Global Aromatherapy Carrier Oil Market Size, Share Analysis Report By Type (Vegetable Oils, Nut Oils), By Application (Cosmetic, Personal Care, Food and Beverages, Medical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153907

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

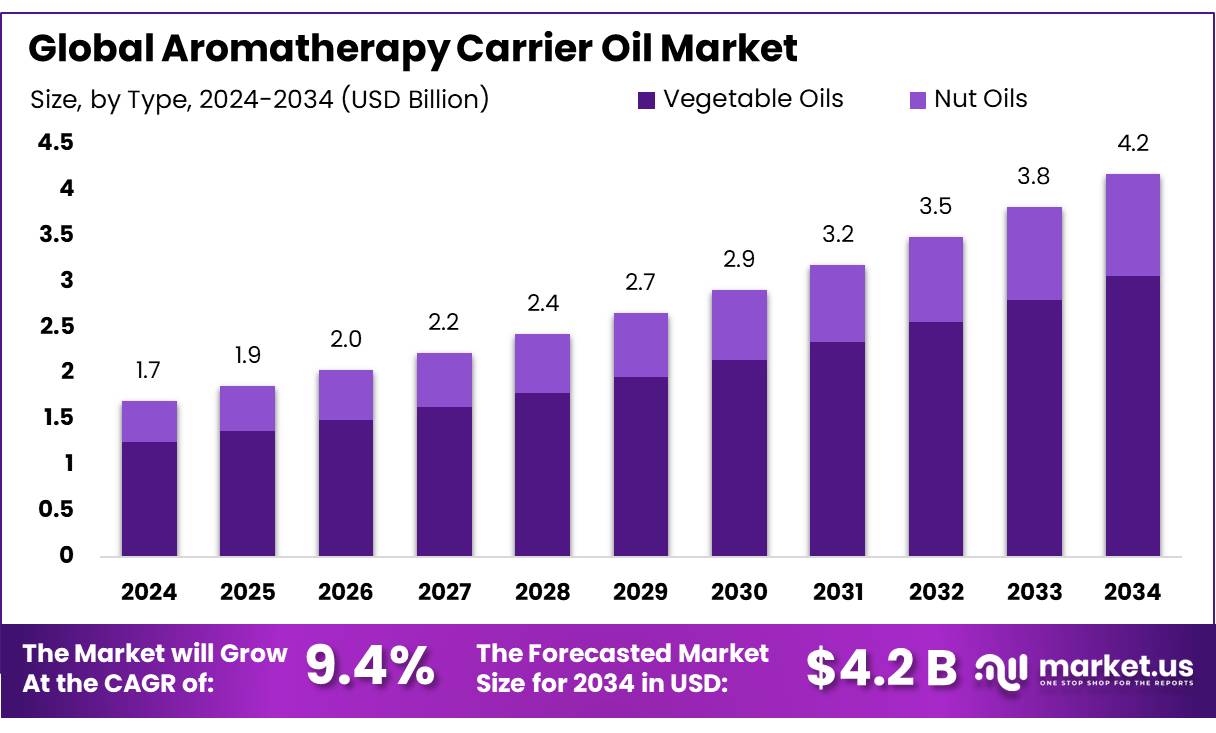

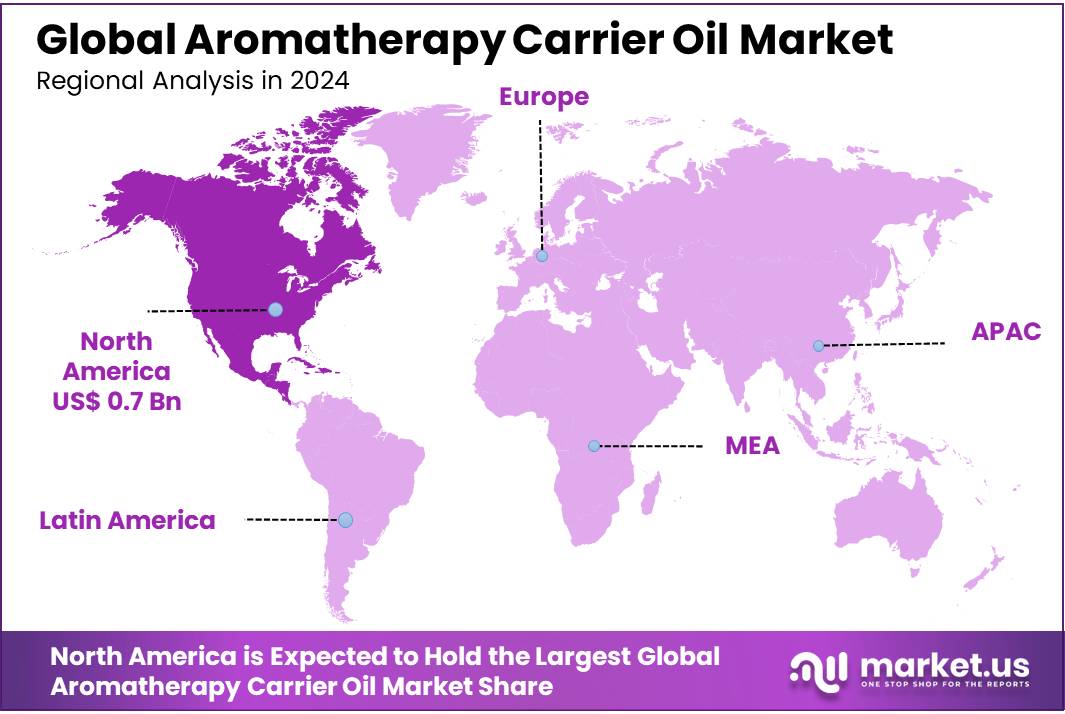

The Global Aromatherapy Carrier Oil Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 9.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.8% share, holding USD 0.7 Billion revenue.

The aromatherapy carrier oil concentrates sector encompasses natural, vegetable‑derived oils (e.g. jojoba, sweet almond, coconut, grapeseed) used to dilute essential oils for safe topical or diffuser use in aromatherapy and skincare. These carrier oils serve as inert vehicles, enabling diffuse delivery, massage application, and dilution of highly concentrated essential oils; their quality and purity are critical for consistent product performance and consumer safety.

Government initiatives also play a crucial role in supporting the growth of this market. For instance, the U.S. Department of Agriculture (USDA) allocated over $3.1 billion in April 2023 to fund agricultural sustainability projects, including those focused on organic farming practices that benefit essential oil production. Such investments enhance the availability and sustainability of raw materials essential for carrier oil concentrates.

Government initiatives in India supporting the medicinal and aromatic plants (MAP) sector contribute significantly to growth. The Ministry of AYUSH and National Medicinal Plants Board have supported cultivation schemes covering over 100,000 hectares under MAP cultivation, aiming to boost exports and rural incomes. Though precise financial allocations for carrier oils are not separately reported, sector wide funding exceeded INR 500 crore in recent annual budget cycles under grants and market development assistance programmes. These schemes have facilitated large-scale cultivation of raw materials used for carrier oils such as almond, sesame, coconut, and jojoba.

Key Takeaways

- The Aromatherapy Carrier Oil Market is projected to grow from USD 1.7 billion in 2024 to approximately USD 4.2 billion by 2034, registering a CAGR of 9.4% over the forecast period.

- Vegetable Oils held the dominant position, accounting for over 73.5% of the total market share.

