Global Automotive Crankshaft Market Size, Share, Growth Analysis By Type (Forged Crankshaft, Cast Crankshaft, Billet Crankshaft), By Material (Steel Alloy, Cast Iron, Billet Steel, Other Materials), By Manufacturing Process (Precision Forging, Casting, CNC Machining, Heat Treatment & Surface Finishing), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153218

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

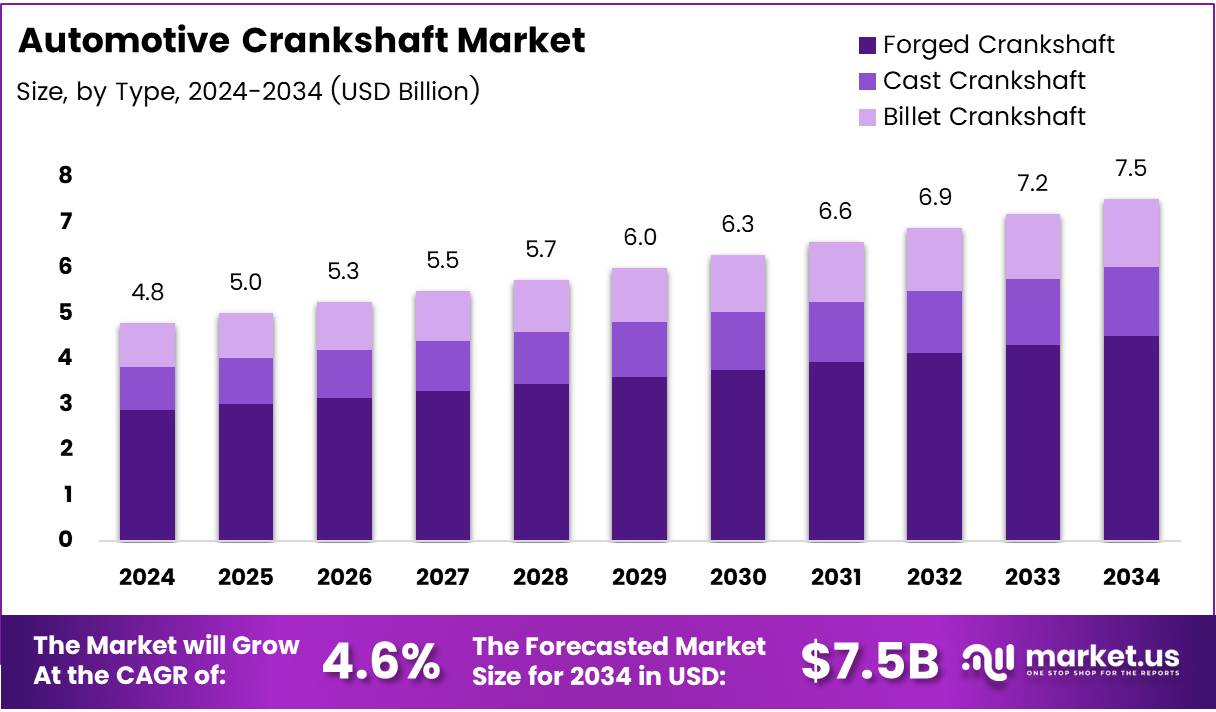

The Global Automotive Crankshaft Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The automotive crankshaft market plays a critical role in modern engine systems, transforming linear piston motion into rotational force that drives vehicles forward. As a key engine component, the crankshaft directly affects performance, fuel efficiency, and engine durability. This market is increasingly influenced by advancements in materials, forging technology, and precision engineering.

Currently, manufacturers are innovating lightweight, high-strength crankshafts to support fuel economy standards. The shift from cast iron to forged steel and micro-alloy materials is helping automakers meet emission norms. Automakers are investing in advanced manufacturing techniques like induction hardening and CNC machining to increase output consistency and mechanical strength.

Meanwhile, the market is witnessing rising demand from hybrid and turbocharged engines, where performance and compact size are critical. These trends are prompting OEMs to integrate digitally designed crankshafts with higher fatigue resistance and tighter tolerances, which is reshaping production and sourcing strategies across global supply chains.

