Global Barium Market Size, Share, And Industry Analysis Report By Compound Type (Barium Carbonate, Barium Sulfate, Barium Chloride, Barium Nitrate, Barium Titanate, Barium Oxide), By End-User (Glass and Ceramics, Construction, Electronics, Metal and Alloys, Mining, Medical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177920

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

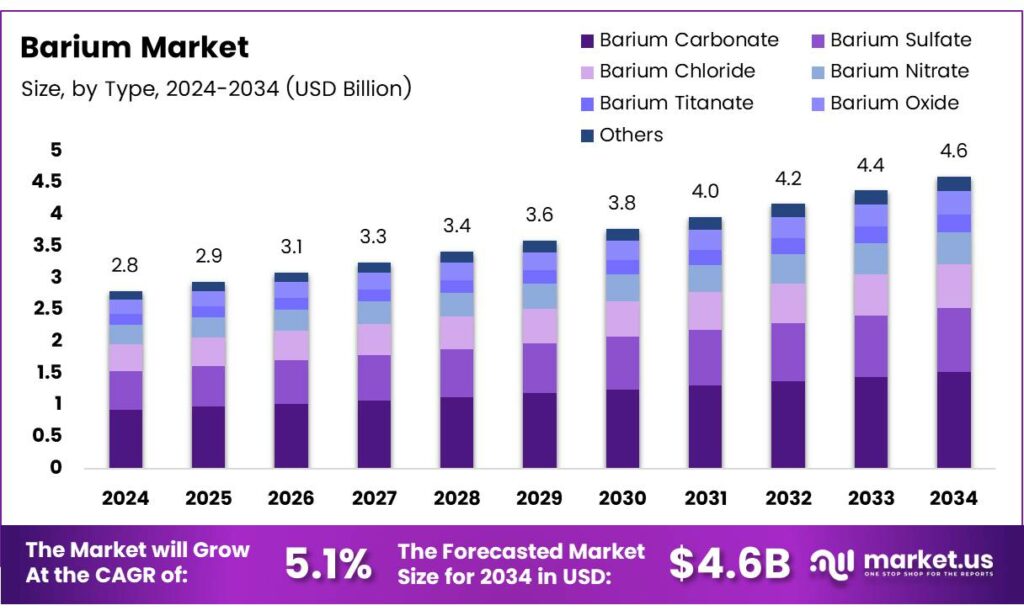

The Global Barium Market size is expected to be worth around USD 4.6 billion by 2034 from USD 2.8 billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

Barium represents a critical industrial mineral with diverse commercial applications across multiple sectors. This silvery-white alkaline earth metal carries atomic number 56 and atomic weight 137.3 grams per mole. Industries utilize barium primarily through its stable compounds rather than pure metallic form due to its high reactivity with air and moisture.

The element constitutes approximately 0.03% of Earth’s crust by weight. Natural deposits concentrate in barite and witherite minerals, which serve as primary commercial extraction sources. These minerals exhibit exceptional density characteristics, with barium sulfate reaching 4.5 grams per cubic centimeter. Moreover, the name derives from the Greek word “barys,” meaning heavy, reflecting this fundamental property.

- India’s export value for natural barium sulphate reached USD 153.6 million in 2024, establishing its position as the world’s largest exporter. This demonstrates significant production capacity and international trade influence. China followed closely with export values of USD 143.9 million in 2024, positioning it as the second-largest global supplier. These export volumes reflect robust mining operations and processing infrastructure in major producing nations.

Manufacturing sectors consume barium compounds extensively in glass production, ceramics, electronics, and construction materials. Oil and gas industries require barium sulfate for drilling fluid formulations. Medical applications employ barium compounds in diagnostic imaging procedures. Additionally, automotive manufacturers incorporate barium chemicals into specialized paint and coating systems.

