Automotive Heat Shield Market Report By Vehicle type (Passenger car, Light commercial vehicle, Heavy commercial vehicle , Electric vehicle), By Product (Single shell, Double shell, Sandwich), By Application (Engine, Underbody heatshield, Tank heatshield, Starter motor, Turbo charger), By Material, By Sales channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 20194

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

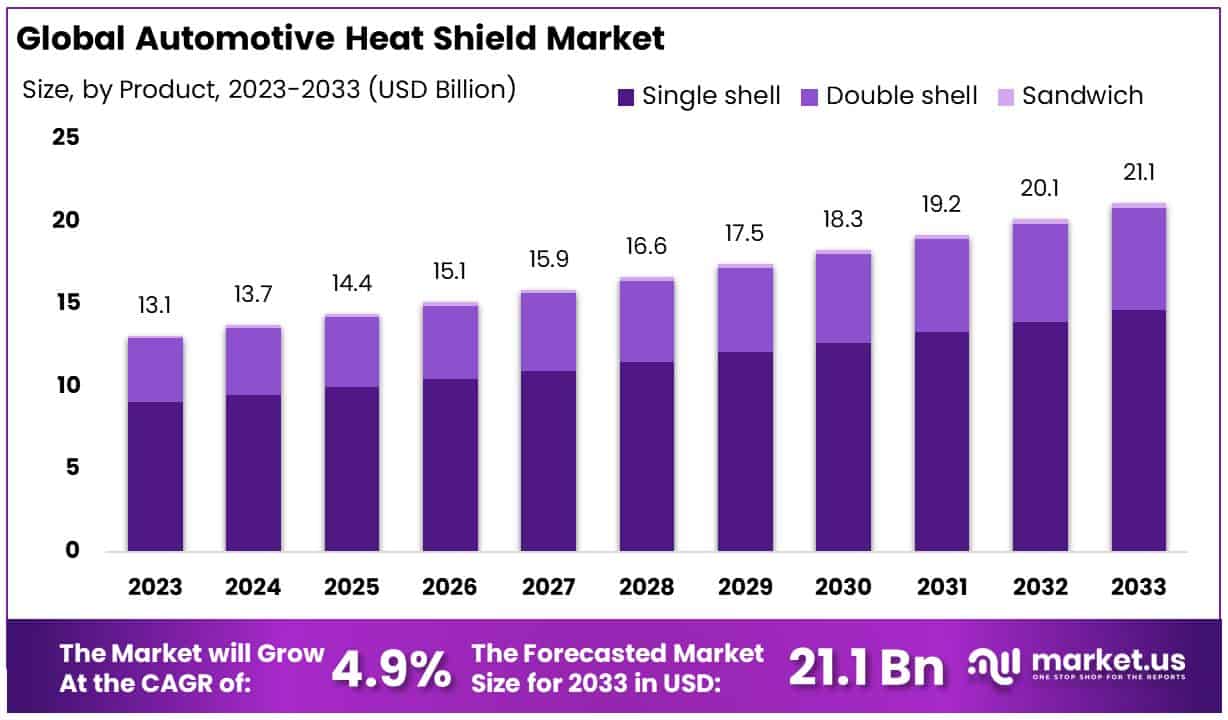

The Global Automotive Heat Shield Market size is expected to be worth around USD 21.1 Billion by 2033, from USD 13.1 Billion in 2023, growing at a CAGR of 4.90% during the forecast period from 2024 to 2033.

The Automotive Heat Shield Market refers to a specialized sector focused on manufacturing and distributing protective components designed to shield automotive parts from excessive heat. These shields play a crucial role in enhancing vehicle performance and safety by preventing heat-related damage to essential components.

The market caters to a diverse clientele, including vehicle manufacturers and aftermarket services, addressing the needs for both passenger and commercial vehicles. With advancements in automotive technology and increased emphasis on vehicle efficiency and safety, the demand for heat shields is experiencing significant growth.

