Global Airline Industry Market By Type of Transport (Domestic, International), By Application (Passenger, Freight/Cargo), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 119167

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

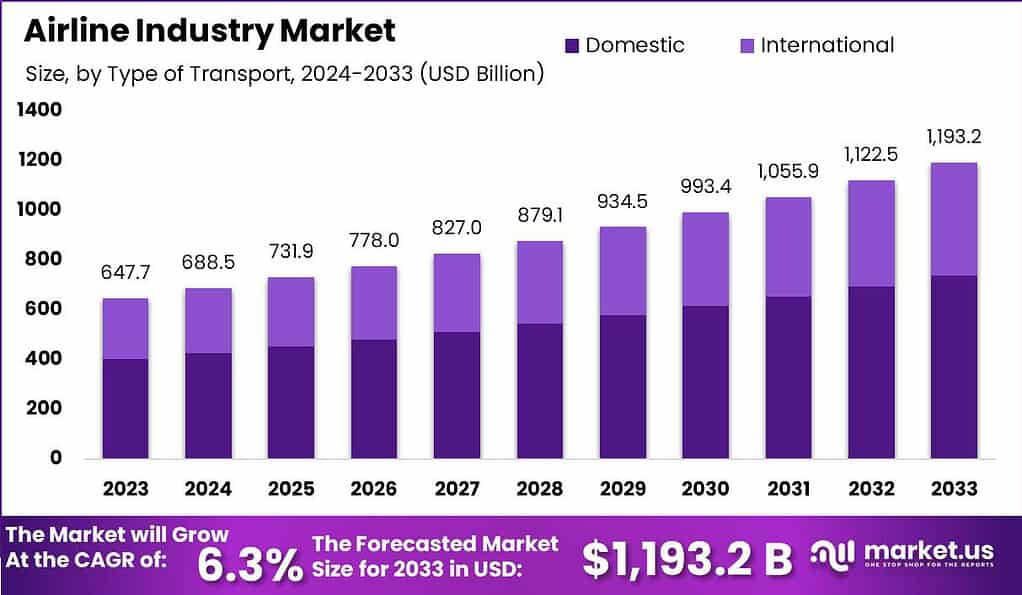

The Global Airline Industry Market size is expected to be worth around USD 1,193.2 Billion by 2033, from USD 647.7 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

The airline industry refers to the sector that encompasses all activities related to air transportation, including the operation of airlines, airports, and associated services. It plays a significant role in global transportation, connecting people and goods across the world.

The airline industry market refers to the competitive marketplace where airlines operate and compete for passengers and cargo. It involves various factors such as ticket pricing, route networks, customer service, and market demand. The market is influenced by factors like economic conditions, fuel prices, government regulations, and technological advancements.

The airline industry market is highly competitive, with numerous airlines vying for market share. Airlines strive to attract passengers by offering competitive fares, convenient schedules, comfortable cabins, and exceptional customer service. They also focus on expanding their route networks to serve more destinations and cater to the diverse travel needs of customers.

The airline industry market is influenced by various external factors. Economic conditions, such as GDP growth, inflation rates, and exchange rates, can impact passenger demand and airline profitability. Fuel prices play a significant role in determining operating costs and ticket prices. Government regulations and policies, including air traffic control, safety regulations, and market liberalization, also shape the competitive landscape of the industry.

In 2022, the U.S. airline industry demonstrated a robust recovery, witnessing a significant increase in passenger numbers. A total of ~747 million passengers were reported, marking a substantial rise of 141.4 million, or 125.9%, compared to 2021. This resurgence in travel demand contributed to U.S. airlines generating approximately ~$206.3 billion in revenue through the first three quarters of the year.

Despite these positive trends, the industry faced several challenges. Seat capacity operated at 94%, while cargo traffic reached 90%. Revenue passenger kilometers (RPKs), a measure of airline traffic, remained at 75%, indicating a slower recovery in actual flight demand relative to capacity. Additionally, fuel costs escalated to around 30% of total revenue, significantly impacting profitability.

The COVID-19 pandemic had a devastating effect on the industry, erasing 81% of all-time profits. In response, airlines received substantial government support, totaling $243 billion globally, which helped stabilize many operators. Post-pandemic, the number of global airlines increased slightly from 702 to 715.

European airfares also saw significant inflation, with a 28% increase due to the compounded pressures of recovering demand and rising operational costs. The industry’s supply chain was notably affected, with Boeing and Airbus experiencing delivery delays that set back schedules by approximately ten years.

Looking forward, 5 world regions reported losses in 2022, but 3 are projected to become profitable in 2023. Despite the ongoing challenges, the industry remains committed to achieving a net zero carbon footprint by 2050, setting a long-term goal 27 years from now. This commitment underscores the sector’s focus on sustainability alongside its financial recovery and growth strategies.

