Global Automated Liquid Handling Market By Modality (Fixed Tips and Disposable Tips), By Procedure (PCR Setup, Array Printing, High-throughput Screening, Serial Dilution, Cell Culture, Whole Genome Amplification, and Plate Reformatting), By Type (Standalone, Benchtop Workstation, and Multi-Instrument System), By End-user (Academic & Government Research Institutes, Biotechnology & Pharmaceutical Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 129930

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

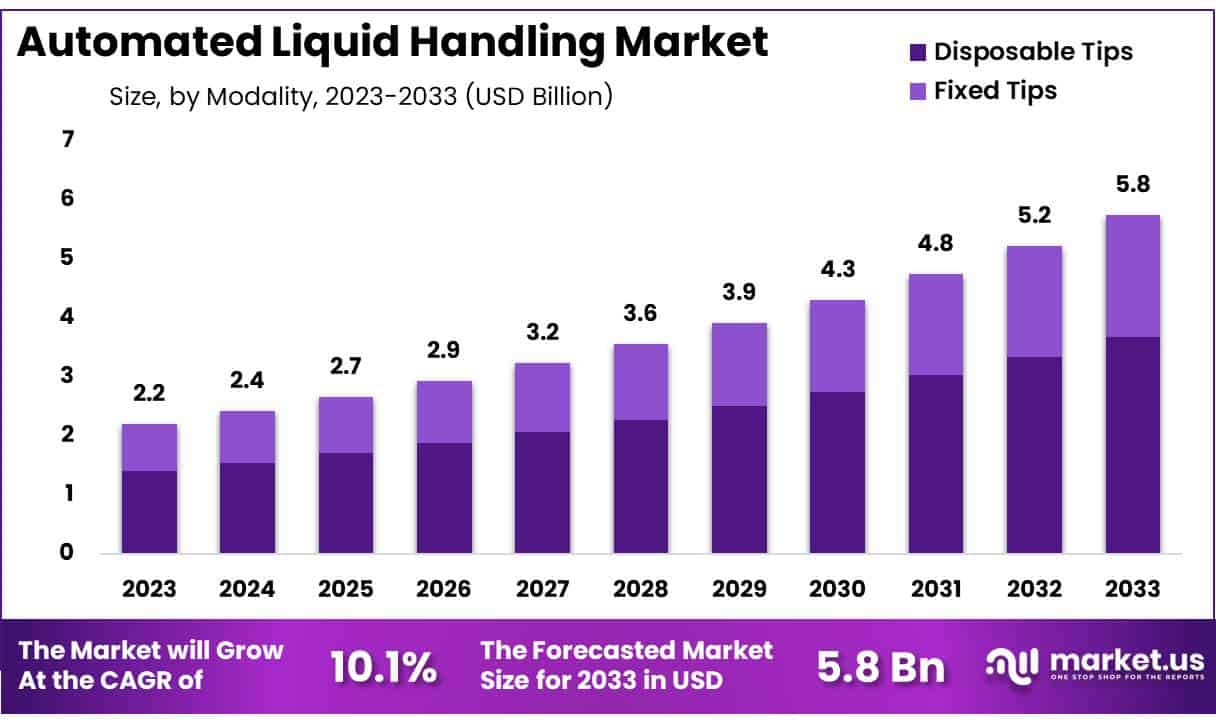

Global Automated Liquid Handling Market size is expected to be worth around USD 5.8 billion by 2033 from USD 2.2 billion in 2023, growing at a CAGR of 10.1% during the forecast period 2024 to 2033.

Growing demand for automated liquid handling systems is driven by the need for precision, speed, and efficiency in laboratory workflows across industries such as pharmaceuticals, biotechnology, and diagnostics. These systems play a crucial role in applications like high-throughput screening, sample preparation, and drug discovery, where accuracy and reproducibility are essential.

The market sees significant opportunities as laboratories adopt automation to minimize human error, reduce operational costs, and increase throughput. In May 2023, Biosero, Inc. formed a strategic co-marketing collaboration with Hamilton, a global leader in liquid handling automation, to enhance and streamline automated workflows in laboratories.

