Global Asset Based Lending Market Size, Share, Statistics Analysis Report By Type (Inventory Financing, Receivables Financing, Equipment Financing, Others), By Interest Rate (Fixed Rate, Floating Rate), By End-User (Large Enterprises, Small and Medium-sized Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134734

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

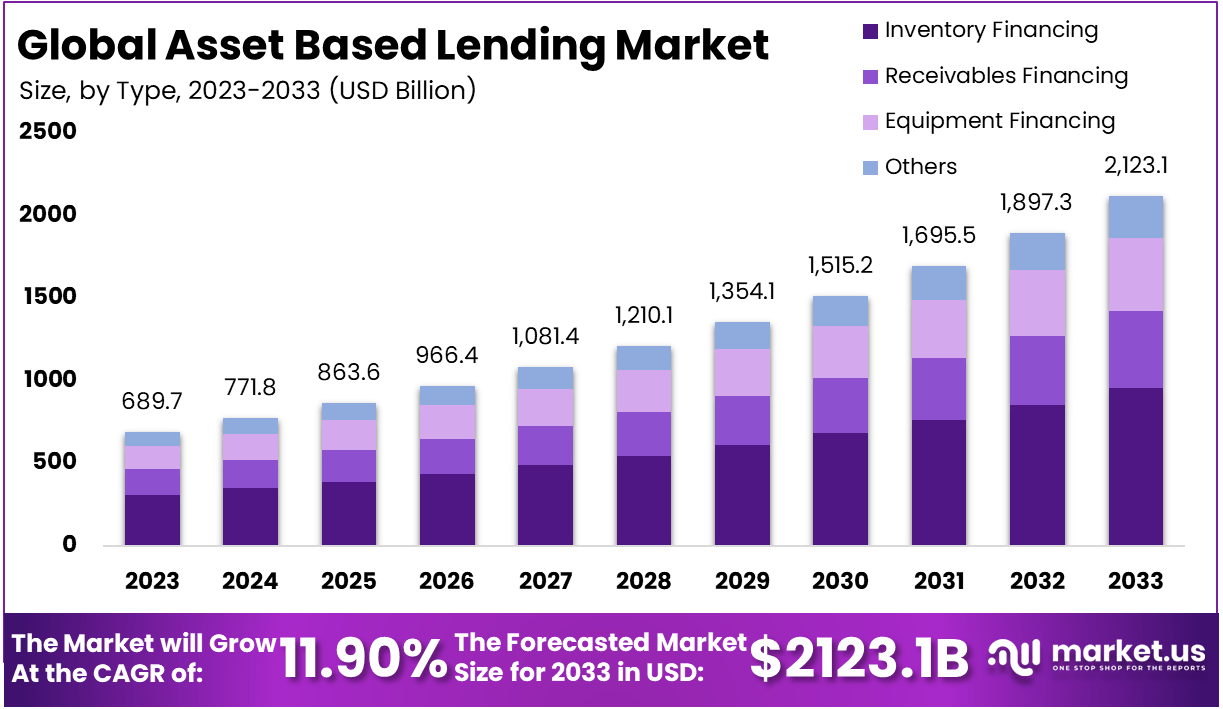

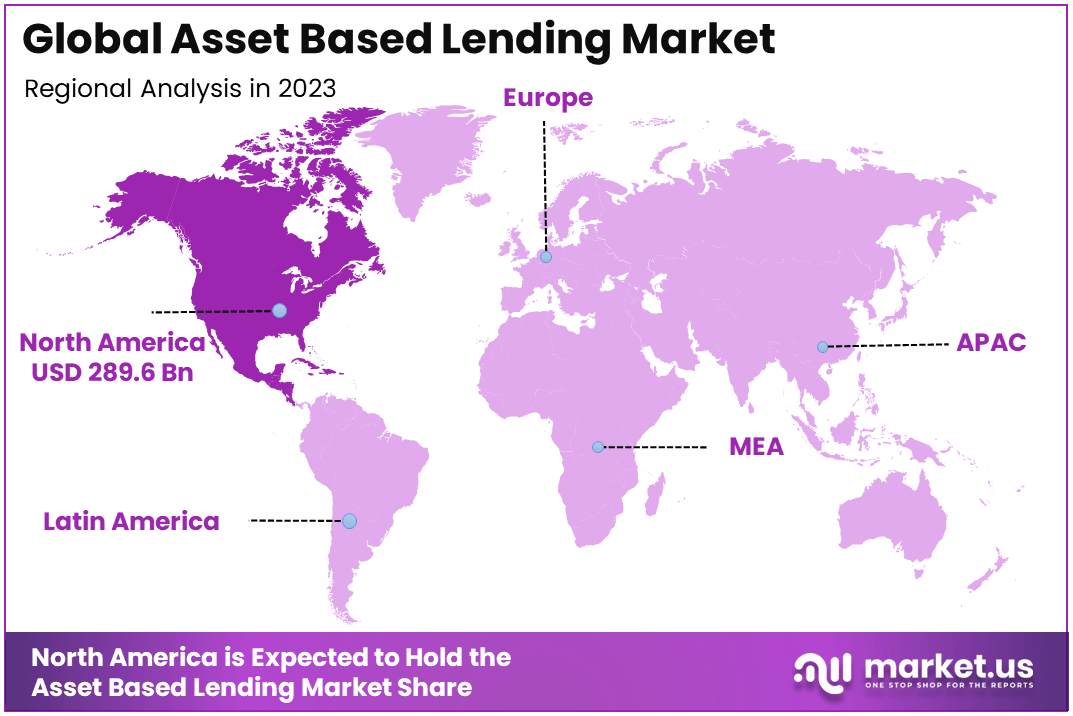

The Global Asset Lending Market size is expected to be worth around USD 2123.1 Billion By 2033, from USD 689.7 Billion in 2023, growing at a CAGR of 11.90% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 42% share, holding USD 289.6 Billion in revenue.

Asset-based lending (ABL) is a type of financing where a borrower secures a loan by using their business assets as collateral. These assets can include receivables, inventory, machinery, or real estate. The lender typically offers a loan based on the value of these assets, with the amount of credit extended varying according to the liquidity and quality of the collateral.

ABL is popular among businesses that may not have a strong credit history but have valuable assets to leverage for financing. This form of lending allows companies to access working capital to meet short-term operational needs or expand their business, without needing to provide personal guarantees or show a significant track record of profitability.

The Asset-Based Lending Market refers to the global financial services industry that provides loans backed by collateral. Over recent years, the market has grown steadily as more businesses, especially small to medium-sized enterprises (SMEs), turn to ABL as a flexible financing option. The market is driven by factors such as the increasing need for working capital, a rising number of SMEs, and the growing use of assets for financial leverage.

