Global Automotive Drivetrain Market Size, Share, Growth Analysis By Propulsion Type (ICE, Electric Motor), By Drive Type (FWD, RWD, AWD), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151278

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

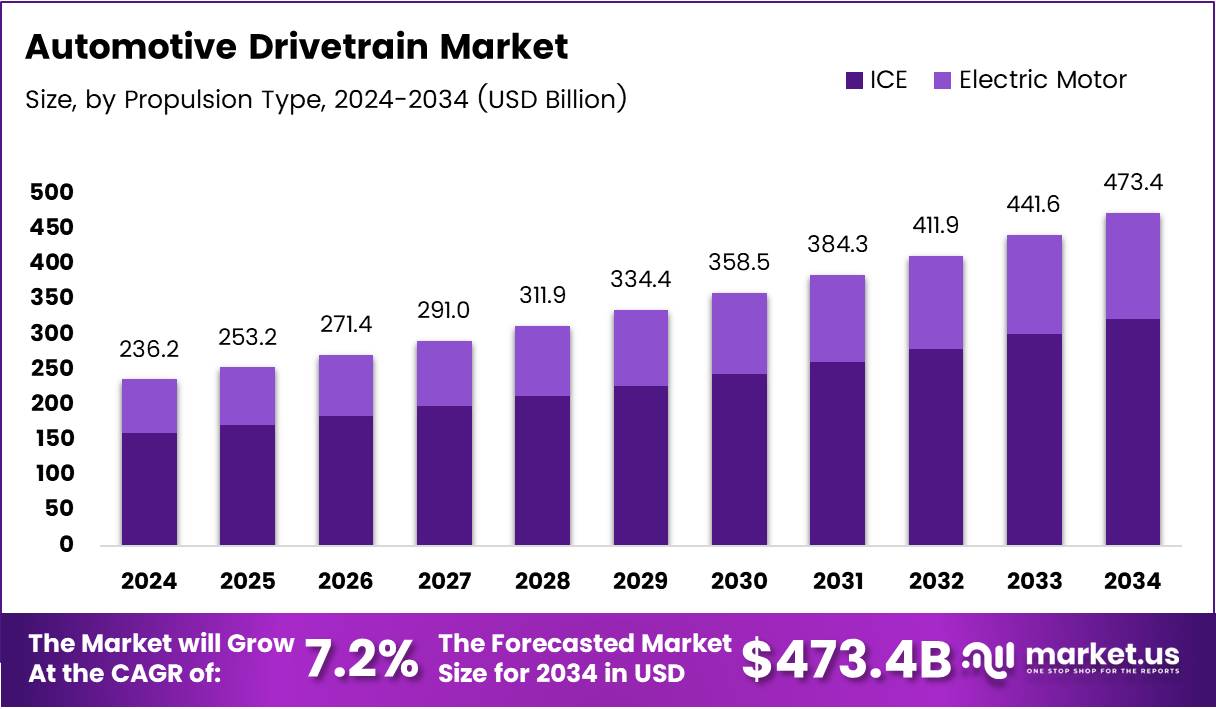

The Global Automotive Drivetrain Market size is expected to be worth around USD 473.4 Billion by 2034, from USD 236.2 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

The Automotive Drivetrain Market is a crucial segment of the automotive industry, encompassing all components that deliver power from the engine or motor to the wheels. This includes transmissions, axles, driveshafts, and differentials. As vehicle electrification gains traction, traditional mechanical systems are rapidly evolving into integrated electric drivetrains.

Today’s automotive market is experiencing significant transformation driven by the shift toward electric and hybrid vehicles. Automakers are heavily investing in efficient drivetrain systems to reduce emissions and meet government regulations. The drivetrain’s role in vehicle performance and energy efficiency makes it a key focus area for innovation and development.

