Global Automotive Extended Reality (xr) Market Size, Share, Growth Analysis By Technology (Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR)), By Component (Hardware (Headsets, Sensors, Displays), Software (XR Platforms, CAD/Simulation Tools), Services (Integration, Support, Consulting)), By End User (Automotive OEMs, Automotive Suppliers, Dealerships & Retailers, Training Institutes, Fleet Operators, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166785

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

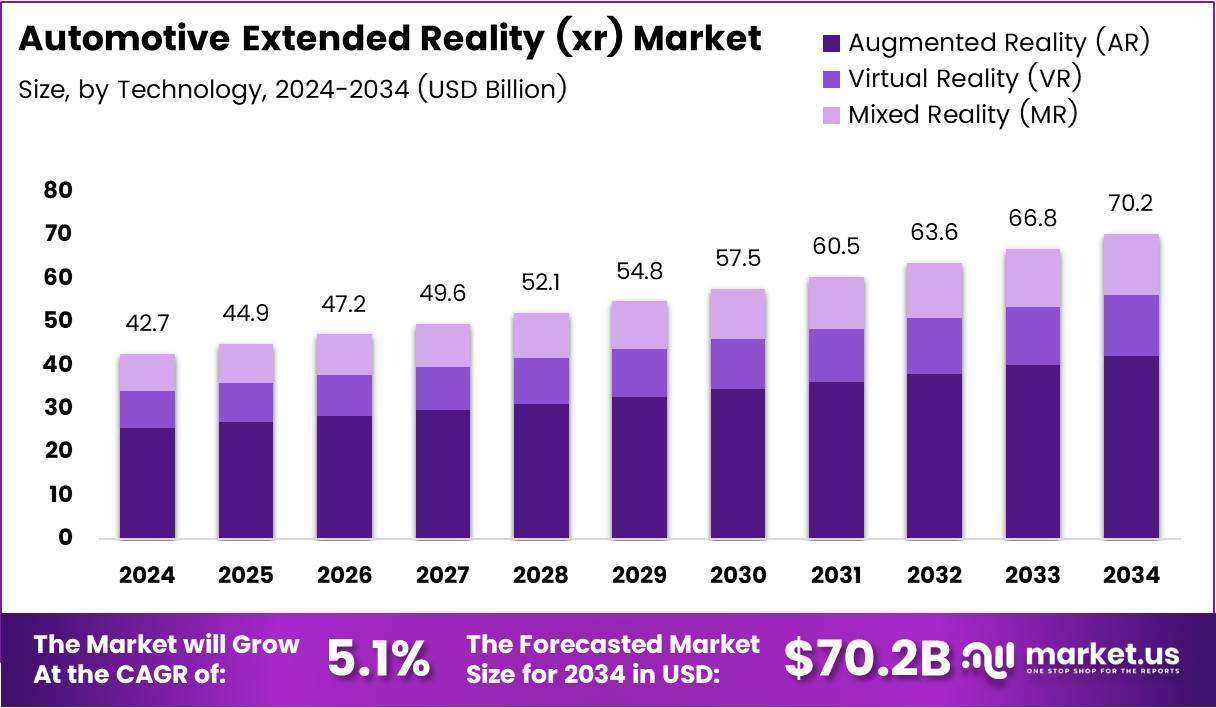

The Global Automotive Extended Reality (xr) Market size is expected to be worth around USD 70.2 Billion by 2034, from USD 42.7 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Automotive Extended Reality (XR) refers to integrated AR, VR, and MR tools that enhance vehicle design, production, retail, and driving experiences. It merges digital layers with real-world automotive environments, enabling immersive visualization, remote collaboration, and advanced simulation that support faster development and more intuitive customer engagement across mobility ecosystems.

Moreover, the XR market continues expanding as automakers adopt immersive training, smart manufacturing, and driver-assistance visualization to improve operational efficiency. Rising demand for virtual prototyping and real-time 3D interaction strengthens XR adoption, especially as connected vehicle platforms, digital twins, and advanced sensor fusion accelerate transformation opportunities across global automotive value chains.