The demand for asset-based loans is rising across industries such as manufacturing, retail, and healthcare, where businesses often hold valuable assets that can be used for securing loans. The market has been expanding with increasing penetration in emerging markets, supported by a greater focus on alternative lending channels and improved asset valuation techniques.

The growth of the asset-based lending market is largely driven by the increasing need for working capital among small and medium-sized businesses (SMEs). Many SMEs lack access to traditional credit due to limited operating history or low credit scores, making ABL a crucial option for financing.

In addition, businesses in sectors such as retail, manufacturing, and logistics often have substantial tangible assets like inventory, equipment, or real estate, making it easier for them to qualify for asset-based loans. This is particularly important in times of economic uncertainty, as companies seek alternative means to secure capital without relying on conventional financial products like lines of credit or equity financing.

The demand for asset-based lending is expected to increase as companies face challenges in securing traditional loans. As SMEs expand globally, the need for liquidity to finance operations and growth remains a high priority. Additionally, the rapid digitization of business operations has led to better tracking and management of assets, making it easier to assess their value and structure more flexible ABL deals.

With growing financial inclusion efforts in developing regions, ABL is becoming more accessible to businesses, which adds to its market demand. The trend of using assets for securing loans is anticipated to rise as businesses seek cost-effective and less restrictive financial solutions compared to traditional lending.

