Global Automotive Engine Front Module Market Size, Share, Growth Analysis By Component (Radiator, Cooling Fan, Air Conditioning Condenser, Headlights & Grilles, Others), By Vehicle (Passenger Vehicles, Commercial Vehicles), By Material (Metal, Composites, Plastics), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159231

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

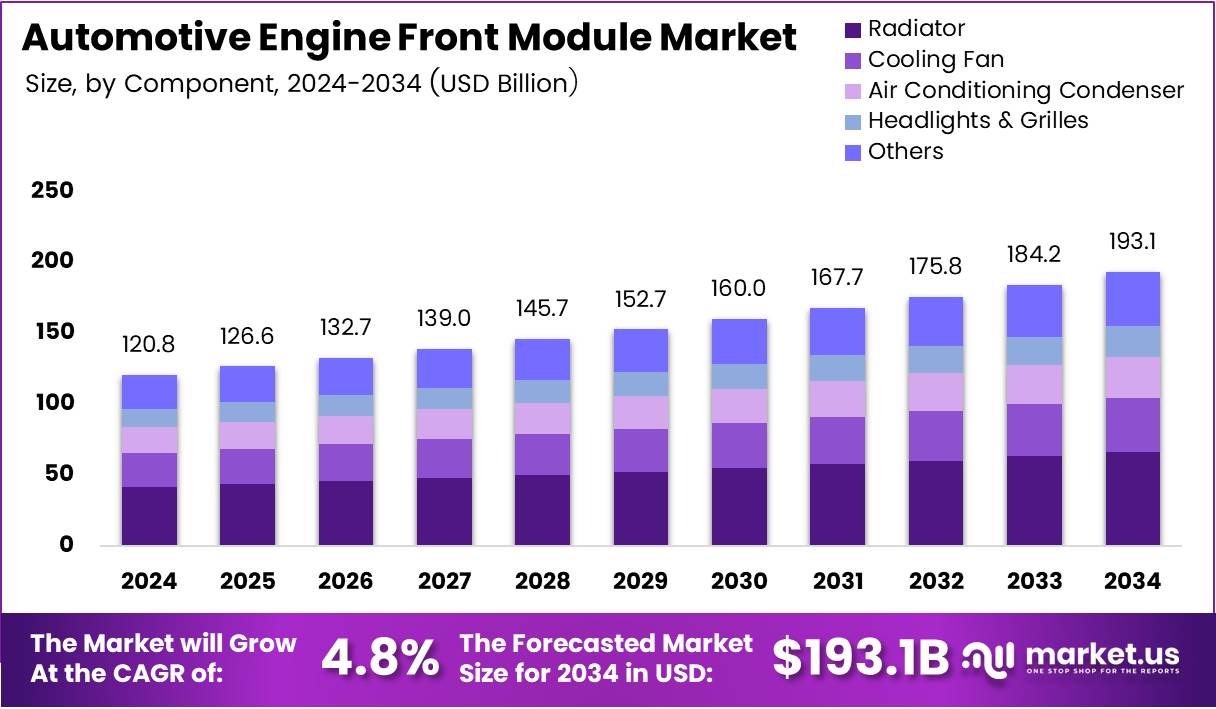

The Global Automotive Engine Front Module Market size is expected to be worth around USD 193.1 Billion by 2034, from USD 121.1 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The Automotive Engine Front Module (EFM) market plays a critical role in the automotive industry, primarily integrating various components like the front bumper, cooling modules, and other essential parts. It serves as a structural unit that enhances vehicle safety, aesthetics, and efficiency, gaining increasing importance in modern automotive designs. The market has seen steady growth due to advancements in vehicle technology and consumer demand for more fuel-efficient and safety-oriented vehicles.

Growth in the automotive engine front module market is expected to be driven by the growing demand for lightweight and energy-efficient vehicles. Manufacturers are focusing on reducing the overall weight of vehicles to meet regulatory standards while improving fuel efficiency. This shift towards lightweight materials and efficient designs is projected to drive the market, especially in regions like North America and Europe, where emissions standards are stricter.

Government regulations are playing a pivotal role in shaping the future of the automotive engine front module market. The implementation of stringent safety standards and crash regulations is encouraging manufacturers to invest in the development of more advanced modules. Additionally, incentives for electric vehicles (EVs) are boosting demand for advanced EFM systems, which play a crucial role in the overall safety and performance of electric vehicles.