Furthermore, analysts observe that expanding electrification and autonomous vehicle programs fuel strong XR integration, helping brands reduce development time and enhance safety validation. Governments actively promote digital innovation, encouraging automotive players to deploy XR for workforce upskilling, mobility infrastructure testing, and sustainability planning that supports long-term industry modernization.

Additionally, market growth benefits from increased investment in intelligent mobility solutions, where XR tools streamline testing of EV platforms, cockpit interfaces, and human-machine interaction. Evolving regulations promoting simulation-based validation further drive XR usage, allowing manufacturers to minimize physical testing and meet compliance standards with greater accuracy and cost efficiency.

Consequently, expanding digital retail models create new opportunities as buyers increasingly explore vehicles through immersive platforms. Automakers leverage XR showrooms, virtual configurators, and AR-assisted guidance to strengthen consumer decision-making. This shift supports higher customer engagement while reducing dealership costs and improving transparency during the vehicle purchase journey.

Finally, accelerating consumer adoption reinforces market momentum. According to survey, 35% of consumers prefer an online VR/AR-based car walkthrough before purchase, illustrating rising comfort with immersive tools. Additionally, 38% prefer more voice controls in vehicles, up from 33% pre-COVID, indicating strong demand for hands-free digital experiences that enhance automotive XR market growth.

Key Takeaways

- The global Automotive XR market is valued at USD 42.7 Billion in 2024 and is expected to reach USD 70.2 Billion by 2034, growing at a 5.1% CAGR.

- Augmented Reality (AR) leads the technology segment with a 49.8% market share.

- Hardware components dominate the market with a 56.2% share in 2024.

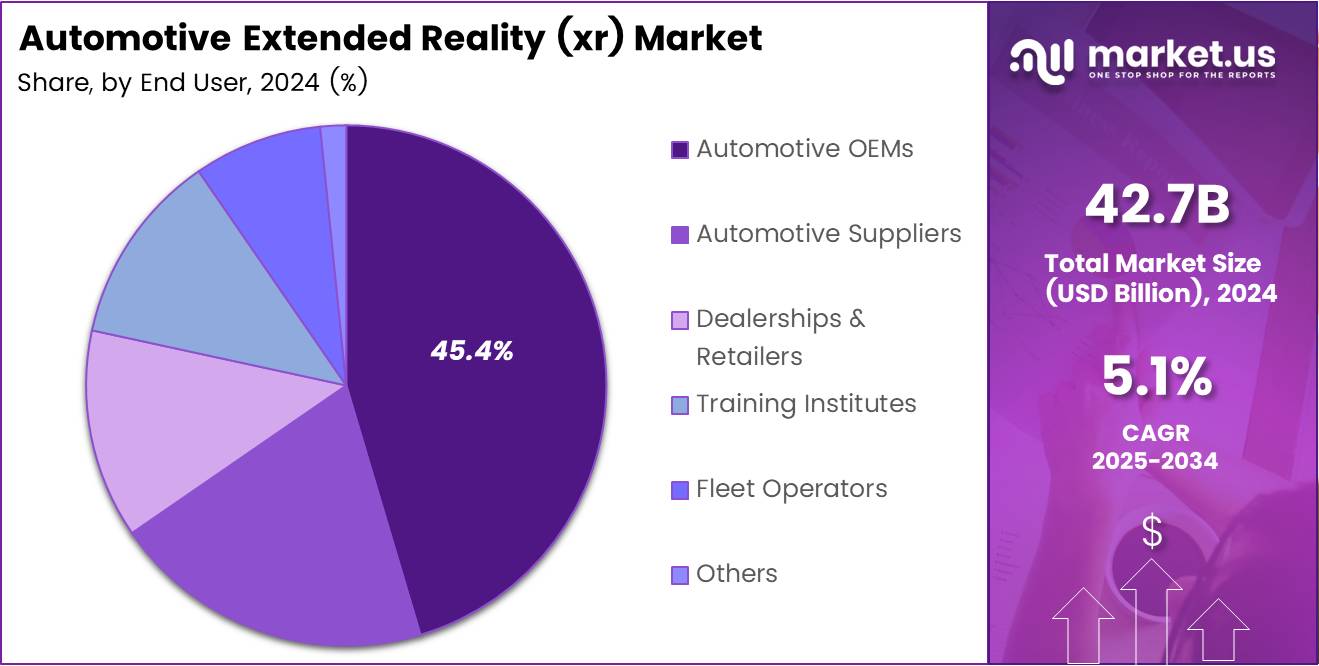

- Automotive OEMs represent the largest end-user segment with a 45.4% market share.