The Automotive Heat Shield Market is poised for considerable growth, influenced by evolving automotive production forecasts and shifting industry dynamics. In 2023, the projection for U.S. new vehicle sales stands at 14.1 million units, according to Cox Automotive. This figure underscores the market’s resilience and potential for expansion, given the global automotive industry’s recovery trajectory.

Furthermore, the surge in new energy vehicle production, notably by companies such as BYD and Tesla, highlights a pivotal shift towards sustainability and innovation within the sector. BYD’s remarkable achievement of producing more than 3 million new energy vehicles in 2023, outpacing Tesla’s production of 1.84 million vehicles, signifies a competitive and rapidly advancing market landscape.

This upward trend in vehicle production, especially new energy vehicles, directly impacts the demand for automotive heat shields. These components are integral to vehicle safety and performance, safeguarding against excessive heat and contributing to vehicle longevity and fuel efficiency. The increasing focus on vehicle performance and the adoption of advanced technologies necessitate enhanced heat management solutions, thereby driving the growth of the heat shield market.

Moreover, the automotive heat shield market’s development is further buoyed by regulatory pressures and consumer demand for more efficient, safe, and environmentally friendly vehicles. As manufacturers and suppliers navigate these market dynamics, the importance of innovative heat management solutions becomes increasingly pronounced.

Key Takeaways

- Market Value Projection: The Global Automotive Heat Shield Market is anticipated to reach approximately USD 21.1 Billion by 2033, indicating significant growth potential from USD 13.1 Billion in 2023, with a projected CAGR of 4.90% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Vehicle Types: Passenger cars constitute the dominant segment, holding 78.1% of the market share, driven by factors such as rising disposable incomes, increasing vehicle ownership in emerging economies, and consumer demand for enhanced comfort and safety features.

- Product Types: Single shell heat shields lead the market with a share of 69.2%, owing to their simplicity, cost-effectiveness, and widespread application across various vehicle types.

