Global Augmented Connected Workforce Market Size, Share Analaysis Report By Component (Hardware (Wearables, IoT Devices, Sensors, Others), Software (Augmented Reality (AR) Platforms, Virtual Reality (VR) Platforms, Artificial Intelligence (AI) Solutions, Others), Services (Consulting Services, Integration Services, Support & Maintenance Services, Training Services)), By Deployment (Cloud-Based, On-Premises), By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-User Industry (Manufacturing, Healthcare, Logistics & Supply Chain, Retail, Construction, Energy & Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154489

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Outlook

- By Component – Hardware (58.6%)

- By Deployment – On-Premises (61.4%)

- By Enterprise Size – Large Enterprises (78.3%)

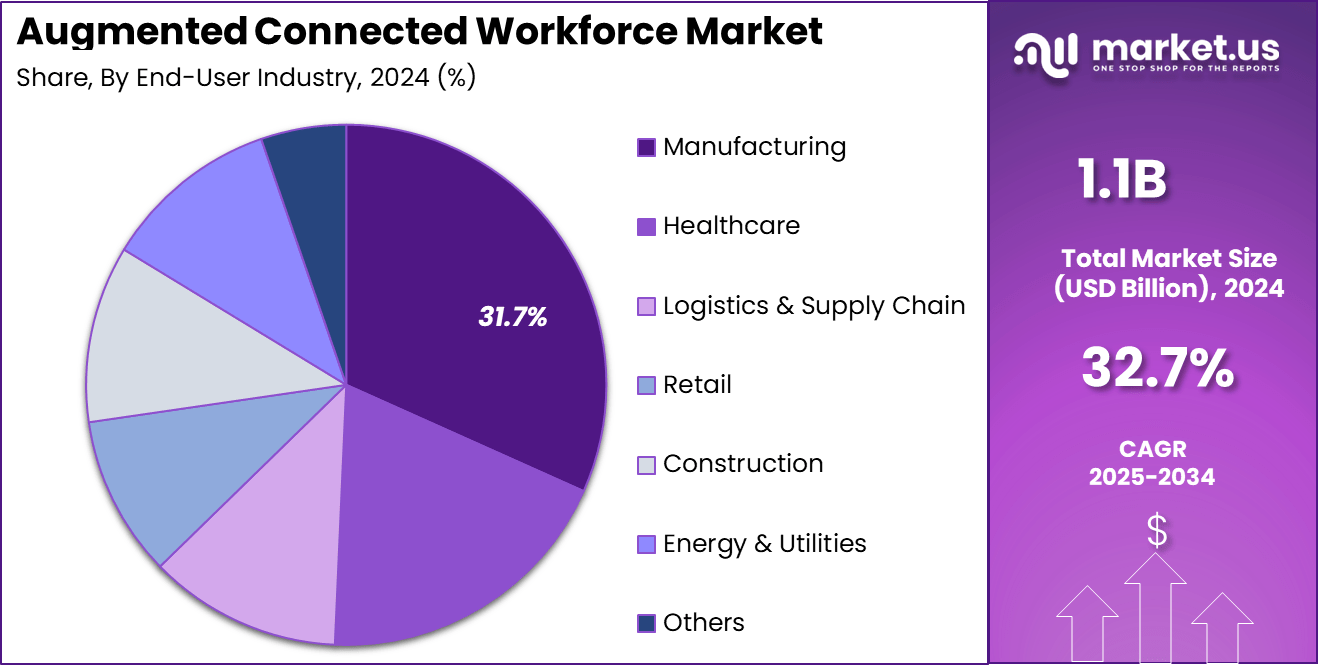

- By End-User Industry – Manufacturing (31.7%)

