Global Apparel Re-commerce Market Size, Share, Growth Analysis By Product Type (Clothing and garments, Handbags, Footwear, Accessories, Others), By Companies (Tier-1 Companies, Tier-2 Companies, Tier-3 Companies), By End User (Adult, Kids), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153477

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

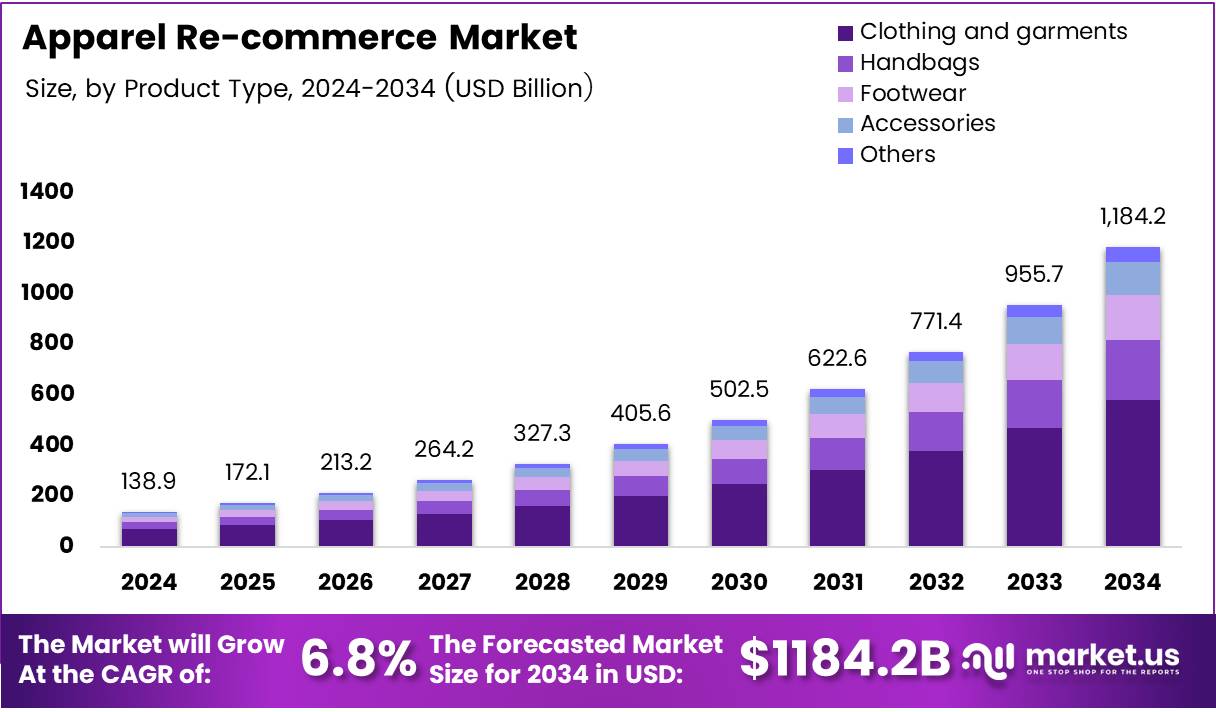

The Global Apparel Re-commerce Market size is expected to be worth around USD 1184.2 Billion by 2034, from USD 138.9 Billion in 2024, growing at a CAGR of 23.9% during the forecast period from 2025 to 2034.

The apparel re-commerce market refers to the buying and selling of pre-owned clothing and fashion accessories. This sector has seen rapid growth due to changing consumer preferences, an increased emphasis on sustainability, and growing concerns over the environmental impact of fast fashion. It is also driven by a shift in consumer behavior towards secondhand goods.

The market for apparel re-commerce offers significant growth opportunities. Consumers are becoming more conscious of the impact of their purchasing decisions, contributing to a rise in the demand for pre-loved clothing. Additionally, platforms dedicated to reselling fashion items provide an easier way for individuals to access and dispose of unwanted apparel.

Government investment and regulatory frameworks are helping to shape the growth of the apparel re-commerce market. Various governments are introducing policies to support sustainable fashion initiatives, aiming to reduce waste and promote circular economy practices. These policies create a favorable environment for the re-commerce market to thrive and further expand in the coming years.