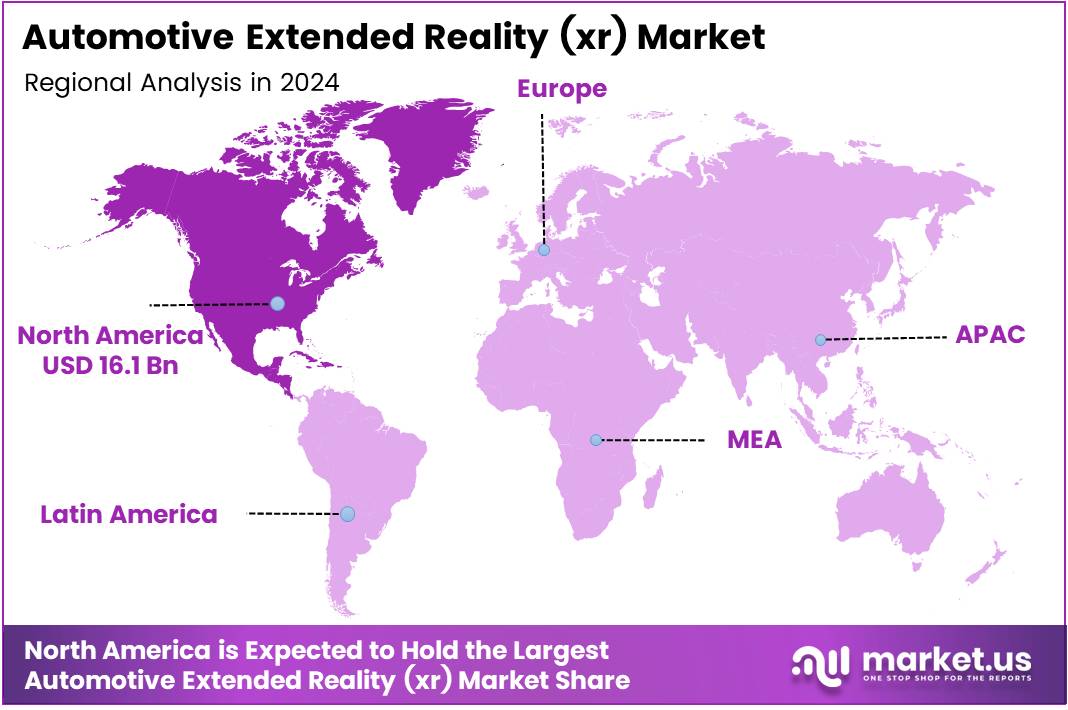

- North America holds the highest regional share at 37.9%, valued at USD 16.1 Billion.

By Technology Analysis

Augmented Reality (AR) dominates with 49.8% due to its rapid integration into automotive design, training, and in-vehicle assistance systems.

In 2024, Augmented Reality (AR) held a dominant market position in the By Technology segment of the Automotive Extended Reality (XR) Market, with a 49.8% share. It enhances vehicle prototyping, improves production accuracy, and advances driver-assistance features, thereby strengthening its widespread adoption across major automotive applications.

Furthermore, Virtual Reality (VR) continued gaining traction as automakers expanded immersive simulations for vehicle testing and customer showcasing. VR streamlines design verification and accelerates concept approvals, allowing manufacturers to reduce development cycles while improving decision-making through realistic digital environments that support efficient automotive engineering processes.

Additionally, Mixed Reality (MR) advanced steadily by merging physical prototypes with digital overlays. It improves collaborative engineering and supports remote maintenance workflows. MR enables teams to iterate designs dynamically, thereby enhancing productivity while bridging the gap between fully virtual experiences and real-world automotive engineering requirements.