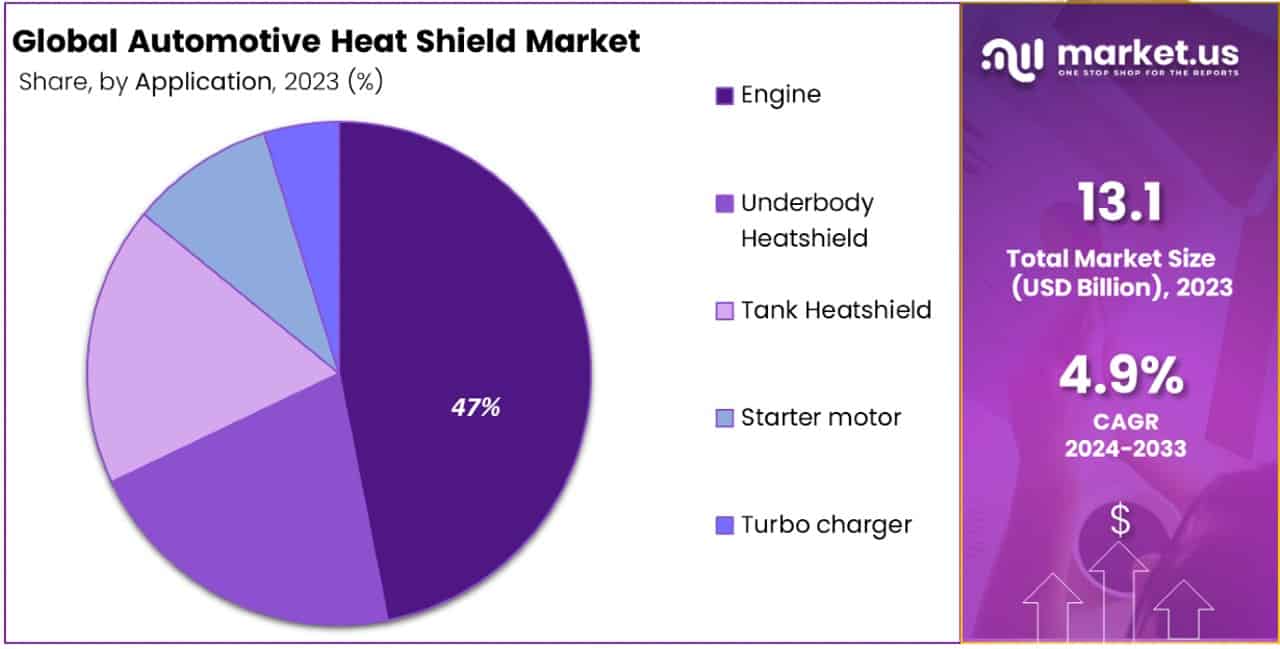

- Applications: Engine heat shields dominate the application segment with a share of 46.9%, highlighting their importance in protecting engines and surrounding components from excessive heat.

- Materials: Metallic heat shields hold the majority share (43.8%) due to their excellent thermal resistance and durability. Non-metallic heat shields cater to specialized needs and address the industry’s push towards lighter, more fuel-efficient vehicles.

- Sales Channels: The OEM channel commands a significant majority (76.1%) due to the integration of heat shields into new vehicles from the initial stages of design and assembly.

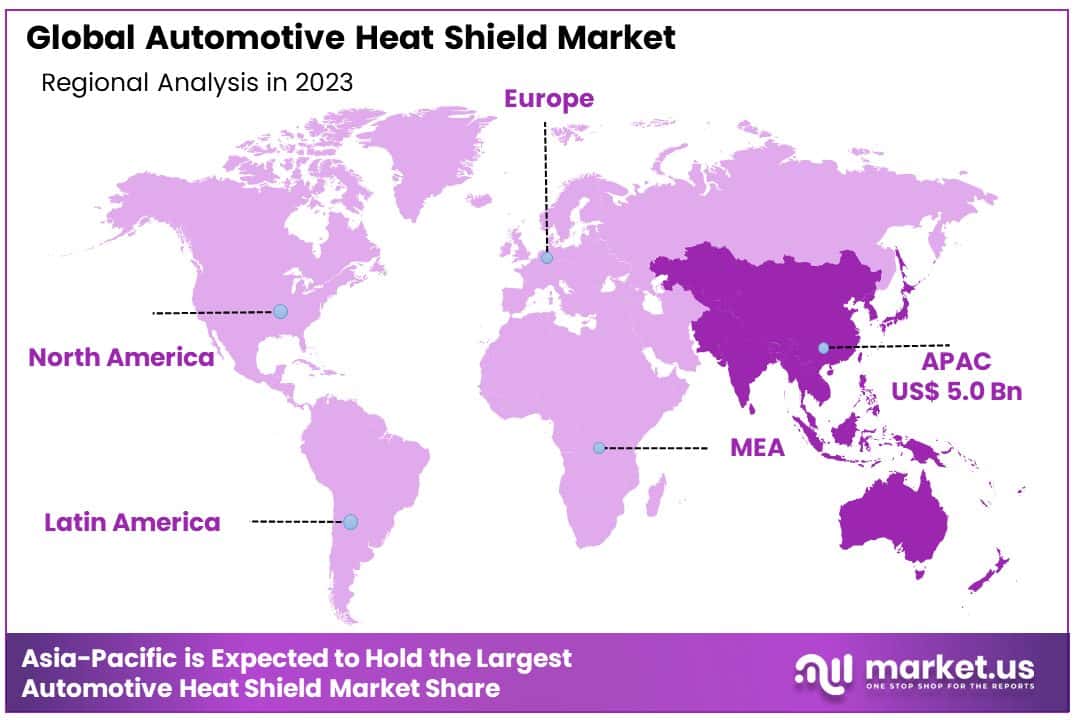

- Regional Dynamics: Asia-Pacific dominates the market with a 38.2% market share, followed by North America with a 24.3% share.

- Analyst Viewpoint: The market’s growth is fueled by factors such as increasing vehicle production, stringent emission regulations, evolving automotive safety and performance standards, and the growing demand for fuel-efficient and electric vehicles.

- Growth Opportunities: Opportunities for market growth lie in innovations in heat shield technology to meet evolving industry requirements, expansion into emerging markets with increasing vehicle demand, and strategic partnerships or mergers to enhance product offerings and market presence.

