At-Home Testing Market By Product Type (Kits, Devices, Strips and Others), By Sample Type (Blood, Urine, Saliva, Stool and Others), Application (Chronic Disease Monitoring, Infectious Disease Detection, Pregnancy & Fertility, Cancer Screening and Others), By Distribution Channel (Offline and Online), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151994

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

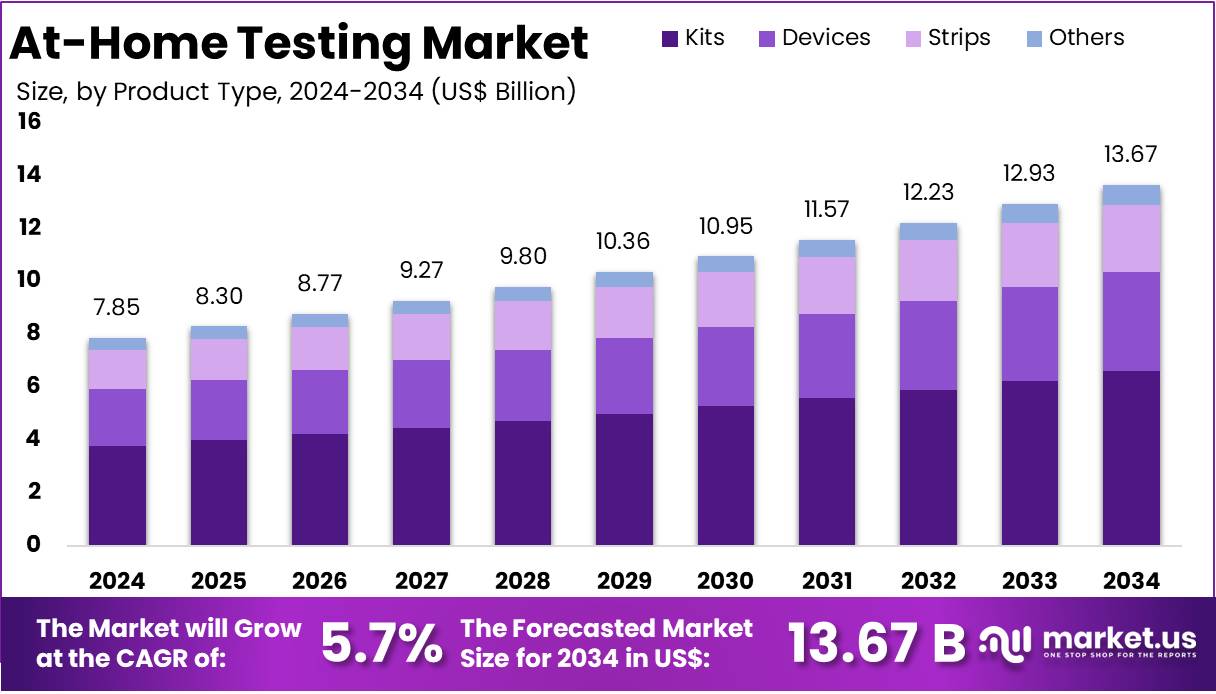

The At-Home Testing Market Size is expected to be worth around US$ 13.67 billion by 2034 from US$ 7.85 billion in 2024, growing at a CAGR of 5.70% during the forecast period 2025 to 2034.

At-home medical tests, often referred to as home use tests, are diagnostic kits available for purchase online or at local pharmacies and supermarkets. These tests enable individuals to monitor, screen, or diagnose certain conditions and diseases from the comfort and privacy of their home. Common examples of at-home tests include pregnancy tests, blood glucose tests for managing diabetes, fecal occult blood tests for screening colon cancer, and tests for detecting infectious diseases like hepatitis, HIV, and COVID-19. Additionally, genetic tests are available to help individuals assess their risk for specific diseases, allowing for proactive health management.

The at-home testing market has experienced significant growth in recent years, driven by advancements in diagnostic technology, consumer demand for convenience, and increased health awareness. This market allows individuals to conduct various health tests from the comfort of their homes, including glucose, cholesterol, pregnancy, and infectious disease tests. The global at-home testing market is expected to continue its upward trajectory, fueled by the rising preference for self-management of health, particularly chronic conditions. The COVID-19 pandemic accelerated this trend, with an increased demand for at-home COVID-19 testing kits and other diagnostic solutions.

