Antibody Therapeutics Market By Product Type (Monoclonal Antibodies (mAbs) and Antibody-drug Conjugates (ADCs)), By Source (Human mAb, Murine mAb, Humanized mAb, and Chimeric mAb), By Application (Cancer, Inflammatory Diseases, Infectious Diseases, Autoimmune Diseases, and Others), By End-user (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 130808

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

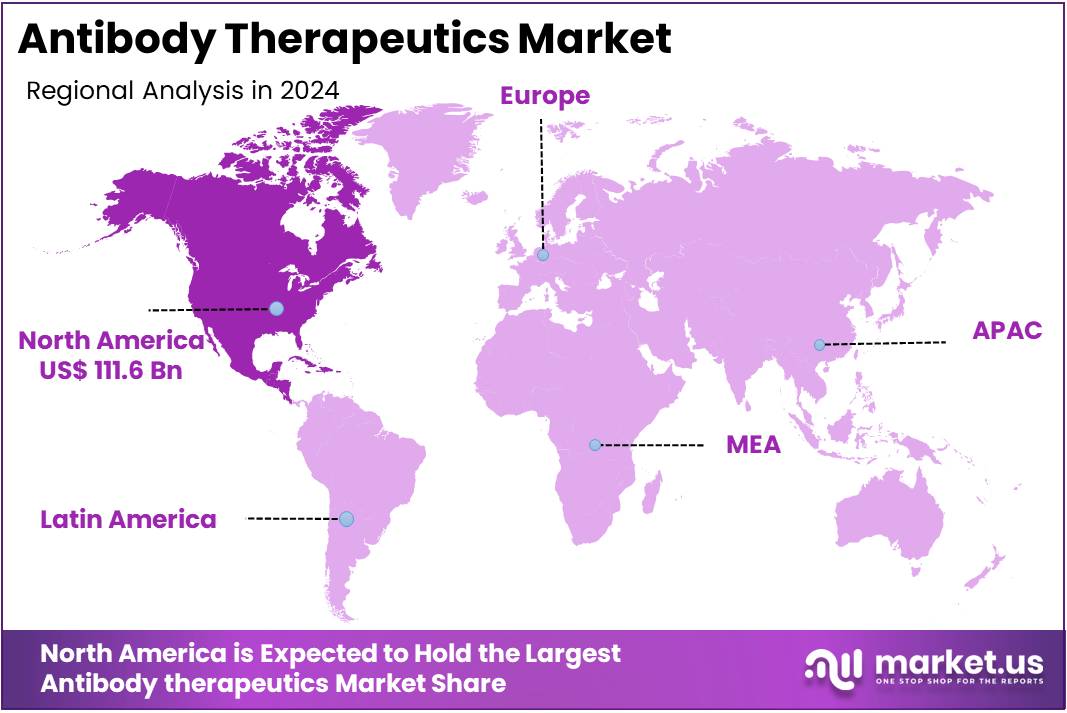

The Antibody Therapeutics Market size is expected to be worth around US$ 737.6 billion by 2034 from US$ 266.9 billion in 2024, growing at a CAGR of 10.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.8% share and holds US$ 111.6 Billion market value for the year.

Increasing demand for advanced therapies and growing investments in biotechnology are driving the expansion of the antibody therapeutics market. Antibody-based therapeutics have shown remarkable efficacy in treating various conditions, such as cancer, autoimmune diseases, and infectious diseases, which significantly contributes to the market’s growth.

Innovations in drug development, such as the use of machine learning for predicting molecular changes, are opening new opportunities for faster and more precise antibody drug development. In July 2024, researchers from Stanford University developed a machine learning-based approach that forecasts molecular changes rapidly and accurately, enhancing the development of antibody therapeutics. This innovative method utilizes large language models to identify rare mutations, eliminating the need for time-consuming experimental trials.

The increasing prevalence of chronic and life-threatening diseases has further accelerated the demand for antibody-based treatments. Furthermore, advancements in biotechnology and the growing focus on precision medicine provide substantial opportunities for market growth.