- Growth Factors

- Latest Trends

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

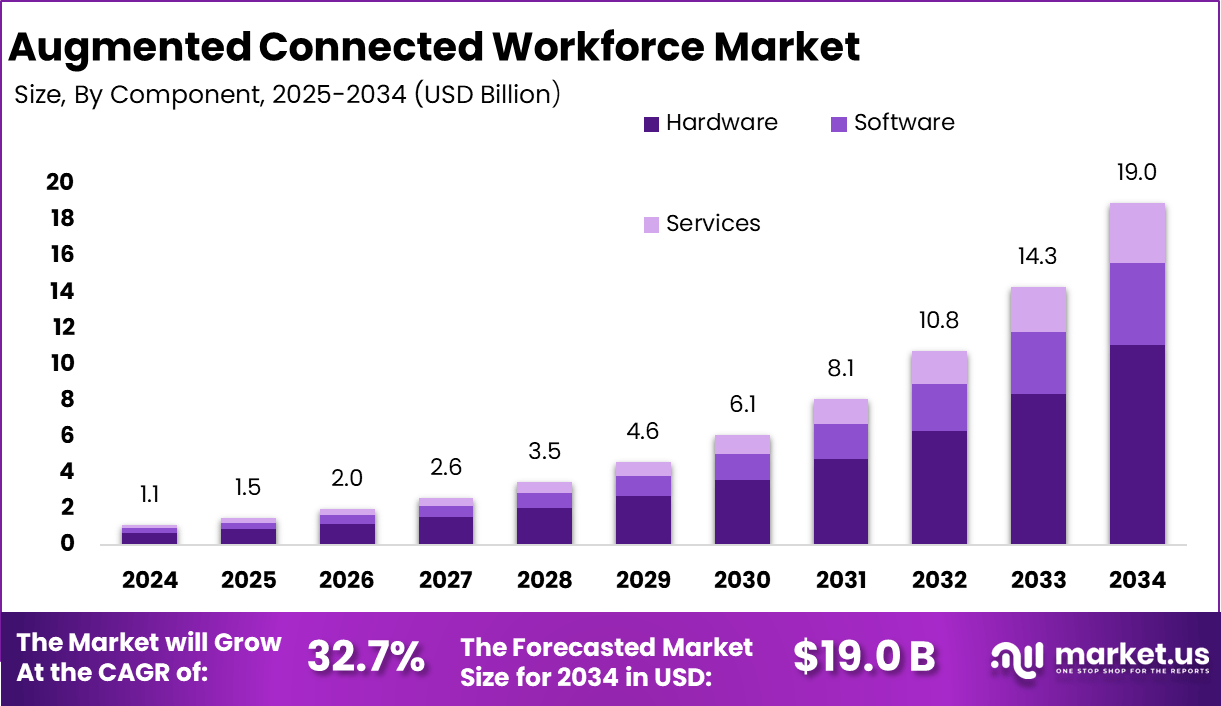

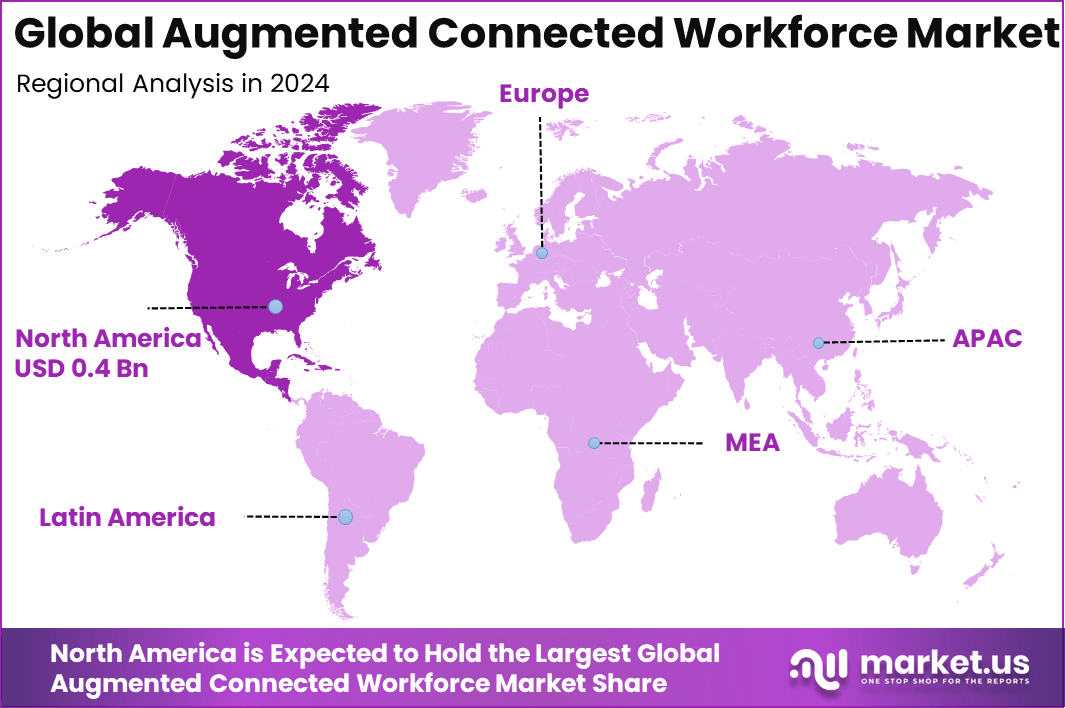

The Global Augmented Connected Workforce Market size is expected to be worth around USD 19.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 32.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.1% share, holding USD 0.4 Billion revenue.

