Alopecia Market Analysis By Disease Type (Alopecia Areata, Cicatricial Alopecia, Traction Alopecia, Alopecia Totalis, Alopecia Universalis, Androgenetic Alopecia, Other Disease Types), By Treatment [Pharmaceuticals (Topical (OTC (Minoxidil, Others), Prescription (Betamethasone Dipropionate, Fluocinolone Acetonide, Finasteride, Minoxidil)), Oral (OTC, Prescription (Minoxidil, Finasteride, Corticosteroids, Others)), PRP), Devices (Laser Cap, Laser Comb, Laser Helmet)], By Gender (Male, Female), By Sales Channel (Prescriptions, OTC), By End-use (Homecare Settings, Dermatology Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 25195

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

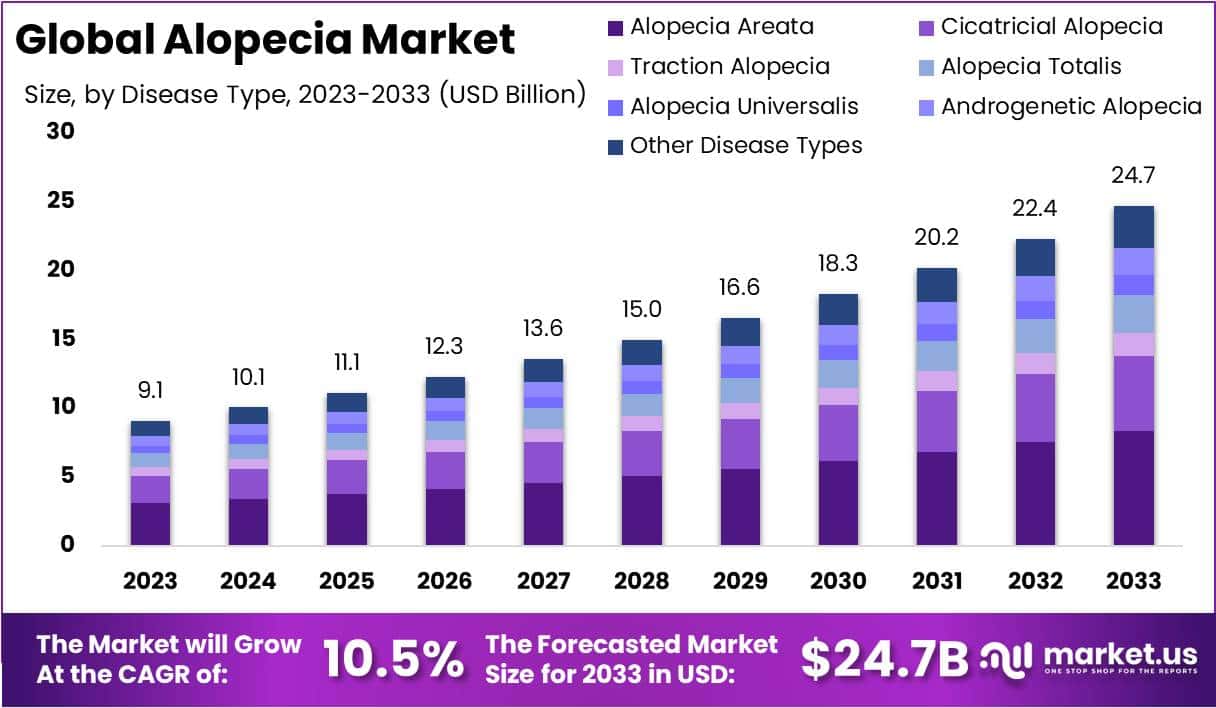

The Global Alopecia Market size is expected to be worth around US$ 27.7 Billion by 2033, from US$ 9.1 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Alopecia, a medical term denoting hair loss, manifests in various forms, predominantly affecting the scalp. Among its diverse types, alopecia areata stands out-a condition where the immune system erroneously attacks hair follicles, resulting in distinct, circular patches of hair loss. In more severe cases, it may progress to total scalp hair loss (alopecia totalis) or even extend to complete body hair loss (alopecia universalis).

