Global Automated Feeder Systems Market Based on Type(Conveyor, Rail-Guided, Self-Propelled), Based on Technology(Robotics and Telemetry, Guidance and Remote Sensing Technology, RFID Technology, Others), Based on Function(Mixing, Controlling, Filling, Others), Based on Livestock(Poultry, Swine, Ruminants, Equine, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 103142

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

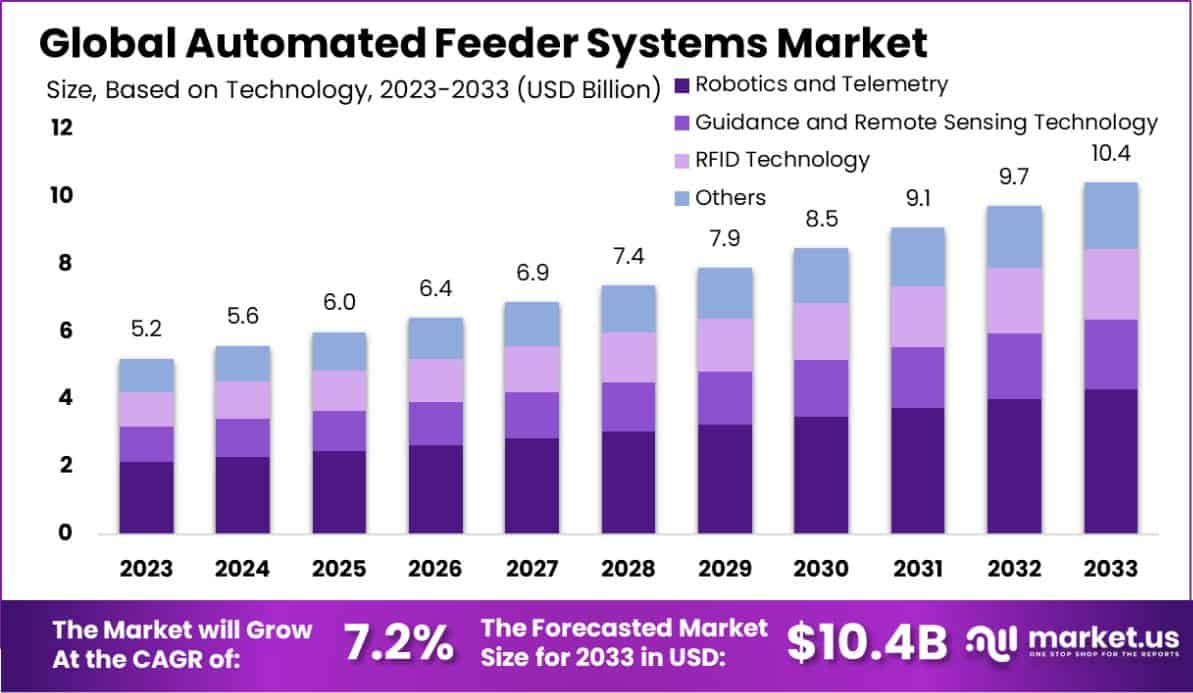

The Global Automated Feeder Systems Market is expected to be worth around USD 10.4 billion by 2033, up from USD 5.2 billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

Automated feeder systems are mechanized units designed to dispense materials or products automatically in manufacturing, smart packaging, and processing industries. These systems ensure precision and efficiency in delivering the correct material to the right place at the right time, optimizing the production process, and reducing labor costs.

The Automated Feeder Systems Market refers to the global industry landscape of deploying and integrating these systems across various sectors. This market is driven by the growing demand for automation in smart manufacturing processes to enhance productivity and maintain competitiveness in rapidly changing industry environments.

The expansion of the Automated Feeder Systems Market can primarily be attributed to the increasing adoption of automation technologies within manufacturing sectors. As industries strive for higher operational efficiency and reduced downtime, automated feeder systems are increasingly recognized for streamlining production lines and minimizing labor dependency.

Demand for automated feeder systems is rising sharply with the surge in manufacturing automation. Industries such as automotive, pharmaceuticals, and food and beverage are increasingly integrating these systems to meet the demands for high-speed, precise production capabilities, driving significant market growth.

Opportunities within the Automated Feeder Systems Market are abundant due to advancements in technology such as IoT and AI. These technologies enable smarter, more adaptive systems capable of handling complex feeding tasks, thus opening new applications in customization and flexible manufacturing processes, particularly in industries requiring high precision and variability.