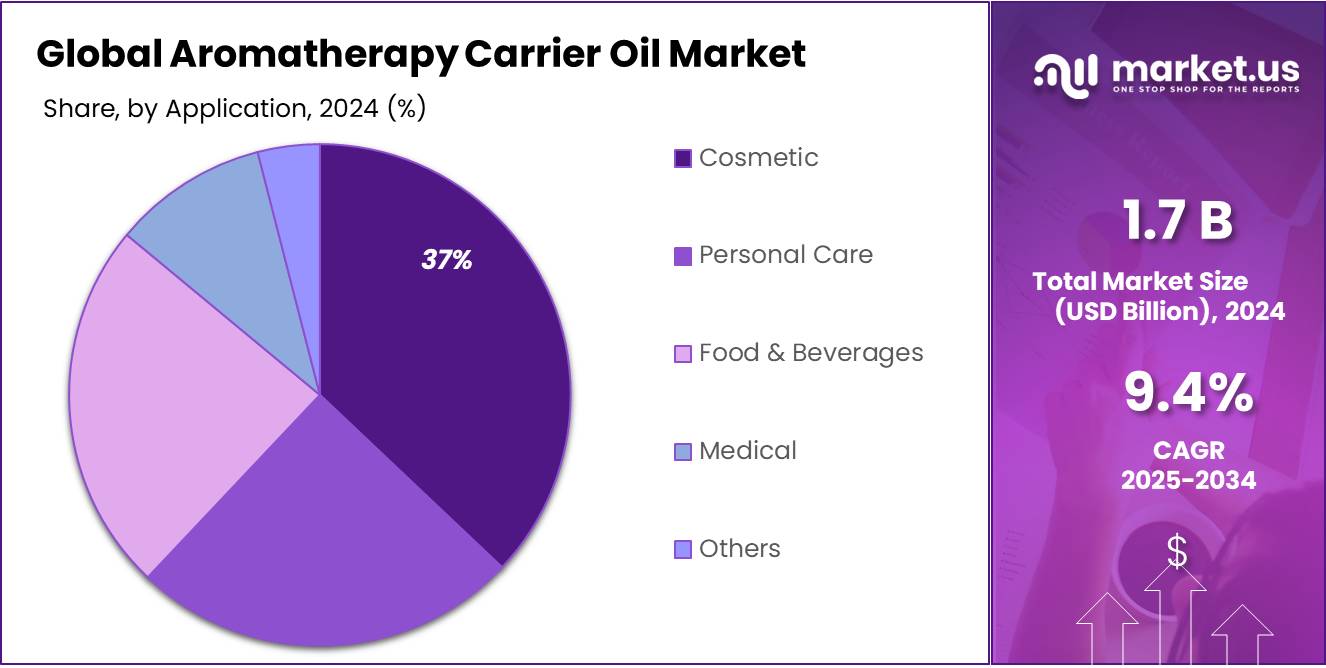

- The Cosmetic segment led the market, capturing more than 37.1% of the global share.

- North America secured a strong market position, contributing around 42.8% of global revenue, with total sales estimated at USD 0.7 billion in 2024.

By Type Analysis

Vegetable Oils dominate with 73.5% due to their natural origin and high skin compatibility.

In 2024, Vegetable Oils held a dominant market position, capturing more than a 73.5% share in the aromatherapy carrier oil market by type. This strong demand is primarily driven by the oils’ natural source, ease of skin absorption, and rich nutritional value, which make them ideal for blending with essential oils in aromatherapy. Commonly used oils such as coconut, jojoba, sweet almond, and grapeseed are preferred due to their non-reactive properties and compatibility with various skin types.

The preference for chemical-free and plant-derived solutions has further increased the use of vegetable oils across wellness centers, spas, and personal care routines. By 2025, this segment is expected to maintain its leadership due to growing consumer awareness and the ongoing trend towards organic and clean-label ingredients. The widespread use of vegetable oils in both topical and diffuser applications continues to support their substantial share in the overall market landscape.

By Application Analysis

Cosmetic application leads with 37.1% due to rising demand for natural skincare solutions.

In 2024, Cosmetic held a dominant market position, capturing more than a 37.1% share in the aromatherapy carrier oil market by application. This strong presence is largely driven by increasing consumer preference for plant-based and chemical-free cosmetic products. Carrier oils such as argan, jojoba, and almond oil are widely used in skincare formulations, including facial serums, moisturizers, and massage oils, due to their nourishing, hydrating, and anti-inflammatory properties.

The growing trend toward clean beauty, coupled with rising awareness about the side effects of synthetic cosmetics, has boosted the use of carrier oils in personal care routines. By 2025, this application segment is expected to continue growing steadily, supported by expanding wellness markets, increased product innovations, and the global shift towards sustainable and eco-conscious beauty products.

Key Market Segments

By Type

- Vegetable Oils

- Nut Oils

By Application

- Cosmetic

- Skin Care

- Others

- Personal Care

- Household

- Soap

- Food & Beverages

- Medical

- Others

Emerging Trends

Rise of Functional Fragrances in Aromatherapy

In recent years, the world of aromatherapy has experienced a significant transformation, with a notable shift towards functional fragrances. These are scents crafted not just for their pleasant aromas but also for their scientifically-backed benefits, such as stress relief, mood enhancement, and improved sleep quality.