Key Takeaways

- The Global Barium Market is projected to grow from USD 2.8 billion in 2024 to USD 4.6 billion by 2034 at a CAGR of 5.1%

- Barium Carbonate leads the compound segment with 32.6% market share

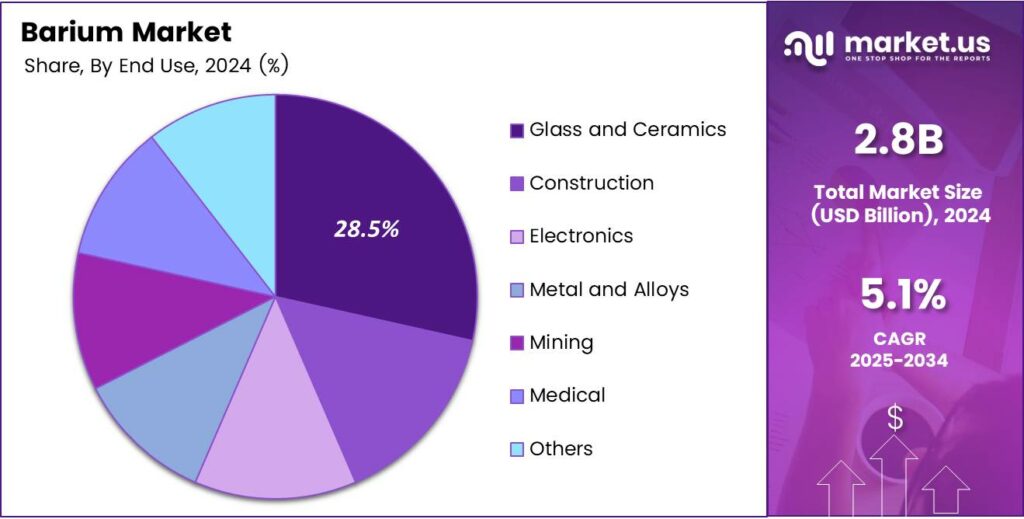

- Glass and Ceramics sector holds the largest end-user share at 28.5%

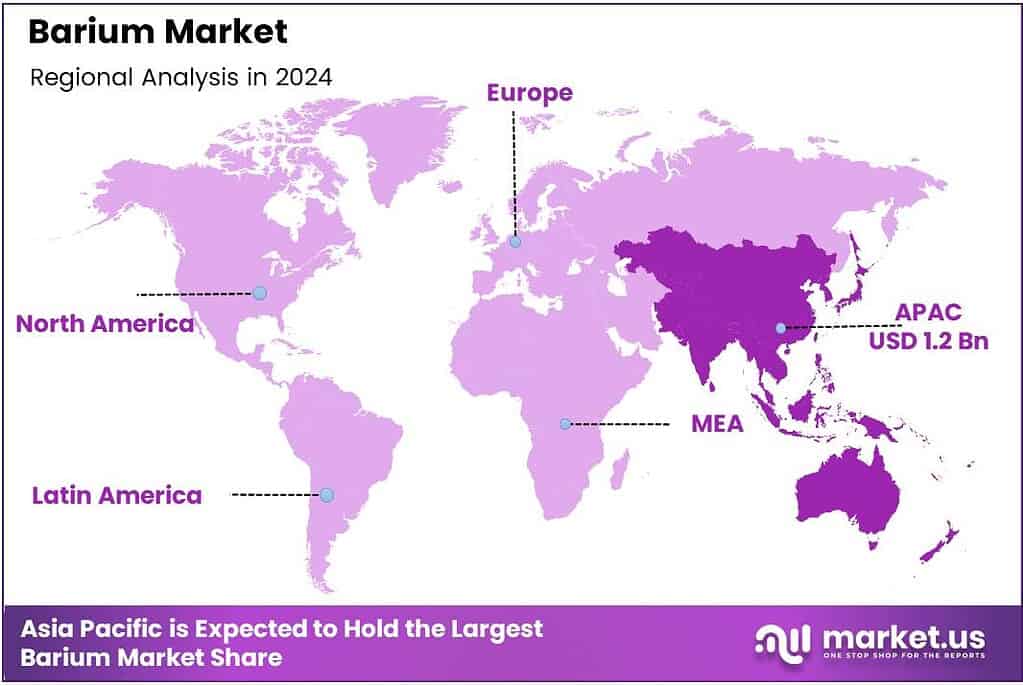

- Asia Pacific dominates the market with 43.3% share, valued at USD 1.2 billion

Compound Type Analysis

Barium Carbonate dominates with 32.6% due to extensive applications in glass manufacturing and ceramics production.