Technological innovations are transforming the at-home diagnostics market. The integration of artificial intelligence and mobile apps with testing devices has improved the accuracy and ease of use of home testing products. These tools help users track their health and receive real-time insights. At the same time, the increasing adoption of telemedicine is expanding the reach of home diagnostics. It allows individuals to consult with healthcare professionals remotely. This shift is reducing the need for physical clinic visits and boosting the demand for reliable home testing solutions.

In June 2025, Amazon India launched Amazon Diagnostics, a new at-home lab testing service. Customers can now book lab tests, schedule sample collection, and access digital reports through the Amazon app. The service offers more than 800 diagnostic tests with doorstep collection in under 60 minutes. Routine test results are delivered digitally within six hours. Developed in partnership with Orange Health Labs, the service is currently available in Bengaluru, Delhi, Gurgaon, Noida, Mumbai, and Hyderabad. It covers over 450 pin codes across these cities.

Despite its growth, the market faces challenges, including concerns over the accuracy and reliability of some home testing products. Regulatory scrutiny and the need for validation of testing kits are essential for fostering consumer trust. Overall, the at-home testing market presents vast opportunities for innovation and expansion, providing more accessible and personalized healthcare solutions.

Key Takeaways

- In 2024, the market for At-Home Testing generated a revenue of US$ 85 billion, with a CAGR of 5.7%, and is expected to reach US$ 13.67 billion by the year 2034.

- The Product Type segment is divided into Kits, Devices, Strips, and Others with Kits taking the lead in 2024 with a market share of 48.25%.

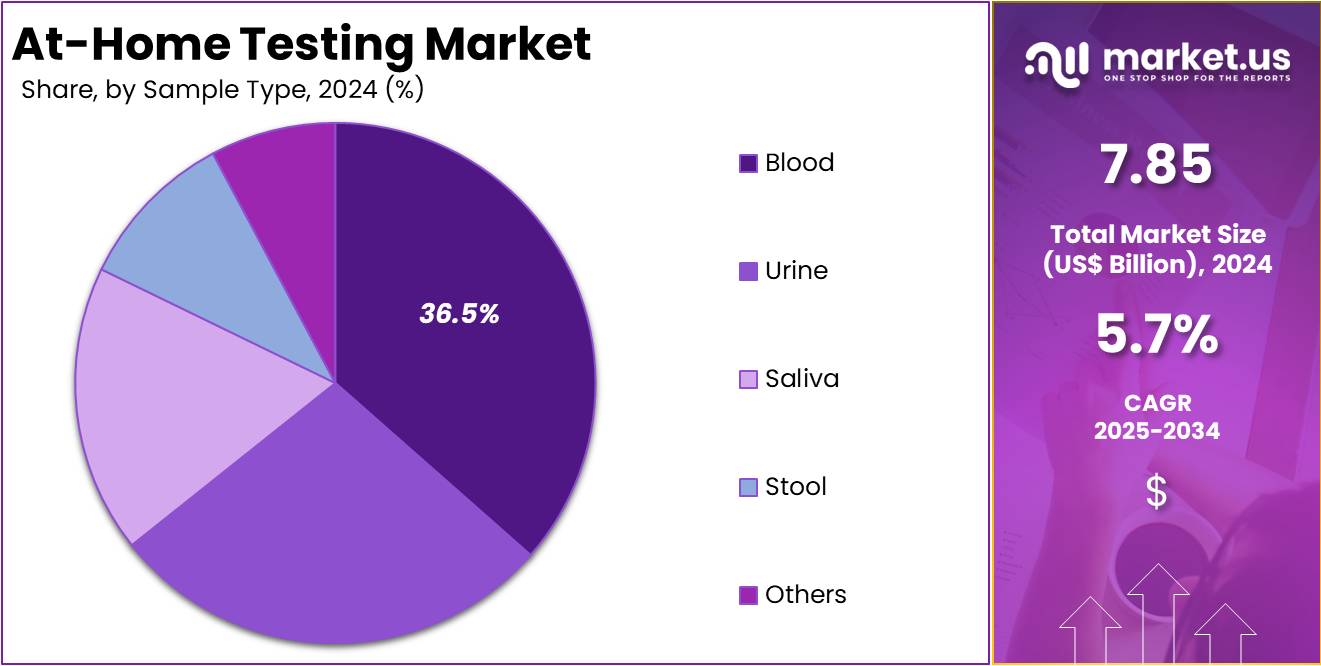

- By Sample Type, the market is bifurcated into Blood, Urine, Saliva, Stool, and Others, with Blood leading the market with 36.5% of market share.

