Global Allergy Diagnostics Market By Product Type (Fungal Allergy Diagnostic and Neutral Lactase Enzymes), By Allergen Type (Inhaled Allergens, Drug Allergens, Food Allergens and Others), By Test Type (In-Vitro Allergy Tests and In-Vivo Allergy Tests), By End-user (Diagnostic Laboratories, Academic Research Institutes, Hospitals and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 23441

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

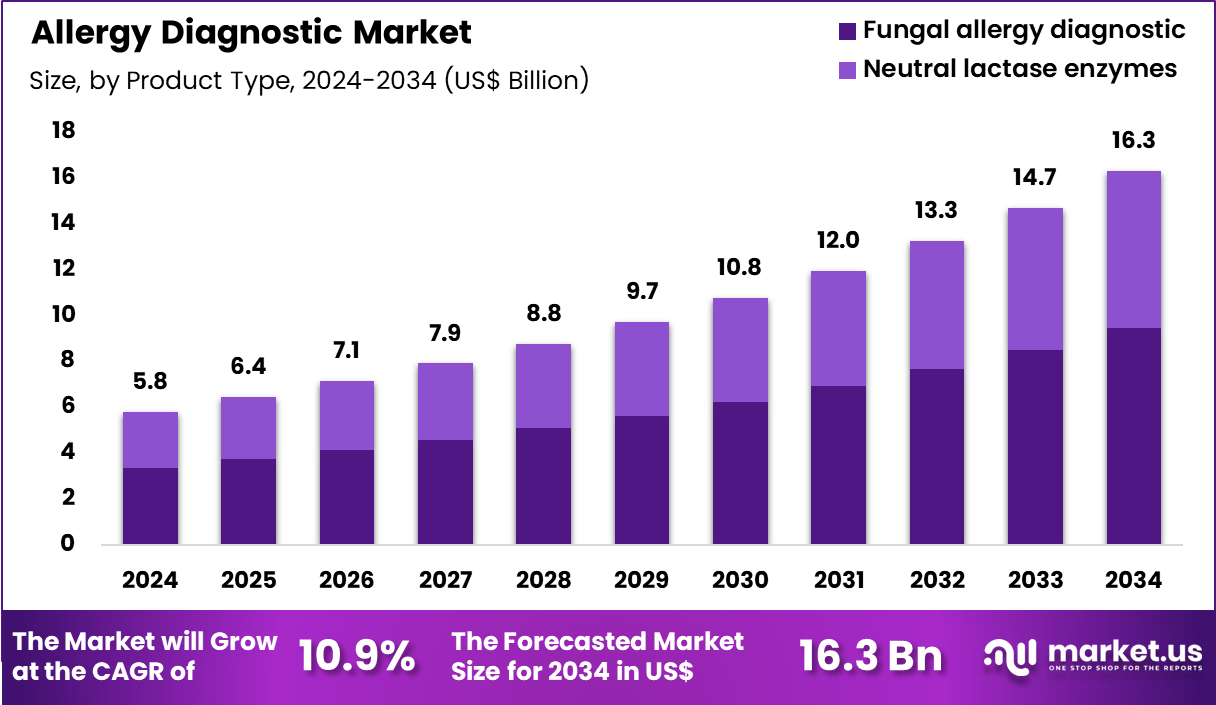

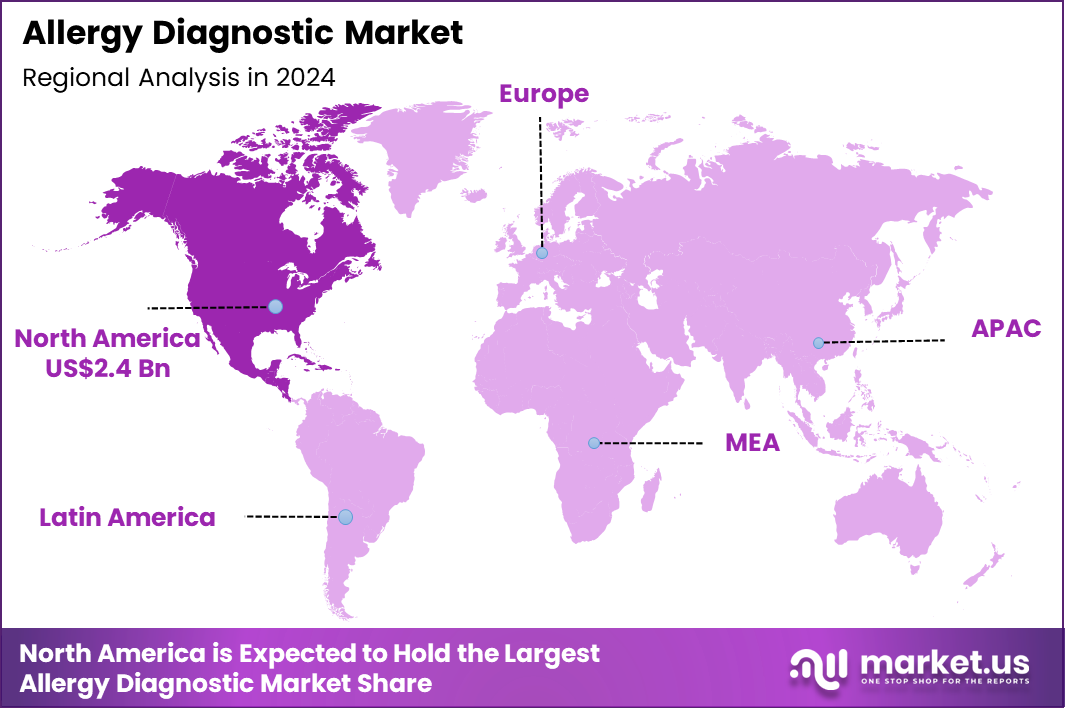

The Global Allergy Diagnostics Market size is expected to be worth around US$ 16.3 Billion by 2034 from US$ 5.8 Billion in 2024, growing at a CAGR of 10.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.8% share with a revenue of US$ 2.4 Billion.

Increasing prevalence of allergic disorders propels the Allergy Diagnostics market, as clinicians seek precise tools to identify sensitization patterns and guide immunotherapy or avoidance strategies effectively. Diagnostics manufacturers develop component-resolved Diagnosticss that distinguish cross-reactive from primary allergens using recombinant proteins.

These tests enable food allergy risk stratification through Ara h 2 quantification in peanut challenges, respiratory allergy profiling via Phl p 1 and Phl p 5 for grass pollen immunotherapy selection, venom allergy confirmation with Api m 1 for bee sting reactions, and drug hypersensitivity evaluation through beta-lactam-specific IgE measurement.

Regulatory milestones create opportunities for expanded clinical adoption of advanced immunoassays. In July 2024, AliveDx secured IVDR CE marking for its microarray-based immunoassay detecting specific IgE to protein allergens in serum, establishing a robust pathway for European clinical integration and enriching the toolkit for comprehensive patient evaluation. This approval directly elevates Diagnostics precision and accelerates market penetration in regulated environments.