In 2025, Barium Carbonate held a dominant market position in the By Compound Type segment of the Barium Market, with a 32.6% share. Manufacturing industries prefer this compound for glass production, ceramics, and specialty chemical synthesis. Its chemical stability and cost-effectiveness support widespread industrial adoption. Additionally, barium carbonate serves as a key precursor for producing other barium compounds used across diverse applications.

Barium Sulfate commands substantial market presence through drilling fluid applications in oil and gas extraction operations. Industries utilize its high density and chemical inertness for weighing drilling muds. Medical sectors employ barium sulfate as a radiopaque contrast agent for diagnostic imaging procedures. Furthermore, paint and coating manufacturers incorporate this compound as a functional extender and brightening agent.

Barium Chloride finds applications in chemical synthesis, heat treatment processes, and wastewater treatment facilities. Manufacturing operations use this compound for purification processes and as a chemical intermediate. However, handling requires strict safety protocols due to water solubility and toxicity concerns. Consequently, industrial consumption remains concentrated among specialized chemical processing operations with proper safety infrastructure.

Barium Nitrate serves the pyrotechnic industries for producing green-colored flames in fireworks and signal flares. Electronics manufacturers utilize this compound in vacuum tube production and specialized oxidizer formulations. Moreover, chemical laboratories employ barium nitrate as an analytical reagent and oxidizing agent. Market growth correlates with entertainment industry expansion and specialty electronics production.

Barium Titanate represents a critical material for electronic component manufacturing, particularly multilayer ceramic capacitors. This compound exhibits exceptional dielectric properties, enabling miniaturization of electronic devices. Telecommunications and consumer electronics sectors drive demand growth. Additionally, researchers explore barium titanate applications in piezoelectric devices and energy storage systems.

Barium Oxide applications span cathode coating in vacuum tubes and glass manufacturing processes requiring decolorization properties. Chemical industries use this compound as a drying agent and precursor for synthesizing other barium chemicals. Therefore, consumption patterns align with specialty glass production and electronic component manufacturing activities.

End-User Analysis

Glass and Ceramics dominate with 28.5% due to extensive barium carbonate consumption in manufacturing processes.

In 2025, Glass and Ceramics held a dominant market position in the By End-User segment of the Barium Market, with a 28.5% share. This sector consumes barium carbonate extensively for improving optical properties and reducing glass expansion coefficients. Ceramic manufacturers utilize barium compounds to enhance glaze quality and thermal stability. Moreover, specialty glass production for electronics and telecommunications requires high-purity barium materials.

Construction industries incorporate barium compounds in concrete additives, sealants, and specialized building materials. Infrastructure development projects drive the consumption of barium-based construction chemicals. Weatherproofing applications benefit from barium compound properties. Additionally, manufacturers produce barium-containing paints and protective coatings for structural applications requiring enhanced durability and corrosion resistance.

Electronics manufacturing relies heavily on barium titanate for capacitor production and semiconductor components. Consumer electronics demand drives growth in high-purity barium material requirements. Telecommunications infrastructure expansion creates additional consumption opportunities. Furthermore, emerging technologies in electric vehicles and renewable energy systems require specialized barium compounds for electronic control systems.

The metal and Alloys sector uses barium as a deoxidizer and degasifier in aluminum production processes. Foundry operations incorporate barium compounds to improve casting quality and reduce porosity. Steel manufacturing applies barium materials for specialized alloy formulations. Therefore, metal processing industries maintain a consistent demand for industrial-grade barium compounds.

Mining operations consume massive quantities of barite for drilling fluid formulations in oil and gas exploration. Drilling mud requires high-density materials to control wellbore pressure and prevent blowouts. Offshore drilling activities particularly depend on barite-based fluids. Consequently, petroleum industry activity levels directly influence barium sulfate demand patterns.

Medical applications utilize barium sulfate as a radiopaque contrast medium for gastrointestinal and radiological imaging procedures. Diagnostic imaging centers and hospitals represent primary consumers. Pharmaceutical manufacturers produce barium sulfate suspensions meeting strict purity and safety standards. Additionally, medical device companies incorporate barium compounds in specialized equipment and therapeutic applications.

