Global Automotive Brake Pad Market Size, Share, Growth Analysis By Material Type (Semi-metallic, Non-asbestos Organic, Low-metallic, Ceramic), By Position Type (Front, Rear), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel Type (Aftermarket, Original Equipment Manufacturers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155254

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

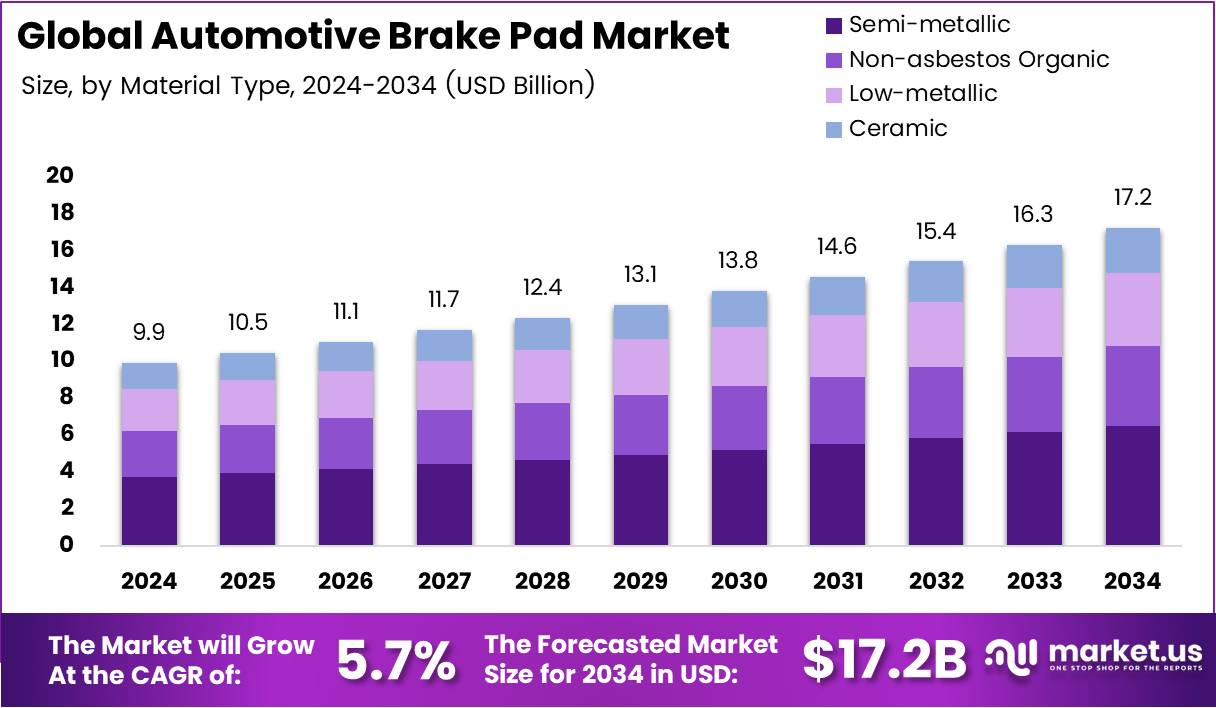

The Global Automotive Brake Pad Market size is expected to be worth around USD 17.2 Billion by 2034, from USD 9.9 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The automotive brake pad market is integral to the vehicle’s safety and performance. Brake pads are essential components of braking systems, converting kinetic energy into heat. The market is expanding due to rising vehicle production and growing demand for safer, more efficient braking systems. Additionally, with an increased focus on electric vehicles, brake pad demand is projected to surge.

Several opportunities lie ahead for businesses in the automotive brake pad market. With technological advancements, manufacturers are shifting towards developing low-noise, high-performance brake pads that also reduce wear and tear.

Additionally, growing awareness of the environmental impact of traditional brake pads creates opportunities for eco-friendly alternatives, such as ceramic brake pads. These products are poised to drive market growth further.

Government regulations also play a significant role in shaping the automotive brake pad market. Governments across various regions are implementing strict regulations concerning vehicle safety standards, which mandate the use of high-quality brake pads.

These regulations ensure that automotive companies continuously improve their braking technologies, contributing to market growth. Additionally, environmental concerns have prompted regulatory bodies to introduce standards for reducing brake dust and particulate emissions.

Investments in the automotive sector from both governments and private companies are stimulating innovations in brake pad technology. Governments are funding research and development to encourage sustainable automotive components. Moreover, with the rise of electric and autonomous vehicles, investments in specialized braking systems are expected to grow. This is anticipated to open new avenues for market expansion.

