Global Revenue Based Financing Market Size, Share, Statistics Analysis Report By Enterprise Size (SMEs, Large Enterprises), By End-User (BFSI, IT & Telecom, Healthcare, Retail & E-commerce, Media & Entertainment, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133575

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

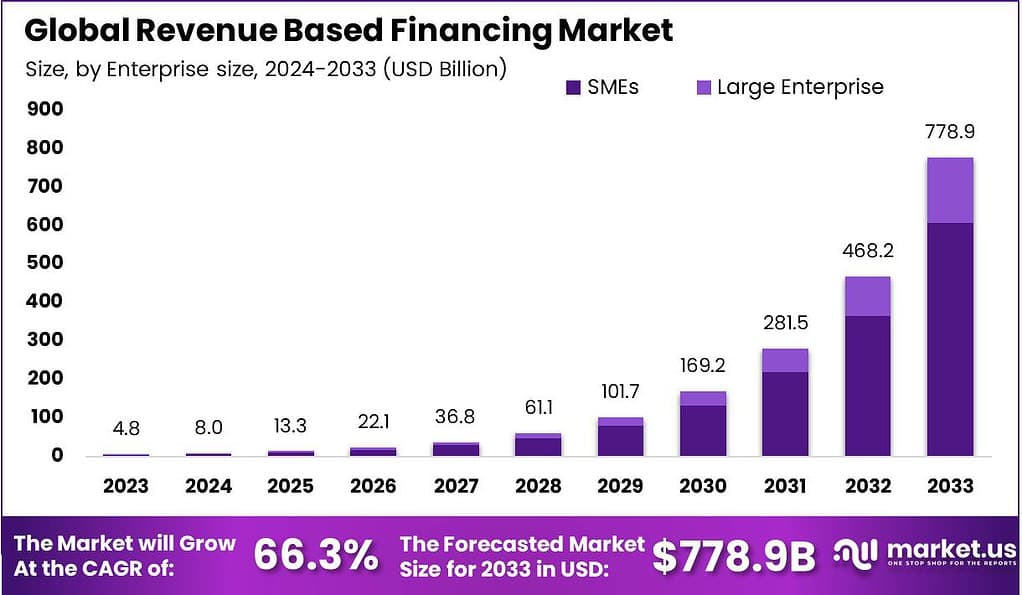

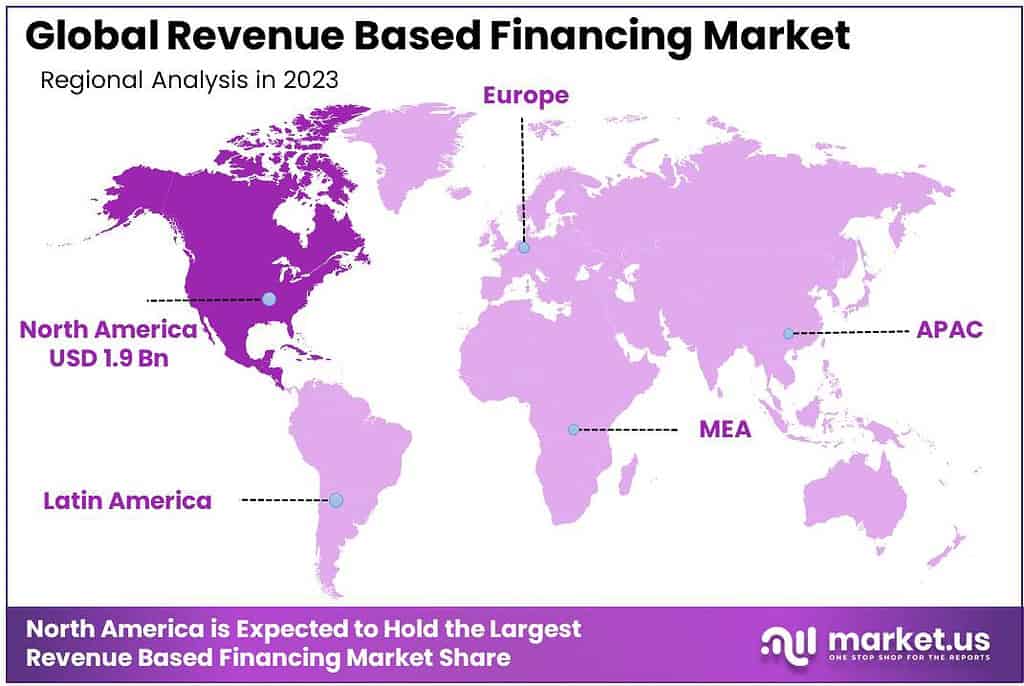

The Global Revenue Based Financing Market size is expected to be worth around USD 778.9 Billion By 2033, from USD 4.8 Billion in 2023, growing at a CAGR of 66.35% during the forecast period from 2024 to 2033. In 2023, North America emerged as the dominant force in the Revenue Based Financing market, accounting for over 40% of the global share and generating USD 1.9 billion in revenue across the region.

Revenue Based Financing (RBF) is a financial model where investors provide capital to businesses in exchange for a percentage of ongoing gross revenues. This model is particularly attractive for companies with high margins but perhaps not enough hard assets to serve as loan collateral. The repayments are flexible, fluctuating with the company’s revenue ups and downs, which offers businesses greater financial breathing room during slower periods.

The Revenue Based Financing market is expanding as more businesses seek alternative funding sources beyond traditional equity and debt financing. This market caters especially to startups and growth-stage companies in sectors like technology, healthcare, and consumer services, where revenue streams are strong but often fluctuating. As these companies grow, so does the demand for RBF as a less dilutive financing option.

Major Driving Factors for the RBF market include the growing preference for financing options that do not require equity dilution. Many entrepreneurs are keen to retain control over their businesses, making RBF an attractive option. Moreover, the speed of funding in RBF transactions, often quicker than traditional equity processes, is a compelling factor for fast-growing companies that need immediate funding to capitalize on market opportunities.