Another prevalent variant, androgenetic alopecia, commonly known as male-pattern or female-pattern baldness, has genetic and hormonal roots, unfolding gradually in predictable patterns. Traction alopecia, arising from persistent hair pulling, and cicatricial alopecia, characterized by scarring of the scalp, constitute additional noteworthy forms.

Telogen effluvium, a transient hair loss type, emerges when numerous hair follicles simultaneously enter a resting phase, prompting heightened shedding. The causative factors for alopecia span a spectrum of genetics, environment, and hormones. Effective interventions hinge on accurate diagnosis and may encompass medications, lifestyle adjustments, or surgical procedures. For those grappling with hair loss, seeking consultation with healthcare professionals or dermatologists ensures tailored guidance, aligning with the specific alopecia type and its underlying triggers.

The global alopecia market has witnessed significant growth, driven by an increasing prevalence of hair loss across diverse age groups. Lifestyle changes, elevated stress levels, and environmental factors contribute to this trend. The market includes pharmaceuticals, over-the-counter products, and medical devices, offering diverse solutions. Treatments range from medications like minoxidil and finasteride for androgenetic alopecia to advanced options like hair transplant surgeries.

Key players such as Johnson & Johnson and Merck & Co., Inc. shape the market, with geographical variations influenced by healthcare infrastructure and cultural perspectives on hair loss. Ongoing research focuses on improving treatments, while regulatory compliance and consumer trends, driven by increased awareness and acceptance, further contribute to market dynamics. Online platforms play a significant role in product accessibility and education.

Key Takeaways

- Market Growth Projection: Alopecia market to reach USD 24.7 billion by 2033, with a CAGR of 10.5% from 2024 to 2033.

- Disease Type Impact: Alopecia Areata dominates with over 33.8% market share in 2023, showcasing robust growth.

