Global Assisted Living Market Size, Share Analysis Report By Service Type (Medication Monitoring, Palliative & Hospice Care, Disease Monitoring, Mobility, Others), By Facility Type (Adult Family Homes, Community-Based Residential Facilities, Residential Care Apartment Complexes) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151292

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

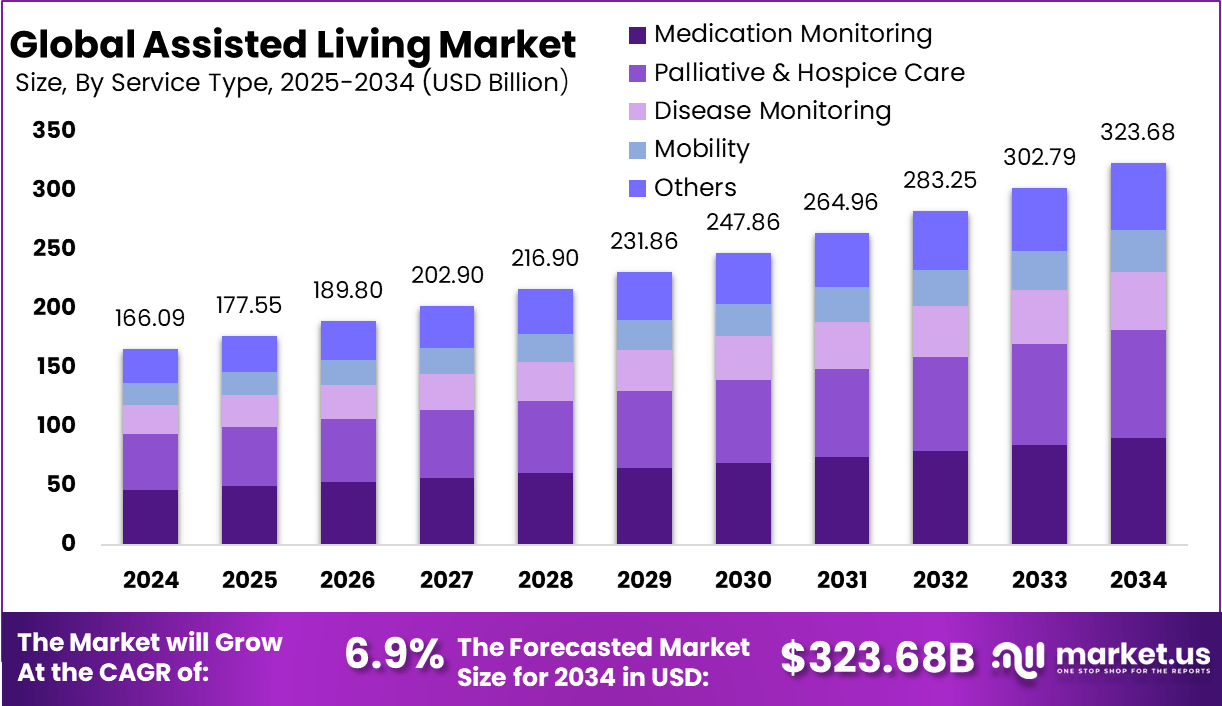

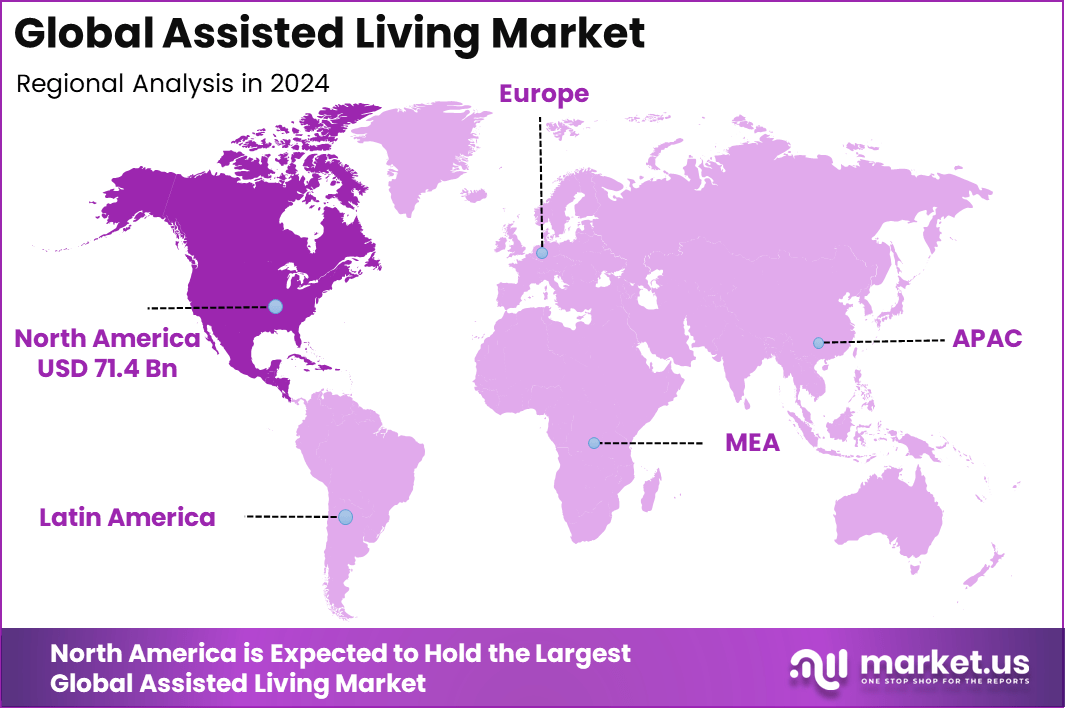

The Global Assisted Living Market size is expected to be worth around USD 323.68 billion by 2034, from USD 166.09 billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43% share, holding USD 71.4 billion in revenue.

The Assisted Living market is experiencing sustained expansion as global populations age and care needs evolve. This growth can be attributed to increased life expectancy and a rising proportion of elderly individuals, which has amplified the demand for supportive environments beyond traditional home care. The sector is transitioning from basic residential support toward integrated, person‑centred care ecosystems that emphasise autonomy, well‑being, and social engagement.

A significant growth driver is the increasing prevalence of chronic health conditions, which necessitates day‑to‑day assistance and medical coordination . Concurrently, changing family structures and urban migration have reduced informal caregiving, prompting a shift toward formal assisted living solutions. Supportive public policies and healthcare reforms encouraging ageing‑in‑place also reinforce investment in this segment.

