Global Automotive E-Compressor Market Size, Share, Growth Analysis Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Compressor Type (Scroll Compressors, Rotary Compressors, Centrifugal Compressors, Reciprocating Compressors, Axial Compressors), Capacity (Small, Medium, Large), Propulsion Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV), Fuel-cell Electric Vehicle (FCEV), Hybrid Electric Vehicle (HEV)), Technology Type (VFD, Fixed Speed), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177629

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

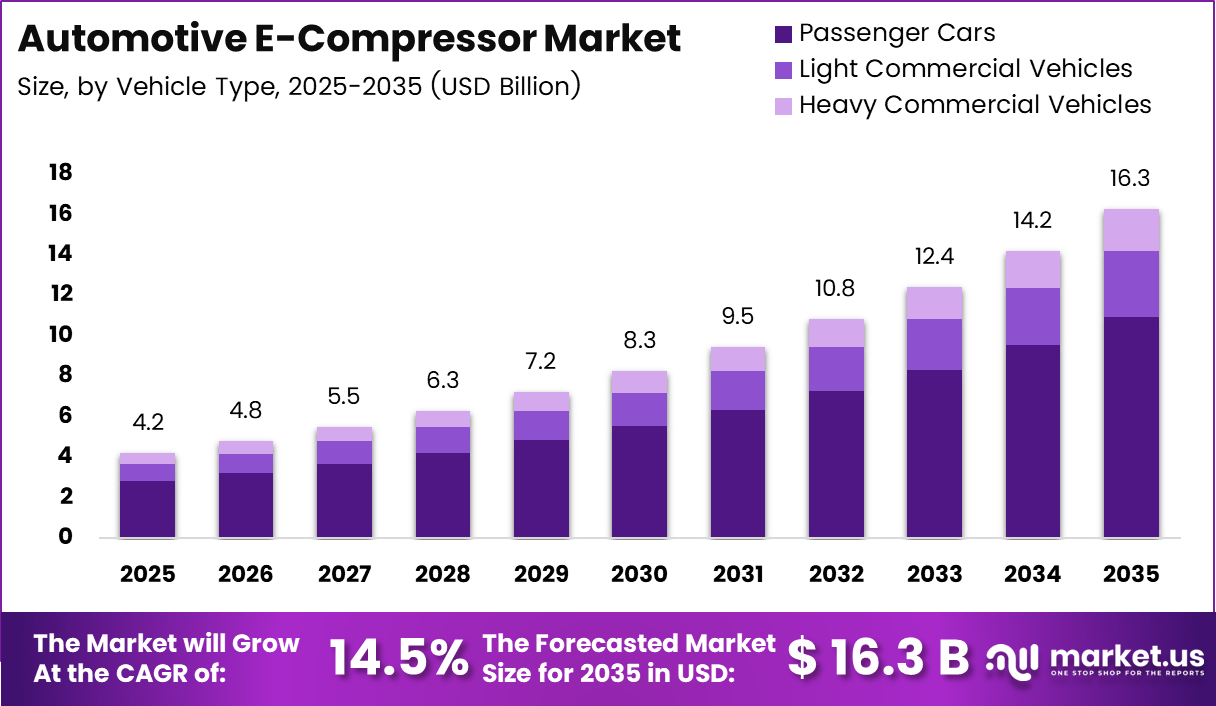

Global Automotive E-Compressor Market size is expected to be worth around USD 16.3 Billion by 2035 from USD 4.2 Billion in 2025, growing at a CAGR of 14.5% during the forecast period 2026 to 2035.

The automotive e-compressor market represents electrically driven compression systems used in vehicle thermal management and air supply applications. These advanced components operate independently of engine mechanical systems, utilizing high-voltage electrical power. Moreover, they provide efficient cooling and heating solutions for electric and hybrid vehicles.

E-compressors have become critical components in modern vehicle architectures. They support HVAC Service, battery thermal management, and fuel cell air delivery. Additionally, these units enable precise climate control while reducing energy consumption. Therefore, manufacturers prioritize their integration in electrified powertrains.