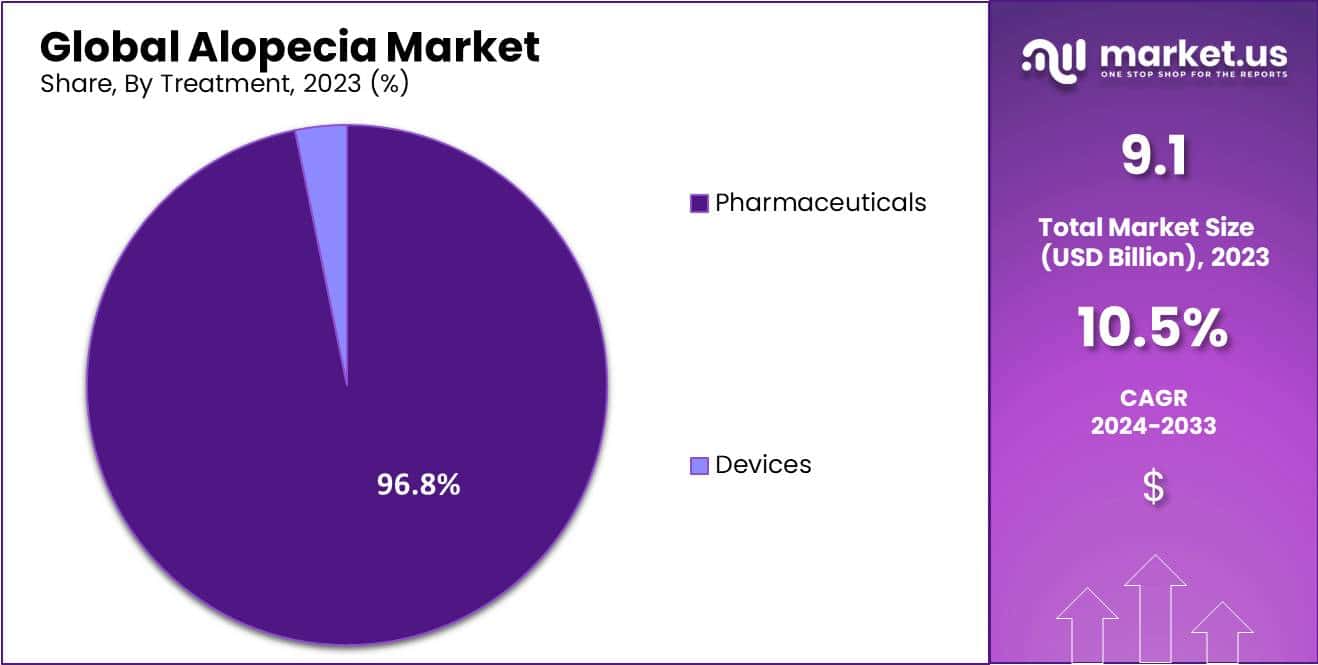

- Treatment Landscape: Pharmaceuticals lead with 97% market share in 2023, Topical sub-segment stands out prominently.

- Gender Dynamics: Male segment commands 61.5% market share in 2023, while the Female segment plays a noteworthy role.

- Sales Channel Trends: Prescriptions lead with 63% market share in 2023, indicating reliance on healthcare professionals.

- End-use Scenario: Dermatology Clinics hold a strong position with 57.6% market share, emphasizing specialized care.

- Market Drivers: Increasing prevalence of alopecia worldwide, advancements in treatment technologies, and rising cosmetic concerns drive market growth.

- Restraints Impacting Growth: High treatment costs, safety concerns, and limited insurance coverage are identified as significant challenges.

- Opportunities for Growth: Expansion of product portfolios, geographical expansion, and focus on personalized medicine present growth opportunities.