There are significant opportunities for growth in the asset-based lending market, especially in emerging economies where SMEs represent a large portion of the economic structure. In these regions, there is a growing trend toward alternative financing options as traditional banking systems may be underdeveloped.

Additionally, technological advancements in asset tracking and valuation, such as artificial intelligence (AI) and blockchain, offer opportunities to enhance the efficiency and security of ABL transactions. The increased use of data analytics to assess the value of assets could help streamline the loan approval process, creating further opportunities for lenders and borrowers alike.

Technological advancements play a pivotal role in the growth of the asset-based lending market. The integration of artificial intelligence (AI) and machine learning (ML) into asset valuation processes has greatly improved the accuracy and speed of asset assessments. AI algorithms can now better predict the future value of assets, allowing lenders to offer more precise loan terms.

Blockchain technology is also being explored for its potential to securely track and verify the ownership of assets, reducing the risk of fraud and increasing trust in the system. These advancements are helping lenders evaluate the collateral more effectively, while borrowers benefit from faster approval processes and better terms.

The demand for ABL is driven by various factors, including the need for working capital among businesses. For instance, a report indicated that about $633 billion is currently trapped in working capital among S&P 1500 companies, highlighting the liquidity challenges many firms face. In the UK alone, approximately $4.5 billion was lent to small and medium-sized enterprises (SMEs) in the fourth quarter of 2023, marking a significant rebound in lending activity.

The average loan size varies widely, with small loans starting around $1 million, mid-market loans ranging from $1 million to $10 million, and larger loans exceeding $10 million. Furthermore, data from the Secured Finance Network indicates that total committed credit lines among consistent respondents increased by 3% year-over-year, while new credit commitments more than doubled (+109.1%) from the previous quarter in Q2 2024. This reflects a robust appetite for asset-based financing solutions as businesses continue to navigate economic uncertainties and seek flexible funding options.

Key Takeaways

- Market Size: The global Asset-Based Lending market is valued at USD 689.7 billion in 2023 and is projected to reach USD 2,123.1 billion by 2033, growing at a strong CAGR of 11.90%.

- Dominant Type: The Receivables Financing segment holds the largest share, accounting for 45% of the market in 2023, driven by its liquidity benefits and its ability to offer fast access to working capital.