The market experiences robust growth driven by global vehicle electrification trends. Automakers increasingly adopt electric and hybrid platforms requiring independent auxiliary systems. Furthermore, stringent emission regulations accelerate the transition from engine-driven compressors. Consequently, demand for high-voltage e-compressor solutions continues rising across all vehicle segments.

Government policies worldwide promote zero-emission transportation through incentives and mandates. Regulatory frameworks establish aggressive targets for electric vehicle adoption rates. Moreover, infrastructure investments support charging networks and battery production facilities. Therefore, these initiatives create favorable conditions for e-compressor market expansion.

Technological advancements enhance e-compressor efficiency and performance capabilities. Manufacturers develop oil-free designs with reduced noise and vibration characteristics. Additionally, integration with smart energy management systems optimizes power consumption. However, high system costs and thermal reliability concerns remain challenges.

According to Bosch Mobility, e-compressors require 11 kW cooling capacity at 45 cc displacement with 800 V voltage range. According to Infineon, application boards enable performance testing with input voltage dropping below 6V on terminals. According to MAHLE, high-voltage compressors reach voltage ratings up to 900 volts with displacements up to 57 cm3.

According to DENSO, electric motors operate at high voltages of 200V or greater with refrigerant cooling systems. MAHLE generates over 60 percent of sales independently from combustion engines, targeting 75 percent by 2030. Additionally, MAHLE offers the most powerful electric air-conditioning compressor at 18 kW with optimized noise reduction.

Key Takeaways

- Global Automotive E-Compressor Market projected to reach USD 16.3 Billion by 2035 from USD 4.2 Billion in 2025