Market Demand for RBF is being propelled by the increase in innovative startups that do not fit the traditional profiles for bank loans or private equity funding. These businesses often have predictable, recurring revenue streams, making them ideal candidates for RBF. As these companies achieve consistency in their revenue generation, the demand for flexible financing solutions like RBF continues to rise.

Market Opportunities in RBF are expanding as more sectors begin to recognize the benefits of this type of financing. Industries with high sales volumes and variable revenue peaks, such as retail and seasonal businesses, find RBF particularly advantageous. This expansion is also facilitated by the growing number of RBF providers who offer specialized services and understand the unique dynamics of different industries.

According to forbes, Revenue-based financing (RBF) providers typically focus on businesses with ~$4 million to $10 million in annual sales. This segment represents companies with steady cash flow but limited access to traditional loans or equity funding. In most RBF deals, repayments are tied to monthly revenues, with total repayment amounts ranging from 1.5x to 3x the original borrowed sum. This model works well for growing businesses that prefer flexible repayments linked to their performance, offering an alternative to rigid financing structures.

Technological advancements have significantly shaped the RBF market. Sophisticated algorithms and data analytics tools allow RBF providers to assess risks more accurately and manage their investment portfolios effectively. Technology also enables quicker, more efficient processing of financing applications, allowing businesses to gain access to funds faster than ever before.

Key Takeaways

- The Global Revenue Based Financing Market is projected to reach USD 778.9 billion by 2033, up from USD 4.8 billion in 2023, growing at an impressive CAGR of 66.35% during the forecast period from 2024 to 2033.

- In 2023, the SMEs segment dominated the Revenue Based Financing market, holding over 78% of the market share.

