Global Banking Process Automation Market By Deployment Mode (Cloud-Based and On-Premise), By Application (Customer Service and Support, Risk Management and Compliance, Payment Processing, Account Management, and Other Applications), Organization Size, By Region and Companies -Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 106046

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factor

- Restraining Factor

- Deployment Mode Analysis

- Application Analysis

- Organization Size Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Market Share and Key Player Analysis

- Top Key Players in Banking Process Automation Market

- Recent Developments

- Report Scope

Report Overview

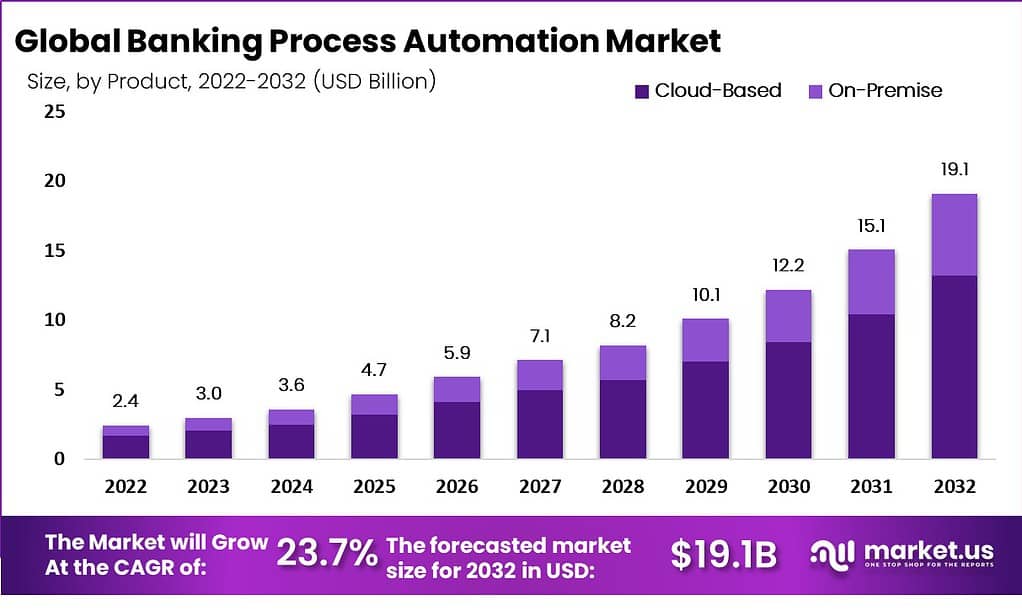

The Global Banking Process Automation Market is anticipated to achieve a value of roughly USD 19.1 Billion by 2032, a substantial rise from its 2022 value of USD 3.0 Billion, at a compound annual growth rate (CAGR) of 23.7% during the forecast period from 2023 to 2032.

Banking process automation involves the integration of technology and software solutions to optimize various operational tasks within financial institutions. This includes automating repetitive tasks, thereby reducing manual intervention, minimizing errors, and enhancing overall efficiency. By automating routine and rule-based tasks, such as data entry, account management, loan processing, and fraud detection, financial institutions can dedicate more resources to strategic endeavors, promoting innovation and enhancing customer satisfaction. The banking process automation market has experienced significant growth in response to the growing demand for enhanced operational efficiency and improved customer experiences within the financial sector.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Banking Process Automation Market is expected to reach a value of approximately USD 19.1 Billion by 2032, reflecting a remarkable Compound Annual Growth Rate (CAGR) of 23.7% during the forecast period from 2023 to 2032.

- Importance of Banking Process Automation: Banking Process Automation plays a pivotal role in enhancing operational efficiency within financial institutions, reducing manual errors, and optimizing customer experiences, thereby contributing to increased customer satisfaction and loyalty.

- Benefits of BPA for Banks: The integration of technology and software solutions through banking process automation aids in streamlining routine tasks like data entry, account management, and fraud detection, enabling financial institutions to allocate resources towards innovation and strategic growth.

- Key Drivers of BPA Market: The digital transformation in the banking industry, driven by evolving customer expectations for seamless and 24/7 services, is a significant factor propelling the demand for banking process automation.

- Challenges in Implementing BPA: High initial costs associated with implementing automated systems pose a significant challenge, especially for smaller financial institutions, hindering immediate large-scale investments necessary for efficient automation.

- Future Trends in BPA for the Banking Industry: The future trends in banking process automation highlight the increasing adoption of AI-powered chatbots and virtual assistants, transforming customer engagement within the banking sector. These advanced tools facilitate personalized customer interactions and provide tailored financial guidance, thus enhancing overall customer experiences.

