Global Ammonium Fluoride Market Size, Share, And Industry Analysis Report By Product Type (Industrial Grade, Electronic Grade), By Application (Glass Etching, Surface Treatment, Chemical Synthesis, Electronics, Others), By End-User (Electronics, Chemical, Metallurgy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177589

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

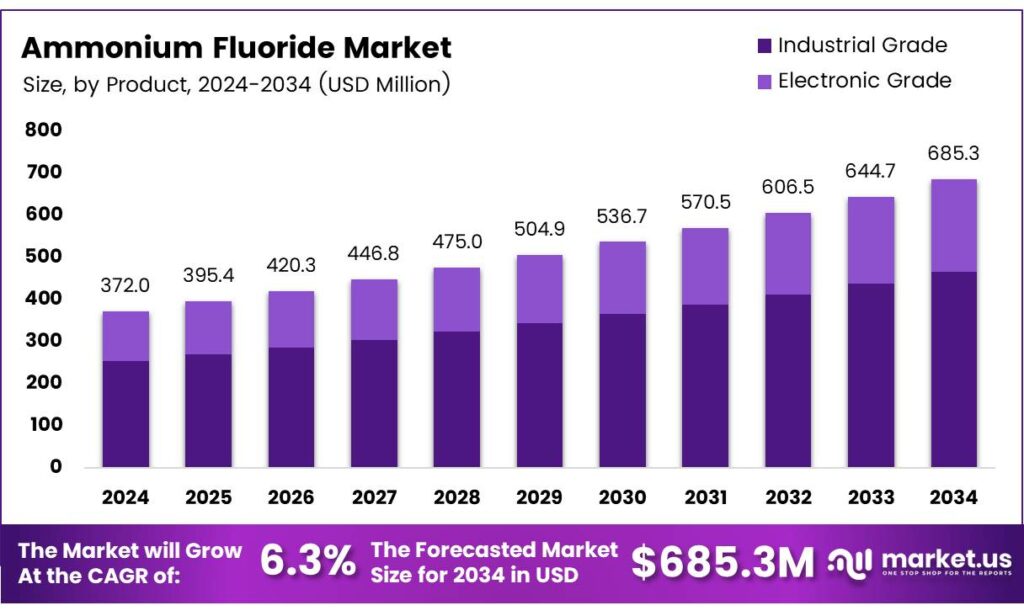

The Global Ammonium Fluoride Market size is expected to be worth around USD 685.3 million by 2034 from USD 372.0 million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034.

Ammonium fluoride represents a critical inorganic compound used extensively across semiconductor manufacturing, glass processing, and surface treatment applications. This white crystalline chemical serves industries requiring precision etching and high-purity fluorine compounds. Moreover, its versatile chemical properties enable specialized synthesis reactions in advanced materials production.

The market experiences robust expansion driven by semiconductor industry growth and electronics miniaturization trends. Manufacturers increasingly adopt ultra-high-purity grades for microfabrication processes requiring nanometer-scale precision. Additionally, innovations in fluorine chemistry enhance product safety profiles and environmental compliance.

Industrial applications dominate consumption patterns, particularly in metal surface preparation and specialty chemical synthesis sectors. Electronics-grade variants command premium pricing due to stringent purity requirements exceeding 95% assay specifications. Consequently, suppliers invest in advanced purification technologies to meet evolving quality standards.

- Suppliers are adopting advanced purification methods to meet strict quality standards. The material is a white, odorless crystalline solid at 20°C that sublimes on heating and forms an acidic solution in water. It has a density of 1.01 g/cm³, dissolves easily (100 g per 100 ml at 0°C), and meets high-purity specifications with a minimum 95% assay and very low impurity limits.

Regulatory frameworks shape market dynamics as governments enforce stricter handling protocols for toxic fluorine compounds. Companies develop eco-optimized formulations addressing environmental sustainability concerns while maintaining performance characteristics. Therefore, product innovation focuses on reducing waste disposal costs and improving workplace safety measures.

Key Takeaways

- The Ammonium Fluoride Market is projected to grow from USD 372.0 million in 2024 to USD 685.3 million by 2034 at a CAGR of 6.3%.

- The Industrial Grade segment leads the Product Type category with 67.9% market share.