By Component Analysis

Hardware (Headsets, Sensors, Displays) dominates with 56.2% owing to strong adoption across manufacturing, design, and training ecosystems.

In 2024, Hardware captured a dominant 56.2% share in the By Component segment of the Automotive Extended Reality (XR) Market, driven by surging demand for headsets, sensors, and advanced displays. These components enable precise visualization, enhance production workflows, and strengthen employee training across various automotive functions.

Moreover, Software solutions, including XR platforms and CAD/simulation tools, expanded as automotive firms increasingly leveraged digital twins and immersive simulation programs. These tools reduced prototyping costs, simplified design iterations, and improved operational collaboration within engineering teams utilizing XR-based development environments.

Additionally, Services such as integration, support, and consulting advanced as manufacturers sought expert guidance to adopt XR technologies. Services helped streamline deployment, optimize system performance, and ensure seamless integration with existing automotive processes, thereby enhancing the overall value of XR investments.

By End User Analysis

Automotive OEMs lead with 45.4% due to extensive XR adoption across design, manufacturing, and testing workflows.

In 2024, Automotive OEMs held a leading 45.4% share in the By End User segment of the Automotive Extended Reality (XR) Market. OEMs embraced XR to accelerate prototyping, enhance production efficiency, and reduce development errors, thereby strengthening organizational productivity across vehicle design and manufacturing.

Additionally, Automotive Suppliers increasingly implemented XR to optimize assembly operations, monitor component quality, and support remote diagnostics. Suppliers relied on immersive visualization tools for accurate component validation, reducing operational inefficiencies and improving collaboration with OEM partners during product development cycles.

Moreover, Dealerships & Retailers leveraged XR to modernize customer experiences through virtual showrooms and interactive vehicle demonstrations. These technologies enabled faster purchasing decisions, improved product understanding, and enhanced customization experiences for consumers exploring new automotive models.

Furthermore, Training Institutes adopted XR to deliver realistic learning environments for automotive mechanics and engineers. Immersive training modules reduced skill-development time, improved safety awareness, and supported hands-on learning without requiring physical vehicle availability.

Additionally, Fleet Operators utilized XR to enhance driver training, streamline fleet maintenance procedures, and simulate real-world driving conditions. This adoption helped reduce operational risks and strengthen performance management across large vehicle fleets.

Lastly, Others encompassed various stakeholders adopting XR for niche automotive applications, such as aftermarket services, mobility research, and autonomous technology development. Their gradual adoption contributed to broader XR integration within the automotive ecosystem.

Key Market Segments

By Technology

- Augmented Reality (AR)

- Virtual Reality (VR)

- Mixed Reality (MR)

By Component

- Hardware (Headsets, Sensors, Displays)

- Software (XR Platforms, CAD/Simulation Tools)

- Services (Integration, Support, Consulting)

By End User

- Automotive OEMs

- Automotive Suppliers

- Dealerships & Retailers

- Training Institutes

- Fleet Operators

- Others

Drivers

Rising Integration of XR in Advanced Driver-Assistance Systems (ADAS)

The automotive XR market is gaining strong momentum as XR technologies become increasingly integrated into advanced driver-assistance systems. Automakers are using XR to create more intuitive visual overlays that help drivers understand road conditions, hazards, and navigation details more clearly. This enhanced visibility supports safer and more confident driving experiences.

Another major driver is the growing use of immersive XR-based training for automotive workers. Companies now rely on XR simulations to train technicians and assembly-line teams more efficiently. These virtual environments reduce training time and allow workers to learn complex tasks without the risk of damaging vehicles or equipment.

Consumer expectations are also driving market growth. Drivers now want richer in-vehicle infotainment features, and XR makes it possible to deliver more interactive entertainment, navigation, and comfort functions. This shift is encouraging automakers to integrate XR into dashboards and smart displays.

Additionally, XR-enabled prototyping is transforming the vehicle design process. Engineers and designers can test concepts in virtual environments, helping them reduce development costs and speed up time-to-market for new models. This trend further strengthens the adoption of XR across the automotive industry.