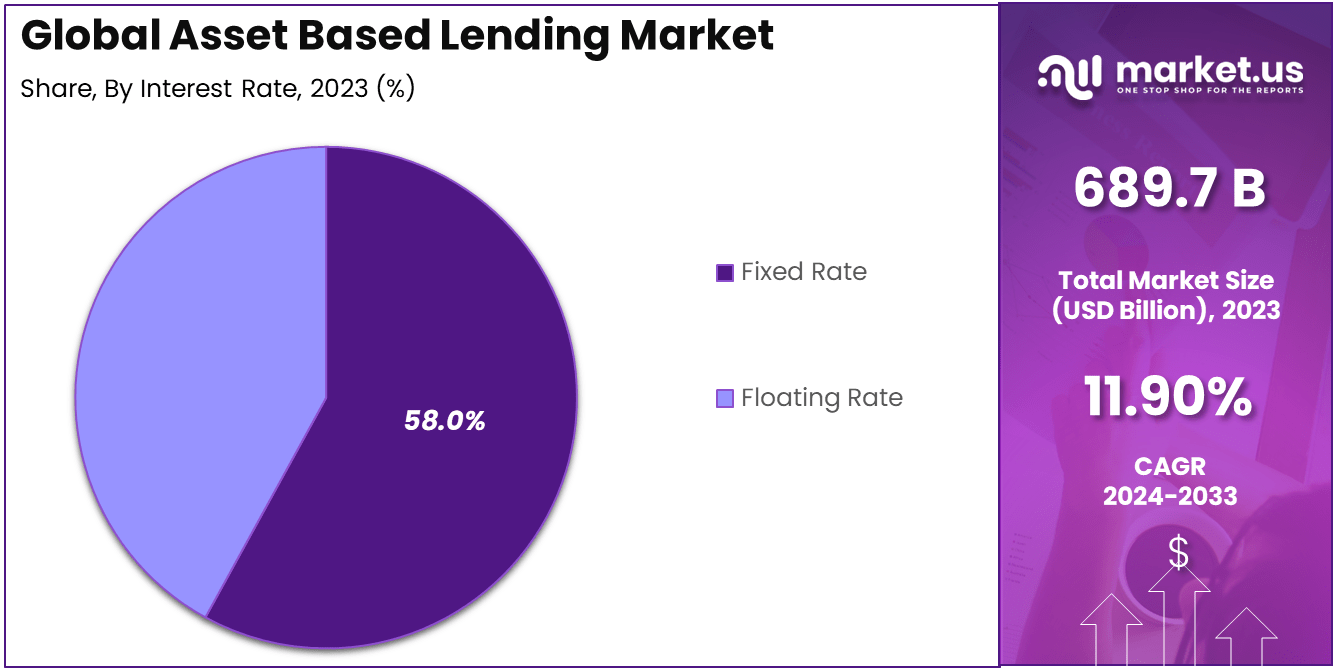

- Interest Rate Preferences: The Fixed Rate category dominates the market, with 58% of the loans being offered at fixed interest rates, providing stability and predictability for businesses.

- End-User Focus: The Large Enterprises segment is the leading end-user, holding a significant 61% share in 2023. Large businesses often prefer ABL due to their substantial asset base, which allows them to access larger loan amounts.

- Regional Dominance: North America accounts for 42% of the global market share, owing to the mature financial services sector and the widespread adoption of ABL by enterprises in the region.

By Type

In 2023, the Receivables Financing segment held a dominant market position, capturing more than a 45% share of the Asset-Based Lending (ABL) market. This segment’s leadership is primarily driven by its ability to provide businesses with quick access to liquidity by leveraging outstanding invoices.

Receivables financing enables companies to secure working capital without the need for traditional loans, which makes it particularly appealing to businesses facing cash flow challenges or those in seasonal industries.

Receivables financing allows firms to unlock the value of their accounts receivable, ensuring they have the necessary funds to continue operations, manage day-to-day expenses, or invest in growth opportunities. Its flexibility in terms of borrowing limits, where companies can access a percentage of their receivables, has made it an attractive option for businesses with fluctuating cash flow needs. Another contributing factor to the dominance of the Receivables Financing segment is the increasing preference for alternative lending solutions.

As businesses look for quicker, more flexible financing methods, receivables financing provides a streamlined option without the time-consuming approval processes that are common in traditional bank loans. This has further fueled its popularity, especially among small to medium-sized enterprises (SMEs) that require agility in their financial management.

By Interest Rate

In 2023, the Fixed Rate segment held a dominant market position, capturing more than a 58% share of the Asset-Based Lending (ABL) market. This segment’s leadership can be attributed to the predictability and stability it offers to borrowers.

Fixed-rate loans are particularly attractive to businesses seeking to manage their finances with certainty, as they lock in the interest rate for the duration of the loan. This predictability is important for budgeting and cash flow management, especially for companies with tight financial planning and long-term project commitments.

The preference for fixed-rate financing has grown due to its ability to shield businesses from interest rate fluctuations. In an environment of economic uncertainty or when market interest rates are volatile, businesses are more inclined to opt for fixed-rate loans to avoid the risk of rising borrowing costs. This is particularly appealing in sectors where the cost of capital is a critical factor in pricing, profitability, and competitive positioning.

Furthermore, the Fixed Rate segment is favored by larger enterprises, which have a higher need for long-term financing solutions. These companies prefer the security of fixed payments over the life of the loan, making fixed-rate lending a more viable and stable option for their financing needs. Lenders, too, benefit from this structure, as it provides a clear repayment schedule, enhancing financial predictability.