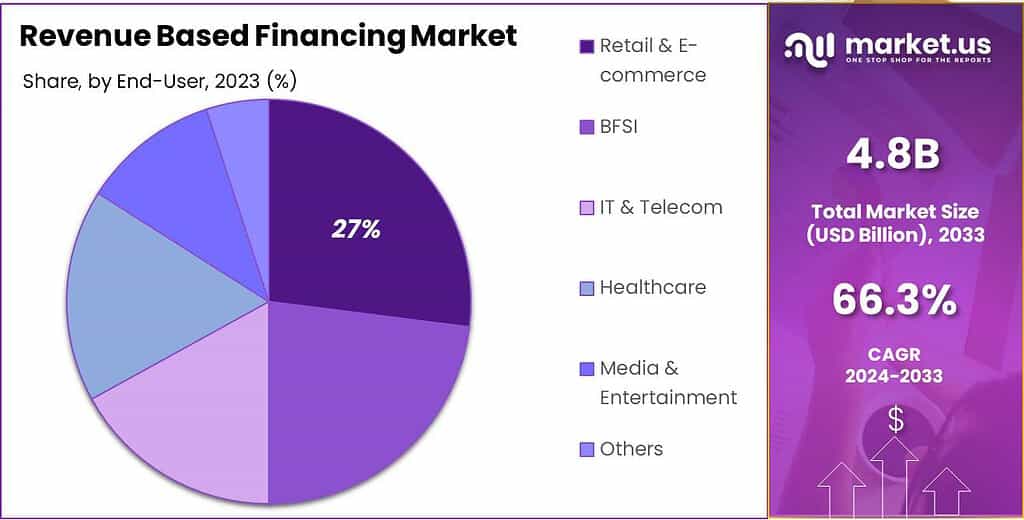

- The Retail & E-commerce segment also held a significant position in 2023, capturing more than 27% of the Revenue Based Financing (RBF) market.

- North America was the leading region in 2023, securing over 40% of the market share and generating approximately USD 1.9 billion in revenue.

Enterprise Size Analysis

In 2023, the SMEs segment held a dominant market position within the Revenue Based Financing market, capturing more than a 78% share. This considerable share is largely attributed to the nature of RBF, which aligns well with the financial dynamics and needs of SMEs.

The flexibility of Revenue Based Financing is particularly appealing to SMEs, as it allows for repayment terms that adjust based on revenue flow. This means that during periods of lower revenue, the financial burden on the business is reduced, which is crucial for small to medium-sized enterprises that experience fluctuating sales volumes.

In an era where maintaining strategic autonomy is crucial, RBF provides the financial backing needed without the typical trade-off of ownership shares, making it a preferred choice for SMEs looking to scale without external interference in business decisions.

The rise of digital platforms that facilitate RBF transactions has made it more accessible for SMEs to apply for and manage financing. These platforms use advanced algorithms to assess revenue projections and risk rapidly, streamlining the approval process and making it easier for SMEs to obtain funding.

End-User Analysis

In 2023, the Retail & E-commerce segment held a dominant market position in the Revenue Based Financing (RBF) market, capturing more than a 27% share. This leadership is attributed to the inherently variable revenue streams typical in the retail sector, where sales can fluctuate significantly due to seasonal trends, consumer preferences, and promotional activities.

E-commerce businesses, often characterized by rapid growth and scalability needs, find RBF particularly attractive. It enables them to secure necessary capital without diluting equity or taking on burdensome debt loads, facilitating smoother operational expansions and inventory management.

The Retail & E-commerce industry is highly competitive, requiring businesses to constantly innovate and expand their online presence. RBF provides the financial agility needed to invest in marketing, new technology, and customer acquisition strategies without the immediate financial strain of fixed repayments.

Fintech solutions has made Revenue Based Financing more accessible to small and medium-sized enterprises within the Retail & E-commerce sector. Advanced analytics and digital platforms allow for a more streamlined assessment process, enabling quicker funding with less administrative hassle.

Key Market Segments

By Enterprise Size

- SMEs

- Large Enterprises

By End-User

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- Others

Driver

Flexibility in Repayment Structures

Revenue-Based Financing (RBF) offers a flexible repayment model that aligns with a company’s revenue streams, making it an attractive option for businesses seeking growth capital without the rigidity of traditional loans.