- Deployment Mode Analysis: Cloud-based deployment dominates the market, representing a major revenue share of 69.3%, owing to its scalability, flexibility, and cost-efficiency, which align with the evolving needs of the banking sector.

- Application Analysis: The customer service and support segment hold the largest revenue share of 32.7%, emphasizing the critical need for banks to enhance customer experiences while optimizing operational efficiency.

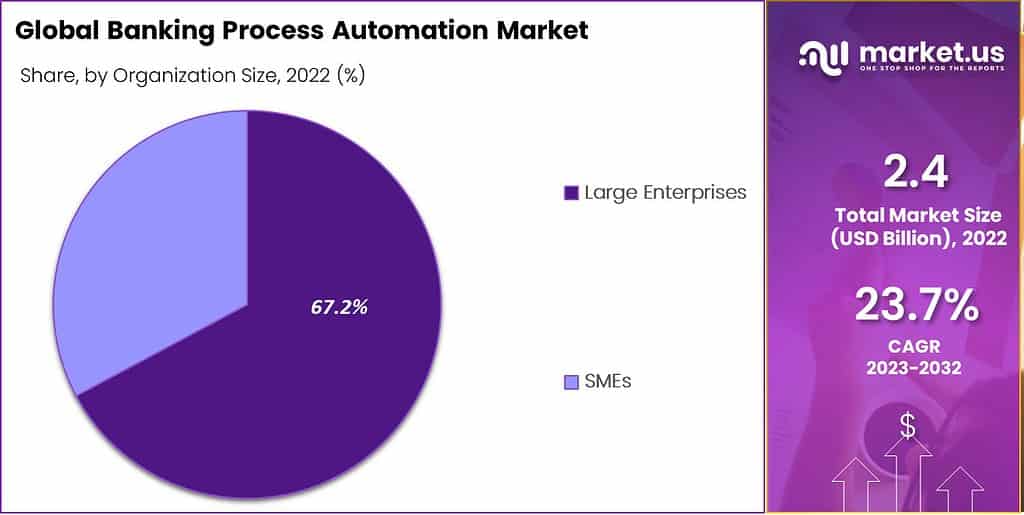

- Organization Size Analysis: Large enterprises dominate the market, accounting for a significant revenue share of 67.2%, as they have the financial resources to invest in cutting-edge automation technologies, leading to substantial cost savings.

- Growth Opportunity in Data-Driven Decision Making: The vast data generated through automation presents banks with an opportunity to enhance their decision-making processes, leveraging advanced analytical techniques and machine learning algorithms to extract valuable insights for product development, marketing strategies, and risk assessment.

Driving Factor

Digital Transformation and Customer Expectations

The banking industry is experiencing a significant shift towards digitalization, primarily driven by evolving consumer demands for quick, user-friendly and 24/7 services. Automating banking processes provides a mechanism for financial institutions to align with these changing consumer behaviors. By using automation in areas like opening new accounts, transferring funds, and customer support, banks can significantly increase the speed and accuracy of these operations. This efficiency directly contributes to higher levels of customer satisfaction and loyalty, which is crucial in today’s competitive environment, where customers are more inclined than ever to change banking providers. Therefore, investing in process automation has become a crucial strategy for banks aiming to stay relevant and competitive.

Restraining Factor

High Initial Costs

Initiating automated systems within the banking sector demands a hefty upfront capital commitment in areas like advanced technology, employee training, and possibly even reorganizing the organizational structure. Although the long-term advantages, including increased efficiency and cost savings, are convincing, the immediate financial requirements pose a significant obstacle. This is especially true for smaller financial institutions that might not have a sufficient budget to make such an immediate, large-scale investment.

Deployment Mode Analysis

Cloud-Based Dominates the Deployment Mode Segment with a Major Revenue Share in Account.

On the basis of deployment mode, the market is further classified into cloud-based and on-premise. Among these deployment mode segments, the cloud-based segment leads the market by covering the major revenue share of 69.3%. This growth of the cloud-based segment can be attributed to its inherent advantages. Cloud-based solutions offer great scalability, flexibility, and cost-efficiency, which aligns with the evolving needs of the banking sector. Banks can easily scale their automation initiatives up or down as needed without the heavy infrastructure investments required for on-premises solutions.

Application Analysis

Customer Service and Support Segment Dominates the Global Banking Process Automation Market by Holding Major Revenue Share in Account.