This partnership aims to provide scientists with a more integrated and efficient automation solution. Recent trends include advancements in AI-driven liquid handling systems and the development of compact, versatile platforms, further expanding the market’s growth potential and driving innovation in laboratory automation.

Key Takeaways

- Market Size: Global Automated Liquid Handling Market size is expected to be worth around USD 5.8 billion by 2033 from USD 2.2 billion in 2023.

- Market Growth: The market growing at a CAGR of 10.1% during the forecast period 2024 to 2033.

- Modality Analysis: The disposable tips segment led in 2023, claiming a market share of 63.8% owing to the increasing demand for high-precision, contamination-free liquid handling in laboratories.

- Procedure Analysis: The serial dilution held a significant share of 32.8% due to its critical role in drug discovery and microbiology research.

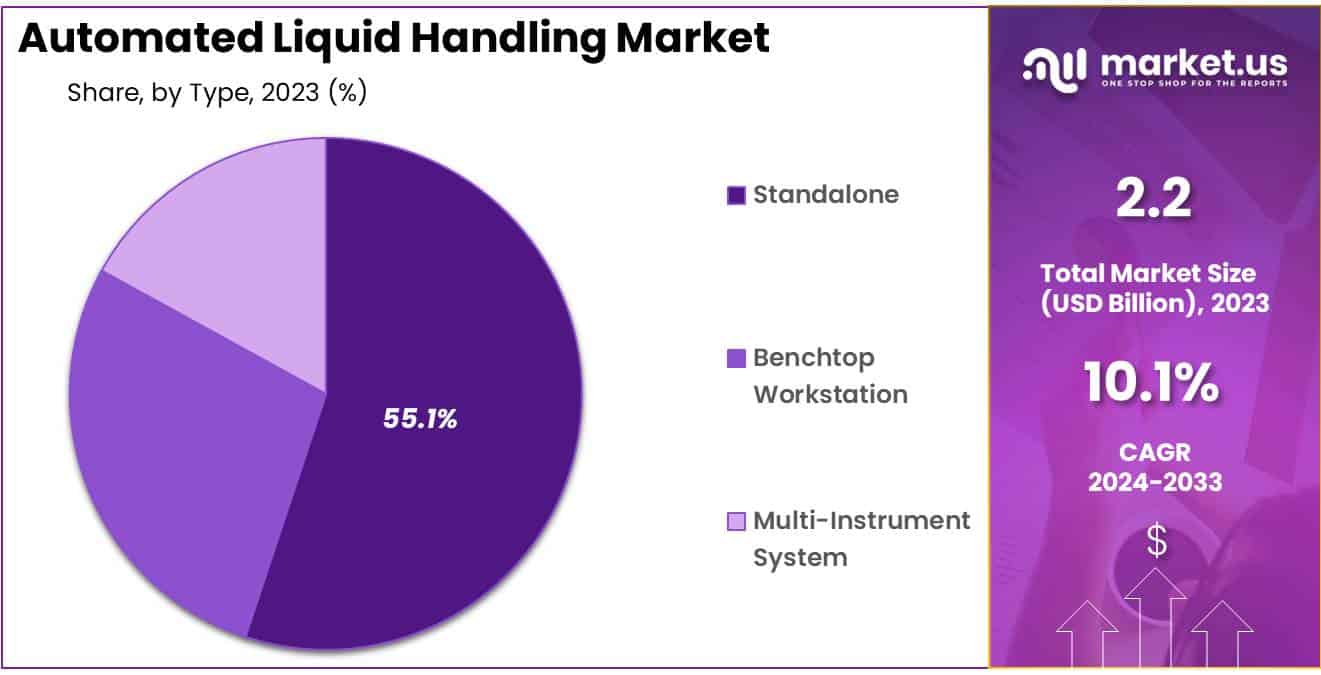

- Type Analysis: The standalone segment had a tremendous growth rate, with a revenue share of 55.1% owing to its flexibility, cost-effectiveness, and ease of use.

- End-Use Analysis: The biotechnology & pharmaceutical companies segment grew at a substantial rate, generating a revenue portion of 54.4%.