Demand is strong across developed regions such as North America and Europe, where ageing demographics are most pronounced, while emerging markets in Asia‑Pacific are witnessing rapid uptake due to rising middle‑class incomes and shifting cultural norms . Pressure on family caregivers and increased healthcare awareness has triggered higher occupancy rates and earlier community entry, often well before residents require intensive support.

For instance, in February 2025, Onestep partnered with Yardi to deploy AI-powered motion analysis in senior living communities. This solution uses advanced sensors and artificial intelligence to track residents’ movements in real time, helping detect fall risks early and enabling timely, personalized interventions. The integration aims to enhance resident safety, improve care quality, and streamline operational efficiency.

Key Takeaway

- The Global Assisted Living Market is projected to grow from USD 166.09 billion in 2024 to approximately USD 323.68 billion by 2034, registering a steady CAGR of 6.9%.

- North America led the market in 2024, securing over 43% of global revenue, which totaled around USD 71.4 billion, driven by an aging population and advanced senior care infrastructure.

- The U.S. alone generated USD 67.7 billion, with growth progressing at a moderate CAGR of 4.8%, supported by increased healthcare spending and rising chronic illness cases among the elderly.

- Medication Monitoring services accounted for 28% share, as healthcare providers focus on managing complex drug regimens for aging residents.