- Market growing at CAGR of 14.5% during forecast period 2026-2035

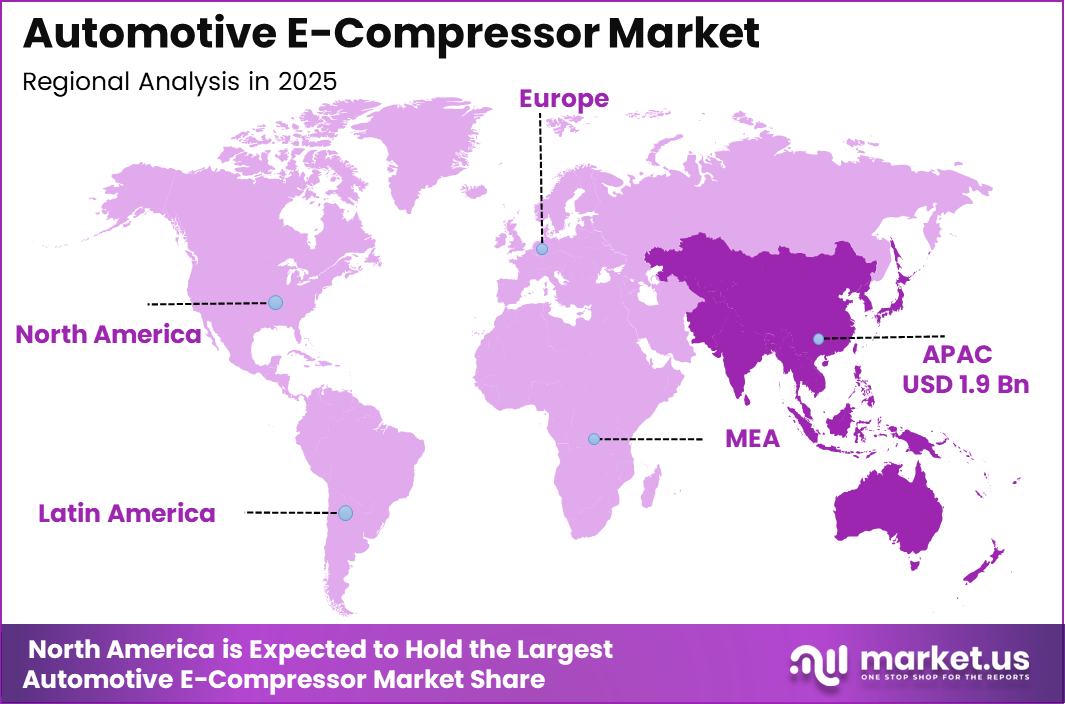

- Asia Pacific dominates with 45.90% market share valued at USD 1.9 Billion

- Passenger Cars segment leads Vehicle Type category with 67.2% market share

- Scroll Compressors dominate Compressor Type segment holding 41.6% share

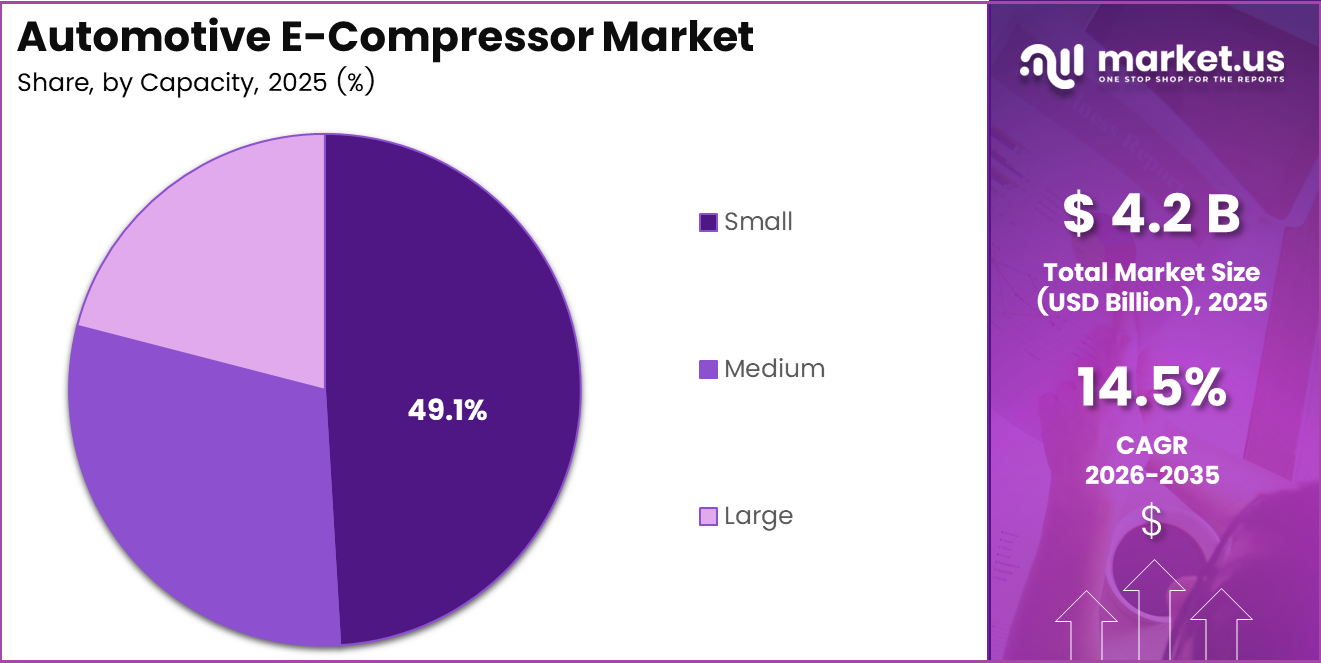

- Small Capacity segment accounts for 49.1% of total market

- Battery Electric Vehicles command 49.7% share in Propulsion Type segment

- VFD Technology Type holds dominant position with 68.4% market share

Vehicle Type Analysis

Passenger Cars dominate with 67.2% due to rapid electric vehicle adoption and thermal management requirements.

In 2025, Passenger Cars held a dominant market position in the Vehicle Type segment of Automotive E-Compressor Market, with a 67.2% share. The segment benefits from increasing production of electric and hybrid passenger vehicles worldwide. Moreover, consumer preference for climate-controlled cabin environments drives e-compressor integration. Therefore, automakers prioritize advanced HVAC systems in passenger car platforms.

