Global Automotive Engine Oil Coolant Market Type (Synthetic Coolant, Organic coolant, Hybrid coolant), Vehicle type (Passenger cars, Commercial cars), Distribution channel(Automotive Aftermarket, Original Equipment Manufacturer), Product(Propylene glycol, Ethylene glycol, Glycerine) By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 62034

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Automotive Engine Oil Coolant Market Overview:

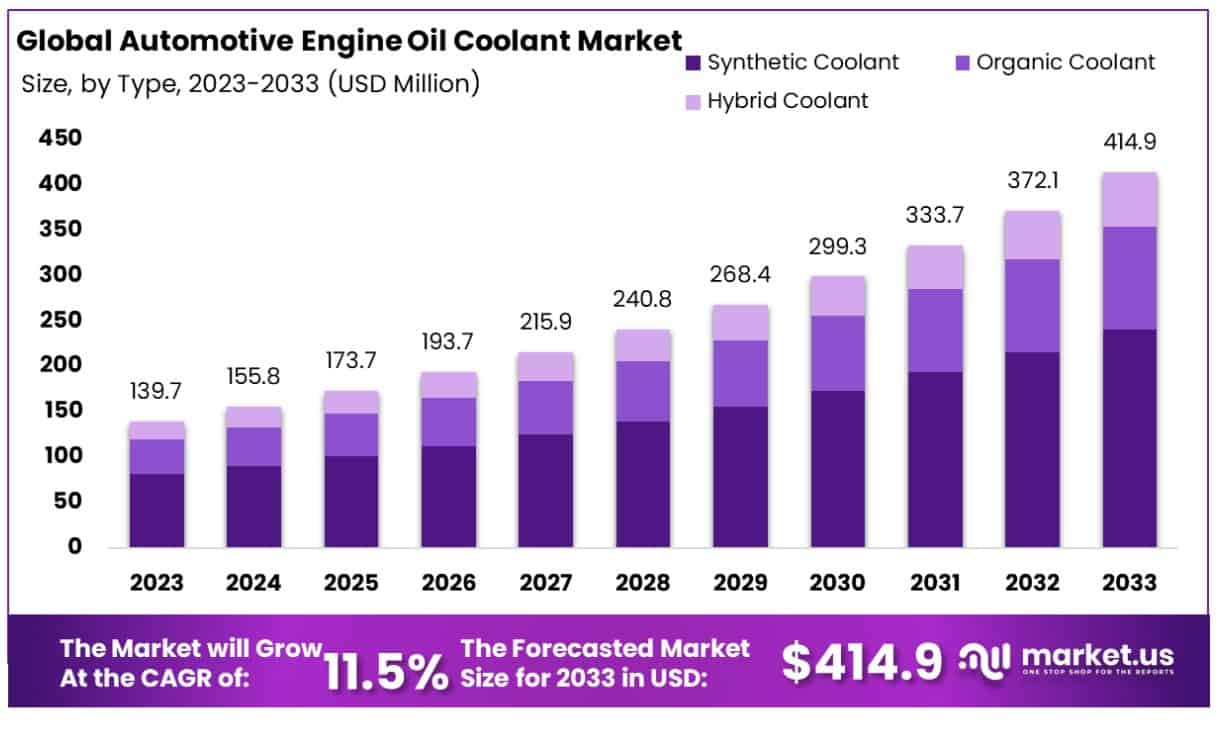

The Global Automotive Engine Oil Coolant Market size is expected to be worth around USD 414.9 Million by 2033, from USD 139.7 Million in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

One of the forces influencing market growth is the surge in demand for fuel-efficient vehicles. Engine oil lubricates the vehicle’s internal parts so they run smoothly, and cooling is intended to prevent an engine from overheating while it is running.

The Automotive Engine Oil Coolant Market is an integral segment of the global automotive industry, focusing on the development, manufacturing, and distribution of specialized coolants used to maintain optimal temperature and performance of vehicle engines.