Growing demand for molecular allergy Diagnosticss accelerates the Allergy Diagnostics market, as allergists incorporate microarray platforms that simultaneously analyze hundreds of allergens from microliter serum volumes. Biotechnology firms refine multiplex chip technologies that quantify IgE binding to individual epitopes for nuanced reactivity profiles.

Applications encompass pediatric eczema management through early introduction guidance based on egg and milk component testing, occupational allergy screening via latex and flour allergen arrays in bakers, chronic urticaria investigations for auto-allergy markers, and anaphylaxis risk assessment in mast cell disorder cohorts.

High-density arrays open avenues for personalized allergen immunotherapy formulations derived from exact sensitization maps. Pharmaceutical developers increasingly utilize these Diagnosticss in sublingual tablet trials to select responsive patient subsets. This molecular shift drives evidence-based desensitization and enhances therapeutic outcomes.

Rising integration of digital health solutions invigorates the Allergy Diagnostics market, as providers connect test results with mobile apps for real-time symptom correlation and environmental trigger alerts. Technology companies embed AI algorithms that interpret IgE profiles alongside patient diaries for predictive flare modeling.

These connected systems support pollen forecast-linked testing for seasonal rhinitis management, food diary synchronization with oral challenge planning, medication adherence tracking in asthma-allergy overlap syndromes, and telemedicine consultations for remote result review in rural practices. Digital ecosystems create opportunities for longitudinal data aggregation that refines Diagnostics algorithms over time.