Unlike conventional debt financing, which mandates fixed monthly payments regardless of a company’s financial performance, RBF adjusts repayments based on actual revenue. This means that during periods of lower income, businesses pay less, and during more prosperous times, they pay more.

Such flexibility is particularly beneficial for startups and small to medium-sized enterprises (SMEs) experiencing fluctuating revenues, as it reduces the risk of financial strain during downturns.

Restraint

Limited Suitability for Pre-Revenue Companies

A significant limitation of Revenue-Based Financing is its inapplicability to pre-revenue companies. Since RBF repayments are directly tied to a company’s revenue, businesses that have not yet generated income are typically ineligible for this type of financing.

This restriction poses a challenge for early-stage startups that require capital to develop products, enter markets, or scale operations but have not commenced revenue generation. Consequently, such companies must seek alternative funding sources, such as equity financing or traditional loans, which may come with their own set of challenges, including equity dilution or stringent collateral requirements.

Opportunity

Expansion into Diverse Industry Sectors

The adaptability of Revenue-Based Financing presents a significant opportunity for its application across various industry sectors beyond its traditional use in technology and SaaS companies. Industries such as healthcare, consumer goods, and renewable energy, which often have predictable and recurring revenue models, can benefit from the flexible repayment structures of RBF.

For instance, healthcare companies with subscription-based services or renewable energy firms with long-term power purchase agreements can leverage RBF to fund expansion without diluting ownership or taking on restrictive debt. By tailoring financing solutions to the unique revenue patterns of different industries, RBF providers can tap into new markets, fostering innovation and supporting sustainable business growth across diverse sectors.

Challenge

Navigating Regulatory and Compliance Landscapes

One of the primary challenges facing Revenue-Based Financing is the complex and evolving regulatory environment. As a relatively new financing model, RBF operates in a space that may lack clear regulatory guidelines, leading to uncertainties for both investors and businesses.

Compliance with existing financial regulations, which are often designed for traditional debt and equity instruments, can be complex and may vary significantly across jurisdictions. This complexity necessitates thorough due diligence and legal expertise to ensure that RBF agreements adhere to applicable laws and regulations. Additionally, the absence of standardized practices in RBF can result in inconsistent terms and conditions, potentially leading to disputes or misunderstandings between parties.

Emerging Trends

A significant trend in RBF is its appeal to tech and SaaS startups. These companies often struggle to meet the stringent requirements of traditional bank loans due to their business models. RBF offers a solution by providing funding without the need for collateral or equity dilution, making it an attractive option.

The rise of digital platforms and fintech integration is also reshaping the RBF landscape. Fintech companies are leveraging technology to streamline the funding process, making it more accessible and efficient for businesses. This digital transformation is enhancing the speed and transparency of RBF transactions, benefiting both investors and entrepreneurs.

Another emerging trend is the expansion of RBF into emerging markets. As startups in these regions seek alternative funding sources, RBF provides a viable option that aligns with their growth trajectories. This expansion is fostering innovation and supporting the growth of small businesses in developing economies.

Business Benefits

Revenue-based financing offers several advantages that make it an appealing option for businesses seeking capital. One of the primary benefits is the preservation of ownership. Unlike equity financing, RBF does not require businesses to give up a stake in their company which allows entrepreneurs to retain full control over their operations and decision-making processes.

RBF offers a faster approval process compared to traditional loans. The focus on revenue potential rather than credit history or collateral requirements allows for quicker access to funds. This speed can be crucial for businesses looking to capitalize on growth opportunities or address immediate financial needs.

Additionally, RBF is particularly beneficial for businesses with recurring revenue models, such as SaaS companies. The predictable revenue streams of these businesses make them ideal candidates for RBF, as investors can anticipate consistent repayments. This alignment between business model and financing structure can facilitate sustainable growth.

