Global Antifibrinolytic Drugs Market By Product Type (Oral and Injectable), By Application (Gynecology, Fibrinolytic Response Testing, Hereditary Angioedema, Surgeries, and Others), By End-user (Hospitals & Clinics, Trauma Centers, and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132045

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

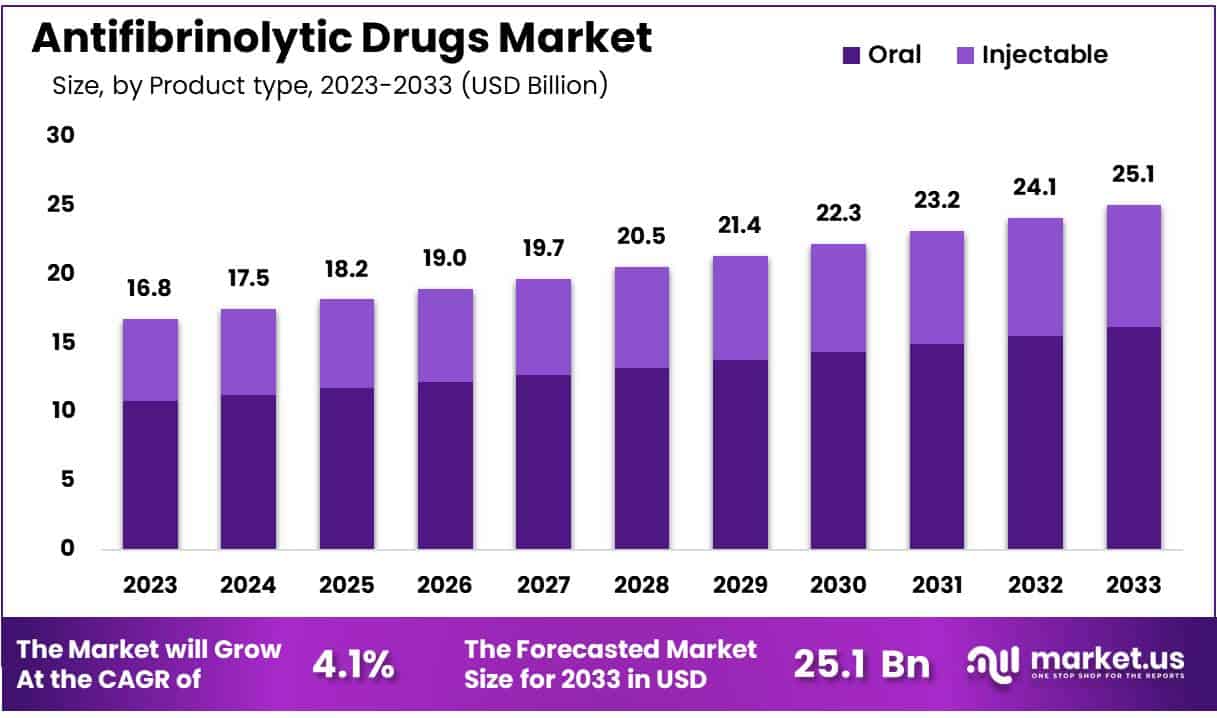

Global Antifibrinolytic Drugs Market size is expected to be worth around US$ 25.1 billion by 2033 from US$ 16.8 billion in 2023, growing at a CAGR of 4.1% during the forecast period 2024 to 2033.

Increasing demand for antifibrinolytic drugs stems from their critical role in managing severe bleeding across surgical, trauma, and obstetric care. Trauma remains the leading cause of death among individuals aged 1 to 65 in the United States, as highlighted by the National Trauma Institute in May 2023, underscoring the necessity for effective hemorrhage control.

Antifibrinolytic drugs, such as tranexamic acid and aminocaproic acid, prevent excessive blood loss by inhibiting fibrinolysis, making them essential in trauma and emergency care. Recent advancements in antifibrinolytic formulations and delivery methods focus on enhancing rapid absorption and efficacy, addressing the urgent needs of emergency and surgical settings.

Growing utilization of these drugs in cardiac and orthopedic surgeries further supports market growth, as practitioners increasingly seek solutions to reduce perioperative blood loss. The market also sees promising opportunities with rising awareness of postpartum hemorrhage (PPH) management, where antifibrinolytics play a pivotal role in reducing maternal mortality.