Moreover, rising hybrid vehicle adoption is propelling drivetrain demand. According to Experian, hybrid new retail registrations in the U.S. rose from 9.5% in Q3 2023 to 11.5% in Q3 2024. This indicates a clear consumer shift towards low-emission alternatives, amplifying the market opportunity for hybrid-compatible drivetrain systems.

Parallelly, electric vehicles are gaining moderate traction. Experian also noted EV registrations in the U.S. increased from 7.7% to 8.2% over the same period. This growth, although slower than hybrids, underscores the need for high-efficiency electric drivetrains tailored to EV platforms.

In support of this shift, drivetrain technologies now prioritize energy efficiency. As per electricmotorrepairsales, modern electric motors boast over 90% efficiency, a vital component of EV drivetrain systems. Their widespread use enhances performance while minimizing energy loss, positioning them as an environmentally sustainable solution.

Additionally, government regulations around CO₂ emissions and fuel economy are prompting OEMs to develop more advanced drivetrain systems. The integration of lightweight materials and smart controls into drivetrains helps manufacturers align with these mandates while maintaining performance standards.

Global electricity consumption also highlights the importance of efficient systems. According to the International Energy Agency (IEA), electric motor-driven systems account for 53% of global electricity usage. In automotive contexts, this calls for optimization of powertrains to manage energy loads and reduce overall consumption.

At the same time, governments are ramping up investments in EV infrastructure, creating indirect opportunities for drivetrain component suppliers. Financial incentives and emission norms are prompting automakers to redesign propulsion systems, making the drivetrain market ripe for innovation.

Key Takeaways

- The Global Automotive Drivetrain Market is projected to reach USD 473.4 Billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

- In 2024, ICE dominated the propulsion type segment due to its global reach, mature technology, and lower initial costs.

- In 2024, FWD led the drive type segment, driven by cost-effectiveness, lightweight design, and improved fuel efficiency.