The rising focus on personalized therapies and monoclonal antibodies contributes to the increasing adoption of antibody drugs, as they offer tailored treatments with higher effectiveness and fewer side effects. As technology continues to evolve, the antibody therapeutics market is set to witness further breakthroughs, positioning it as a key player in the future of medical treatments.

Key Takeaways

- In 2024, the market for antibody therapeutics generated a revenue of US$ 266.9 billion, with a CAGR of 10.7%, and is expected to reach US$ 737.6 billion by the year 2034.

- The product type segment is divided into monoclonal antibodies (mAbs) and antibody-drug conjugates (ADCs), with monoclonal antibodies (mAbs) taking the lead in 2024 with a market share of 62.7%.

- Considering source, the market is divided into human mAb, murine mAb, humanized mAb, and chimeric mAb. Among these, human mAb held a significant share of 56.9%.

- Concerning the application segment, the cancer sector stands out as the dominant player, holding the largest revenue share of 58.4% in the antibody therapeutics market.

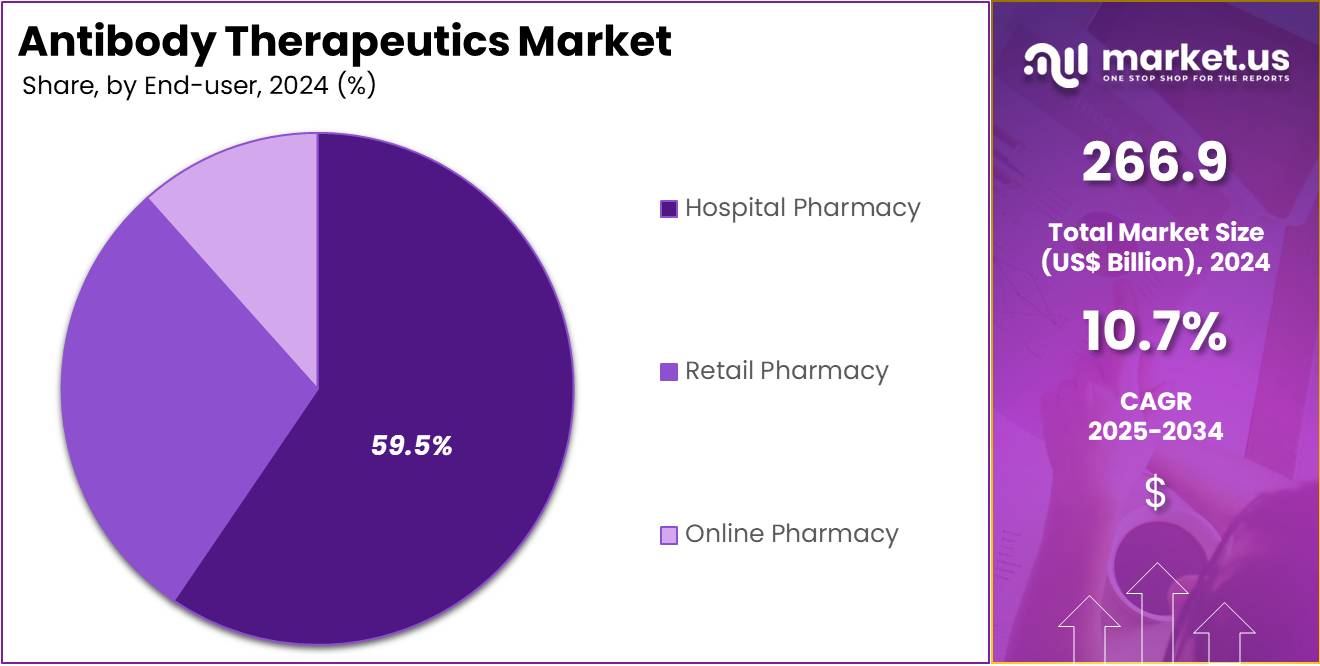

- The end-user segment is segregated into hospital pharmacy, retail pharmacy, and online pharmacy, with the hospital pharmacy segment leading the market, holding a revenue share of 59.5%.

- North America led the market by securing a market share of 41.8% in 2024.

