Global Automotive Adhesive Tapes Market By Product Type (Double-Sided Adhesive Tapes, Single-Sided Adhesive Tapes, Others), By Application(Interior, Exterior, Electrical Systems, Others), By Material(Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Others), By Adhesive Chemistry(Solvent, Emulsion), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 17072

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

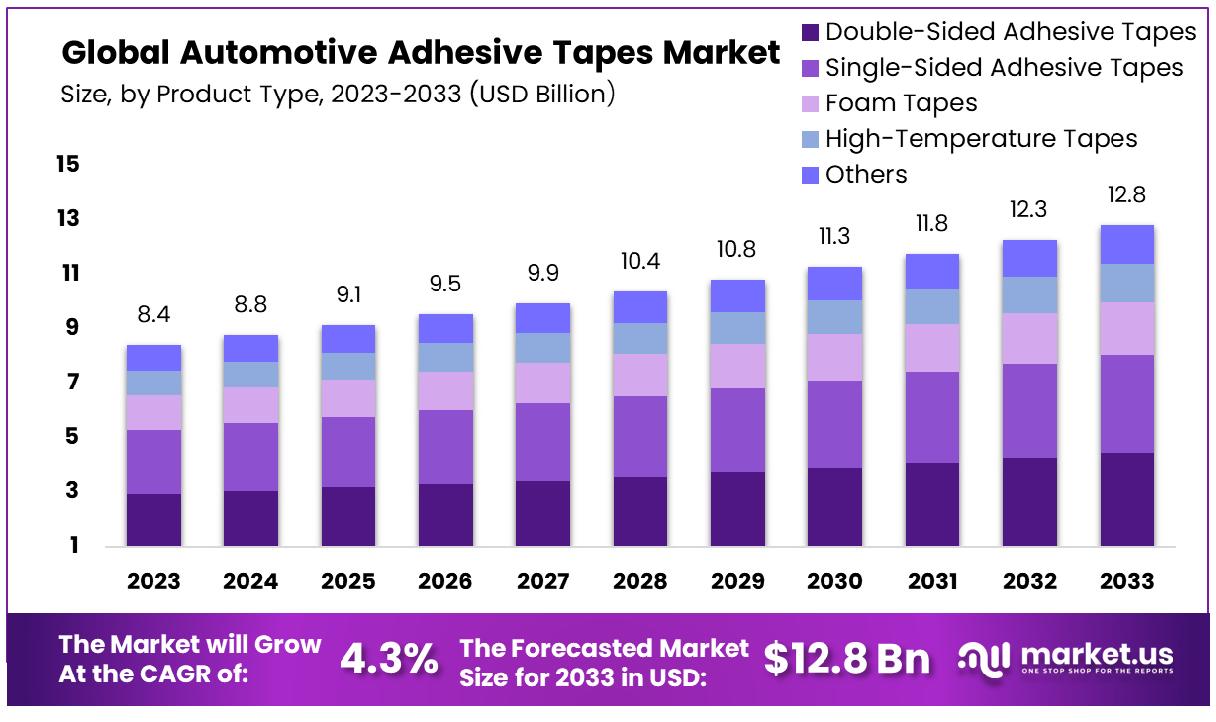

The Global Automotive Adhesive Tapes Market size is expected to be worth around USD 12.8 Billion by 2033, from USD 8.4 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Automotive Adhesive Tapes Market encompasses the production, distribution, and sale of adhesive tapes used for bonding, sealing, and assembly in automotive manufacturing and repair processes.

The Automotive Adhesive Tapes Market represents a specialized segment within the broader automotive industry, focused on the innovation, production, and application of adhesive tapes designed to meet the rigorous demands of automotive manufacturing and maintenance. These tapes play a crucial role in enhancing vehicle performance, safety, and aesthetics through applications in bonding, sealing, insulation, and vibration damping.

As automotive manufacturers continue to prioritize efficiency, durability, and lightweight design, the demand for high-quality adhesive tapes that offer superior adhesion, environmental resistance, and ease of application is on the rise. This market is pivotal for stakeholders aiming to leverage advanced materials technology to drive automotive innovation and competitiveness.

