Americas COVID-19 Testing Market By Sample Type (Nasopharyngeal Swabs and Blood), By Test Type (SARS-CoV-2 Antigen, SARS-CoV-2 IgM/IgG Antibody, and Multiplex Real-time RT-PCR), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Sales Channel, Drug Store, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170060

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

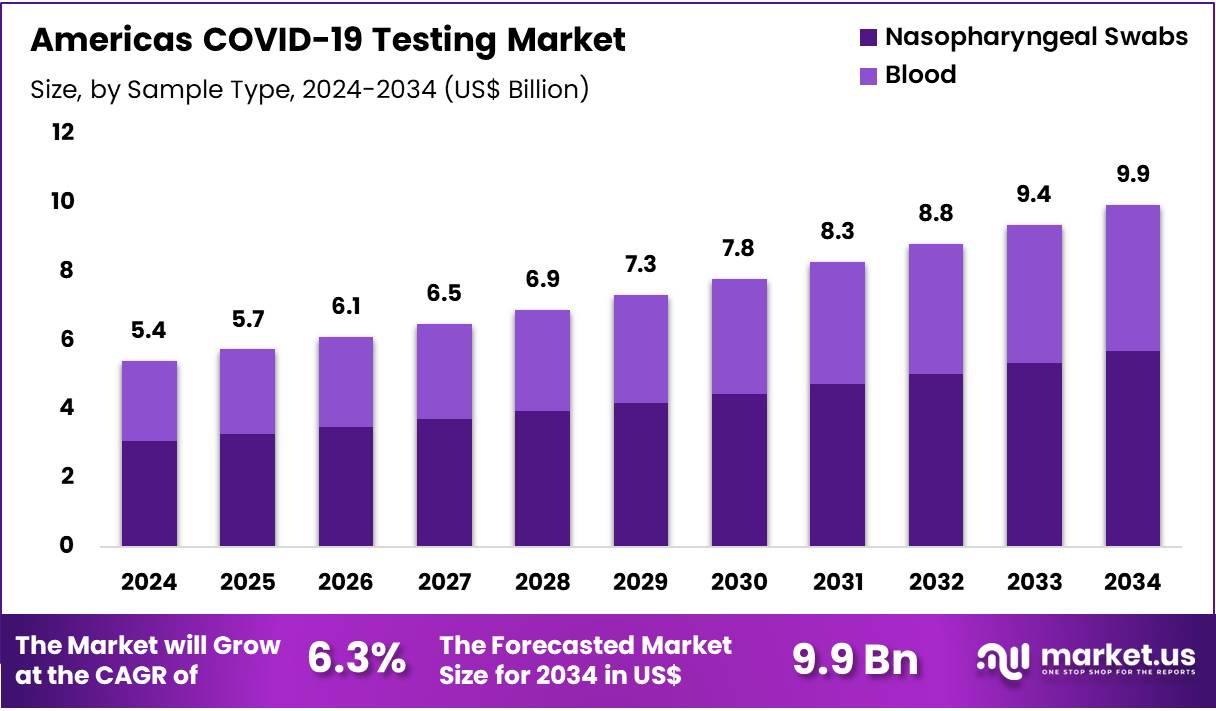

The Americas COVID-19 Testing Market size is expected to be worth around US$ 9.9 Billion by 2034 from US$ 5.4 Billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034.

Increasing demand for integrated respiratory pathogen diagnostics propels the Americas COVID-19 Testing market, as healthcare providers seek streamlined solutions to differentiate viral illnesses during peak seasons and reduce diagnostic delays. Laboratories and clinics deploy multiplex molecular panels that simultaneously detect SARS-CoV-2 alongside other common viruses, enabling efficient resource allocation in high-volume settings.

These tests apply in emergency department triage for symptomatic patients presenting with fever and cough, community health screening programs to identify co-infections in vulnerable populations, and hospital surveillance to monitor nosocomial transmission risks. Opportunities emerge from the shift toward consolidated testing workflows that lower operational costs and enhance turnaround times.

By September 2024, major diagnostics manufacturers including Roche and Abbott expanded their molecular testing portfolios with multiplex panels detecting COVID-19, Influenza A and B, and RSV from a single sample, facilitating faster evaluation of seasonal respiratory threats. This development directly supports clinical decision-making and positions the market for sustained relevance in routine infectious disease management.