Driving Factors

Stringent Emission Regulations and Fuel Efficiency Standards Drive Market Growth

Governments around the globe are increasingly enforcing strict emission regulations and fuel efficiency standards to tackle environmental pollution and encourage sustainable automotive practices. This regulatory landscape plays a pivotal role in propelling the Automotive Heat Shield Market forward. The direct correlation between lower underhood temperatures, enhanced engine efficiency, and reduced emissions positions heat shields as key components in meeting these stringent standards.

The implementation of the European Union’s Euro 6 emission standards, alongside the United States’ Corporate Average Fuel Economy (CAFE) regulations, exemplifies how legislative measures are catalyzing the adoption of heat shields in the automotive sector. These regulations necessitate the development and integration of heat shields across a broad spectrum of vehicles to ensure compliance, thereby driving market expansion. This trend reflects a broader industry shift towards sustainability and efficiency, with heat shields at the forefront of innovative solutions designed to meet evolving regulatory demands.

Increasing Demand for High-Performance Vehicles Spurs Market Growth

The escalating popularity of high-performance vehicles, including sports cars and luxury models, significantly contributes to the demand for automotive heat shields. High-performance engines, characteristic of such vehicles, generate substantial heat, making effective heat management systems indispensable. Heat shields are crucial for protecting vital engine and exhaust system components from thermal damage, thereby ensuring vehicle performance and durability.

Prominent manufacturers such as Ferrari, Porsche, and BMW heavily rely on advanced heat shielding solutions to maintain the integrity and performance of their vehicles. This increasing demand underscores the critical role of heat shields in the high-performance vehicle segment, highlighting their importance in meeting consumer expectations for speed, power, and reliability. The focus on high-performance vehicles not only reflects consumer preferences but also emphasizes the automotive industry’s drive towards innovation and excellence in vehicle design and functionality.

Advancements in Materials and Design Enhance Market Potential

Continuous innovation in materials and design marks a significant trend in the Automotive Heat Shield Market. The shift towards lightweight materials, such as aluminum and composites, alongside innovative design approaches that optimize heat dissipation and insulation, plays a crucial role in the market’s expansion. These advancements not only improve the efficiency and durability of heat shields but also extend their application across various vehicle segments.

By enhancing the performance and versatility of heat shields, manufacturers are able to meet the growing demands of the automotive industry for solutions that contribute to fuel efficiency, emissions reduction, and overall vehicle performance. This evolution in heat shield technology reflects the broader industry trend towards material innovation and design excellence, driving market growth through enhanced product offerings that address both current and future automotive requirements.

Restraining Factors

High Material and Manufacturing Costs Restrain Market Growth

The Automotive Heat Shield Market faces significant challenges due to the high costs associated with specialized materials and complex manufacturing processes. Specialized alloys and composites, essential for crafting effective heat shields, come with a hefty price tag. Furthermore, the intricate procedures required to tailor these shields for specific vehicle models elevate production costs.

This financial burden can deter the widespread adoption of advanced heat shielding solutions, especially in markets where cost sensitivity is paramount or within segments targeting entry-level vehicles. The impact of these elevated costs is twofold: they not only increase the overall vehicle price but also limit innovation in heat shield development by making cost-effective solutions more appealing to manufacturers, thereby constraining market growth.

Weight Considerations and Design Constraints Restrain Market Growth

Automotive heat shields, while crucial for vehicle safety and performance, introduce additional weight to vehicles. This added weight can adversely affect fuel efficiency and overall vehicle performance, presenting a significant challenge for manufacturers. The industry’s push towards lighter vehicles for better fuel economy and reduced emissions necessitates a balance between incorporating essential heat management components and minimizing weight.

This balancing act is further complicated by design and packaging constraints within different vehicle models, which can limit the feasibility of integrating comprehensive heat shielding solutions. These factors collectively create a complex scenario for manufacturers, who must innovate to develop lighter, more efficient heat shields without compromising on effectiveness, ultimately posing a restraint on market growth.

