Global Back To College Market Size, Share, Growth Analysis By Product (Clothing & Accessories, Electronics, Dorm/Apartment Furnishings, Stationery Supplies, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167329

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

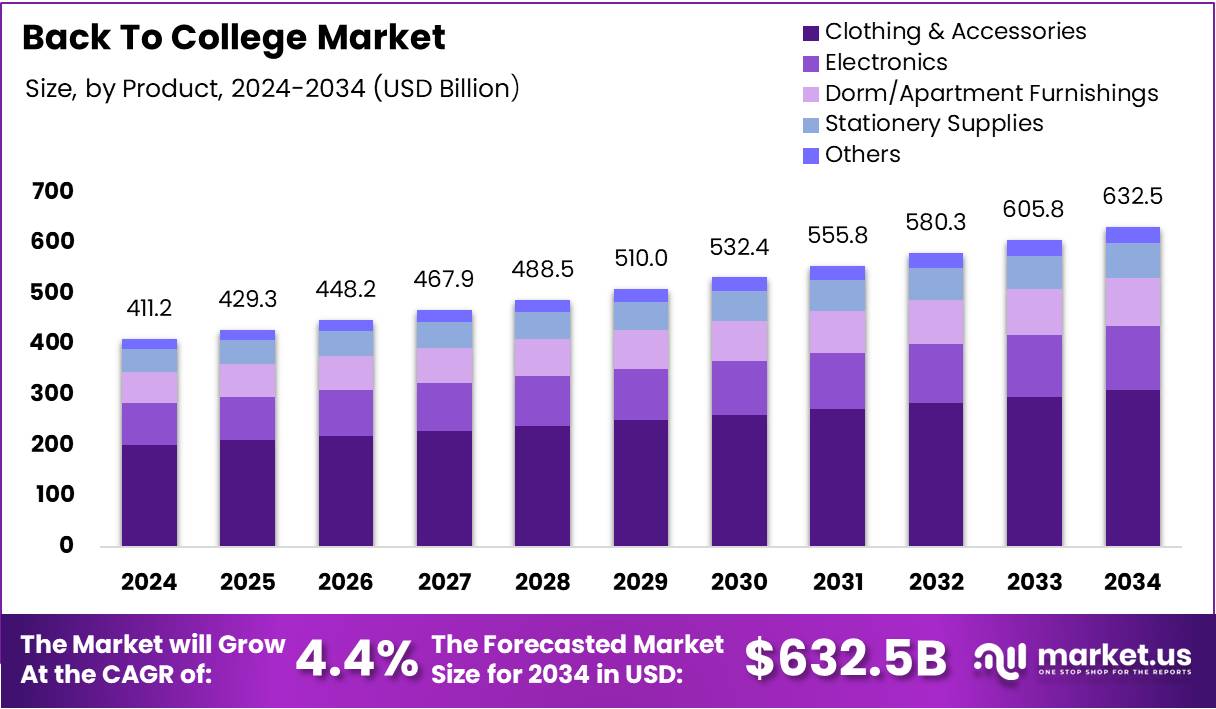

The Global Back To College Market size is expected to be worth around USD 632.5 Billion by 2034, from USD 411.2 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The Back To College Market represents seasonal demand for student essentials, academic supplies, dorm furnishings, electronics, and digital learning tools purchased before the new academic year. It reflects shifting student lifestyles, evolving campus needs, and growing expectations for value-driven assortments during the peak preparation period.

Moving ahead, the Back To College segment continues expanding as higher education participation increases and families prioritize readiness. Retailers gain from predictable seasonal cycles, while brands benefit from stable demand for technology devices, stationery, personal care items, and dorm-related products. This market also strengthens planning around merchandising and promotional strategies.

Additionally, government investment in digital education, campus upgrades, and financial support programs encourages consistent purchasing of learning devices and accessories. Supportive regulations around sustainability, material safety, and e-commerce operations further influence product innovation and responsible sourcing, creating a more transparent Back To College ecosystem.

Furthermore, the market offers strong opportunities across personalization, eco-friendly supplies, curated bundles, and budget-friendly product lines. Students increasingly expect convenience, leading to higher demand for fast delivery, flexible pick-up options, and value-based assortments. Retailers that refine inventory planning and promotional timing remain well-positioned for seasonal growth.