Product Type Analysis

The monoclonal antibodies (mAbs) segment claimed a market share of 62.7% owing to the increasing demand for targeted therapies in the treatment of various diseases, including cancer, autoimmune disorders, and inflammatory diseases. mAbs have revolutionized the treatment landscape due to their ability to specifically target disease-causing antigens with high precision.

The segment’s growth is anticipated to be supported by the expanding pipeline of mAb-based drugs, improved efficacy, and better safety profiles compared to conventional therapies. Additionally, the development of biosimilars is expected to enhance the availability and affordability of mAb-based therapies, further propelling the expansion of the segment in the coming years.

Source Analysis

The human mAb held a significant share of 56.9% due to the increasing preference for fully human monoclonal antibodies over other types. Human mAbs offer several advantages, including reduced immunogenicity and a lower risk of adverse reactions, making them highly suitable for long-term treatments.

The segment’s growth is driven by the continuous advancements in humanization technologies that enable the development of highly specific and effective therapeutic antibodies. As the demand for personalized medicine rises and more indications are identified for human mAb treatments, the segment is expected to witness robust growth, especially in oncology and autoimmune disease management.

Application Analysis

The cancer segment had a tremendous growth rate, with a revenue share of 58.4% owing to the increasing incidence of various cancer types and the growing demand for more effective and targeted therapies. Monoclonal antibodies have become the cornerstone of cancer treatment, offering enhanced specificity and minimal side effects compared to traditional chemotherapy.

The growth of this segment is expected to be propelled by the increasing research into cancer immunotherapy and the success of checkpoint inhibitors and targeted therapies in clinical trials. As healthcare providers continue to seek better therapeutic options for cancer patients, the demand for antibodies targeting cancer cells is likely to surge, further accelerating the growth of the segment.

End-user Analysis

The hospital pharmacy segment recorded significant growth, accounting for 59.5% of the total revenue share. This was mainly driven by the increasing number of hospital-based treatments for chronic and complex conditions such as cancer, autoimmune disorders, and infectious diseases. Hospitals remain the primary setting for administering monoclonal antibody therapies, as these treatments often require close monitoring and specialized care. Their ability to manage acute care settings makes them critical for delivering biologic drugs, especially those administered intravenously.

Moreover, hospitals typically have the infrastructure needed for handling advanced therapeutic products. This includes proper cold storage, infusion facilities, and trained personnel. As the demand for innovative antibody-based treatments continues to rise, hospitals are likely to maintain their dominant role in therapy administration. Their position as a trusted distribution channel supports the segment’s expansion. The ongoing shift toward targeted and personalized medicines will further drive hospital dependency for these complex pharmaceutical therapies.

Key Market Segments

By Product Type

- Monoclonal Antibodies (mAbs)

- Antibody-drug conjugates (ADCs)

By Source

- Human mAb

- Murine mAb

- Humanized mAb

- Chimeric mAb

By Application

- Cancer

- Inflammatory Diseases

- Infectious Diseases

- Autoimmune Diseases

- Others

By End-user

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Drivers

Rising Prevalence of Chronic Diseases is Driving the Market

The increasing global incidence of chronic diseases, such as cancer, autoimmune disorders, and inflammatory conditions, is a major driver for the antibody therapeutics market. Antibodies offer highly targeted therapies for these complex diseases, often with fewer side effects compared to traditional treatments. The World Health Organization (WHO) continuously highlights the rising burden of non-communicable diseases globally.

For instance, in 2023, cancer remained a leading cause of death worldwide, underscoring the persistent need for effective and innovative treatments like antibody therapies. As populations age and lifestyles change, the prevalence of these chronic conditions is expected to continue its upward trajectory, directly translating into sustained demand for antibody-based therapeutics.

Restraints

High Cost of Development and Production is Restraining the Market

The substantial cost associated with the research, development, and manufacturing of antibody therapeutics presents a significant restraint on market expansion. Biologics, including antibodies, are complex molecules that require intricate and expensive production processes, including cell culture and purification. This leads to high production costs compared to small-molecule drugs. Furthermore, the extensive clinical trials and regulatory hurdles add significantly to the overall development expenditure.