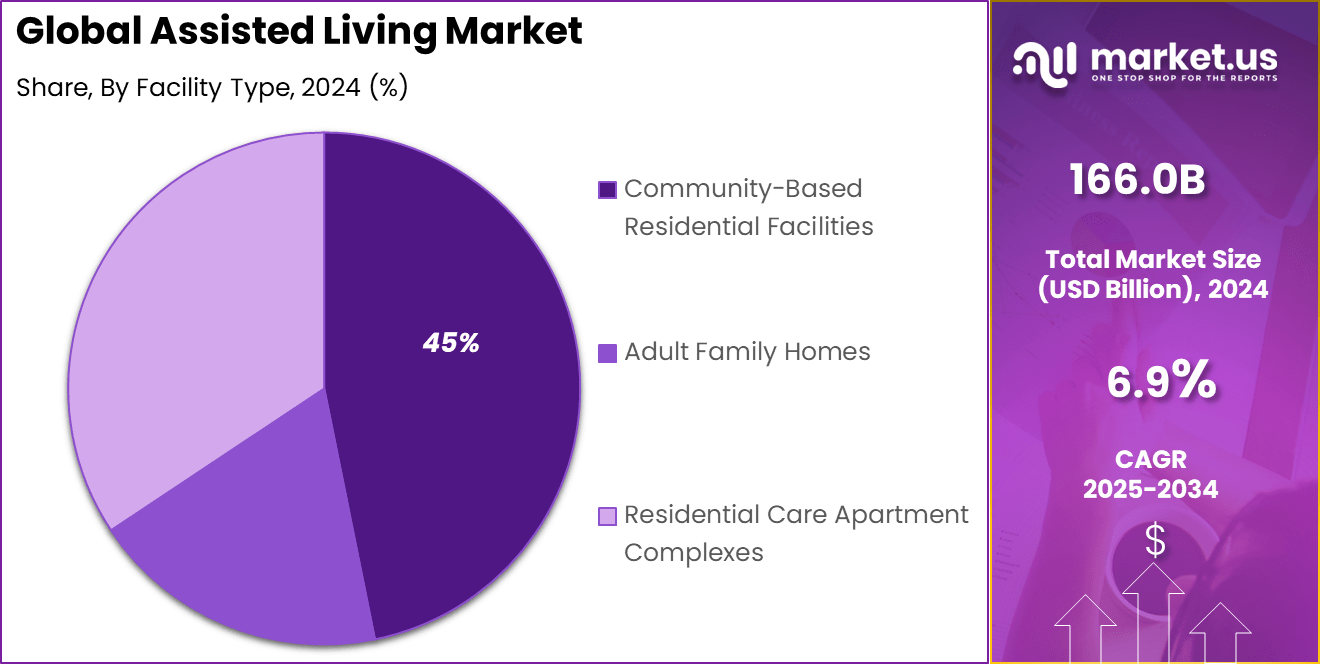

- Community-Based Residential Facilities held the largest facility share at 45%, favored for their home-like environments and flexible care models that promote resident independence.

Role of AI

The integration of artificial intelligence within assisted living facilities is transforming senior care into an ecosystem characterized by adaptive, efficient, and insightful support systems. No longer a supplementary aid, AI has become a fundamental platform through which enhanced safety, personalized engagement, and operational efficacy are achieved.

A foundational application lies in safety and health monitoring. AI-driven motion sensors, acoustic detectors, and wearables continuously analyze vital signs and activity patterns. When abnormalities – such as falls or disrupted sleep – are detected, staff are alerted immediately, enabling prompt intervention and reducing hospitalization risks.

In addition, AI facilitates predictive health analytics. By processing data from wearables and environmental sensors, AI models identify early signs of emerging conditions – such as dehydration, infection, or cardiac irregularities – before symptoms escalate. These proactive alerts have been shown to decrease emergency admissions and support ongoing wellness.

AI also promotes enhanced companionship and emotional engagement for residents. Companion robots and virtual assistants provide conversational interaction, therapeutic entertainment, and reminders for social activities such as bathing, medication, or meals. One recent example found that residents interacting with an AI companion experienced improvements in mood and reduced loneliness.