The automotive brake pad market is highly competitive, with several key players focusing on strategic partnerships and acquisitions to maintain market leadership. As the demand for high-performance and sustainable brake systems increases, manufacturers are investing in advanced materials and technologies. This focus on innovation is expected to enhance product offerings and meet evolving consumer needs.

Key Takeaways

- Global Automotive Brake Pad Market size is expected to reach USD 17.2 Billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

- Semi-metallic segment held 37.8% market share in 2024, driven by its durability and balance between performance and cost.

- Front position type held 68.9% market share in 2024, as front brake pads handle more of the braking load and wear out faster.

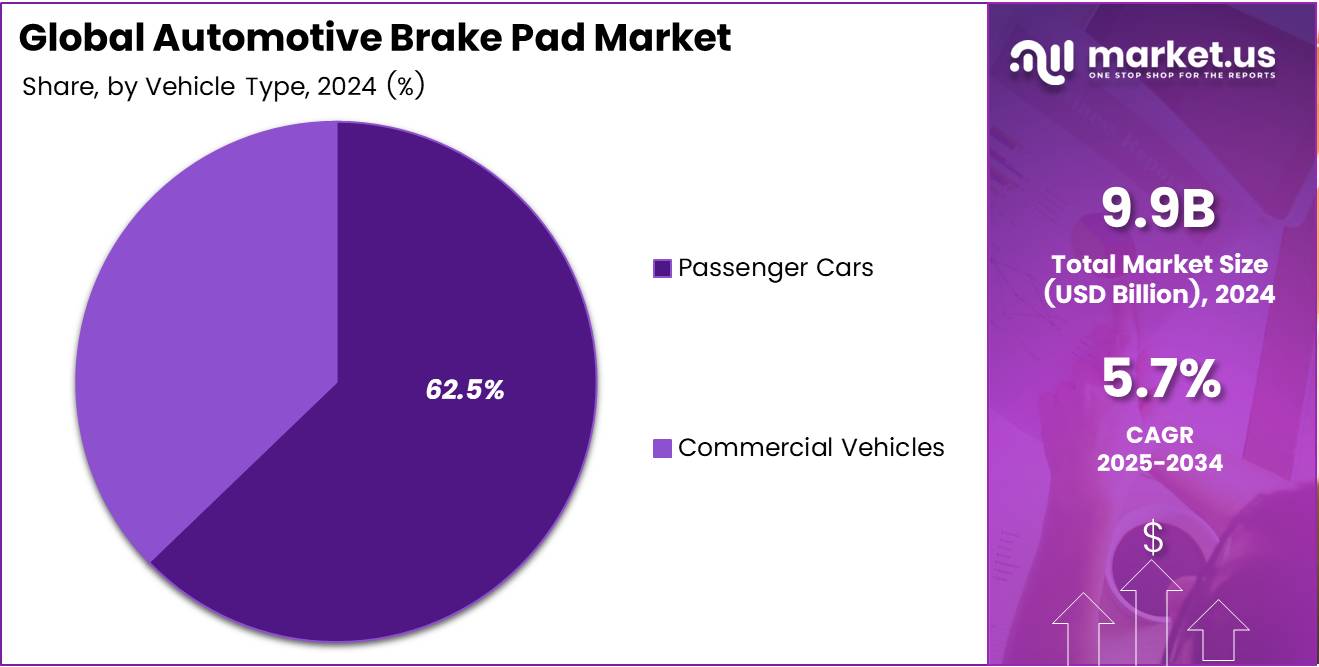

- Passenger cars commanded 62.5% market share in 2024, driven by the high number of vehicles and aftermarket replacement demand.

- Aftermarket segment accounted for 62.4% of the market in 2024, favored for affordability and frequent brake pad replacements.