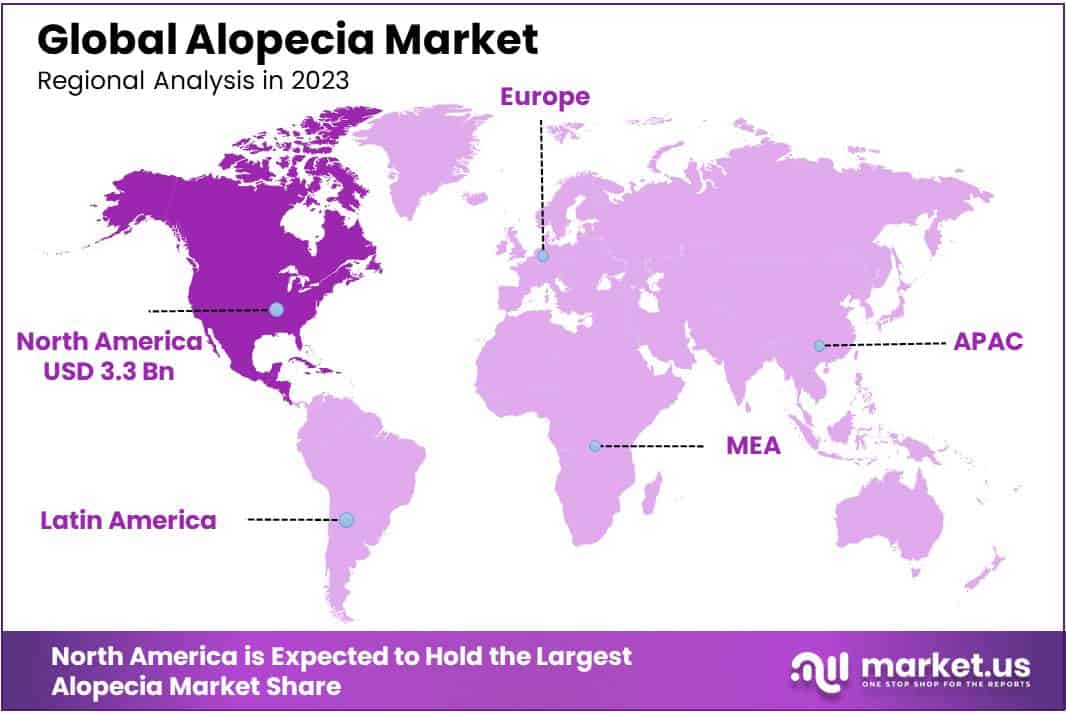

- Geographical Presence: North America has secured a dominant position in the Alopecia Market, surpassing other regions. The region’s market share of over 36.2% reflects its leadership in addressing alopecia-related concerns.

Disease Type Analysis

In 2023, the Alopecia Areata segment emerged as a frontrunner in the market, securing a significant market share of over 33.8%. This form of alopecia, characterized by patchy hair loss, exhibited robust growth and dominance in the overall alopecia market landscape.

Cicatricial Alopecia, another notable player, showcased steady traction in 2023. This specific type, often associated with irreversible hair loss due to scarring, made its mark with a notable market presence, contributing to the diversity within the alopecia market.

Traction Alopecia, recognized for hair loss caused by prolonged tension on hair follicles, demonstrated noteworthy performance in the market. Its unique characteristics and growing awareness contributed to its share in the overall alopecia market.

Alopecia Totalis, marked by complete hair loss on the scalp, and Alopecia Universalis, characterized by the loss of hair across the entire body, exhibited notable market positions in 2023. These segments attracted attention due to their distinct features and impact on patients, securing a noteworthy share in the market.

Androgenetic Alopecia, a common form of genetic hair loss, continued to maintain a substantial market presence. Its prevalence and ongoing research for effective treatments positioned it as a key segment within the alopecia market.

Other Disease Types in the alopecia market also played a role in diversifying the landscape, with various conditions contributing to the overall market dynamics. These segments collectively shaped the market in 2023, highlighting the multifaceted nature of alopecia and the need for comprehensive solutions.

Treatment Analysis

In 2023, the Pharmaceuticals segment emerged as the front-runner in the Alopecia market, claiming a robust market share exceeding 97%. This dominance underscores the widespread reliance on pharmaceutical solutions for addressing hair loss concerns. Within the pharmaceutical category, the Topical sub-segment stood out prominently.

Topical solutions, available over-the-counter (OTC) or through prescription, played a pivotal role in the pharmaceutical landscape. Over-the-counter options, such as Minoxidil and others, gained popularity for their accessibility and ease of use, contributing to the segment’s overall prominence. Meanwhile, prescription-based topical treatments like Betamethasone Dipropionate, Fluocinolone Acetonide, and Finasteride showcased a significant market presence, emphasizing the importance of professional guidance in managing alopecia.

Oral pharmaceuticals emerged as another influential player within the broader pharmaceutical segment. Over-the-counter oral solutions and prescription medications like Minoxidil, Finasteride, and Corticosteroids demonstrated their effectiveness in addressing hair loss concerns. The availability of diverse oral options reflected the industry’s commitment to providing varied choices for individuals seeking oral pharmaceutical interventions.

Further diversifying the pharmaceutical landscape was the inclusion of Platelet-Rich Plasma (PRP) therapy. This innovative approach offered a promising alternative for those looking beyond traditional topical and oral solutions. PRP’s distinctive role in stimulating hair growth and promoting overall scalp health contributed to its recognition as a noteworthy pharmaceutical treatment option.

While Pharmaceuticals dominated the alopecia market, Devices emerged as a notable player in addressing hair loss concerns. Laser-based devices, including Laser Caps, Laser Combs, and Laser Helmets, carved a niche for themselves. These devices, leveraging advanced technologies, presented non-invasive solutions for individuals seeking alternatives to pharmaceutical interventions. Their growing acceptance underscored the increasing preference for technologically-driven approaches in alopecia management.