The Augmented Connected Workforce refers to a digitally enabled workforce where employees are equipped with advanced technologies such as AR, virtual reality (VR), Internet of Things (IoT), AI and ML. In this environment, human capabilities are enhanced through real‑time data access, remote expert support and immersive training scenarios.

A major driver can be attributed to the urgent need to close persistent skills gaps amid retiring talent and rapid technological shifts. Demand for immersive training and real‑time assistance is also raising interest. Immersive technologies like AR and VR provide hands‑free guidance, improved retention and faster onboarding.

According to Market.us, The Global Connected Worker Market is poised for robust expansion, projected to reach approximately USD 58.74 billion by 2034, rising from USD 6.89 billion in 2024, and registering a CAGR of 23.9% over the forecast period from 2025 to 2034. This growth is driven by rising use of digital tools, wearables, and real-time communication to boost workforce productivity and safety.

The demand has been stimulated by escalating requirements for operational efficiency, employee safety and accelerated upskilling. Industries such as manufacturing, logistics and healthcare are pioneering adoption, using connected platforms to support distributed teams, remote maintenance, and procedural guidance. Digital transformation has been prioritized by roughly 78 % of senior leaders surveyed, reflecting growth in adoption across sectors facing talent constraints

Key Takeaway

- The Hardware segment led the market in 2024, accounting for 58.6%, driven by increased demand for AR headsets, wearable sensors, and smart devices across frontline operations.

- On-Premises deployments held a 61.4% share, as organizations emphasized data ownership, latency reduction, and integration with legacy systems.

- Large enterprises dominated the market with a 78.3% share, leveraging augmented tools to optimize workforce productivity, safety, and training at scale.

- The Manufacturing sector was the top industry user, capturing 31.7%, as factories adopted smart technologies for real-time support and operational efficiency.