These coolants play a crucial role in preventing overheating, minimizing wear and tear, and ensuring the efficient operation of automotive engines across various conditions and vehicle types. The market is driven by advancements in automotive technology, stringent environmental regulations, and the increasing demand for high-performance and fuel-efficient vehicles.

Stakeholders, including manufacturers, distributors, and end-users, engage in this market to leverage innovative coolant solutions that enhance engine longevity and efficiency, contributing significantly to the automotive sector’s growth and sustainability.

The addition of oil coolant to a machine, typically to remove excess heat from an internal combustion engine, is referred to as oil cooling. The hot engine transfers heat to the oil, passing through a heat exchanger and an oil cooler radiator. Oil-based cooling is more lubricating than water-based coolant.

Because heat is generated by friction between moving parts, reducing friction will reduce heat. Lubricant and coolant form a fundamental part of any vehicle. This market report gives a detailed analysis of the automotive engine oil coolant industry size, share, growth, key trends, and other key factors.

Key Takeaways

- The Automotive Engine Oil Coolant Market was valued at USD 414.9 Million in 2023 and is expected to reach USD 139.7 Million in 2033, at a CAGR of 11.5%

- Synthetic coolant held a dominant market position, capturing more than a 58.03% share.

- Passenger cars held a dominant market position, capturing more than a 76.2% share.

- The automotive aftermarket held a dominant market position capturing more than an 80.9% share.

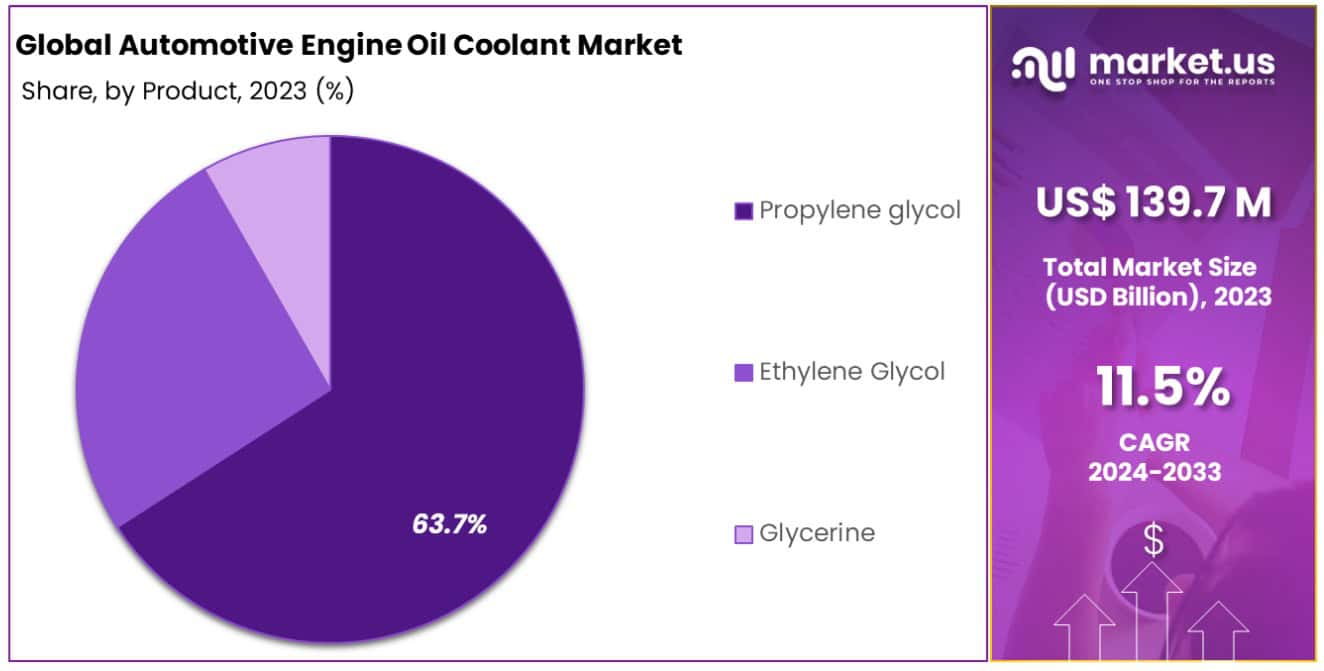

- Propylene glycol held a dominant market capturing more than a 63.7% share.