As the market continues to evolve, younger generations like Gen Z are leading the charge. According to WGSN Barometer, 40% of Gen Z consumers buy pre-loved clothes because they are unable to find the style in traditional retail outlets. This trend has increased the appeal of secondhand apparel as a unique and sustainable choice.

Additionally, data from Mastercard reveals that 27% of online spending on luxury apparel was made through fashion resellers last year. This highlights the growing shift towards secondhand luxury goods, as consumers recognize the value in buying high-end items at a fraction of the price.

The global shift toward buying pre-loved apparel is not limited to a specific demographic. According to eBay’s 2024 Recommerce Report, 86% of shoppers globally have bought or sold a pre-loved item in the past year, with over 70% planning to purchase used goods in the coming year. This indicates a significant cultural shift in consumer preferences, emphasizing the growing importance of sustainable fashion.

Key Takeaways

- The Global Apparel Re-commerce Market is projected to reach USD 1184.2 Billion by 2034, growing at a CAGR of 23.9% from 2025 to 2034.

- In 2024, the Clothing and Garments segment held 48.6% of the market share, driven by demand for sustainable fashion.

- Tier-1 companies held 63.2% of the market share in 2024, backed by strong brand presence and infrastructure.

- The Adult segment dominated with 60.1% market share in 2024, driven by a demand for affordable, high-quality second-hand clothing.

- North America led the market in 2024 with 35.6% market share, valued at USD 49.4 Billion, fueled by e-commerce infrastructure and consumer interest in sustainable fashion.

Product Type Analysis

Clothing and garments dominate with 48.6% share, driven by their versatility and high demand.

In 2024, the Clothing and Garments segment held a dominant market position in the Apparel Re-commerce Market, accounting for 48.6% of the overall market share. This significant share is largely attributed to the enduring popularity and consistent demand for second-hand clothing. Consumers are increasingly attracted to sustainable fashion options, and this trend has fueled the growth of the clothing and garments sector.

Handbags, while contributing to the market, represent a smaller portion of the market share. The demand for second-hand handbags is rising, driven by the luxury resale market, though it remains behind clothing in overall market significance.

Footwear, similarly, holds a smaller share in comparison but still contributes significantly to the re-commerce market. The Accessories segment, though notable, remains in the background, as accessories typically have a niche market compared to larger apparel items.

The Others category includes miscellaneous apparel products, which also hold a part of the market but remain secondary in the overall re-commerce landscape.

Companies Analysis

Tier-1 Companies lead with 63.2% share, highlighting their dominant position in the apparel re-commerce market.

In 2024, Tier-1 companies commanded a substantial portion of the Apparel Re-commerce Market, holding 63.2% of the market share. This dominance is driven by their strong brand presence, well-established infrastructure, and wide customer reach. Tier-1 companies have extensive resources to engage in large-scale operations, making them pivotal players in the apparel re-commerce market.

Tier-2 companies hold a smaller yet significant portion of the market. Their market share reflects a growing presence, with these companies focusing on niche segments and unique product offerings. Tier-3 companies, while important, have a limited market footprint compared to their Tier-1 and Tier-2 counterparts. However, they contribute to the overall market by catering to specific customer needs or local preferences.

The competitive landscape remains heavily skewed toward Tier-1 companies due to their established reputations and ability to dominate the digital re-commerce platforms.

