Global Back to School Market Size, Share, Growth Analysis By Product (Clothing & Accessories, Electronics, Stationery Supplies), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150555

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

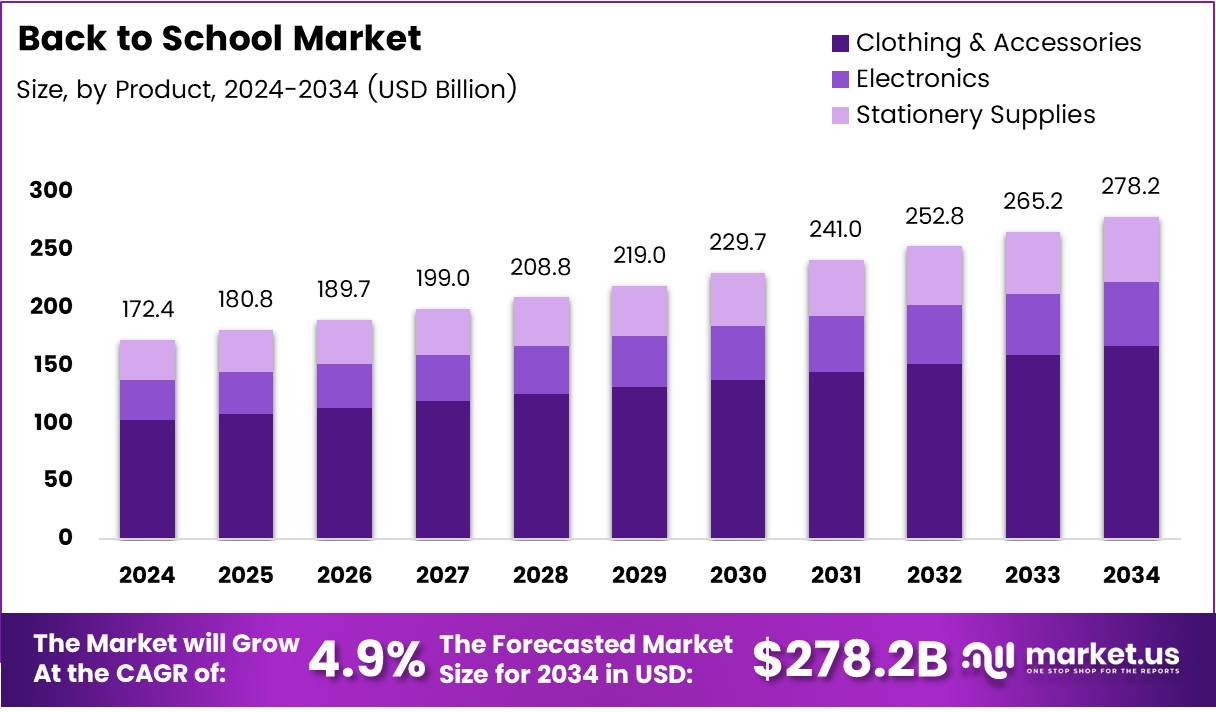

The Global Back to School Market size is expected to be worth around USD 278.2 Billion by 2034, from USD 172.4 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Back to School market refers to the period when parents and guardians prepare their children for the new academic year by purchasing supplies, apparel, and tech products. It also includes digital tools and educational services that students utilize throughout their academic journey. This market experiences a significant surge in consumer spending as the academic calendar approaches, making it an essential segment for retailers and service providers.

In 2024, the market is expected to witness strong growth, driven by shifts in consumer shopping behaviors. According to Fitsmallbusiness, 70% of shoppers are expected to use multiple channels, a slight increase from 66% in 2023.

This change indicates a rise in cross-channel retail engagement, with parents planning to shop across 4.7 retail channels, up from 3.9 in the previous year. Multi-channel shoppers will account for 80% of the total back-to-school spending, up from 73% in 2023, highlighting the increasing integration of online and offline shopping experiences.

Simultaneously, the growing digitalization in education is reshaping the back-to-school landscape. As per Yr Media, approximately 57% of students use digital learning tools daily, spending at least 50% of their classroom time engaging with devices.