Vehicle Type Analysis

Within the Automotive Heat Shield Market, the vehicle type segment is instrumental in understanding market dynamics and growth drivers. This segment is broadly categorized into passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles. Among these, passenger cars emerge as the dominant sub-segment, accounting for 78.1% of the market share.

This predominance is attributed to the sheer volume of passenger cars produced globally, coupled with the increasing consumer demand for enhanced comfort, safety, and performance features in these vehicles. Passenger cars are the mainstay of the automotive industry, and as such, the demand for advanced heat shielding solutions in this sub-segment significantly influences market trends and growth prospects.

The substantial market share held by passenger cars is driven by several factors, including rising disposable incomes, the proliferation of vehicle ownership in emerging economies, and the continuous evolution of automotive safety and performance standards. Additionally, the increasing emphasis on fuel efficiency and emission control mandates the integration of high-performance heat shields to manage engine and exhaust system temperatures effectively. This necessity is further amplified by the growing consumer preference for high-performance and luxury passenger vehicles, which require sophisticated heat management systems to protect sensitive components and enhance vehicle longevity.

While passenger cars dominate the market, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and electric vehicles (EVs) represent essential segments with unique contributions to market growth. LCVs and HCVs are critical for transportation and logistics, with specific heat shielding needs due to their engine configurations and operational demands. The rising adoption of EVs introduces new challenges and opportunities in heat management, given their distinct thermal management requirements to safeguard battery systems and electronics.

Product Analysis

In products offered within the Automotive Heat Shield Market, there exists a segmentation that includes single shell, double shell, and sandwich heat shields. The single shell product type is the market leader, holding a 69.2% share, underscored by its widespread application across various vehicle types and its effectiveness in heat management.

The single shell heat shield’s dominance is largely due to its simplicity, cost-effectiveness, and ease of installation, making it a preferred choice for manufacturers and consumers alike. Its design, typically a single layer of heat-resistant material, offers sufficient protection in a vast majority of driving conditions, contributing to its widespread adoption.

The prominence of single shell heat shields is further bolstered by the automotive industry’s continuous push towards cost reduction and efficiency optimization. Manufacturers prioritize solutions that offer a balance between performance and cost, wherein single shell heat shields stand out. Additionally, the evolving landscape of emission regulations and fuel efficiency standards compels automakers to integrate effective yet economical heat management solutions, further cementing the position of single shell heat shields in the market.

Despite the dominance of single shell heat shields, double shell and sandwich variants play critical roles in market diversification and addressing specific heat management challenges. Double shell heat shields, featuring two layers of material, offer enhanced protection for high-heat environments, making them suitable for high-performance and luxury vehicles. Sandwich heat shields, comprising multiple layers with insulating materials in between, provide superior thermal insulation, essential for vehicles with stringent heat management requirements.

Application Analysis

The application segment within the Automotive Heat Shield Market is critical for understanding the specific areas where heat shields are utilized within vehicles. This segment is categorized into engine heat shields, underbody heat shields, tank heat shields, starter motor heat shields, and turbocharger heat shields.

The engine sub-segment, accounting for 46.9% of the market, stands out as the dominant area of application. Engine heat shields are vital for protecting the vehicle’s engine and surrounding components from excessive heat, thereby enhancing performance and longevity. Their significance is underscored by the engine’s role as the heart of the vehicle, where thermal management is crucial for optimal operation and efficiency.

The dominance of engine heat shields is attributed to the increasing complexity of modern engines, which generate considerable heat due to tighter packaging and higher power outputs. As environmental regulations become stricter and demand for fuel efficiency grows, the importance of effective thermal management in engines escalates, driving the demand for advanced heat shielding solutions.

Other application areas, such as underbody, tank, starter motor, and turbocharger heat shields, also contribute to market growth. Each serves unique protective functions, mitigating heat impact in different vehicle parts and systems. For instance, underbody heat shields protect the vehicle’s lower parts from heat emitted by the exhaust system, while turbocharger heat shields are specialized to handle the extreme temperatures generated by turbocharged engines. These segments, though smaller in comparison to engines, are essential for comprehensive vehicle protection and performance enhancement.