Light Commercial Vehicles represent significant growth opportunities in urban delivery and last-mile logistics applications. Electric vans and small trucks require efficient thermal management for cargo and cabin areas. Additionally, commercial fleet operators seek reduced operating costs through electrification. However, this segment faces challenges from higher payload requirements and duty cycles.

Heavy Commercial Vehicles demonstrate emerging adoption as manufacturers develop electric truck and bus platforms. These vehicles demand robust e-compressor systems for extended range and heavy-duty operations. Furthermore, government regulations targeting commercial fleet emissions accelerate market penetration. Consequently, specialized high-capacity compressor solutions continue evolving for this segment.

Compressor Type Analysis

Scroll Compressors dominate with 41.6% due to superior efficiency and reliability in automotive applications.

In 2025, Scroll Compressors held a dominant market position in the Compressor Type segment of Automotive E-Compressor Market, with a 41.6% share. This technology offers excellent volumetric efficiency and continuous compression characteristics. Moreover, scroll designs provide quieter operation with fewer moving parts compared to alternatives. Therefore, automotive manufacturers prefer scroll compressors for passenger vehicle HVAC systems.

Rotary Compressors gain traction in compact vehicle applications requiring space-efficient thermal management solutions. These units deliver consistent performance across variable speed operations with simplified mechanical design. Additionally, rotary technology enables lightweight construction suitable for smaller electric vehicles. However, manufacturers continue optimizing lubrication and sealing systems for enhanced durability.

Centrifugal Compressors serve high-performance applications demanding exceptional airflow rates and boost pressure capabilities. These compressors excel in fuel cell systems and performance-oriented hybrid powertrains. Furthermore, centrifugal designs achieve superior power-to-weight ratios at elevated operating speeds. Consequently, premium vehicle segments increasingly adopt this advanced compressor technology.

Reciprocating Compressors maintain presence in specific commercial vehicle applications requiring proven reliability. Traditional piston-based designs offer robust performance under demanding thermal loads and environmental conditions. Moreover, reciprocating units provide cost-effective solutions for heavy-duty applications. Therefore, commercial fleet operators continue specifying these compressors for certain vehicle types.

Axial Compressors represent specialized solutions for unique automotive applications requiring high-volume airflow delivery. These compressors find use in advanced fuel cell systems and experimental vehicle platforms. Additionally, axial designs enable compact packaging with efficient air handling characteristics. However, complexity and manufacturing costs limit broader market adoption currently.

Capacity Analysis

Small Capacity dominates with 49.1% due to widespread adoption in passenger electric vehicles.

In 2025, Small Capacity held a dominant market position in the Capacity segment of Automotive E-Compressor Market, with a 49.1% share. Compact passenger cars and subcompact EVs primarily utilize small-capacity e-compressor units for cabin climate control. Moreover, these systems optimize energy consumption while meeting thermal management requirements efficiently. Therefore, small-capacity solutions align with mainstream electric vehicle market demands.

Medium Capacity serves mid-size vehicles and crossover segments requiring balanced performance and efficiency characteristics. These compressors handle increased thermal loads from larger cabin volumes and battery systems. Additionally, medium-capacity units support extended range requirements in premium electric vehicle offerings. Consequently, this segment experiences steady growth across diverse vehicle platforms.

Large Capacity addresses heavy commercial vehicles and luxury electric vehicles demanding maximum thermal management capabilities. These high-output compressors deliver substantial cooling and heating performance for challenging applications. Furthermore, large-capacity systems enable fast cabin conditioning in extreme environmental conditions. However, power consumption and cost considerations influence adoption in mainstream vehicle segments.

Propulsion Type Analysis

Battery Electric Vehicles dominate with 49.7% due to complete electrification requiring independent thermal systems.

In 2025, Battery Electric Vehicle (BEV) held a dominant market position in the Propulsion Type segment of Automotive E-Compressor Market, with a 49.7% share. BEVs depend entirely on electric e-compressors for all thermal management functions without engine-driven alternatives. Moreover, battery thermal conditioning requires precise temperature control across diverse operating conditions. Therefore, e-compressors represent essential components in BEV architectures.