Gender Analysis

In 2023, the market for alopecia solutions showed a clear gender-based trend. Among the segments, the Male segment stood out, securing a strong foothold with a commanding market position, boasting a substantial share of over 61.5%. This highlights the prevalent concern and demand for hair loss remedies among men, emphasizing the significance of addressing this issue within the industry.

On the other hand, the Female segment also played a noteworthy role in the market, though it held a comparatively smaller share. With a discernible presence, women contributed to the overall dynamics of the alopecia market, indicating that the demand for hair-related solutions is not confined to a specific gender.

This gender-centric segmentation underscores the need for tailored approaches in the development and marketing of alopecia products. Understanding the distinct requirements of both male and female consumers is crucial for industry players to effectively cater to the diverse needs within this dynamic market landscape. As the market continues to evolve, keeping a close eye on these gender-specific trends will be essential for stakeholders aiming to capitalize on emerging opportunities and meet the evolving demands of consumers battling hair loss.

Sales Channel Analysis

In 2023, the Prescriptions segment emerged as a frontrunner in the alopecia market, securing a dominant position with a robust 63% market share. This indicates a substantial reliance on healthcare professionals and their prescribed treatments among alopecia sufferers.

Prescriptions play a pivotal role in addressing the diverse needs of individuals grappling with alopecia. Patients often seek the expertise of medical practitioners who prescribe personalized medications and treatments based on the specific nature and severity of their hair loss condition. This approach not only underscores the complexity of alopecia but also highlights the importance of targeted and tailored therapeutic interventions.

Conversely, the Over-the-Counter (OTC) segment, while holding promise, trails behind prescriptions in market share. OTC products are more easily accessible to consumers without the need for a prescription, allowing for greater convenience. However, the lower market share suggests that many individuals affected by alopecia prefer or require the specialized guidance of healthcare professionals to address their unique hair loss concerns.

The dominance of the Prescriptions segment underscores the significance of medical expertise in managing alopecia. As research and development continue to advance, it will be interesting to observe how the dynamics between Prescriptions and OTC evolve, shaping the future landscape of the alopecia market.

End-use Analysis

In 2023, Dermatology Clinics took the lead in the Alopecia market, holding a strong position with a significant 57.6% share. This dominance can be attributed to the specialized expertise and focused care provided by dermatologists in addressing hair loss concerns. Patients often prefer the personalized attention and comprehensive treatment options available in dermatology clinics, making it a pivotal segment in the market.

On the other hand, Homecare Settings emerged as a noteworthy player, showcasing a growing trend in patient-centric approaches. With a substantial market share, Homecare Settings accounted for a notable portion, underscoring the importance of convenient and accessible solutions for individuals experiencing alopecia.

The preference for Dermatology Clinics can be linked to the advanced diagnostic capabilities and tailored treatment plans offered by dermatologists. Their in-depth understanding of hair and scalp health positions them as key players in addressing the multifaceted challenges associated with alopecia.

In contrast, the Homecare Settings segment appeals to patients seeking comfort and flexibility in managing alopecia. Homecare solutions provide individuals with the autonomy to address hair loss concerns in the familiar environment of their homes, fostering a sense of control and convenience.

Looking forward, the market dynamics between Dermatology Clinics and Homecare Settings are likely to evolve, influenced by factors such as technological advancements, patient preferences, and the accessibility of innovative treatment options. As the alopecia market continues to grow, understanding and catering to the diverse needs of patients across both segments will be crucial for stakeholders aiming to make a meaningful impact in this dynamic landscape.