- North America emerged as the dominating region in 2023, with a market share of 46.02%.

Driving Factors

Surge in Demand for Fuel-Efficient Vehicles

The escalating demand for fuel-efficient vehicles significantly contributes to the growth of the Automotive Engine Oil Coolant Market. As manufacturers strive to meet stringent fuel economy standards and consumers seek to reduce operational costs, the development and integration of advanced engine oil coolants become imperative.

These coolants enhance engine efficiency by maintaining optimal operating temperatures, thereby reducing fuel consumption and emissions. The correlation between fuel efficiency and engine temperature regulation underscores the coolant market’s expansion, with projections indicating a sustained increase in demand for these specialized fluids as the automotive industry continues to emphasize fuel economy.

Increasing Demand for Lubricant and Coolant Due to Heat Generated by Friction

The inherent friction between moving engine parts generates substantial heat, necessitating effective lubrication and cooling solutions to prevent damage and ensure smooth operation. This thermal challenge drives the demand for high-quality automotive engine oil coolants, which not only dissipate heat but also serve as lubricants, reducing friction and wear.

The dual functionality of these coolants amplifies their importance in the automotive sector, directly influencing market growth. As engines evolve to deliver higher performance and efficiency, the role of advanced coolants in managing thermal and frictional challenges becomes increasingly critical, further stimulating market development.

Ongoing Developments in Engine Technology

Advancements in engine technology, particularly the shift towards electric and hybrid engines, present new opportunities and challenges for the Automotive Engine Oil Coolant Market. These modern engines operate under different thermal dynamics compared to traditional internal combustion engines, necessitating specialized coolant formulations to manage heat effectively.

The innovation in coolant solutions tailored for electric and hybrid vehicles expands the market’s scope, catering to a broader spectrum of automotive technologies. This diversification of engine types reinforces the market’s growth trajectory, as stakeholders innovate to meet the cooling requirements of emerging engine technologies.

Preference for Automotive Engine Oil Coolers by Fleet Operators

Fleet operators, who manage vehicles operational for extended periods, exhibit a strong preference for automotive engine oil coolers. This preference is rooted in the need to maintain vehicle efficiency, minimize downtime, and extend engine life, especially under rigorous operational conditions.

Engine oil coolers enhance thermal management, crucial for fleets that endure prolonged usage cycles, thereby reducing maintenance costs and improving vehicle reliability. This targeted demand from fleet operators underscores the market’s expansion, highlighting the critical role of efficient cooling solutions in optimizing fleet operations and driving market growth.

Restraining Factors

Technological Advancements Leading to Longer Intervals Between Oil Changes

Technological advancements in engine design and lubricant formulation have extended the intervals between oil changes, posing a nuanced challenge to the growth of the Automotive Engine Oil Coolant Market. Modern engines are increasingly efficient and less prone to wear, while advanced lubricants offer enhanced protection and longevity, reducing the frequency of coolant replacement.

This evolution, while beneficial for vehicle maintenance and environmental impact, potentially dampens the immediate demand for engine oil coolants. However, it also pushes the market towards innovation, encouraging the development of even more sophisticated coolant solutions that align with the extended lifecycle of modern automotive lubricants and contribute to overall market resilience.

Environmental Regulations Promoting the Use of More Sustainable Alternatives

Stringent environmental regulations have a significant impact on the Automotive Engine Oil Coolant Market, driving the demand for eco-friendly and sustainable coolant solutions. As governments worldwide implement stricter emissions standards and promote environmental sustainability, there is a concerted push towards coolants that are less harmful to the ecosystem.

