Global Anti-Biofilm Wound Dressing Market By Mode Of Mechanism (Physical, Chemical, and Biological), By Wound Type (Acute Wound, and Chronic Wounds), By End-Users (Hospitals, Specialty Clinics, Home Healthcare, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 102559

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

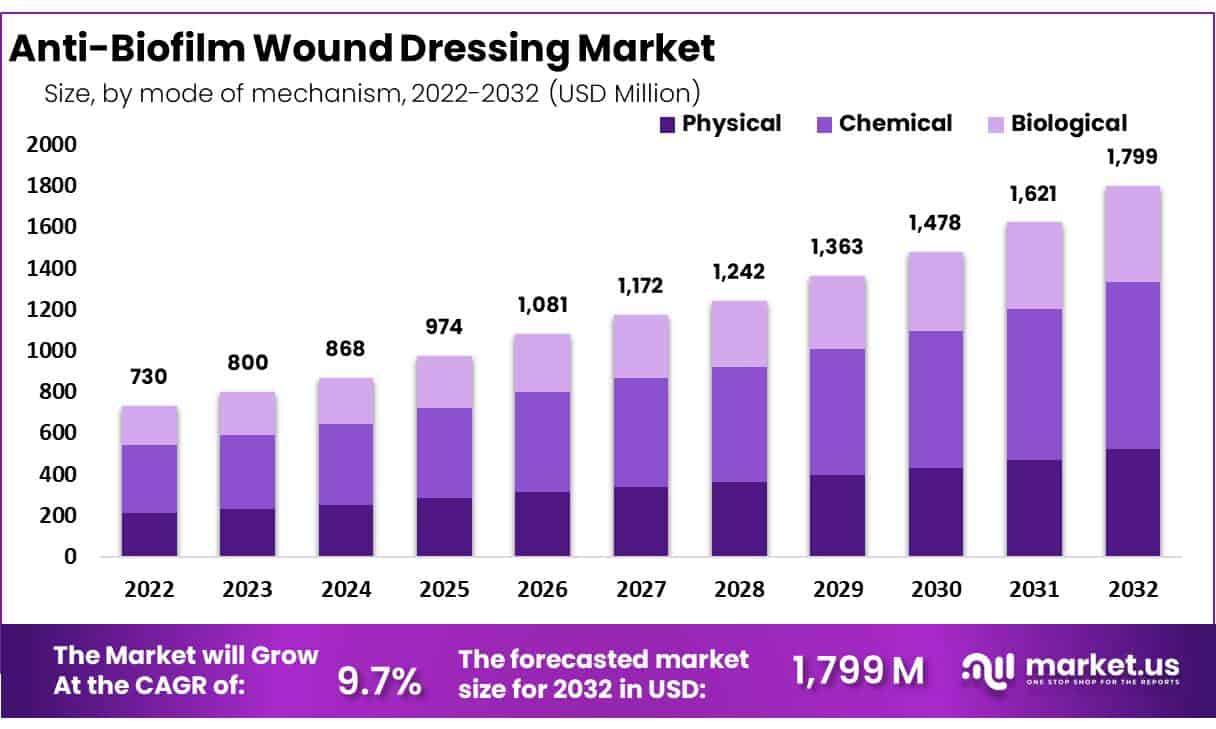

In 2022, the Global Anti-Biofilm Wound Dressing Market accounted for USD 730 Million and is expected to grow to around USD 1,799 Million in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 9.7%.

The global anti-biofilm wound dressing market refers to the market for specialized wound dressings that are designed to prevent or treat bacterial biofilms that can develop on the surface of chronic wounds. These dressings are typically made with materials that have antimicrobial properties.

These can disrupt the formation of biofilms, which are complex communities of bacteria that can form on the surface of a wound. The market for anti-biofilm wound dressings involves a wide range of products, from simple adhesive bandages to advanced dressings that incorporate sophisticated materials as well as technologies.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Anti-biofilm wound dressing sales are projected to surpass USD USD 1,799 Million by 2032, growing at an expected compound annual compound growth rate of 9.7% between 2023-2032.

- Increased chronic wound prevalence, the increased demand for advanced wound care products and an increasing awareness of biofilms are driving forces behind market expansion.