Collaborative platforms actively standardize reporting formats to facilitate multi-center research on climate change impacts on allergen sensitization. This connectivity trend positions allergy Diagnosticss as dynamic components of modern, patient-centered care pathways.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.8 billion, with a CAGR of 10.9%, and is expected to reach US$ 16.3 billion by the year 2034.

- The product type segment is divided into fungal allergy Diagnostics and neutral lactase enzymes, with fungal allergy Diagnostics taking the lead in 2023 with a market share of 57.9%.

- Considering allergen type, the market is divided into inhaled allergens, drug allergens, food allergens and others. Among these, inhaled allergens held a significant share of 48.6%.

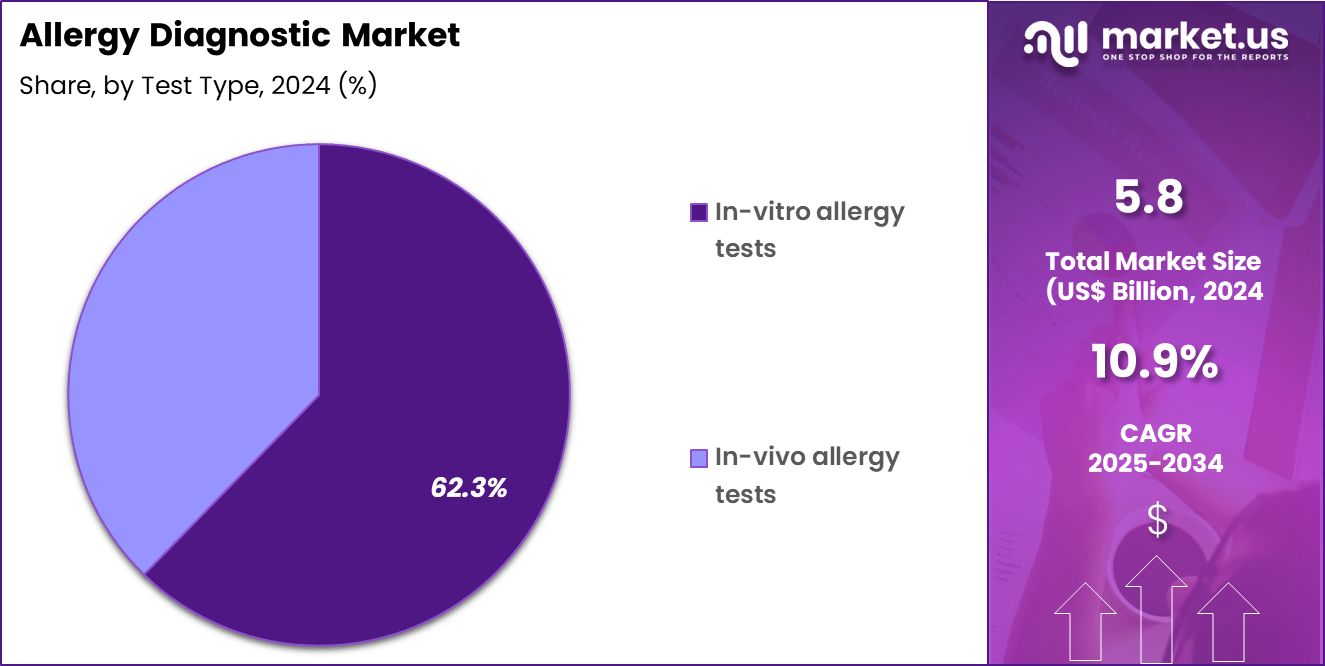

- Furthermore, concerning the test type segment, the market is segregated into in-vitro allergy tests and in-vivo allergy tests. The in-vitro allergy tests sector stands out as the dominant player, holding the largest revenue share of 62.3% in the market.

- The end-user segment is segregated into Diagnostics laboratories, academic research institutes, hospitals and others, with the Diagnostics laboratories segment leading the market, holding a revenue share of 46.8%.

- North America led the market by securing a market share of 41.8% in 2024.

Product Type Analysis

Fungal allergy Diagnostics, holding 57.9%, is expected to dominate because increasing exposure to mold spores in indoor environments drives higher testing volumes. Climate change and urban pollution raise respiratory sensitivity among children and adults, strengthening Diagnostics demand. Physicians increasingly evaluate fungal allergen responses in asthma and chronic sinusitis management.