Growing emphasis on decentralized and self-testing options accelerates the Americas COVID-19 Testing market, as public health initiatives promote accessible tools to empower individuals and curb community spread without overburdening facilities. Diagnostic firms innovate with user-friendly antigen kits and mail-in PCR services that deliver reliable results from home-collected nasopharyngeal or saliva samples.

Applications encompass workplace wellness programs for pre-shift screening to maintain productivity, school return-to-learn protocols for asymptomatic student testing, travel preparation verification through at-home antigen confirmation, and chronic condition management in immunocompromised patients requiring frequent monitoring. Point-of-care advancements create avenues for integration with telehealth platforms that provide instant result interpretation and follow-up guidance. Pharmaceutical partners increasingly bundle these tests with antiviral prescriptions to expedite treatment access. This consumer-centric evolution drives market expansion through enhanced equity in testing availability.

Rising adoption of genomic surveillance technologies invigorates the Americas COVID-19 Testing market, as authorities leverage sequencing capabilities to track variant emergence and inform vaccination strategies proactively. Reference laboratories utilize next-generation sequencing platforms paired with bioinformatics tools to analyze viral genomes from positive samples, enabling precise lineage identification.

These systems find applications in epidemiological outbreak investigations to map transmission clusters, vaccine efficacy studies evaluating breakthrough infections, public health policy formulation based on mutation prevalence, and research collaborations assessing long-term immunity profiles. AI-enhanced analytics open opportunities for predictive modeling that anticipates surge risks and optimizes resource deployment. Collaborative networks among diagnostic providers and health agencies foster standardized reporting protocols. This forward-looking approach solidifies the market’s role in pandemic preparedness and response infrastructure.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.4 billion, with a CAGR of 6.3%, and is expected to reach US$ 9.9 billion by the year 2034.

- The sample type segment is divided into nasopharyngeal swabs and blood, with nasopharyngeal swabs taking the lead in 2023 with a market share of 57.2%.