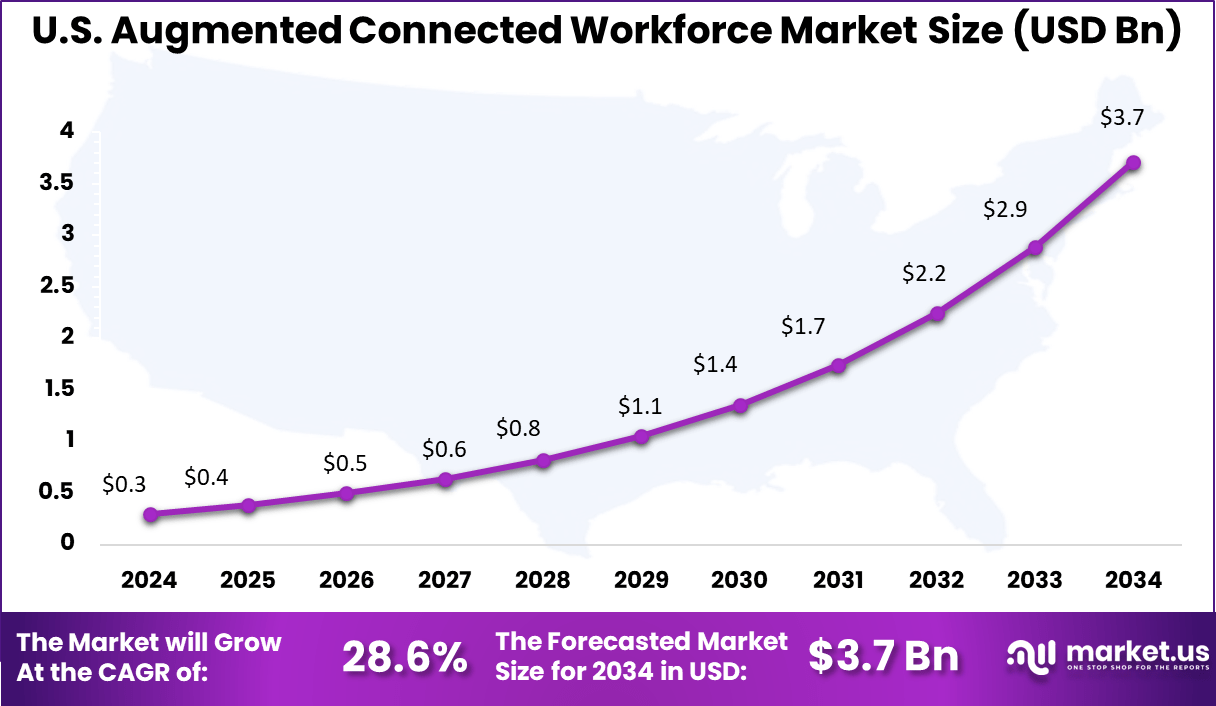

- The U.S. market reached USD 0.3 billion in 2024 and is projected to grow at a CAGR of 28.6%, reflecting strong adoption in industrial, defense, and logistics sectors.

- North America remained the largest regional market with a 38.1% share, supported by innovation hubs, advanced infrastructure, and enterprise digital transformation efforts.

U.S. Market Outlook

The U.S. Augmented Connected Workforce Market was valued at USD 0.3 Billion in 2024 and is anticipated to reach approximately USD 3.7 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 28.6% during the forecast period from 2025 to 2034.

The United States has emerged as the leading region in the Augmented Connected Workforce Market due to a combination of advanced technological infrastructure, strong digital adoption, and proactive investment in workforce modernization. The presence of highly skilled labor, widespread use of enterprise software, and early experimentation with immersive and intelligent technologies have accelerated adoption across industrial, healthcare, logistics, and energy sectors.

The CHIPS and Science Act, enacted in 2022, allocates approximately $13 billion for semiconductor research, development, and workforce training. This investment aims to bolster domestic manufacturing capabilities and address the anticipated shortage of skilled workers in the semiconductor industry. Additionally, the Infrastructure Investment and Jobs Act includes provisions for workforce development, emphasizing the need for a skilled labor force to support infrastructure modernization efforts.

In 2024, North America held a dominant market position in the global Augmented Connected Workforce market, capturing more than a 38.1% share. The North American augmented connected workforce (ACWF) market is experiencing significant growth, driven by substantial investments and technological advancements.

For instance, In 2024, the Bipartisan Infrastructure Law allocated $65 billion to expand broadband access, aiming to bridge the digital divide and enhance connectivity for remote and frontline workers. This investment is expected to facilitate the adoption of connected worker solutions across various industries. Additionally, Zebra Technologies introduced automation solutions at MODEX 2024, empowering connected workers with real-time data and analytics to improve operational efficiency.

By Component – Hardware (58.6%)

The hardware segment dominates the augmented connected workforce market with a 58.6% share. This reflects the critical role of wearable devices, AR/VR headsets, smart glasses, and other physical components in enabling seamless connectivity and real-world interaction for workers.

These hardware tools provide frontline employees with real-time data, remote assistance, and hands-free operations, which are key for improving productivity and safety in complex work environments. Investments in rugged, reliable, and ergonomically designed devices continue to drive growth in this segment, as organizations seek durable hardware that integrates smoothly with augmented workforce applications.

By Deployment – On-Premises (61.4%)

On-premises deployments hold the majority share at 61.4%, largely due to enterprises prioritizing security, control, and customization. Many organizations, especially those in sectors with sensitive data or strict compliance requirements, prefer to host augmented workforce solutions within their own IT ecosystems.

This model allows greater control over connectivity, data privacy, and system integration with existing operational technologies. Despite increasing cloud adoption, on-premises solutions remain favored for their reliability and ability to meet stringent enterprise-grade standards.

By Enterprise Size – Large Enterprises (78.3%)

Large enterprises constitute a significant 78.3% of this market, driven by their extensive workforce sizes and complex operational needs. These organizations have the resources to invest in advanced augmented workforce technologies at scale, aiming to enhance worker productivity, safety, and collaboration across dispersed locations. Their broad integration needs across multiple departments and geographies also favor comprehensive solutions that large hardware deployments and on-premises control can best support.

By End-User Industry – Manufacturing (31.7%)

The manufacturing sector leads the end-user industry segment with 31.7% of the market share. This is due to the sector’s intensive reliance on manual, technical labor and the critical need for real-time operational insights and error reduction.