The Automated Feeder Systems market is witnessing substantial growth, driven by the escalating demand for advanced manufacturing processes across multiple industries. This surge is underpinned by a compelling need for efficiency and precision in production lines, with automation playing a pivotal role in achieving these objectives. Recent investments in related technologies highlight the robust market dynamics and the confidence of investors in the sector’s growth trajectory.

For instance, AquaExchange, an aquaculture technology startup, successfully secured $6 million in Series A funding, as reported by yourstory.com. This investment, led by Ocean 14 Capital and supported by existing stakeholders like Endiya Partners and Accion Venture Labs, underscores the growing interest in automating complex, resource-intensive sectors such as aquaculture.

Furthermore, the health tech sector is also embracing automation, with generative AI startup TORTUS raising $4.2 million in seed funding. Led by Khosla Ventures, this funding, as detailed by tech. eu, signifies the potential of automated systems to revolutionize healthcare through enhanced data processing and management capabilities.

Additionally, the industrial automation software sphere is advancing with significant capital infusion. OTee, an Oslo-based company, raised €1.25 million to enhance operations through open control system architectures, marking a pivotal step towards modernizing industrial automation.

These developments collectively illustrate a market ripe with opportunities for innovation and growth. The continued investment into diverse applications of automated feeder systems not only validates the market’s viability but also forecasts a trend toward more integrated, intelligent automation solutions across various sectors. This trend is expected to propel the market forward, making it an attractive avenue for future technological advancements and capital investments.

Key Takeaways

- The Global Automated Feeder Systems Market is expected to be worth around USD 10.4 billion by 2033, up from USD 5.2 billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

- In 2023, Conveyor held a dominant market position in the Based on Type segment of the Automated Feeder Systems Market, with a 45.5% share.

In 2023, Robotics and Telemetry held a dominant market position in the Based on Technology segment of the Automated Feeder Systems Market, with a 41.2% share.

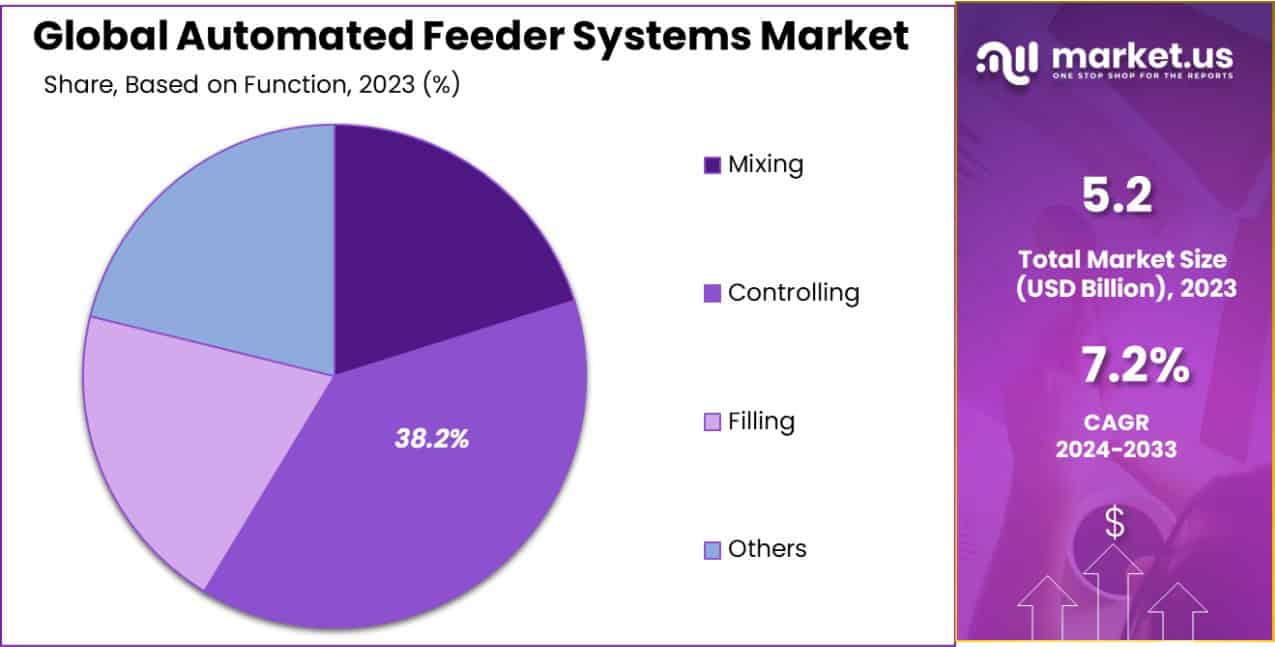

In 2023, Controlling held a dominant market position in the Based on Function segment of the Automated Feeder Systems Market, with a 38.2% share.