Opportunities in the market are expanding with the increasing adoption of autonomous vehicles. As the automotive industry moves towards automation, the integration of advanced technologies into engine front modules will be essential for optimizing vehicle performance and safety. Moreover, rising consumer preference for electric and hybrid vehicles is further expanding the market, as EFMs are crucial in supporting battery cooling and other essential functions in electric vehicles.

The market’s competitive landscape is continuously evolving, with key players focusing on innovations in materials and design. Lightweight metals, composites, and advanced plastic materials are being increasingly used to create more efficient and durable engine front modules. As the market grows, companies that can align with regulatory requirements and deliver cost-effective, high-performance solutions will have a competitive edge.

Key Takeaways

- The Global Automotive Engine Front Module Market is expected to reach USD 193.1 Billion by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

- The Radiator segment holds a dominant market share of 34.2% in 2024 due to its essential role in thermal management systems.

- Passenger Vehicles dominate the market with a 73.4% share in 2024, driven by high production volume and diverse application needs.

- The Metal segment leads with a 51.7% share in 2024, known for its performance characteristics and familiarity in manufacturing.

- The OEM sales channel dominates with an 89.7% share in 2024, due to direct integration with vehicle production lines.

- Asia Pacific holds a dominant market share of 42.9%, valued at USD 51.9 Billion, driven by a strong manufacturing base and demand for fuel-efficient vehicles.

Component Analysis

Radiator dominates with 34.2% due to its critical thermal management function and widespread integration across vehicle platforms.

In 2024, Radiator held a dominant market position in the By Component Analysis segment of Automotive Engine Front Module Market, with a 34.2% share. The radiator segment maintains its leadership position by serving as the cornerstone of vehicle thermal management systems.

This component’s dominance stems from its essential role in preventing engine overheating and maintaining optimal operating temperatures. Radiators are universally required across all vehicle types, ensuring consistent demand patterns throughout the automotive industry.

Cooling Fan components complement radiator functionality by providing active airflow management during low-speed operations and stationary conditions. These components work synergistically with radiators to enhance heat dissipation efficiency. The cooling fan segment benefits from increasing vehicle electrification trends, where electric fans offer superior control and energy efficiency compared to mechanical alternatives.

Air Conditioning Condenser represents a growing segment driven by rising consumer comfort expectations and climate control system sophistication. These components are becoming standard equipment even in entry-level vehicles, particularly in emerging markets experiencing rapid motorization. The segment growth aligns with increasing global temperatures and urbanization trends.

Headlights & Grilles contribute to the segment through integrated front-end module designs that optimize aerodynamics and aesthetics. Meanwhile, Others components including various sensors, mounting brackets, and auxiliary systems collectively support the overall front module functionality and market expansion.

Vehicle Analysis

Passenger Vehicles dominates with 73.4% due to higher production volumes and diverse model portfolios across global markets.

In 2024, Passenger Vehicles held a dominant market position in the By Vehicle Analysis segment of Automotive Engine Front Module Market, with a 73.4% share. The passenger vehicle segment maintains overwhelming market dominance through sheer production volume and diverse application requirements.

This segment encompasses everything from compact cars to luxury SUVs, each requiring sophisticated front module systems. Growing middle-class populations globally continue driving passenger vehicle demand, particularly in developing markets where vehicle ownership rates remain below saturation levels.

Commercial Vehicles represent a substantial but smaller market share, focusing on durability and performance optimization rather than volume. This segment includes light commercial vehicles, trucks, and buses that require robust front module systems capable of withstanding heavy-duty operating conditions. Commercial vehicle applications often demand enhanced cooling capacity and structural integrity to support larger engines and extended operational cycles.

Material Analysis

Metal dominates with 51.7% due to superior durability, heat dissipation properties, and established manufacturing processes.

In 2024, Metal held a dominant market position in the By Material Analysis segment of Automotive Engine Front Module Market, with a 51.7% share. The metal segment maintains its leadership through proven performance characteristics and manufacturing familiarity.

Aluminum and steel components offer excellent thermal conductivity essential for heat exchangers like radiators and condensers. Metal materials provide structural integrity required for mounting systems and crash protection. Additionally, metal components demonstrate superior corrosion resistance when properly treated, ensuring long-term reliability in diverse operating environments.