Augmented connected workforce solutions help manufacturers improve assembly accuracy, equipment maintenance, and employee training, while reducing downtime and enhancing overall operational efficiency. The strong push towards Industry 4.0 and digital transformation further fuels adoption in manufacturing, making it the most prominent vertical within this market.

Growth Factors

Key Factors Description Advances in AR, VR, and Immersive Technology Adoption of augmented reality (AR), virtual reality (VR), and immersive tech powers worker training, safety, and field support. Demand for Enhanced Productivity & Workforce Efficiency Companies need to upskill, support, and connect workers in real time to boost productivity amid labor shortages and increased complexity. Expansion of Wearable and IoT Devices Smart wearables, sensors, and IoT platforms provide real-time data, health monitoring, and instant collaboration for frontline workers. Cloud-Based and Scalable Solutions Cloud platforms allow for flexible, scalable implementations and seamless updates to rapidly-evolving connected workforce technologies. Safety, Compliance, and Risk Mitigation Regulations and industry standards push adoption of tech that tracks safety, assures compliance, and reduces operational risks. Latest Trends

Key Trends Description Integration of AR/VR & IoT with AI Combining augmented reality, Internet of Things, and AI for contextual, data-driven support, predictive insights, and automation. Remote Assistance and Virtual Collaboration Enabling real-time expert guidance, digital collaboration, and troubleshooting for distributed or remote teams. Workforce Analytics & Real-Time Dashboards Using analytics and dashboards for continuous monitoring, performance tracking, and productivity enhancement. Focus on Upskilling and Training Interactive, simulation-based training for onboarding and continuous learning, especially in manufacturing and field roles. Expansion of 5G and Edge Computing High-speed, low-latency connectivity supports advanced AR/IoT applications, mobile workforces, and instant data exchange. Key Market Segments

By Component

- Hardware

- Wearables

- IoT Devices

- Sensors

- Others

- Software

- Augmented Reality (AR) Platforms

- Virtual Reality (VR) Platforms

- Artificial Intelligence (AI) Solutions

- Others

- Services

- Consulting Services

- Integration Services

- Support & Maintenance Services

- Training Services

By Deployment

- Cloud-Based

- On-Premises

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- Manufacturing

- Healthcare

- Logistics & Supply Chain

- Retail

- Construction

- Energy & Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Productivity and Flexibility

The need to boost productivity while maintaining flexibility is a core driver propelling the growth of the augmented connected workforce. Businesses are constantly under pressure to do more with less, speed up processes, and deliver personalized experiences to customers.

Digital augmentation empowers workers by filling skill gaps, expediting decision-making, and streamlining complex workflows. This leads to higher output quality and shorter turnaround times, which are critical in highly competitive and fast-changing industries. Moreover, the rise of remote and hybrid work scenarios has created demand for tools that maintain connectivity and collaboration across dispersed teams.

Cloud computing, intelligent wearables, and collaborative software platforms enable seamless communication and access to data regardless of location. This connectivity ensures continuity and agility in operations, even amid disruptions, ultimately strengthening business resilience and workforce engagement.

Restraint Analysis

High Initial Costs and Infrastructure Concerns

Despite its benefits, adopting augmented connected workforce solutions involves significant upfront costs, which can be a major restraint for many organizations. Investments are required not only in advanced technologies like AI, IoT devices, and cloud services but also in overhauling existing IT infrastructure to integrate these components smoothly.

Additionally, substantial resources must be allocated to training employees and managing change effectively, which can strain budgets and delay implementation timelines. Infrastructure challenges also arise because many legacy systems are not designed to support real-time data exchange and collaboration on a large scale.

Without proper integration and robust IT architecture, the risk of data silos and communication breakdowns increases, limiting the technology’s effectiveness. Companies must carefully evaluate their readiness and prioritize strategic investments to build a solid foundation for sustainable augmented workforce initiatives.

Opportunity Analysis

Personalized and Inclusive Work Experiences

The augmented connected workforce opens up exciting opportunities to design work environments that are tailored to individual employee needs and strengths. Digital tools can provide customized interfaces, adaptive learning modules, and real-time guidance, making work more accessible and intuitive.

This personalization supports diverse talents and helps employees develop skills at their own pace, creating more fulfilling and productive work experiences. Additionally, these technologies promote inclusion by enabling people with various abilities and backgrounds to contribute meaningfully.