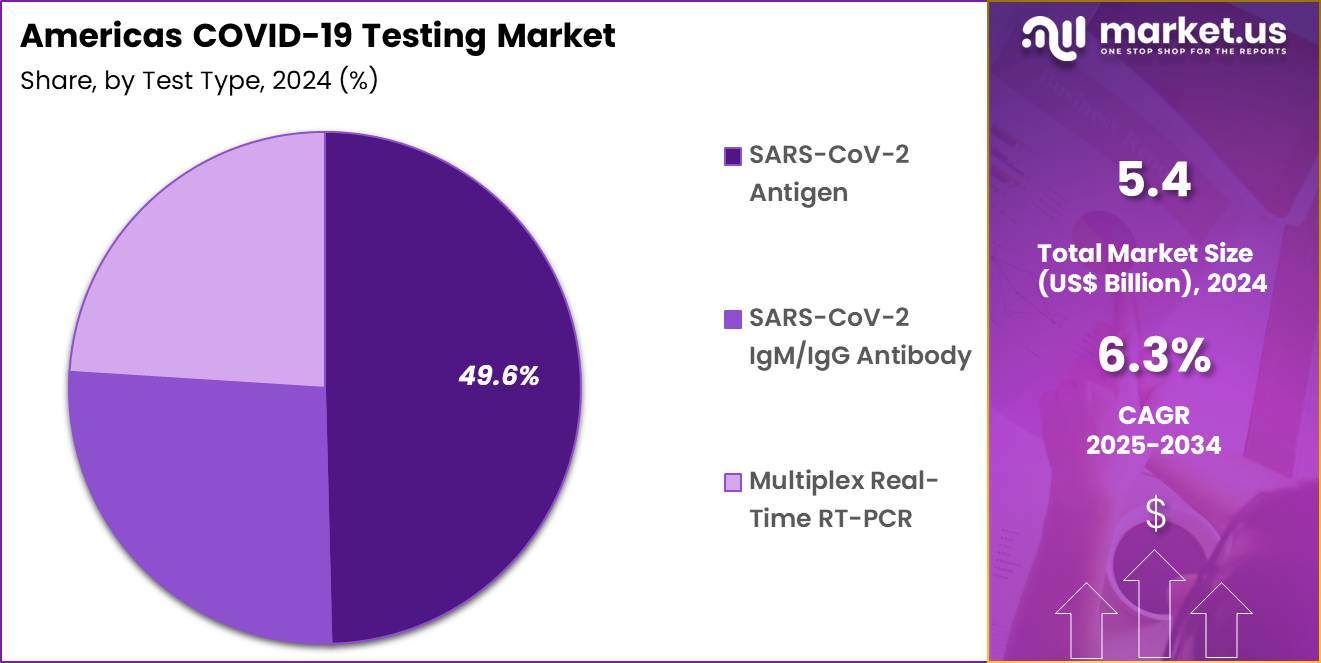

- Considering test type, the market is divided into SARS-CoV-2 antigen, SARS-CoV-2 IgM/IgG antibody, multiplex real-time RT-PCR. Among these, SARS-CoV-2 antigen held a significant share of 49.6%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, retail pharmacies, online sales channel, drug store, diagnostic laboratories. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 46.3% in the market.

Sample Type Analysis

Nasopharyngeal swabs, holding 57.2%, are expected to dominate due to their critical role in SARS-CoV-2 detection, especially in symptomatic and high-risk patients. Healthcare providers widely use nasopharyngeal swabs for PCR, antigen, and antibody testing due to their ability to provide highly reliable samples for viral RNA detection. The widespread use of nasopharyngeal swabs is driven by their proven efficacy in detecting viral loads in the upper respiratory tract, where the virus initially replicates.

Hospitals and diagnostic labs rely on these samples for routine screening and early detection. With increasing COVID-19 testing demand, the adoption of nasopharyngeal swabs continues to grow in both clinical and public health settings. Testing guidelines also favor nasopharyngeal swabs for their compatibility with a broad range of testing platforms. These factors keep nasopharyngeal swabs anticipated to remain the dominant sample type.

Test Type Analysis

SARS-CoV-2 antigen tests, holding 49.6%, are anticipated to dominate due to their rapid results and ease of use, making them a preferred choice for large-scale screening, especially in non-clinical settings. Antigen tests offer quick and affordable detection of the virus, which is particularly beneficial for mass testing in schools, workplaces, and public health initiatives. As the world continues to address the pandemic, demand for antigen tests is expected to rise, particularly for asymptomatic or pre-symptomatic screening.

Antigen tests provide a cost-effective solution for high-volume testing, particularly in resource-limited settings. The availability of at-home antigen test kits further drives adoption by providing an easy-to-use option for self-testing. These factors contribute to SARS-CoV-2 antigen tests being projected to remain the dominant test type in the Americas COVID-19 testing market.

Distribution Channel Analysis

Hospital pharmacies, holding 46.3%, are expected to remain the dominant distribution channel due to their central role in managing COVID-19 testing in both outpatient and inpatient settings. Hospitals serve as major hubs for diagnostic testing, especially for symptomatic patients or those in critical care. Hospital pharmacies supply a variety of COVID-19 testing options, including PCR and antigen tests, to ensure timely and accurate results for patients.

The demand for testing is expected to remain high due to the continuous monitoring of COVID-19 cases, especially with the emergence of new variants. Hospitals also provide PCR testing for patients before surgeries, further driving testing demand. The availability of rapid antigen testing in hospital pharmacies supports efficient patient management, enhancing hospital pharmacies’ pivotal role in the testing process. These factors ensure that hospital pharmacies remain a key player in the distribution of COVID-19 testing kits and reagents.

Key Market Segments

By Sample Type

- Nasopharyngeal Swabs

- Blood

By Test Type

- SARS-CoV-2 Antigen

- SARS-CoV2 IgM/IgG Antibody

- Multiplex Real-time RT-PCR

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Sales Channel

- Drug Store

- Diagnostic Laboratories

Drivers

The Persistent Circulation of SARS-CoV-2 in the Americas Is Driving the Market

The persistent circulation of SARS-CoV-2 in the Americas continues to drive the COVID-19 testing market by necessitating ongoing surveillance to monitor variants and community transmission levels. Health authorities across the region emphasize the importance of diagnostic capacity to inform public health responses and mitigate resurgence risks. This sustained presence, evidenced by consistent case reporting, underscores the value of scalable testing infrastructure in both urban and rural settings.