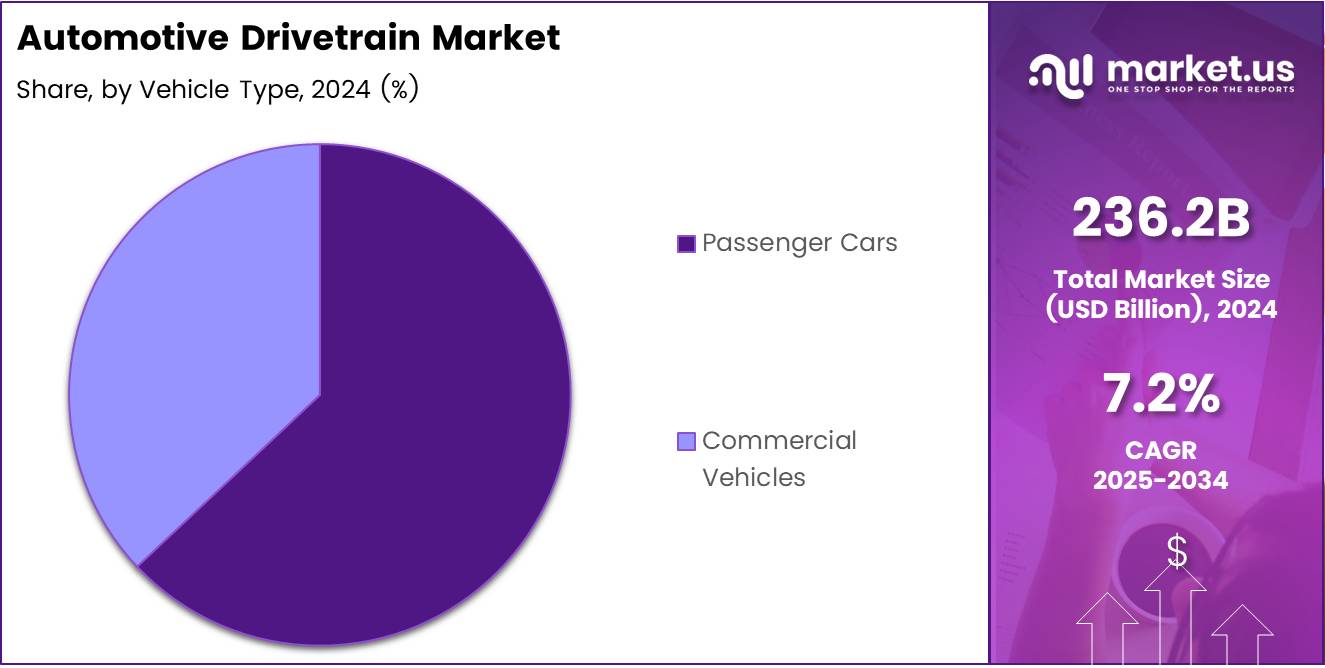

- In 2024, Passenger Cars held the largest share in vehicle type, supported by strong consumer demand and urbanization trends.

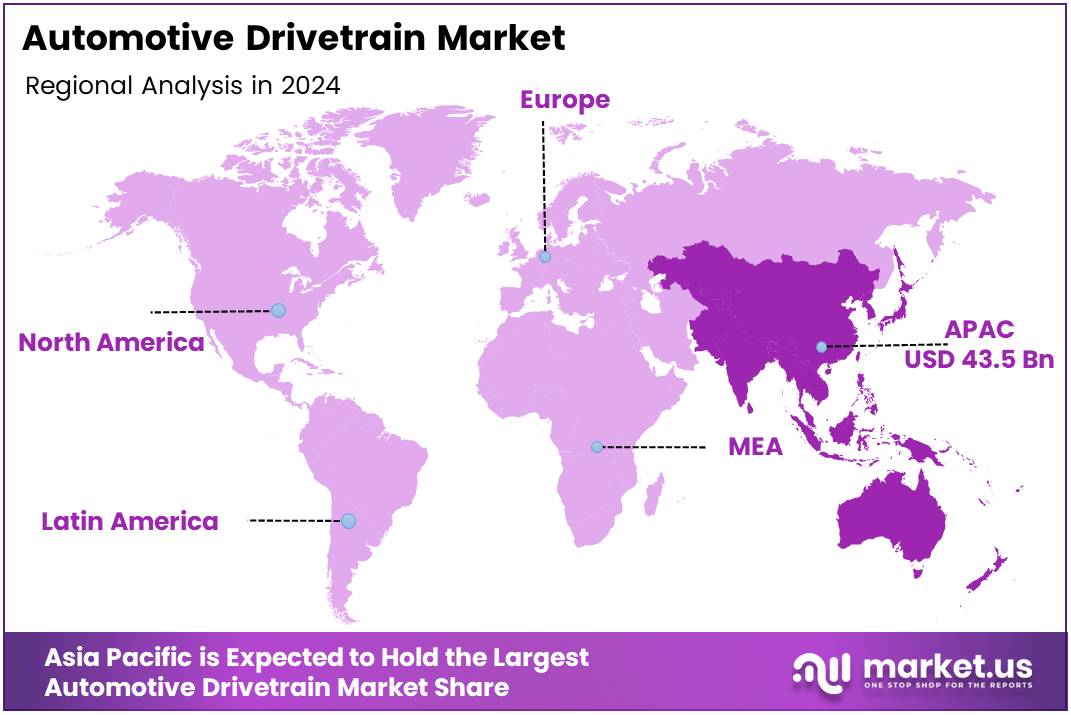

- Asia Pacific led the regional market in 2024, capturing 43.5% share with a market value of USD 102.7 Billion, fueled by growing automotive production and supportive EV policies.

Propulsion Type Analysis

ICE dominates with 2024 leading market share due to its established infrastructure and cost-efficiency.