Advancements in fungal allergen panels improve accuracy, encouraging wider clinical use. Growing awareness about workplace-related mold allergies increases screening in occupational health programs. Rising adoption of laboratory-based fungal IgE assays supports this segment’s growth trajectory. These factors keep fungal allergy Diagnostics anticipated to remain the leading product type in this market.

Allergen Type Analysis

Inhaled allergens, holding 48.6%, are projected to dominate due to the high prevalence of allergic rhinitis and asthma linked to dust mites, pollen, pet dander, and mold. Urban air pollution and seasonal environmental changes intensify respiratory allergies globally. Healthcare providers prioritize inhaled allergen testing for faster diagnosis and targeted immunotherapy recommendations.

Increasing pediatric allergy cases further support routine sensitization screening. Expanding personalized and preventive care programs encourages frequent respiratory allergy assessments. These factors keep inhaled allergens expected to remain the dominant allergen category in Diagnosticss.

Test Type Analysis

In-vitro allergy tests, holding 62.3%, are expected to dominate because they offer safer testing conditions for patients at risk of severe reactions and provide quantitative results supporting long-term disease monitoring. Technological improvements, including automated immunoassay analyzers, enhance sensitivity and reduce turnaround time.

Growing preference for blood-based IgE testing increases adoption in both hospitals and laboratories. Remote care models boost demand for samples that do not require direct allergen exposure. Expansion of multiplex testing panels allows simultaneous detection of multiple allergens, improving Diagnostics efficiency. These advantages keep in-vitro allergy tests anticipated to lead the testing segment.

End-User Analysis

Diagnostics laboratories, holding 46.8%, are anticipated to dominate as they manage high-volume sample processing with advanced allergen testing platforms. Clinicians rely on laboratories to confirm clinical suspicion and guide treatment strategies for complex allergy cases. Integration of automated systems increases lab throughput and supports widespread screening initiatives.

Insurance coverage and reimbursement structures favor laboratory-validated tests for clinical decision-making. The rise in allergy prevalence boosts referrals to specialized testing labs for accurate result interpretation. These factors keep Diagnostics laboratories projected to remain the dominant end-user segment in the allergy Diagnostics market.

Key Market Segments

By Product Type

- Fungal Allergy Diagnostics

- Neutral Lactase Enzymes

By Allergen Type

- Inhaled Allergens

- Drug Allergens

- Food Allergens

- Others

By Test Type

- In-Vitro Allergy Tests

- In-Vivo Allergy Tests

By End-user

- Diagnostics Laboratories

- Academic Research Institutes

- Hospitals

- Others

Drivers

Increasing prevalence of allergic respiratory conditions is driving the market

The global rise in allergic respiratory diseases has amplified the necessity for advanced Diagnostics tools to identify and manage conditions like asthma and allergic rhinitis effectively. This surge prompts healthcare providers to integrate comprehensive testing protocols into routine clinical practice for early detection and intervention. Diagnostics innovations, such as specific IgE assays and component-resolved Diagnosticss, are essential for pinpointing triggers in affected individuals. Public health surveillance data reveal a persistent upward trend, underscoring the market’s expansion through heightened testing demands in primary care settings.

The economic implications of untreated allergies, including productivity losses, further incentivize investment in scalable Diagnostics solutions. Educational initiatives by governmental bodies enhance clinician proficiency in utilizing these tools, fostering broader adoption. Environmental factors, including urbanization and climate shifts, exacerbate allergen exposure, necessitating vigilant monitoring via Diagnosticss.

Collaborative research efforts refine test sensitivities, ensuring reliability across diverse populations. As prevalence escalates, regulatory frameworks prioritize accessible Diagnosticss to alleviate healthcare burdens. In conclusion, this driver propels sustained innovation and market growth in allergy Diagnosticss.

Restraints

Underutilization of confirmatory testing is restraining the market

The discrepancy between perceived and confirmed allergic conditions limits the full deployment of Diagnostics resources, as many cases remain unverified through gold-standard methods. Self-reported symptoms often outpace objective assessments, leading to over-reliance on preliminary screenings without follow-up. This gap arises from patient hesitancy toward invasive procedures like oral food challenges, delaying accurate profiling. Resource allocation in healthcare systems favors acute care over elective allergy evaluations, constraining test availability.