Key Market Segments

By Disease Type

- Alopecia Areata

- Cicatricial Alopecia

- Traction Alopecia

- Alopecia Totalis

- Alopecia Universalis

- Androgenetic Alopecia

- Other Disease Types

By Treatment

- Pharmaceuticals

- Topical

- OTC

- Minoxidil

- Others

- Prescription

- Betamethasone Dipropionate

- Fluocinolone Acetonide

- Finasteride

- Minoxidil

- OTC

- Oral

- OTC

- Prescription

- Minoxidil

- Finasteride

- Corticosteroids

- Others

- PRP

- Topical

- Devices

- Laser Cap

- Laser Comb

- Laser Helmet

By Gender

- Male

- Female

By Sales Channel

- Prescriptions

- OTC

By End-use

- Homecare Settings

- Dermatology Clinics

Drivers

Increasing Prevalence of Alopecia

The surge in alopecia cases worldwide is a key factor propelling market growth. Lifestyle changes, environmental pollution, and genetic factors collectively contribute to the rising occurrence of alopecia, fostering a higher demand for treatment solutions.

Advancements in Treatment Technologies

Continual progress in treatment technologies, encompassing the development of innovative drugs, therapies, and surgical procedures, is steering the market ahead. Emerging techniques like stem cell therapy and laser treatments are gaining popularity, presenting more effective and varied treatment choices for those affected by alopecia.

Growing Awareness and Patient Education

The escalating awareness regarding alopecia and the available treatment options is positively impacting market expansion. Educational initiatives, both online and offline, are empowering patients to comprehend the solutions at their disposal, encouraging early diagnosis and initiation of treatment, thus elevating the demand for alopecia products.

Rising Cosmetic Concerns and Social Stigma

The increasing emphasis on aesthetics and the societal stigma linked with hair loss are prompting individuals to actively seek remedies for alopecia. The aspiration to maintain a youthful appearance and address societal pressures related to hair loss significantly contribute to the demand for alopecia treatments.

Restraints

High Cost of Treatment

The cost associated with alopecia treatments, especially advanced therapies and surgical procedures, serves as a significant restraining factor. Affordability remains a challenge for a considerable portion of the population, limiting the widespread adoption of certain treatments.

Side Effects and Safety Concerns

Concerns about potential side effects and safety issues associated with some alopecia treatments restrain market growth. Patients and healthcare providers may hesitate to opt for certain therapies due to perceived risks, impacting the adoption rate.

Limited Insurance Coverage

The limited coverage by insurance providers for alopecia treatments poses a challenge for many patients. Insurance policies often do not fully cover the costs of certain procedures or medications, making these options less accessible for a significant portion of the population.

Lack of Curative Treatments

The absence of a definitive cure for alopecia remains a significant restraining factor. While various treatments aim to manage symptoms and stimulate hair growth, the lack of a curative solution hinders market growth, as patients seek more permanent and reliable outcomes.

Opportunities

Expansion of Product Portfolios

Companies have a significant growth opportunity by expanding their product portfolios to include a diverse range of alopecia treatments. Developing new formulations, combination therapies, and targeted solutions can tap into unmet needs within the market.

Geographical Expansion

Exploring untapped geographical markets presents a growth opportunity. Regions with a high prevalence of alopecia and increasing healthcare awareness can be strategic targets for market expansion, enabling companies to reach a broader patient base.

Collaborations and Partnerships

Collaborations between pharmaceutical companies, research institutions, and healthcare providers offer growth opportunities. Joint ventures and partnerships can accelerate the development of innovative treatments and enhance market penetration.

Focus on Personalized Medicine

The trend towards personalized medicine provides an avenue for growth in the alopecia market. Tailoring treatments based on individual patient characteristics, such as genetic predisposition and response to therapies, can lead to more effective and targeted solutions.

Trends

Rise of Over-the-Counter (OTC) Products

A notable trend in the alopecia market is the growing prevalence and appeal of over-the-counter products. Shampoos, topical solutions, and supplements designed to promote hair growth are becoming more popular, thanks to consumers’ inclination towards self-care and the convenience these products offer.