Consumer behavior continues evolving, with students and families placing greater emphasis on value, convenience, and early planning. Many compare prices, explore multiple channels, and prioritize practical essentials, reinforcing the relevance of strategic promotions and competitive pricing throughout the season.

Recent industry data highlights shifting spending patterns. 66% of the Back To School budget is expected to be spent by the end of July as families seek the best deals. College students and their families plan to spend $1,325.85, slightly lower than $1,364.75 last year. Moreover, most plan back-to-class shopping, with 43% choosing more online purchasing and 30% expecting to do increased comparison shopping.

Key Takeaways

- The global market reached USD 411.2 Billion in 2024 and is projected to hit USD 632.5 Billion by 2034 with a CAGR of 4.4%.

- Clothing & Accessories led the product segment with a dominant share of 34.7% in 2024.

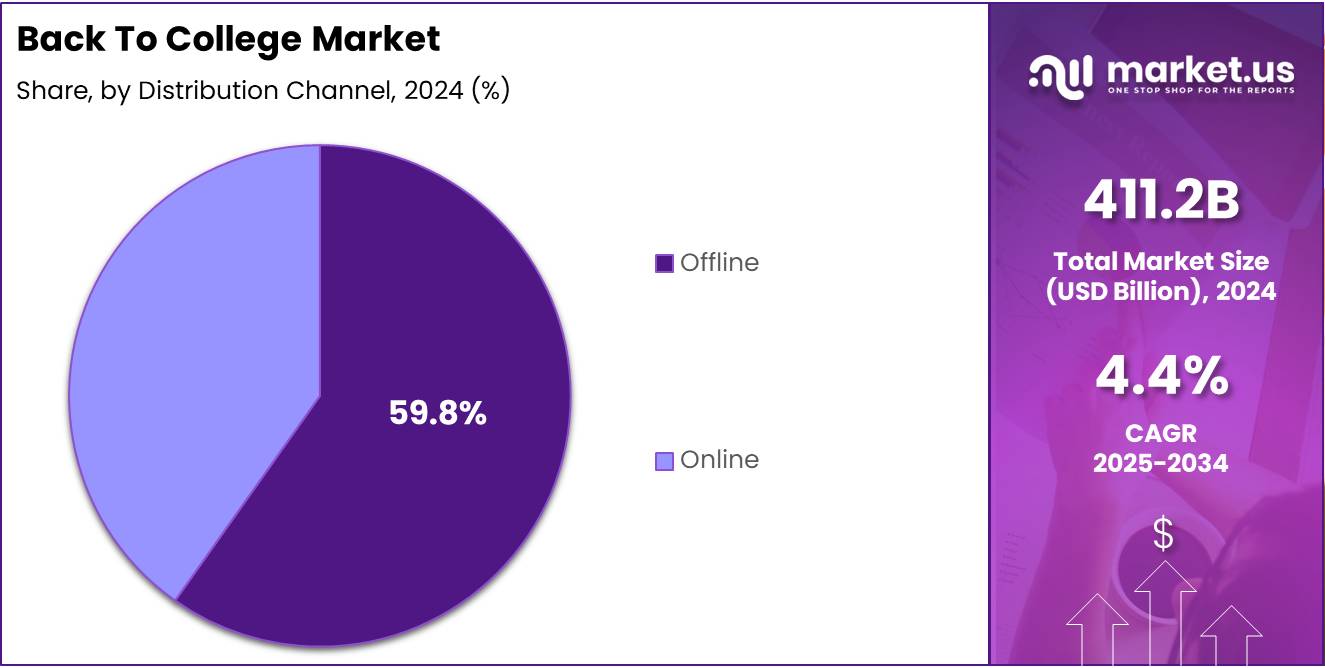

- Offline channels captured the largest distribution share at 59.8% in 2024.