In 2024, ICE held a dominant market position in By Propulsion Type Analysis segment of Automotive Drivetrain Market. The internal combustion engine (ICE) continues to maintain its lead, supported by its extensive global presence, mature technology, and lower upfront costs compared to electric alternatives. Many emerging economies still rely heavily on ICE-powered vehicles due to limited charging infrastructure and lower fuel prices, which further strengthens its dominance.

Meanwhile, electric motors are steadily gaining attention in the market. Growing environmental concerns, government incentives, and advancements in battery technology are driving the adoption of electric propulsion.

Although currently holding a smaller share compared to ICE, the electric motor segment is witnessing continuous technological improvements that enhance vehicle range, reduce charging time, and lower production costs. This ongoing evolution is positioning electric motors as a promising growth area for the future of automotive drivetrains.

Drive Type Analysis

FWD dominates with 2024 leading market share driven by its affordability and space efficiency.

In 2024, FWD held a dominant market position in By Drive Type Analysis segment of Automotive Drivetrain Market. Front-wheel drive (FWD) remains the preferred choice for most passenger vehicles due to its cost-effectiveness, lightweight design, and better fuel economy. Its ability to maximize interior cabin space makes it particularly popular among compact and mid-sized vehicle segments, contributing to its leading share.

RWD continues to serve its niche, particularly in sports cars, luxury sedans, and performance vehicles. Its ability to deliver superior handling and driving dynamics keeps it relevant for specific consumer segments.

On the other hand, AWD is increasingly being adopted for SUVs and off-road vehicles, offering better traction and safety in various driving conditions. While FWD maintains the highest market share, both RWD and AWD are important contributors, catering to their specific user needs and preferences.

Vehicle Type Analysis

Passenger Cars dominate with 2024 leading market share due to high consumer demand and wide model variety.

In 2024, Passenger Cars held a dominant market position in By Vehicle Type Analysis segment of Automotive Drivetrain Market. The segment benefits from strong consumer demand, frequent model refreshes, and wide availability across all price points. Urbanization, rising disposable incomes, and preference for personal mobility solutions continue to support the growth of passenger cars globally.

Commercial Vehicles, though holding a smaller share, play a crucial role in the market. The expansion of logistics, e-commerce, and industrial activities sustains demand for commercial fleets. Additionally, government regulations encouraging cleaner commercial transport options are gradually influencing drivetrain choices within this segment. Despite this, passenger cars maintain clear dominance due to their sheer volume and diverse applications in daily personal transportation.

Key Market Segments

By Propulsion Type

- ICE

- Electric Motor

By Drive Type

- FWD

- RWD

- AWD

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Drivers

Surge in Hybrid Drivetrain Integration Across Mid-Range Vehicles Drives Market Growth

The automotive industry is witnessing a significant rise in the integration of hybrid drivetrains, especially in mid-range vehicles. Consumers are becoming more environmentally conscious, and automakers are responding by offering affordable hybrid models that deliver better fuel efficiency without sacrificing performance.

Simultaneously, electric mobility solutions are benefiting from the increasing adoption of e-axles. These integrated systems combine electric motors, power electronics, and transmissions into a single compact unit, simplifying vehicle architecture while enhancing energy efficiency. Automakers are leveraging e-axles to improve driving range and reduce production costs in electric vehicles.

Additionally, the growing emphasis on fuel economy is driving demand for lightweight drivetrain components. By using advanced materials such as aluminum alloys and composites, manufacturers can significantly reduce vehicle weight, leading to lower fuel consumption and reduced emissions. This focus aligns with stricter global regulations on fuel efficiency and emissions control.

Restraints

High Development Cost of Advanced Multi-Speed Transmission Systems Hinders Market Expansion

Developing advanced multi-speed transmission systems requires substantial financial investment. These sophisticated systems involve complex engineering, precision manufacturing, and extensive testing to ensure durability and efficiency. The high upfront costs often limit their widespread adoption, especially among smaller automakers.