This regulatory environment challenges market players to innovate and reformulate their products, potentially restricting the growth of traditional coolant solutions but simultaneously opening new avenues for growth through the development of green, biodegradable coolants. This shift not only addresses environmental concerns but also aligns with consumer preferences for sustainable automotive products, thus reshaping market dynamics.

Fluctuating Raw Material Prices Impacting Production Costs

The volatility in raw material prices directly influences the production costs of automotive engine oil coolants, presenting a significant restraint on market growth. As the prices of essential components such as ethylene glycol and other additives fluctuate due to economic, geopolitical, and supply chain factors, manufacturers face challenges in maintaining stable pricing and profit margins.

This uncertainty can lead to increased product costs for end-users, potentially dampening demand. However, it also encourages market players to explore alternative materials and more cost-effective production methods, driving innovation and efficiency within the market. This adaptation may initially strain the market but can ultimately lead to a more resilient and diverse product offering.

Type Analysis

Synthetic Coolant Dominates the Market with a 58.03% Share

Synthetic coolant held a dominant market position, capturing more than a 58.03% share. This segment’s prominence is attributed to the superior thermal stability, enhanced cooling efficiency, and longer lifespan of synthetic coolants compared to their counterparts.

Engineered to withstand extreme temperatures and pressures, synthetic coolants are particularly favored in high-performance and heavy-duty vehicles, where engine efficiency and reliability are paramount. The adoption of synthetic coolant is further bolstered by its ability to offer better protection against corrosion and scaling, contributing to extended engine life and reduced maintenance costs.

Organic coolant, characterized by its use of organic acids for corrosion protection, also plays a significant role in the market. While it captured a smaller market share relative to synthetic coolants, its demand is on the rise due to its environmental benefits and biodegradability.

Organic coolants are designed to provide long-lasting engine protection without the need for frequent changes, aligning with the automotive industry’s growing emphasis on sustainability and reduced environmental impact. This segment’s growth is driven by consumers and fleet operators who prioritize eco-friendly products and seek to minimize their ecological footprint.

Hybrid coolant, which combines the advantages of both synthetic and organic formulations, represents an innovative segment in the market. This type of coolant offers a balanced approach to engine cooling and protection, catering to a wide range of vehicles and operating conditions.

Hybrid coolants are engineered to provide the high-temperature protection of synthetic coolants while incorporating the environmental benefits of organic coolants. As automotive manufacturers and consumers increasingly demand products that offer both performance and sustainability, the hybrid coolant segment is expected to witness significant growth, appealing to a broad spectrum of users seeking versatile and efficient cooling solutions.

Vehicle Type Analysis

Passenger Cars Dominate the Automotive Engine Oil Coolant Market with a Share of 76.2%

Passenger cars held a dominant market position within the Automotive Engine Oil Coolant Market, capturing more than a 76.2% share. This substantial market share underscores the pivotal role passenger vehicles play in driving demand for engine oil coolants, reflecting the extensive global ownership and usage rates of these vehicles. The consistent need for maintenance and the growing emphasis on vehicle efficiency and longevity have bolstered the demand for advanced coolant solutions in the passenger car segment.

Conversely, Commercial vehicles accounted for the remaining market share, signaling a significant yet smaller portion of the market compared to passenger cars. Despite this, the commercial sector presents unique growth opportunities for the Automotive Engine Oil Coolant Market.

The intensive usage patterns and the necessity for high performance and durability in commercial vehicles amplify the need for specialized engine oil coolants. These vehicles, often operational for extended periods under demanding conditions, require robust cooling systems to prevent overheating and maintain operational efficiency.