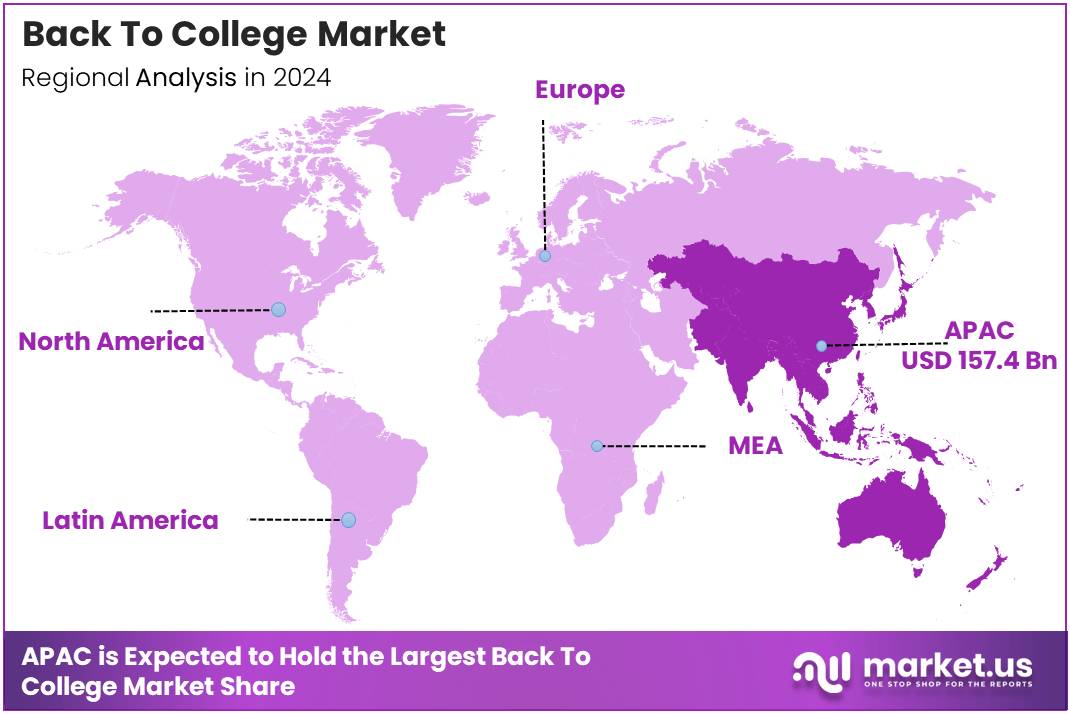

- Asia Pacific dominated the regional market with a 38.3% share valued at USD 157.4 Billion in 2024.

By Product Analysis

Clothing & Accessories dominates with 34.7% due to essential student demand and seasonal purchasing patterns.

In 2024, Clothing & Accessories held a dominant market position in the By Product Analysis segment of the Back To College Market, with a 34.7% share. This segment grew steadily as students prioritized apparel, footwear, and lifestyle accessories, and retailers expanded affordable bundles to strengthen overall purchase frequency.

In 2024, Electronics witnessed consistent demand as students increasingly required laptops, tablets, and audio devices for academic productivity. This segment benefited from rising digital coursework and attractive student-focused discounts, encouraging families to upgrade essential gadgets before each academic cycle.

In 2024, Dorm/Apartment Furnishings expanded gradually as students invested in bedding, storage units, and décor essentials. This segment increased due to rising campus housing occupancy and the growing preference for personalized dorm spaces that enhance comfort, organization, and long-term usability throughout academic sessions.

In 2024, Stationery Supplies maintained steady traction as students purchased notebooks, planners, writing tools, and organizational materials. Despite digital adoption, this segment remained relevant due to continued reliance on physical materials across many academic environments and the affordability of bulk stationery packs.

In 2024, Others captured additional spend across hygiene products, backpacks, sports equipment, and miscellaneous dorm essentials. This segment expanded as students diversified their purchases, opting for supplementary items that support daily routines, convenience, and overall academic readiness.

By Distribution Channel Analysis

Offline dominates with 59.8% due to strong retail presence and product accessibility.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Back To College Market, with a 59.8% share. Physical stores attracted students through instant product availability, in-store trials, and promotional discounts that encouraged bulk purchases during the peak back-to-college season.

In 2024, Online recorded strong growth as students increasingly preferred digital shopping for convenience, price comparison, and quick delivery. E-commerce platforms improved engagement through curated bundles, cashback offers, and fast replacements, driving higher adoption among tech-savvy students and parents seeking seamless purchase experiences.

Key Market Segments

By Product

- Clothing & Accessories

- Electronics

- Dorm/Apartment Furnishings

- Stationery Supplies

- Others

By Distribution Channel

- Offline

- Online

Drivers

Growing Enrollment in Higher Education Across Emerging Markets Drives Market Growth

Rising enrollment in colleges across emerging markets is boosting demand for essential back-to-college products. As more students pursue higher education, spending increases on supplies, electronics, dorm essentials, and academic tools. This steady rise creates consistent market opportunities and encourages brands to expand their product lines.