The Automotive Adhesive Tapes Market is experiencing a transformative phase, driven by the global automotive industry’s shift towards sustainability and efficiency. The market’s growth is intricately linked to the automotive sector’s adaptation to evolving regulatory standards, consumer preferences for eco-friendly vehicles, and the relentless pursuit of performance enhancements.

The significant uptick in global plug-in vehicle deliveries, as reported by the International Energy Agency’s Global EV Outlook 2019, with deliveries reaching 2,264,400 units in 2019, underscores a paradigm shift towards electric vehicles (EVs). This trend not only signals a departure from traditional automotive fuels but also highlights the increasing demand for lightweight and high-performance materials, including automotive adhesive tapes.

These adhesive solutions are pivotal in enabling automotive manufacturers to achieve substantial weight reductions without compromising on vehicle integrity or performance. As evidenced by a study from the U.S. Department of Energy, a mere 10% reduction in vehicle weight can lead to a 6-8% increase in fuel efficiency.

This data underscores the critical role of automotive adhesive tapes in the broader context of industry efforts to enhance fuel efficiency and reduce emissions. Manufacturers are leveraging these tapes to secure materials that are both lighter and more durable, thereby contributing to the overall sustainability of automotive production.

In this light, the Automotive Adhesive Tapes Market is positioned at the nexus of innovation and environmental stewardship. Market leaders and stakeholders are increasingly focused on developing adhesive solutions that meet the dual demands of performance and sustainability. As the automotive industry continues to evolve, the demand for these tapes is expected to rise, reflecting broader trends toward vehicle electrification, efficiency, and reduced environmental impact.

Key Takeaways

- Market Size: Automotive Adhesive Tapes Market size is expected to be worth around USD 12.8 Billion by 2033, from USD 8.4 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

- Product Type Analysis: The Automotive Adhesive Tapes Market is characterized by product type held by a dominant share of 34.6%.

- Application Analysis: The Automotive Adhesive Tapes Market is characterized by applications holding a dominant share of 30.1%.

