Global Almond Butter Market, By Product (Regular and Flavored), By Nature, (Organic and Conventional), By Distribution Channel (B2B and B2C), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 21493

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

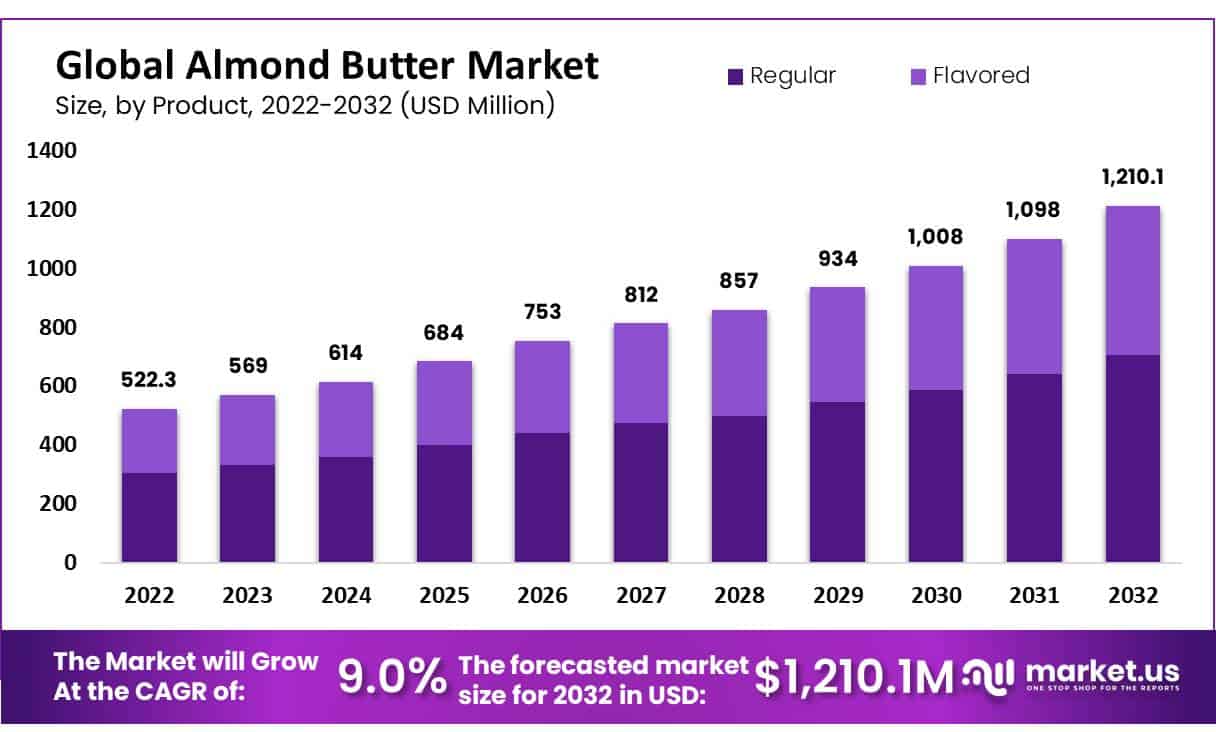

In 2022, the global almond butter market was valued at USD 522.3 million and is expected to grow USD 1210 million in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 9.0%.

Recent years have seen a significant increase in the number of health-conscious customers, particularly in developed economies. Almond butter is a form of plant-based spread made from roasted or raw almonds. It is a rich source of unsaturated fats that are good for the heart. It also contains many proteins, vitamins, and minerals. Almond butter is often used on bread or as a snack sauce.

Almond butter is a vital feature in the creation of skincare products like lotions, body creams, moisturizers, and others in the cosmetics industry. Growing awareness of the advantages of using cosmetic products made from plant-based ingredients is another driver encouraging manufacturers to include plant-based components, like almond butter, in their products.

In turn, this has driven the growth of the almond butter market. However, during the past few years, many nations have identified lifestyle-related disorders like obesity as a major concern, raising consumer awareness of health issues.