- Glass Etching application holds 34.7% dominance in the Application segment.

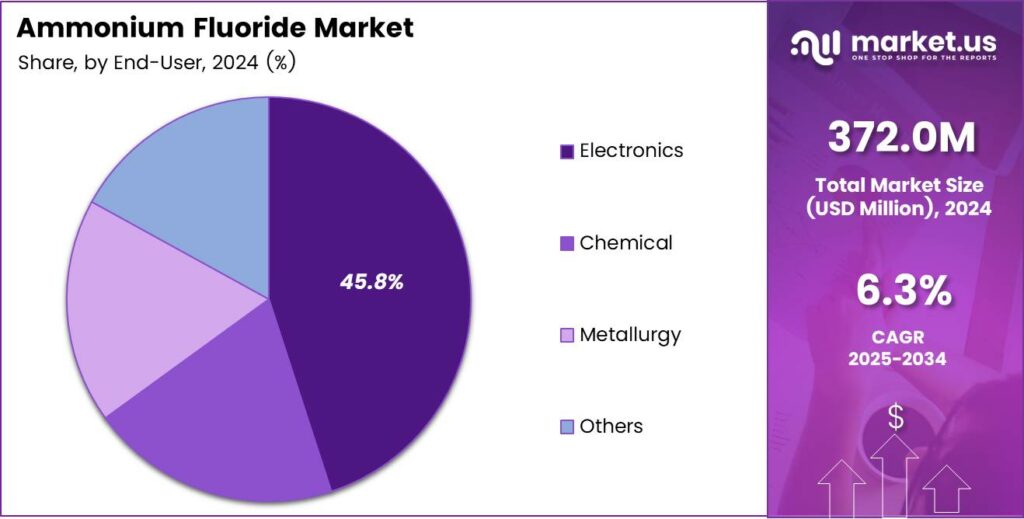

- The Electronics end-user segment captures 45.8% of the market share.

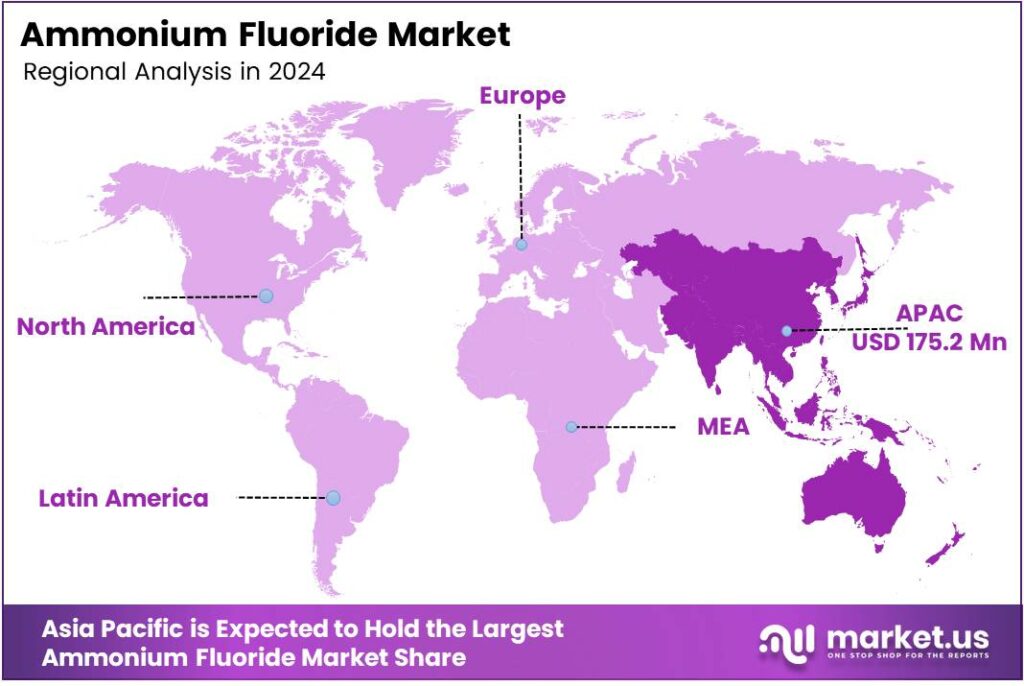

- Asia Pacific dominates the market, with a 47.1% share and a value of USD 175.2 Million.