Material Analysis

In the material segment of the Automotive Heat Shield Market, products are primarily differentiated by the materials used in their construction, namely metallic and non-metallic. Metallic heat shields, with a market share of 43.8%, are the predominant choice. This preference is due to the excellent thermal resistance and durability offered by metals, making them ideal for high-temperature environments typically encountered in automotive applications. Metallic heat shields, commonly made from aluminum or stainless steel, are favored for their ability to reflect and dissipate heat effectively, protecting vehicle components from thermal damage.

The widespread use of metallic materials in heat shields is driven by their reliability and performance across a wide range of automotive applications, from passenger cars to heavy commercial vehicles. The adaptability of metal to various shapes and sizes also allows for a broad spectrum of applications, further solidifying its dominance in the market.

Non-metallic heat shields and those designed for specific parts like exhaust manifolds and catalytic converters represent vital segments that cater to specialized needs. Non-metallic materials, such as ceramic or composite fibers, offer advantages in weight reduction and insulation properties, addressing the industry’s push towards lighter, more fuel-efficient vehicles. Although smaller in market share, these segments are crucial for innovation and meeting the diverse requirements of modern automotive designs.

Sales Channel Analysis

The sales channel segment is a fundamental aspect of the Automotive Heat Shield Market, encompassing OEM (Original Equipment Manufacturer) and aftermarket channels. The OEM channel, commanding a significant majority with 76.1% of the market, is the primary avenue for heat shield sales. This dominance is attributed to the integral role heat shields play in vehicle manufacturing, necessitating their inclusion from the initial stages of vehicle design and assembly. OEMs’ focus on meeting regulatory standards for safety, emissions, and fuel efficiency directly drives the incorporation of heat shields into new vehicles.

The aftermarket channel, while smaller, plays a critical role in replacements, upgrades, and customizations. It caters to vehicle owners seeking to enhance their vehicle’s performance or replace worn heat shields, reflecting the ongoing need for thermal management solutions beyond the initial purchase. The aftermarket’s role is particularly significant in the context of aging vehicles and the increasing emphasis on vehicle maintenance and longevity.

Key Market Segments

By Vehicle type

- Passenger car

- Light commercial vehicle

- Heavy commercial vehicle

- Electric vehicle

By Product

- Single shell

- Double shell

- Sandwich

By Application

- Engine

- Underbody heatshield

- Tank heatshield

- Starter motor

- Turbo charger

By Material

- Metallic

- Non metallic

- Exhaust manifold

- Catalytic converter

By Sales channel

- OEM

- Aftermarket

Growth Opportunities

Integrated Thermal Management Systems Offer Growth Opportunity

The development of integrated thermal management systems presents a significant growth opportunity within the Automotive Heat Shield Market. This innovative approach combines heat shields with insulation materials, cooling systems, and sensors to create a more comprehensive solution for managing vehicle temperatures.

Especially in electric and hybrid vehicles, where effective thermal management is crucial for battery performance and longevity, these integrated systems can ensure optimal functioning and efficiency. The push towards electrification in the automotive industry, with a growing number of electric vehicles (EVs) on the road, underscores the need for advanced thermal management solutions. By offering integrated systems, manufacturers can tap into this burgeoning market segment, addressing the specific needs of EVs and hybrid models, thereby expanding their market presence and customer base.

Customization and Aftermarket Offerings Present Market Expansion

The customization and aftermarket segment within the Automotive Heat Shield Market provides a substantial opportunity for growth. Vehicle enthusiasts and consumers with a focus on performance are increasingly interested in enhancing their vehicle’s thermal management capabilities. This demand creates a niche market for customized and specialized heat shielding solutions tailored to individual vehicle models or performance specifications.

Offering these bespoke products allows manufacturers to cater to a dedicated segment of the market looking for upgrades beyond standard offerings. The automotive aftermarket industry’s vitality, characterized by consumers’ willingness to invest in vehicle improvements and customization, supports this growth avenue. Manufacturers that can deliver on these specialized demands will likely see expanded market reach and customer loyalty, tapping into the enthusiasm of performance-oriented vehicle owners.

