Global Amphibious Vehicle Market Size, Share, Growth Analysis By Vehicle (Armored Amphibious Vehicles, Amphibious Excavators, Light Amphibious Utility Vehicles, Commercial Amphibious Transport), By Propulsion (Track-Based Propulsion, Water Jet Propulsion, Screw Propeller), By Application (Military Combat & Troop Transport, Disaster Response & Humanitarian Aid, Construction & Dredging, Commercial & Recreational Transport), By End Use (Defense Forces, Disaster Management Agencies, Construction & Dredging Contractors, Tourism & Transport Operators, Government Municipalities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 150095

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Size

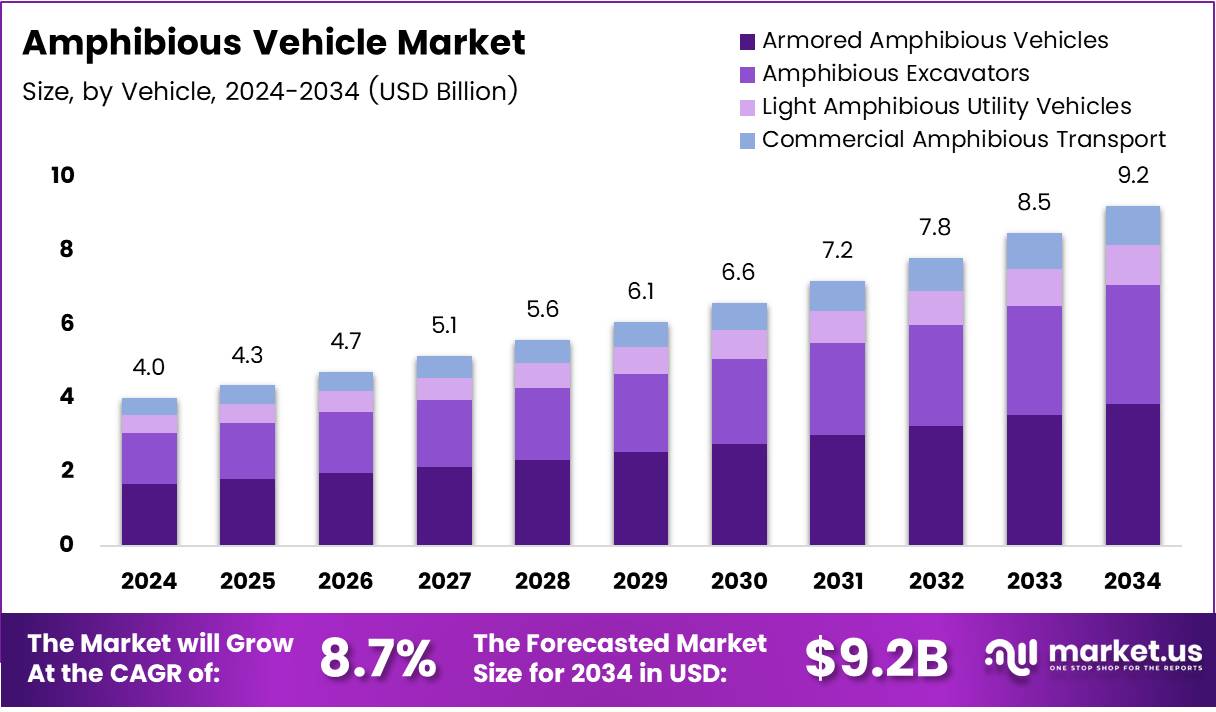

The Global Amphibious Vehicle Market size is expected to be worth around USD 9.2 Billion by 2034, from USD 4.0 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. This growth is driven by increasing demand for versatile vehicles in defense, commercial sectors, and advancements in amphibious vehicle technologies.

Key Takeaways

- Global Amphibious Vehicle Market size is projected to reach USD 9.2 Billion by 2034, growing at a CAGR of 8.7% from USD 4.0 Billion in 2024.

- Armored Amphibious Vehicles held a dominant market share in the By Vehicle Analysis segment in 2024, driven by demand in global defense sectors.

- Military Combat & Troop Transport led the By Application Analysis segment in 2024, offering strategic mobility across land and water.