Research into combining antifibrinolytic drugs with other hemostatic agents is gaining traction, as these combinations show potential in improving patient outcomes and minimizing side effects. As healthcare systems continue to prioritize effective blood management, the antifibrinolytic drugs market stands poised for steady expansion, driven by innovations that enhance both safety and accessibility.

Key Takeaways

- In 2023, the market for antifibrinolytic drugs generated a revenue of US$ 8 billion, with a CAGR of 4.1%, and is expected to reach US$ 25.1 billion by the year 2033.

- The product type segment is divided into oral and injectable, with oral taking the lead in 2023 with a market share of 64.5%.

- Considering application, the market is divided into gynecology, fibrinolytic response testing, hereditary angioedema, surgeries, and others. Among these, gynecology held a significant share of 36.8%.

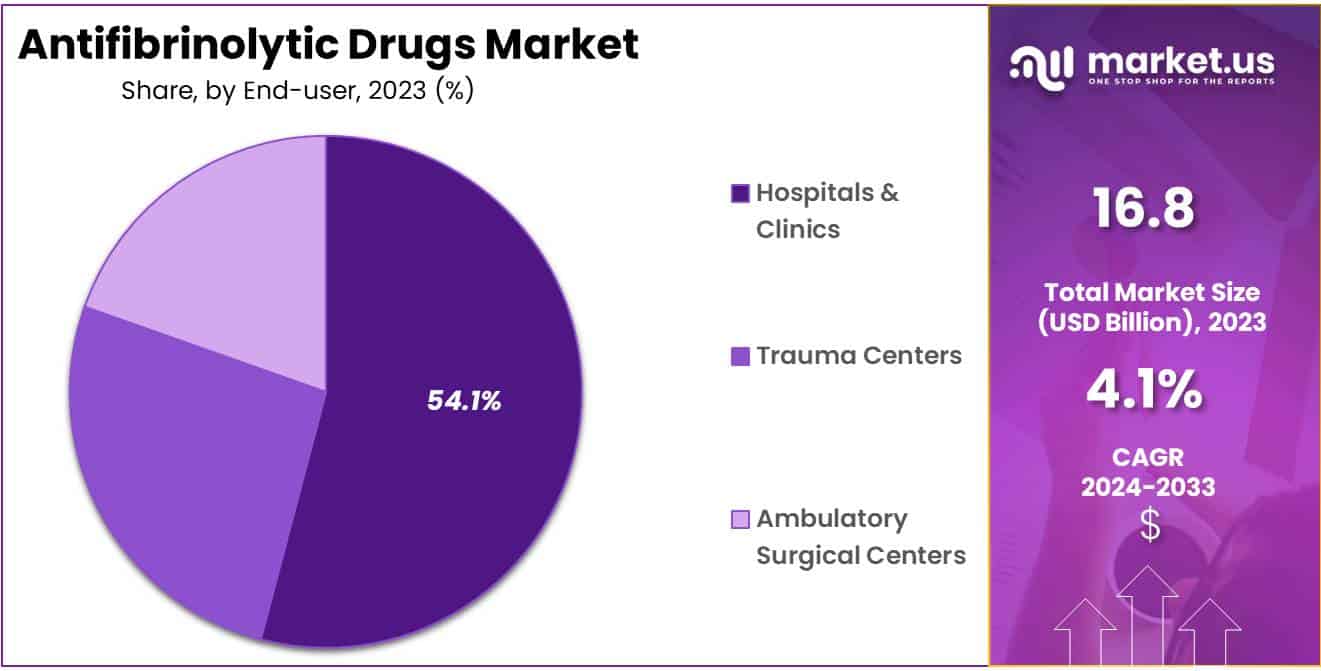

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, trauma centers, and ambulatory surgical centers. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 54.1% in the antifibrinolytic drugs market.