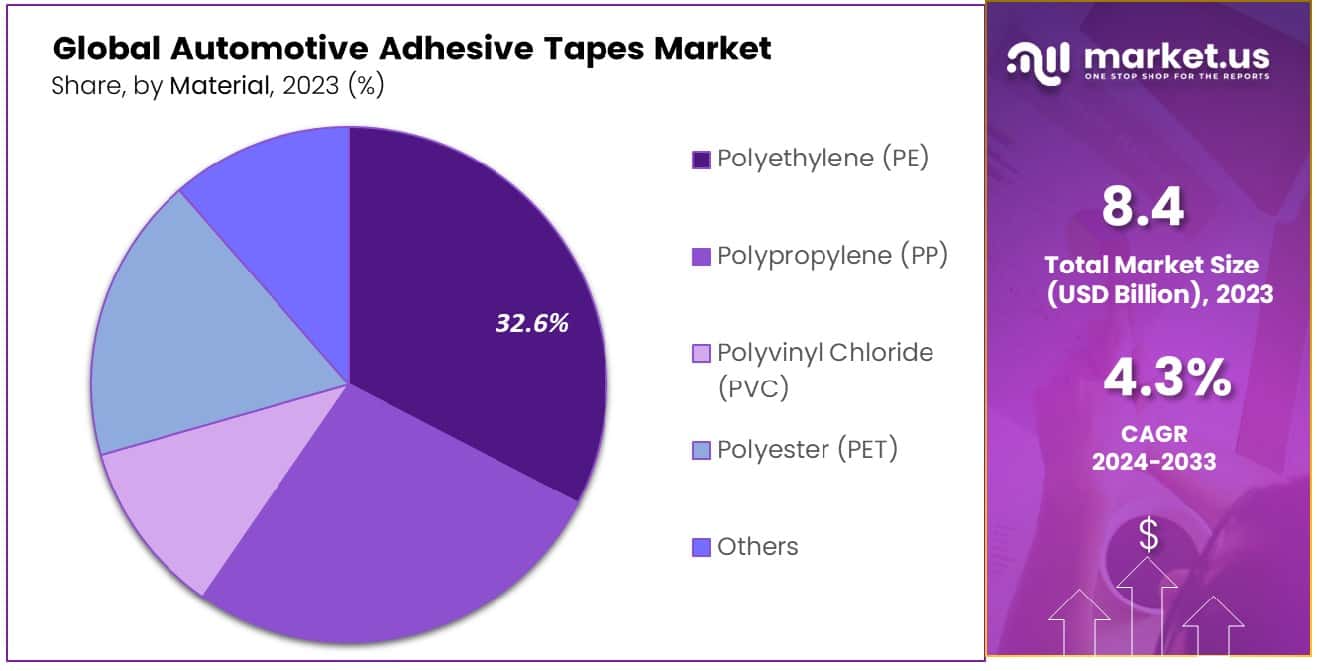

- Material Analysis: The Polyethylene (PE) sub-segment held a dominant market position, capturing more than a 32.6% share.

- Adhesive Chemistry Analysis: The Solvent sub-segment held a dominant market position, capturing more than a 43.4% share.

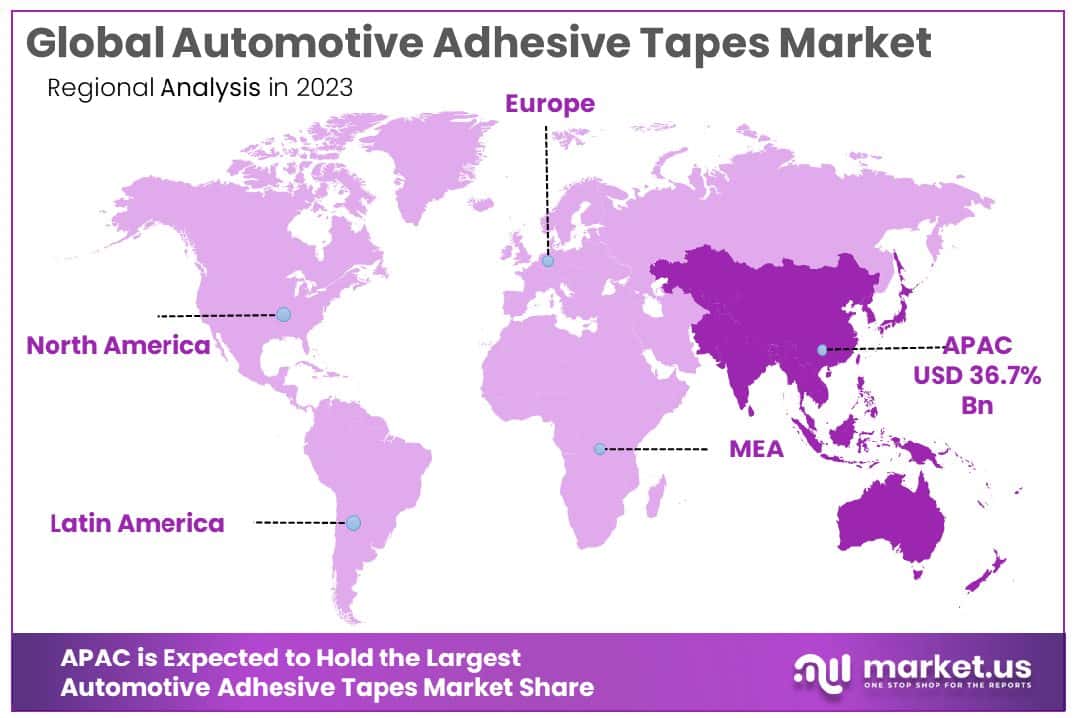

- Regional Analysis: Asia-Pacific dominates the Automotive Adhesive Tapes Market, holding a substantial share of 36.7%.