Governments and institutions are investing in laboratory networks to ensure rapid detection, particularly in high-burden countries like Brazil and Mexico. The Pan American Health Organization facilitated the procurement of 1,082,500 antigen-detecting rapid diagnostic tests in 2022 to bolster regional response capabilities. Such efforts highlight the market’s role in supporting equitable access to diagnostics amid fluctuating epidemiology.

Key players are adapting by enhancing supply chains for reagents and kits to meet variable demand. Integration of testing into routine respiratory illness protocols further amplifies utilization in primary care facilities. Economic analyses reveal that proactive testing reduces hospitalization burdens, justifying sustained funding allocations. This driver ultimately reinforces the market’s essential function in fostering regional health security.

Restraints

The Sharp Decline in Demand for COVID-19-Specific Tests Is Restraining the Market

The sharp decline in demand for COVID-19-specific tests is restraining the Americas COVID-19 testing market by shifting priorities toward broader diagnostic applications and reducing dedicated investments. As vaccination coverage and immunity levels rise, the perceived urgency for standalone SARS-CoV-2 screening diminishes, leading to surplus inventory and underutilized equipment.

Public health budgets are reallocating resources to emerging threats like dengue and avian influenza, sidelining COVID-19-focused expansions. Manufacturers face challenges in maintaining production scales without volume commitments from governments. Roche reported a decline in sales from COVID-19 products amounting to CHF 4.3 billion in 2023, reflecting the tapering regional need. This contraction pressures smaller labs to consolidate operations, limiting innovation in test formats.

Reimbursement policies are evolving to favor multiplex options, de-emphasizing single-pathogen assays. Supply chain disruptions from reduced orders exacerbate cost inefficiencies for remaining stockpiles. Rural areas, already strained, experience delayed replenishments, widening access gaps. Overcoming this restraint involves repositioning COVID-19 tests within integrated platforms to sustain viability.

Opportunities

The Emergence of Multiplex Respiratory Pathogen Testing Is Creating Growth Opportunities

The emergence of multiplex respiratory pathogen testing is creating growth opportunities in the Americas COVID-19 testing market by enabling simultaneous detection of SARS-CoV-2 alongside influenza and RSV, optimizing resource use. This approach addresses the overlap in seasonal illnesses, streamlining workflows in overburdened healthcare systems. Regulatory advancements facilitate quicker adoption, with validations confirming high specificity across targets. Opportunities arise from partnerships between regional labs and developers to customize panels for local epidemiology.

The U.S. Food and Drug Administration granted marketing authorization to three multiplex assays in 2024, including those targeting COVID-19, flu, and RSV combinations. Such endorsements encourage procurement by national programs, particularly in Latin America where co-circulation burdens diagnostics. Cost savings from reduced sample processing attract ambulatory and point-of-care settings, expanding market reach.

Training initiatives by organizations like PAHO can accelerate clinician uptake, enhancing surveillance integration. Export potential to Caribbean nations offers diversification for manufacturers. These opportunities position multiplex testing as a versatile solution for future pandemic preparedness.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and rising public health investments sustain the Americas COVID-19 testing market, as countries maintain surveillance programs and prepare for future variants through rapid and at-home diagnostics. Inflation, however, raises costs for reagents, swabs, and cartridges, which forces manufacturers to increase prices and limits access in lower-income communities across the region. Geopolitical tensions, especially ongoing U.S.-China trade disputes, disrupt shipments of key testing components from Asia, which creates delays and higher freight charges for suppliers serving North and South America.

These same tensions, on the positive side, encourage Brazil, Mexico, and Canada to expand local production capacity, which sparks new partnerships and strengthens regional independence. Current U.S. tariffs add substantial duties on imported diagnostic products and equipment, which pressures distributors and raises end-user costs for hospitals and clinics throughout the Americas.

Yet, these measures strongly motivate U.S. and Canadian companies to build domestic manufacturing lines, which creates jobs and secures more reliable supply. Despite short-term challenges, continued demand for accurate, user-friendly testing keeps the market active and forward-moving. In the end, ongoing innovation and cross-border cooperation position the Americas COVID-19 testing sector for lasting stability and improved public health protection.