Key Takeaways

- Market Growth: In 2022, the almond butter market was valued at USD 522.3 million and is expected to grow to USD 1210 million by 2032, with an estimated Compound Annual Growth Rate (CAGR) of 9.0% between 2023 and 2032.

- Health-Conscious Consumers: Recent years have witnessed a significant increase in the number of health-conscious consumers, especially in developed economies. Almond butter, made from roasted or raw almonds, has gained popularity due to its health benefits. It is rich in unsaturated fats, proteins, vitamins, and minerals, making it a preferred choice for health-conscious individuals.

- Growth Opportunities: The market for almond butter is expected to grow further, driven by increasing consumer preference for healthy and natural food products, a rising demand for plant-based protein sources, and growing awareness of the health benefits of almond butter. The growth of e-commerce platforms has also made it easier for small and medium-sized almond butter producers to reach a wider audience.

- Flavored Almond Butter: Manufacturers are introducing flavored almond butter to cater to evolving consumer tastes. Flavors like cinnamon, vanilla, and chocolate are gaining popularity. E-commerce platforms are making it easier for consumers to purchase almond butter online.

- Product Analysis: Product Segmentation: The almond butter market is categorized into two primary product types: “Regular” and “Flavored.”

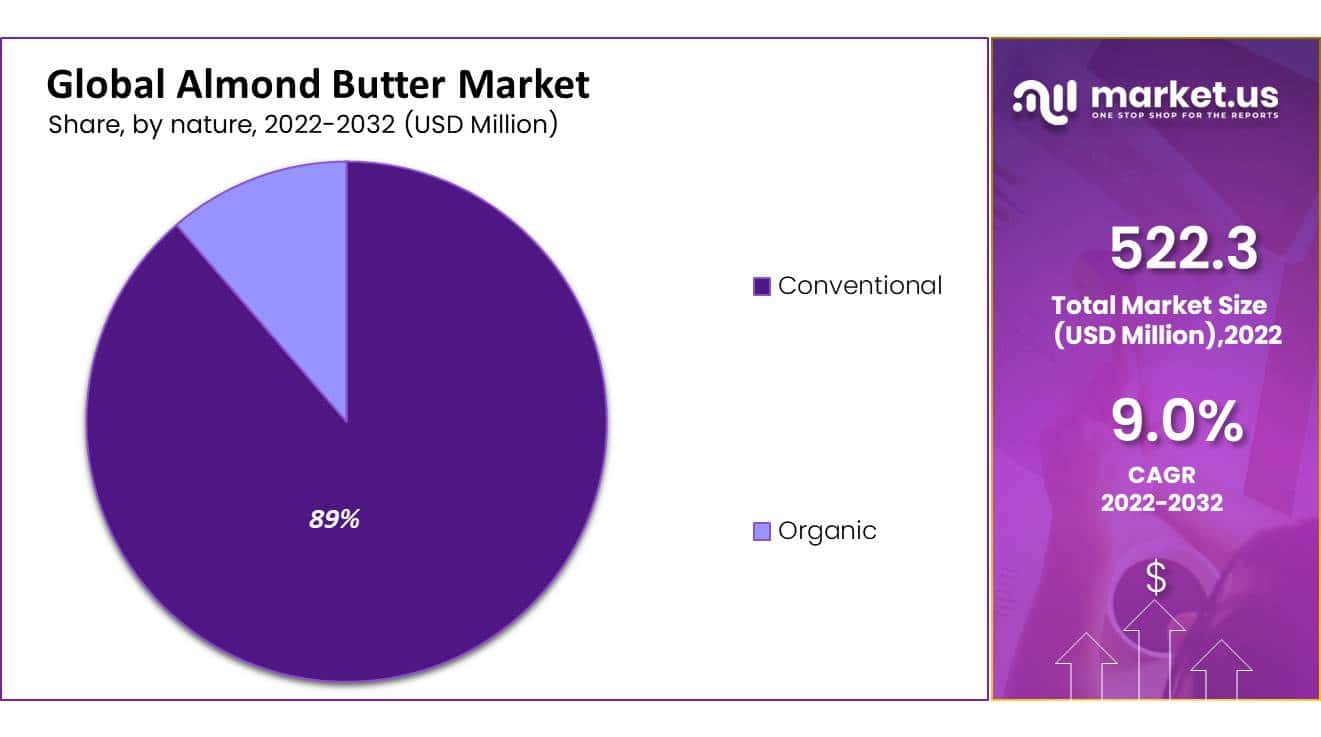

- Nature Analysis: Market Share: In 2022, the “Conventional” segment held the largest market share, accounting for 89% of the market. Organic Growth Over the projected period of 2022-2032, the “Organic” sector is anticipated to experience the fastest Compound Annual Growth Rate (CAGR) of 10.6%.

-

Distribution Channel Analysis: B2C Segment Overview Within the “B2C” segment, the hypermarket and supermarket sub-segment held the largest market share in 2022 and is expected to expand at a Compound Annual Growth Rate (CAGR) of 8.4% from 2022 to 2030.

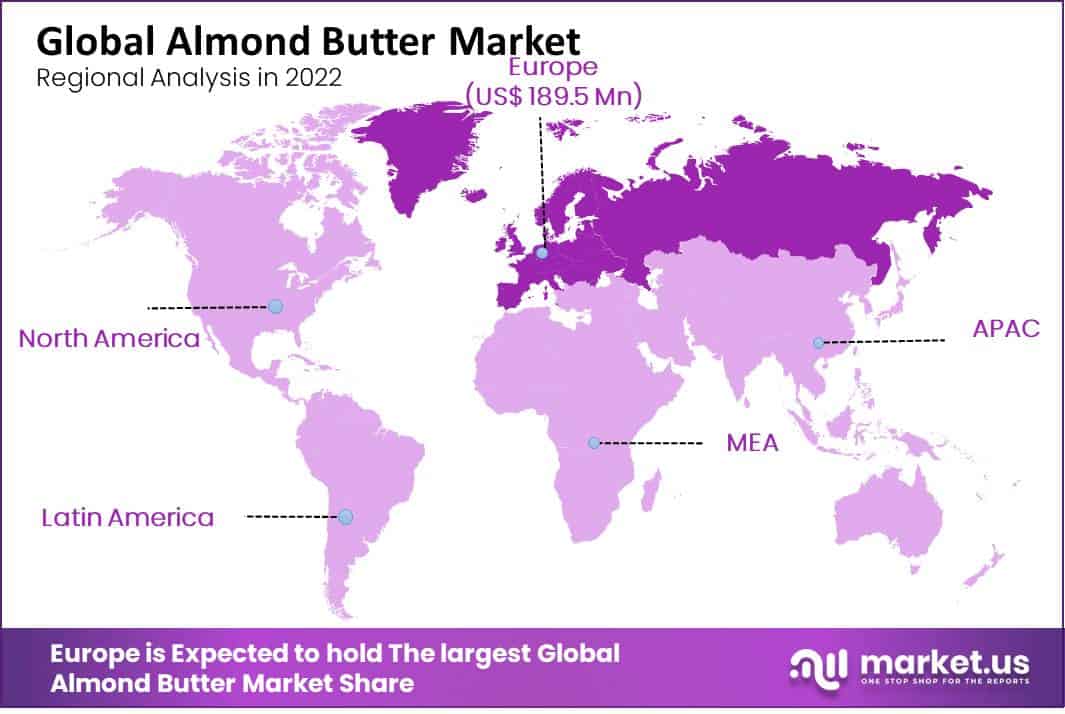

- Regional Analysis: Europe dominated the market with the largest market share of 36.3% due to its use in food and cosmetic products. Asia Pacific is expected to grow at the fastest CAGR of 8.5% due to the region’s growing personal care and cosmetics industry and organic food sector.