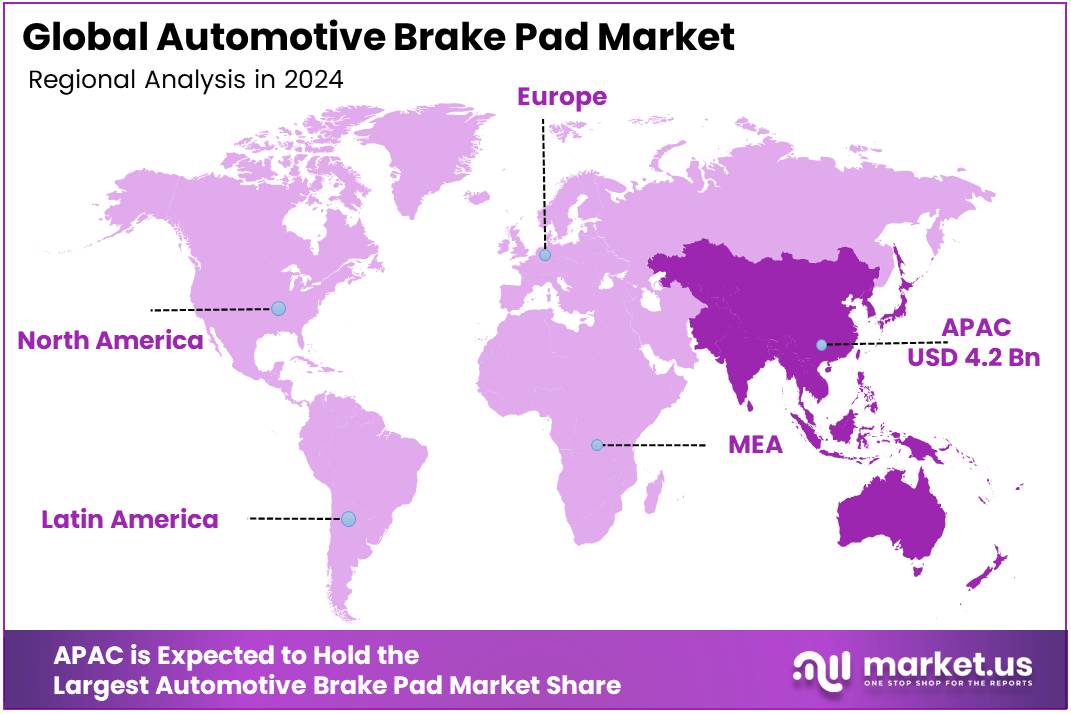

- Asia Pacific region holds 42.8% market share, valued at USD 4.2 Billion, driven by the growing automotive industry in China and India.

Material Type Analysis

Semi-metallic dominates with 37.8% due to its durability and cost-effectiveness.

In 2024, the semi-metallic segment held the largest market share in the automotive brake pad market by material type, commanding a significant 37.8% share. This dominance is attributed to the material’s durability, which makes it suitable for a variety of vehicle types and driving conditions. Semi-metallic brake pads offer a balance between performance and cost, making them popular among both manufacturers and consumers.

The non-asbestos organic brake pads, although effective, account for a smaller market share, as they are often seen as less durable compared to semi-metallic options. These brake pads are favored for their quieter operation and eco-friendly attributes but are less common in heavy-duty applications.

Low-metallic brake pads are expected to see moderate growth, primarily driven by their improved braking performance compared to non-asbestos options. However, their share remains smaller due to the higher cost associated with their materials.

Ceramic brake pads, while offering superior performance and less dust, continue to capture a niche segment in the market, catering to higher-end vehicles and premium applications. The segment, however, holds a smaller share compared to semi-metallic brake pads.

Position Type Analysis

Front dominates with 68.9% due to higher demand for braking performance in the front axle.

In 2024, the front position type held the dominant market share in the automotive brake pad market, accounting for 68.9% of the total market. This can be attributed to the fact that the front brake pads handle more of the braking load compared to the rear pads, as they are crucial for the vehicle’s overall stopping power. The front brake pads are more likely to wear out faster, driving the higher demand.

Rear brake pads are generally less in demand due to their secondary role in vehicle braking. They contribute less to the overall performance, which is why they hold a smaller market share compared to their front counterparts. Despite this, rear brake pads still maintain a significant share, particularly for certain vehicle types that require balanced braking.

Vehicle Type Analysis

Passenger Cars dominate with 62.5% due to their widespread use and consistent demand.

In 2024, passenger cars held the dominant share in the automotive brake pad market by vehicle type, commanding 62.5% of the market. This dominance is driven by the high number of passenger vehicles on the road and the consistent demand for replacement brake pads. Passenger cars also contribute significantly to aftermarket sales, further reinforcing the segment’s position.

Commercial vehicles, while critical to the industry, account for a smaller share compared to passenger cars. The brake pad needs for commercial vehicles are specialized, and their relatively lower numbers in comparison to passenger vehicles result in a smaller market share for this category.

Sales Channel Type Analysis

Aftermarket dominates with 62.4% due to the high demand for brake pad replacements.

In 2024, the aftermarket segment held the largest market share in the automotive brake pad market, with 62.4% of the total market. This can be attributed to the high frequency of brake pad replacements in passenger vehicles and commercial fleets. Consumers and service providers prefer aftermarket brake pads due to their affordability and availability, driving this segment’s dominance.