The dichotomy between Passenger and Commercial vehicles in the Automotive Engine Oil Coolant Market illustrates a diverse demand landscape. While passenger cars remain the primary market driver due to their sheer volume and widespread usage, the commercial vehicle segment is poised for growth, driven by the global expansion of logistics and transportation services. This sector’s demand for durable and efficient coolant solutions is expected to rise, influenced by the increasing emphasis on vehicle maintenance, fuel efficiency, and the reduction of operational downtime.

Distribution Channel Analysis

Automotive Aftermarket Leads the Automotive Engine Oil Coolant Market with an 80.9% Share

The automotive aftermarket held a dominant market position within the Automotive Engine Oil Coolant Market, capturing more than an 80.9% share. This commanding presence highlights the aftermarket’s crucial role in supplying engine oil coolants to a vast array of vehicles post their initial sale. The aftermarket sector thrives on the continuous need for vehicle maintenance and repair, catering to the demand for high-quality coolants that ensure engine performance and longevity.

The growth in this segment is propelled by the increasing vehicle age, the global rise in vehicle parc, and consumers’ preference for maintaining and extending the life of their vehicles, alongside the pursuit of cost-effective alternatives to OEM parts.

On the other hand, the Original Equipment Manufacturer (OEM) segment, while smaller in comparison, represents a critical aspect of the Automotive Engine Oil Coolant Market. OEMs integrate coolants into new vehicles, ensuring that each vehicle meets specific performance and safety standards from the outset.

This segment’s market share is driven by the production of new vehicles and the development of advanced engine technologies that require specialized cooling solutions. Although it accounts for a lesser portion of the market, the OEM segment is instrumental in introducing innovative coolant technologies and standards, setting benchmarks for quality and performance in the industry.

The contrast between the Automotive aftermarket and Original Equipment Manufacturer (OEM) segments encapsulates the comprehensive scope of the Automotive Engine Oil Coolant Market.

While the aftermarket leads in terms of market share, driven by widespread demand for vehicle maintenance and the appeal of cost-effective solutions, the OEM segment plays a pivotal role in the initial application of coolant technologies in new vehicles.

Together, these segments cater to the entire lifecycle of the automotive industry, from vehicle manufacture to ongoing maintenance, underpinning the market’s growth and dynamism.

Product Analysis

Propylene Glycol Holds a Dominant 63.7% Market Share in the Automotive Engine Oil Coolant Market

Propylene glycol held a dominant market position within the Automotive Engine Oil Coolant Market, capturing more than a 63.7% share. This prominence underscores the increasing preference for propylene glycol-based coolants, attributed to their lower toxicity and enhanced safety profiles compared to alternatives.

Propylene glycol’s environmental friendliness and biodegradability, coupled with its effective heat transfer capabilities, make it a preferred choice for manufacturers and consumers aiming for sustainable and safe automotive maintenance solutions.

Ethylene glycol, while holding a significant portion of the market, trails behind propylene glycol due to its toxic nature. Despite this, its effective heat transfer properties and cost-effectiveness ensure its continued use in various applications, particularly in regions with less stringent environmental regulations or in applications where human exposure risks are minimized. Ethylene glycol’s market share reflects its established presence and the ongoing demand within certain segments of the automotive industry.

Glycerine, emerging as an alternative coolant base, occupies the smallest share of the market. Its use is driven by its non-toxicity and renewable sourcing, presenting an eco-friendly option.

However, the adoption of glycerine-based coolants is limited by factors such as cost and compatibility with existing automotive systems. As the industry progresses towards more sustainable practices, glycerine could see increased interest, particularly if advancements address current limitations.

Key Market Segments

Type

- Synthetic Coolant

- Organic coolant

- Hybrid coolant

Vehicle type

- Passenger cars

- Commercial cars

Distribution channel

- Automotive Aftermarket

- Original Equipment Manufacturer

Product

- Propylene glycol

- Ethylene glycol

- Glycerine

Growth Opportunities

Increasing Demand for High-Performance Automobiles Globally:

The rising consumer appetite for high-performance vehicles, characterized by robust engines and enhanced efficiency, directly correlates with an increased demand for advanced engine oil coolants. These high-performance automobiles require superior cooling solutions to maintain optimal engine temperatures and prevent overheating, thereby ensuring longevity and peak performance. The market is expected to see a surge in demand for sophisticated coolant formulations capable of meeting these high-performance standards, driving growth and innovation within the sector.