Product Type Analysis

Industrial Grade dominates with 67.9% share, driven by widespread use across general manufacturing applications.

In 2025, Industrial Grade held a dominant market position in the By Product Type segment of the Ammonium Fluoride Market, with a 67.9% share. This grade serves diverse applications, including glass etching, metal surface treatment, and chemical synthesis processes. Manufacturers prefer this variant for cost-effectiveness and adequate purity levels meeting most industrial requirements.

Electronic Grade captures the premium segment with ultra-high purity specifications exceeding standard industrial thresholds. Semiconductor fabrication facilities require this variant for precision etching processes where impurity levels below 0.002% ensure defect-free chip production. Consequently, electronic-grade commands higher pricing despite smaller volume shares compared to industrial alternatives.

Application Analysis

Glass Etching dominates with 34.7% due to extensive use in architectural and specialty glass processing.

In 2025, Glass Etching held a dominant market position in the By Application segment of the Ammonium Fluoride Market, with a 34.7% share. Architectural glass manufacturers utilize this chemical for creating decorative patterns and anti-reflective surfaces. Additionally, automotive glass producers employ etching processes to enhance optical clarity and safety performance characteristics.

Surface Treatment applications serve metal finishing industries requiring controlled chemical cleaning and activation processes. Manufacturers prepare aluminum, steel, and specialty alloy surfaces before coating or bonding operations. Therefore, this segment supports aerospace, automotive, and industrial equipment production workflows.

Chemical Synthesis applications leverage ammonium fluoride as a fluorinating agent in organic and inorganic compound production. Pharmaceutical and agrochemical manufacturers employ this reagent for producing fluorine-containing active ingredients. Moreover, specialty chemical producers synthesize advanced materials requiring precise fluorine incorporation.

Electronics applications encompass semiconductor wafer cleaning, photoresist stripping, and silicon dioxide etching processes. Chip manufacturers demand consistent quality and ultra-low impurity levels for nanoscale device fabrication. Furthermore, display panel producers utilize this chemical in thin-film transistor manufacturing.

Others include niche applications in analytical chemistry, textile processing, and water treatment operations. Research laboratories employ high-purity grades for specialized analytical procedures and material characterization studies. Additionally, emerging applications in advanced battery technologies create new growth opportunities.

End-User Analysis

Electronics dominates with 45.8% due to semiconductor industry expansion and miniaturization trends.

In 2025, Electronics held a dominant market position in the By End-User segment of the Ammonium Fluoride Market, with a 45.8% share. Semiconductor fabrication plants consume significant volumes for wafer etching, cleaning, and surface preparation processes. Moreover, display panel manufacturers require a consistent chemical supply for thin-film deposition and patterning operations.

Chemical end-users encompass specialty chemical producers, pharmaceutical manufacturers, and agrochemical companies requiring fluorine incorporation. These industries value reliable supply chains and consistent product specifications for maintaining production quality standards. Additionally, research institutions utilize analytical-grade variants for laboratory applications.

Metallurgy sector applications include metal surface preparation, corrosion inhibition, and specialty alloy processing operations. Steel producers employ controlled etching processes before applying protective coatings or conducting quality inspections. Therefore, this segment demands industrial-grade products meeting cost-performance requirements.

Others represent diverse end-users, including glass manufacturers, textile processors, and water treatment facilities. Architectural glass companies utilize etching solutions for decorative applications and functional surface modifications. Furthermore, emerging applications in renewable energy technologies expand market reach beyond traditional sectors.

Key Market Segments

By Product Type

- Industrial Grade

- Electronic Grade

By Application

- Glass Etching

- Surface Treatment

- Chemical Synthesis

- Electronics

- Others

By End-User

- Electronics

- Chemical

- Metallurgy

- Others

Emerging Trends

Digital Transformation Reshapes Market Landscape

Manufacturers shift toward ultra-high-purity ammonium fluoride grades exceeding traditional electronic-grade specifications for advanced chip production. Next-generation semiconductor nodes below 5 nanometers demand unprecedented chemical purity, eliminating trace contaminants affecting device performance. Consequently, suppliers invest in cutting-edge analytical equipment and cleanroom manufacturing infrastructure.

