Global AI in Oncology Market By Product Type (Software Solutions, Services, and Hardware), By Application (Diagnostics, Research & Development, Radiation Therapy, Immunotherapy, and Chemotherapy), By Cancer Type (Breast Cancer, Prostate Cancer, Lung Cancer, Colorectal Cancer, Brain Tumor, and Others), By End-user (Hospitals, Surgical Centers & Medical Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 102596

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

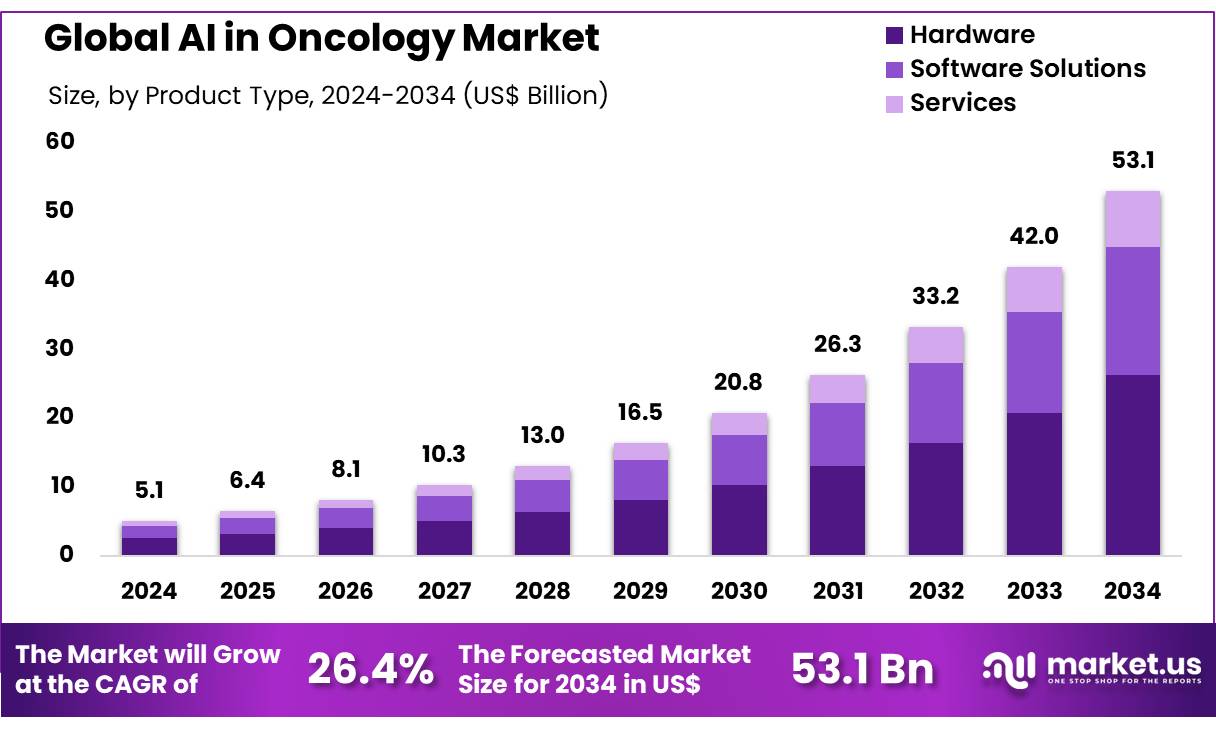

Global AI in Oncology Market size is expected to be worth around US$ 53.1 Billion by 2034 from US$ 5.1 Billion in 2024, growing at a CAGR of 26.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 2.1 Billion.

Increasing advancements in artificial intelligence (AI) and the rising prevalence of cancer are driving the growth of the AI in oncology market. AI-powered technologies are transforming the way oncology professionals diagnose, treat, and monitor cancer, offering solutions that improve accuracy, speed, and personalization of cancer care. AI applications in oncology span across areas like image analysis, drug discovery, clinical decision support, and patient management, enabling better clinical outcomes.

The growing volume of cancer cases, combined with the complexity of personalized treatment plans, demands advanced tools to process and analyze large datasets. AI enhances early cancer detection by analyzing medical imaging, such as radiographs and CT scans, to identify abnormalities more accurately than traditional methods. In April 2025, researchers at Johns Hopkins Kimmel Cancer Center introduced an AI-enhanced liquid biopsy aimed at identifying brain cancer.