Driving Factors

Noise Reduction and Vibration Damping A Quiet Revolution in Comfort

The quest for quieter, more comfortable vehicles is driving the demand for innovative solutions in noise reduction and vibration damping. Automotive adhesive tapes play a pivotal role in this area by enabling the secure bonding of materials that absorb or isolate noise and vibrations. This application is critical in enhancing the quality of the driving experience and reducing the intrusion of road noise and the discomfort of vibrations. By improving the NVH (Noise, Vibration, and Harshness) characteristics of vehicles, these adhesive solutions directly contribute to the market’s expansion, addressing consumer demands for more refined and comfortable automotive interiors.

Adhesive Tapes The Unsung Heroes in Automotive Design and Manufacturing

The increasing use of adhesive tapes in automotive interiors and exteriors is a testament to their versatility and efficacy in addressing a range of manufacturing and design challenges. These tapes offer a lightweight, strong, and flexible alternative to traditional fastening methods, such as bolts, screws, and welds, facilitating the assembly of components with improved efficiency and reduced manufacturing complexity. In interiors, adhesive tapes are used for attaching, laminating, and securing trim parts, dashboard components, and other decorative elements. On exteriors, they are crucial for the assembly of lightweight panels, emblems, and protective films, contributing to both the aesthetic appeal and aerodynamic efficiency of vehicles.

Aesthetic Enhancement Driving Visual Appeal and Brand Differentiation

The increasing focus on vehicle aesthetics reflects a broader trend toward personalization and brand differentiation in the automotive market. Adhesive tapes offer manufacturers a means to achieve high-quality finishes and intricate designs without compromising on durability or performance.

Automotive companies are focusing on innovating exterior designs to inspire future market trends, with an emphasis on the vehicle’s color, as it is considered an essential factor for 40% of consumers when making a purchase. This focus on aesthetics is further supported by the use of artificial intelligence (AI) to create more appealing car designs, with product aesthetics being linked to roughly 60% of purchasing decisions in the automotive industry.

The ability of adhesive tapes to seamlessly bond different materials, such as metals, plastics, and composites, opens up new possibilities for innovative exterior and interior designs. This capability is particularly valuable in the premium segment, where aesthetic appeal and brand identity are critical competitive factors.

Restraining Factors

Impact of Technological Advancements on Traditional Adhesive Tapes

The automotive industry’s shift towards smart cars and advanced technologies is fostering the development and use of alternative bonding methods, which could potentially impact the demand for traditional automotive adhesive tapes. Innovations in material science and bonding techniques, such as hybrid laser welding and advanced mechanical fasteners tailored for smart vehicle applications, are becoming more prevalent.

These alternatives might offer benefits that compete directly with adhesive tapes, especially in scenarios requiring highly specialized or advanced performance characteristics that adhesive tapes might not fully address.

Reduced Maintenance Trends Affecting Adhesive Tape Demand

As the automotive industry evolves towards vehicles with reduced maintenance needs, the reliance on adhesive tapes could see a decline. Adhesive tapes have been integral in reducing maintenance requirements by providing durable and long-lasting bonds that minimize the need for repairs and replacements.

However, the overall trend towards vehicles designed to require less maintenance—through the use of more durable materials and advanced manufacturing techniques—may lessen the demand for adhesive tapes. This shift reflects a broader industry movement towards efficiency and sustainability, potentially reshaping the market dynamics for automotive adhesive tapes.

By Product Type Analysis

The Automotive Adhesive Tapes Market is characterized by product type held by a dominant share of 34.6%.

Double-Sided Adhesive Tapes Commanding a significant market share, these tapes offer versatile attachment solutions, facilitating strong bonds between diverse materials without visible fasteners, enhancing both aesthetic and structural integrity.

Single-Sided Adhesive Tapes Utilized for masking, protection, and simple bonding tasks, single-sided tapes are essential for tasks requiring a single adhesive surface, such as paint jobs or temporary protection.

Foam Tapes Known for their cushioning, sealing, and vibration-damping properties, foam tapes are critical in reducing noise and improving comfort within the vehicle.

High-Temperature Tapes Designed to withstand extreme heat, these tapes are indispensable in engine compartments and near exhaust systems, ensuring durability and performance under harsh conditions.

Others This category includes a variety of specialized tapes, such as reinforced, filament, and transfer tapes, each serving unique functions in enhancing vehicle assembly, safety, and performance.