- Key Players: The almond butter market is competitive, with global, regional, and local companies. Top businesses use alliances, agreements, partnerships, mergers, and acquisitions to expand their market share. For instance, Justin’s introduced a new variety of honey almond butter, and Conscious Alliance collaborated with brands to provide sustainable food to those in need.

Driving Factors

Almond butter is becoming more widely used as a healthy alternative:

An increase in customer desire for healthy food options and shifting food consumption habits are the main factors influencing the demand for almond butter globally. The need for a healthy breakfast that includes ready-to-eat foods is also anticipated to drive the market for almond butter during the projected period.

Moreover, the worldwide almond butter market benefits from a shift towards healthy diets to avoid cardiovascular disease and manage blood sugar levels.

The innovation of using almond butter in cosmetic products and the increase in almond butter production:

Almond butter is moisturizing, nourishing, and a natural emollient, therefore being an important component to use in massages. It also mixes well with essential oils. Also, the global almond butter market is anticipated to grow due to the growing demand for natural cosmetics and skin care products.

The presence of vitamins in almond butter, including vitamins A, B, and E, which are necessary for the production of lotions and creams to increase their emollience and make them extra rich, is expected to accelerate target market expansion.

Restraining Factors

High Production Costs:

Due to the high cost of raw materials and processing facilities, almond butter production can be expensive. As a result, the production of almond butter may become less profitable, and fewer businesses may be able to enter the market.

Limited Supply of Raw Materials:

The manufacturing of almond butter is highly dependent on the supply of raw materials, and changes in almond crop yields can affect the cost and supply of almonds. Almond butter shortages caused by scarcity of raw materials have the potential to drive up prices and stifle market growth.

Growth Opportunities

The growth of the market depends on increasing consumer preference for healthy and natural food products, increasing demand for plant-based protein sources, and increasing awareness about the health benefits of almond butter.

Also, the growth of e-commerce platforms has made it simpler for small and medium-sized almond butter producers to connect with a larger audience, helping in the market’s expansion worldwide. In general, the market for almond butter offers a potential prospect for business people and investors wishing to break into the food industry, particularly those interested in the health and wellness sector.

Trending Factors

Manufacturers are introducing flavored almond butter to the evolving taste preferences of consumers. More people are getting interested in flavors like cinnamon, vanilla, and chocolate. Almond butter may now be purchased online more easily for consumers due to e-commerce platforms, and many producers are taking advantage of this. There is a growing demand for organic and non-GMO almond butter as a result of consumers’ growing interest in natural and organic food products.

Product Analysis

By product type, the almond butter market is further divided into regular, and flavored, in which the regular segment accounted for the largest market share.

This is mostly due to its simplicity of use and easy accessibility in the market to various distribution channels, including supermarkets, hypermarkets, specialty shops, and others. In terms of value sales, the flavored segment is anticipated to increase at a faster rate over the projection period.

Nature Analysis

The market has been divided into organic and conventional products based on nature. In 2022, the conventional segment had the largest market share at 89%. Over the projected period of 2022-2032, the organic sector is anticipated to develop at the fastest CAGR of 10.6%.

This can be attributed to consumers switching from meat- and dairy-based products to organic products that are free of harmful chemicals, and are cruelty-free. Acceptance of vegan and gluten-free products, as well as the vegan moment are also the reasons.

Distribution Channel Analysis

By distribution channel, the market is further divided into B2B and B2C. The B2B segment growth is being driven by the increasing use of almond butter, frequently used in the food and beverage processing sector, particularly in dips, sauces, soups, and other applications.

In the B2C segment, the hypermarket and supermarket segment held the largest market share in 2022 and is anticipated to expand at a CAGR of 8.4% from 2022 to 2030. A strong and well-coordinated data analytics management strategy is being implemented by supermarkets and hypermarkets.

Using this technology will increase consumer interaction, grow process speed, and expand supply chain loyalty. Since supermarkets and hypermarkets find it easier to understand the needs and expectations of their customer, this segment is projected to be influenced by the retail chain’s rising sales in the future year.

For instance, Planet Organic Limited unveiled a brand-new organic supermarket in December 2022 that offers tens of thousands of products, including almond butter.