A pivotal factor driving this trend is the increasing consumer demand for products that offer tangible wellness benefits. According to a study by Mintel, 78% of UK consumers believe that fragrances can enhance their mental well-being, prompting brands to innovate beyond traditional perfumery.

Brands like Moods, Vyrao, and Edeniste are at the forefront of this movement, developing scents that claim to have mind-altering, energy-lifting, and sleep-inducing properties. These products often incorporate natural essential oils and are supported by neuroscience, aiming to provide consumers with more than just a pleasant scent but a holistic sensory experience.

Even established beauty giants are embracing this shift. Estée Lauder, for instance, reported a decline in fragrance growth from 30% in 2022 to just 1% in 2024, leading them to introduce science-based functional scents that promote emotional and mental well-being.

Drivers

Regulatory Oversight and Quality Assurance

In India, the Food Safety and Standards Authority of India (FSSAI) plays a pivotal role in ensuring the safety and quality of edible oils, including those used in aromatherapy carrier oils. The FSSAI’s Edible Oil Survey 2020 analyzed 4,461 oil samples from 584 districts across 27 states and 5 union territories. The survey revealed that approximately 30% of the samples failed to meet one or more of the 161 parameters tested, including chemical composition, fatty acid profiles, and labeling accuracy.

Notably, states like Uttar Pradesh and Telangana exhibited higher failure rates, with 50% and 10.6% non-compliance, respectively. These findings underscore the necessity for stringent quality control measures in the production and distribution of edible oils, which directly impacts the quality of aromatherapy carrier oils.

To address these concerns, the FSSAI has implemented various initiatives. The Repurpose Used Cooking Oil (RUCO) program, launched in 2018, encourages the collection and conversion of used cooking oil into biodiesel, thereby promoting sustainability and reducing the risk of harmful substances in edible oils. Additionally, the FSSAI’s Food Safety Compliance System (FoSCoS) facilitates the digitalization of food safety processes, enhancing transparency and efficiency in monitoring and enforcement.

These regulatory measures and quality assurance programs are instrumental in maintaining the integrity of edible oils used in aromatherapy carrier oils. By adhering to FSSAI standards and participating in initiatives like RUCO and FoSCoS, producers can ensure the delivery of high-quality, safe, and sustainable products to consumers.

Restraints

Adulteration and Quality Control Challenges

A significant challenge in the aromatherapy carrier oil industry is the prevalence of adulteration and compromised quality standards in edible oils, which are integral to the production of these carrier oils. The Food Safety and Standards Authority of India (FSSAI) conducted a comprehensive Edible Oil Survey in 2020, analyzing 4,461 oil samples across various states. The findings revealed that approximately 24.21% (1,080 samples) failed to meet quality parameters, indicating potential adulteration or blending with other oils or materials.

Common issues included deviations in refractive index, iodine value, and fatty acid profile, which are critical indicators of oil purity and composition. Additionally, 12.82% (572 samples) were misbranded, failing to meet labeling requirements such as fortification claims for vitamins A and D, highlighting concerns over transparency and consumer trust .

This widespread adulteration poses a significant risk to the integrity of aromatherapy carrier oils, as the presence of substandard or contaminated oils can undermine the therapeutic benefits and safety of the final products.

- For instance, the detection of aflatoxins, pesticide residues, and heavy metals in edible oils not only breaches safety standards but also endangers consumer health. The FSSAI’s survey identified that 2.42% (108 samples) of the tested oils were unsafe due to such contaminants.

To address these issues, the FSSAI has implemented several initiatives aimed at improving the quality and safety of edible oils. These include stringent surveillance activities, public awareness campaigns, and enforcement actions against non-compliant producers. The FSSAI has also developed a pan-India surveillance system to monitor food safety and identify hotspots of food safety non-compliance and adulteration.

Opportunity

Government Initiatives to Enhance Edible Oil Quality

The Indian government has undertaken several initiatives to improve the quality and safety of edible oils, which directly impacts the production of aromatherapy carrier oils. The Food Safety and Standards Authority of India (FSSAI) conducted a nationwide survey in 2020, testing 4,461 edible oil samples from 587 districts. The findings revealed that approximately 24.2% of these samples failed to meet quality standards, indicating potential adulteration or blending with other substances.

Additionally, 2.42% of the samples were non-compliant due to safety concerns, including the presence of aflatoxins, pesticide residues, and heavy metals at levels higher than prescribed by the Food Safety and Standards Regulations (FSSR).

