U.S. Food and Drug Administration (FDA) mandates an extensive premarket approval process for medical devices, which includes stringent testing for safety and effectiveness. According to a report, the average time taken for FDA approval can range from 3 to 7 years, depending on the device classification, with associated costs rising into the millions of dollars.

This prolonged and costly approval process can delay product launches and market entry, particularly for new manufacturers or for products that incorporate novel technologies. The FDA has also launched initiatives focused on improving the accuracy standards of pulse oximeters, especially in response to findings about variability in performance across different skin pigments. These regulatory pressures can impede market growth as manufacturers struggle to align with evolving standards and varied international regulations.

Opportunities

Technological Advancements

Technological advancements in bedside and tabletop pulse oximeters, such as improved connectivity and data analysis features, are poised to drive growth in their market. The ability to monitor patients in real-time in clinical and home settings significantly enhances patient care. According to a report by the Food and Drug Administration, the reliability and performance of pulse oximeters are critical, and ongoing regulatory efforts aim to ensure these devices meet stringent safety standards.

The global pulse oximeter market is projected to expand, driven by the rising prevalence of chronic diseases and the ongoing demand for effective patient monitoring technologies. These enhancements support continuous monitoring and enable better management of conditions like COPD and asthma, which is essential given their impact on a significant portion of the population. Thus, the integration of advanced technologies in pulse oximeters represents a significant opportunity for market growth, catering to an increased need for efficient, reliable healthcare solutions.

Trends

Rising Adoption of Telehealth and Remote Patient Monitoring

The increasing adoption of telehealth and remote patient monitoring (RPM), particularly accelerated by the COVID-19 pandemic, has significantly driven the market for bedside and tabletop pulse oximeters in home care settings. Notably, a report by the American Medical Association (AMA) highlights that telehealth visits have surged by up to 3000% during the pandemic, reinforcing the necessity and efficiency of remote monitoring technologies in continuous patient care. Additionally, the RPM market size, which includes devices like pulse oximeters, has seen considerable growth. It was valued at $23 billion in 2021 and is expected to reach $49.7 billion by 2028, marking a substantial increase and reflecting the sector’s rapid expansion. This trend underlines the shift towards more home-based healthcare solutions and suggests a continuing demand for devices that support remote patient management effectively.

Regional Analysis

In 2023, North America maintained a leading position in the Bedside and Table Top Pulse Oximeters Market, holding a substantial 42% share with a market valuation of USD 442.8 million. This dominance is primarily due to the region’s advanced healthcare infrastructure, heightened awareness of respiratory health, and significant R&D investments by key market players. The region also benefits from a high incidence of chronic respiratory diseases and favorable reimbursement policies, which support the widespread adoption of pulse oximeters.

Following North America, Europe stands as a significant player in the market, influenced by its robust healthcare systems and an aging population prone to respiratory ailments. The region’s strong focus on maintaining high healthcare standards and safety, along with substantial healthcare spending, fuels the market’s growth. In contrast, the Asia-Pacific region is poised for the fastest growth, driven by improvements in healthcare infrastructure, rising disposable incomes, and increasing health consciousness. Countries like China and India are crucial to this expansion due to their large populations and escalating healthcare investments.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Bedside and Table Top Pulse Oximeters Market, several key players stand out for their contributions and competitive strengths. Medtronic is notable for its extensive product offerings and significant R&D investments, enhancing its technological edge and global distribution network. Masimo is distinguished by its proprietary Signal Extraction Technology (SET), which improves accuracy under challenging conditions, coupled with strong global marketing and partnerships.

Koninklijke Philips is recognized for reliable, user-friendly devices and a strong brand reputation, bolstered by continuous investment in healthcare solutions. Nonin Medical, a pioneer in pulse oximetry, is praised for durable, precise devices catering to both professional and personal use markets. Meditech Equipment, while smaller, offers cost-effective solutions without sacrificing quality, making its devices popular in emerging markets.

Other key players contribute to market diversity with innovative technologies and competitive pricing strategies. Together, these companies drive the dynamic landscape of the Bedside and Table Top Pulse Oximeters Market, pushing the boundaries of innovation to meet modern healthcare demands.

Market Key Players

- Medtronic

- Masimo

- Koninklijke Philips

- Nonin Medical

- Meditech Equipment

- Contec Medical Systems

- General Electric

- ChoiceMMed

- Promed

- Shenzhen Aeon Technology

Recent Developments

- In April 2024, Masimo announced that they had received FDA 510(k) clearance for their Radius-7 Pulse CO Oximeter. This wrist-worn device measures oxygen saturation (SpO2), perfusion index (PI), and respiration rate (RR). Although it is not a traditional bedside or tabletop model, this wearable device could significantly impact the market with its emphasis on continuous monitoring.

- In March 2024, Koninklijke Philips announced a partnership with Alibaba Health to develop and commercialize telemedicine solutions in China. This collaboration could indirectly affect the pulse oximeter market by increasing the demand for remote patient monitoring solutions, which are likely to incorporate pulse oximeters.

- In February 2024, Medtronic acquired Intermountain Medical Center’s (IMC) patient monitoring and connected care assets. This acquisition is expected to enhance Medtronic’s offerings in patient monitoring, potentially including bedside and tabletop pulse oximeters.

- In January 2024, ChoiceMMed received CE certification for their Fingertip Pulse Oximeter M200. While this new product is not a bedside device, it underscores ChoiceMMed’s ongoing commitment to advancing pulse oximeter technology.

Report Scope

Report Features Description Market Value (2023) USD 1,054.2 Mn Forecast Revenue (2033) USD 2,187.8 Mn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Equipment, Sensor), By Technology (Conventional, Connected), By Age Group (Adult, Pediatric, Infant, Neonatal), By End-Use (Hospitals, Ambulatory Care Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, Masimo, Koninklijke Philips, Nonin Medical, Meditech Equipment, Contec Medical Systems, General Electric, ChoiceMMed, Promed, Shenzhen Aeon Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bedside and Table Top Pulse Oximeters MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Bedside and Table Top Pulse Oximeters MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Masimo

- Koninklijke Philips

- Nonin Medical

- Meditech Equipment

- Contec Medical Systems

- General Electric

- ChoiceMMed

- Promed

- Shenzhen Aeon Technology