Variability in test interpretation among practitioners contributes to inconsistent outcomes, eroding confidence in Diagnostics pathways. Inadequate integration of molecular Diagnosticss into standard workflows perpetuates Diagnostics delays, particularly in non-specialized facilities. Reimbursement challenges for advanced assays deter widespread implementation, exacerbating inequities in access.

Awareness deficits among at-risk groups hinder proactive screening, sustaining undiagnosed burdens. These factors collectively impede market maturation by reducing utilization rates and innovation incentives. Addressing this restraint demands streamlined protocols to bridge perception and confirmation effectively.

Opportunities

Development of AI-enhanced skin prick test interpretation is creating growth opportunities

Artificial intelligence applications in allergy Diagnosticss streamline the analysis of skin prick test results, offering precise wheal measurements to minimize subjective errors. This technology enables automated quantification of reactions, supporting remote consultations and telehealth integrations. Validation studies demonstrate substantial reductions in readout times, enhancing clinic efficiency for high-volume screening.

Compatibility with existing devices positions AI tools for seamless adoption in diverse clinical environments. By improving reproducibility, these advancements facilitate personalized allergen profiling, optimizing immunotherapy selections. Global collaborations accelerate regulatory validations, paving the way for standardized AI protocols.

Cost savings from reduced manual labor unlock scalability in community health programs. Integration with digital health records enables longitudinal tracking of sensitization patterns. As AI refines predictive models for cross-reactivity, it broadens applicability to complex cases. Overall, this opportunity catalyzes a shift toward intelligent, equitable Diagnostics ecosystems.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces energize the allergy Diagnostics market as growing healthcare spending and rising allergy prevalence push clinics and hospitals to adopt advanced skin-prick, blood-based, and molecular tests for faster, more accurate patient management. Manufacturers rapidly introduce multiplex panels and component-resolved Diagnosticss, capturing strong demand from immunology specialists eager to deliver personalized treatment plans.

Stubborn inflation and softer economic growth, however, squeeze lab budgets and elevate reagent prices, forcing many facilities to delay instrument upgrades and limit testing volumes in cost-sensitive regions. Geopolitical tensions, particularly U.S.-China trade friction and global supply disruptions, repeatedly interrupt shipments of critical allergens, antibodies, and plastic consumables, creating shortages and price instability across the supply chain.

Current U.S. tariffs significantly raise landed costs on imported Diagnostics kits and raw materials, compressing margins for distributors and making premium allergy testing less affordable for American providers. These duties also spark retaliatory barriers abroad that slow U.S. exports of innovative panels and hinder joint research partnerships.

Yet the mounting pressure accelerates domestic production expansions, regional sourcing strategies, and home-grown technology breakthroughs, forging a more secure and responsive industry that will deliver sustained growth and improved patient access for years ahead.

Latest Trends

FDA public workshop on new patch tests for contact dermatitis is a recent trend

In October 2025, the U.S. Food and Drug Administration convened a public workshop to discuss regulatory pathways for approving novel patch tests used in diagnosing allergic contact dermatitis. This event gathered insights from healthcare professionals, researchers, and industry stakeholders on evaluation criteria for new allergens. The focus emphasized standardized potency assessments and safety profiles to ensure Diagnostics reliability.

Discussions highlighted the need for updated special controls under Class II device classifications. This initiative reflects evolving oversight to accommodate innovative allergen panels without compromising efficacy. Participants explored bridging studies to validate test performance across populations. The workshop outcomes are poised to expedite submissions for expanded allergen kits.

It aligns with broader efforts to address rising contact allergy incidences through enhanced Diagnosticss. Regulatory feedback mechanisms introduced during the session promote iterative improvements. This 2025 development signifies a proactive stance in fostering accessible, precise tools for dermatologic allergy management.

Regional Analysis

North America is leading the Allergy Diagnostics Market

North America accounted for 41.8% of the overall market in 2024, and the region saw robust growth in the Allergy Diagnostics market as clinicians and public-health programs responded to a rising burden of allergic conditions across all age groups. Healthcare providers increased use of IgE panel testing, skin-prick tests, and component-resolved Diagnosticss to detect sensitivities to pollens, food, dust mites, and environmental allergens more accurately.