This innovative approach uses machine learning to detect specific DNA fragment patterns found in blood, providing valuable insights into brain tumor detection. This development exemplifies a recent trend toward integrating AI with non-invasive diagnostic tools, offering significant opportunities for faster and more cost-effective cancer detection.

AI also supports the development of targeted therapies by analyzing genetic and molecular data, making treatments more personalized and precise. As oncology continues to evolve with the integration of AI, the market offers substantial opportunities to improve not only diagnosis and treatment but also patient outcomes through more efficient, data-driven healthcare approaches.

Key Takeaways

- In 2024, the market for AI in oncology generated a revenue of US$ 5.1 billion, with a CAGR of 26.4%, and is expected to reach US$ 53.1 billion by the year 2034.

- The product type segment is divided into software solutions, services, and hardware, with hardware taking the lead in 2024 with a market share of 49.4%.

- Considering application, the market is divided into diagnostics, research & development, radiation therapy, immunotherapy, and chemotherapy. Among these, diagnostics held a significant share of 47.6%.

- Furthermore, concerning the cancer type segment, the market is segregated into breast cancer, prostate cancer, lung cancer, colorectal cancer, brain tumor, and others. The breast cancer sector stands out as the dominant player, holding the largest revenue share of 32.4% in the AI in oncology market.

- The end-user segment is segregated into hospitals, surgical centers & medical institutes, and others, with the hospitals segment leading the market, holding a revenue share of 50.8%.

- North America led the market by securing a market share of 42.1% in 2024.

Product Type Analysis

Hardware holds the largest share of 49.4% in the AI in oncology market. This growth is expected to continue as healthcare institutions and research organizations increasingly adopt advanced hardware solutions for oncology applications. AI hardware, such as high-performance computing systems and specialized imaging equipment, plays a crucial role in processing the large volumes of data generated in cancer diagnosis, treatment planning, and research.

As cancer care becomes more personalized and data-driven, the demand for powerful computing hardware that can run complex AI algorithms is likely to rise. Additionally, AI-based imaging and diagnostic tools that rely on advanced hardware are anticipated to see widespread use in the detection of early-stage cancers, which could lead to improved survival rates.

The growth in the number of oncology research projects and the need for faster data processing for clinical trials further fuels the demand for AI hardware in oncology. The continued development of more efficient and cost-effective hardware will likely contribute to the further expansion of this segment in the market.

Application Analysis

Diagnostics is the dominant application segment, holding 47.6% of the market share. This growth is expected to continue as AI in diagnostics revolutionizes cancer detection by enabling faster, more accurate identification of tumors through advanced imaging and data analysis. AI technologies, such as deep learning algorithms, are projected to improve the accuracy of early-stage cancer detection, which is crucial for successful treatment outcomes.

The demand for AI-driven diagnostic tools is also being driven by the increasing prevalence of cancer globally, coupled with the rising need for non-invasive diagnostic techniques. AI in diagnostics allows for the analysis of vast amounts of medical data, such as medical images and genetic information, which can be used to identify specific biomarkers and predict cancer progression.

As healthcare providers seek ways to enhance diagnostic capabilities and reduce human error, the adoption of AI-powered diagnostic tools in oncology is expected to grow rapidly. Moreover, the integration of these tools with other clinical systems will likely support the continued growth of AI in diagnostics.

Cancer Type Analysis

Breast cancer holds the largest share of 32.4% in the cancer type segment of the AI in oncology market. This growth is expected to be driven by the high incidence of breast cancer worldwide, making it a priority for early detection and treatment. AI technologies are increasingly being applied to breast cancer diagnosis, particularly through advanced imaging techniques such as mammography, ultrasound, and MRI.

AI-powered tools are expected to improve the accuracy of detecting breast cancer, enabling early intervention and better treatment outcomes. The growing adoption of AI in personalized medicine, where treatment plans are tailored based on the genetic and molecular profile of the tumor, is also projected to enhance the market for AI in breast cancer.

Furthermore, the increased availability of large-scale datasets for training AI algorithms and the continuous improvement of machine learning models are expected to drive further innovation in breast cancer diagnosis and treatment. As more women undergo regular screening and AI-based diagnostic tools become more widely available, the demand for AI technologies in breast cancer care is projected to increase.

End-User Analysis

Hospitals represent the largest end-user segment in the AI in oncology market, holding 50.8% of the market share. This growth is expected to continue as hospitals increasingly adopt AI solutions to enhance cancer care delivery, including in diagnostics, treatment planning, and patient monitoring. The increasing complexity of cancer treatment protocols and the growing volume of patients seeking cancer care are driving hospitals to adopt AI-based tools that can improve operational efficiency and treatment outcomes.