Restraints

High Deployment Costs of Hardware and Software Ecosystems

Despite its potential, the automotive XR market faces challenges due to the high cost of deploying both hardware and software solutions. Automakers must invest in advanced headsets, sensors, and computing systems to support XR functions. These expenses make it difficult for smaller manufacturers and suppliers to adopt XR at a large scale.

Another major restraint is the lack of standardization across XR platforms and automotive interfaces. Different XR systems often operate with varying protocols, making it harder for automakers to integrate them smoothly into vehicles. This fragmentation increases development time and creates compatibility issues between devices, software platforms, and in-vehicle electronics.

Because of these limitations, some companies remain hesitant to make long-term investments in XR. Without consistent standards, the risk of rework or system upgrades increases. This slows down decision-making and affects the overall pace of innovation in the industry.

Both cost and standardization challenges need to be addressed for XR to become a fully scalable technology across automotive applications. As the ecosystem matures, industry-wide collaboration will be essential to overcome these barriers and support broader adoption.

Growth Factors

Emergence of XR-Based Remote Vehicle Diagnostics and Maintenance

One of the most promising opportunities in the automotive XR market is the rise of remote diagnostics and maintenance solutions. XR tools allow technicians to visualize faults in real time and guide customers through basic repair steps. This reduces service downtime and improves after-sales efficiency for automakers and dealerships.

Virtual car showrooms present another major growth avenue. Automotive brands are adopting immersive digital experiences that allow buyers to explore vehicle models, customize features, and take virtual test drives. This trend helps manufacturers reach more customers while reducing showroom operating costs.

XR also plays a crucial role in supporting autonomous vehicle development. Simulation platforms allow engineers to test self-driving algorithms in safe virtual environments, speeding up innovation while lowering the risk of real-world testing. As autonomy advances, demand for XR simulation tools is expected to rise.

Additionally, companies are working on lightweight, automotive-grade XR wearables. These devices aim to enhance driver assistance, navigation, and infotainment functions without causing discomfort. As these wearables improve, they will create new opportunities for both consumer and enterprise applications.

Emerging Trends

Surge in Mixed-Reality Head-Up Displays for Next-Gen Cockpits

A key trend shaping the automotive XR market is the growing adoption of mixed-reality head-up displays for next-generation cockpits. These systems project real-time information directly onto the windshield, offering immersive navigation cues, safety alerts, and infotainment visuals that improve the driving experience.

AI-enhanced spatial mapping is also becoming an important trend. Automakers are using AI to analyze surroundings and create precise XR overlays, helping vehicles interpret road conditions more accurately. This innovation supports both assisted and autonomous driving functions.

Cloud-based XR content delivery platforms are gaining popularity as well. These systems allow automakers to update XR features over the air, reduce hardware dependency, and offer more scalable digital services. Cloud platforms also enable seamless content streaming for navigation, entertainment, and training.

Digital twins are another major trend influencing the market. By creating virtual replicas of vehicles, manufacturers can test upgrades, analyze performance, and improve maintenance planning. As digital twin technology evolves, it will strengthen the use of XR across design, engineering, and customer experience functions.

Regional Analysis

North America Dominates the Automotive Extended Reality (XR) Market with a Market Share of 37.9%, Valued at USD 16.1 Billion

North America leads the global automotive XR market, supported by rapid adoption of immersive technologies across automotive design, manufacturing, and dealership experiences. The region’s dominance is reinforced by significant investment in advanced digital infrastructure and early integration of XR in product development. The market share of 37.9%, valued at USD 16.1 Billion, highlights its technological leadership and strong ecosystem supporting innovation in virtual design, simulation, and enhanced customer engagement.

Europe Automotive Extended Reality (XR) Market Trends

Europe exhibits steady growth in the automotive XR market, driven by stringent regulatory standards and a strong focus on smart manufacturing. Automakers are increasingly deploying XR solutions to enhance training, quality control, and prototyping. The region benefits from extensive R&D activities and a rising shift toward digital transformation in automotive operations.