Additionally, growth in vehicle production, especially in Asia-Pacific and Latin America, is expanding the crankshaft supplier base. Emerging economies are experiencing increased investments in automotive infrastructure and industrial development, creating fresh opportunities for component suppliers. Demand from two-wheelers and light commercial vehicles is also pushing crankshaft volumes higher in mid-size segments.

Government investments in clean mobility and vehicle electrification have sparked R&D efforts to produce lightweight crankshafts. Though EV adoption may reduce demand in the long term, hybrid vehicle growth still favors advanced internal combustion engine (ICE) components. Regulatory frameworks like Euro 7 and Bharat Stage VI are also shaping crankshaft design for lower emissions.

In North America, diesel-powered trucks still dominate long-haul transportation. According to enginetechforum, more than 15 million commercial vehicles are registered in the U.S., and 76% are powered by diesel engines. These trucks support 711,000 companies and 3.5 million drivers who fuel the U.S. logistics sector.

This vehicle density reinforces a stable aftermarket for crankshaft replacements and performance upgrades. The expanding freight movement across states also demands reliable engine components, making crankshafts vital for fleet uptime. As engine remanufacturing grows, the demand for high-quality crankshafts in both OEM and aftermarket channels is set to rise steadily.

Key Takeaways

- Global Automotive Crankshaft Market is projected to reach USD 7.5 Billion by 2034, growing at a CAGR of 4.6% from USD 4.8 Billion in 2024.

- In 2024, Forged Crankshaft led the By Type segment due to its high tensile strength and durability for heavy-duty and high-performance vehicles.

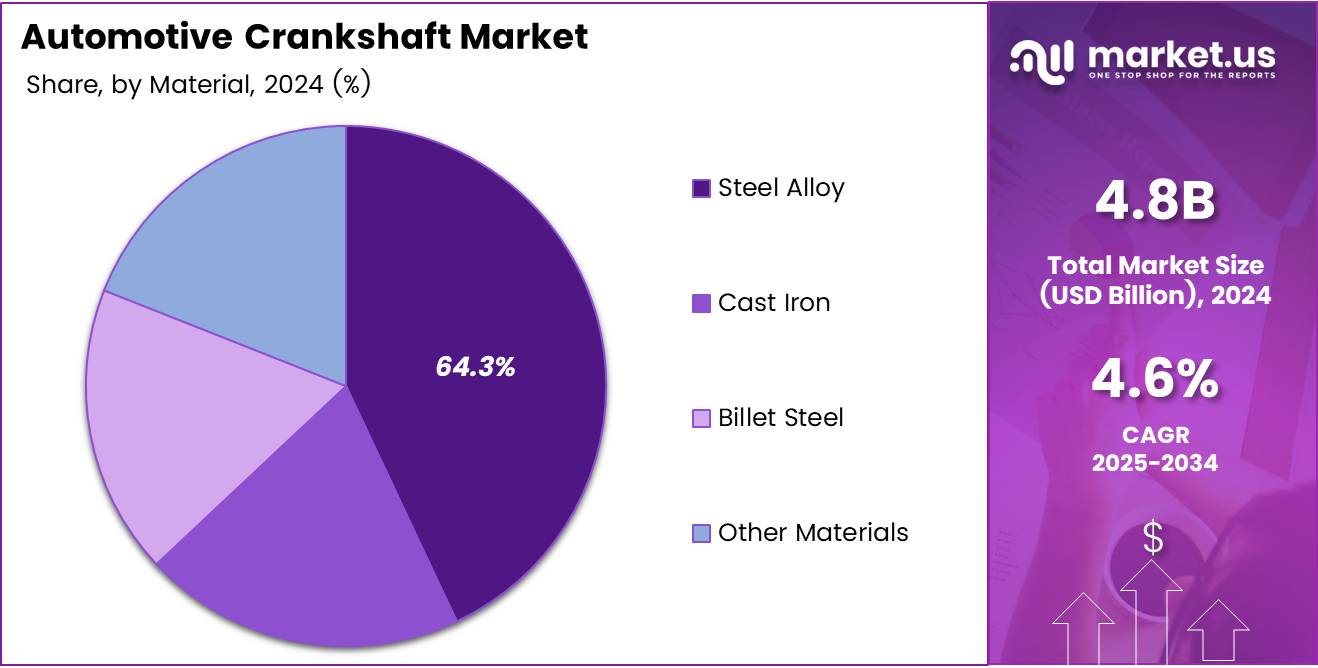

- Steel Alloy dominated the By Material segment in 2024, holding a 64.3% share, owing to its fatigue strength and wear resistance.