Based on application, the global banking process automation market is divided into customer service and support, risk management and compliance, payment processing, account management, and other applications. Among these application segments, the customer service and support segment dominates the market by holding a major revenue share of 32.7%. This dominance of the customer service and support segment is driven by the critical need for banks to enhance customer experiences while optimizing operational efficiency.

Banking institutions are under increasing pressure to deliver fast, personalized, and error-free services. Automation in customer service and support streamlines tasks such as account inquiries, dispute resolution, and transaction processing, reducing response times and errors.

Organization Size Analysis

Large Enterprises Dominate the Organization Size Segment in the Global Banking Process Automation Market.

Based on organization size, the market is segmented into large enterprises and SMEs. Among these organization size segments, the large enterprises segment holds a major revenue share of 67.2% in 2022. This growth of the large enterprises segment can be attributed to the high financial budgets, complex operational needs, and strategic priorities of these enterprises.

Large banks have the resources to invest significantly in cutting-edge automation technologies, making them early adopters in the market. Their extensive operations involve numerous manual and repetitive tasks, which automation can streamline effectively, resulting in substantial cost savings.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Customer Service and Support

- Risk Management and Compliance

- Payment Processing

- Account Management

- Other Applications

Organization Size

- Large Enterprises

- SMEs

Growth Opportunity

Data-Driven Decision Making

The vast data generated by automation presents banks with an opportunity to enhance their decision-making processes through a data-centric approach. Utilizing advanced analytical techniques and machine learning algorithms, banks can extract valuable insights from this data. These insights can play an important role in guiding strategic decisions related to product development, refining marketing strategies, and assessing risk.

Harnessing the potential of data empowers banks to gain deeper insights into customer behaviors, preferences, and the dynamic landscape of emerging market trends. This newfound understanding serves as the foundation for developing tailored financial products and services and enhancing customer satisfaction.

Latest Trends

AI-powered chatbots and Virtual Assistants

Advanced chatbots and virtual assistants are transforming customer engagements within the banking industry. These virtual assistants excel at managing routine inquiries, delivering tailored suggestions, and even facilitating complex transactions. Through the application of natural language processing and advanced algorithms, banks can uplift their customer service standards, minimize response delays, and augment overall customer contentment. Additionally, virtual assistants are progressing towards providing more sophisticated capabilities. These encompass financial guidance, investment counsel, and efficient account administration. This factor not only enhances the customer experience but also reduces the workload of human customer support personnel.

Regional Analysis

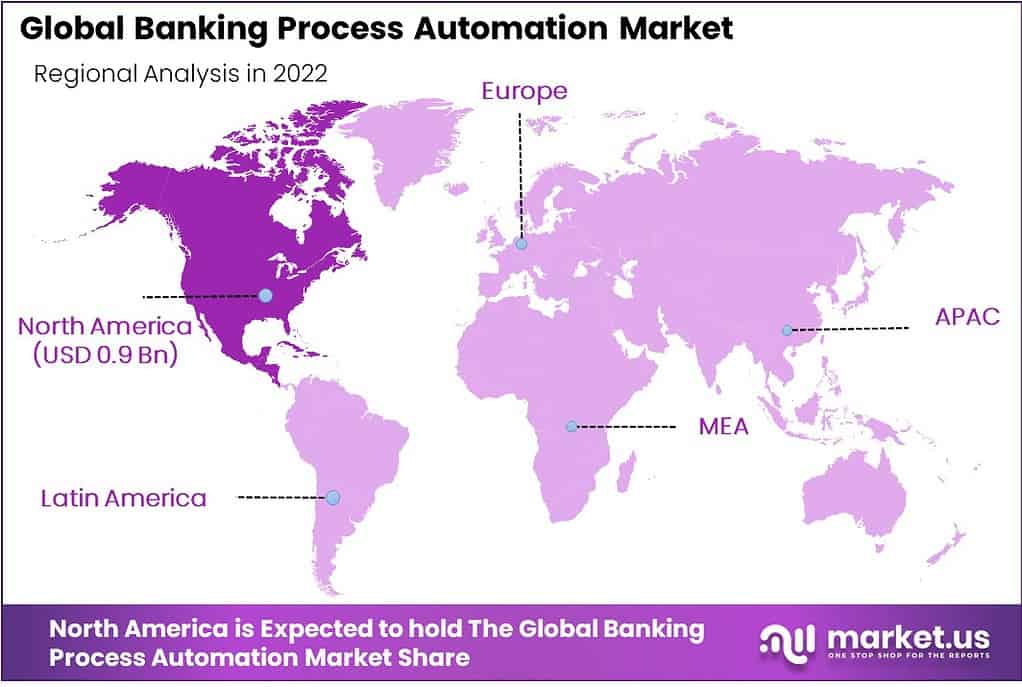

North America Dominates the Global Banking Process Automation Market by Holding the Major Revenue Share.