Original Equipment Manufacturers (OEMs) play a crucial role, but their market share is smaller at present, accounting for a lesser portion of the brake pad market. OEM brake pads are typically sold with new vehicles and are designed for specific models, which limits their market presence compared to the broader aftermarket segment.

Key Market Segments

By Material Type

- Semi-metallic

- Non-asbestos Organic

- Low-metallic

- Ceramic

By Position Type

- Front

- Rear

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Sales Channel Type

- Aftermarket

- Original Equipment Manufacturers (OEMs)

Drivers

Increasing Vehicle Production and Sales Drives Automotive Brake Pad Market Growth

The growing production and sales of vehicles worldwide are significantly driving the demand for automotive brake pads. As the number of vehicles on the road increases, so does the need for high-quality brake pads to ensure vehicle safety. This trend is especially noticeable in emerging economies, where the automotive sector is expanding rapidly due to urbanization and rising income levels. The ongoing production of both internal combustion engine (ICE) and electric vehicles (EVs) is further propelling market demand for reliable braking solutions.

With the demand for vehicles continuing to rise, manufacturers are focusing on developing brake pads that meet the increasing performance and safety standards required for modern vehicles. This shift contributes to the growth of the brake pad market, driven by consumers’ need for durable, efficient, and high-performance braking systems. The demand is anticipated to continue its upward trajectory as the automotive industry recovers and expands globally.

Restraints

Volatile Raw Material Prices Impacting Brake Pad Manufacturing

One of the major challenges faced by the automotive brake pad market is the volatility in raw material prices. Brake pads are primarily made from materials like steel, copper, rubber, and friction compounds, and fluctuations in the prices of these raw materials can impact manufacturing costs.

Any significant increase in the cost of raw materials forces manufacturers to adjust their pricing, which can result in higher production costs and, in some cases, reduced profit margins. This instability poses a challenge for brake pad manufacturers in maintaining competitive pricing while ensuring high-quality products.

Additionally, fluctuations in raw material prices can disrupt supply chains, making it difficult for manufacturers to secure consistent material availability. These issues create uncertainty in the production schedules and can lead to delays in the delivery of brake pads to the automotive market. As a result, companies in the brake pad industry need to find ways to mitigate these challenges, such as securing long-term contracts with suppliers or exploring alternative materials.

Growth Factors

Expansion of Electric Vehicle Market Driving Automotive Brake Pad Market Growth

The expansion of the electric vehicle (EV) market presents significant growth opportunities for the automotive brake pad market. EVs have unique braking requirements, necessitating the development of specialized brake pads to ensure optimal performance and safety. As the global EV market grows, manufacturers are focusing on producing brake pads that are compatible with the regenerative braking systems in these vehicles, which reduce the wear on conventional brake pads.

The rising adoption of regenerative braking systems in hybrid and electric vehicles is another key factor contributing to the growth of the automotive brake pad market. These systems recover energy during braking, reducing the reliance on traditional friction braking and extending the lifespan of brake pads. As the adoption of these technologies continues to grow, manufacturers are innovating in brake pad materials and designs to meet the specific needs of hybrid and electric vehicles.

Emerging Trends

Growing Preference for Environmentally Friendly and Sustainable Brake Pad Solutions

There is a noticeable shift towards environmentally friendly and sustainable brake pad solutions, driven by increasing consumer awareness of environmental issues and regulatory pressures. Brake pads traditionally contain copper, which has raised environmental concerns due to its harmful effects on ecosystems when it is released into the environment through brake wear. As a result, many manufacturers are focusing on producing eco-friendly brake pads that contain minimal or no copper and use sustainable materials.

Advancements in brake pad coatings are also enhancing their performance. These coatings improve braking efficiency and reduce wear, leading to longer-lasting products. Additionally, the integration of smart sensors into brake pads is becoming increasingly popular. These sensors enable predictive maintenance, alerting vehicle owners when brake pads need replacement, improving safety, and reducing unnecessary replacements.

Lastly, there is a growing shift towards lightweight brake pad solutions. By reducing the weight of brake pads, manufacturers help improve the fuel efficiency of vehicles, especially in the context of electric and hybrid vehicles, where every reduction in weight contributes to longer battery life and overall vehicle efficiency.

Regional Analysis

Asia Pacific Dominates the Automotive Brake Pad Market with a Market Share of 42.8%, Valued at USD 4.2 Billion

The Asia Pacific region holds the Market Share of 42.8%, Valued at USD 4.2 Billion of the automotive brake pad market, driven by the rapidly growing automotive industry, particularly in countries like China and India. The region’s dominance is also supported by a high volume of vehicle production and the increasing demand for both OEM and aftermarket brake pads. Additionally, the rise in automotive safety regulations and advancements in braking technologies contribute significantly to the market’s expansion in this region.