Composites represent an emerging segment driven by lightweighting initiatives and performance optimization requirements. These advanced materials offer superior strength-to-weight ratios and design flexibility, enabling complex geometries impossible with traditional materials. Composite materials also provide enhanced vibration damping and noise reduction properties, contributing to improved vehicle refinement and passenger comfort levels.

Plastics continue gaining market share through cost advantages and design versatility in non-critical applications. This segment benefits from advanced polymer technologies that offer improved temperature resistance and mechanical properties. Plastic components enable integrated designs combining multiple functions while reducing part count and assembly complexity, appealing to manufacturers focused on cost optimization.

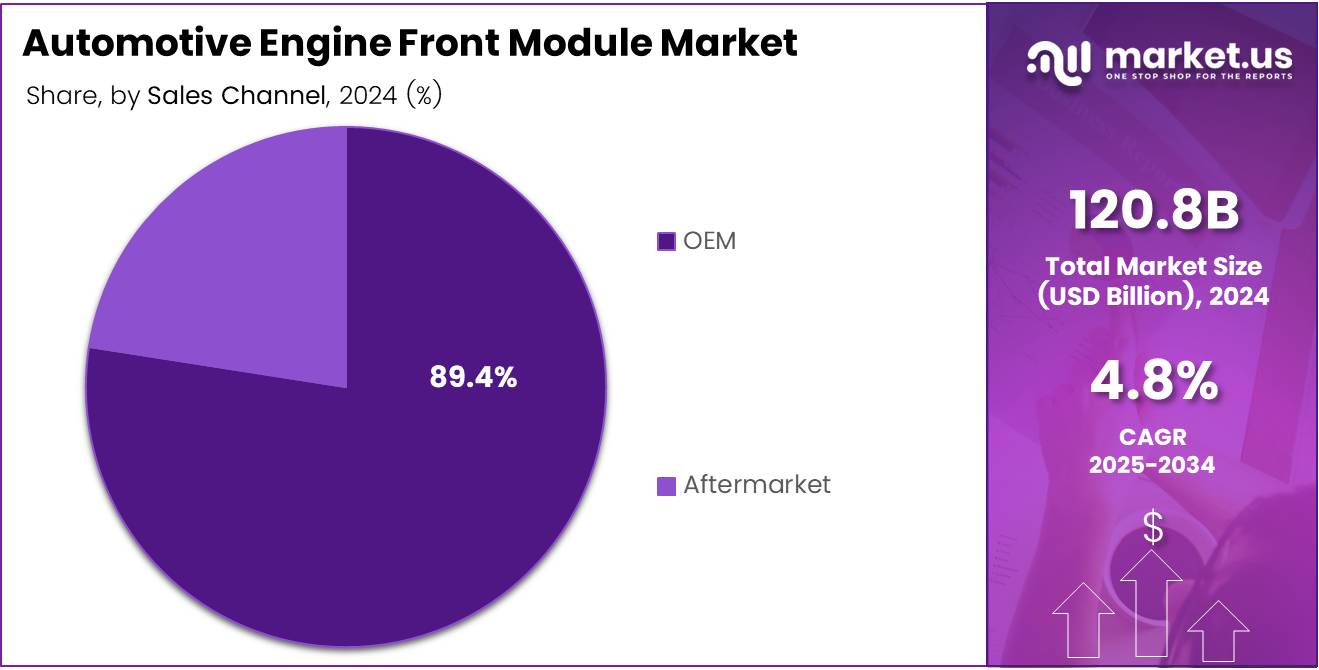

Sales Channel Analysis

OEM dominates with 89.7% due to integrated manufacturing processes and direct supplier relationships with vehicle manufacturers.

In 2024, OEM held a dominant market position in the By Sales Channel Analysis segment of Automotive Engine Front Module Market, with a 89.7% share. The OEM channel maintains overwhelming dominance through direct integration with vehicle production lines and established supplier partnerships.

Original equipment manufacturers benefit from economies of scale, standardized specifications, and quality control integration throughout the manufacturing process. This channel ensures consistent product availability aligned with vehicle production schedules while maintaining warranty compliance and technical support structures.