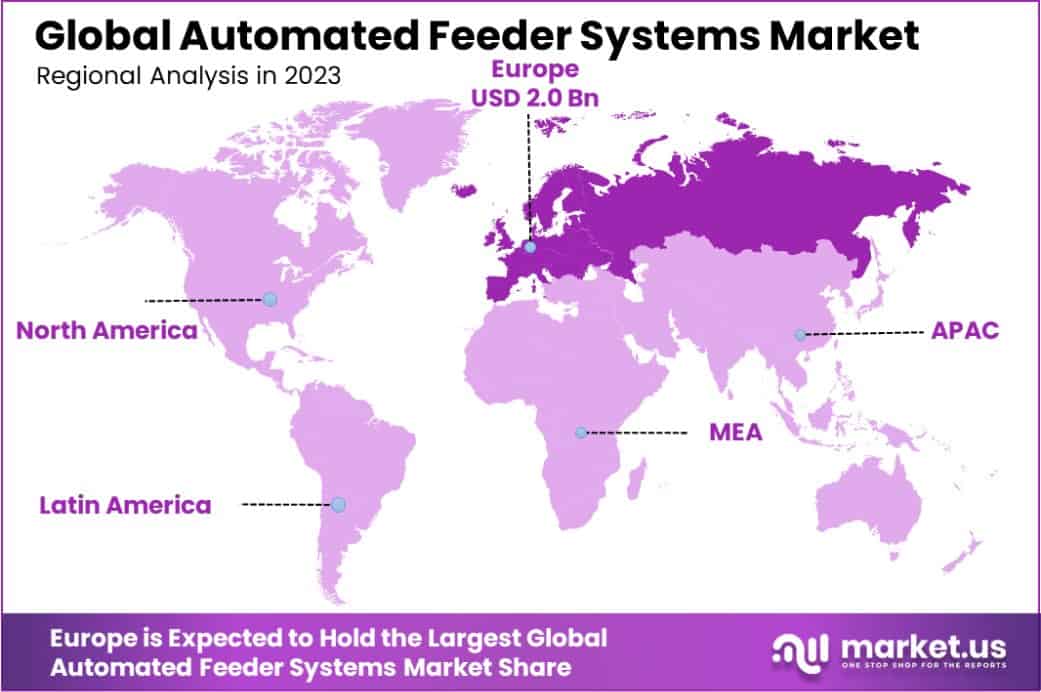

In 2023, Ruminants held a dominant market position in the Based on Livestock segment of the Automated Feeder Systems Market, with a 32.3% share. - Europe dominated a 39.3% market share in 2023 and held USD 2.0 Billion revenue of the Automated Feeder Systems Market.

Based on Type Analysis

In 2023, the “Based on Type” segment of the Automated Feeder Systems Market was led by Conveyor systems, which accounted for a dominant 45.5% share. This segment’s prominence is primarily due to the widespread adoption of conveyor systems in various industries for their reliability and efficiency in handling bulk materials.

Following Conveyor, the Rail-Guided and Self-Propelled types also represent significant portions of the market, each playing critical roles in specific industrial applications.

Rail-Guided systems are highly valued in environments where precise material handling is crucial, offering guided pathways that ensure consistent and accurate delivery of materials. These systems are particularly beneficial in complex manufacturing settings where spatial constraints necessitate precise control over the movement of materials.

On the other hand, Self-Propelled feeder systems are gaining traction for their versatility and mobility, allowing for the automated transport of goods within various parts of a production facility without the need for fixed routes. This flexibility is particularly advantageous in dynamically changing environments where adaptation to new operational layouts is frequently required.

The integration of these automated feeder types into diverse industrial processes underscores the sector’s innovative push to enhance production efficiencies and reduce operational costs, positioning the Automated Feeder Systems Market for continued growth and technological advancement in the coming years.