Plug-in Hybrid Vehicles (PHEV) utilize e-compressors to maintain thermal management during electric-only operation modes. These vehicles benefit from independent compressor operation when combustion engines remain off. Additionally, PHEVs require flexible thermal systems supporting both electric and hybrid driving scenarios. Consequently, e-compressor integration enhances overall vehicle efficiency and user experience.

Fuel-cell Electric Vehicles (FCEV) demand specialized e-compressor solutions for hydrogen fuel cell air supply systems. These compressors deliver precise airflow management critical for fuel cell stack performance and efficiency. Furthermore, FCEVs require additional thermal management for cabin conditioning and component cooling. Therefore, dual-function e-compressor systems serve emerging fuel cell vehicle platforms.

Hybrid Electric Vehicles (HEV) incorporate e-compressors to supplement engine-driven systems and improve overall efficiency. These vehicles optimize energy consumption by selectively operating electric compressors during specific driving conditions. Moreover, HEVs benefit from reduced engine load and enhanced fuel economy through electrified auxiliaries. However, system complexity and cost considerations influence adoption rates in this segment.

Technology Type Analysis

VFD dominates with 68.4% due to superior efficiency and precise speed control capabilities.

In 2025, VFD held a dominant market position in the Technology Type segment of Automotive E-Compressor Market, with a 68.4% share. Variable Frequency Drive technology enables precise compressor speed modulation matching real-time thermal demands. Moreover, VFD systems minimize energy consumption by eliminating unnecessary full-speed operation periods. Therefore, automotive manufacturers prioritize VFD-equipped e-compressors for optimized vehicle range and efficiency.

Fixed Speed compressors serve cost-sensitive applications requiring simplified control systems and reduced component complexity. These units operate at constant speeds with on-off cycling for temperature regulation. Additionally, fixed-speed designs offer proven reliability with lower initial investment requirements. However, reduced efficiency and limited operational flexibility restrict adoption in premium vehicle segments.

Drivers

Rapid Electrification of Powertrains Increasing Demand for Independent Electric Air Compression

Global automotive industry transitions toward electric and hybrid propulsion systems at unprecedented rates. Automakers invest heavily in electrified platforms requiring independent thermal management solutions. Moreover, electric vehicles eliminate traditional engine-driven compressors creating absolute dependency on e-compressor technology. Therefore, powertrain electrification directly drives substantial market growth.

Stricter emission regulations worldwide mandate significant reductions in vehicle carbon footprints and pollutant outputs. Governments establish aggressive targets requiring automakers to electrify substantial portions of product portfolios. Additionally, compliance necessitates advanced auxiliary electrification including air conditioning and thermal systems. Consequently, regulatory pressure accelerates e-compressor adoption across all vehicle segments.

Rising thermal management complexity in modern vehicles demands sophisticated e-compressor solutions with precise control capabilities. Electric powertrains generate substantial heat requiring active cooling for batteries, motors, and power electronics. Furthermore, manufacturers focus on engine downsizing and turbocharging efficiency improvements in hybrid applications. Therefore, advanced e-compressor systems enable optimal performance across diverse operating conditions.

Restraints

High System Cost and Integration Challenges of High-Voltage E-Compressor Units

E-compressor systems require substantial investment in high-voltage components, specialized motors, and advanced control electronics. Manufacturing complexity drives unit costs significantly higher than traditional engine-driven compressor alternatives. Moreover, integration demands extensive vehicle electrical architecture modifications and safety system enhancements. Therefore, cost considerations remain primary barriers limiting broader market penetration.

Thermal durability concerns under extreme operating conditions challenge e-compressor reliability and longevity expectations. High-voltage motors generate substantial heat requiring effective cooling solutions to prevent performance degradation. Additionally, electronic components face reliability risks from temperature cycling and environmental exposure. Consequently, manufacturers invest heavily in thermal management and component validation.