- Defense Forces were the dominant end-user segment in 2024, supported by increased defense budgets and amphibious operational strategies.

- North America held a dominant market position in 2024, accounting for 45.9% of the market share, valued at USD 1.8 Billion.

Report Overview

The Amphibious Vehicle Market has experienced notable growth in recent years, driven by increasing demand across several sectors, including defense, tourism, and recreational vehicles. These vehicles are designed to operate both on land and water, making them essential for various applications, including military operations, rescue missions, and leisure activities. As a result, their demand is on the rise due to their versatile and unique functionality.

According to Alibaba, new amphibious trucks and RVs may cost between $300,000 and $500,000, highlighting the high price point associated with these specialized vehicles. Despite the cost, the market is thriving, thanks to their increased utility in various regions. Governments and private entities alike are investing in amphibious vehicles for both practical and strategic purposes, such as improving disaster response times and enhancing recreational tourism experiences.

Government regulations play a significant role in shaping the growth trajectory of this market. Different regions have different requirements for vehicle certifications, emissions standards, and waterway safety protocols. These regulations ensure that amphibious vehicles meet safety and environmental standards, which can influence the overall design and functionality of the vehicles. As manufacturers adapt to these guidelines, they enhance the reliability and sustainability of their products, making them more attractive to end-users.

In terms of opportunity, the increasing focus on military defense is driving the demand for amphibious vehicles. These vehicles offer an advantage in naval operations and coastal defense, providing a multi-terrain mobility solution that traditional land-based vehicles cannot. Additionally, the tourism industry sees potential in offering unique experiences such as amphibious tours, further expanding the consumer base.

Moreover, technological advancements in amphibious vehicle manufacturing are also opening up new growth avenues. The introduction of hybrid powertrains, enhanced propulsion systems, and lightweight materials are making these vehicles more cost-efficient, reducing operational costs over time. Furthermore, with increasing awareness of the environmental impact of traditional vehicles, the adoption of eco-friendly amphibious vehicles is expected to see a rise.

Vehicle Analysis

Armored Amphibious Vehicles dominate due to their integral role in military and defense operations.

In 2024, Armored Amphibious Vehicles held a dominant market position in By Vehicle Analysis segment of Amphibious Vehicle Market. Their high demand across global defense sectors, driven by increasing geopolitical tensions and the need for tactical mobility across land and water, contributed significantly to this dominance.

Amphibious Excavators are gaining steady traction owing to their growing use in marine construction and dredging projects. These vehicles are vital for operations in swampy, shallow, or flooded terrains, supporting infrastructure development and environmental restoration activities.

Light Amphibious Utility Vehicles continue to serve critical roles in rapid mobility and versatile transportation, particularly in rugged and remote areas. Their compact design and adaptability make them useful for both defense and civilian applications in challenging terrains.

Commercial Amphibious Transport vehicles are expanding their presence, particularly in tourism and intermodal logistics. Though they currently represent a smaller portion of the market, their utility in enhancing mobility in flood-prone and island regions suggests strong growth potential in coming years.