Trending Factors

Lightweight and Sustainable Material Innovations Are Trending Factors

The shift towards lightweight and sustainable materials is a significant trending factor in the Automotive Heat Shield Market. Manufacturers are keenly exploring the potential of advanced composites, recycled materials, and innovative design approaches to create heat shields that not only offer superior heat protection but also contribute to the overall reduction of vehicle weight and environmental impact. This trend is driven by the automotive industry’s ongoing efforts to improve fuel efficiency and meet stringent emissions regulations.

Lightweight materials directly contribute to lower fuel consumption and CO2 emissions, aligning with global sustainability goals. Furthermore, the use of recycled materials in heat shield production is gaining traction as companies seek to minimize their environmental footprint and cater to the growing consumer demand for eco-friendly vehicles. These innovations not only present opportunities for market expansion but also reflect the industry’s commitment to environmental sustainability and technological advancement.

Integration of Smart Technologies Are Trending Factors

The integration of smart technologies into automotive heat shields represents a cutting-edge trend that is shaping the future of the market. Incorporating sensors, data analytics, and Internet of Things (IoT) connectivity into heat shields allows for real-time temperature monitoring, predictive maintenance, and enhanced vehicle system integration.

This technological evolution is in response to the increasing complexity of modern vehicles and the demand for smarter, more connected automotive solutions. Smart heat shields can significantly improve vehicle safety and performance by enabling dynamic thermal management and early detection of potential issues. As the automotive industry continues to embrace digitalization and connectivity, the demand for heat shields with integrated smart technologies is expected to grow, presenting manufacturers with opportunities to innovate and differentiate their offerings in a competitive market.

Regional Analysis

Asia-Pacific Dominates with 38.2% Market Share

Asia-Pacific stands as a dominant force in the Automotive Heat Shield Market, commanding a 38.2% share. This prominence is driven by several key factors, including the region’s robust automotive manufacturing and export base, particularly in countries like China, Japan, and South Korea. The rapid expansion of the automotive sector in this region, coupled with increasing investments in vehicle production and technology advancements, significantly contributes to its leading position. Additionally, the growing demand for vehicles, spurred by rising incomes and an expanding middle class, fuels the need for automotive heat shields.

Regional characteristics such as high population density, urbanization, and environmental concerns also play a crucial role in shaping market dynamics. Asia-Pacific’s commitment to environmental sustainability prompts the adoption of new energy vehicles (NEVs), further driving the demand for innovative heat shield solutions tailored to electric and hybrid vehicles.

Asia-Pacific’s influence on the global Automotive Heat Shield Market is expected to continue growing. With ongoing investments in automotive technologies and a strong focus on electric vehicles, the region is poised to lead market trends and innovations, setting the pace for global market developments.

North America:

North America, with a 24.3% share, is a significant market, driven by advanced automotive technologies and a high adoption rate of electric vehicles. The region benefits from stringent environmental regulations, which foster innovations in heat management solutions.

Europe:

Europe holds a 26.5% market share, with its strong emphasis on environmental regulations such as the Euro 6 standards promoting the development of advanced automotive heat shield solutions. The region’s commitment to reducing vehicle emissions and increasing the adoption of electric vehicles contributes to its substantial market presence.

Middle East & Africa:

The Middle East & Africa region, with a 4.7% market share, shows potential for growth due to its emerging automotive sector and increasing vehicle demand. Investments in infrastructure and growing awareness of environmental issues are expected to drive demand for advanced automotive heat shields.

Latin America:

Latin America accounts for a 6.3% market share, where economic recovery and automotive industry growth present opportunities for heat shield market expansion. Increasing vehicle production and exports are key drivers in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Automotive Heat Shield Market, key players such as Dana Incorporated, Morgan Advanced Materials, Autoneum, Elringklinger AG, Lydall Inc, Tenneco Inc, Carcoustics, UGN Inc, Thermotec Automotive, and Federal-Mogul Holding Corporation, along with Progress-Werkoberkirch AG, play pivotal roles. These companies are distinguished by their innovative product offerings, strategic market positioning, and significant influence on market trends and standards.