System integration complexity increases vehicle development timelines and engineering resource requirements substantially. E-compressors demand sophisticated control algorithms coordinating with battery management and vehicle thermal systems. Furthermore, safety protocols for high-voltage systems require extensive testing and certification procedures. Therefore, integration challenges slow adoption rates particularly among smaller automotive manufacturers.

Growth Factors

Technological Advancements Accelerate Market Expansion

Expansion of electric commercial vehicles creates substantial demand for advanced HVAC and boost system solutions. Fleet operators increasingly adopt electric trucks and vans requiring robust thermal management capabilities. Moreover, commercial applications demand higher capacity e-compressors supporting extended duty cycles and payload requirements. Therefore, commercial vehicle electrification represents significant growth opportunity.

Growing adoption of 800V electrical architectures enables high-efficiency e-compressor operation with reduced current requirements. Higher voltage systems minimize electrical losses while supporting faster charging and improved performance. Additionally, 800V platforms facilitate compact motor designs with enhanced power density characteristics. Consequently, next-generation electrical architectures accelerate advanced e-compressor technology adoption.

Increasing investment in fuel cell vehicles drives demand for specialized electrified air supply systems. Fuel cell stacks require precise airflow management delivered by sophisticated e-compressor solutions. Furthermore, hydrogen vehicle development programs expand globally supported by government infrastructure investments. Therefore, fuel cell applications create additional market opportunities beyond traditional thermal management.

Emerging Trends

Digital Transformation Reshapes Market Landscape

Shift toward oil-free and low-noise electric compressor technologies addresses consumer comfort and environmental concerns. Manufacturers develop advanced bearing systems and magnetic drive solutions eliminating lubrication requirements. Moreover, oil-free designs reduce maintenance needs while improving system reliability and longevity. Therefore, next-generation e-compressors prioritize simplified operation and enhanced user experience.

Integration of e-compressors with smart vehicle energy management systems optimizes overall vehicle efficiency. Advanced algorithms coordinate compressor operation with battery state, driving conditions, and climate demands. Additionally, predictive thermal management anticipates requirements reducing energy consumption and extending vehicle range. Consequently, intelligent system integration becomes critical differentiator.

Rising use of lightweight materials improves power-to-weight ratios enhancing vehicle performance and efficiency. Manufacturers employ advanced composites, aluminum alloys, and optimized designs reducing component mass. Furthermore, weight reduction directly improves vehicle range and acceleration characteristics in electric platforms. Therefore, material innovation drives continuous e-compressor advancement.

Development of compact, high-speed motor designs enables faster boost response and improved packaging flexibility. Advanced motor technologies deliver higher power density supporting reduced component dimensions. Moreover, high-speed operation enhances compressor efficiency across broader operating ranges. Consequently, motor innovation accelerates next-generation e-compressor performance improvements.

Regional Analysis

Asia Pacific Dominates the Automotive E-Compressor Market with a Market Share of 45.90%, Valued at USD 1.9 Billion

Asia Pacific leads global automotive e-compressor adoption with 45.90% market share valued at USD 1.9 Billion. The region benefits from massive electric vehicle production in China, Japan, and South Korea. Moreover, government policies aggressively promote electrification through subsidies and infrastructure investments. Therefore, Asia Pacific drives worldwide market growth and technological innovation.

North America Automotive E-Compressor Market Trends

North America demonstrates strong growth driven by increasing electric vehicle adoption and domestic manufacturing expansion. Major automakers invest heavily in electrified platforms requiring advanced thermal management solutions. Additionally, regulatory emissions standards accelerate transition from conventional powertrains. Consequently, the region represents significant market opportunity.

Europe Automotive E-Compressor Market Trends

Europe maintains robust demand supported by stringent emission regulations and aggressive electrification targets. Premium automotive manufacturers prioritize advanced e-compressor technologies in luxury and performance vehicles. Furthermore, established supplier base enables rapid technology development and market penetration. Therefore, Europe continues driving innovation.