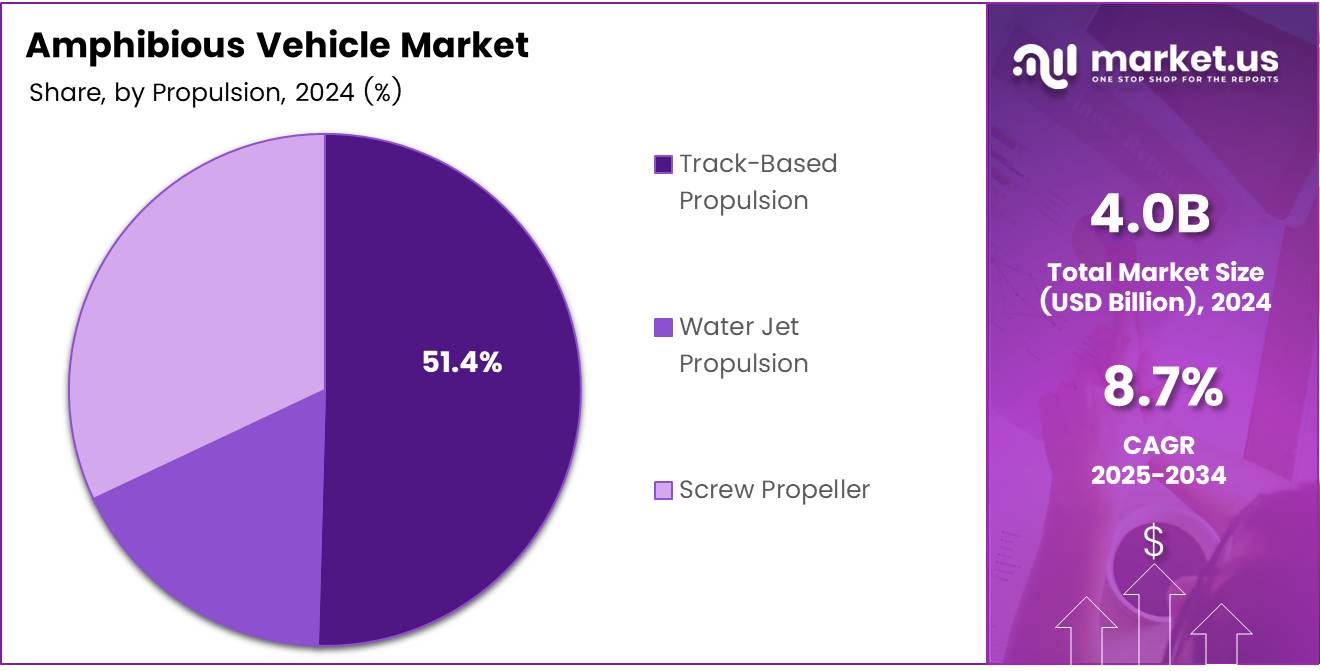

Propulsion Analysis

Track-Based Propulsion leads with 51.4% due to its superior terrain adaptability and heavy-load capability.

In 2024, Track-Based Propulsion held a dominant market position in By Propulsion Analysis segment of Amphibious Vehicle Market, with a 51.4% share. Its ability to provide strong traction over soft, marshy, or uneven surfaces makes it ideal for defense and construction-related amphibious operations.

Water Jet Propulsion is recognized for its high-speed performance in water, offering smooth transitions between aquatic and terrestrial environments. It is increasingly favored for lightweight and swift amphibious crafts, particularly in commercial and recreational uses.

Screw Propeller systems, though niche, provide robust propulsion in highly muddy or icy waters. Their usage remains limited but essential in specialized dredging and arctic applications, where conventional systems are less effective.

Application Analysis

Military Combat & Troop Transport dominate due to growing global defense investments and mission-critical demands.

In 2024, Military Combat & Troop Transport held a dominant market position in By Application Analysis segment of Amphibious Vehicle Market. These vehicles offer strategic mobility, enabling armed forces to maneuver across rivers, coastal regions, and battlefield terrains seamlessly.

Disaster Response & Humanitarian Aid applications are increasingly leveraging amphibious vehicles for rapid rescue and relief deployment in flood-hit or inaccessible areas. Their versatility supports agencies during extreme weather events and natural calamities.

Construction & Dredging remain vital application areas where amphibious excavators and utility vehicles play a central role in shoreline stabilization, sediment removal, and waterway maintenance.

Commercial & Recreational Transport is a growing segment, especially in tourism-heavy regions. Amphibious buses and recreational crafts enhance the tourist experience and provide unique mobility solutions in archipelagic environments.

End Use Analysis

Defense Forces dominate, due to strategic deployment and national security initiatives.

In 2024, Defense Forces held a dominant market position in By End Use Analysis segment of Amphibious Vehicle Market. Heightened defense budgets, cross-border threats, and amphibious operational strategies are key drivers of adoption among armed forces worldwide.

Disaster Management Agencies are emerging as significant end users, integrating amphibious units into emergency fleets to ensure rapid deployment and accessibility in submerged or isolated areas during natural disasters.

Construction & Dredging Contractors rely heavily on amphibious excavators for marine construction and infrastructure projects in wetlands and riverbanks, making them essential stakeholders in this segment.