Growing Sales of Vehicles, Especially in Emerging Economies:

Emerging economies are witnessing a significant uptick in vehicle sales, attributed to rising income levels and the expanding middle class. This growth is not only limited to passenger vehicles but also encompasses commercial vehicles, contributing to a broader demand base for engine oil coolants. The expanding automotive market in these regions presents a substantial opportunity for coolant manufacturers to capitalize on the increased vehicle parc and the corresponding need for maintenance products, including coolants.

Technological Advancements Leading to Improved Engine Oil Coolant Solutions:

The continuous evolution of engine technologies and cooling systems heralds the introduction of innovative coolant solutions. These advancements aim to enhance efficiency, reduce environmental impact, and offer better protection against overheating and corrosion. The industry’s focus on R&D and the integration of new materials and additives into coolant formulations are set to improve product offerings, catering to the evolving needs of modern engines. This trend toward innovation underscores the market’s potential for growth, driven by technological progress.

Trending Factors

Technological Advancements Leading to Improved Engine Oil Coolant Solutions:

Innovations in chemical engineering and materials science have culminated in the development of advanced engine oil coolants. These new formulations offer superior heat dissipation, enhanced corrosion resistance, and longer service life, catering to the modern engine’s requirements for efficiency and durability. The market has observed a notable shift towards environmentally friendly and biodegradable coolants, reflecting a compounded annual growth rate (CAGR) in the demand for sustainable automotive products.

Rising Sales of Vehicles, Especially in Emerging Economies:

The automotive market in emerging economies is experiencing robust growth, driven by increasing consumer purchasing power and the expansion of the middle class. Countries such as China, India, and Brazil are witnessing a surge in vehicle sales, contributing significantly to the global demand for engine oil coolants. This trend is expected to persist, with emerging markets projected to contribute substantially to the global automotive industry’s growth.

Increasing Demand for High-Performance Automobiles Globally:

There’s a growing consumer inclination towards high-performance vehicles, necessitating advanced cooling systems to manage the higher thermal output efficiently. This demand is fostering innovation in the engine oil coolant market, where high-performance coolants are increasingly preferred for their ability to maintain engine integrity and performance under extreme conditions. The high-performance vehicle segment’s expansion is catalyzing the development of specialized coolant solutions, underscoring a significant growth avenue for the market.