By Application Analysis

The Automotive Adhesive Tapes Market is characterized by applications holding a dominant share of 30.1%.

Interior Adhesive tapes in interior applications offer solutions for upholstery attachment, dashboard assembly, and trim fixation, enhancing both aesthetic appeal and functionality.

Exterior Used for bonding and sealing exterior parts, these tapes improve aerodynamics and durability while contributing to the vehicle’s overall design and integrity.

Electrical Systems Essential for insulating and securing electrical components, adhesive tapes ensure safety and reliability in automotive electrical systems.

Paint Masking In the finishing stages, paint masking tapes protect surfaces and ensure precision during painting, crucial for high-quality finishes.

Wire Harnessing Tapes are designed for wire harnessing bundles and protecting wires, contributing to the organization and protection of the vehicle’s electrical system.

Others This category encompasses a variety of specialized applications, including thermal management, noise reduction, and vibration damping, highlighting the adhesive tapes’ versatility in addressing specific automotive challenges.

By Material Analysis

In 2023, Polyethylene (PE) held a dominant market position, capturing more than a 32.6% share.

Polyethylene (PE) with a dominant market position, capturing more than a 32.6% share, PE stood out for its versatility, durability, and chemical resistance, making it the material of choice for a broad range of automotive adhesive tape applications, from wire harnessing to surface protection.

Polypropylene (PP) is valued for its excellent mechanical properties and resistance to chemical solvents, PP adhesive tapes were widely used for bundling and securing automotive components, reinforcing its strong presence in the market.

Polyvinyl Chloride (PVC), and PVC adhesive tapes, known for their superior electrical insulation properties and flexibility, were extensively utilized in automotive electrical systems, contributing significantly to the safety and reliability of vehicles.

Polyester (PET) PET adhesive tapes, recognized for their high tensile strength and thermal stability, played a critical role in high-temperature applications, such as under-hood automotive components, highlighting their importance in advanced manufacturing processes.

Other categories encompassed a variety of materials, including but not limited to, foam, fabric, and non-woven substrates, offering specialized solutions for noise reduction, vibration damping, and interior finishing, reflecting the market’s adaptability and innovation in meeting specific automotive needs.

By Adhesive Chemistry Analysis

In 2023, Solvent held a dominant market position, capturing more than a 43.4% share.

Solvent dominating the market with over a 43.4% share, solvent-based adhesives were prized for their robustness and effectiveness across a wide range of surfaces, despite environmental concerns over VOC emissions.

Emulsion as eco-friendly alternatives, emulsion adhesives gained traction for their lower VOC emissions and safety profile, appealing particularly for interior automotive applications.

Hot Melt is known for its rapid bonding capabilities and strength, hot melt adhesives solidified their position in the market, offering versatility and efficiency for assembly processes.

Radiation through niche, radiation-curable adhesives captured interest for their quick curing times and durable bonds, marking them as an innovative solution in high-speed manufacturing settings.

Key Market Segments

By Product Type

- Double-Sided Adhesive Tapes

- Single-Sided Adhesive Tapes

- Foam Tapes

- High-Temperature Tapes

- Others

By Application

- Interior

- Exterior

- Electrical Systems

- Paint Masking

- Wire Harnessing

- Others

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyester (PET)

- Others

By Adhesive Chemistry

- Solvent

- Emulsion

- Hot Melt

- Radiation

Growth Opportunities

Luxury Vehicle Market Expansion

The rising consumer demand for high-end vehicles, characterized by superior interior design and innovative features, is set to drive the demand for automotive adhesive tapes. Luxury and premium automotive manufacturers are increasingly focusing on enhancing interior aesthetics, comfort, and functionality. This trend is expected to boost the use of various adhesive tapes, especially those that offer aesthetic appeal without compromising performance.

The global luxury car market size was valued at USD 495.7 billion in 2022 and is expected to grow significantly, projected to reach USD 733.2 billion by 2028, reflecting substantial growth opportunities. As interiors become a critical selling point, the demand for adhesive tapes that can seamlessly integrate with sophisticated design elements is anticipated to rise, presenting a lucrative growth opportunity within the market.