Asia Pacific Automotive Extended Reality (XR) Market Trends

The Asia Pacific region is witnessing rapid expansion, propelled by large-scale automotive production and rising adoption of advanced visualization technologies. Growing investments in connected and smart factories further strengthen XR integration across assembly lines and engineering workflows. The increasing demand for enhanced virtual customer experiences also supports market growth in emerging economies.

Middle East and Africa Automotive Extended Reality (XR) Market Trends

The Middle East and Africa market is gradually emerging, supported by diversification efforts and digital transformation initiatives in the automotive industry. XR applications are gaining traction in training, remote maintenance, and dealership modernization. Increased interest in adopting future-ready technologies is expected to accelerate growth over the coming years.

Latin America Automotive Extended Reality (XR) Market Trends

Latin America shows growing potential in the automotive XR market, driven by the modernization of manufacturing processes and rising interest in immersive tools for training and product design. Although adoption is still developing, investments in digital optimization and evolving dealership experiences are contributing to steady market advancement.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Extended Reality (xr) Company Insights

The global Automotive Extended Reality (XR) market in 2024 is shaped heavily by a handful of technology leaders driving advanced visualization, simulation, and immersive interfaces across design, manufacturing, and in-vehicle experiences.

Bosch continues to strengthen its position through XR-enabled training and maintenance solutions, leveraging its automotive electronics expertise to integrate augmented interfaces directly into vehicle diagnostics. The company’s focus on merging XR with connected mobility platforms helps OEMs accelerate service efficiency and reduce operational downtime.

Continental is expanding its XR footprint by embedding immersive technologies in human–machine interface (HMI) development and driver assistance systems. Its XR-driven cockpit simulations allow automakers to validate user-experience designs earlier in the development cycle, supporting faster innovation. Continental’s commitment to virtual prototyping enhances collaboration across global engineering teams.

Siemens plays a pivotal role by integrating XR into its comprehensive digital twin and automotive engineering ecosystems. Through XR-enhanced design validation, manufacturers can visualize complex mechanical interactions more intuitively, reducing production errors. Siemens’ industrial XR platforms help bridge design and manufacturing, enabling smarter, more efficient factory workflows.

Nvidia remains a critical enabler of XR acceleration in automotive through its high-performance GPUs and real-time simulation platforms. By powering spatial computing and photorealistic environments, Nvidia allows automakers to test autonomous systems, cockpit interfaces, and vehicle ergonomics in highly realistic virtual settings. Its focus on AI-driven XR tools continues to elevate development precision across the automotive value chain.

Together, these companies reinforce XR as a transformative pillar in automotive innovation, supporting faster prototyping, safer testing, and enhanced user interaction across next-generation vehicles.

Top Key Players in the Market

- Bosch

- Continental

- Siemens

- Nvidia

- PTC

- Unity Technologies

- Dassault Systèmes

- Toyota Motor Corporation

Recent Developments

- In Sep 2025: Valeo Racer, a unique extended-reality in-car gaming experience, was selected for key automotive markets across Asia. It introduces immersive entertainment directly into vehicles, redefining passenger engagement and smart-mobility interaction.

- In Sep 2025: EON Reality launched a comprehensive Spatial AI Training Platform to help address America’s critical electric-vehicle workforce shortage. The platform leverages advanced XR and AI tools to prepare technicians, engineers, and specialists for emerging EV-industry demands.

- In Sep 2024: Finnish startup Distance Technologies secured €10M in funding led by Google Ventures (GV). The investment supports development of its cutting-edge spatial computing technology and expansion into international markets.

Report Scope

Report Features Description Market Value (2024) USD 42.7 Billion Forecast Revenue (2034) USD 70.2 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR)), By Component (Hardware (Headsets, Sensors, Displays), Software (XR Platforms, CAD/Simulation Tools), Services (Integration, Support, Consulting)), By End User (Automotive OEMs, Automotive Suppliers, Dealerships & Retailers, Training Institutes, Fleet Operators, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bosch, Continental, Siemens, Nvidia, PTC, Unity Technologies, Dassault Systèmes, Toyota Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Extended Reality (xr) MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Extended Reality (xr) MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bosch

- Continental

- Siemens

- Nvidia

- PTC

- Unity Technologies

- Dassault Systèmes

- Toyota Motor Corporation