Regional Analysis

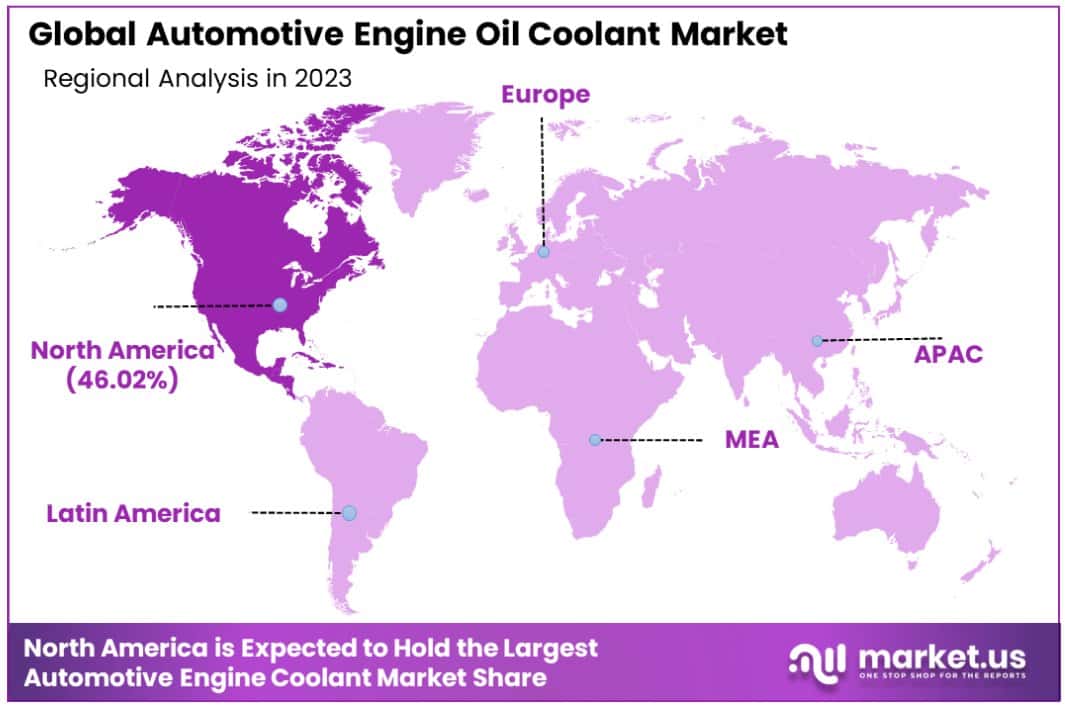

Automotive Engine Oil Coolant Market, North America emerged as the dominating region in 2023, commanding a significant market share of 46.02%.

The North America dominance is attributed to the widespread adoption of advanced automotive technologies, stringent environmental regulations promoting sustainable automotive practices, and a robust automotive aftermarket sector. North America’s mature automotive industry, coupled with a high concentration of vehicle fleets and a strong emphasis on vehicle maintenance, continues to drive the demand for engine oil coolants.

In Europe, the Automotive Engine Oil Coolant Market witnessed steady growth, buoyed by the region’s focus on automotive innovation, stringent emission standards, and a strong presence of automotive manufacturers. The region’s commitment to sustainability and technological advancement further propelled the demand for eco-friendly coolant solutions. Europe accounted for a notable share of the global market, supported by its robust automotive aftermarket and growing consumer awareness regarding vehicle maintenance and performance.

Asia Pacific emerged as a promising market for automotive engine oil coolants, fueled by the region’s burgeoning automotive industry, rapid urbanization, and increasing vehicle ownership rates. The growing middle-class population and expanding transportation infrastructure in countries such as China, India, and Japan contributed to the region’s market growth. Additionally, the rise of electric and hybrid vehicles in the Asia Pacific region presented new opportunities for coolant manufacturers to innovate and adapt to evolving market dynamics.

Middle East & Africa and Latin America, while holding smaller market shares, showcased the potential for growth driven by the region’s expanding automotive sectors and increasing investments in infrastructure development.

These regions are characterized by a growing demand for automotive aftermarket products, including engine oil coolants, as vehicle ownership rates continue to rise. Despite facing challenges such as economic volatility and regulatory uncertainties, Middle East & Africa, and Latin America present untapped opportunities for market expansion, particularly with the growing emphasis on vehicle performance and longevity.

Some of the most prominent manufacturers in the United States, including Ford Motor Company, General Motors, Detroit Diesel, and Cummins, have accredited auto coolant equipment and stringent recycled antifreeze standards. This factor has benefited the North American market, owing to surging consumer awareness of the benefits of recycled resources and sustainability.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

MAHLE GmbH, a leading global supplier of automotive parts and systems, focuses on providing innovative thermal management solutions, including engine oil coolants, to enhance vehicle performance and efficiency.

Dana Incorporated, another prominent player in the automotive industry, specializes in designing and manufacturing advanced drivetrain technologies and thermal management solutions, offering engine oil coolers that improve engine durability and performance.