Strategic Industry Collaborations

The automotive adhesive tapes market is witnessing an increasing trend of strategic partnerships, mergers, acquisitions, and collaborations among key players. These alliances are strategically aimed at expanding product portfolios, entering new markets, and leveraging technological innovations to meet evolving customer requirements.

Such collaborations not only strengthen market presence but also enable companies to share resources, reduce costs, and accelerate the development of new, innovative adhesive tape solutions. This trend is expected to create new growth avenues, enhancing the market’s capacity to serve the automotive industry’s changing needs.

Latest Trends

Rapid Assembly and Production Processes

The automotive industry is undergoing a significant transformation, with manufacturers facing increasing pressure to streamline production processes and reduce assembly times. This urgency is driving the adoption of efficient automotive adhesive tapes that can offer quick bonding solutions without sacrificing strength or durability. The demand for these tapes is particularly high in applications that require rapid assembly,

Such as the attachment of interior and exterior components, where traditional fastening methods can be time-consuming and less efficient. Automotive adhesive tapes provide a versatile and reliable solution that aligns with the industry’s push for faster production cycles and lean manufacturing practices.

Regulatory Shifts Toward Sustainability

Concurrently, there is a growing emphasis on sustainability within the automotive sector, propelled by regulatory shifts and consumer demand for eco-friendly products. This trend is pushing manufacturers to seek more sustainable, environmentally friendly adhesive solutions.

The market is responding with the development of adhesive tapes made from bio-based materials, as well as those with lower VOC emissions, to meet these regulatory and consumer demands. These sustainable adhesive tapes not only help manufacturers comply with stringent environmental regulations but also appeal to environmentally conscious consumers, opening new avenues for market growth.

Regional Analysis

Asia-Pacific dominates the Automotive Adhesive Tapes Market, holding a substantial share of 36.7%

The Automotive Adhesive Tapes Market exhibits significant regional diversities, with Asia-Pacific, North America, Europe, the Middle East & Africa, and Latin America each contributing uniquely to the global landscape.

Dominating the market, Asia-Pacific holds a substantial share of 36.7%, driven by the robust automotive manufacturing sector in countries like China, Japan, and South Korea. This region benefits from high production volumes, technological advancements, and a strong emphasis on automotive exports, which fuel the demand for automotive adhesive tapes.

North America follows, with its market expansion supported by advanced automotive technologies and a high adoption rate of electric vehicles, necessitating specialized adhesive tapes for battery solutions and lightweight materials. Europe’s market is characterized by stringent environmental regulations, pushing for the development of eco-friendly adhesive tapes, mirroring the region’s commitment to sustainability.

The Middle East & Africa and Latin America, while holding smaller shares, are witnessing growth due to increasing automotive manufacturing and assembly activities, particularly in countries aiming to strengthen their automotive sectors. These regions are gradually adopting more advanced automotive adhesive solutions, driven by global trends towards efficiency and sustainability.

Overall, the global Automotive Adhesive Tapes Market is shaped by regional dynamics, with Asia-Pacific leading the charge due to its massive automotive industry, followed by North America and Europe, which are focused on innovation and environmental sustainability.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Automotive Adhesive Tapes Market is characterized by the presence and strategic movements of key players, each contributing to the industry’s growth and innovation. These companies, through their diverse product portfolios and global footprints, play pivotal roles in shaping market dynamics:

3M Company leads with its extensive range of automotive adhesive tapes, known for innovation, quality, and performance, catering to various automotive applications from interior attachments to electronic insulation.

Nitto Denko Corporation stands out for its technological advancements and strong R&D capabilities, offering specialized adhesive solutions that address the evolving needs of the automotive industry.

ABI Tape Products focuses on niche markets, providing high-quality tapes for protective and masking applications, demonstrating the importance of specialized products in meeting detailed industry requirements.

Sika Automotive AG emphasizes its strength in structural bonding solutions, playing a crucial role in enhancing vehicle durability and safety.