The aftermarket segment serves replacement and upgrade applications for existing vehicle fleets. This channel addresses maintenance needs, collision repairs, and performance modifications across diverse vehicle populations. Aftermarket demand correlates with vehicle age demographics and regional service infrastructure development, providing steady revenue streams independent of new vehicle production cycles.

Key Market Segments

By Component

- Radiator

- Cooling Fan

- Air Conditioning Condenser

- Headlights & Grilles

- Others

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

By Material

- Metal

- Composites

- Plastics

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing Demand for Fuel-Efficient Vehicles Drives Automotive Engine Front Module Market Growth

The increasing demand for fuel-efficient vehicles is a key driver in the automotive engine front module market. As consumers and manufacturers focus on reducing fuel consumption, engine front modules are evolving to accommodate more energy-efficient designs. These modules contribute to lowering overall vehicle weight and improving engine performance, which aligns with global sustainability trends.

The rising adoption of lightweight materials in automotive manufacturing is another major factor. Materials like aluminum and composites are being integrated into engine front modules, helping reduce vehicle weight. This trend not only improves fuel efficiency but also enhances vehicle handling and safety, making lightweight materials a critical component of modern engine designs.

Additionally, the integration of advanced safety features in engine front modules is boosting market growth. Features like adaptive bumpers and impact sensors improve crashworthiness and vehicle protection. These developments are driven by stricter safety regulations, which encourage manufacturers to design more robust and safe vehicle structures.

Technological advancements in engine cooling systems are also playing a significant role. Improved cooling systems in engine front modules enhance engine efficiency and reliability. These advancements ensure that engines perform optimally under varying driving conditions, meeting the growing demand for both high performance and energy efficiency.

Restraints

Challenges in Integration of Electric Powertrains and Regulatory Costs Restrain Market Growth

The automotive engine front module market faces several restraints. One of the key challenges is the limited availability of skilled workforce in automotive manufacturing. As new technologies and materials are incorporated into engine front modules, the need for highly specialized labor increases. This shortage of skilled workers hampers the production capacity of advanced engine modules.

Stringent regulatory standards and compliance costs are another significant restraint. Manufacturers must adhere to increasingly complex safety, environmental, and performance regulations, driving up operational costs. Compliance with these regulations is essential but burdensome, especially in regions with stringent emission and safety norms.

Finally, the integration of electric powertrains with engine front modules presents technical challenges. Electric vehicles (EVs) require different structural and cooling systems compared to traditional internal combustion engine (ICE) vehicles. This integration process can complicate the design and manufacturing of engine front modules, especially as OEMs strive to maintain performance while incorporating EV-specific components.

Growth Factors

Expanding Electric Vehicle Market and OEM Partnerships Drive Automotive Engine Front Module Market Growth

The expanding electric vehicle (EV) market presents significant growth opportunities for the automotive engine front module market. As the demand for electric vehicles rises, the need for specialized modular solutions increases. These modules must cater to the unique requirements of EVs, such as battery cooling and energy-efficient power distribution.

The aftermarket vehicle customization sector is also creating new avenues for growth. Consumers are increasingly seeking personalized vehicle modifications, and engine front modules are a key area for such customizations. Manufacturers can tap into this demand by offering modular solutions that cater to specific customer needs.

Additionally, there is a growing focus in the automotive industry on reducing carbon footprints. Engine front modules that contribute to lighter, more fuel-efficient vehicles are in high demand as manufacturers strive to meet sustainability targets. This shift towards greener solutions is expected to drive further demand for advanced engine modules.

Strategic collaborations between automotive original equipment manufacturers (OEMs) and component manufacturers are creating synergies and driving innovation in the engine front module market. These partnerships help improve product design, streamline production processes, and create more efficient and cost-effective solutions for the automotive industry.

Emerging Trends

Technological Advancements and Consumer Preferences Shape Automotive Engine Front Module Market Trends

One of the key trends in the automotive engine front module market is the shift towards autonomous driving technologies. As the automotive industry moves towards fully autonomous vehicles, engine front modules must adapt to incorporate sensors, cameras, and other critical components that support autonomous driving features. This trend is expected to drive demand for more complex and integrated engine front modules.

Consumer preferences for high-performance and luxury vehicles are also impacting the market. These vehicles require more advanced engine front modules that support increased power output, better cooling systems, and enhanced safety features. The growing demand for such vehicles is encouraging manufacturers to invest in more sophisticated engine module designs.