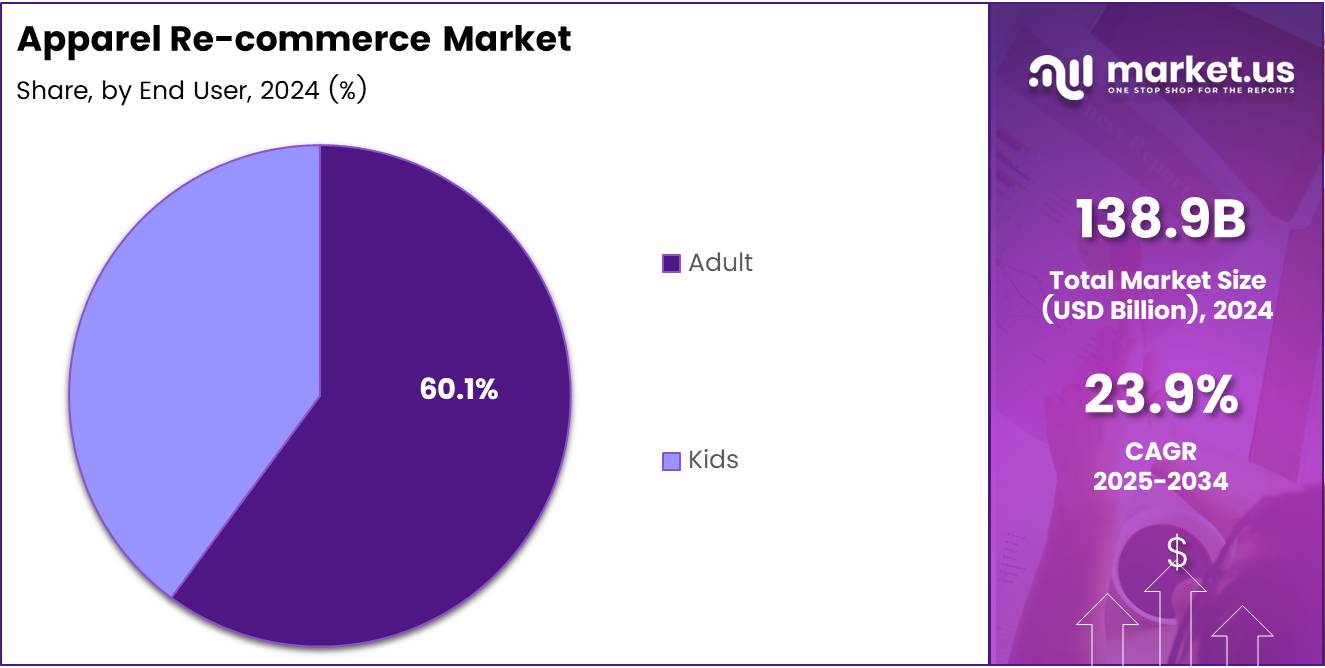

End User Analysis

Adult consumers dominate with 60.1% share, reflecting their primary role in the apparel re-commerce market.

In 2024, the Adult segment held the largest share in the Apparel Re-commerce Market with 60.1%. Adults continue to be the primary consumers in this market, driven by a growing demand for second-hand clothing and sustainable fashion options. With a focus on affordability and unique pieces, adult consumers have embraced re-commerce as a way to access high-quality apparel at lower prices.

The Kids segment, while significant, accounts for a smaller portion of the market share. Although there is an increasing trend in second-hand kids’ clothing, the demand remains more limited compared to adult apparel. Parents are increasingly turning to the resale market for affordable, gently-used clothes for their children, but this category still lags behind in overall market size.

Adult consumers are expected to continue leading the market, thanks to their larger purchasing power and a wider variety of clothing needs in the re-commerce space.

Key Market Segments

By Product Type

- Clothing and garments

- Handbags

- Footwear

- Accessories

- Others

By Companies

- Tier-1 Companies

- Tier-2 Companies

- Tier-3 Companies

By End User

- Adult

- Kids

Drivers

Rising Consumer Demand for Sustainable Fashion Drives Apparel Re-Commerce Market Growth

The growing interest in sustainable fashion is one of the main drivers for the apparel re-commerce market. More consumers are becoming aware of the environmental impact of fast fashion and are seeking alternative ways to shop. Re-commerce offers a sustainable option, as it allows consumers to buy and sell pre-owned clothing, reducing the demand for new production and ultimately cutting down on waste. This demand for eco-friendly alternatives is pushing the market towards new growth opportunities.

Younger generations, particularly Millennials and Gen Z, are driving this shift. These groups are more inclined to buy second-hand clothing as they view it as a way to support sustainability. The increased popularity of second-hand fashion among these demographics further contributes to the growth of re-commerce platforms. These factors highlight a significant change in consumer attitudes towards fashion, moving away from fast fashion and embracing sustainable practices.

Restraints

Challenges in Quality and Authenticity Affect Apparel Re-Commerce Market Growth

One of the main challenges facing the apparel re-commerce market is consumer concerns regarding the quality and authenticity of pre-owned clothing. Shoppers may worry about the condition of items, as well as whether they are purchasing genuine brand items. These concerns can deter potential buyers from fully engaging in the re-commerce space.

Additionally, the availability of high-quality pre-loved apparel can be inconsistent. While some platforms offer a great selection, others may have limited options, which can make it harder for consumers to find the items they want. This gap in availability can hinder market growth.