- Furthermore, concerning the Application segment, theChronic Disease Monitoring sector stands out as the dominant segment, holding the largest revenue share of 38.9% in the At-Home Testing market.

- By Distribution Channel, the market is bifurcated into Offline and Online, with Offline leading the market in 2024 with a market share of 63.4%.

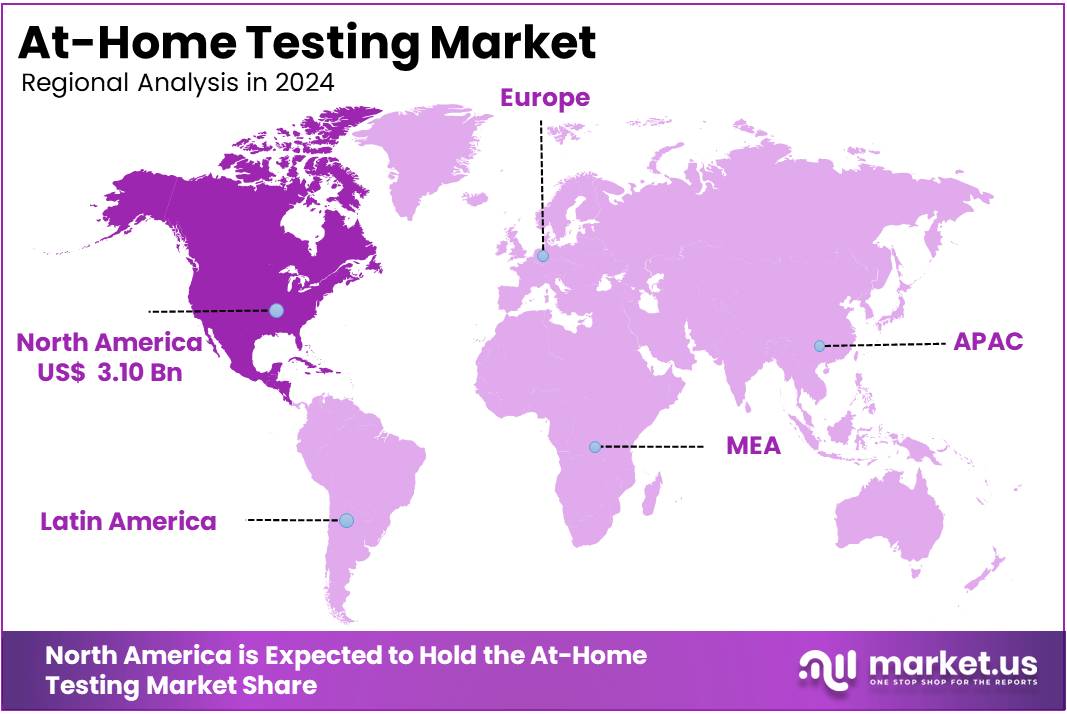

- North America led the market by securing a market share of 39.5% in 2023.

Product Type Analysis

The kits segment held the largest share in the at-home testing market, accounting for 48.25% of total revenue. This dominance is due to their versatility, ease of use, and wide range of applications. At-home test kits are designed for consumers to use independently, without clinical assistance. Each kit generally includes testing materials, sample collection tools, and result interpretation guides. They are used for various conditions, including pregnancy, glucose levels, cholesterol, and infections, making them a practical choice for everyday health monitoring.

Consumer demand for at-home test kits is rising due to growing interest in preventive healthcare. People now seek quick, private, and cost-effective ways to check their health. These kits are easy to purchase over the counter and require no appointments or laboratory visits. This convenience appeals to both chronic disease patients and wellness-focused individuals. The flexibility to test from home supports self-care, encourages early detection, and aligns with the broader trend toward patient-centered health solutions.