Tourism & Transport Operators utilize amphibious vehicles to offer novel experiences to travelers, especially in cities with waterfronts, contributing to local economies while supporting eco-tourism.

Government Municipalities are increasingly investing in these vehicles for public service roles, including waterway patrolling, flood response, and remote area logistics, reinforcing the vehicle’s utility across civic operations.

Key Market Segments

By Vehicle

- Armored Amphibious Vehicles

- Amphibious Excavators

- Light Amphibious Utility Vehicles

- Commercial Amphibious Transport

By Propulsion

- Track-Based Propulsion

- Water Jet Propulsion

- Screw Propeller

By Application

- Military Combat & Troop Transport

- Disaster Response & Humanitarian Aid

- Construction & Dredging

- Commercial & Recreational Transport

By End Use

- Defense Forces

- Disaster Management Agencies

- Construction & Dredging Contractors

- Tourism & Transport Operators

- Government Municipalities

Drivers

Rising Need for Amphibious Vehicles in Military Applications Drives Market Growth

The demand for amphibious vehicles is rising due to their ability to operate on both land and water. These vehicles are ideal for areas affected by floods, coastal operations, and rough terrains. Their versatility makes them useful in both civilian and military sectors, driving consistent demand across regions.

Recent advancements in propulsion systems and vehicle design have made amphibious vehicles more efficient, durable, and safer. Improved engines, lighter materials, and smart navigation features are helping manufacturers meet diverse operational needs while reducing fuel consumption and maintenance issues.

Governments around the world are investing in amphibious vehicles for disaster relief and humanitarian missions. These vehicles are essential during floods, earthquakes, and other emergencies where road infrastructure may be damaged. Public sector interest is supporting market growth and encouraging innovation.

In the defense sector, amphibious vehicles are increasingly used for coastal security, troop transport, and special operations. Their ability to move quickly between land and water is highly valuable in military missions. With rising geopolitical tensions, countries are investing more in these vehicles to strengthen their defense capabilities.

Restraints

High Manufacturing and Maintenance Costs Limit Market Expansion

Amphibious vehicles are expensive to manufacture due to the need for specialized parts and dual-function designs. This increases the upfront cost for buyers and limits access for smaller commercial operators or developing regions.

Apart from cost, regulatory barriers also slow down market growth. These vehicles must pass several safety and environmental certifications before they can be sold or operated. The complex approval process can delay product launches and discourage new entrants.

There is also a lack of proper infrastructure to support amphibious vehicle operations. Most areas do not have designated access points or maintenance facilities for such vehicles, making their use less practical in many regions.

Environmental concerns are another growing restraint. Amphibious vehicles can disturb aquatic life and damage fragile ecosystems if not operated carefully. As a result, stricter environmental rules are being introduced, which can increase compliance costs for manufacturers.

Growth Factors

Expansion in Commercial and Recreational Tourism Offers Growth Potential

Amphibious vehicles are gaining popularity in tourism. Many cities and natural attractions are using them for guided tours, allowing passengers to explore both land and water routes. This trend is opening up new commercial opportunities, especially in coastal and lake-rich regions.

There is also a strong push to create energy-efficient and eco-friendly amphibious vehicles. As fuel prices rise and environmental awareness increases, manufacturers are focusing on greener technologies like electric or hybrid propulsion systems to meet future demand.

In the construction and dredging industries, these vehicles can be used in hard-to-reach or waterlogged areas. Their ability to move on both land and water makes them useful for shoreline projects, improving efficiency and reducing the need for multiple machines.

Amphibious vehicles also play a growing role in emergency rescue efforts. Governments and NGOs are looking to expand their fleets to ensure quick response during floods or natural disasters. This increased use in rescue operations presents a strong opportunity for manufacturers and service providers.

Emerging Trends

Integration of AI and Automation in Amphibious Vehicles Shapes Market Trends

Artificial Intelligence (AI) and automation are being added to amphibious vehicles, making them smarter and easier to operate. These systems improve navigation, obstacle detection, and route planning, reducing the need for highly trained drivers and boosting safety.