For example, assistive devices and AI-powered translation can break down barriers for workers with disabilities or those operating in multilingual settings. By fostering diversity and equity, companies can unlock new levels of creativity and innovation while enhancing employee satisfaction and retention.

Challenge Analysis

Addressing Skills Gaps and Resistance to Change

One of the biggest challenges in deploying augmented connected workforce models is bridging the skills gap among employees. Many workers may not have the digital literacy or technical know-how to fully leverage new tools, which can hinder adoption and reduce potential benefits.

Continuous training programs and easy-to-use interfaces are essential to help employees build confidence and competence in the changing workplace. Resistance to change is another significant hurdle. People generally fear the unknown and may worry about job security or becoming irrelevant in an AI-enhanced environment.

To overcome this, organizations must take a thoughtful approach, emphasizing that technology is meant to augment rather than replace human roles. Building a culture of trust and openness, where workers feel supported and involved in the transformation, is critical to achieving a smooth transition and realizing long-term value.

Key Players Analysis

The Augmented Connected Workforce Market features a wide range of leading players driving innovation through digital transformation, wearable integration, and data-driven automation. Companies such as 3M Company, Honeywell International Inc., and Zebra Technologies Corporation are recognized for their strong hardware solutions. These include smart glasses, rugged devices, and intelligent sensors used in industrial, logistics, and field operations.

Digital service providers like Accenture, Tata Consultancy Services (TCS), Oracle Corporation, and Fujitsu Ltd. are focusing on deploying advanced enterprise platforms. These platforms offer end-to-end solutions combining cloud infrastructure, AI-based analytics, and workforce management tools. Their strategies are aimed at enabling remote support, knowledge-sharing, and connected workflows across manufacturing, energy, and utility sectors.

Several niche and emerging players are also contributing to market growth. Firms like Smart Track S.R.L, Vandrico Solutions Inc., Wearable Technologies Limited, Scandit AG, and Augmentir, Inc. are building specialized platforms for location tracking, augmented task assistance, and AI-enabled performance insights. In parallel, TELUS Corporation, Avnet, Inc., and TeamViewer AG are accelerating remote collaboration and real-time communication solutions.

Top Key Players in the Market

- 3M Company

- Accenture

- Avnet, Inc.

- Fujitsu Ltd.

- Honeywell International Inc.

- Oracle Corporation

- Smart Track S.R.L

- Tata Consultancy Services (TCS)

- TELUS Corporation

- Vandrico Solutions Inc.

- Wearable Technologies Limited

- Zebra Technologies Corporation

- TeamViewer AG

- Scandit AG

- Augmentir, Inc.

- Others

Recent Developments

- In their 2024 Global Impact Report, 3M reemphasized commitment to technological innovation and sustainable workforce solutions, integrating digital tools for smarter operations.

- Avnet, Inc. pushes their Smart Connected Worker IoT SaaS to improve safety in manufacturing with wearable sensors, analytics, and compliance tracking, helping industries minimize risks and maximize intelligence from connected workers (solution actively highlighted through 2024).

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 19 Bn CAGR (2025-2034) 32.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Wearables, IoT Devices, Sensors, Others), Software (Augmented Reality (AR) Platforms, Virtual Reality (VR) Platforms, Artificial Intelligence (AI) Solutions, Others), Services (Consulting Services, Integration Services, Support & Maintenance Services, Training Services)), By Deployment (Cloud-Based, On-Premises), By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-User Industry (Manufacturing, Healthcare, Logistics & Supply Chain, Retail, Construction, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M Company, Accenture, Avnet, Inc., Fujitsu Ltd., Honeywell International Inc., Oracle Corporation, Smart Track S.R.L, Tata Consultancy Services (TCS), TELUS Corporation, Vandrico Solutions Inc., Wearable Technologies Limited, Zebra Technologies Corporation, TeamViewer AG, Scandit AG, Augmentir, Inc., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Augmented Connected Workforce MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Augmented Connected Workforce MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Accenture

- Avnet, Inc.

- Fujitsu Ltd.

- Honeywell International Inc.

- Oracle Corporation

- Smart Track S.R.L

- Tata Consultancy Services (TCS)

- TELUS Corporation

- Vandrico Solutions Inc.

- Wearable Technologies Limited

- Zebra Technologies Corporation

- TeamViewer AG

- Scandit AG

- Augmentir, Inc.

- Others