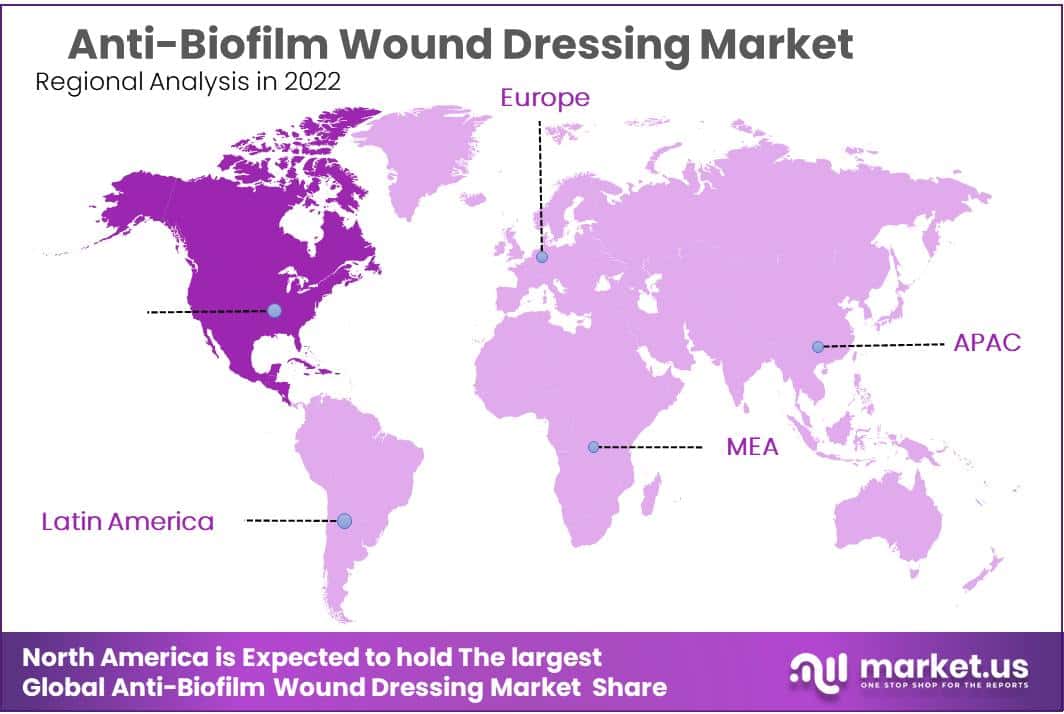

- North America holds the largest market for anti-biofilm wound dressings, followed by Europe and Asia-Pacific.

- Hydrocolloid products are expected to dominate market shares during this time.

- Hospitals are projected to capture the greatest market share over time.

Mode Of Mechanism Analysis

Based on the mode of mechanism, the market for anti-biofilm wound dressing is segmented into Physical. Among these types, the chemical segment is the most lucrative in the global anti-biofilm wound dressing market, with a projected CAGR of 9.7%. The total revenue share of chemical-type anti-biofilm wound dressing is 45% in 2022.

Physical dressings work by physically disrupting the biofilm and its attachment to the wound bed. Examples of physical anti-biofilm dressings include silver dressings, foam dressings, and hydrocolloid dressings. Biological dressings work by using living organisms, enzymes, or bacteria-killing agents derived from living organisms to disrupt the biofilm.