- Industries increasingly prefer sustainable fluorine process agents incorporating renewable feedstocks and energy-efficient production methods. SEMI forecasts global semiconductor equipment sales to reach $125.5 billion in 2025, which signals continued fab upgrades where chemical quality becomes a procurement priority.

Automated dosing systems integration transforms industrial chemical handling practices, improving safety, precision, and operational efficiency. Smart sensors monitor real-time consumption rates, optimizing inventory management and reducing chemical waste. Additionally, digital platforms enable predictive maintenance, preventing equipment failures and production disruptions.

Drivers

Increasing Adoption in Semiconductor Etching Processes Drives Market Growth

Semiconductor manufacturers expand production capacity to meet surging demand for microchips across automotive, consumer electronics, and industrial automation sectors. Advanced node fabrication requires ultra-high-purity ammonium fluoride for achieving nanometer-scale precision in silicon dioxide etching. Consequently, electronics-grade variants experience accelerated consumption rates as global chip production intensifies.

- Precision glass treatment chemicals gain traction as the architectural and automotive industries demand enhanced optical performance characteristics. The “NanoIC” pilot line initiative is worth €2.5 billion, combining €1.4 billion public funding with €1.1 billion private funding, aimed at prototyping process steps beyond 2 nm before they scale to manufacturing.

Specialty metal surface cleaning applications expand across aerospace, automotive, and industrial equipment manufacturing sectors. Companies adopt controlled chemical cleaning processes, replacing mechanical methods that risk substrate damage. Additionally, ammonium fluoride enables activation treatments, improving adhesion performance for subsequent coating or bonding operations.

Restraints

Strict Handling Regulations Due to Toxicity Risks Limit Market Adoption

Regulatory agencies enforce stringent safety protocols governing ammonium fluoride storage, transportation, and workplace handling procedures. Companies invest heavily in specialized containment systems, personal protective equipment, and employee training programs. Therefore, compliance costs create barriers for smaller manufacturers entering high-purity chemical segments.

- Environmental regulations mandate proper disposal methods for fluorine-containing waste streams generated during manufacturing processes. The Semiconductor Industry Association said global semiconductor sales totaled $791.7 billion in 2025, a 25.6% year-over-year increase, and that the industry expects chip sales to hit $1 trillion in 2026.

Toxicity concerns prompt industries to explore alternative chemistries offering comparable performance with improved safety profiles. Research institutions develop fluorine-free etching solutions and surface treatment agents addressing regulatory pressures. However, performance gaps compared to ammonium fluoride limit widespread substitution in critical applications.

Growth Factors

Technological Advancements Accelerate Market Expansion

Emerging applications in advanced microfabrication technologies drive demand for ultra-high-purity chemical grades meeting stringent semiconductor industry specifications. Manufacturers develop next-generation purification processes, achieving impurity levels below 0.001% for critical electronic applications. Moreover, innovation in fluorine chemistry enables novel etching formulations optimized for emerging materials.

High-purity electronic chemical manufacturing facilities expand capacity, supporting regional semiconductor ecosystem development. Governments provide incentives for domestic production, reducing reliance on international supply chains. Additionally, strategic partnerships between chemical suppliers and chip manufacturers ensure customized formulation development.

Development of eco-optimized fluorine chemistry solutions addresses environmental sustainability concerns while maintaining performance characteristics. Researchers explore biodegradable additives and closed-loop recycling systems, minimizing waste generation. Furthermore, green chemistry initiatives align with corporate sustainability goals, attracting environmentally conscious customers.

Regional Analysis

Asia Pacific Dominates the Ammonium Fluoride Market with a Market Share of 47.1%, Valued at USD 175.2 Million

Asia Pacific commands market leadership driven by concentrated semiconductor manufacturing capacity and electronics assembly operations. China, Japan, South Korea, and Taiwan host major chip fabrication facilities consuming significant ammonium fluoride volumes. Moreover, regional glass processing industries support construction and automotive sectors experiencing sustained growth. Regional suppliers benefit from proximity to end-users, enabling cost-effective logistics and technical support services.