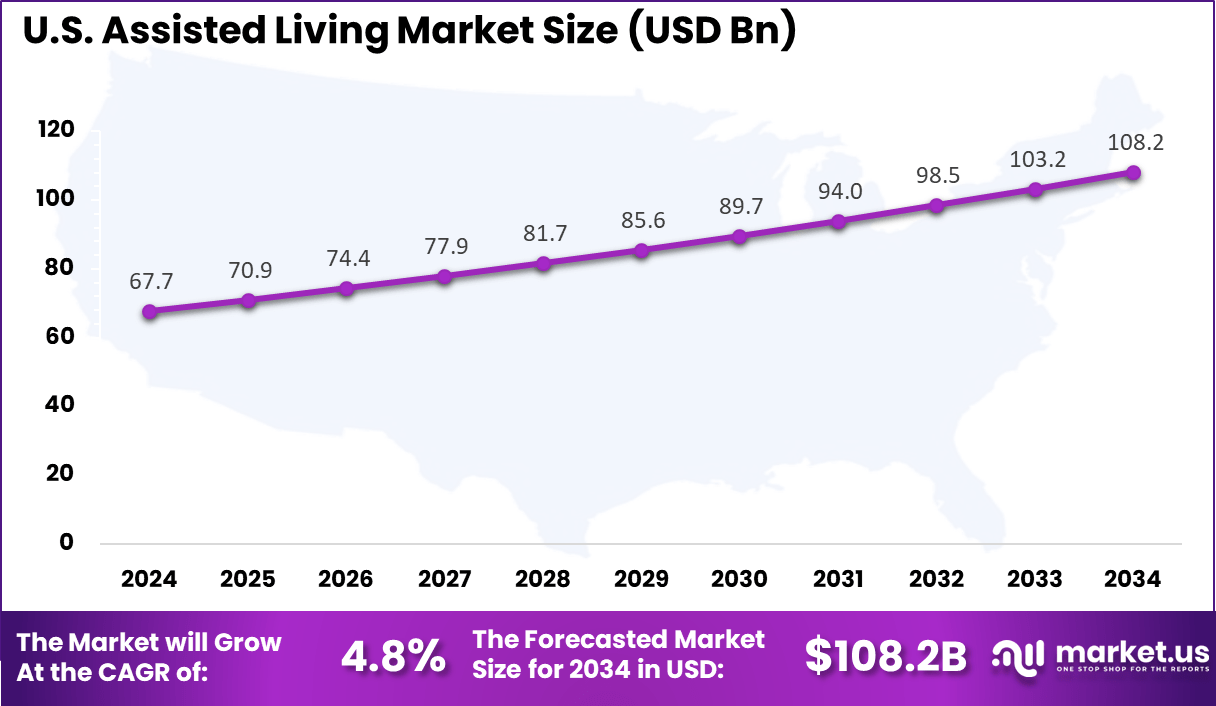

U.S. Market Size

The US Assisted Living Market is valued at USD 67.7 Billion in 2024 and is predicted to increase from USD 85.6 Billion in 2029 to approximately USD 108.2 Billion by 2034, projected at a CAGR of 4.8% from 2025 to 2034.

In 2024, the United States holds a leading position in the global assisted living market, primarily driven by a rapidly ageing population, well-established healthcare infrastructure, and strong institutional investment in senior care facilities.

The U.S. Census Bureau estimates that by 2030, all baby boomers will be over 65, resulting in one in every five Americans being of retirement age. This demographic shift is generating unprecedented demand for specialized, semi-independent care environments that balance medical support with lifestyle amenities.

For instance, in April 2025, Mynd Immersive Select Rehabilitation partnered with HTC VIVE and AT&T to deploy next-generation immersive therapeutic technologies across more than 150 U.S. senior living communities. This collaboration brings virtual reality-based rehabilitation and cognitive therapy into assisted living settings, enhancing resident engagement, accelerating recovery, and improving mental health outcomes.

In 2024, North America held a dominant market position in the Global Assisted Living Market, capturing more than a 43% share, holding USD 71.4 billion in revenue. This dominance is due to its well-established healthcare infrastructure and large population.

Assisted living services are supported by modern regulatory frameworks and significant investments in senior care facilities due to high awareness and acceptance among people in North America. Moreover, the maturity of technological advancements and integrated healthcare models in North America has allowed providers to provide comprehensive, high-quality care for older adults.

For instance, In April 2025, a recent project in Baltimore County, Maryland, plans to introduce 52 villa homes alongside an assisted living facility, reflecting a trend toward integrating diverse housing options within senior living communities. This development underscores the focus on creating resident-centric environments that offer both independence and accessible care, catering to evolving preferences of older adults seeking comfort, community, and comprehensive support.