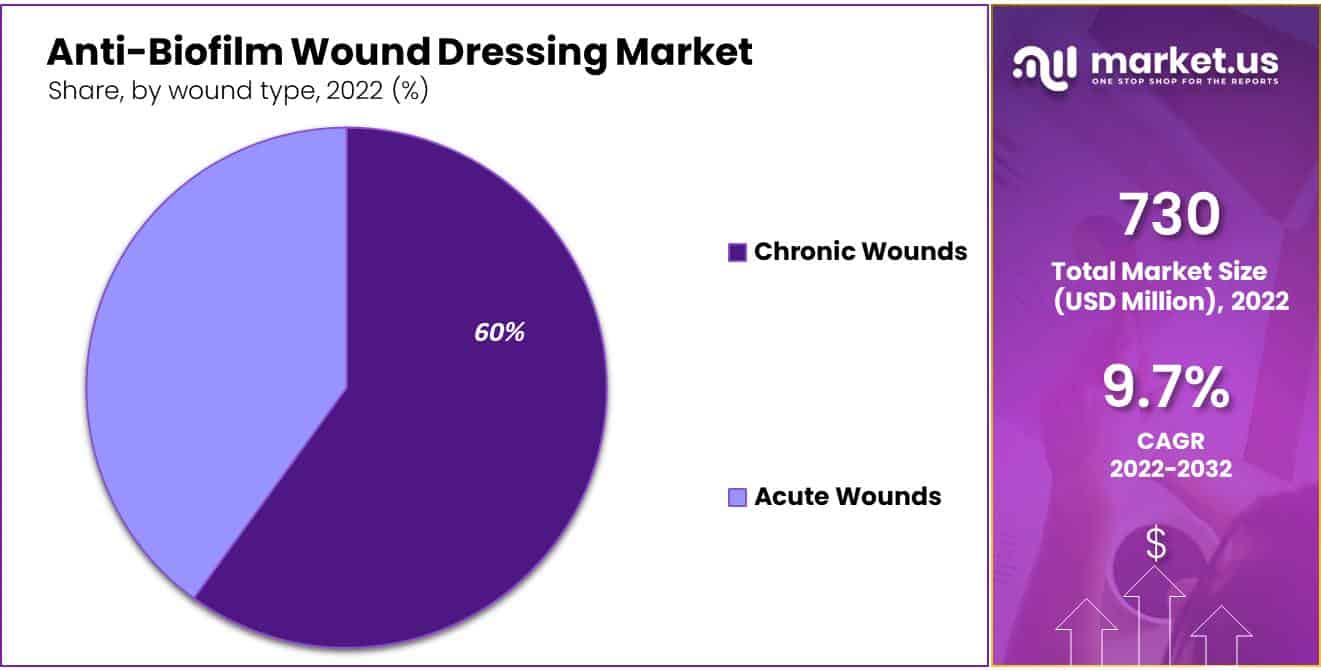

Wound Type Analysis

By wound type, the market is further divided into acute wounds and chronic wounds. The chronic wounds segment is estimated to be the most lucrative segment in the global anti-biofilm wound dressing market, with a market share of 60% and a projected CAGR of 9.7%, in 2022.

Acute wounds are injuries that occur suddenly and typically heal within a relatively short period, such as cuts, lacerations, and burns. Anti-biofilm wound dressings for acute wounds may be used to prevent infection and promote healing, as these types of wounds are also at risk of developing biofilms.

End-User Analysis

Based on end-user, the market is segmented into Hospitals, Specialty Clinics, Home Healthcare, & Other End-Users. Among these end-users, the hospitals segment is estimated to be the most lucrative segment in the global anti-biofilm wound dressing market, with the largest revenue share of 46% and a projected CAGR of 9.7% during the forecast period. Hospitals are the major end-user of anti-biofilm wound dressings, as they treat a large number of patients with acute as well as chronic wounds.

Home healthcare is a growing market for anti-biofilm wound dressings, as more patients are receiving care in their homes rather than in hospitals or clinics. Anti-biofilm wound dressings that are easy to use and also require minimal maintenance may be preferred for home healthcare patients. Other end-users may include long-term care facilities, ambulatory surgical centers, or emergency medical services providers, among others.

Key Market Segments

Based on the Mode of Mechanism

- Physical

- Chemical

- Biological

Based on Wound Type

- Acute wounds

- Chronic wounds

Based on End-User

- Hospitals

- Specialty clinics

- Home healthcare

- Other End-Users

Drivers

Growing awareness of the importance of wound care and Advances in wound care technology:

As healthcare providers or patients become more aware of the impact of wound care on overall health or quality of life, there is a growing demand for effective wound care solutions. Anti-biofilm wound dressings are increasingly recognized as an important component of wound care, as they can help to prevent infection or promote healing.

Advances in wound care technology have led to the development of new or innovative anti-biofilm wound dressings that are more effective & easier to use than traditional wound dressings. For example, some dressings incorporate advanced materials or technologies that can disrupt the biofilm or promote healing.

A Growing aging population and Increasing healthcare expenditure:

The aging population is more prone to chronic wounds, which are at high risk of developing biofilms. As the global population continues to age, the demand for anti-biofilm wound dressings is expected to increase. Governments or healthcare organizations are increasing their expenditure on wound care products as well as services, which is driving the growth of the anti-biofilm wound dressing market. This is particularly true in developed countries, where healthcare spending is high.

Restraints

Anti-biofilm wound dressings can be more expensive than traditional wound dressings, which can limit their adoption, particularly in low-income countries. Anti-biofilm wound dressings are not widely available in all regions, which can hinder their use in certain areas. While anti-biofilm wound dressings have shown promise in laboratory studies, there is limited clinical evidence to support their effectiveness in humans.

Regulatory approval processes can be lengthy as well as costly, which can slow down the development or availability of anti-biofilm wound dressings. There is the risk that bacteria may develop resistance to the active ingredients in anti-biofilm wound dressings over time, potentially reducing their effectiveness.

Opportunity

There is increasing awareness of the importance of preventing or treating biofilm infections, particularly in healthcare settings. This could drive demand for anti-biofilm wound dressings. As the global population ages, there is a growing incidence of chronic wounds, which are particularly susceptible to biofilm infections.