By End-User

In 2023, the Large Enterprises segment held a dominant market position, capturing more than a 61% share of the Asset-Based Lending (ABL) market. This significant share can be attributed to the greater borrowing capacity and financing needs of large corporations.

Large enterprises often require substantial amounts of capital for various purposes, such as expansion, acquisitions, working capital, and ongoing operations. ABL offers these companies the flexibility to secure funding based on their existing assets, like receivables, inventory, or equipment, which makes it an ideal solution for meeting liquidity needs without affecting ownership or taking on excessive debt.

Large enterprises benefit from more favorable terms and conditions, including lower interest rates and larger credit lines, due to their financial stability and lower credit risk compared to smaller businesses. This makes ABL an attractive option for them. Additionally, these companies often have complex operations and diverse asset bases, allowing them to leverage their assets more effectively to secure larger and more advantageous loans.

Moreover, large corporations typically have sophisticated financial teams and internal processes that are well-equipped to manage asset-based financing, making the execution and management of these loans more streamlined. With a greater volume of assets, large enterprises are better positioned to unlock liquidity and use ABL as a strategic financial tool.

Key Market Segments

By Type

- Inventory Financing

- Receivables Financing

- Equipment Financing

- Others

By Interest Rate

- Fixed Rate

- Floating Rate

By End-User

- Large Enterprises

- Small and Medium-sized Enterprises

Driving Factors

Growing Demand for Working Capital

One of the main drivers fueling the growth of the Asset-Based Lending (ABL) market is the increasing demand for working capital, especially among small and medium-sized enterprises (SMEs) and large corporations alike. As businesses continue to expand and diversify their operations, maintaining sufficient liquidity is critical.

Traditional financing options, such as bank loans, may not always be viable for companies with fluctuating revenues or limited credit histories. In contrast, asset-based lending provides a more flexible and accessible alternative, allowing businesses to secure loans by leveraging their existing assets.

The growing global economy has led to increased business activities across various sectors, such as manufacturing, retail, and logistics, all of which require a steady flow of working capital. This has heightened the demand for quick, reliable, and cost-effective funding solutions, of which ABL is a key player. ABL, backed by tangible assets like receivables, inventory, and equipment, offers businesses a way to access capital quickly without requiring a perfect credit score or long approval processes.

As a result, businesses of all sizes are turning to ABL as a means to bridge the gap between cash inflows and outflows. For large enterprises, ABL allows them to tap into their asset pools to meet operational costs, fund expansions, or invest in new projects. Similarly, SMEs, which may struggle to access traditional financing, are increasingly relying on ABL to fund growth and maintain operations.

Restraining Factors

Limited Awareness and Understanding of ABL

Despite its advantages, one of the major restraints to the growth of the Asset-Based Lending (ABL) market is the limited awareness and understanding of ABL among businesses, especially small and medium-sized enterprises (SMEs).

While larger corporations may have dedicated financial teams that are familiar with ABL, SMEs often lack the in-depth knowledge or resources to explore this financing option fully. As a result, many businesses continue to rely on traditional loans or lines of credit, which they are more comfortable with, even though ABL might be a better fit for their needs.

A significant barrier to adoption is the complexity and misconceptions surrounding ABL. Some businesses perceive asset-based lending as risky or only suitable for large corporations, while others are unaware of the various forms of collateral that can be used to secure loans, such as inventory or receivables. This lack of understanding can prevent businesses from exploring ABL as a viable financial solution, thus limiting the market’s potential.

Moreover, the process of securing an ABL loan can be more complicated compared to traditional loans. Businesses must ensure that their assets are properly appraised, and they may need to undergo a rigorous vetting process to determine the value of their collateral. This can create an intimidating experience for businesses that are new to ABL or have not engaged with financial institutions offering this service.

Growth Opportunities

Rising Demand for Flexible Financing Solutions

A significant opportunity for growth in the Asset-Based Lending (ABL) market lies in the increasing demand for flexible financing solutions, particularly in emerging markets and among underserved small and medium-sized enterprises (SMEs).