In March 2020, Abbott received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for a rapid COVID-19 molecular test. The test runs on the ID NOW platform and delivers positive results in just five minutes. Negative results appear within 13 minutes. This development marked a significant milestone in rapid testing, allowing faster diagnosis in emergency rooms, urgent care centers, and physician offices, while reinforcing the importance of point-of-care diagnostics.

Sample Type Analysis

Blood sample type held the largest share in the at-home testing market, accounting for 36.50% in 2025. This dominance is due to the high accuracy and reliability of blood-based tests. Such tests are essential for monitoring chronic conditions like diabetes, cardiovascular health, and cholesterol levels. Devices like blood glucose meters and cholesterol monitors are widely adopted by individuals for routine health tracking. Consumers prefer blood-based testing due to its diagnostic precision and ease of regular use within home settings.

Advancements in non-invasive blood collection methods have further supported this trend. Fingerstick sampling technologies allow individuals to draw small blood samples without visiting a clinic. These innovations have made at-home testing more accessible and less intimidating. Blood tests offer deeper insights into a person’s health, which drives their popularity over other sample types like saliva or urine. The combination of diagnostic value and user-friendly collection methods has led to widespread adoption among health-conscious consumers.

In March 2025, BD (Becton, Dickinson and Company) and Babson Diagnostics shared study findings supporting this growth. The results confirmed that blood tests using fingerstick samples are as accurate as traditional venous draws. BD’s MiniDraw Capillary Blood Collection technology, used in Babson’s BetterWay service, was central to these studies. This method eliminates the need for venipuncture, enabling more patient-friendly and convenient testing solutions at home and in decentralized settings.

Application Analysis

The Chronic Disease Monitoring segment accounted for the largest share of 38.90% in the global at-home testing market. This dominance is due to the rising global burden of chronic conditions such as diabetes, hypertension, and cardiovascular diseases. These health issues require regular monitoring to ensure effective disease management. At-home testing kits offer a convenient and cost-effective solution for patients. They reduce the need for frequent clinic visits. As a result, individuals are empowered to manage their conditions more independently and efficiently.

With the aging global population and rising awareness of health management, this segment is expected to grow further. The ease of testing blood glucose, cholesterol, or blood pressure from home has increased adoption. Moreover, the ability to track health trends over time adds value for both patients and providers. This growth is also supported by expanding healthcare access and a focus on preventive care. The trend reflects a broader shift toward decentralized healthcare models.

Technological advancements continue to enhance the segment’s appeal. The integration of data analytics and digital platforms allows real-time health tracking and personalized care. For instance, in April 2024, Royal Philips partnered with smartQare to integrate viQtor with Philips’ patient monitoring systems. This collaboration aims to advance continuous monitoring at hospitals and at home. It initially launched in Europe to support better chronic care.

Distribution Channel Analysis

The Offline distribution channel continues to dominate the at-home testing market with 63.40% market share due to the long-established presence of retail pharmacies, drugstores, and supermarkets that sell these products. Consumers are familiar with purchasing at-home testing kits from physical stores, and the convenience of in-store shopping ensures that the segment remains a significant source of sales.

Additionally, offline channels offer immediate access to test kits, allowing consumers to obtain products without delay. While online sales have grown significantly, particularly due to the convenience offered by e-commerce platforms, offline retail remains the preferred choice for many customers. The tangible interaction with products and in-person assistance in stores contribute to the dominance of offline channels.

In July 2022, Abingdon Health plc, a leading global developer and manufacturer of high-quality rapid tests, has announced the launch of its new B2C e-commerce platform, abingdonsimplytest.com. The website will offer UK and international customers access to Abingdon Simply Test products, as well as third-party branded self-tests that are Abingdon-assured.

Key Market Segments

By Product Type

- Kits

- Devices

- Strips

- Others

By Sample Type

- Blood

- Urine

- Saliva

- Stool

- Others

By Application

- Chronic Disease Monitoring

- Infectious Disease Detection

- Pregnancy & Fertility

- Cancer Screening

- Others

By Distribution Channel

- Offline

- Online

Drivers

Increasing Consumer Demand for Convenient Healthcare Solutions

The growing demand for convenience and privacy in healthcare is a significant driver for the at-home testing market. Consumers are increasingly seeking solutions that allow them to manage their health without visiting medical facilities. At-home testing provides convenience, enabling individuals to test for various conditions such as diabetes, cholesterol, pregnancy, and infectious diseases from the comfort of their homes.