L&L Products, Inc. distinguishes itself with its range of sealant and adhesive tapes, contributing to the industry’s push towards lightweight and efficient vehicles.

Saint-Gobain offers a broad spectrum of adhesive tapes, including high-temperature and acoustic damping solutions, aligning with the industry’s focus on comfort and performance.

Market Key Players

- 3M Company

- Nitto Denko Corporation

- ABI Tape Products

- Sika Automotive AG

- L&L Products, Inc.

- Saint-Gobain

- PPG Industries

- Lida Industry Co, Ltd.

- tesa SE

- ThreeBond Holdings Co., Ltd.

- Berry Plastics

- Adchem Corp.

- Lintec Corporation

Recent Development

- In January 2024, Afera and the German Adhesives Association (IVK), in collaboration with Sphera, completed workshops paving the way for the development of a Product Carbon Footprint (PCF) tool for adhesive tape manufacturers in 2024.

- In October 2023, 3M opened its first purpose-built Skills Development Center in St. Paul, designed to train 1,000 automotive technicians annually from the U.S. and Canada in collision repair and car painting techniques, addressing the industry’s technician shortage and evolving technological needs.

- In March 2023, Lawrence Berkeley National Laboratory (Berkeley Lab) developed a conductive polymer coating, HOS-PFM, that improves lithium-ion battery life and performance, potentially extending electric vehicle battery lifespan from 10 to 15 years and enhancing the durability of silicon– and aluminum-based electrodes.

Report Scope

Report Features Description Market Value (2023) USD 8.4 Billion Forecast Revenue (2033) USD 12.8 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Double-Sided Adhesive Tapes, Single-Sided Adhesive Tapes, Foam Tapes, High-Temperature Tapes, Others), By Application(Interior, Exterior, Electrical Systems, Paint Masking, Wire Harnessing, Others), By Material(Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyester (PET), Others), By Adhesive Chemistry(Solvent, Emulsion, Hot Melt, Radiation) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M Company, Nitto Denko Corporation, ABI Tape Products, Sika Automotive AG, L&L Products, Inc., Saint-Gobain, PPG Industries, Lida Industry Co, Ltd., tesa SE, ThreeBond Holdings Co., Ltd., Berry Plastics, Adchem Corp., Lintec Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Automotive Adhesive Tapes Market in 2023?The Automotive Adhesive Tapes Market size is USD 8.4 Billion in 2023.

What is the projected CAGR at which the Automotive Adhesive Tapes Market is expected to grow at?The Automotive Adhesive Tapes Market is expected to grow at a CAGR of 4.3% (2024-2033).

List the segments encompassed in this report on the Automotive Adhesive Tapes Market?Market.US has segmented the Automotive Adhesive Tapes Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa).By Product Type(Double-Sided Adhesive Tapes, Single-Sided Adhesive Tapes, Foam Tapes, High-Temperature Tapes, Others), By Application(Interior, Exterior, Electrical Systems, Paint Masking, Wire Harnessing, Others), By Material(Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyester (PET), Others), By Adhesive Chemistry(Solvent, Emulsion, Hot Melt, Radiation)

List the key industry players of the Automotive Adhesive Tapes Market?3M Company, Nitto Denko Corporation, ABI Tape Products, Sika Automotive AG, L&L Products, Inc., Saint-Gobain, PPG Industries, Lida Industry Co, Ltd., tesa SE, ThreeBond Holdings Co., Ltd., Berry Plastics, Adchem Corp., Lintec Corporation

Which region is more appealing for vendors employed in the Automotive Adhesive Tapes Market?Asia-Pacific holds a substantial share of 36.7%, therefore, the Automotive Adhesive Tapes Market in APAC is expected to garner significant business opportunities over the forecast period.

Automotive Adhesive Tapes MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Adhesive Tapes MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Nitto Denko Corporation

- ABI Tape Products

- Sika Automotive AG

- L&L Products, Inc.

- Saint-Gobain

- PPG Industries

- Lida Industry Co, Ltd.

- tesa SE

- ThreeBond Holdings Co., Ltd.

- Berry Plastics

- Adchem Corp.

- Lintec Corporation