Hybrid propulsion systems are another trending feature. By combining traditional engines with electric motors, these vehicles can reduce emissions and fuel costs. This trend is especially important as global regulations push for greener transportation solutions.

Manufacturers are also focusing on lighter materials like aluminum and composite fibers to make vehicles more fuel-efficient. A lighter vehicle uses less energy and performs better on both land and water, which is increasingly important in competitive markets.

Emerging markets in Asia, South America, and Africa are showing rising interest in amphibious vehicles. These regions often face challenging terrains and lack proper roads, making dual-purpose vehicles a practical solution. Growing demand from these areas is helping to expand the global market.

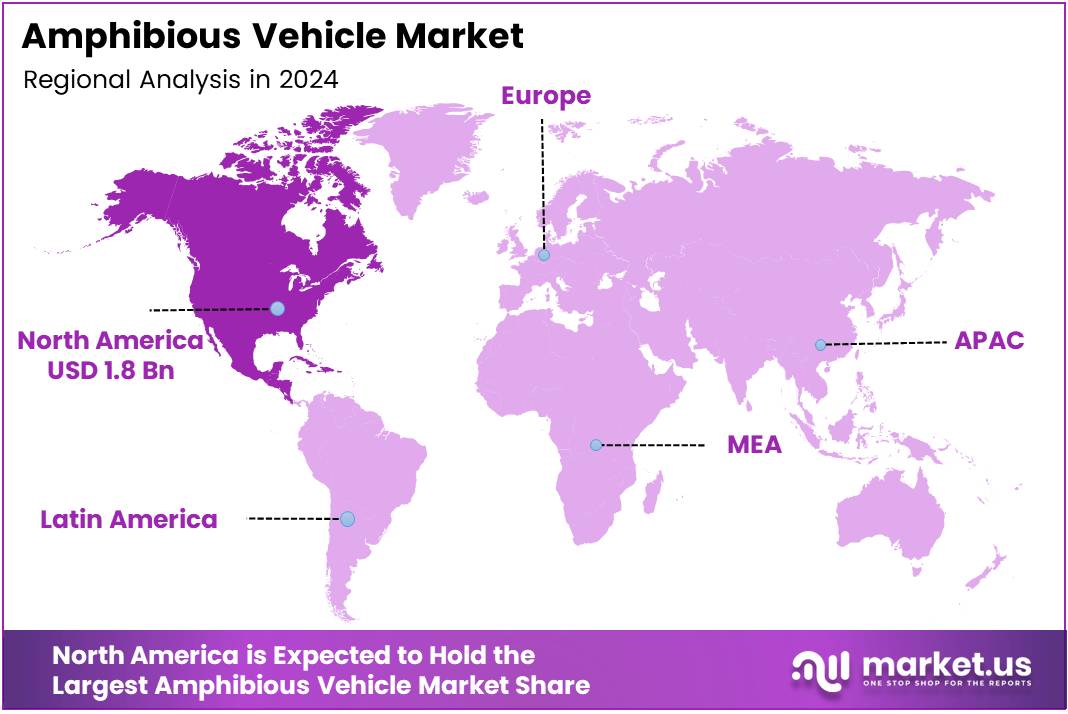

Regional Analysis

North America Dominates the Amphibious Vehicle Market with a Market Share of 45.9%, Valued at USD 1.8 Billion

In 2024, North America held the dominant position in the amphibious vehicle market, accounting for 45.9% of the market share, valued at USD 1.8 Billion. The region’s leadership is attributed to the significant demand for specialized military and commercial vehicles, along with robust investment in technological advancements. The growing use of amphibious vehicles in defense and disaster response operations further drives this dominance.

Europe Amphibious Vehicle Market Trends

Europe is the second-largest market, benefiting from increasing demand in both military and recreational sectors. Technological innovations and partnerships among manufacturers to develop advanced amphibious vehicle systems are fostering growth. Additionally, Europe’s increasing focus on defense infrastructure development contributes significantly to market expansion.

Asia Pacific Amphibious Vehicle Market Trends

Asia Pacific is emerging as a strong player in the amphibious vehicle market, driven by growing defense budgets and the rise of coastal and island nations that rely on amphibious vehicles for both military and commercial applications. The region is also witnessing substantial growth in recreational amphibious vehicle usage, fueled by a booming tourism sector.