In May 2025, Ovatient, a virtual-first healthcare delivery company, announced the launch of MyCare Anywhere. The company was co-founded by The MetroHealth System in Ohio and MUSC Health in South Carolina. The platform is powered by League, a healthcare consumer experience (CX) platform that uses data and AI to boost patient engagement. MyCare Anywhere offers an omni-channel approach to improve how patients connect with health systems and trusted providers. It is designed to enhance virtual care experiences using advanced personalization and smart health tools.

MyCare Anywhere is available on both desktop and mobile devices, including iOS and Android. It is integrated with electronic medical records (EMRs), enabling personalized care plans, expert content, and guided health journeys. The service helps users navigate their health proactively and efficiently. Initially, it will serve patients in Northeast Ohio through Ovatient’s collaboration with MetroHealth. The launch supports growing trends in digital health, where convenience and continuous engagement are key to better outcomes.

The rise of digital health technologies and increased awareness about health monitoring also contributes to this trend. With advancements in testing technologies, accuracy, and ease of use, more people are turning to self-diagnostic tools to monitor chronic conditions and assess health risks. The COVID-19 pandemic played a crucial role in accelerating this trend, as more individuals preferred home testing to minimize exposure to the virus.

Moreover, as people become more health-conscious and tech-savvy, they are increasingly opting for personalized and on-demand health monitoring solutions. This consumer-driven shift towards home-based healthcare services is expected to fuel the market’s growth in the coming years, driven by innovations in test accuracy, affordability, and ease of use.

Restraints

Limited Accuracy and Reliability of Some Tests

One of the major restraints for the at-home testing market is the perceived or actual limitations in accuracy and reliability of certain home testing kits. While many home tests offer convenience, there are concerns regarding their precision and the potential for false positives or negatives. For instance, at-home diagnostic tests for conditions like diabetes, cholesterol, and even COVID-19 can have variations in test results depending on factors such as user error, test conditions, or the quality of the test kits themselves.

For example, limited accuracy in at-home tests is seen with at-home COVID-19 rapid antigen tests. These tests typically have an overall sensitivity of about 85%, meaning they correctly identify 85% of people who are actually infected, but miss about 15% (false negatives). Their real-world performance can be even lower, especially if the test is taken early in the infection before the virus has reached detectable levels.

This can undermine consumer trust and affect market adoption, particularly for more critical conditions requiring highly accurate diagnostics. Additionally, some at-home tests lack sufficient regulatory oversight or are not FDA-approved, further contributing to doubts about their reliability. Inaccurate results can lead to misdiagnoses, delayed treatments, and unnecessary panic, especially when used for detecting serious health issues. The need for continuous improvements in testing technology and robust validation from regulatory bodies is crucial to overcoming this challenge and gaining consumer confidence.

Opportunities

Integration with Telemedicine for Remote Healthcare

A major opportunity in the at-home testing market is the integration of testing kits with telemedicine services, enabling remote healthcare consultations. As telehealth adoption rises, combining at-home testing with virtual consultations offers a seamless experience for consumers. Patients can take tests at home and share the results with healthcare providers via digital platforms, receiving timely medical advice and prescriptions without leaving their homes.

This model of healthcare improves access for underserved populations and individuals with limited mobility. By integrating with telemedicine, it enables continuous and real-time health monitoring. This supports better decision-making for physicians. It also reduces costs by limiting the need for in-person visits. This approach is especially useful for managing chronic illnesses like diabetes, hypertension, and mental health disorders. Frequent remote tracking helps maintain patient health. It also ensures early intervention, which enhances outcomes and prevents complications. This makes care more proactive and efficient.

A relevant example occurred in May 2021, when United Airlines and Abbott introduced a joint initiative. They launched the BinaxNOW™ COVID-19 Home Test with the NAVICA app. The program was aligned with CDC updates that allowed self-testing under telehealth supervision. Travelers could take the test at home. If the result was negative, it qualified them to board international flights to the U.S. This reduced the need for testing centers. It also streamlined international travel while ensuring public health compliance.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the at-home testing market, impacting both supply and demand. The global economic environment, including inflation and economic downturns, can affect consumer spending power. In times of economic uncertainty, consumers may prioritize essential healthcare services and products, such as at-home testing kits, over discretionary items. This creates a steady demand for affordable, convenient testing solutions that do not require expensive healthcare visits. Conversely, economic recessions may reduce discretionary spending, which could slightly hinder growth in non-essential sectors of at-home testing.