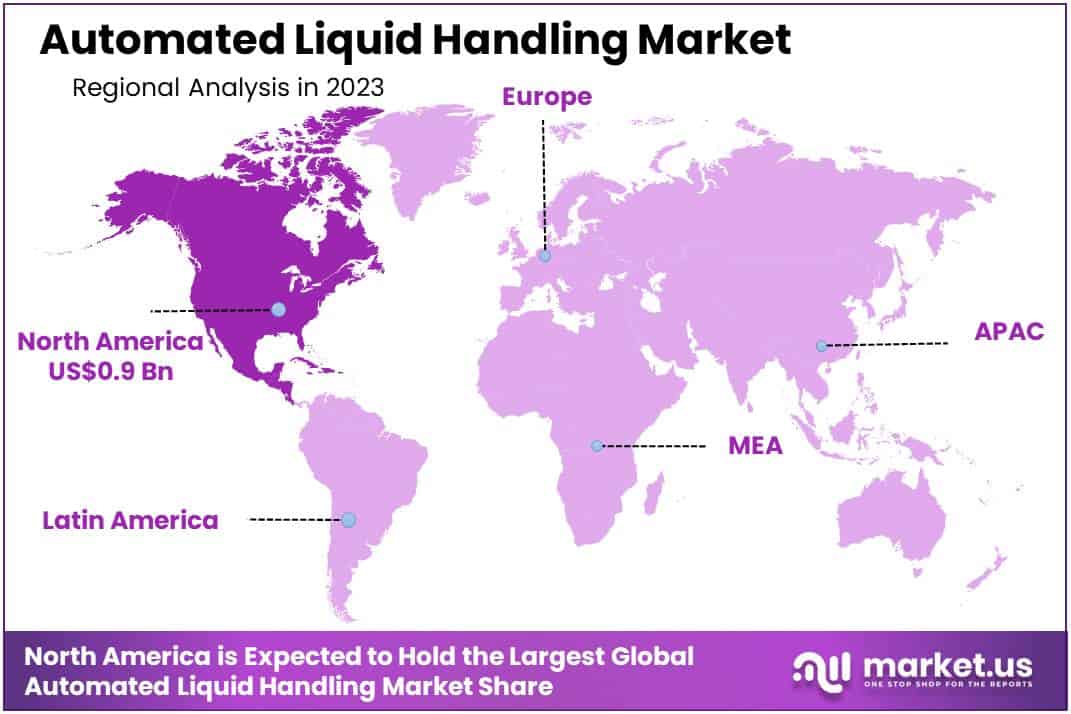

- Regional Analysis: In 2023, North America dominated the market with the highest revenue share of 40.1%.

By Modality Analysis

The disposable tips segment led in 2023, claiming a market share of 63.8% owing to the increasing demand for high-precision, contamination-free liquid handling in laboratories. Disposable tips offer significant advantages, such as reducing the risk of cross-contamination and ensuring accuracy in applications like PCR and high-throughput screening.

As the number of molecular biology and genomics studies grows, the need for disposable tips in research labs and clinical diagnostics is likely to rise. Additionally, regulatory requirements for contamination control, particularly in pharmaceutical and biotechnology labs, are expected to further propel the demand for disposable tips in automated liquid handling systems.

By Procedure Analysis

The serial dilution held a significant share of 32.8% due to its critical role in drug discovery and microbiology research. Serial dilution is essential for accurately preparing solutions of varying concentrations, especially in pharmaceutical testing and microbiological assays.

The increasing use of high-throughput screening in drug development and the rising need for precise solution preparation are anticipated to fuel growth in this segment. Advances in liquid handling technologies that automate the serial dilution process, thereby enhancing efficiency and reducing human error, are likely to contribute to its widespread adoption across research and clinical labs.

By Type Analysis

The standalone segment had a tremendous growth rate, with a revenue share of 55.1% owing to its flexibility, cost-effectiveness, and ease of use. Standalone systems provide laboratories with a simple and reliable solution for specific tasks such as PCR setup or sample preparation without the complexity of larger, multi-instrument systems.

Smaller labs and institutions often prefer standalone systems because they can perform high-precision tasks without requiring extensive space or infrastructure. The increasing demand for affordable and user-friendly liquid handling solutions, particularly in emerging markets, is anticipated to drive the growth of standalone systems. Continuous technological advancements further enhance their efficiency and appeal.