Additionally, the rapid expansion of online and hybrid learning tools is reshaping purchasing patterns. Students now require digital devices, productivity software, ergonomic study setups, and connectivity accessories. This shift is driving strong demand for tech-enabled solutions that support flexible learning environments.

Furthermore, parents are spending more on student safety and well-being products. Items such as health kits, smart trackers, secure storage solutions, and wellness accessories are becoming priorities. This focus on safety strengthens market growth because families increasingly invest in reliable and protective products as students transition to college life.

Restraints

Rising Tuition Costs Reduce Student Spending Capacity

Rising tuition fees continue to limit how much students can spend on back-to-college essentials. As education becomes more expensive, households prioritize tuition and accommodation over discretionary items. This shift reduces the demand for non-essential products such as new clothing, accessories, and premium learning tools. As a result, retailers experience slower growth in categories linked to lifestyle and convenience.

Moreover, higher education costs also influence student budgeting behavior. Many learners now focus on buying only what is necessary, delaying purchases until discounts or seasonal offers appear. This cautious spending environment puts pressure on brands to offer competitive pricing, ultimately affecting overall market profitability.

At the same time, the market faces strong competition from second-hand and rental platforms. These channels attract students looking to save money, especially for textbooks, electronics, and dorm supplies. Since these products can be reused, students increasingly choose affordable alternatives instead of purchasing new items.

Additionally, easy access to rental marketplaces and peer-to-peer exchanges further shifts demand away from primary retail channels. These options provide cost-effective choices, reducing the sales volume of new goods. As these platforms expand, they continue to challenge traditional retailers and slow the overall growth of the back-to-college market.

Growth Factors

Expansion of Direct-to-Student Subscription Kits Creates New Market Opportunities

The Back to College Market is seeing fresh opportunities as direct-to-student subscription kits gain popularity. These kits offer monthly or quarterly essentials, making student life easier and more organized. As more students prefer convenience, brands can introduce tailored bundles that support daily needs and encourage repeat purchases.

Moreover, rising interest in smart dorm appliances is creating strong growth potential. Students increasingly want connected devices that improve comfort, save time, and support energy efficiency. This shift allows brands to innovate with compact, multi-functional products that fit small living spaces while delivering a modern experience.

Additionally, the growing adoption of flexible micro-credentials and skill-based courses is opening new avenues for education-focused companies. Students now seek short, targeted programs to improve career readiness alongside traditional degrees. This trend creates opportunities for digital platforms to launch new modules, tools, and learning support products.

Together, these factors show that convenience, technology, and flexible learning models will shape future growth in the Back to College Market. Businesses that adapt to these evolving student preferences can tap into long-term demand and strengthen their presence in this expanding category.

Emerging Trends

Growing Popularity of AI-Powered Learning and Productivity Tools Drives Market Trends

The Back to College Market is seeing strong momentum as students increasingly prefer eco-friendly and sustainable products. Brands are shifting toward recycled materials, reusable essentials, and low-waste packaging. This shift reflects rising student awareness about environmental impact and a willingness to invest in greener alternatives for everyday academic and dorm needs.

At the same time, AI-powered learning and productivity tools are becoming a major trend. Students are adopting apps and smart devices that help them manage time, improve study efficiency, and enhance learning outcomes. This trend is growing quickly as colleges integrate more digital tools, creating strong demand for intelligent study solutions that support hybrid learning.

Additionally, personalization is emerging as a key growth factor. Students now want dorm décor, stationery, and academic supplies that reflect their individual style. From customized organizers to themed décor items, the move toward personalized products is reshaping shopping patterns. This trend is also boosted by online platforms that make customization easier and more affordable.

Together, these shifts highlight how student preferences are evolving toward sustainable choices, smarter learning tools, and personalized experiences, shaping the next phase of growth in the Back to College Market.

Regional Analysis

Asia Pacific Back To College Market Dominates with a Market Share of 38.3%, Valued at USD 157.4 Billion

The Asia Pacific region leads the Back to College Market, supported by rising student enrollment and expanding middle-income households. In 2024, APAC held 38.3% share valued at USD 157.4 Billion, driven by strong demand for digital learning tools, affordable supplies, and improved education infrastructure. Growing urbanization and higher investment in student-focused services further accelerate regional growth.