Regional Analysis

In 2023, North America held a dominant market position in the Revenue Based Financing market, capturing more than a 40% share with revenues amounting to USD 1.9 billion. This substantial market presence can be attributed to several pivotal factors.

The region’s robust startup ecosystem, coupled with a strong entrepreneurial culture, creates a fertile ground for alternative financing models such as Revenue Based Financing. North America, especially the United States, is home to a vast number of tech startups and high-growth companies that frequently seek flexible financing solutions that align with their growth trajectories without diluting ownership.

Moreover, North America benefits from a mature financial sector that is highly receptive to innovative financing models. The presence of numerous fintech companies and alternative finance platforms has facilitated the wider adoption of Revenue Based Financing.

Additionally, regulatory environments in North American countries are relatively supportive of financial innovations, which helps in nurturing the growth of RBF solutions. Regulatory clarity and supportive policies encourage both investors and businesses to engage with Revenue Based Financing as a credible alternative to traditional debt and equity financing.

High level of digital integration into business operations across North America allows for easy and efficient management of RBF arrangements. The availability of real-time data on company revenues ensures that the repayment aligns seamlessly with the company’s financial performance, reducing risks for both financiers and borrowers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the dynamic landscape of Revenue Based Financing, several key players are pivotal in shaping the industry.

Clearco has emerged as a prominent figure in the Revenue Based Financing market. Founded as a solution for e-commerce businesses seeking non-dilutive funding, Clearco offers financing based on revenue data and analytics, bypassing traditional credit scores. Clearco’s success is marked by its expansive portfolio of funded businesses and its role in pioneering data-driven funding solutions.

Wayflyer is another influential player in the Revenue Based Financing arena. Specializing in helping e-commerce businesses grow, Wayflyer provides capital based on revenue forecasts, coupled with marketing and analytics support. This holistic approach not only furnishes the necessary capital but also empowers businesses with insights to optimize their sales and marketing strategies.

Outfund stands out for its straightforward and scalable financing solutions aimed at online businesses. By offering Revenue Based Financing that aligns repayment with a business’s income, Outfund facilitates a stress-free financing option that adapts to business cycles.

Top Key Players in the Market

- Clearco

- Wayflyer

- Outfund

- 8fig

- Yardline

- Viceversa

- Booste

- Ritmo

- Karmen

- Silvr

- Liberis

- Unlimitd

- Paperstack

- Shopify Capital

- Amazon Lending

- Other Key Players

Recent Developments

- In March 2024, Wayflyer broadened its reach with the launch of a new Wholesale Financing product. This extension caters to both online and offline consumer brands, supporting those selling into brick-and-mortar retail channels.

- In July 2024, Liberis and Nexi have partnered to introduce a groundbreaking revenue-based financing solution in Germany, aimed at empowering 120,000 merchants. This initiative offers SMEs flexible financing options designed to support business growth and sustainability.

- In August 2024,

Efficient Capital Labs (ECL), a provider of non-dilutive capital for B2B SaaS companies through revenue-based financing, has successfully raised $11 million in a Series A funding round. The round was co-led by QED Investors and 645 Ventures.

Report Scope

Report Features Description Market Value (2023) USD 4.8 Bn Forecast Revenue (2033) USD 778.9 Bn CAGR (2024-2033) 66.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Enterprise Size (SMEs, Large Enterprises), By End-User (BFSI, IT & Telecom, Healthcare, Retail & E-commerce, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Clearco, Wayflyer, Outfund, 8fig, Yardline, Viceversa, Booste, Ritmo,Karmen, Silvr, Liberis, Unlimitd, Paperstack, Shopify Capital, Amazon Lending, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Revenue Based Financing MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Revenue Based Financing MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Clearco

- Wayflyer

- Outfund

- 8fig

- Yardline

- Viceversa

- Booste

- Ritmo

- Karmen

- Silvr

- Liberis

- Unlimitd

- Paperstack

- Shopify Capital

- Amazon Lending

- Other Key Players