Latest Trends

The FDA Marketing Authorization for the Panther Fusion SARS-CoV-2/Flu A/B/RSV Assay in 2024 Is a Recent Trend

The FDA marketing authorization for the Panther Fusion SARS-CoV-2/Flu A/B/RSV Assay by Hologic, Inc. on July 18, 2024, exemplifies a recent trend toward automated, high-throughput molecular diagnostics for respiratory viruses in the Americas. This real-time RT-PCR assay detects multiple targets in a single run, supporting efficient triage in clinical laboratories across the U.S. and beyond. Its integration with existing Panther systems minimizes infrastructure overhauls, appealing to regional networks.

The authorization confirms performance equivalence to predicate devices, with sensitivity exceeding 95% for SARS-CoV-2 detection. This development aligns with seasonal demands, enabling proactive stockpiling ahead of winter surges. Hologic’s expansion into Latin American markets through distribution agreements accelerates adoption in high-volume centers.

Early implementations report reduced turnaround times to under four hours, improving patient flow. The trend reflects a broader shift to consolidated testing amid resource constraints. As similar authorizations proliferate, it fosters competition and refines algorithmic enhancements for variant monitoring. Overall, this 2024 milestone advances precision diagnostics in evolving epidemiological contexts.

Key Players Analysis

Key firms in the Americas COVID‑19 diagnostics market drive growth by rapidly expanding molecular testing capacity and launching scalable point‑of‑care antigen and PCR platforms that meet demand during infection waves while adapting for long‑term surveillance needs. They extend reach by building comprehensive distribution networks including clinical labs, hospitals, community testing sites and direct‑to‑consumer channels to sustain testing demand even in post‑pandemic phases.

They integrate digital reporting tools, AI‑powered result interpretation and automated sample workflows to shorten turnaround times and improve lab efficiency across large‑volume operations. They diversify offerings by combining diagnostic assays with multiplex respiratory panels or read‑out services, appealing to clinics and public‑health agencies that require flexible testing frameworks. They secure ongoing revenue through government contracts, institutional partnerships, and recurring-use programs to buffer against fluctuations in demand.

One major player, Quest Diagnostics Incorporated, operates a vast network of clinical laboratories across the Americas, offers broad molecular and serology services including SARS‑CoV‑2 detection, leverages high‑throughput processing infrastructure and well‑established logistics to deliver reliable testing services at scale and maintain market leadership across diverse healthcare settings.

Top Key Players

- Abbott Laboratories

- Roche

- Thermo Fisher Scientific, Inc.

- Danaher (Cepheid)

- Becton Dickinson & Co. (BD)

- bioMérieux SA

- QIAGEN N.V.

- Siemens Healthineers

Recent Developments

- On December 1, 2025, Abbott Laboratories was identified as one of the leading suppliers of point-of-care testing systems in North America, holding an estimated 18% share of the market. Its strong position is supported by a wide range of rapid diagnostics, including assays for respiratory infections such as COVID-19 and influenza.

- In November 2022, Siemens Healthineers introduced the Atellica® Solution, a platform capable of performing COVID-19 antigen testing alongside routine clinical assays. This launch responded to U.S. laboratory demand for systems that streamline operations by combining multiple testing needs into a single automated workflow.

Report Scope

Report Features Description Market Value (2024) US$ 5.4 Billion Forecast Revenue (2034) US$ 9.9 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sample Type (Nasopharyngeal Swabs and Blood), By Test Type (SARS-CoV-2 Antigen, SARS-CoV-2 IgM/IgG Antibody, and Multiplex Real-time RT-PCR), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Sales Channel, Drug Store, and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Roche, Thermo Fisher Scientific, Inc., Danaher (Cepheid), Becton Dickinson & Co., bioMérieux SA, QIAGEN N.V., Siemens Healthineers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Americas COVID-19 Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Americas COVID-19 Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Roche

- Thermo Fisher Scientific, Inc.

- Danaher (Cepheid)

- Becton Dickinson & Co. (BD)

- bioMérieux SA

- QIAGEN N.V.

- Siemens Healthineers