Integration of Technology in Treatment

Technology integration, including the use of artificial intelligence, virtual consultations, and digital platforms for monitoring treatment progress, is a key trend. This trend enhances patient engagement, treatment adherence, and overall healthcare outcomes in the alopecia market.

Focus on Natural and Herbal Remedies

There is a growing trend towards natural and herbal remedies for alopecia. Consumers are showing interest in products with botanical extracts and natural ingredients, driven by the perception of these options being safer and more sustainable.

Increasing Emphasis on Mental Health Support

Recognizing the psychological impact of alopecia, there is a trend towards integrated care that includes mental health support. Holistic treatment approaches addressing both the physical and emotional aspects of alopecia are gaining attention in the market.

Regional Analysis

In 2023, North America has emerged as the leading force in the Alopecia Market, securing a substantial market share exceeding 36.2% and boasting an impressive market value of USD 3.2 billion. This dominance is anchored by the region’s sophisticated healthcare infrastructure, providing seamless alopecia diagnosis and treatment. With heightened awareness among healthcare professionals and the public, North America stands out as a key player in the market, driven by advanced facilities.

The surge in alopecia prevalence in North America is a pivotal factor fueling market growth. Lifestyle shifts, environmental influences, and genetic predispositions contribute to the escalating incidence of alopecia, creating a fertile ground for innovative treatment solutions. Additionally, North America’s proactive stance in technological advancements and robust research initiatives in healthcare is evident. Substantial investments have led to the introduction of cutting-edge therapies, solidifying North America’s position as a market leader in alopecia treatments.

The region is home to several key market players and pharmaceutical companies specializing in dermatology and hair care. These companies have played a pivotal role in driving innovation, introducing novel products, and expanding the overall Alopecia Market. The competitive landscape in North America has been characterized by strategic collaborations, mergers, and acquisitions, consolidating the market further.

The relatively high healthcare expenditure per capita in North America has facilitated increased spending on alopecia treatment. Patients have greater access to a wide range of treatment options, including advanced therapies and personalized medicine, contributing to the region’s dominant market position.

Efforts in raising awareness about alopecia and educating the population about available treatment options have been substantial in North America. This increased awareness has led to early diagnosis and treatment-seeking behavior, positively impacting the market dynamics.

North America benefits from a favorable regulatory environment that supports the development and commercialization of alopecia treatment solutions. Regulatory agencies in the region have been proactive in ensuring the safety and efficacy of new therapeutic interventions, providing a conducive landscape for market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Alopecia Market, key players like Merck & Co. Inc., Cipla Limited, Sun Pharmaceuticals Industries Ltd, and Dr. Reddy’s Laboratories Ltd play pivotal roles in shaping the industry. Let’s delve into a brief analysis of these key players, shedding light on their impact and contributions.

Merck stands as a stalwart in the pharmaceutical realm, actively participating in the Alopecia Market. Their commitment to scientific advancements and therapeutic breakthroughs has positioned them as a key player. Merck’s range of dermatological solutions demonstrates a focused effort to meet the specific needs of alopecia patients.

Cipla Limited, with its global footprint, brings accessible and cost-effective solutions to the Alopecia Market. Their emphasis on affordability and widespread availability of treatments caters to diverse demographics. Cipla’s presence significantly impacts the market’s accessibility and inclusivity.

Sun Pharmaceuticals contributes substantially to the Alopecia Market with a diverse portfolio of dermatological solutions. Known for its research-driven approach, Sun Pharmaceuticals introduces innovative therapies, addressing the evolving needs of alopecia patients. Their global reach fosters market expansion and patient-centric care.

Dr. Reddy’s Laboratories plays a crucial role in the Alopecia Market through its commitment to excellence in pharmaceuticals. With a focus on research and development, the company introduces novel treatments, enhancing the market’s therapeutic options. Dr. Reddy’s Laboratories’ dedication to quality and efficacy shapes the competitive landscape.