Based on Technology Analysis

In 2023, Robotics and Telemetry held a dominant market position in the “Based on Technology” segment of the Automated Feeder Systems Market, commanding a 41.2% share. This segment’s leadership is attributed to the significant efficiencies these technologies introduce into automated feeding operations, enhancing precision and reducing manual oversight.

Robotics technology has become integral in settings where complex maneuvers and consistent material handling are paramount. Its ability to perform repetitive tasks with high accuracy ensures minimal wastage and optimizes resource utilization.

Telemetry systems complement these robotics solutions by providing real-time data on system performance, which is crucial for maintaining operational effectiveness and preemptive maintenance.

The segment also includes Guidance and Remote Sensing Technology, RFID Technology, and others, each contributing to the overall functionality and adaptability of feeder systems. Guidance and Remote Sensing Technology is increasingly being utilized for navigation and monitoring in unmanned environments, thereby enhancing the autonomy of feeding systems. Meanwhile, RFID Technology is pivotal in streamlining inventory management and tracking, ensuring materials are replenished efficiently and accurately within the production cycle.

Collectively, these technologies are driving the Automated Feeder Systems Market forward, with robust growth projected as industries continue to embrace automation for improved productivity and operational reliability.

Based on Function Analysis

In 2023, Controlling held a dominant market position in the “Based on Function” segment of the Automated Feeder Systems Market, securing a 38.2% share. This segment’s leading status underscores the critical role of control systems in optimizing the operational efficiency of automated feeding mechanisms across various industrial sectors.

Control systems are integral to the precise management of material flow, timing, and allocation, ensuring that production processes align with predetermined quality and quantity standards. Their ability to synchronize multiple feeding operations simultaneously allows for streamlined production workflows and minimizes human error, leading to enhanced productivity and reduced waste.

Following Controlling, the segments of Mixing, Filling, and Others also contribute significantly to the market dynamics. Mixing technologies are essential for industries where ingredients need to be combined in exact proportions for product consistency, while Filling technologies are crucial in packaging and dispensing applications, ensuring that products are delivered in the correct volumes with high precision.

The Other functions segment includes various specialized feeder systems that cater to niche market requirements, further broadening the scope and applicability of automated feeder technologies. Together, these functionalities reflect a market geared towards innovation and efficiency, poised for continued growth as more industries recognize the benefits of automation in their operational processes.

Based on Livestock Analysis

In 2023, Ruminants held a dominant market position in the “Based on Livestock” segment of the Automated Feeder Systems Market, capturing a 32.3% share. This leading position reflects the significant adoption of automated feeding solutions in the ruminant sector, driven by the need to optimize feed efficiency and productivity in dairy and meat production.

Automated feeder systems for ruminants enhance the precision and consistency of feed delivery, crucial for maintaining the health and productivity of these animals. By automating the feeding process, farms can ensure that ruminants receive a balanced diet tailored to their specific nutritional requirements, thereby improving yield and quality.

Following Ruminants, other key segments include Poultry, Swine, Equine, and Others. Poultry and Swine industries also heavily invest in automated feeding technologies to support large-scale operations and improve feed conversion ratios.

Equine feeders are tailored for specific dietary needs and feeding schedules, emphasizing the customization capabilities of modern systems. The Others category captures specialized applications in less common livestock types, where bespoke feeding solutions are increasingly being deployed.

Together, these segments illustrate a robust and diversified market landscape where automation plays a pivotal role in enhancing livestock management practices across various animal categories, driving efficiency and productivity in the agricultural sector.

Key Market Segments

Based on Type

- Conveyor

- Rail-Guided

- Self-Propelled

Based on Technology

- Robotics and Telemetry

- Guidance and Remote Sensing Technology

- RFID Technology

- Others

Based on Function

- Mixing

- Controlling

- Filling

- Others

Based on Livestock

- Poultry

- Swine

- Ruminants

- Equine

- Others

Drivers

Key Drivers of Feeder System Growth

The Automated Feeder Systems Market is experiencing robust growth driven by several key factors. Firstly, the increasing demand for automation across various industries plays a significant role. Businesses are seeking to enhance efficiency and reduce labor costs, making automated systems crucial for their operations.

Additionally, technological advancements are making these systems more reliable and efficient, capable of handling complex tasks with greater precision. Another driver is the growing focus on sustainability and waste reduction; automated feeders optimize material usage and reduce waste, aligning with environmental goals.