Key Market Segments

By Compound Type

- Barium Carbonate

- Barium Sulfate

- Barium Chloride

- Barium Nitrate

- Barium Titanate

- Barium Oxide

- Others

By End-User

- Glass and Ceramics

- Construction

- Electronics

- Metal and Alloys

- Mining

- Medical

- Others

Emerging Trends

Sustainable Processing Technologies Transform Barium Production and Environmental Performance

Mining companies adopt advanced beneficiation technologies, reducing the environmental impact of barium extraction operations. Low-impurity processing methods improve product quality while minimizing waste generation. Energy-efficient production facilities lower carbon footprint and operational costs. Therefore, sustainability initiatives drive technological innovation across the barium supply chain.

- Strategic partnerships between mining enterprises and chemical manufacturers strengthen market integration and supply reliability. Collaborative ventures facilitate technology transfer and operational efficiency improvements. Morocco’s export value for natural barium sulphate totaled USD 105.3 million in 2024, ranking as the third-largest global exporter. This reflects the successful development of processing infrastructure and international market access.

Automation technologies revolutionize barium extraction and processing operations through improved productivity and safety performance. Mining companies implement remote-controlled equipment, reducing worker exposure to hazardous conditions. Digital monitoring systems optimize processing parameters and quality control. Additionally, predictive maintenance technologies minimize equipment downtime and operational disruptions.

Drivers

Expanding Oil and Gas Drilling Activities Drive Market Growth Through Increased Barite Demand

Petroleum exploration companies expand drilling operations across conventional and unconventional oil reserves globally. These activities require substantial quantities of barite-based drilling fluids for wellbore stability and pressure control. The U.S. imports for the consumption of barite reached 1,100 thousand metric tons.

Glass manufacturing industries consume increasing volumes of barium carbonate for producing specialty glass products. Television screens, optical lenses, and decorative glassware require barium compounds for improved clarity and refractive properties. Ceramic manufacturers utilize barium materials to enhance glaze quality and thermal shock resistance.

Automotive manufacturers incorporate barium-based pigments and compounds in paint formulations for enhanced corrosion protection. Coating systems require barium sulfate as a functional extender, providing opacity and weatherability. Industrial finishing operations consume barium chemicals for specialized surface treatments.

Restraints

Environmental Regulations and Toxicity Concerns Limit Market Expansion Across Multiple Applications

Regulatory agencies impose strict guidelines on the handling, storage, and disposal of barium compounds due to toxicity risks. Water-soluble barium salts pose significant health hazards requiring comprehensive safety protocols. Manufacturing facilities face increased compliance costs for environmental protection measures.

Mining operations face challenges from fluctuating barite ore quality and from the accessibility of deposits. Production levels vary significantly based on geological conditions and extraction infrastructure investments. Supply chain disruptions affect pricing stability and material availability for downstream consumers.

Industrial users evaluate substitute materials offering comparable performance characteristics without toxicity concerns. Calcium carbonate and other alternatives compete in specific applications where barium compounds previously dominated. Research initiatives explore safer compound formulations, reducing environmental impact.

Growth Factors

Technological Advancements in Electronics Manufacturing Accelerate High-Purity Barium Demand

Electronics industries require ultra-high-purity barium titanate for advanced capacitor manufacturing and semiconductor applications. Miniaturization trends in consumer electronics drive demand for superior dielectric materials. Telecommunications infrastructure expansion consumes increasing quantities of barium-containing electronic components.

- Renewable energy sector expansion generates demand for specialty glass materials containing barium compounds. Solar panel manufacturing utilizes barium-doped glass for enhanced light transmission and durability. Wind turbine components incorporate barium materials in electronic control systems. The average value of ground barite reached USD 210 per metric ton, reflecting improved market conditions and quality requirements.

Infrastructure development projects across emerging economies boost the consumption of barium-based construction materials. Urban expansion requires substantial quantities of concrete additives and specialized building chemicals. Government investments in transportation networks, commercial complexes, and residential construction drive material demand.

Regional Analysis

Asia Pacific Dominates the Barium Market with a Market Share of 43.3%, Valued at USD 1.2 Billion

Asia Pacific commands a dominant market position driven by extensive manufacturing activities and natural resource availability. The region holds 43.3% market share valued at USD 1.2 billion, reflecting concentrated industrial consumption. China leads production and consumption through massive electronics manufacturing, construction activities, and oil exploration operations.

North America maintains a substantial market presence through oil and gas drilling operations, consuming large quantities of barite. The United States represents the primary consumer driven by petroleum exploration and chemical manufacturing activities. Medical imaging applications generate consistent demand for pharmaceutical-grade barium sulfate. Additionally, the automotive and electronics industries support diverse consumption patterns across compound types.