A study published in MDPI in April 2024, discussing the utilization and costs of biological therapies in Europe, noted that biological drugs pose a significant challenge to healthcare systems, primarily in terms of economic sustainability, due to their inherently costly production methods. These high costs can limit patient access and put a considerable financial strain on healthcare systems, thereby hindering broader market penetration.

Opportunities

Expanding Therapeutic Applications Create Growth Opportunities

The continuous discovery of new therapeutic applications for antibodies across a broader range of diseases presents significant growth opportunities for the antibody therapeutics market. Beyond oncology and autoimmune disorders, researchers are exploring the use of antibodies in areas such as infectious diseases, neurological disorders, and rare genetic conditions.

This expansion into new indications broadens the patient base and creates new revenue streams for manufacturers. For example, the Antibodies to Watch in 2025 report highlighted 21 antibody therapeutics granted a first approval in at least one country or region during 2024, including bispecific antibodies and antibody-drug conjugates, indicating ongoing diversification of therapeutic areas. The versatility of antibodies and advancements in understanding disease mechanisms are likely to unlock further therapeutic potential, driving market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the antibody therapeutics market. Economic stability and growth generally foster increased healthcare spending, which can translate into greater investment in research and development for novel antibody therapies and improved patient access to these often high-cost medications. Conversely, economic downturns or recessions can lead to tighter healthcare budgets, potentially impacting drug reimbursement policies and patient affordability.

Geopolitical factors, such as international trade agreements, intellectual property rights, and the stability of global supply chains for biopharmaceutical manufacturing, also play a critical role. For instance, trade disputes can disrupt the flow of raw materials or finished products, affecting manufacturing costs and drug availability. Despite these influences, the critical and growing medical need for targeted treatments for complex diseases ensures a fundamental demand for these drugs, often leading to resilience in the face of broader economic and political shifts.

Current US tariff policies can have a direct impact on the antibody therapeutics market. Tariffs on imported raw materials, manufacturing components, or even finished antibody drug products could increase production costs for pharmaceutical companies. A May 2025 analysis from the Petrie-Flom Center at Harvard Law School discussed how potential US tariffs on pharmaceutical products could significantly impact global healthcare systems, potentially raising prices for consumers. This could lead to higher prices for antibody therapeutics, potentially affecting patient access and affordability, particularly for therapies that already carry a high price tag.

However, these tariffs might also incentivize domestic manufacturing of antibody drugs and their components within the US, potentially leading to a more secure and resilient domestic supply chain in the long term. While short-term cost increases might be a challenge, the tariffs could foster greater self-sufficiency in biopharmaceutical production.

Trends

Advances in Antibody Engineering and Design is a Recent Trend

A prominent recent trend in the antibody therapeutics market is the significant advancement in antibody engineering and design techniques. Researchers are developing more sophisticated antibodies, including bispecific antibodies, antibody-drug conjugates (ADCs), and engineered antibodies with enhanced specificity, potency, and reduced immunogenicity. These innovations lead to the creation of next-generation therapies with improved efficacy and safety profiles.

For instance, a May 2025 publication on accelerating antibody discovery emphasized the role of next-generation sequencing technologies in enabling massive parallel high-throughput sequencing of antibody repertoires, providing detailed views of diverse antibody repertoires crucial for identifying novel therapeutic candidates. This ongoing evolution in antibody design capabilities is transforming the pipeline for new antibody drugs and expanding their therapeutic potential.

Regional Analysis

North America is leading the Antibody therapeutics Market

North America dominated the market with the highest revenue share of 41.8% owing to the high prevalence of chronic and complex diseases, and the continuous innovation in biopharmaceutical research. The FDA’s ongoing approvals of novel antibody-based therapies for various indications are crucial for this growth. For instance, the FDA’s Center for Drug Evaluation and Research (CDER) approved 37 novel drugs in 2022 and 55 in 2023, many of which were biologics, including monoclonal antibodies, targeting specific diseases.