AI technologies in hospitals are expected to streamline processes such as imaging analysis, pathology reporting, and treatment recommendations, ultimately leading to faster and more accurate decision-making. Furthermore, hospitals are adopting AI to improve personalized treatment plans based on patients’ genetic profiles and tumor characteristics, which is anticipated to boost the effectiveness of cancer therapies.

As the demand for high-quality cancer care rises, hospitals are projected to continue investing in AI-powered solutions to improve patient outcomes and reduce the burden on healthcare professionals.

Key Market Segments

By Product Type

- Software Solutions

- Services

- Hardware

By Application

- Diagnostics

- Research & Development

- Radiation therapy

- Immunotherapy

- Chemotherapy

By Cancer Type

- Breast Cancer

- Prostate Cancer

- Lung Cancer

- Colorectal Cancer

- Brain Tumor

- Others

By End-user

- Hospitals

- Surgical Centers & Medical Institutes

- Others

Drivers

Growing Burden of Cancer and Need for Precision Medicine is Driving the Market

The increasing global burden of cancer and the escalating demand for precision medicine approaches are significant drivers propelling the AI in oncology market. Cancer remains a leading cause of mortality worldwide, and traditional diagnostic and treatment pathways often face challenges in terms of speed, accuracy, and personalized efficacy. AI offers transformative capabilities, including accelerated drug discovery, more accurate diagnosis through image analysis, personalized treatment planning, and enhanced patient monitoring.

These capabilities are crucial for managing the complex and diverse nature of cancer. In 2022, global cancer statistics revealed approximately 20 million new cases and 9.7 million deaths related to the disease, as reported by the International Agency for Research on Cancer (IARC) and the World Health Organization (WHO). This substantial number of new cases underscores the urgent need for advanced tools to improve cancer care.

Furthermore, projections indicate that the global cancer burden will increase by approximately 77% by 2050, further straining health systems. AI’s ability to process vast amounts of genomic, pathological, and clinical data to identify subtle patterns and recommend highly targeted therapies directly addresses this growing demand, driving significant innovation and adoption in the oncology sector.

Restraints

Regulatory Hurdles and Data Privacy Concerns are Restraining the Market

Significant regulatory hurdles and persistent concerns regarding data privacy and security pose a considerable restraint on the AI in oncology market. AI systems in healthcare, particularly those involved in diagnosis and treatment recommendations, are subject to stringent regulations as medical devices.

The process of gaining regulatory approval, such as from the US Food and Drup Administration (FDA), is rigorous, time-consuming, and costly, requiring extensive validation and clinical evidence. This creates a barrier to market entry for new innovators and can delay the widespread deployment of promising AI solutions.

Furthermore, AI in oncology often involves analyzing vast datasets of highly sensitive patient information, including medical images, genomic sequences, and electronic health records. The potential for data breaches, unauthorized access, or misuse of this information raises serious privacy concerns for patients and legal liabilities for healthcare providers.

The European Commission noted in a March 2025 public health document that integrating AI into healthcare faces challenges in building trust and acceptance, and ensuring AI systems are safe and trustworthy. These regulatory complexities and data security imperatives necessitate robust compliance frameworks and advanced cybersecurity measures, which add to the implementation costs and slow the pace of adoption, thereby restraining the overall market.

Opportunities

Advancements in Genomic Profiling and Liquid Biopsy Data are Creating Growth Opportunities

The rapid advancements in genomic profiling and the increasing availability of data from liquid biopsies are creating significant growth opportunities for the AI in oncology market. These technologies generate immense volumes of complex biological data that are difficult for humans to interpret efficiently but are ideal for AI analysis.

AI algorithms can sift through genomic sequences to identify actionable mutations, predict treatment responses, and detect minimal residual disease with higher precision. Liquid biopsies, which involve analyzing circulating tumor DNA (ctDNA) from a blood sample, offer a less invasive method for cancer detection and monitoring. The American Society of Clinical Oncology (ASCO) Annual Meeting in 2025 reaffirmed that precision oncology is evolving beyond basic personalized care, emphasizing the refining of matches and adapting care as disease evolves.