The increasing integration of smart technologies and the Internet of Things (IoT) in automotive systems is another trend. Modern engine front modules are being designed with connectivity in mind, allowing them to communicate with other vehicle systems for enhanced performance and diagnostics.

Finally, the adoption of 3D printing technologies is revolutionizing the prototyping and manufacturing of engine front modules. This technology allows for faster, more cost-effective production of complex components, enabling manufacturers to respond quickly to market demands and improve product designs.

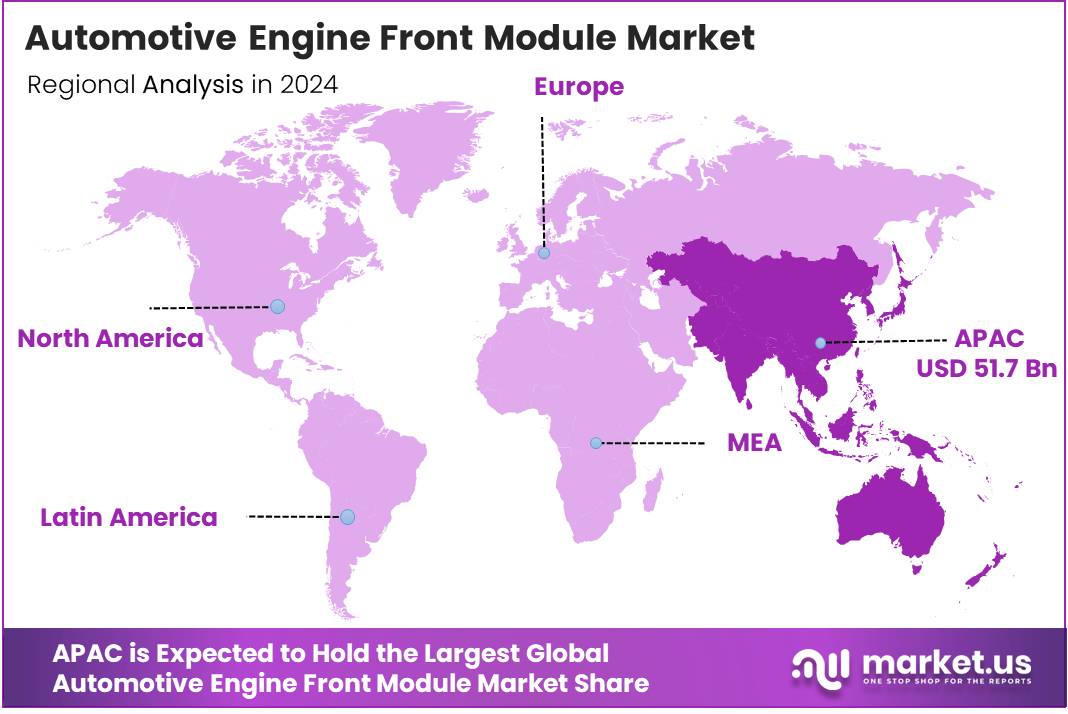

Regional Analysis

Asia Pacific Dominates the Automotive Engine Front Module Market with a Market Share of 42.9%, Valued at USD 51.9 Billion

Asia Pacific leads the global Automotive Engine Front Module Market, holding a dominant share of 42.9%, valued at USD 51.9 Billion. The region’s strong manufacturing base, coupled with increasing demand for fuel-efficient vehicles, is driving this market growth. Additionally, the adoption of advanced automotive technologies further strengthens its position as the leading market.

Europe Automotive Engine Front Module Market Trends

Europe holds a significant share of the Automotive Engine Front Module Market, supported by stringent regulations for safety and fuel efficiency. The region’s automotive industry is investing heavily in electric vehicles (EVs), enhancing the need for advanced engine modules. European manufacturers focus on lightweight and high-performance materials, further boosting market growth.

North America Automotive Engine Front Module Market Trends

North America continues to be a key player in the Automotive Engine Front Module Market. The region is driven by the increasing demand for electric vehicles and the integration of advanced safety features in engine front modules. Moreover, the growing focus on reducing vehicle emissions and fuel consumption accelerates the adoption of these modules.

Middle East and Africa Automotive Engine Front Module Market Trends

The Middle East and Africa region is experiencing steady growth in the Automotive Engine Front Module Market, primarily due to rising automotive production and consumption in key countries. Investments in the automotive sector, particularly in electric vehicles, are expected to further strengthen the market in the coming years.