This shift presents substantial opportunities for tech companies offering educational products, software, and online learning tools, as demand for digital resources continues to increase.

Government initiatives are playing a pivotal role in supporting the back-to-school market. Investments in educational technology and digital infrastructure are fostering an environment where schools can integrate these resources into their curricula.

Regulations that support digital learning are opening avenues for ed-tech companies, with governments encouraging innovation in education.

Retailers and businesses can tap into this growing trend by diversifying their offerings to cater to both traditional and digital needs. Companies that focus on multichannel retail strategies and educational technology integration are poised for growth.

Additionally, expanding product lines to include eco-friendly school supplies and technology-driven learning tools could provide further competitive advantages.

Key Takeaways

- The Global Back to School Market size is expected to reach USD 278.2 Billion by 2034, growing at a CAGR of 4.9% from 2025 to 2034.

- Clothing & Accessories led the By Product Analysis segment in 2024, with a 53.7% market share.

- Offline shopping dominated the By Distribution Channel segment in 2024, holding 61.7% of the market.

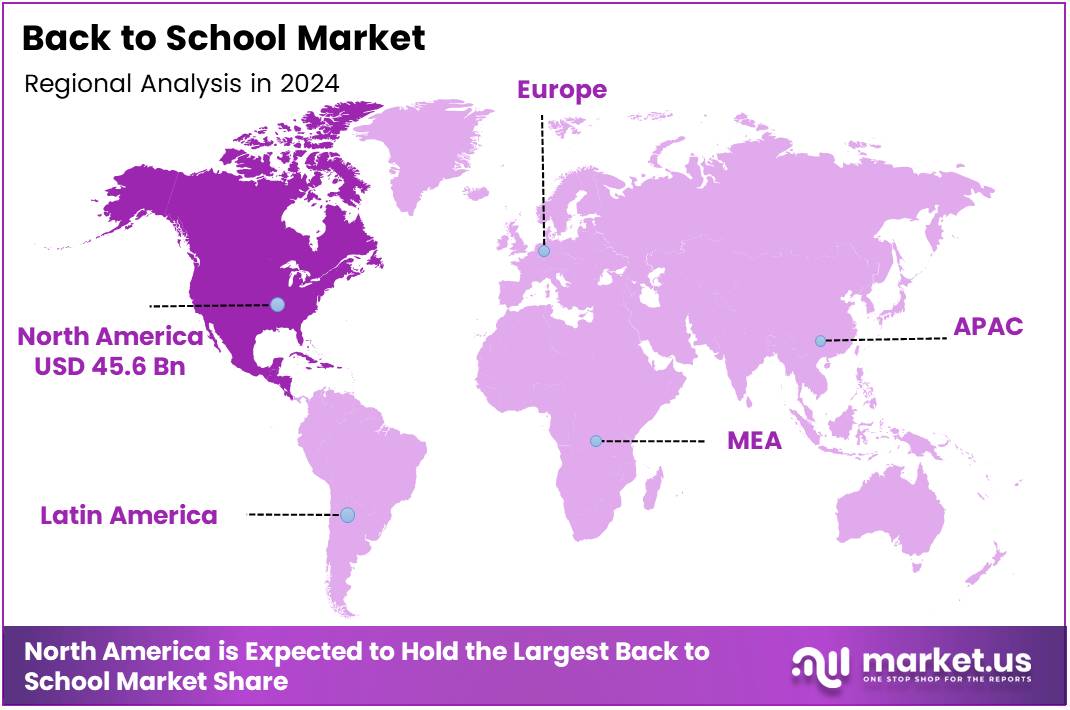

- North America holds a 26.5% share of the Back to School Market, valued at USD 45.6 Billion.

Product Analysis

Clothing & Accessories holds a dominant position with a 53.7% share in the Back to School Market.

In 2024, Clothing & Accessories led the By Product Analysis segment of the Back to School Market with a 53.7% share. This category’s strong performance is attributed to the high demand for uniforms, casual wear, and other essential clothing items required by students for the new school year. Clothing and accessories are often seen as a significant purchase during the back-to-school period, with families prioritizing comfortable and durable options for children.