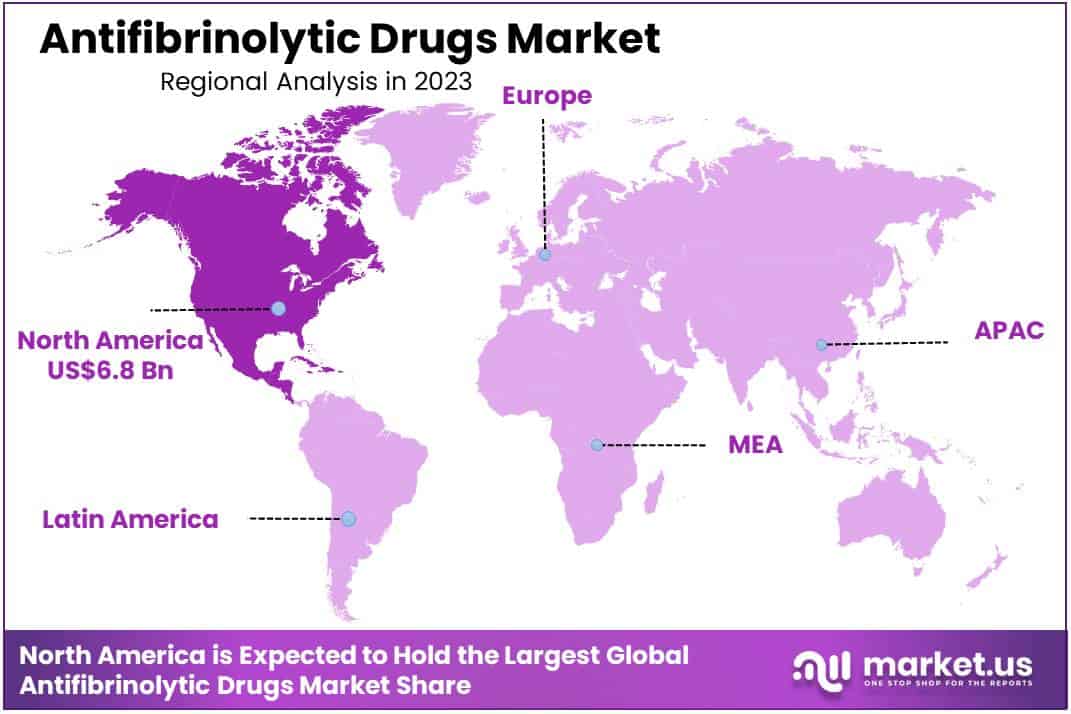

- North America led the market by securing a market share of 40.7% in 2023.

By Product Type Analysis

The oral segment led in 2023, claiming a market share of 64.5% owing to its ease of administration and patient convenience. Oral antifibrinolytic drugs, preferred for non-emergency settings, provide an effective solution for managing conditions that require long-term therapy, such as heavy menstrual bleeding and hereditary angioedema.

The rising incidence of conditions requiring antifibrinolytic therapy, combined with patient preference for non-invasive treatment options, drives demand for oral formulations. Increased awareness of antifibrinolytic therapy in managing various bleeding disorders encourages more patients and healthcare providers to opt for oral options. Technological advancements in drug formulation enhance the bioavailability and effectiveness of oral antifibrinolytics, contributing to market growth.

Furthermore, improved patient compliance with oral therapies supports sustained usage, which positively impacts this segment. These factors collectively position the oral segment as a growing choice in antifibrinolytic drug therapy.

By Application Analysis

The gynecology held a significant share of 36.8% due to the rising incidence of gynecological conditions requiring bleeding management. Antifibrinolytic drugs effectively address heavy menstrual bleeding and postpartum hemorrhage, common issues that significantly impact women’s health globally. Increasing awareness of menstrual health encourages women to seek effective therapies, which supports the demand for antifibrinolytic drugs in gynecology.

As healthcare providers emphasize minimally invasive management for gynecological bleeding, antifibrinolytics become a preferred choice over surgical interventions. Additionally, the growing availability of oral formulations enhances accessibility and compliance among women.

Government health initiatives focusing on maternal health and women’s well-being further boost adoption in this segment. These trends position the gynecology segment for expansion as antifibrinolytic drugs become integral to managing gynecological conditions safely and effectively.

By End-user Analysis

The hospitals & clinics segment had a tremendous growth rate, with a revenue share of 54.1% as these facilities remain primary providers of acute and critical care for bleeding disorders. Hospitals and clinics often manage emergency cases, such as trauma and surgery-related bleeding, where antifibrinolytic drugs play a crucial role in stabilizing patients.

The increasing number of surgeries and rising prevalence of trauma cases globally drive demand for immediate access to antifibrinolytic therapies in hospital settings. Improved healthcare infrastructure in emerging markets expands access to these drugs in hospital environments, supporting market growth. Additionally, healthcare providers increasingly recognize the benefits of antifibrinolytics in reducing blood loss and minimizing transfusion needs, which aligns with hospitals’ goals of efficient resource utilization.