Key Market Segments

Based on Product

- Regular

- Flavored

Based on Nature

- Organic

- Conventional

Based on Distribution Channel

- B2B

- HoReCa

- Food & Beverage Processing Industry

- Personal Care & Cosmetic Industry

- B2C

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Regional Analysis

Europe was dominating with the largest market share 36.3% of total revenue. As almond butter is widely used as an ingredient in several food and cosmetic products, this is related to the rising demand for organic products and the expansion of end-use sectors, such as food & beverage processing and personal care & cosmetics.

Over the projection period, Asia Pacific is anticipated to develop at the quickest CAGR of 8.5%. This is a result of the region’s growing personal care and cosmetics business as well as its organic food sector.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The almond butter market is competitive due to the broad range of global, regional, and local companies. The top businesses in the world use alliances, agreements, partnerships, mergers, and acquisitions as a means of surviving fierce competition and expanding their market share.

Manufacturers of almond butter products invest a lot of money in product improvement and new product development, such as adding new flavors. For instance, Justin’s unveiled a brand-new variety of honey almond butter in August 2022, that uses real honey and toasted almonds.

In November 2022, Conscious Alliance, a non-profit organization that aims to eliminate hunger in communities all around the United States, announced cooperation with Justin’s, LLC and Applegate Farms, LLC. The collaboration centered on using Conscious Alliance’s food distribution and rescue programmes to provide wholesome, sustainable food to those in need.

Market Key Players

- Unilever

- Procter & Gamble

- The J.M. Smucker

- Hormel Foods Corporation

- Boulder Brands

- The Kraft Heinz

- Algood Food Co.

- Conagra Brands, Inc

- Britannia Dairy Private Limited

- Hormel Foods Corporation

- Justin’s, LLC

- The Leavitt Corporation

- DiSano

- Alpino

- Pintola

- Other Key Players

Recent Developments

- In January 2022, Justins, a leading brand in almond butter, launched a new flavor called Maple Cashew Butter.

- In December 2021, Barney Butter, another leading brand in almond butter, launched a new line of flavored almond butter, including Chocolate, Vanilla Bean Espresso, and Gingerbread.

- In November 2021, Artisana Organics, a producer of organic nut butters, launched a new line of almond butter with superfood ingredients like maca, turmeric, and spirulina.

- In October 2021, RXBAR, a popular brand of protein bars, launched a new line of almond butter squeeze packs in three flavors.

Report Scope

Report Features Description Market Value (2022) USD 522.3 Mn Forecast Revenue (2032) USD 1,210.1 Mn CAGR (2023-2032) 9.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product (Regular and Flavoured) Nature (Organic and Conventional) Distribution Channel (B2B and B2C) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Unilever, Procter & Gamble, The J.M. Smucker, Hormel Foods Corporation, Boulder Brands, The Kraft Heinz, Algood Food Co., Conagra Brands, Inc, Britannia Dairy Private Limited, Hormel Foods Corporation, Justin’s, LLC, The Leavitt Corporation, DiSano, Alpino, Pintola, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the almond butter market?Some of the key players operating in the almond butter market include Hormel Foods Corporation, BARNEY BUTTER, Nutty Novelties, 8th Avenue Food & Provisions, Hallstar, The Hain Celestial Group, Inc., Cache Creek Foods, Nuts 'N More, Once Again, SOPHIM IBERIA S.L. among others.

What is the almond butter market growth?The global almond butter market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 1,284.1 million by 2030.

What is the North America Almond Butter Market Outlook?North America almond butter market is expected to register 6.2% CAGR between 2022 and 2032.

-

-

- Unilever

- Procter & Gamble

- The J.M. Smucker

- Hormel Foods Corporation

- Boulder Brands

- The Kraft Heinz

- Algood Food Co.

- Conagra Brands, Inc

- Britannia Dairy Private Limited

- Hormel Foods Corporation

- Justin's, LLC

- The Leavitt Corporation

- DiSano

- Alpino

- Pintola

- Other Key Players