North America Automotive Brake Pad Market Trends

North America is another major player in the automotive brake pad market, with strong demand primarily driven by the United States. The region’s growth is fueled by the rising adoption of electric vehicles (EVs) and hybrid cars, which require advanced braking systems. Furthermore, the presence of well-established automotive manufacturers and a high emphasis on vehicle safety standards continue to support the region’s dominance in the market.

Europe Automotive Brake Pad Market Trends

Europe has a significant share in the automotive brake pad market, supported by the increasing focus on automotive innovation and the demand for sustainable automotive solutions. The European market is witnessing a shift towards eco-friendly and noise-reducing brake pads, driven by stringent regulatory policies regarding vehicle emissions and safety. The region is also a hub for the production of high-performance automotive systems, further bolstering market growth.

Middle East and Africa Automotive Brake Pad Market Trends

The Middle East and Africa region is experiencing gradual growth in the automotive brake pad market, driven by increasing automotive sales and infrastructural developments in countries like the UAE and Saudi Arabia. While the region’s market is relatively smaller compared to others, it shows promising potential with the growing adoption of high-end vehicles and the expansion of transportation networks, leading to an increasing demand for automotive components, including brake pads.

Latin America Automotive Brake Pad Market Trends

Latin America represents a developing market for automotive brake pads, where growth is driven by the expansion of the automotive sector in countries like Brazil and Mexico. Rising vehicle production and growing automotive aftermarket activities are significant contributors to the region’s market growth. Additionally, government regulations aimed at improving vehicle safety are expected to further propel the demand for advanced brake pads in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Brake Pad Company Insights

In 2024, Akebono Brake Corporation continues to maintain a strong presence in the global automotive brake pad market, known for its innovative brake technologies. With a focus on providing advanced friction materials, the company is well-positioned to meet the growing demand for high-performance, environmentally friendly brake systems across various automotive sectors.

Delphi Technologies remains a key player, leveraging its extensive experience in brake technologies to offer a broad range of solutions for both OEMs and aftermarket suppliers. The company’s emphasis on smart braking systems and its focus on sustainability allow it to cater to evolving market needs, driving demand in both conventional and electric vehicle segments.

DRIV Automotive Inc., a prominent player, focuses on providing cost-effective and reliable brake pads to its customer base. Its extensive product line caters to various vehicle types, including heavy-duty and passenger vehicles. DRIV Automotive’s ability to supply a diverse array of high-quality products contributes significantly to its standing in the competitive brake pad market.

Dynamic Friction Company continues to solidify its position by offering cutting-edge brake components designed to meet stringent safety standards. The company’s commitment to precision manufacturing and innovative materials helps it capture a significant share of the global market, especially in North America and Europe, where safety regulations are rigorous.

These companies play a pivotal role in shaping the global automotive brake pad landscape, with a focus on quality, innovation, and environmental sustainability driving their market growth.

Top Key Players in the Market

- Akebono Brake Corporation

- Delphi Technologies

- DRIV Automotive Inc.

- Dynamic Friction Company

- EBC Brakes

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Maruti Suzuki India Limited

- Masu Brakes

- Robert Bosch LLC

Recent Developments

- In December 2024, Momentum USA, Inc., a prominent friction company, acquired Max Power Friction, located in Toronto, Canada, enhancing its market presence and expanding its portfolio in the friction industry.

- In September 2024, Monroe Capital launched a $1 billion fund aimed at supporting small automotive suppliers as they navigate the industry’s shift towards electric vehicles (EVs), ensuring they remain competitive in a rapidly changing market.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Billion Forecast Revenue (2034) USD 17.2 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Semi-metallic, Non-asbestos Organic, Low-metallic, Ceramic), By Position Type (Front, Rear), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel Type (Aftermarket, Original Equipment Manufacturers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Akebono Brake Corporation, Delphi Technologies, DRIV Automotive Inc., Dynamic Friction Company, EBC Brakes, HELLA GmbH & Co. KGaA, Hitachi Astemo, Ltd., Maruti Suzuki India Limited, Masu Brakes, Robert Bosch LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Brake Pad MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Brake Pad MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akebono Brake Corporation

- Delphi Technologies

- DRIV Automotive Inc.

- Dynamic Friction Company

- EBC Brakes

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Maruti Suzuki India Limited

- Masu Brakes

- Robert Bosch LLC