Geopolitical factors also play a crucial role in shaping the market. Trade policies, tariffs, and political tensions between nations can disrupt supply chains, affecting the availability and cost of testing kits. For example, tensions between countries like the U.S. and China could lead to delays in the production and distribution of test kits, influencing market dynamics.

Moreover, geopolitical instability or health crises, such as the COVID-19 pandemic, can drive an increased reliance on at-home testing solutions, as individuals seek alternatives to crowded healthcare facilities. Conversely, geopolitical stability often fosters global collaboration, encouraging innovation and smoother market access. In the long term, these factors create both challenges and opportunities for businesses, influencing the development, availability, and affordability of at-home testing products.

Latest Trends

Rising Adoption of AI and Data Analytics for Test Interpretation

One key trend in the at-home testing market is the integration of Artificial Intelligence (AI) and data analytics for test interpretation. Traditionally, home test kits required follow-up consultations for understanding results. However, AI now enables real-time data analysis. It offers users accurate, easy-to-understand feedback. AI-powered applications can interpret test results and provide actionable insights. This shift is making self-diagnosis more reliable. Consumers now benefit from improved accuracy and faster interpretation, bridging the gap between home testing and professional medical guidance.

This innovation is especially prominent in chronic disease management, such as diabetes. AI-based tools can track blood glucose trends and predict potential complications. They also suggest personalized lifestyle changes to help users maintain better control over their condition. As a result, individuals receive ongoing support without needing frequent in-person appointments. These tools empower users with better health awareness. The continuous feedback loop enhances disease prevention and promotes proactive healthcare management at home.

In June 2023, Sanofi introduced an advanced AI platform called plai, developed with Aily Labs. The platform supports Sanofi’s digital transformation by providing a 360-degree view of all operations. It helps analyze data in real time, enabling smarter decision-making. The app improves operational efficiency across departments. With this tool, Sanofi sets a new benchmark in AI-driven healthcare operations. It demonstrates how pharmaceutical companies are leveraging AI to improve internal workflows and external outcomes.

More recently, in February 2025, Validic launched a new digital solution that uses Generative AI (GenAI). This innovation is part of its Validic Impact™ platform, integrated with Electronic Health Records (EHR). The solution summarizes patient data trends and improves remote patient monitoring (RPM). It allows healthcare providers to quickly assess patient health. This tool increases efficiency and supports better clinical decisions. By using GenAI, Validic expands AI’s role in home-based healthcare. The advancement signals ongoing growth in smart, AI-driven diagnostic technologies.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.5% share and holds US$ 7.19 Billion market value for the year. This region is a significant segment of the global self-testing industry, characterized by robust growth, technological advancements, and a strong regulatory framework. Key factors propelling the market include technological advancements, such as the integration of artificial intelligence (AI) and mobile applications with testing devices, which enhance accuracy and user experience. Additionally, rising consumer awareness about health and wellness encourages proactive health management, and supportive regulatory frameworks facilitate the approval and availability of at-home testing products.

In October 2024, the U.S. Food and Drug Administration has granted marketing authorization for the Healgen Rapid Check COVID-19/Flu A&B Antigen Test in the region. Authorized for use without a prescription, the test is designed for individuals experiencing respiratory symptoms. It uses a nasal swab sample to deliver at-home results in approximately 15 minutes for both COVID-19 and influenza. The test detects proteins from both SARS-CoV-2, the virus responsible for COVID-19, and influenza A and B, the viruses that cause the flu.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the At-Home Testing market include Abbott Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers, Becton, Dickinson and Company (BD), Cardinal Health, OraSure Technologies, Inc., Quidel Corporation, bioMérieux, Everly Health Inc., iHealth Labs Inc., 23 andMe Inc., MyHeritage Ltd., Teal Health, Guardant Health, Natera, Exact Sciences, Lucira Health, ACON Laboratories Inc., Bionime Corporation, Geratherm Medical AG, PRIMA Lab SA, Piramal Enterprises Ltd., and Others.