A standout example highlighted the growing role of liquid biopsy technologies, which were used to track circulating tumor DNA in real-time, demonstrating how real-time molecular monitoring is playing an increasingly important role in guiding treatment adaptation. This massive influx of rich, real-time data from advanced diagnostic techniques provides fertile ground for AI to develop more sophisticated analytical tools, leading to highly personalized cancer care strategies and driving substantial market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic factors, including inflation and shifting national healthcare investment priorities, significantly influence the AI in oncology market by affecting R&D budgets and the cost of technology deployment. Inflation can increase the operational expenses for AI developers, including the cost of high-performance computing hardware, cloud services, and specialized AI talent. This may lead to higher prices for AI oncology solutions or slower product development.

However, the critical and growing need for effective cancer care, coupled with the potential for AI to deliver significant cost savings and efficiency gains in the long term, often drives sustained investment regardless of short-term economic fluctuations. The World Health Organization (WHO) reported that global health expenditure reached 6.36% of GDP in Iceland in 2023, and 3.31% in India in 2022, showcasing varied but consistent investment in healthcare infrastructure globally.

Geopolitical stability also plays a role, ensuring consistent supply chains for critical AI hardware. The intrinsic value of improving cancer patient outcomes and optimizing expensive treatment pathways ensures continued demand for AI in oncology, fostering resilience and ongoing market growth even amidst broader economic challenges.

Evolving US trade policies, including the imposition of tariffs on imported technology components, are shaping the AI in oncology market by influencing the cost of essential AI hardware and potentially impacting supply chain stability. AI in oncology relies heavily on specialized computing infrastructure, such as Graphics Processing Units (GPUs) and high-capacity data storage solutions, many of which are manufactured outside the US.

Tariffs on these components can increase the acquisition costs for healthcare providers and technology companies developing AI solutions, potentially leading to higher prices for AI oncology products or slower adoption. The Atlantic Council noted in a June 2025 blog that tariffs on AI hardware could undermine US competitiveness by raising hardware costs for US AI firms and punishing important partners. This situation highlights the financial burden on companies.

Conversely, trade policies often include a focus on domestic innovation and supply chain security, which can encourage US-based development and manufacturing of AI hardware. While tariffs may present an initial cost hurdle, the strategic importance of AI in advancing cancer care encourages investment in robust and compliant technologies, fostering a more secure and domestically resilient ecosystem for AI in oncology.

Latest Trends

Integration of Generative AI for Clinical Workflow Automation is a Recent Trend

A prominent recent trend impacting the AI in oncology market in 2024 and extending into 2025 is the rapid integration of generative AI and large language models (LLMs) to automate and streamline various clinical and administrative workflows. Generative AI is being leveraged to assist with tasks such as generating clinical notes, drafting patient summaries, creating discharge instructions, and even automating aspects of medical coding. This technology aims to reduce the significant administrative burden on oncologists and other healthcare professionals, allowing them to dedicate more time to direct patient care.

The National Cancer Institute (NCI) noted in a June 2025 publication that AI is revolutionizing pathology by analyzing high-resolution digital images of biopsy samples and revolutionizing cancer imaging by bringing unprecedented accuracy and speed to the detection, characterization, and monitoring of tumors.

Furthermore, AI-powered systems are assisting in synthesizing information from vast medical literature to provide decision support to clinicians, helping them stay updated on the latest research and treatment protocols. This practical application of generative AI to enhance operational efficiency, improve documentation, and support clinical decision-making is a key area of innovation and adoption in the oncology sector.

Regional Analysis

North America is leading the AI in Oncology Market

North America led the market with the biggest revenue share of 42.1% owing to the increasing demand for precision medicine, the rising incidence of cancer, and continuous technological advancements in AI and machine learning algorithms. Healthcare providers are increasingly adopting AI-powered solutions to enhance the accuracy and efficiency of cancer diagnosis, treatment planning, and drug discovery.

These advanced systems assist in analyzing complex medical imaging data, genomic information, and patient records to provide more personalized and effective care. The American Cancer Society projected 1,958,310 new cancer cases and 609,820 cancer deaths in the United States for 2023, underscoring the critical need for innovative solutions to combat this disease.

The US Food and Drug Administration (FDA) has also been actively reviewing and approving AI-enabled medical devices, including those for oncology applications. While specific revenue figures for AI in oncology from all key players are often integrated within broader segments, major diagnostic and healthcare technology companies demonstrate strong performance in areas relevant to AI in cancer care.