Inconsistent return and exchange policies across different resale platforms are another challenge. Consumers may feel uncertain about the buying process if return policies vary widely between sellers. Finally, regulatory challenges surrounding the resale of apparel can complicate operations, creating additional hurdles for the market.

Growth Factors

Growth Opportunities in Apparel Re-Commerce Market Driven by Technological Advancements

There are numerous growth opportunities in the apparel re-commerce market, particularly with the expansion of technology-driven resale platforms. As online platforms become more user-friendly and efficient, the purchasing and selling of pre-loved apparel become increasingly seamless. New technologies are improving inventory management and streamlining the shopping experience for consumers.

Additionally, the rise of subscription-based re-commerce models offers an interesting opportunity. These models allow customers to receive regular deliveries of curated, pre-owned apparel, which could drive long-term customer loyalty.

Strategic partnerships with major apparel brands are also opening up new avenues, allowing well-known labels to participate in the second-hand market and reach a wider audience. As investments in circular economy initiatives grow, the market will likely see increased funding and focus on sustainability.

Emerging Trends

Trending Factors Shaping the Apparel Re-Commerce Market

Several trending factors are shaping the apparel re-commerce market. One significant trend is the integration of AI and machine learning in inventory management. These technologies help optimize the stock and ensure the availability of popular items, improving the overall customer experience.

Social media marketing is also playing a big role in boosting the popularity of pre-loved fashion. Platforms like Instagram and TikTok have helped normalize second-hand shopping, particularly in the luxury apparel segment. The growing demand for luxury and high-end second-hand apparel is attracting both consumers and sellers, making it a key trend in the market.

Another trend is the increased focus on sustainable packaging in resale channels. Consumers are paying more attention to how items are packaged and shipped, and many re-commerce platforms are responding by offering eco-friendly packaging options. These trends reflect the evolving landscape of apparel re-commerce, driven by sustainability and digital innovations.

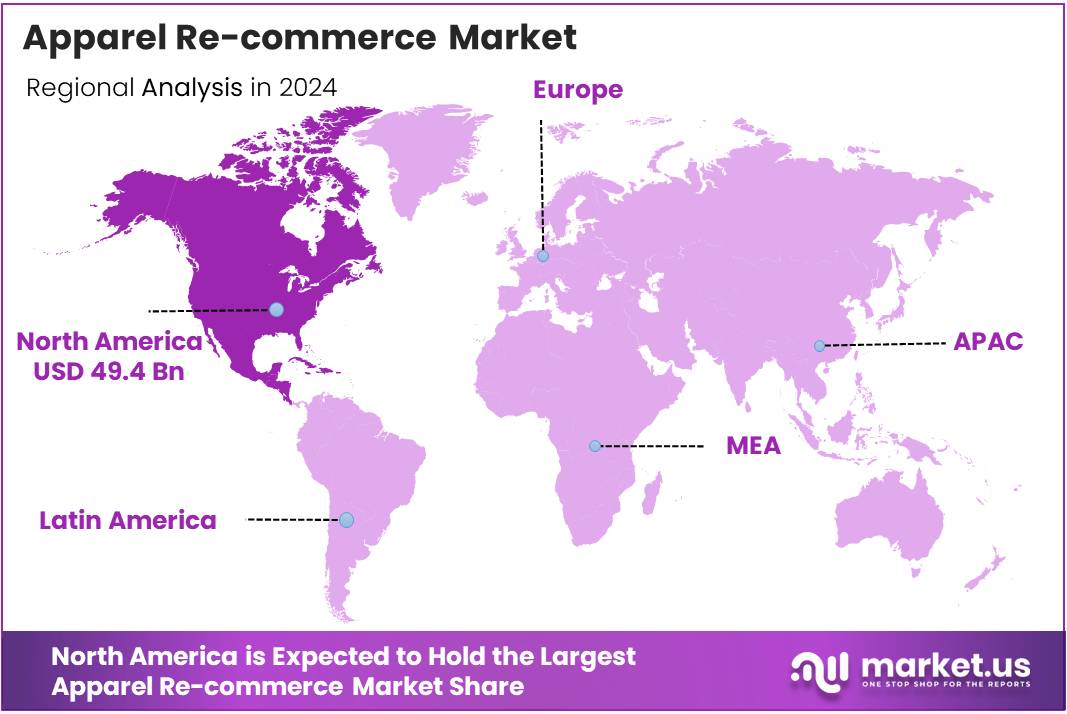

Regional Analysis

North America Dominates the Apparel Re-commerce Market with a Market Share of 35.6%, Valued at USD 49.4 Billion

North America remains the dominant region in the apparel re-commerce market, accounting for 35.6% of the market share, valued at USD 49.4 Billion. The region’s robust e-commerce infrastructure, high disposable income, and growing consumer interest in sustainable fashion have significantly contributed to its leading position. The adoption of re-commerce platforms by mainstream brands further bolsters growth in the market.