By End-user Analysis

The biotechnology & pharmaceutical companies segment grew at a substantial rate, generating a revenue portion of 54.4% due to the increasing demand for automation in drug discovery, development, and production processes. Automated liquid handling systems improve accuracy, throughput, and reproducibility, making them essential in high-volume screening and genomics research.

As the pharmaceutical industry invests heavily in developing new therapies, particularly biologics and personalized medicines, the need for advanced liquid handling technologies is likely to grow. Additionally, rising R&D spending in biotech firms and the focus on reducing manual errors in drug formulation processes are expected to further support growth in this segment.

Key Market Segments

By Modality

- Fixed Tips

- Disposable Tips

By Procedure

- PCR Setup

- Array Printing

- High-throughput Screening

- Serial Dilution

- Cell Culture

- Whole Genome Amplification

- Plate Reformatting

By Type

- Standalone

- Benchtop Workstation

- Multi-Instrument System

By End-user

- Academic & Government Research Institutes

- Biotechnology & Pharmaceutical Companies

- Others

Drivers

Growing Awareness for Diagnostic Error

Growing awareness of diagnostic errors drives the automated liquid handling market as laboratories and healthcare providers aim to improve accuracy in clinical diagnostics. Errors in manual liquid handling can lead to inaccurate results, affecting patient outcomes. A study published in February 2022 by the AZO Network on lab automation in clinical diagnostics estimated that 10 to 20% of diagnoses in the United States are incorrect, potentially resulting in 40,000 to 80,000 fatalities annually.

This alarming statistic highlights the urgent need for precision, which automated systems offer by minimizing human error and improving consistency in diagnostic processes. The rising focus on reducing diagnostic mistakes is likely to propel the demand for automated solutions in clinical settings.

Restraints

Rising Lack of Skilled Professionals

The rising lack of skilled professionals hampers the growth of the automated liquid handling market. Operating advanced automation technologies requires specialized training and expertise, which many laboratories and institutions lack. The shortage of experienced personnel impedes the adoption of these systems, as proper calibration and operation are critical to ensuring accurate and reliable results.

In regions where access to such training is limited, the market faces additional barriers, particularly in smaller or resource-limited facilities. This skills gap is projected to restrain market expansion, as organizations struggle to implement these complex systems without the necessary workforce expertise.

Opportunities

Growing Use of Cutting-Edge Technologies

The growing use of cutting-edge technologies presents a significant opportunity for the automated liquid handling market. The integration of advanced technologies enables laboratories to enhance efficiency, particularly in high-precision tasks such as next-generation sequencing (NGS) and diagnostic research.

In July 2023, Revvity introduced the Fontus Automated Liquid Handling Workstation, a sophisticated platform that integrates Revvity’s advanced technologies to accelerate workflows for NGS and other diagnostic applications. Innovations like these are anticipated to drive market growth, as laboratories increasingly seek automated solutions to improve productivity and accuracy in complex research and diagnostic procedures.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the automated liquid handling market, shaping both growth and challenges. Economic downturns may reduce funding for research and development, slowing the adoption of high-cost laboratory equipment. Geopolitical tensions, such as trade restrictions or supply chain disruptions, may lead to increased costs for components and delay production timelines.

On the positive side, governments in developed and emerging markets are investing heavily in life sciences and biotechnology, driving demand for automated systems to improve efficiency and precision in research. Despite some challenges, rising healthcare and pharmaceutical needs continue to foster optimism in the automated liquid handling industry.

Latest Trends

Surge in Partnerships and Collaborations among Key Players

Rising partnerships and collaborations among key players are driving growth in the automated liquid handling market. In June 2023, Biosero, Inc. and Analytik Jena entered into a co-marketing agreement to promote their integrated laboratory automation technologies. This partnership is anticipated to enhance the adoption of advanced automated solutions across various research applications.

Increasing collaborations between companies are expected to accelerate technological innovation, improve product offerings, and expand market reach. As more firms focus on joint efforts, the market is likely to experience continued growth, delivering enhanced solutions that cater to the evolving needs of laboratories worldwide.