Service Type Analysis

In 2024, the Medication Monitoring segment held a dominant market position within the Assisted Living sector, capturing more than a 28% share of total service-type revenue. This strong performance can be attributed to the increasing prevalence of multi-morbidity among seniors, necessitating accurate dosing and frequent oversight.

Medication Monitoring services – encompassing digital tracking systems, nurse-led reviews, and automated dispensers – have been widely adopted across facilities to reduce risks associated with incorrect dosing, avoid hospital readmissions, and ensure compliance. Additionally, regulatory pressures and payer incentives for reducing medication errors have fueled investment in such solutions, contributing to the segment’s sustained leadership in 2024.

The decision of Assisted Living providers to allocate significant resources toward Medication Monitoring has been justified by measurable improvements in resident outcomes and cost efficiencies. Integration of electronic medication administration records (eMAR) and telemedicine-backed review mechanisms has enhanced workflow and accountability.

For Instance, In March 2025, Electronic Caregiver partnered with Samsung Electronics America to showcase Addison Care, an AI-powered platform tailored for seniors in assisted living and home care. Utilizing Samsung’s advanced hardware and AI, the platform offers real-time health monitoring, medication reminders, and personalized alerts. This collaboration reflects the growing use of AI to enable safer, more autonomous living and improve the efficiency and personalization of care delivery.

Facility Type Analysis

In 2024, the Community‑Based Residential Facilities (CBRF) segment held a dominant market position within the Assisted Living sector, capturing more than a 45 % share of global facility‑type revenue. This leading status can be attributed to the segment’s scalable care model, which combines shared living with professional support and easy regulatory compliance.

CBRFs offer a balance between personalized attention and cost efficiency, making them the preferred choice for a growing elderly population requiring moderate assistance. Their widespread adoption has been reinforced by a documented rise in ageing demographics and strategic emphasis on mid-tier care solutions that align well with payer systems and family preferences

The attractiveness of the CBRF model is further explained by its operational flexibility. These facilities are typically designed to support communal living environments, enabling access to group activities, shared meals, and on‑site care teams without the overhead of large-scale residential complexes. As a result, providers are able to maintain competitive pricing while ensuring 24/7 supervision and a suite of assistance services.

For instance, In August 2024, The Reserve on Arbor Way, a new senior living community, is scheduled to open in Kaukauna, Wisconsin, signaling ongoing growth in the North American assisted living market. The facility features modern, resident-centered design and amenities that support independence and social interaction. This development reflects a broader trend toward expanding quality assisted living options in suburban and smaller urban areas, meeting rising demand from aging baby boomers seeking supportive yet engaging lifestyles.

Key Market Segments

By Service Type

- Medication Monitoring

- Palliative & Hospice Care

- Disease Monitoring

- Mobility

- Others

By Facility Type

- Adult Family Homes

- Community-Based Residential Facilities

- Residential Care Apartment Complexes

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Smart and Connected Environments

Assisted living facilities increasingly incorporate smart-home technologies and ambient monitoring to enhance resident well-being. Sensors track movement, air quality, and vital signs, enabling timely responses without intruding on independence. These systems support aging in place and ease caregiver duties but require careful integration.

By combining ambient intelligence with automated alerts and remote telehealth abilities, facilities can provide personalized care at scale. Residents benefit from enhanced safety and autonomy, while staff gain tools for efficient support. This shift marks a move from traditional institutional models to digitally-enriched living spaces.

Drivers

Rising Demand and Occupancy Pressure

A growing senior population is pushing demand for assisted living. With many Baby Boomers reaching retirement age, available housing is in short supply and occupancy rates remain high. As more families seek structured yet supportive environments, providers are under pressure to expand capacity.

Meanwhile, existing facilities are reaching near-full occupancy, and new developments lag behind. This imbalance gives operators leverage to invest in quality upgrades and specialized services, as seniors seek both care and comfort in environments that feel like home.

Restraint

High Cost of Care and Affordability Issues

Assisted living remains a significant hurdle, with costs frequently exceeding the financial means of elderly individuals who require fixed incomes or confined pension funds. Due to the affordability gap, there is a significant hindrance to market penetration, particularly among middle- and lower-income groups, and it could potentially increase socioeconomic disparities in access to quality eldercare.