Europe Apparel Re-commerce Market Trends

Europe is a strong contender in the apparel re-commerce market, driven by increasing consumer demand for eco-friendly and sustainable shopping alternatives. The region is witnessing a steady rise in secondhand clothing sales, supported by growing awareness of environmental concerns and the shift toward circular fashion. European consumers are increasingly turning to online platforms for resale, contributing to the region’s market expansion.

Asia Pacific Apparel Re-commerce Market Trends

Asia Pacific is experiencing rapid growth in the apparel re-commerce sector, with a growing middle class and increasing awareness of sustainability driving market demand. Countries like China and India are becoming key players, with online resale platforms gaining popularity. The region is also expected to see continued growth due to rising disposable income and digital penetration.

Middle East and Africa Apparel Re-commerce Market Trends

The Middle East and Africa (MEA) region is gradually adopting the concept of apparel re-commerce, with a growing interest in sustainable and cost-effective fashion solutions. While the market is still in the early stages, increasing awareness of environmental issues, combined with digital adoption, is expected to drive growth. The region is also witnessing the emergence of local online platforms catering to the demand for secondhand clothing.

Latin America Apparel Re-commerce Market Trends

In Latin America, the apparel re-commerce market is gaining traction, particularly in countries like Brazil and Mexico, where economic shifts are leading consumers to seek affordable and sustainable alternatives. The region’s young, digitally savvy population is accelerating the adoption of secondhand apparel, though the market is still in its nascent stages compared to other regions. Nonetheless, digital platforms are poised to drive growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Apparel Re-commerce Company Insights

In 2024, Vestiaire Collective is expected to maintain its leadership in the global apparel re-commerce market. The company continues to attract high-end fashion buyers and sellers, offering a curated selection of pre-owned luxury items. Its global presence and commitment to sustainability are major drivers of growth in the market.

The RealReal has also carved a niche in the luxury segment, capitalizing on the increasing demand for authenticated pre-owned luxury goods. With its deep focus on customer trust and authentication services, The RealReal is anticipated to see continued success by expanding its reach and solidifying its position as a trusted name in high-end resale.

SnobSwap is gaining attention with its growing community and user-friendly platform. Focused on affordable and trendy apparel, it has successfully attracted a younger demographic interested in sustainable fashion choices. Its innovative features, such as swapping clothes between users, are driving engagement and are expected to support its expansion in 2024.

Tradesy remains a prominent player with its focus on accessible luxury. The company offers a streamlined buying and selling experience, making it a go-to platform for those seeking to resell designer items. Tradesy’s ease of use and dedication to enhancing the consumer experience position it well for continued growth in the competitive re-commerce space.

Top Key Players in the Market

- Vestiaire Collective

- The RealReal

- SnobSwap

- Tradesy

- Poshmark

- ThredUP

- Vinted

- Threadflip

Recent Developments

- In May 2025, Slikk raised $10 million in Series A funding, led by Nexus Venture Partners, to accelerate its 60-minute fashion commerce model, enabling rapid delivery and increasing customer convenience in the fast-fashion sector.

- In July 2025, Zulu Club secured $250K in funding to innovate urban fashion shopping, focusing on providing instant try-at-home kits, allowing consumers to experience fashion pieces before making a purchase decision.

- In April 2025, Faume successfully raised €8 million to support its expansion into the second-hand fashion market, with notable partnerships including brands like Lacoste and Victoria Beckham, catering to the growing demand for sustainable fashion.

Report Scope

Report Features Description Market Value (2024) USD 138.9 Billion Forecast Revenue (2034) USD 1184.2 Billion CAGR (2025-2034) 23.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Clothing and garments, Handbags, Footwear, Accessories, Others), By Companies (Tier-1 Companies, Tier-2 Companies, Tier-3 Companies), By End User (Adult, Kids) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Vestiaire Collective, The RealReal, SnobSwap, Tradesy, Poshmark, ThredUP, Vinted, Threadflip Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-