In response to these challenges, the FSSAI has implemented the Repurpose Used Cooking Oil (RUCO) program. Launched in 2018, this initiative encourages the collection and conversion of used cooking oil into biodiesel, thereby promoting sustainability and reducing the risk of harmful substances in edible oils. The program mandates that food businesses using more than 50 liters of edible oil per day discard any leftover oil by the end of the day, ensuring that only fresh oil is used in food preparation.

These government initiatives play a crucial role in enhancing the quality and safety of edible oils, thereby supporting the production of high-quality aromatherapy carrier oils. By ensuring that the base oils meet stringent safety and quality standards, these programs help in delivering safe and effective products to consumers. The continued focus on quality assurance and sustainability will further bolster the growth and credibility of the aromatherapy carrier oil industry.

Regional Insights

North America leads with 42.8% share and approximately USD 0.7 billion in 2024 revenue.

In 2024, North America held a commanding position in the aromatherapy carrier oil market, accounting for around 42.8% of global revenue, with total sales estimated at USD 0.7 billion. This regional dominance reflects a well-established consumer base for wellness products, matured retail channels, and strong awareness of plant-based therapeutic oils.

Consumer demand for natural and organic personal care products continues to drive uptake of carrier oils such as jojoba, almond, coconut, and grape seed. The region’s advanced spa and wellness infrastructure amplifies this demand, as these oils are widely adopted in massage, aromatherapy, and skin treatments. In addition, retailers and online platforms in the United States and Canada maintain robust distribution networks, contributing to strong market penetration.

State and federal regulations in North America have also played a supportive role. In the U.S., the Food and Drug Administration’s guidelines on botanical ingredients and labelling have encouraged transparency and improved product quality standards. Similarly, Canadian natural health product regulations ensure rigorous testing and safe formulations, enhancing consumer trust and market expansion. These regulatory environments reinforce consumer confidence and enable premium carrier oil products to flourish.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Edens Garden is a family‑owned and women‑operated U.S.-based brand recognised for offering affordable, high-quality essential and carrier oils. All products are 100% pure and GC/MStested to ensure potency and contaminant-free formulations. The company sources ethically from global growers and maintains transparency through batch-specific lab results. Its extensive portfolio includes over 250 single oils and blends, making it a trusted choice in aromatherapy and wellness sectors. Market observers often cite it among the top players alongside Rocky Mountain Oils and Plant Therapy

Rocky Mountain Oils, LLC is headquartered in Utah, USA, and is a leading player in essential and carrier oils. The company prioritises purity and consumer trust by providing independent GC/MS test results for each batch, ensuring product integrity and transparency. Offered in amber glass bottles, its broad range features singles, blends, organic lines, and a loyalty rewards programme. As a non-MLM brand, Rocky Mountain Oils has earned a reputation for quality and accessibility among aromatherapy users

Plant Therapy, based in Idaho, U.S., provides therapeutic-grade carrier and essential oils at competitive price points. The brand distinguishes itself through batch-specific third-party testing, with all GC/MS results openly available to consumers. Its KidSafe line appeals to families, and extensive educational resources support safe use. Plant Therapy consistently ranks among the top companies in the category, praised for affordability, transparency, and product breadth.

Top Key Players Outlook

- Edens Garden

- Rocky Mountain Oils, LLC

- Plant Therapy

- Falcon

- Florihana Distillerie

- Moksha Lifestyle Products

Recent Industry Developments

In 2024, Plant Therapy delivered over 997,962 plant-based products—including carrier oils, essential oils, and blends—to homes across the United States.

As of 2024 Rocky Mountain Oils, company revenue is estimated at USD 5.5 million annually, reflecting its stable presence in the natural wellness space.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 4.2 Bn CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vegetable Oils, Nut Oils), By Application (Cosmetic, Personal Care, Food and Beverages, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Edens Garden, Rocky Mountain Oils, LLC, Plant Therapy, Falcon, Florihana Distillerie, Moksha Lifestyle Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aromatherapy Carrier Oil MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Aromatherapy Carrier Oil MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Edens Garden

- Rocky Mountain Oils, LLC

- Plant Therapy

- Falcon

- Florihana Distillerie

- Moksha Lifestyle Products