These businesses often face challenges in accessing traditional forms of credit due to limited credit histories or insufficient collateral. ABL, however, offers a viable alternative by allowing businesses to secure financing using their existing assets, such as inventory, receivables, or equipment.

As global economies continue to develop, particularly in Asia-Pacific, Latin America, and Africa, there is a growing need for financing solutions that cater to a broad spectrum of businesses. In these regions, SMEs represent the backbone of the economy, but many struggle to access capital through conventional channels. As a result, these businesses are turning to ABL to unlock the value of their assets, facilitating growth and ensuring business continuity.

Furthermore, with the increasing trend of digitalization, businesses are becoming more adept at managing their assets, which enhances the effectiveness and security of asset-based loans. This opens up new opportunities for lenders to offer more tailored ABL products that cater to specific industries or business models, creating a win-win scenario for both lenders and borrowers.

Challenging Factors

Regulatory and Legal Complexities

A significant challenge faced by the Asset-Based Lending (ABL) market is the regulatory and legal complexities surrounding asset-based financing, especially as it pertains to international transactions and cross-border lending.

Regulations governing asset-based loans can vary significantly from one country to another, leading to confusion and potential risks for both lenders and borrowers. The complex legal framework can be a deterrent for businesses looking to explore ABL, particularly those operating in multiple jurisdictions or unfamiliar markets.

For instance, the laws surrounding the classification and valuation of collateral may differ across regions. This can create challenges for both borrowers and lenders in terms of asset appraisal, as well as in the enforcement of loan agreements.

The legal processes for claiming collateral in case of loan default can also be cumbersome, requiring businesses to invest time and money in navigating the legal system, which can deter some from considering ABL as a financing option.

Furthermore, the lack of standardization in ABL practices can create complications for lenders offering cross-border financing. Different regulatory bodies and compliance standards can complicate the structuring of asset-based loans, leading to delays in approvals and higher costs for businesses. This could limit the growth of ABL in emerging markets or sectors where businesses require quick access to capital.

Growth Factors

The Asset-Based Lending (ABL) market is witnessing robust growth, driven by several key factors. One of the main growth catalysts is the rising demand for working capital across businesses, particularly small and medium-sized enterprises (SMEs).

With traditional forms of financing being less accessible to companies with inconsistent revenues or lower credit ratings, ABL offers a flexible and viable solution. By leveraging assets such as receivables, inventory, and equipment, companies can secure funding with fewer barriers compared to conventional loans. The increasing complexity of business operations across industries like manufacturing, retail, and logistics further propels the need for such flexible financial solutions.

Emerging Trends

The ABL market is undergoing several emerging trends, with technology playing a key role. The rise of digital platforms for lending has made asset-based financing more streamlined and accessible to a broader set of companies.

Automation and real-time data analytics are increasingly being incorporated into the lending process, improving accuracy, speed, and risk assessment. Additionally, sustainability-linked lending is gaining momentum, where companies are offering loans tied to environmental or social goals, aligning the borrowing process with modern corporate responsibility practices.

Business Benefits

The most significant business benefit of asset-based lending lies in its flexibility and ease of access. ABL offers businesses quicker access to capital, which can be crucial for growth, operations, or overcoming cash flow challenges. For larger companies, it provides a way to unlock the value of their assets without diluting equity.

For SMEs, ABL serves as an essential tool for scaling operations, enabling them to fund working capital or investments without relying on traditional credit avenues. Furthermore, the ability to obtain financing based on assets—rather than credit scores or income levels—ensures that more companies can leverage ABL to meet their financial needs.

Regional Analysis

In 2023, North America held a dominant position in the Asset-Based Lending (ABL) market, capturing more than 42% of the global market share, equivalent to USD 289.6 Billion in revenue. This leadership is largely attributed to the region’s robust financial infrastructure, a well-established lending ecosystem, and a mature market for asset-based financing solutions.

In particular, the presence of major financial institutions, banks, and non-bank lenders, as well as a highly developed regulatory environment, makes North America an attractive hub for businesses seeking alternative financing options.