- Precision Forging was the leading Manufacturing Process in 2024, favored for its high strength and deformation resistance.

- Passenger Vehicles held the top position in the By Vehicle Type segment in 2024, driven by growing urban mobility and rising compact car sales.

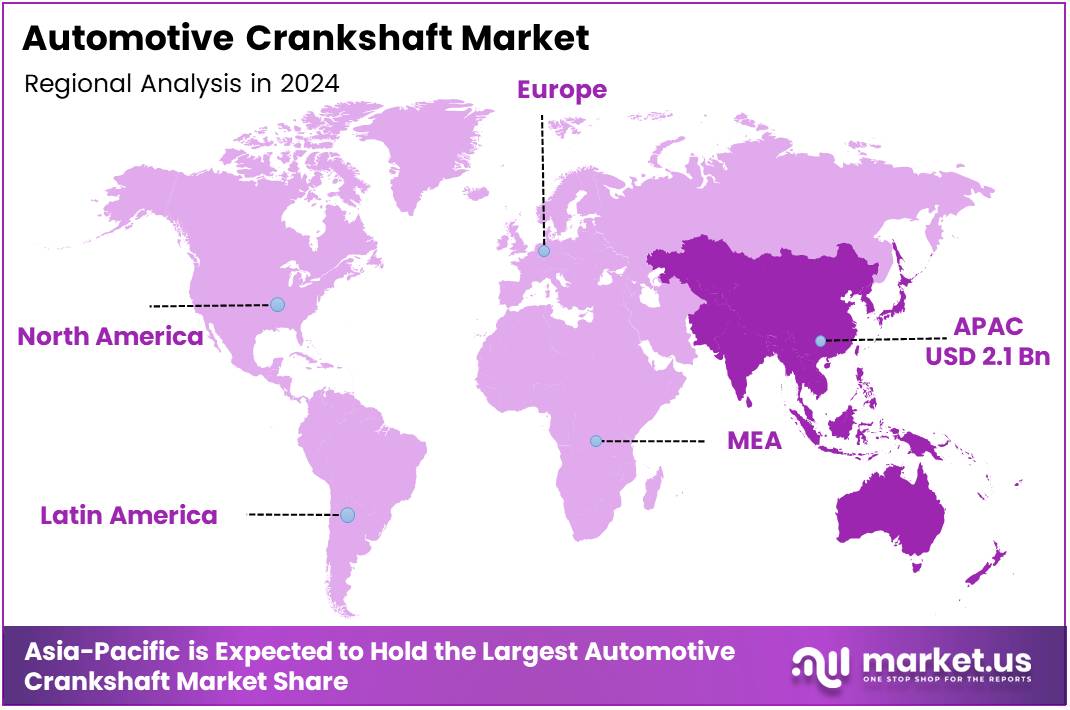

- Asia Pacific dominated the market with a 42.8% share, valued at USD 2.1 Billion in 2024, supported by large-scale production in China, India, and Japan.

Type Analysis

Forged Crankshaft leads with highest share due to its superior strength and fatigue resistance.

In 2024, Forged Crankshaft held a dominant market position in By Type Analysis segment of the Automotive Crankshaft Market. Its high tensile strength and impact resistance make it the preferred choice for high-performance and heavy-duty vehicles. Automakers continue to rely on forging techniques to enhance durability and service life in demanding applications.

Cast Crankshaft followed with a moderate market share, benefiting from its cost-effectiveness and ease of production. Though not as strong as forged types, cast variants are widely used in economy and passenger vehicles where stress requirements are lower. The segment maintains relevance due to lightweight construction and lower tooling costs.