Growing prevalence of allergic rhinitis, eczema, and food allergies pushed demand for Diagnosticss: the Centers for Disease Control and Prevention (CDC) reports that about 25.7% of U.S. adults had a diagnosed seasonal allergy in 2021, and roughly 18.9% of children had one in the same period. Allergy clinics expanded capacity, and Diagnostics laboratories invested in high-throughput platforms to meet testing needs.

Rising environmental pollution and climate-driven extensions of pollen seasons led more patients to seek Diagnostics confirmation. Additionally, increased public awareness of allergy management and advances in multiplex assays contributed to the market’s strong performance in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to see substantial growth during the forecast period as rising urbanization and changing lifestyles contribute to increasing allergy prevalence across the region. Hospitals and Diagnostics labs expand allergy-testing services in response to growing respiratory and skin-allergy cases. Public-health initiatives promote early detection of allergies, particularly in children and young adults prone to atopic conditions.

Expanding middle-class populations with greater healthcare access boost demand for comprehensive IgE and skin-test Diagnostics panels. Diagnostics manufacturers strengthen distribution networks across India, China, Southeast Asia, and Japan to ensure availability of reagents and test kits. Environmental change and increased pollution amplify allergen exposure, driving more people to seek formal allergy diagnosis. These factors collectively position Asia Pacific for consistent expansion in the allergy-Diagnostics market over the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in allergy Diagnosticss expand growth by advancing multiplex immunoassays that identify dozens of aeroallergens and food triggers in a single test, helping clinicians streamline evaluation in high-volume practices. They strengthen their market reach by partnering with pediatric and respiratory-care networks, where early detection and long-term patient monitoring drive recurring demand. Automation upgrades improve throughput and result consistency, enabling large laboratories to manage seasonal surges in testing.

Companies differentiate through digital reporting tools that translate sensitization results into clear clinical guidance, enhancing physician confidence and patient engagement. They also invest in education initiatives and collaborations with healthcare systems to broaden screening adoption in underserved regions. Thermo Fisher Scientific illustrates this strategy through its extensive allergen-specific IgE testing portfolio, robust global laboratory presence, and integrated clinical-support services that reinforce its position as a trusted partner in allergy Diagnosticss across both primary and specialty care settings.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers AG

- bioMérieux SA

- Danaher Corporation

- Omega Diagnosticss Group PLC

- HYCOR Biomedical

- EUROIMMUN / PerkinElmer

- Minaris Medical America, Inc.

Recent Developments

- In October 2024, ALK introduced a refreshed portfolio of allergy skin testing tools, including AllerTest-1, AllerTest-8, and AllerTest-10. These devices are designed to make the Diagnostics process more efficient and easier to administer, supporting healthcare providers who require dependable and streamlined allergy-testing methods. The broader product offering is expected to increase access to allergy Diagnosticss and reinforce ALK’s competitive position in the market.

- Also in October 2024, scientists from the University of Bern working with Bern University Hospital reported progress on a simplified approach to allergy testing. Their new Diagnostics method, validated in children and teenagers with peanut allergies, has the potential to improve early identification of allergic conditions. This research is expected to accelerate innovation in pediatric allergy Diagnosticss and expand the demand for next-generation testing solutions.

Report Scope

Report Features Description Market Value (2024) US$ 5.8 Billion Forecast Revenue (2034) US$ 16.3 Billion CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fungal Allergy Diagnostics and Neutral Lactase Enzymes), By Allergen Type (Inhaled Allergens, Drug Allergens, Food Allergens and Others), By Test Type (In-Vitro Allergy Tests and In-Vivo Allergy Tests), By End-user (Diagnostics Laboratories, Academic Research Institutes, Hospitals and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Siemens Healthineers AG, bioMérieux SA, Danaher Corporation, Omega Diagnosticss Group PLC, HYCOR Biomedical, EUROIMMUN / PerkinElmer, Minaris Medical America, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc.

- Siemens Healthineers AG

- bioMérieux SA

- Danaher Corporation

- Omega Diagnostics Group PLC

- HYCOR Biomedical

- EUROIMMUN / PerkinElmer

- Minaris Medical America, Inc.