Their impact is marked by a continuous drive for technological advancements and sustainable solutions in heat shield materials and designs. For instance, companies like Dana Incorporated and Elringklinger AG are at the forefront of developing lightweight and efficient thermal management systems, catering to the evolving needs of electric and internal combustion engine vehicles alike. Meanwhile, Morgan Advanced Materials and Lydall Inc emphasize the integration of advanced materials and composites for superior heat resistance and environmental sustainability.

The strategic positioning of these companies within the global market is reinforced by their global manufacturing footprints, extensive research and development activities, and strong partnerships with automotive OEMs. This enables them to respond swiftly to changing market demands, regulatory standards, and technological shifts, securing their influence and leadership in the Automotive Heat Shield Market. Their contributions are instrumental in shaping the future direction of the market, driving innovation, and setting industry benchmarks for quality and performance.

Market Key Players

- Dana Incorporated

- Morgan Advanced Materials

- Autoneum

- Elringklinger AG

- Lydall Inc

- Tenneco Inc

- Carcoustics

- UGN Inc

- Thermotec Automotive

- Federal-Mogul Holding Corporation

- Progress-Werkoberkirch AG

Recent Developments

- On Nov 2023, Talbros Automotive Components announced securing new business worth Rs 580 crore, including EV-related business valued at Rs 270 crore. These orders are set to be executed over the next five years, starting from the financial year 2025, covering a range of products such as gaskets, heat shields, forgings, chassis, and rubber hoses.

- On October 2023, StarShield introduced a groundbreaking solution to combat the issue of high heat entering car interiors through glass. The company developed the “”Star Heat Shield for Car Glass,”” an ultra-thin Nano Modified transparent coating designed to reflect up to 90% of infrared light, effectively reducing the heat entering the vehicle.

Report Scope

Report Features Description Market Value (2023) USD 13.1 Billion Forecast Revenue (2033) USD 21.1 Billion CAGR (2024-2033) 4.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle type (Passenger car, Light commercial vehicle, Heavy commercial vehicle , Electric vehicle), By Product (Single shell, Double shell, Sandwich), By Application (Engine, Underbody heatshield, Tank heatshield, Starter motor, Turbo charger), By Material (Metallic, Non metallic, Exhaust manifold, Catalytic converter), By Sales channel (OEM, Aftermarket) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dana Incorporated, Morgan Advanced Materials, Autoneum, Elringklinger AG, Lydall Inc, Tenneco Inc, Carcoustics, UGN Inc, Thermotec Automotive, Federal-Mogul Holding Corporation, Progress-Werkoberkirch AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the expected size of the Global Automotive Heat Shield Market by 2033?The Global Automotive Heat Shield Market is expected to be worth around USD 21.1 Billion by 2033, growing from USD 13.1 Billion in 2023, at a CAGR of 4.90%.

What does the Automotive Heat Shield Market cater to?The market caters to vehicle manufacturers and aftermarket services, addressing the needs for both passenger and commercial vehicles by manufacturing and distributing protective components designed to shield automotive parts from excessive heat.

What are the dominant segments within the Automotive Heat Shield Market?The dominant segments include vehicle types (passenger cars), product types (single shell heat shields), applications (engine heat shields), materials (metallic heat shields), and sales channels (OEM).

What are the growth opportunities in the Automotive Heat Shield Market?Integrated thermal management systems, customization, and aftermarket offerings present growth opportunities within the market.

Which regions dominate the Automotive Heat Shield Market?Asia-Pacific holds a significant share, followed by North America and Europe.

Automotive Heat Shield MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Heat Shield MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Dana Incorporated

- Morgan Advanced Materials

- Autoneum

- Elringklinger AG

- Lydall Inc

- Tenneco Inc

- Carcoustics

- UGN Inc

- Thermotec Automotive

- Federal-Mogul Holding Corporation

- Progress-Werkoberkirch AG