Middle East and Africa Automotive E-Compressor Market Trends

Middle East and Africa show emerging adoption as electric vehicle infrastructure develops in key markets. Extreme climate conditions create substantial demand for efficient thermal management solutions. Moreover, government initiatives promote sustainable transportation reducing petroleum dependency. Consequently, the region demonstrates gradual market growth.

Latin America Automotive E-Compressor Market Trends

Latin America experiences developing market conditions as electric vehicle adoption accelerates in Brazil and Mexico. Automotive manufacturers establish local production facilities supporting regional electrification trends. Additionally, improving charging infrastructure enables broader consumer acceptance of electric vehicles. Therefore, Latin America presents long-term growth potential.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

BorgWarner Inc. maintains strong market position through comprehensive thermal management solutions for electrified powertrains. The company develops advanced e-compressor technologies serving major global automakers across multiple vehicle segments. Moreover, BorgWarner invests significantly in high-voltage systems supporting 800V electrical architectures. Therefore, the company continues expanding its electrification product portfolio strategically.

Continental AG delivers innovative e-compressor solutions integrated with sophisticated vehicle thermal management systems. The supplier leverages extensive automotive electronics expertise developing intelligent compressor control algorithms. Additionally, Continental focuses on lightweight designs and energy-efficient operation enhancing vehicle range. Consequently, the company strengthens its position in premium electric vehicle applications.

DENSO Corp. pioneers high-voltage e-compressor development with proven reliability and performance capabilities. The company manufactures systems operating at voltages of 200V or greater with advanced refrigerant cooling. Furthermore, DENSO maintains strong relationships with Asian automakers driving regional market leadership. Therefore, the supplier continues expanding global production capacity.

MAHLE GmbH leads high-voltage compressor innovation offering voltage ratings up to 900 volts with displacements reaching 57 cm3. The company achieves 18 kW power output representing the industry’s most powerful electric air-conditioning compressor. Moreover, MAHLE generates over 60 percent of sales independently from combustion engines targeting 75 percent by 2030. Therefore, MAHLE demonstrates strong commitment to electrification transformation.

Key Players

- Anhui Dyne Automotive Air Conditioning Co. Ltd.

- BorgWarner Inc.

- Brose Fahrzeugteile SE and Co. KG

- Continental AG

- DENSO Corp.

- Faurecia SE

- Ingersoll Rand Inc.

- MAHLE GmbH

- Marelli Holdings Co. Ltd.

- Mitsubishi Heavy Industries Ltd.

Recent Developments

- January 2025 – Hankook & Company Group completed acquisition of Hanon Systems, the world’s second-largest automotive thermal management solutions provider, strengthening global market position and technological capabilities significantly.

- October 2025 – Danfoss acquired Palladio Compressors integrating screw compressor technologies with existing product portfolio, promising competitive and advanced high-temperature solutions for automotive applications.

Report Scope

Report Features Description Market Value (2025) USD 4.2 Billion Forecast Revenue (2035) USD 16.3 Billion CAGR (2026-2035) 14.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Compressor Type (Scroll Compressors, Rotary Compressors, Centrifugal Compressors, Reciprocating Compressors, Axial Compressors), Capacity (Small, Medium, Large), Propulsion Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV), Fuel-cell Electric Vehicle (FCEV), Hybrid Electric Vehicle (HEV)), Technology Type (VFD, Fixed Speed) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Anhui Dyne Automotive Air Conditioning Co. Ltd., BorgWarner Inc., Brose Fahrzeugteile SE and Co. KG, Continental AG, DENSO Corp., Faurecia SE, Ingersoll Rand Inc., MAHLE GmbH, Marelli Holdings Co. Ltd., Mitsubishi Heavy Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive E-Compressor MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive E-Compressor MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Anhui Dyne Automotive Air Conditioning Co. Ltd.

- BorgWarner Inc.

- Brose Fahrzeugteile SE and Co. KG

- Continental AG

- DENSO Corp.

- Faurecia SE

- Ingersoll Rand Inc.

- MAHLE GmbH

- Marelli Holdings Co. Ltd.

- Mitsubishi Heavy Industries Ltd.