Moreover, the expansion of manufacturing sectors in emerging economies provides a substantial market for deploying these innovative solutions. Collectively, these drivers are propelling the adoption of automated feeder systems, promising continued market expansion and technological integration.

Restraint

Challenges in Feeder System Adoption

A significant restraint in the Automated Feeder Systems Market is the high initial investment required for these technologies. Automated systems often come with a steep price tag for setup and integration, making them less accessible, especially for small to medium-sized enterprises.

Additionally, the complexity of these systems requires skilled technicians for maintenance and operation, which can further increase operational costs. There is also a reluctance among some industries to adopt full automation due to fears of technical failures that could disrupt production.

These factors combined can slow down the adoption rate of automated feeder systems, as companies weigh the benefits against the potential risks and costs associated with transitioning to automated processes. Thus, despite the advantages, the high cost and complexity present considerable challenges to widespread market penetration.

Opportunities

Expanding Opportunities in Automation

The Automated Feeder Systems Market offers numerous opportunities for growth and expansion. One significant opportunity lies in the integration of advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT).

These technologies can make automated feeder systems smarter and more efficient, enabling them to predict maintenance needs and optimize feeding schedules based on real-time data. Additionally, the rising demand for automation in developing regions presents a vast potential market for deployment.

There’s also an increasing trend towards customization in manufacturing processes, where automated feeders can be tailored to specific production needs, enhancing flexibility and efficiency.

Furthermore, as industries increasingly focus on sustainability, automated systems that reduce waste and improve resource use become even more attractive, opening new avenues for innovation and market penetration.

Challenges

Navigating Market Adoption Barriers

The Automated Feeder Systems Market faces several challenges that could impede its growth. One major challenge is the resistance to change within traditional industries, where there is often skepticism toward fully automating critical processes.

Additionally, the complexity of integrating new automated systems with existing infrastructure can be daunting for many companies, requiring significant technical expertise and resources. There’s also the issue of regulatory hurdles, as industries like food and pharmaceuticals are heavily regulated, making compliance a complex and costly affair when introducing new technologies.

Furthermore, the global disparity in technological adoption rates means that not all markets are prepared to implement and support advanced automated systems. These challenges require strategic planning and innovation from both manufacturers and adopters to ensure successful integration and utilization of automated feeder technologies.

Growth Factors

Driving Forces Behind Market Growth

The Automated Feeder Systems Market is propelled by several key growth factors that enhance its appeal across various industries. The primary driver is the increasing need for efficiency and productivity improvements in manufacturing and processing industries.

As businesses aim to reduce costs and optimize operations, automated feeder systems offer a reliable solution by minimizing labor requirements and enhancing speed and accuracy in material handling. Technological advancements are also crucial, as they improve the capabilities and reliability of these systems, making them adaptable to different operational needs.

Furthermore, the push towards sustainable practices is encouraging companies to adopt automated systems that ensure precise material usage and reduce waste. As industries continue to grow and evolve, the demand for such automated solutions is expected to rise, continually driving the market forward.

Emerging Trends

Trends Shaping Feeder Systems Market

Emerging trends in the Automated Feeder Systems Market are significantly influencing its growth trajectory. One prominent trend is the integration of Internet of Things (IoT) technology, which enables systems to become more connected and intelligent, allowing for remote monitoring and management of operations.

Additionally, the increasing adoption of Industry 4.0 practices is pushing for more automated and data-driven manufacturing environments, where automated feeder systems play a critical role. There is also a growing focus on customizability and flexibility in automated systems to accommodate varying production needs across different industries.

Moreover, advancements in artificial intelligence are enhancing the predictive capabilities of these systems, improving their efficiency, and reducing downtime by foreseeing maintenance needs. These trends are setting the stage for a more dynamic and technologically advanced market landscape, offering enhanced solutions to modern industrial challenges.

Regional Analysis

The Automated Feeder Systems Market showcases significant regional differentiation, with Europe leading as the dominant region, holding a substantial 39.3% market share and generating revenues of USD 2.0 billion.

This prominence is attributed to the advanced manufacturing base in countries like Germany, Italy, and France, where high levels of automation are integral to industrial operations. Europe’s leadership in implementing Industry 4.0 technologies contributes further to its market dominance, fostering growth through innovation in automated systems.