Latin America Automotive Engine Front Module Market Trends

Latin America is witnessing gradual growth in the Automotive Engine Front Module Market, driven by expanding automotive manufacturing and rising consumer demand for fuel-efficient vehicles. The region’s economic development and automotive industry initiatives are expected to contribute to market expansion, although it lags behind in comparison to other global regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Engine Front Module Company Insights

In 2024, Aisin Seiki is expected to maintain a strong position in the automotive engine front module market. Known for its high-quality manufacturing and engineering capabilities, Aisin Seiki continues to innovate in advanced materials and lightweight structures, enhancing fuel efficiency and safety in vehicles. The company’s focus on reducing environmental impact aligns with growing industry demand for sustainable solutions.

Denso remains a key player in the market, leveraging its expertise in automotive parts and electronic systems. Denso’s contribution to engine front modules, particularly in cooling systems and integration of electrical components, is projected to drive significant market growth. The company’s strategic partnerships with OEMs further solidify its presence in the automotive sector.

Grupo Antolin has expanded its role in the automotive industry with its expertise in manufacturing modules and interior components. Its focus on integrating advanced technologies into engine front modules, such as energy-efficient materials and smart sensors, is anticipated to support the evolving automotive trends of automation and electrification.

Hella continues to lead with innovative solutions in automotive lighting, electronics, and cooling. As a prominent supplier for engine front modules, Hella’s strong portfolio of active safety systems and thermal management technologies positions the company to benefit from the growing need for enhanced vehicle performance, safety, and environmental regulations. Their focus on energy-efficient solutions is aligned with the ongoing trend toward sustainability in the automotive sector.

Top Key Players in the Market

- Aisin Seiki

- Denso

- Grupo Antolin

- Hella

- HYUNDAI Mobis

- Magna

- Magneti Marelli

- Mahle

- Robert Bosch

- Valeo

Recent Developments

- In Jan 2025, Eccentric Engine raised $5 million in Pre-Series A funding, aimed at scaling their engine technology for enhanced fuel efficiency and performance in the automotive sector. This funding will support their efforts in expanding R&D and production capabilities.

- In Sep 2024, DeepDrive successfully raised €30 million in an oversubscribed Series B funding round, which will be used to accelerate the development of their advanced electric drivetrains. The investment highlights growing confidence in the company’s technology and potential within the electric vehicle market.

- In Jun 2025, RIIICO secured $5 million in Seed Funding to drive the commercialization of its innovative solutions in the robotics and automation sector. The funds will help the company expand its product offerings and enhance their manufacturing capabilities.

- In Aug 2025, Motive raised $150 million to strengthen its position in the fleet management market, expanding its product suite and enhancing its AI-powered platform. This significant funding boost underscores Motive’s growing influence in the logistics and fleet management sectors.

- In Mar 2024, Stellantis announced a €5.6 billion investment in South America, marking its largest commitment to the region’s automotive industry. The investment will focus on increasing local production capacity and supporting the development of electric and hybrid vehicles.

- In Jan 2024, SKY ENGINE AI raised $7 million to accelerate its vision AI development for applications in automotive, robotics, and medical diagnostics. The funding will enable the company to enhance its machine learning algorithms and expand its global customer base.

- In Jun 2025, a leading car giant committed $2.7 billion to preserve and innovate the V8 engine, ensuring its continued presence in the market amidst rising demand for electric and hybrid vehicles. The investment aims to modernize the V8 technology while meeting global emissions standards.

Report Scope

Report Features Description Market Value (2024) USD 121.1 Billion Forecast Revenue (2034) USD 193.1 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Radiator, Cooling Fan, Air Conditioning Condenser, Headlights & Grilles, Others), By Vehicle (Passenger Vehicles, Commercial Vehicles), By Material (Metal, Composites, Plastics), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aisin Seiki, Denso, Grupo Antolin, Hella, HYUNDAI Mobis, Magna, Magneti Marelli, Mahle, Robert Bosch, Valeo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Engine Front Module MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Engine Front Module MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aisin Seiki

- Denso

- Grupo Antolin

- Hella

- HYUNDAI Mobis

- Magna

- Magneti Marelli

- Mahle

- Robert Bosch

- Valeo