Moreover, integrating drivetrain systems with autonomous vehicle platforms presents technical challenges. Autonomous systems require real-time data exchange between various vehicle components, including the drivetrain. Ensuring seamless communication and synchronization between these systems demands significant R\&D efforts, further increasing the complexity and cost for manufacturers.

Growth Factors

Expansion of All-Wheel-Drive Systems in Off-Road and Luxury Vehicle Segments Creates New Opportunities

The demand for all-wheel-drive (AWD) systems is growing rapidly in both off-road and luxury vehicle segments. Consumers value AWD for its superior traction and stability, particularly in challenging road conditions. Automakers are capitalizing on this trend by introducing advanced AWD drivetrains that enhance driving performance and safety.

Advancements in software-defined drivetrains are also opening new doors. Predictive maintenance enabled by real-time data analysis allows automakers to proactively address potential issues, minimizing downtime and improving vehicle reliability. This technology enhances customer satisfaction and reduces long-term maintenance costs.

In parallel, rising investments in 48V mild hybrid systems are driving innovation. These systems offer an efficient way to improve fuel economy and reduce emissions without the need for full electrification. Automakers are increasingly adopting 48V technology as a cost-effective solution to meet regulatory standards and consumer expectations for greener vehicles.

Emerging Trends

Integration of AI-Based Torque Vectoring Systems Influences Market Trends

Artificial intelligence (AI) is playing a key role in enhancing torque vectoring systems within modern drivetrains. By dynamically adjusting power distribution across wheels, AI-based systems improve handling, stability, and performance, particularly in high-performance and luxury vehicles.

The adoption of solid-state battery-powered drivetrains is also gaining traction. These next-generation batteries promise higher energy density, faster charging, and improved safety, making them an attractive option for future electric drivetrains.

Furthermore, collaboration between automakers and semiconductor firms is intensifying. Joint efforts to develop advanced drivetrain control chips are crucial for managing complex electronic systems in modern vehicles, ensuring efficiency, responsiveness, and safety.

Finally, modular drivetrain platforms are emerging as a flexible solution for vehicle architecture. These platforms enable manufacturers to design multiple vehicle models using a common drivetrain foundation, reducing development costs and accelerating time-to-market for new models.

Regional Analysis

Asia Pacific Dominates the Automotive Drivetrain Market with a Market Share of 43.5%, Valued at USD 102.7 Billion

In Asia Pacific, the automotive drivetrain market has emerged as the leader, holding a significant share of 43.5% and reaching a valuation of USD 102.7 Billion. The rapid growth of automotive production, robust demand for electric vehicles, and the presence of major manufacturing hubs are driving this dominance. Additionally, favorable government policies supporting electric mobility further stimulate market expansion across the region.

North America Automotive Drivetrain Market Trends

In North America, the market shows steady growth driven by rising adoption of electric and hybrid vehicles. The ongoing shift toward fuel-efficient technologies, supported by strict environmental norms, accelerates the development of lightweight and advanced drivetrain components. Continued investment in research and innovation is reinforcing the region’s competitive position.

Europe Automotive Drivetrain Market Trends

In Europe, stringent emission standards and aggressive electrification targets are fueling demand for innovative drivetrain solutions. Government incentives promoting electric mobility, alongside rising consumer preference for sustainable transportation, are encouraging manufacturers to develop more efficient transmission and propulsion systems.

Middle East and Africa Automotive Drivetrain Market Trends

In the Middle East and Africa, gradual growth is observed as automotive sales increase, especially in luxury and high-performance vehicle segments. Improved economic conditions, expanding urbanization, and rising demand for technologically advanced drivetrains contribute to the market’s development.

Latin America Automotive Drivetrain Market Trends

In Latin America, the automotive drivetrain market is advancing steadily due to the recovery of automotive production and supportive government policies. Growing consumer interest in cost-effective and fuel-efficient vehicles, coupled with increasing local manufacturing capabilities, supports this positive outlook.