Europe demonstrates steady consumption growth focused on specialty chemical applications and high-purity material requirements. Germany leads regional demand through advanced manufacturing sectors and the automotive industry. Environmental regulations drive the adoption of low-toxicity processing methods and sustainable sourcing practices. Furthermore, medical applications maintain a stable demand for certified pharmaceutical-grade barium compounds.

Middle East & Africa region experiences demand growth through petroleum industry activities and construction sector expansion. Oil-rich nations consume substantial barite quantities for drilling operations. Infrastructure projects across Gulf Cooperation Council countries drive construction material demand. Additionally, mining sector development creates opportunities for local processing facilities and export operations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CIMBAR PERFORMANCE MINERALS operates as a leading supplier of processed barium sulfate and specialty minerals for diverse industrial applications. The company maintains extensive processing facilities producing high-purity materials for coating, plastic, and rubber industries. Their product portfolio includes natural barite, precipitated barium sulfate, and specialty grades meeting stringent quality specifications.

Solvay represents a major global chemical manufacturer producing a comprehensive range of barium compounds for industrial markets. The company supplies barium carbonate, barium sulfate, and specialty derivatives serving the glass, ceramics, and electronics sectors. Solvay’s integrated production network ensures consistent quality and reliable supply chain performance.

Venator Materials PLC manufactures titanium dioxide pigments and performance additives, including barium-based specialty chemicals. The company serves the coating, plastic, and paper industries with functional mineral products. Venator operates global production facilities, maintaining technical expertise in mineral processing and surface treatment technologies.

Nippon Chemical Industrial Co., Ltd. produces high-purity barium compounds for electronic applications and specialty chemical markets. The company specializes in barium titanate and related materials for capacitor manufacturing and telecommunications equipment. Their advanced processing technologies deliver consistent product quality, meeting stringent electronics industry standards.

Top Key Players in the Market

- CIMBAR PERFORMANCE MINERALS

- Divjyot Chemicals Private Limited

- Guizhou Redstar Co., Ltd.

- Hebei Xinji Chemical Group Co., Ltd.

- Hubei Jingshan Chutian Barium Salt Corp., Ltd

- Nippon Chemical Industrial Co., Ltd.

- SAKAI CHEMICAL INDUSTRY CO., LTD.

- Solvay

- Venator Materials PLC

- Vishnu Chemicals

Recent Developments

- In 2025, CIMBAR Resources Inc., a key entity in the CIMBAR group focused on barium sulfate products, has seen several updates in its operations within the barium sector. The company remains a major producer of API-grade barite for oilfield applications and industrial uses like coatings and fillers.

- In 2025, Guizhou Redstar, a major Chinese producer of barium salts like barium carbonate and sulfate, continues to expand its high-purity product lines for applications in electronics, batteries, and chemicals. The company announced plans to invest approximately 6.23 billion yuan in the Tianzhu County Barium Salt Fine Chemical Products Project, aimed at enhancing production capacity in barium-related fine chemicals.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 4.6 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Compound Type (Barium Carbonate, Barium Sulfate, Barium Chloride, Barium Nitrate, Barium Titanate, Barium Oxide, Others), By End-User (Glass and Ceramics, Construction, Electronics, Metal and Alloys, Mining, Medical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CIMBAR PERFORMANCE MINERALS, Divjyot Chemicals Private Limited, Guizhou Redstar Co., Ltd., Hebei Xinji Chemical Group Co., Ltd., Hubei Jingshan Chutian Barium Salt Corp., Ltd., Nippon Chemical Industrial Co., Ltd., SAKAI CHEMICAL INDUSTRY CO., LTD., Solvay, Venator Materials PLC, Vishnu Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- CIMBAR PERFORMANCE MINERALS

- Divjyot Chemicals Private Limited

- Guizhou Redstar Co., Ltd.

- Hebei Xinji Chemical Group Co., Ltd.

- Hubei Jingshan Chutian Barium Salt Corp., Ltd

- Nippon Chemical Industrial Co., Ltd.

- SAKAI CHEMICAL INDUSTRY CO., LTD.

- Solvay

- Venator Materials PLC

- Vishnu Chemicals