Castrol, renowned for its lubricants and automotive fluids, offers a comprehensive range of engine oil coolants formulated to meet the specific needs of modern engines, ensuring optimal cooling and lubrication. Fluidyne Control Systems Pvt Ltd, an Indian manufacturer, specializes in custom cooling solutions, including engine oil coolers tailored to meet diverse customer requirements.

TitanX Engine Cooling Inc., a global supplier of cooling solutions for commercial vehicles, provides durable and efficient engine oil coolers designed for reliable performance in challenging environments. PWR Holdings, an Australian company, delivers high-performance cooling solutions for motorsports and automotive applications, including engine oil coolers engineered to maximize heat dissipation and engine reliability. Setrab, a leading manufacturer of heat exchangers, offers high-quality engine oil coolers known for their efficient cooling performance.

Lastly, Amsoil Inc., a major producer of synthetic lubricants, provides engine oil coolants formulated for superior protection against heat and friction, ensuring optimal engine performance and longevity.

Market Key Players

- MAHLE GmbH

- Dana Incorporated

- Castrol

- Fluidyne Control Systems pvt ltd

- Titanx Engine Cooling Inc

- PWR Holdings

- Setrab

- Amsoil Inc

- Blue Star Lubrication Technology

- Valvoline LLC

- Royal Dutch Shell

- Chevron Corporation

Recent Developments

- In August 2023 Valvoline Cummins introduced the glycol-based, full-antifreeze coolant designed for commercial and car vehicles, Valvoline Advanced Coolant. The coolant incorporates OAT technology that provides five years or 5,00,000 Km in service life/drain time.

- In July 2023, Castrol introduced the brand innovative Castrol ON e-thermal liquid, an innovative new direct battery ethermal fluid that will allow the next generation of EVs to be charged faster and provide better performance, protection, and long-term sustainability.

- In February 2023, UPM Biochemicals and HAERTOL announced a strategic alliance to develop a new line of carbon-neutral engines and battery coolants that can help automotive producers reduce their carbon footprint.

Report Scope

Report Features Description Market Value (2023) USD 139.7 Million Forecast Revenue (2033) USD 414.9 Million CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type(Synthetic Coolant, Organic coolant, Hybrid coolant), Vehicle type(Passenger cars, Commercial cars), Distribution channel(Automotive Aftermarket, Original Equipment Manufacturer), Product(Propylene glycol, Ethylene glycol, Glycerine) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape MAHLE GmbH, Dana Incorporated, Castrol, Fluidyne Control Systems pvt ltd, Titanx Engine Cooling Inc, PWR Holdings, Setrab, Amsoil Inc, Blue Star Lubrication Technology, Valvoline, Royal Dutch Shell, Chevron Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Automotive Engine Oil Coolant Market in 2033?In 2033, the Automotive Engine Oil Coolant Market will reach USD 414.9 Million

What CAGR is projected for the Automotive Engine Oil Coolant market?The Automotive Engine Oil Coolant market is expected to grow at 11.50% CAGR (2024-2033).

Name the major industry players in the Automotive Engine Oil Coolant market.Valvoline LLC, BASF SE, Exxon Mobil Corporation, Chevron Corporation, Prestone Products Corporation, and Other Key Players are the main vendors in Automotive Engine Oil Coolant.List the segments encompassed in this report on the Automotive Engine Oil Coolant market?Type(Synthetic Coolant, Organic coolant, Hybrid coolant), Vehicle type(Passenger cars, Commercial cars), Distribution channel(Automotive Aftermarket, Original Equipment Manufacturer), Product(Propylene glycol, Ethylene glycol, Glycerine)

Automotive Engine Oil Coolant MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Engine Oil Coolant MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- MAHLE GmbH

- Dana Incorporated

- Castrol

- Fluidyne Control Systems pvt ltd

- Titanx Engine Cooling Inc

- PWR Holdings

- Setrab

- Amsoil Inc

- Blue Star Lubrication Technology

- Valvoline LLC

- Royal Dutch Shell

- Chevron Corporation