Favorable government funding for healthcare facilities enhances the availability of these drugs, making hospitals and clinics central to antifibrinolytic therapy distribution. Consequently, this segment is likely to grow as hospitals continue to integrate antifibrinolytic drugs into routine care for bleeding management.

Key Market Segments

By Product Type

- Oral

- Injectable

By Application

- Gynecology

- Fibrinolytic Response Testing

- Hereditary Angioedema

- Surgeries

- Others

By End-user

- Hospitals & Clinics

- Trauma Centers

- Ambulatory Surgical Centers

Drivers

Growing Incidence of Road Accidents Drives the Antifibrinolytic Drugs Market

Growing incidence of road accidents significantly drives the demand for antifibrinolytic drugs, which are essential in managing trauma-induced bleeding. According to recent data from the World Health Organization, approximately 1.35 million people lose their lives each year due to traffic accidents, and millions more suffer from serious injuries.

These high accident rates increase the need for medical interventions that control bleeding and enhance survival rates for trauma patients. Antifibrinolytic drugs, such as tranexamic acid, play a critical role in emergency care by stabilizing blood clots and reducing excessive blood loss during surgery or trauma recovery.

As global road traffic continues to increase, particularly in low- and middle-income countries where safety measures may be lacking, healthcare systems are expected to see a rising demand for these drugs. Thus, the surge in road accidents is projected to drive market growth by fostering reliance on antifibrinolytic therapies in emergency and trauma care settings.

Restraints

High Cost of Antifibrinolytic Drugs is a Restraint in the Market

The high cost associated with antifibrinolytic drugs limits accessibility, especially for patients in low- to middle-income countries. Antifibrinolytic drugs like tranexamic acid are frequently used for preventing excessive bleeding during surgeries and for managing conditions such as heavy menstrual bleeding and hereditary angioedema.However, the cost of treatment can be prohibitively expensive, particularly as these drugs may need to be administered over long periods or in multiple doses depending on the severity of the condition. Furthermore, costs can escalate with the need for hospital care, especially in trauma centers where such drugs are regularly utilized for managing acute bleeding.

In regions with limited healthcare coverage, this cost barrier makes it difficult for many patients to access necessary antifibrinolytic treatments, impacting their health outcomes.

Opportunities

Increasing Application in Cardiovascular Disease Treatment as an Opportunity

Increasing applications of antifibrinolytic drugs in cardiovascular disease (CVD) treatment present a major opportunity for market expansion. The World Health Organization reported in June 2021 that CVDs are the leading cause of death globally, with over 75% of these fatalities occurring in low- and middle-income countries.

As healthcare providers seek advanced therapeutic options for CVD management, antifibrinolytics offer essential support in preventing complications related to excessive bleeding during surgical procedures or treatments like coronary artery bypass grafting. The application of these drugs in cardiac surgery and other cardiovascular treatments is expected to grow, particularly in regions experiencing high CVD rates.

As awareness increases regarding the benefits of antifibrinolytic therapies in reducing perioperative bleeding and improving patient outcomes, demand for these drugs in cardiovascular care is likely to rise. This trend highlights the expanding role of antifibrinolytic drugs as a critical element in comprehensive cardiovascular treatment strategies, positioning the market for substantial growth in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors create both challenges and opportunities for the antifibrinolytic drugs market. Economic instability and inflationary pressures can strain healthcare budgets, limiting funding for advanced medical treatments, particularly in low- and middle-income countries.

Additionally, trade disruptions and supply chain issues due to geopolitical tensions can restrict access to critical raw materials, impeding the manufacturing and distribution of essential medications. On the other hand, countries with stable economies and growing healthcare budgets increasingly invest in trauma and emergency care, expanding access to essential drugs used to manage severe bleeding.

International collaboration on health standards also supports the approval and availability of antifibrinolytic drugs, driving global adoption. Positive governmental policies, especially in regions that prioritize healthcare innovation, further encourage advancements in antifibrinolytic therapies. Overall, while macroeconomic and geopolitical uncertainties pose challenges, a focus on healthcare improvements globally supports a favorable outlook for this market.