This could increase the demand for anti-biofilm wound dressings. Ongoing advancements in wound care technology, such as the development of new materials or the incorporation of antimicrobial agents, could lead to the development of more effective and innovative anti-biofilm wound dressings.

There is growing demand for wound care products in emerging markets, particularly in Asia & Latin America. This could create opportunities for companies to expand their presence in these regions. Collaboration between industry players, academic institutions, or healthcare providers could accelerate the development as well as the adoption of anti-biofilm wound dressings. Governments around the world are recognizing the importance of preventing or treating biofilm infections as well as development in this area.

Trends

Infection prevention is becoming a key focus of healthcare providers & governments around the world, which is driving demand for anti-biofilm wound dressings. The prevalence of chronic diseases, such as diabetes & obesity, is increasing globally, which is contributing to the growing demand for wound care products, including anti-biofilm wound dressings. Telemedicine is becoming increasingly popular, particularly in remote or underserved areas. Anti-biofilm wound dressings that can be used in telemedicine settings could become increasingly important in the future. The use of advanced wound care products, such as anti-biofilm wound dressings, is growing as healthcare providers seek to improve patient outcomes and reduce healthcare costs.

Regional Analysis

North America is estimated to be the most lucrative market in the global anti-biofilm wound dressing market, with the largest market share of 33.8%, or is expected to register a CAGR of 9.7% during the forecast period. Europe is also a significant market for anti-biofilm wound dressings, with a high incidence of chronic wounds & focus on infection prevention in healthcare settings. The Asia-Pacific region is expected to experience significant growth in the anti-biofilm wound dressing market.

Market-driven by the rising incidence of chronic wounds & increasing healthcare spending in emerging markets. Latin America is also expected to experience growth in the anti-biofilm wound dressing market, with growing demand for wound care products and increasing investment in healthcare infrastructure. The Middle East & Africa region is expected to experience moderate growth in the anti-biofilm wound dressing market, with increasing investment in healthcare infrastructure or growing incidence of chronic wounds.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global anti-biofilm wound dressing market is highly competitive, with several key players vying for market share. 3M Healthcare, Cardinal Health, Inc., ConvaTec Inc., Integra LifeSciences Corporation, Mölnlycke Health Care AB, Smith & Nephew plc, and Systagenix Wound Management are some of the leading companies in the market. These companies are investing in research or development to develop new & innovative anti-biofilm wound dressings, as well as expanding their product portfolios through strategic partnerships & acquisitions.

Market Key Players

- Conva-Tec

- Smith & Nephew Plc

- Coloplast

- 3M

- Urgo Medical

- Imbed Biosciences

- Lohmann & Rauscher

- Other companies

Recent Developments

- In June 2021, Smith & Nephew announced the launch of its new PICO 7Y single-use negative pressure wound therapy system, which is designed to improve patient outcomes and reduce the risk of wound complications.

- In April 2021, Mölnlycke Health Care announced the launch of its new Mepilex Border Flex Dressing, which is designed to provide enhanced comfort and flexibility while improving wound healing outcomes.

Report Scope

Report Features Description Market Value (2022) USD 730 Million Forecast Revenue (2032) USD 1,799 Million CAGR (2023-2032) 9.7% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Mode Of Mechanism -Physical, Chemical, and Biological; By Wound Type-Acute Wound and Chronic Wounds; By End-Users- Hospitals, Specialty Clinics, Home Healthcare, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Conva-Tec, Smith & Nephew Plc, Coloplast, 3M, Urgo Medical, Imbed Biosciences, Lohmann & Rauscher, Other companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the global Anti-biofilm wound dressing market ?Anti-biofilm wound dressing market accounted for USD 730 Million and is expected to grow to around USD 1,799 Million in 2032.

What is the Anti-Biofilm Wound Dressing Market CAGR During the Forecast Period 2022-2032?The Global Anti-Biofilm Wound Dressing Market size is growing at a CAGR of 09.07% during the forecast period from 2022 to 2032.

Who are some of the major players in the global anti-biofilm wound dressing Market?Conva-Tec, Smith & Nephew Plc, Coloplast , 3M, Urgo Medical, Imbed Biosciences, Lohmann & Rauscher, Other companies .

Anti-Biofilm Wound Dressing MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Anti-Biofilm Wound Dressing MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Conva-Tec

- Smith & Nephew Plc

- Coloplast

- 3M

- Urgo Medical

- Imbed Biosciences

- Lohmann & Rauscher

- Other companies