For instance, GE HealthCare reported total revenues of US$19.7 billion for the full year 2024, with growth driven by Advanced Visualization Solutions and Pharmaceutical Diagnostics, segments that increasingly integrate AI for enhanced diagnostic capabilities in oncology. Similarly, Siemens Healthineers, a significant provider of diagnostic imaging and advanced therapy solutions, continues to invest in AI-driven tools that support cancer care.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s large and aging population, which contributes to a rising cancer burden, coupled with increasing healthcare expenditure and proactive government initiatives promoting digital health. Countries like China, India, Japan, and Australia are witnessing a growing demand for advanced diagnostic and therapeutic solutions to manage the escalating number of cancer cases.

For example, According to the World Cancer Research Fund, China recorded 4,824,703 new cancer cases in 2022, while India reported 1,413,316 new cases, underscoring the large patient population in need of advanced care. Governments across the region are actively supporting the integration of AI into healthcare systems to improve efficiency and access to care.

Asia Pacific attracted US$2 billion in digital health funding across 244 deals in 2024, with a significant portion directed towards medical diagnostics and AI-driven healthcare tools, as reported by Galen Growth.

Key players with a strong regional presence are projected to capitalize on this trend. Roche’s Diagnostics Division, which offers advanced staining solutions and companion diagnostics crucial for cancer pathology, reported that its sales in the International region, including China, grew by 17% in 2024, indicating strong adoption of its diagnostic portfolio.

As healthcare infrastructure develops and digital literacy increases, the deployment of AI-powered systems for early detection, precise diagnosis, and personalized cancer treatment is likely to accelerate across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the AI-driven oncology market employ various strategies to drive growth and enhance cancer care. They focus on integrating advanced technologies such as machine learning, deep learning, and natural language processing to improve diagnostic accuracy, treatment planning, and drug discovery. Companies also prioritize the development of scalable, cloud-based platforms that offer real-time data access and seamless interoperability with existing electronic health record (EHR) systems.

Strategic partnerships with healthcare providers, research institutions, and technology firms enable these companies to expand their market reach and enhance service offerings. Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

Tempus AI, a health technology company established in 2015 by Eric Lefkofsky in Chicago, Illinois, leverages data and artificial intelligence to deliver precision medicine solutions. These solutions span various fields, including oncology, cardiology, radiology, and mental health. The company made its debut on the Nasdaq on June 14, 2024, with the ticker “TEM.” Tempus focuses on helping clinicians make informed decisions by analyzing vast amounts of clinical and molecular data, ultimately offering personalized treatment pathways to improve outcomes in cancer care.

Top Key Players

- Siemens Healthcare GmbH

- Roche’s

- NVIDIA Corporation

- Intel Corporation

- iCAD

- IBM

- GE HealthCare

- Azra AI

Recent Developments

- In April 2025, iCAD announced its collaboration with Microsoft’s Precision Imaging Network, incorporating its ProFound AI Breast Health Suite. This integration will offer cloud-based access for healthcare providers, aiming to improve mammography accuracy, cancer detection, and minimize false positives.

- In April 2025, Roche’s AI-based companion diagnostic test for advanced non-small cell lung cancer (NSCLC) received FDA Breakthrough Device Designation, enhancing the precision of personalized treatment options.

- In April 2025, US startup Gestalt Diagnostics secured USD 7.5 million to advance its AI-powered technology for early-stage cancer detection, aiming to improve diagnostic accuracy and treatment planning

- In April 2025, researchers from South Korea developed an innovative artificial tumor model using AI and 3D printing to simulate a cancer patient’s internal environment, offering insights that could lead to better personalized treatment and prognosis.

Report Scope

Report Features Description Market Value (2024) US$ 5.1 Billion Forecast Revenue (2034) US$ 53.1 Billion CAGR (2025-2034) 26.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software Solutions, Services, and Hardware), By Application (Diagnostics, Research & Development, Radiation Therapy, Immunotherapy, and Chemotherapy), By Cancer Type (Breast Cancer, Prostate Cancer, Lung Cancer, Colorectal Cancer, Brain Tumor, and Others), By End-user (Hospitals, Surgical Centers & Medical Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthcare GmbH, Roche’s, NVIDIA Corporation, Intel Corporation, iCAD , IBM, GE HealthCare, Azra AI. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artificial Intelligence in Oncology MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Artificial Intelligence in Oncology MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthcare GmbH

- Roche’s

- NVIDIA Corporation

- Intel Corporation

- iCAD

- IBM

- GE HealthCare

- Azra AI