Middle East and Africa Amphibious Vehicle Market Trends

The Middle East and Africa region is experiencing a surge in demand for amphibious vehicles, primarily driven by military applications and the need for effective transportation in flood-prone areas. However, the market remains relatively nascent, with growth largely influenced by governmental defense contracts and infrastructure development projects.

Latin America Amphibious Vehicle Market Trends

In Latin America, the market for amphibious vehicles is expanding due to increasing investment in military capabilities and infrastructural projects in flood-prone areas. While the demand is moderate compared to other regions, governmental initiatives and environmental concerns are encouraging the growth of amphibious vehicle adoption in specific regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Amphibious Vehicle Company Insights

In 2024, Hydratrek, Inc. continues to lead the amphibious vehicle market with its robust lineup of amphibious equipment tailored for military and commercial applications. The company’s innovative designs ensure that their vehicles are well-suited for diverse terrains, including wetlands and flood zones.

Marsh Buggies Incorporated is a significant player, specializing in amphibious vehicles that serve the construction and environmental sectors. Their machinery is critical for working in marshy and soft ground conditions, where traditional vehicles struggle to operate effectively.

Rheinmetall AG, known for its strong presence in the defense sector, has made significant strides in amphibious vehicle development, focusing on enhancing the mobility and versatility of its vehicles. The company’s solutions are widely used in military applications, ensuring their vehicles can maneuver through water and land seamlessly.

Hitachi Construction Machinery Co., Ltd. has strengthened its position in the amphibious vehicle market by leveraging its advanced construction machinery technology. By integrating cutting-edge features, the company continues to innovate and cater to infrastructure and environmental projects that require high mobility in challenging terrains.

Top Key Players in the Market

- Hydratrek, Inc.

- Marsh Buggies Incorporated

- Rheinmetall AG

- Hitachi Construction Machinery Co., Ltd.

- Wilco Manufacturing L.L.C.

- General Dynamics Corporation

- EIK Engineering Sdn. Bhd.

- BAE Systems plc

- Hanwha Aerospace

- Wetland Equipment Company

Recent Developments

- In May 2025, the U.S. Marine Corps will receive a $172M upgrade aimed at enhancing the capabilities of their amphibious vehicles, ensuring greater lethality and operational efficiency in combat scenarios. This investment reflects the increasing demand for more advanced military vehicles in future amphibious operations.

- In September 2025, HII secured a $9.6B contract for Navy amphibious multiship procurement, reinforcing the U.S. Navy’s strategic capabilities in amphibious warfare. This substantial contract will bolster the military’s ability to execute complex operations with enhanced support and mobility.

- In April 2025, BAE Systems was awarded a $188M full-rate production contract from the U.S. Marine Corps for the Amphibious Combat Vehicle 30mm, which is designed to increase battlefield effectiveness and mobility. This contract represents a significant milestone in the continuous modernization of amphibious assault vehicles.

- In March 2024, BAE Systems booked a $182M contract option for the production of Amphibious Combat Vehicles for the Marine Corps, marking a critical expansion of its amphibious warfare fleet. The contract ensures ongoing production and enhancement of these vital military assets.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Billion Forecast Revenue (2034) USD 9.2 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Armored Amphibious Vehicles, Amphibious Excavators, Light Amphibious Utility Vehicles, Commercial Amphibious Transport), By Propulsion (Track-Based Propulsion, Water Jet Propulsion, Screw Propeller), By Application (Military Combat & Troop Transport, Disaster Response & Humanitarian Aid, Construction & Dredging, Commercial & Recreational Transport), By End Use (Defense Forces, Disaster Management Agencies, Construction & Dredging Contractors, Tourism & Transport Operators, Government Municipalities) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hydratrek, Inc., Marsh Buggies Incorporated, Rheinmetall AG, Hitachi Construction Machinery Co., Ltd., Wilco Manufacturing L.L.C., General Dynamics Corporation, EIK Engineering Sdn. Bhd., BAE Systems plc, Hanwha Aerospace, Wetland Equipment Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-