Electronics followed closely, capturing a significant portion of the market. This category includes laptops, tablets, and other gadgets essential for modern schooling, which have become increasingly necessary due to the rise in digital learning tools.

Stationery Supplies also maintained a substantial share, with parents and students relying on notebooks, pens, and other academic supplies to kick-start the school year. While this category doesn’t see as large a share as Clothing & Accessories, its steady demand continues to be vital in the overall market dynamics.

Distribution Channel Analysis

Offline dominates with 61.7% in the Back to School Market due to in-store shopping preferences.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Back to School Market, with a 61.7% share. This preference for offline shopping can be attributed to the hands-on experience it offers, allowing consumers to assess the quality of products, especially clothing and accessories. Many parents also find it convenient to visit physical stores for last-minute shopping or to compare prices.

The Online segment is also growing but has a smaller market share. Online shopping continues to gain traction, especially among tech-savvy consumers looking for the convenience of home delivery.

However, despite the growing digital shift, offline channels still retain the majority of market dominance due to their established presence and ease of access during the back-to-school season.

Key Market Segments

By Product

- Clothing & Accessories

- Electronics

- Stationery Supplies

By Distribution Channel

- Offline

- Online

Drivers

Increasing Demand for Back to School Products Drives Market Growth

The rise in consumer spending on education-related products is a major driver for the back-to-school market. As families prioritize education, they are allocating more funds for school supplies, electronics, clothing, and other essentials. This increased spending has helped fuel market growth.

Another key factor is the growing adoption of hybrid learning models. With more students engaging in both in-person and online learning, there is a rising need for tech-enabled learning tools, such as tablets and laptops, contributing to the demand for these products.

The expansion of e-commerce platforms has also played a significant role in driving market growth. Online shopping for school supplies offers convenience and variety, making it easier for parents to find and purchase necessary items.

Government initiatives to support educational infrastructure are boosting the market further. Investments in schools, educational programs, and new learning technologies are creating additional demand for back-to-school products.

Restraints

Challenges Affecting the Back to School Market

Rising costs of school supplies are posing a challenge to the back-to-school market. The increasing prices of essential items, such as stationery, clothing, and electronics, may make it harder for some families to afford everything they need, thus affecting overall market growth.

Supply chain disruptions have also caused delays and product shortages. With the ongoing challenges in global supply chains, it has become difficult for retailers to maintain stock levels, leading to inconsistent product availability.

Economic uncertainty is another restraint on the market. With fluctuating economic conditions, families are becoming more cautious with their spending, which could lead to a decrease in demand for non-essential back-to-school products.

Finally, increasing competition from online educational resources is reducing the demand for traditional school supplies. Many students and parents are turning to digital solutions and platforms for learning, leading to a shift away from physical materials.

Growth Factors

Growth Opportunities in the Back to School Market

One of the most exciting growth opportunities is the emergence of eco-friendly and sustainable school products. As consumers become more environmentally conscious, there is a growing demand for products made from recycled materials, biodegradable items, and other sustainable options.

Personalized school supplies are also gaining traction. Customization options for backpacks, notebooks, and other products are becoming more popular, particularly among younger students. These personalized items are driving a new trend in the market.

The growing market for smart learning tools and gadgets is another opportunity. As technology continues to transform education, there is an increasing demand for devices and tools designed to enhance the learning experience, such as smart whiteboards, interactive tablets, and educational apps.

Finally, the expansion of back-to-school promotions and discounts is helping to drive market growth. Retailers are offering deeper discounts and more attractive sales events to attract price-conscious consumers, boosting overall sales.

Emerging Trends

Trending Factors Shaping the Back to School Market

The integration of technology into traditional school products is one of the key trends driving the market. Items like smart notebooks, interactive whiteboards, and digital learning tools are becoming more common as schools and parents look to blend technology with traditional education methods.

Increasing popularity of virtual back-to-school events is another emerging trend. With social distancing measures in place, many schools and retailers have shifted to online events, allowing parents and students to shop and engage from the comfort of their homes.