North America Back To College Market Trends

North America shows steady expansion driven by strong adoption of technology-based learning solutions and rising spending on student well-being essentials. Higher awareness of academic preparedness and an established education ecosystem continue to support consistent market demand across the region.

Europe Back To College Market Trends

Europe witnesses stable growth due to increasing focus on sustainability, standardized learning supplies, and government support for higher education access. Strong preference for eco-friendly products and growing digital resource usage influence purchasing patterns across key countries.

Middle East and Africa Back To College Market Trends

The Middle East and Africa region is gradually expanding as investments in education infrastructure and digital transformation rise. Growing youth population and improving access to universities contribute to increasing demand for essential supplies and emerging smart learning tools.

Latin America Back To College Market Trends

Latin America experiences moderate growth supported by improving economic conditions and rising enrollment in public and private universities. Increasing preference for affordable learning supplies and gradual digital adoption shape the region’s evolving back-to-college purchasing behavior.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Back To College Company Insights

The global Back To College Market in 2024 continued to benefit from strong digital adoption, evolving student lifestyles, and rising demand for hybrid learning essentials. Among key players, The ODP Corporation strengthened its position by expanding value-driven academic supplies and enhancing omnichannel convenience. The company focused on timely fulfillment and curated college bundles, which helped it maintain steady traction among cost-conscious students.

Amazon.com, Inc. maintained significant influence as students increasingly preferred fast shipping, broad product diversity, and competitive pricing. Its subscription-based services and campus-focused deals further supported strong seasonal demand, reinforcing its leadership across multiple supply categories.

Acco Brands Corporation continued leveraging its diversified stationery and organizational solutions portfolio. The company benefited from consistent demand for durable and functional academic tools, aligning well with students seeking long-lasting value during the academic cycle.

Staples Inc. sustained relevance by optimizing in-store pickup and tailored student offers. Its focus on essential learning products, printing services, and campus-related solutions enabled it to retain a loyal consumer base preparing for both digital and traditional learning needs.

Beyond these major contributors, several global manufacturers and digital-focused suppliers played a supporting role by improving product design, enhancing sustainability features, and catering to personalization trends. Categories such as tech devices, stationery, and home-study accessories continued to show growth as students prioritized convenience, mobility, and academic efficiency. Overall, the competitive landscape remained dynamic, with brands investing in product innovation, stronger logistics capabilities, and value-driven offerings to meet evolving college preparation requirements worldwide.

Top Key Players in the Market

- The ODP Corporation

- Amazon.com, Inc.

- Acco Brands Corporation

- Staples Inc.

- Apple Inc.

- HP Inc.

- Faber Castell AG

- Newell Brands Inc.

- ITC Ltd.

- Mitsubishi Pencil Co. Ltd.

Recent Developments

- In August 2025, Target launched a refreshed Back-to-College style collection, expanding dorm décor lines and game-day apparel. It strengthened its seasonal portfolio by offering trend-driven essentials tailored to modern campus lifestyles.

- In June 2025, Apple introduced its 2025 Back-to-School program, running from June 17–Sept 30, 2025, offering bundled accessories with eligible Mac and iPad purchases. This move reinforced Apple’s annual strategy to boost education-driven demand during the peak buying season.

- In October 2024, Guild Education acquired Nomadic Learning to enhance its Guild Academy capabilities. The acquisition expanded Guild’s learning ecosystem, strengthening its upskilling and workforce-development solutions for enterprise partners.

- In July 2024, Staples (Canada) released its Back-to-School 2024 campaign and trends study, offering curated deals and programs for students and parents. The initiative supported seasonal sales while highlighting insights on evolving classroom and digital-learning needs.

Report Scope

Report Features Description Market Value (2024) USD 411.2 Billion Forecast Revenue (2034) USD 632.5 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Clothing & Accessories, Electronics, Dorm/Apartment Furnishings, Stationery Supplies, Others), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The ODP Corporation, Amazon.com, Inc., Acco Brands Corporation, Staples Inc., Apple Inc., HP Inc., Faber Castell AG, Newell Brands Inc., ITC Ltd., Mitsubishi Pencil Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The ODP Corporation

- Amazon.com, Inc.

- Acco Brands Corporation

- Staples Inc.

- Apple Inc.

- HP Inc.

- Faber Castell AG

- Newell Brands Inc.

- ITC Ltd.

- Mitsubishi Pencil Co. Ltd.