This consistent introduction of new, highly targeted treatments for conditions such as cancer, autoimmune disorders, and infectious diseases directly expands the market. Furthermore, substantial federal investment in biomedical research by organizations like the National Institutes of Health (NIH), with a budget of approximately US$ 47.3 billion in Fiscal Year 2024, fosters the scientific environment necessary for the discovery and development of these advanced therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s increasing healthcare expenditure and the rising burden of chronic diseases. The World Bank reported that current health expenditure as a percentage of GDP in the East Asia & Pacific region was 5.43% in 2022, reflecting a growing commitment to healthcare investment. This increased spending supports greater access to and adoption of advanced treatments, including antibody therapies.

Additionally, governments in several Asia Pacific nations are actively promoting the development of their domestic biopharmaceutical sectors through strategic policies and funding, which is expected to enhance local manufacturing capabilities and drive the availability and utilization of antibody therapeutics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the antibody therapeutics market focus on strategies such as expanding their product portfolios, enhancing the efficiency of antibody production, and securing strategic partnerships. They invest in research and development to innovate new antibody-based drugs that address a wide range of diseases, including cancer, autoimmune disorders, and infectious diseases.

Companies also focus on improving manufacturing processes to reduce costs and increase scalability, ensuring that these drugs reach a broader market. Partnerships with academic institutions and other pharmaceutical companies help accelerate the development and commercialization of new antibody therapies. Additionally, they expand their presence in emerging markets to capitalize on the growing demand for biologic drugs.

Amgen Inc., a leader in the antibody therapeutics market, is known for its strong portfolio of monoclonal antibodies. Founded in 1980 and headquartered in Thousand Oaks, California, Amgen focuses on the development of therapies for cancer, cardiovascular diseases, and autoimmune conditions. Its innovative antibody-based therapies, such as Prolia (denosumab) for osteoporosis and Repatha (evolocumab) for cholesterol management, have made a significant impact. Amgen continues to expand its research efforts and partnerships, solidifying its position in the market and focusing on delivering cutting-edge solutions to patients worldwide.

Top Key Players in the Antibody therapeutics Market

- Hiedelberg Pharma A/G

- Taiho Pharmaceutical Co., Ltd

- GlaxoSmithKline

- ImmunoPrecise Antibodies Ltd

- Genmab A/S

- Genentech, Inc

- AstraZeneca

- ADC Therapeutics

Recent Developments

- In March 2025: It was announced that Taiho Pharmaceutical Co., Ltd., under the leadership of President Masayuki Kobayashi, had reached a definitive agreement to acquire Araris Biotech AG. Araris, a Switzerland-based biotechnology firm, is known for its expertise in next-generation antibody-drug conjugates (ADCs). The transaction, valued at approximately US$ 400 million, is expected to enhance Taiho’s oncology pipeline. By integrating Araris’ ADC drug discovery platform with Cysteinomix, Taiho aims to accelerate the development of innovative cancer therapies.

- In January 2025, ImmunoPrecise Antibodies Ltd. launched a new category of GLP-1 therapies, created using AI via its proprietary LENSai platform. These treatments, developed for diabetes and obesity, are designed to boost effectiveness, safety, and patient satisfaction, while also extending therapy longevity.

Report Scope

Report Features Description Market Value (2024) US$ 266.9 billion Forecast Revenue (2034) US$ 737.6 Billion CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies (mAbs) and Antibody-drug Conjugates (ADCs)), By Source (Human mAb, Murine mAb, Humanized mAb, and Chimeric mAb), By Application (Cancer, Inflammatory Diseases, Infectious Diseases, Autoimmune Diseases, and Others), By End-user (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hiedelberg Pharma A/G, Taiho Pharmaceutical Co., Ltd, GlaxoSmithKline, ImmunoPrecise Antibodies Ltd, Genmab A/S, Genentech, Inc, AstraZeneca, ADC Therapeutics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antibody Therapeutics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Antibody Therapeutics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- F. Hoffmann-La Roche Ltd.

- AbbVie Inc.

- Johnson & Johnson

- Merck KGaA

- Bristol-Myers Squibb

- AstraZeneca

- Sanofi

- Regeneron Pharmaceuticals Inc.

- Novartis AG

- Amgen Inc.

- Biogen Inc.