For instance, In April 2025, Kushal Ramesh of Manasum Senior Living outlines India’s senior care costs: independent living ranges from ₹30,000-₹60,000/month, rentals up to ₹80,000; assisted living starts at ₹30,000-₹35,000/month; specialized dementia care costs ₹85,000-₹1 lakh/month. The labor-intensive, low-tech sector faces high operational costs, creating affordability challenges for many seniors.

Growth Opportunity

Integration of Assistive Technologies

Technology is presenting an opportunity to reshape assisted living delivery. From remote health monitoring to automated fall detection and AI-powered scheduling tools, smart systems are improving safety and care efficiency.

Voice-activated assistants and connected devices enable seniors to maintain a greater sense of independence while reducing the burden on caregivers. The adoption of these technologies has the potential to reduce long-term costs, improve health outcomes, and help facilities manage with limited staffing.

Critical Challenge

Workforce Shortages and Regulatory Pressure

A persistent challenge in the assisted living sector is the shortage of qualified personnel. Many facilities are struggling to attract and retain skilled caregivers, partly due to the physical and emotional demands of the role and relatively low wages.

At the same time, regulatory standards are becoming stricter, with more rigorous health, safety, and documentation requirements. Balancing compliance while maintaining profitability and quality of care poses a growing challenge for providers across both urban and rural settings.

Key Players Analysis

The assisted living market remains fragmented, with the presence of numerous players across regions. Companies operating in this space are actively pursuing strategies such as service expansion, technological innovation in assisted living solutions, and strategic collaborations. Key participants in the market include Atria Senior Living Inc., Brookdale Senior Living Inc., Sunrise Senior Living, Five Star Senior Living, Sonida Senior Living, and Merrill Gardens.

Top Key Players in the Market

- ABB Group

- Assisted Living Technologies, Inc.

- Emeritus Corporation

- Extendicare, Inc.

- Ingersoll Rand Plc

- Legrand S.A.

- Panasonic Corporation

- Sunrise Senior Living, Inc

- United Technologies Corporation

- Atria Senior Living, Inc.

- Brookdale Senior Living Inc.

- Partners Pharmacy

- Place for Mom, Inc

- Crossroads Hospice

- The Courtyards at Mountain View

- Emeritus Corporation

- Lakehouse Senior Living, LLC

- Others

Recent Developments

- In May 2025, Sunrise Senior Living announced the addition of two new communities to its portfolio, signaling a new era of growth for the company. This expansion reflects Sunrise’s commitment to meeting rising demand for quality assisted living services and enhancing its geographic footprint.

- In November 2024, Extendicare Inc. announced an agreement to acquire nine long-term care homes from Revera Inc., marking a significant expansion of its footprint in the senior care market. This acquisition enhances Extendicare’s portfolio across Canada, strengthening its position as a leading provider of long-term and assisted living services.

Report Scope

Report Features Description Market Value (2024) USD 166.09 Bn Forecast Revenue (2034) USD 323.68 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Medication Monitoring, Palliative & Hospice Care, Disease Monitoring, Mobility, Others), By Facility Type (Adult Family Homes, Community-Based Residential Facilities, Residential Care Apartment Complexes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Group, Assisted Living Technologies, Inc., Emeritus Corporation, Extendicare, Inc., Ingersoll Rand Plc, Legrand S.A., Panasonic Corporation, Sunrise Senior Living, Inc., United Technologies Corporation, Atria Senior Living, Inc., Brookdale Senior Living Inc., Partners Pharmacy, Place for Mom, Inc., Crossroads Hospice, The Courtyards at Mountain View, Lakehouse Senior Living, LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Group

- Assisted Living Technologies, Inc.

- Emeritus Corporation

- Extendicare, Inc.

- Ingersoll Rand Plc

- Legrand S.A.

- Panasonic Corporation

- Sunrise Senior Living, Inc

- United Technologies Corporation

- Atria Senior Living, Inc.

- Brookdale Senior Living Inc.

- Partners Pharmacy

- Place for Mom, Inc

- Crossroads Hospice

- The Courtyards at Mountain View

- Emeritus Corporation

- Lakehouse Senior Living, LLC

- Others