The North America region dominates the global Banking Process Automation market by holding a major revenue share of 39.4%. This massive growth of the region can be attributed to the highly developed and technologically advanced banking sector in the region, comprising numerous large financial institutions. These institutions are more willing and financially equipped to invest in cutting-edge automation solutions, driving market growth.

Also, the presence of major technology hubs and a robust ecosystem of technology providers and startups in the region affects its growth positively. The Asia Pacific region is expected to grow at a higher CAGR over the forecast period owing to the rapid technology adoption by financial institutions in the region and constantly improving technology infrastructure.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The global banking process automation market is composed of numerous companies offering banking process automation services, with key players seeking to strengthen their market positions through mergers and acquisitions or partnerships and collaborations in order to enhance their market presence. Some major market players include IBM Corporation, UiPath, Automation Anywhere, Microsoft Corporation, SAP SE, Oracle Corporation, Blue Prism, Pegasystems Inc., Kofax Inc., NICE Systems as well as other key players.

Top Key Players in Banking Process Automation Market

- IBM Corporation

- UiPath

- Automation Anywhere

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Blue Prism

- Pegasystems Inc.

- Kofax Inc.

- NICE Systems

- Other Key Players

Recent Developments

- In July 2023, IBM Corporation and Truist Financial Corporation announced their collaboration for Quantum Computing and Emerging Technology Innovation.

Report Scope

Report Features Description Market Value (2023) US$ 3.0 Bn Forecast Revenue (2032) US$ 19.1 Bn CAGR (2023-2032) 23.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode – Cloud-Based and On-Premise; By Application – Customer Service and Support, Risk Management and Compliance, Payment Processing, Account Management, and Other Applications; By Organization Size – Large Enterprises and SMEs Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, UiPath, Automation Anywhere, Microsoft Corporation, SAP SE, Oracle Corporation, Blue Prism, Pegasystems Inc., Kofax Inc., NICE Systems, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the growth rate of the Banking Process Automation Market?The Banking Process Automation Market is anticipated to achieve a value of roughly USD 19.1 Billion by 2032, a substantial rise from its 2022 value of USD 2.4 Billion, at a compound annual growth rate (CAGR) of 23.7% during the forecast period from 2023 to 2032.

Why is Banking Process Automation important for banks?BPA is crucial for banks as it helps them reduce operational costs, increase efficiency, improve compliance with regulatory requirements, enhance customer experiences, and stay competitive in a rapidly evolving financial landscape.

What are the benefits of BPA for banks?The benefits of BPA for banks include:

- Improved efficiency: BPA can free up employees to focus on more strategic and value-added activities.

- Increased accuracy: BPA can help to reduce errors in manual processes.

- Reduced costs: BPA can help to reduce the costs of operations by eliminating the need for manual labor.

- Improved compliance: BPA can help banks to comply with regulations by automating processes that are subject to compliance requirements.

- Enhanced customer experience: BPA can help to improve the customer experience by providing faster and more convenient service.

What are the key drivers of the Banking Process Automation Market?The key drivers include increasing customer expectations for faster and more convenient services, the need for regulatory compliance, the desire to reduce operational costs, and the advancements in technology like artificial intelligence and robotic process automation.

What are the challenges of implementing BPA in the banking industry?The challenges of implementing BPA in the banking industry include:

- Data integration: BPA solutions need to be able to integrate with the bank's existing systems and data. This can be a complex and time-consuming process.

- Employee resistance: Some employees may be resistant to change and may not be willing to adopt new technologies.

- Security: BPA solutions need to be secure to protect sensitive customer data.

- Cost: BPA solutions can be expensive to implement and maintain.

What are the future trends in BPA for the banking industry?The future trends in BPA for the banking industry include:

- The increasing use of AI and NLP to automate more complex tasks.

- The development of cloud-based BPA solutions that are more scalable and cost-effective.

- The growing adoption of BPA by small and medium-sized banks.

Banking Process Automation MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Banking Process Automation MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- UiPath

- Automation Anywhere

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Blue Prism

- Pegasystems Inc.

- Kofax Inc.

- NICE Systems

- Other Key Players