Billet Crankshaft represents a niche but premium segment. Though more expensive, billet types offer unmatched precision and customization, making them suitable for motorsports and performance tuning. Their adoption is limited by production cost but is rising in aftermarket and racing domains.

Material Analysis

Steel Alloy dominates with 64.3% share due to its excellent performance under high load conditions.

In 2024, Steel Alloy held a dominant market position in By Material Analysis segment of the Automotive Crankshaft Market, with a 64.3% share. This dominance is attributed to its high fatigue strength, wear resistance, and adaptability in both forging and machining applications. It continues to be the preferred material for OEMs producing crankshafts for performance-oriented vehicles.

Cast Iron accounted for a smaller portion of the market, owing to its lower manufacturing cost and adequate performance for entry-level vehicles. It remains a viable material choice in budget-friendly engine designs where maximum load capacity is not critical.

Billet Steel, used in premium and performance-focused applications, combines precision and strength. Though costly, it is chosen for custom-engineered parts and specialty vehicles. Its adoption is increasing among aftermarket manufacturers and racing industries.

Other Materials make up a minimal share and include composites or experimental metals. These are under R\&D focus, offering potential for future growth depending on cost-performance balance and industry acceptance.

Manufacturing Process Analysis

Precision Forging dominates with highest share due to its structural integrity and material efficiency.

In 2024, Precision Forging held a dominant market position in By Manufacturing Process Analysis segment of the Automotive Crankshaft Market. This process ensures superior metallurgical properties, enabling high strength and resistance to deformation under high-speed operations. Automakers widely adopt this method for crankshaft production in both performance and utility vehicles.

Casting is favored for its cost efficiency and design flexibility, making it suitable for lower-stress applications. Though structurally weaker than forged parts, it continues to serve well in compact vehicles and budget models.

CNC Machining holds relevance for achieving tight tolerances and customization. It is commonly used to finish forged or billet crankshafts, enhancing surface quality and performance. However, high tooling costs limit its application to specialized or low-volume runs.

Heat Treatment & Surface Finishing supports durability enhancement by improving hardness and resistance to wear. While not a primary manufacturing process, it remains a vital step across all crankshaft production lines to meet performance and longevity standards.

Vehicle Type Analysis

Passenger Vehicles dominate with highest share due to high production volumes and growing global demand.

In 2024, Passenger Vehicles held a dominant market position in By Vehicle Type Analysis segment of the Automotive Crankshaft Market. Their widespread presence in urban transport and rising consumer preference for personal mobility contribute significantly to this segment’s leadership. Growth in compact and mid-size vehicles further supports crankshaft demand.

Commercial Vehicles occupy a secondary position, driven by their robust engine requirements and the need for high-performance crankshafts in logistics and freight movement. Though lower in unit volume compared to passenger vehicles, the segment benefits from longer operational cycles and heavy-duty application, requiring durable and high-strength crankshafts.

As both vehicle segments evolve with stricter emission norms and increased engine efficiency standards, the demand for advanced crankshaft materials and production techniques is expected to rise in tandem.

Key Market Segments

By Type

- Forged Crankshaft

- Cast Crankshaft

- Billet Crankshaft

By Material

- Steel Alloy

- Cast Iron

- Billet Steel

- Other Materials

By Manufacturing Process

- Precision Forging

- Casting

- CNC Machining

- Heat Treatment & Surface Finishing

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Drivers

Rising Production of Heavy-Duty Commercial Vehicles Drives Crankshaft Demand

As more goods are moved across continents, the demand for heavy-duty commercial vehicles is climbing. Countries like the U.S., China, and India are seeing strong growth in freight transportation. These vehicles require durable crankshafts that can withstand high loads and stress, pushing up global demand.

Advanced forging and machining techniques are also transforming the crankshaft manufacturing process. These new methods ensure higher precision, better fatigue resistance, and longer component life. As a result, automakers are rapidly adopting these technologies to meet strict performance and emissions standards.

Crankshaft sensors are gaining attention due to their role in engine health monitoring. By integrating real-time data collection systems, manufacturers can enhance vehicle efficiency, reduce breakdowns, and enable predictive maintenance—further driving the use of sensor-enabled crankshafts.