Abbott’s at-home testing products focus primarily on diabetes management, with its popular FreeStyle Libre system, which allows patients to monitor their blood glucose levels without the need for fingerstick testing. Abbott also offers rapid antigen tests for infectious diseases like COVID-19, contributing significantly to the at-home testing market.

F. Hoffmann-La Roche Ltd, provides a range of self-testing solutions, particularly for chronic disease management and infectious disease detection. Their at-home testing products include glucose meters, pregnancy tests, and COVID-19 home testing kits. Siemens Healthineers offers products such as home-use blood glucose meters, and it has expanded its focus on integrating digital health technologies with at-home testing solutions. The company’s use of artificial intelligence and cloud-based systems for test result analysis enhances the user experience, providing consumers with actionable insights for managing their health.

Top Key Players in the At-Home Testing Market

- Abbott Laboratories

- Hoffmann-La Roche Ltd

- Siemens Healthineers

- Becton, Dickinson and Company (BD)

- Cardinal Health

- OraSure Technologies, Inc.

- Quidel Corporation

- bioMérieux

- Everly Health Inc.

- iHealth Labs Inc.

- 23 andMe Inc.

- MyHeritage Ltd.

- Teal Health

- Guardant Health

- Natera

- Exact Sciences

- Lucira Health

- ACON Laboratories Inc.

- Bionime Corporation

- Geratherm Medical AG

- PRIMA Lab SA

- Piramal Enterprises Ltd.

- Others

Recent Developments

- January 2025: It was reported that OraSure Technologies, Inc. (NASDAQ: OSUR), recognized for its leadership in point-of-care and at-home diagnostics, received approval from the U.S. Food and Drug Administration’s Center for Biologics Evaluation and Research (CBER) for a significant update to its OraQuick® HIV Self-Test. The newly approved labeling permits the use of the test by individuals aged 14 years and older, expanding access to adolescents. Prior to this change, the product was authorized only for individuals aged 17 and above.

- December 2021: Roche was granted Emergency Use Authorization (EUA) by the U.S. FDA for its COVID-19 At-Home Test. This test employs a self-collected anterior nasal swab and can be used independently by individuals aged 14 years and older. For children between the ages of 2 and 13, the test must be administered by an adult.

- February 2021: A collaboration between BD (Becton, Dickinson and Company), a global medical technology firm, and Scanwell Health, known for its smartphone-enabled diagnostic tools, was announced to develop a rapid at-home test for COVID-19. The initiative aims to integrate BD’s antigen testing technology with the Scanwell mobile application, allowing individuals to conduct the test and access results directly from their homes.

- November 2020: The FDA granted Emergency Use Authorization for the Lucira COVID-19 All-In-One Test Kit. This was the first self-administered, at-home molecular test for COVID-19, delivering rapid results. The single-use device detects SARS-CoV-2 through real-time loop-mediated isothermal amplification, offering a new level of convenience in home-based testing.

Report Scope

Report Features Description Market Value (2024) US$ 7.85 Billion Forecast Revenue (2034) US$ 13.67 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits, Devices, Strips and Others), By Sample Type (Blood, Urine, Saliva, Stool and Others), Application (Chronic Disease Monitoring, Infectious Disease Detection, Pregnancy & Fertility, Cancer Screening and Others), By Distribution Channel (Offline and Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers, Becton, Dickinson and Company (BD), Cardinal Health, OraSure Technologies, Inc., Quidel Corporation, bioMérieux, Everly Health Inc., iHealth Labs Inc., 23 andMe Inc., MyHeritage Ltd., Teal Health, Guardant Health, Natera, Exact Sciences, Lucira Health, ACON Laboratories Inc., Bionime Corporation, Geratherm Medical AG, PRIMA Lab SA, Piramal Enterprises Ltd., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories

- Hoffmann-La Roche Ltd

- Siemens Healthineers

- Becton, Dickinson and Company (BD)

- Cardinal Health

- OraSure Technologies, Inc.

- Quidel Corporation

- bioMérieux

- Everly Health Inc.

- iHealth Labs Inc.

- 23 andMe Inc.

- MyHeritage Ltd.

- Teal Health

- Guardant Health

- Natera

- Exact Sciences

- Lucira Health

- ACON Laboratories Inc.

- Bionime Corporation

- Geratherm Medical AG

- PRIMA Lab SA

- Piramal Enterprises Ltd.

- Others