Regional Analysis

North America is leading the Automated Liquid Handling Market

North America dominated the market with the highest revenue share of 40.1% owing to the increasing demand for precision and efficiency in laboratory processes across various industries, including pharmaceuticals, biotechnology, and genomics. The growing need for high-throughput testing and analysis, particularly in the wake of the COVID-19 pandemic, has further accelerated the adoption of automated systems.

A key development in this sector occurred in November 2023, when SPT Labtech launched Firefly for LDT, a solution designed to optimize liquid handling in laboratory-developed tests based on Next-Generation Sequencing (NGS). This innovation highlights the trend toward enhancing workflow efficiency and accuracy in complex laboratory environments.

Additionally, the rising focus on reducing human error and improving reproducibility in experiments has propelled the demand for advanced liquid handling technologies. Furthermore, increased investments in research and development and the ongoing integration of automation in laboratory settings have solidified the growth trajectory of the automated liquid handling market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapid advancements in laboratory technology and increasing research activities in pharmaceuticals and biotechnology. Countries such as China, India, and Japan are likely to lead this expansion, supported by rising investments in healthcare infrastructure and laboratory automation.

The growing emphasis on high-throughput screening and the need for improved accuracy in liquid handling processes will likely spur demand for innovative solutions. Additionally, as the region focuses on enhancing research capabilities, the adoption of automated systems is projected to rise significantly. The push toward precision medicine and personalized healthcare will further drive the need for reliable and efficient liquid handling technologies.

Collaborations between local and international firms are expected to facilitate the development of cutting-edge solutions, enhancing the overall market landscape. As a result, the automated liquid handling sector in Asia Pacific is poised for significant growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Automated Liquid Handling market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the automated liquid handling market focus on enhancing system precision and throughput by developing advanced robotics and software integration.

They invest in research and development to offer customizable solutions tailored to specific laboratory workflows. Strategic partnerships with biotechnology and pharmaceutical companies allow them to expand their market reach and optimize product offerings. Companies also target emerging markets with growing research and diagnostic needs, driving global expansion.

Additionally, they emphasize user training and support to improve operational efficiency and customer satisfaction.

Top Key Players

- SPT Labtech

- Festo

- Ellutia

- Elemental Scientific

- Distek

- Beckman Coulter Life Sciences

- Aurora Biomed

- Anton-Paar

- Analytik Jena

- Agilent

Recent Developments

- In June 2022, Beckman Coulter Life Sciences, a subsidiary of Danaher Corporation, launched the Biomek NGeniuS liquid handling system, making next-generation sequencing more accessible to research labs of all sizes. This development is relevant to the growth of the automated liquid handling market as it expands the availability of advanced sequencing technology, enhancing research capabilities across diverse labs.

- In February 2022, SPT Labtech introduced the apricot DC1, a versatile automated liquid handling workstation, at the SLAS 2022 International Conference in Boston. This innovation supports the growth of the automated liquid handling market by offering labs a highly adaptable and efficient solution for various liquid handling tasks.

- In January 2022, Festo launched a modular gantry robot platform for automated liquid handling systems, providing equipment designers with a flexible framework to implement custom solutions. This is significant for the automated liquid handling market as it empowers labs to create more tailored, efficient processes for automation.

Report Scope

Report Features Description Market Value (2023) USD 2.2 billion Forecast Revenue (2033) USD 5.8 billion CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Modality (Fixed Tips and Disposable Tips), By Procedure (PCR Setup, Array Printing, High-throughput Screening, Serial Dilution, Cell Culture, Whole Genome Amplification, and Plate Reformatting), By Type (Standalone, Benchtop Workstation, and Multi-Instrument System), By End-user (Academic & Government Research Institutes, Biotechnology & Pharmaceutical Companies, and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape SPT Labtech, Festo, Ellutia, Elemental Scientific, Distek, Beckman Coulter Life Sciences, Aurora Biomed, Anton-Paar, Analytik Jena, and Agilent. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Liquid Handling MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Automated Liquid Handling MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SPT Labtech

- Festo

- Ellutia

- Elemental Scientific

- Distek

- Beckman Coulter Life Sciences

- Aurora Biomed

- Anton-Paar

- Analytik Jena

- Agilent