North America emphasizes high-value semiconductor applications and specialty chemical synthesis requiring ultra-high-purity grades. United States manufacturers focus on advanced node chip production serving aerospace, defense, and computing sectors. Additionally, stringent environmental regulations drive innovation in sustainable fluorine chemistry and waste management technologies. Canadian industries utilize ammonium fluoride in mining and metallurgical applications.

Europe prioritizes regulatory compliance and sustainability initiatives, shaping chemical industry practices. German and French manufacturers develop eco-optimized formulations meeting REACH requirements and circular economy objectives. Moreover, automotive glass producers employ advanced etching technologies for safety and performance enhancements. Regional suppliers collaborate with research institutions advancing green chemistry solutions.

Middle East and Africa markets show emerging potential supported by industrial diversification initiatives and technology sector investments. Gulf Cooperation Council countries develop semiconductor fabrication capabilities aligned with economic transformation strategies. Moreover, South African metallurgical industries utilize surface treatment chemicals for mining and manufacturing applications. Regional growth depends on infrastructure development and technical expertise cultivation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Solvay maintains global leadership through integrated fluorine chemistry expertise and a diversified industrial chemical portfolio. The company supplies pharmaceutical, agrochemical, and semiconductor industries with customized ammonium fluoride formulations meeting stringent purity specifications. Moreover, Solvay invests in sustainable manufacturing processes, reducing environmental footprint while expanding production capacity.

Stella Chemifa specializes in ultra-high-purity electronic-grade chemicals serving semiconductor fabrication facilities throughout the Asia Pacific. The Japanese manufacturer employs advanced purification technologies, achieving impurity levels below industry standards for critical etching applications. Additionally, Stella Chemifa collaborates with leading chip producers to develop next-generation cleaning and surface treatment solutions.

Fujian Kings Fluoride operates as a major Chinese producer offering cost-competitive industrial and electronic-grade ammonium fluoride products. The company leverages domestic raw material access and integrated manufacturing infrastructure, reducing production costs. Furthermore, Fujian Kings Fluoride expands capacity, supporting regional electronics industry growth and export markets.

Fubao Group combines chemical manufacturing expertise with strategic partnerships across electronics and specialty materials sectors. The company develops customized formulations addressing specific customer requirements in semiconductor and display panel production. Moreover, Fubao Group implements quality management systems, ensuring regulatory compliance and product traceability.

Top Key Players in the Market

- Solvay

- Stella Chemifa

- Fujian Kings Fluoride

- Fubao Group

- Shaowu Huaxin Chemical

- Xiangshui Xinlianhe Chemical

- Chengde Yingke Fine Chemical

- Changshu Xinhua Chemical

- Zhejiang Hailan Chemical Group

Recent Developments

- In 2025, Stella Chemifa, a Japanese company specializing in high-purity fluorine compounds, produces buffered hydrofluoric acid that incorporates ammonium fluoride for semiconductor etching and cleaning applications.

- In 2025, Fujian Kings Fluoride Industry Co., Ltd., a Chinese company focused on fluorspar mining and fluorine chemical processing, includes ammonium bifluoride (a derivative related to ammonium fluoride) in its product lineup, used in industrial applications like hydrofluoric acid production.

Report Scope

Report Features Description Market Value (2024) USD 372.0 Million Forecast Revenue (2034) USD 685.3 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Industrial Grade, Electronic Grade), By Application (Glass Etching, Surface Treatment, Chemical Synthesis, Electronics, Others), By End-User (Electronics, Chemical, Metallurgy, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Solvay, Stella Chemifa, Fujian Kings Fluoride, Fubao Group, Shaowu Huaxin Chemical, Xiangshui Xinlianhe Chemical, Chengde Yingke Fine Chemical, Changshu Xinhua Chemical, Zhejiang Hailan Chemical Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Ammonium Fluoride MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Ammonium Fluoride MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Solvay

- Stella Chemifa

- Fujian Kings Fluoride

- Fubao Group

- Shaowu Huaxin Chemical

- Xiangshui Xinlianhe Chemical

- Chengde Yingke Fine Chemical

- Changshu Xinhua Chemical

- Zhejiang Hailan Chemical Group