North America follows closely, driven by its robust automotive and pharmaceutical sectors that extensively utilize automated feeder systems for efficiency and compliance with stringent regulatory standards.

The Asia Pacific region is also a significant player, showing rapid growth due to expanding manufacturing sectors in China and India and increasing investments in automation to compete on a global scale.

Meanwhile, the Middle East & Africa and Latin America are emerging markets, experiencing gradual adoption as industries in these regions begin to recognize the efficiency gains and cost reductions offered by automated feeder systems. These regions present new growth opportunities due to industrial modernization and economic development efforts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Automated Feeder Systems Market, AGCO Corporation, Trioliet B.V., and Pellon Group Oy are key players that significantly shape the industry landscape in 2023. Each company brings unique strengths and strategic approaches that contribute to their competitive positions and the overall market dynamics.

AGCO Corporation has established itself as a leader due to its comprehensive range of high-efficiency feeding solutions tailored for large-scale agricultural operations. Their investment in technology-driven products, coupled with a strong global distribution network, allows them to meet the diverse needs of modern agriculture. AGCO’s focus on innovation and reliability makes it a preferred choice among farmers looking to enhance productivity and operational efficiency.

Trioliet B.V., a specialist in feeding technology, continues to excel by offering customized feeding solutions that cater to a variety of livestock management systems. Their commitment to quality and precision in design and manufacturing enables optimal feed management and has helped solidify their reputation in the European market. Trioliet’s strategy of continuous product development and enhancement ensures they remain at the forefront of feeding technology trends.

Pellon Group Oy stands out for its integration of automation in livestock management. The company’s focus on modular feeder systems, which can be adapted to different farming scales and practices, provides them with a competitive edge in markets that are progressively moving towards flexible and scalable solutions. Pellon’s dedication to sustainability and efficiency resonates well with the growing global demand for environmentally friendly and cost-effective feeding systems.

Together, these companies not only drive innovation within the Automated Feeder Systems Market but also set industry standards for quality, efficiency, and sustainability, positioning themselves strategically for future growth opportunities.

Top Key Players in the Market

- AGCO Corporation

- Trioliet B.V.

- Pellon Group Oy

- GEA Group Aktiengesellschaft

- Rovibec Agrisolutions

- Roxell BV

- VDL Agrotech bv

- Lely International N.V.

- Trioliet B.V.

- Pellon Group Oy

- GEA Group Aktiengesellschaft

- Rovibec Agrisolutions

- Sum-it Computer

- Davisway

- Dairymaster

- Afimilk

- Other key players

Recent Developments

- In May 2024, VDL Agrotech bv, Received €5 million in funding to develop a next-generation feeder system that integrates advanced sensors and AI for optimized feeding schedules.

- In March 2024, Roxell BV, Launched a new series of precision feeders designed to reduce waste and increase feed efficiency, targeted at poultry and swine producers.

- In January 2024, Rovibec Agrisolutions, Announced a partnership to enhance distribution networks across North America, aiming to increase accessibility to their high-tech feeding solutions.

Report Scope

Report Features Description Market Value (2023) USD 5.2 Billion Forecast Revenue (2033) USD 10.4 Billion CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type(Conveyor, Rail-Guided, Self-Propelled), Based on Technology(Robotics and Telemetry, Guidance and Remote Sensing Technology, RFID Technology, Others), Based on Function(Mixing, Controlling, Filling, Others), Based on Livestock(Poultry, Swine, Ruminants, Equine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AGCO Corporation, Trioliet B.V., Pellon Group Oy, GEA Group Aktiengesellschaft, Rovibec Agrisolutions, Roxell BV, VDL Agrotech bv, Lely International N.V., Trioliet B.V., Pellon Group Oy, GEA Group Aktiengesellschaft, Rovibec Agrisolutions, Sum-it Computer, Davisway, Dairymaster, Afimilk, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Feeder Systems MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automated Feeder Systems MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AGCO Corporation

- Trioliet B.V.

- Pellon Group Oy

- GEA Group Aktiengesellschaft

- Rovibec Agrisolutions

- Roxell BV

- VDL Agrotech bv

- Lely International N.V.

- Trioliet B.V.

- Pellon Group Oy

- GEA Group Aktiengesellschaft

- Rovibec Agrisolutions

- Sum-it Computer

- Davisway

- Dairymaster

- Afimilk

- Other key players