The motorsport and luxury car segments are witnessing rising demand for high-performance engines. These engines require lightweight, high-strength crankshafts designed to handle extreme torque and speed. This trend is fueling innovation and volume growth in the premium crankshaft segment.

Restraints

Volatility in Raw Material Prices Pressures Crankshaft Manufacturing Margins

Crankshaft production depends heavily on steel and alloy prices, which often fluctuate due to global trade issues, energy costs, or raw material shortages. Such price swings increase overall production costs, putting pressure on manufacturers’ profit margins.

Another issue arises in the design of crankshafts for hybrid powertrains. These systems are more complex and require precise balancing and strength to support both internal combustion engines and electric motors, leading to engineering and cost challenges.

High-end forged crankshafts are costly, making them less feasible for budget cars. Automakers building entry-level models tend to choose cheaper alternatives like cast crankshafts, limiting the wider adoption of premium technologies.

Growth Factors

Expansion of Automotive Manufacturing in Southeast Asia Fuels Growth

Countries like Vietnam, Indonesia, and Thailand are becoming manufacturing hubs due to lower labor costs and growing vehicle demand. This regional expansion is increasing the local need for crankshafts, especially in commercial and passenger vehicles.

In the aftermarket segment, there is a growing demand for customized crankshafts used in performance tuning. Car enthusiasts and motorsport professionals often replace stock crankshafts to enhance engine output, opening new sales channels for custom units.

The agriculture and marine sectors are also seeing growth in small engines. These sectors use compact crankshafts in tractors, boats, and pumps—extending the market beyond automobiles.

Additionally, OEMs are shifting toward local sourcing of engine components to cut logistics costs and reduce import dependency. This trend benefits regional crankshaft manufacturers, giving them more opportunities to partner with large automakers.

Emerging Trends

Digital Twin and AI-Based Design Are Shaping Future Crankshafts

AI-driven design tools are being used to simulate crankshaft behavior under different load conditions. This leads to better product quality, shorter development time, and reduced need for physical testing, helping companies speed up innovation cycles.

Noise, vibration, and harshness (NVH) levels are critical for modern vehicles, especially EVs and premium models. Manufacturers are investing in crankshaft design improvements to reduce NVH, making driving smoother and more comfortable.

Digital twin technology allows engineers to create a virtual replica of a crankshaft and monitor its performance in real-time. This helps identify faults early and optimize the design based on actual engine usage data—making development smarter and more efficient.

Regional Analysis

Asia Pacific Leads the Automotive Crankshaft Market with a Market Share of 42.8%, Valued at USD 2.1 Billion

In 2024, Asia Pacific emerged as the dominant region in the automotive crankshaft market 42.8%, Valued at USD 2.1 Billion, driven by strong vehicle production across countries like China, India, and Japan. The region benefits from a well-established manufacturing base, abundant availability of raw materials, and increasing demand for both commercial and passenger vehicles. Rising investments in automotive innovation and government-backed industrial initiatives further bolster regional growth.

North America Automotive Crankshaft Market Trends

North America continues to be a mature and technologically advanced market for crankshaft production, supported by a strong presence of engine technology and durable vehicle demand. Growth is propelled by the rising production of high-performance vehicles and the adoption of advanced forging and machining technologies. The region also emphasizes fuel efficiency standards, encouraging the development of lightweight yet durable crankshaft components.

Europe Automotive Crankshaft Market Trends

In Europe, the crankshaft market reflects steady growth, influenced by stringent emission norms and the push towards hybrid and electric powertrains. Nations such as Germany and France remain central to automotive component innovation, and the transition toward sustainable mobility fuels demand for optimized crankshaft designs. Continued R&D and a strong base of auto part suppliers contribute to regional momentum.

Middle East and Africa Automotive Crankshaft Market Trends

The Middle East and Africa region displays gradual expansion in the automotive crankshaft market, supported by infrastructure projects and rising commercial vehicle imports. While local manufacturing is limited, demand for reliable crankshaft components is increasing in response to fleet modernization efforts. Government-led industrial development programs in Gulf nations offer new growth pathways.