U.S. Automotive Drivetrain Market Trends

In the U.S., consumer demand for SUVs, pickup trucks, and electric vehicles drives the growth of the drivetrain market. Technological innovation in multi-speed transmissions and collaborations focusing on electrification strengthen the country’s role in shaping the global drivetrain industry.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Drivetrain Company Insights

In 2024, the global Automotive Drivetrain Market is witnessing notable strategic moves and technological advancements from leading players, contributing to competitive momentum and innovation across the sector.

BorgWarner Inc. continues to strengthen its position through investments in electric drivetrain systems, focusing on integrated drive modules and power electronics. Its emphasis on eMobility aligns with the growing shift toward electric vehicles (EVs).

Magna International has maintained its competitive edge through diversified drivetrain offerings, including hybrid and full-electric solutions. The company’s collaborations with global automakers support its expansive presence in both North American and European markets.

General Motors is accelerating its electrification goals, significantly impacting the drivetrain space with in-house development of Ultium Drive systems. This vertical integration enhances its control over performance and cost in EV platforms.

TOYOTA MOTOR CORPORATION leverages its hybrid leadership to dominate drivetrain efficiency, combining proven hybrid technology with growing BEV ambitions. Its focus remains on scalable drivetrain platforms adaptable across multiple models.

The market trajectory reflects a clear pivot towards electrification, modularity, and fuel efficiency, driven by regulations and consumer demand. While traditional drivetrain components remain essential, the transition to next-generation systems is setting the tone for future competition.

The companies at the forefront, especially those investing in electrified powertrains and scalable architectures, are likely to hold strategic advantages. Overall, the market is dynamic, with key players reshaping the drivetrain landscape through innovation, strategic alliances, and investment in sustainable mobility solutions.

Top Key Players in the Market

- BorgWarner Inc.

- Magna International

- General Motors

- TOYOTA MOTOR CORPORATION

- Schaeffler AG

- Volkswagen Group

- Stellantis NV

- American Axle & Manufacturing, Inc.

- Aisin Seki Co., Ltd.

- ZF Friedrichshafen AG

- Hyundai Motor Company

Recent Developments

- In April 2025, Volektra secured new capital to accelerate the commercialization of its innovative Virtual Magnet Motor technology, targeting applications across mobility, industrial equipment, and defense sectors. This investment is expected to strengthen Volektra’s position in emerging electrification markets.

- In April 2025, electric vehicle motor startup Conifer raised $20 million in seed funding. The capital will be used to advance product development and scale manufacturing capabilities for next-generation EV motors.

- In September 2024, the White House announced its support for a $1 billion EV supplier fund. This initiative aims to boost domestic electric vehicle supply chains and strengthen the U.S. manufacturing ecosystem.

- In June 2025, Toyota revealed plans to invest $531 million to build a 500,000-square-foot drivetrain parts facility at its San Antonio, Texas campus. This expansion is part of Toyota’s strategy to enhance its North American manufacturing capabilities for future drivetrain technologies.

Report Scope

Report Features Description Market Value (2024) USD 236.2 Billion Forecast Revenue (2034) USD 473.4 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (ICE, Electric Motor), By Drive Type (FWD, RWD, AWD), By Vehicle Type (Passenger Cars, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BorgWarner Inc., Magna International, General Motors, TOYOTA MOTOR CORPORATION, Schaeffler AG, Volkswagen Group, Stellantis NV, American Axle & Manufacturing, Inc., Aisin Seki Co., Ltd., ZF Friedrichshafen AG, Hyundai Motor Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Drivetrain MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Drivetrain MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BorgWarner Inc.

- Magna International

- General Motors

- TOYOTA MOTOR CORPORATION

- Schaeffler AG

- Volkswagen Group

- Stellantis NV

- American Axle & Manufacturing, Inc.

- Aisin Seki Co., Ltd.

- ZF Friedrichshafen AG

- Hyundai Motor Company