Latest Trends

Rising Integration of Antifibrinolytic Drugs in Emergency Trauma Care is a Notable Trend

Growing demand for antifibrinolytic drugs in emergency and trauma care settings marks a significant trend in the market. Antifibrinolytic drugs, especially in trauma centers, have seen increased use to manage acute bleeding due to accidents or severe injuries. With approximately 1.35 million people dying each year globally from road traffic accidents, the use of antifibrinolytics in trauma care has become critical to reducing blood loss and improving patient survival rates.In Asia-Pacific, where a high rate of road accidents contributes significantly to trauma cases, the demand for these drugs in emergency care settings is anticipated to grow. This trend reflects the importance of antifibrinolytic drugs in stabilizing patients with severe injuries and supporting positive health outcomes, especially in high-incidence trauma regions.

Regional Analysis

North America is leading the Antifibrinolytic Drugs Market

North America dominated the market with the highest revenue share of 40.7% owing to rising demand for effective bleeding control solutions in surgical and trauma care. The high prevalence of surgical procedures in the region, combined with an aging population that requires frequent surgeries, has heightened the need for drugs that prevent excessive blood loss.

According to the American Society of Anesthesiologists, over 50 million inpatient surgical procedures are performed annually in the U.S., creating a significant demand for antifibrinolytic agents to manage blood loss and improve surgical outcomes. Additionally, an increase in trauma cases due to accidents, as well as a rise in chronic conditions like hemophilia and liver disease, has fueled the adoption of antifibrinolytic drugs in healthcare settings.

Increased government healthcare spending and advancements in pharmaceutical research have further supported the growth of the antifibrinolytic drugs market in North America, enhancing access to critical care medications across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to growing awareness of blood management in surgeries and trauma care. Countries like China and India are projected to witness a rising number of surgical procedures due to an expanding healthcare infrastructure and increasing access to advanced medical facilities.

In China, the number of inpatient surgeries reached nearly 40 million annually, according to data from the National Health Commission, underscoring the regional demand for antifibrinolytic solutions. The Asia Pacific region is also anticipated to benefit from the growing incidence of chronic blood disorders, such as hemophilia, which increases the need for effective blood management solutions.

Expanding healthcare coverage and government initiatives to support rare disease treatment are likely to further bolster demand. As a result, the Asia Pacific market for antifibrinolytic drugs is poised for robust growth, supported by an expanding healthcare sector and increased access to advanced therapeutics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the antifibrinolytic drugs market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the antifibrinolytic drugs market utilize targeted strategies to drive growth and expand their reach.

They focus on research and development to create more effective formulations, addressing the needs of patients with bleeding disorders and improving treatment outcomes. Strategic collaborations with hospitals and clinics support clinical adoption, enhancing product credibility and access. Companies also increase their presence in emerging markets, where healthcare advancements raise demand for advanced blood disorder therapies.

Additionally, educational campaigns inform healthcare professionals and patients about the benefits and applications of these therapies, further stimulating market growth.

Top Key Players

- Zydus Cadila

- Takeda

- Sanofi

- Pfizer

- Mylan

- Ferring Holding SA

- Bayer AG

- Amerigen Pharms Ltd

- Aurobindo Pharma

Recent Developments

- In March 2023, Aurobindo Pharma expanded its production capabilities for antifibrinolytic drugs, specifically focusing on tranexamic acid formulations, to meet rising demand from hospitals and surgical centers. This expansion directly impacts the antifibrinolytic drugs market by strengthening the supply chain for essential bleeding control medications, increasingly used in surgeries and for treating bleeding disorders like hemophilia.

- In January 2023, Pfizer entered into a partnership with a biotechnology firm to develop advanced antifibrinolytic drug formulations aimed at reducing postoperative bleeding complications. This collaboration supports growth in the antifibrinolytic drugs market by advancing therapeutic options for surgical and trauma patients, addressing the increased need for enhanced treatment solutions in critical care settings.

Report Scope

Report Features Description Market Value (2023) USD 16.8 billion Forecast Revenue (2033) USD 25.1 billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oral and Injectable), By Application (Gynecology, Fibrinolytic Response Testing, Hereditary Angioedema, Surgeries, and Others), By End-user (Hospitals & Clinics, Trauma Centers, and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zydus Cadila, Takeda, Sanofi, Pfizer, Mylan, Ferring Holding SA, Bayer AG, Amerigen Pharms Ltd, and Aurobindo Pharma. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antifibrinolytic Drugs MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Antifibrinolytic Drugs MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Zydus Cadila

- Takeda

- Sanofi

- Pfizer

- Mylan

- Ferring Holding SA

- Bayer AG

- Amerigen Pharms Ltd

- Aurobindo Pharma