Latin America Automotive Crankshaft Market Trends

Latin America’s market growth is modest yet promising, with Brazil and Mexico leading vehicle production and aftermarket demand. Economic recovery, urbanization, and improving logistics infrastructure are encouraging vehicle assembly and part manufacturing. Despite challenges such as regulatory uncertainty and fluctuating raw material costs, the region holds potential for long-term crankshaft market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Crankshaft Company Insights

In 2024, the global automotive crankshaft market witnessed strategic growth led by leading manufacturers focusing on technology, performance, and production scale.

NSI Crankshaft Company remained a dependable player in North America, capitalizing on its expertise in producing precision crankshafts for both commercial vehicles and performance applications. The company’s focus on durable materials and tight tolerances helped it maintain strong OEM partnerships.

Bharat Forge Ltd strengthened its global presence by leveraging its high-capacity forging facilities and R&D capabilities. With a strong customer base across Europe and the U.S., the company continued to drive innovation in lightweight and high-strength crankshafts to meet evolving fuel efficiency standards. Its aggressive expansion into electric and hybrid powertrains also positioned it favorably for future demand.

Maschinenfabrik Alfing Kessler GmbH remained influential in the European market, focusing on advanced machining solutions and heat treatment technologies. Its deep integration into premium automotive supply chains allowed the company to deliver high-performance crankshafts, especially for luxury and motorsport engines. Continued investments in digital manufacturing also boosted production efficiency.

Crower Cams & Equipment Co., Inc. upheld its niche in high-performance and custom racing crankshafts. Its specialization in billet crankshafts and custom camshafts sustained demand from motorsport and specialty vehicle segments. The company’s strong reputation for precision engineering and product customization remained central to its competitive edge.

Collectively, these companies shaped the competitive dynamics of the crankshaft market through innovation, reliability, and adaptation to next-gen mobility solutions, including hybrid and EV-compatible crankshaft designs.

Top Key Players in the Market

- NSI Crankshaft Company

- Bharat Forge Ltd

- Maschinenfabrik Alfing Kessler GmbH

- Crower Cams & Equipment Co., Inc.

- Rheinmetall AG

- Tianrun Crankshaft Co. Ltd.

- Arrow Precision Ltd

- Kellogg Crankshaft Company

- Thysse

Recent Developments

- In May 2025, Daimler Truck and Volvo Group announced their intention to establish a joint venture focused on developing a software-defined vehicle platform. This collaboration aims to drive digital transformation in the commercial vehicle sector by enhancing vehicle connectivity and over-the-air service capabilities.

- In June 2025, DEUTZ achieved a key strategic milestone by completing an acquisition that supports its transition toward electrified powertrains. This move significantly boosts DEUTZ’s capabilities in electrifying heavy-duty applications across industrial and off-highway segments.

- In July 2024, HD Hyundai received approval for its merger with STX, solidifying its leadership in South Korea’s crankshaft market. The merger strengthens its production capabilities and secures its dominance in both domestic and global crankshaft supply chains.

- In October 2024, Bharat Forge revealed plans to acquire AAM India Manufacturing Corporation for ₹544 crore. This acquisition is expected to expand Bharat Forge’s footprint in the Indian automotive components market, particularly in driveline and powertrain solutions.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Forged Crankshaft, Cast Crankshaft, Billet Crankshaft), By Material (Steel Alloy, Cast Iron, Billet Steel, Other Materials), By Manufacturing Process (Precision Forging, Casting, CNC Machining, Heat Treatment & Surface Finishing), By Vehicle Type (Passenger Vehicles, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape NSI Crankshaft Company, Bharat Forge Ltd, Maschinenfabrik Alfing Kessler GmbH, Crower Cams & Equipment Co., Inc., Rheinmetall AG, Tianrun Crankshaft Co. Ltd., Arrow Precision Ltd, Kellogg Crankshaft Company, Thyssenkrupp AG, Sandvik AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Crankshaft MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Crankshaft MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NSI Crankshaft Company

- Bharat Forge Ltd

- Maschinenfabrik Alfing Kessler GmbH

- Crower Cams & Equipment Co., Inc.

- Rheinmetall AG

- Tianrun Crankshaft Co. Ltd.

- Arrow Precision Ltd

- Kellogg Crankshaft Company

- Thysse