Beyond these industry giants, various other key players contribute to the diversity and competitiveness of the Alopecia Market. These players bring unique perspectives, fostering innovation and ensuring a vibrant market ecosystem. Their collective efforts contribute to the ongoing evolution of alopecia treatments, catering to the diverse needs of patients globally.

Market Key Players

- Johnson & Johnson Services Inc

- Merck & Co. Inc.

- Cipla Limited

- Sun Pharmaceuticals Industries Ltd

- Dr. Reddy’s Laboratories Ltd

- GlaxoSmithKline plc.

- Aurobindo Pharma

- Viatris Inc.

- Pfizer Inc.

- Lilly Lexington Intl. LLC (Devices)

- Freedom Laser Therapy (iRestore ID-520 helmet)

- Curallux LLC.

- Apira Science Inc. (iGROW Laser)

- Revian Inc.

Recent Developments

- In November 2023: Johnson & Johnson MedTech acquired Laminar, Inc. for $400 million upfront, with additional potential milestone payments. Laminar is noted for its medical devices aimed at cardiovascular treatments, which could indirectly influence research and treatment options in areas like alopecia areata, known to be associated with autoimmune conditions. The acquisition strengthens Johnson & Johnson’s position in high-growth MedTech segments.

- In October 2023: Dr. Reddy’s Laboratories announced strong financial results for the second quarter of fiscal year 2024. The company reported a net profit of Rs. 14,800 million, a significant increase attributed to market share gains and momentum in the U.S. generics business. This performance was bolstered by new product launches and robust growth in Europe, demonstrating the company’s focus on expanding its portfolio which may include treatments for conditions like alopecia.

- In January 2023: Sun Pharmaceuticals acquired Concert Pharmaceuticals for approximately $576 million. This strategic acquisition brought Sun Pharma the rights to a promising new drug, deuruxolitinib, developed by Concert for the treatment of severe alopecia areata. The deal also includes additional financial incentives based on future sales milestones related to deuruxolitinib, which could potentially add up to an extra $3.50 per share for Concert shareholders if certain sales figures are met by specific dates.

Report Scope

Report Features Description Market Value (2023) US$ 9.1 Billion Forecast Revenue (2033) US$ 24.7 Billion CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Disease Type (Alopecia Areata, Cicatricial Alopecia, Traction Alopecia, Alopecia Totalis, Alopecia Universalis, Androgenetic Alopecia, Other Disease Types); Treatment [Pharmaceuticals (Topical (OTC (Minoxidil, Others), Prescription (Betamethasone Dipropionate, Fluocinolone Acetonide, Finasteride, Minoxidil)), Oral (OTC, Prescription (Minoxidil, Finasteride, Corticosteroids, Others)), PRP), Devices (Laser Cap, Laser Comb, Laser Helmet)]; Gender (Male, Female); Sales Channel (Prescriptions, OTC); End-use (Homecare Settings, Dermatology Clinics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Johnson & Johnson Services Inc, Merck & Co. Inc., Cipla Limited, Sun Pharmaceuticals Industries Ltd, Dr. Reddy’s Laboratories Ltd, GlaxoSmithKline plc., Aurobindo Pharma, Viatris Inc., Pfizer Inc., Lilly Lexngton Intl. LLC (Devices), Freedom Laser Therapy (iRestore ID-520 helmet), Curallux LLC., Apira Science Inc. (iGROW Laser), Revian Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson & Johnson Services Inc

- Merck & Co. Inc.

- Cipla Limited

- Sun Pharmaceuticals Industries Ltd

- Dr. Reddy's Laboratories Ltd

- GlaxoSmithKline plc.

- Aurobindo Pharma

- Viatris Inc.

- Pfizer Inc.

- Lilly Lexington Intl. LLC (Devices)

- Freedom Laser Therapy (iRestore ID-520 helmet)

- Curallux LLC.

- Apira Science Inc. (iGROW Laser)

- Revian Inc.