The increasing demand for working capital from large enterprises and small and medium-sized businesses (SMEs) has also significantly driven the growth of ABL in North America. With a large number of businesses utilizing receivables and inventory financing to support their cash flow needs, the ABL market continues to thrive. Furthermore, the rising trend of financial technology (FinTech) solutions in the lending space has further enhanced access to asset-based loans, allowing borrowers to process loans faster and more efficiently.

Additionally, North America’s dominance in the market is supported by the region’s diverse economic sectors, including manufacturing, retail, and healthcare, where businesses increasingly rely on asset-based lending to optimize their operations and improve liquidity. The ongoing trend of digital transformation and the integration of AI and blockchain in the lending process are also contributing to North America’s growth as a leader in the global ABL market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Bank of America is one of the leading players in the asset-based lending (ABL) market. In recent years, the bank has made significant strides in enhancing its ABL offerings, especially in terms of innovative solutions for mid-sized and large enterprises. One of the key factors behind its success has been its strong focus on customer relationship management and the flexibility of its lending solutions.

In 2023, Bank of America expanded its portfolio with new lending products designed to cater to the evolving needs of industries like healthcare, technology, and manufacturing. Additionally, the bank’s strategic acquisitions, such as the 2022 purchase of certain loan portfolios from other financial institutions, have expanded its market reach and capabilities in asset-based financing.

Wells Fargo is another major player in the asset-based lending market, offering a variety of secured lending products. The bank has been focusing on enhancing its ABL services by integrating more advanced technologies, such as data analytics and AI, to streamline the lending process. In 2023, Wells Fargo launched a new line of ABL products targeting the SME sector, allowing smaller businesses to access more flexible and affordable asset-based loans.

The bank has also been actively involved in mergers and partnerships to enhance its market presence. In 2022, Wells Fargo merged its commercial lending division with a leading digital lender, providing customers with quicker approval processes and a more seamless experience. This move positioned Wells Fargo as a more tech-savvy, competitive player in the ABL market.

JPMorgan Chase, a global leader in financial services, has maintained a strong position in the asset-based lending market. The company has been focusing on strategic acquisitions to expand its offerings in the ABL space. In 2023, JPMorgan Chase acquired a technology-driven ABL platform to improve its underwriting processes and offer faster, more efficient solutions to its customers.

The company also launched a new digital platform that simplifies the application and approval process for asset-based loans, helping businesses access capital more easily. JPMorgan Chase continues to leverage its extensive global network to provide customized asset-based lending solutions to companies in various industries, including retail, manufacturing, and energy. With a focus on innovation, JPMorgan Chase is well-positioned to maintain its leadership in the ABL market.

Top Key Players in the Market

- Bank of America

- Wells Fargo

- JPMorgan Chase

- Citigroup

- Barclays

- HSBC

- CIT Group

- TD Bank

- PNC Bank

- Hitachi Capital America

- White Oak Commercial Finance

- Other Key Players

Recent Developments

- In September 2023: Bank of America introduced a new AI-powered asset-based lending platform aimed at improving underwriting efficiency and providing quicker approval timelines.

- In June 2023: Wells Fargo expanded its asset-based lending services with the launch of a specialized line of credit for the healthcare industry.

Report Scope

Report Features Description Market Value (2023) USD 689.7 Bn Forecast Revenue (2033) USD 2123.1 Bn CAGR (2024-2033) 11.90% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Inventory Financing, Receivables Financing, Equipment Financing, Others), By Interest Rate (Fixed Rate, Floating Rate), By End-User (Large Enterprises, Small and Medium-sized Enterprises) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Bank of America, Wells Fargo, JPMorgan Chase, Citigroup, Barclays, HSBC, CIT Group, TD Bank, PNC Bank, Hitachi Capital America, White Oak Commercial Finance, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bank of America

- Wells Fargo

- JPMorgan Chase

- Citigroup

- Barclays

- HSBC

- CIT Group

- TD Bank

- PNC Bank

- Hitachi Capital America

- White Oak Commercial Finance

- Other Key Players