The surge in demand for health and safety products for schools has also been noticeable. Items like face masks, sanitizers, and air purifiers are now essential for ensuring the well-being of students and staff, especially in light of recent global health concerns.

Lastly, there is a rising focus on mental health and wellness in education products. More school supplies, such as planners and stress-relief tools, are being marketed to help students manage their mental health, reflecting an increased awareness of the importance of well-being in education.

Regional Analysis

North America Dominates the Back to School Market with a Market Share of 26.5%, Valued at USD 45.6 Billion

North America holds a dominant position in the back to school market, capturing 26.5% of the total share, valued at USD 45.6 Billion. This region benefits from strong consumer spending power, high demand for school supplies, and the expanding adoption of hybrid learning models. The growing preference for multi-channel shopping also contributes significantly to the region’s market growth.

Europe Back to School Market Trends

Europe follows as a prominent region, experiencing steady demand for back-to-school products. The region benefits from significant government investments in educational infrastructure and a high level of digital learning tool adoption among students. The evolving trends in online shopping further support market expansion.

Asia Pacific Back to School Market Dynamics

Asia Pacific is an emerging high-growth market driven by increasing school enrollments and a rising middle class with greater spending on education. Governments in the region are progressively investing in educational reforms and infrastructure, fueling the demand for school supplies and digital learning tools.

Middle East and Africa Back to School Market Overview

The Middle East and Africa region is witnessing gradual growth in the back to school market, supported by urbanization and expanding educational initiatives. The rising disposable income in select countries contributes to the market’s positive trajectory, with demand growing for both traditional school supplies and new-age learning tools.

Latin America Back to School Market Outlook

Latin America is experiencing moderate growth in the back to school market, with increasing efforts from governments to enhance education systems. However, the market faces challenges such as economic instability in certain countries. Despite these challenges, consumer demand for affordable school products continues to rise steadily.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Back to School Company Insights

In 2024, the global Back to School market continues to be shaped by the strong presence of key players that have strategically positioned themselves to capture significant market share.

Staples Inc. has maintained its dominance in the market by providing a wide range of school supplies through both online and offline channels, leveraging its extensive retail network to cater to the back-to-school rush.

Pelikan is renowned for its premium quality writing instruments and stationery products, which continue to gain popularity among both students and educational institutions. The company’s focus on eco-friendly products has also contributed to its growing market footprint.

Faber Castell AG holds a strong position in the market with its innovative and high-quality stationery products, particularly for the art and school sectors. Its emphasis on sustainable production methods aligns with the increasing demand for eco-conscious products in the education sector.

ITC Ltd has expanded its presence in the Back to School market, primarily through its range of stationery products that appeal to value-conscious consumers. ITC’s strategic distribution across various regions further strengthens its market position.

These companies play crucial roles in meeting the diverse needs of students and parents, combining product innovation, sustainable practices, and robust distribution strategies to capture the growing demand for back-to-school products.

Top Key Players in the Market

- Staples Inc.

- Pelikan

- Faber Castell AG

- ITC Ltd

- The ODP Corporation

- Mitsubishi Pencil Co. Ltd.

- Newell Brands Inc.

- Acco Brands Corporation

- Apple Inc.

- HP Inc.

Recent Developments

- In Nov 2024, Apparel Brands acquired Hype with plans to expand its product range to cater to every family member, enhancing its market position across various age groups and demographics.

- In Mar 2025, Brisk raised US$ 15 million following a strong start in the school market, using the funds to accelerate its product development and increase market penetration.

Report Scope

Report Features Description Market Value (2024) USD 172.4 Billion Forecast Revenue (2034) USD 278.2 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Clothing & Accessories, Electronics, Stationery Supplies), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Staples Inc., Pelikan, Faber Castell AG, ITC Ltd, The ODP Corporation, Mitsubishi Pencil Co. Ltd., Newell Brands Inc., Acco Brands Corporation, Apple Inc., HP Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Staples Inc.

- Pelikan

- Faber Castell AG

- ITC Ltd

- The ODP Corporation

- Mitsubishi Pencil Co. Ltd.

- Newell Brands Inc.

- Acco Brands Corporation

- Apple Inc.

- HP Inc.