Key Takeaways

- The airline industry market is estimated to reach at USD 1,193.2 billion in the year 2033 with a CAGR of 6.3% during the forecast period and was valued at USD 647.7 billion in the year 2023.

- By segmenting the market based on the type of transport, the market is segmented into domestic and international segment where domestic segment leads the market with a market share of 62% in the year 2023.

- On categorizing the market based on the application, the passenger segment has the largest market share of 71.6% in the year 2023.

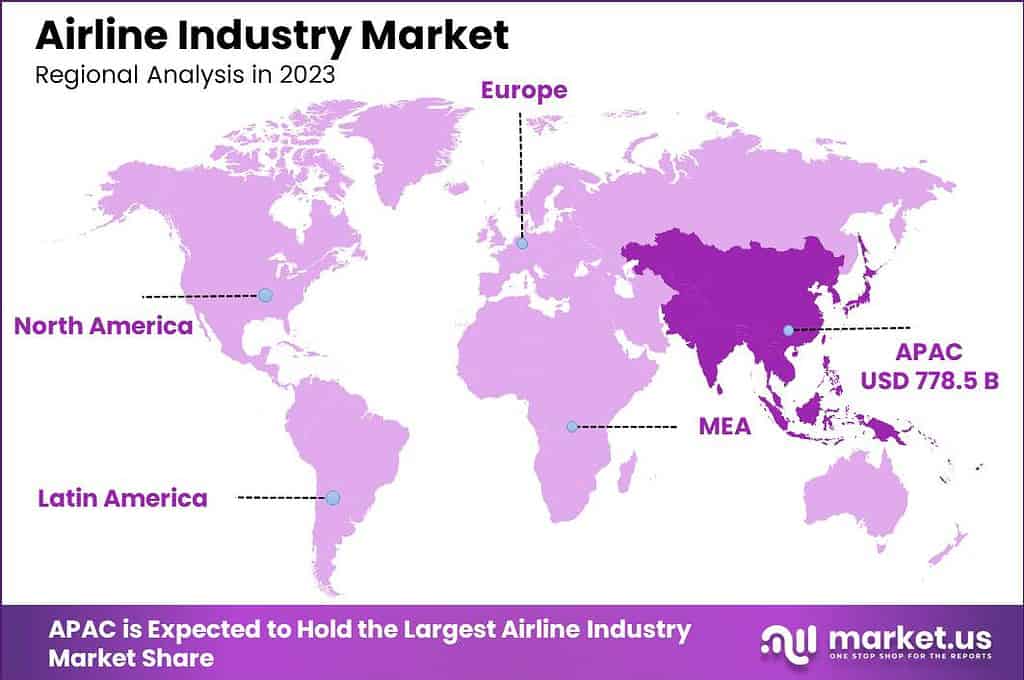

- The Asia Pacific region has the largest market share of 43% in the year 2023 due to the developing economy, infrastructure and government support.

By Type of Transport Analysis

Based on type of transport the market is segmented into domestic and international where the domestic segment has dominated with a market share of 62% in the year 2023. In the airline business, as compared to international travel, domestic travel is typically more common and accessible to a larger population. Numerous people travel within their own nation for a range of purposes, including events, business travel, holidays, and visits with relatives. The market for domestic flights is robust due to the consistent demand.

The domestic segment is leading the market due to the convenience and frequency of the flights. As compared to international flights, domestic flights which are of shorter distances may result in cheaper ticket rates, quicker journey times, and less stress. Government initiatives and infrastructure upgrades that support domestic travel, such as airport networks, favourable legislation, and subsidies, can also help domestic carriers.

By Application Analysis

The airline industry market is segmented into passenger and Freight/Cargo segments based on application where the passenger segment has the largest market share of 71.6% in the year 2023. Large commercial airlines that depend on fuel for continuous operations are included in the passenger segment, which makes it significant in the airline business. Furthermore, there has been a rise in passenger traffic in the Airline Industry, which has raised demand for commercial aircraft.

Furthermore, by using creative low-cost business models, regional airlines have completely transformed the Airline industry. The increasing income of consumers in the market is anticipated to fuel demand for airlines. Furthermore, as air travel expands in several important nations, there will likely be a greater demand for commercial aircraft.

In addition, new aircraft must be introduced to satisfy the yearly rise in air traffic and the rising demand for air travel. To guarantee scheduled aircraft deliveries, the aircraft, and its suppliers are rearranging their manufacturing sites. As a result, during the forecast period, these factors will propel the expansion of this category and the Airline industry market as a whole.

Key Market Segments

By Type of Transport

- Domestic

- International

By Application

- Passenger

- Freight/Cargo

Drivers

Increasing demand for traveling

Consumer demand for travel and tourism industry has been rising recently. In addition to directly increasing demand for air travel, this also benefits the airline industry by adding to the larger economic ecology. The Airline industry’s sustained expansion and prosperity are largely dependent on the positive interaction between tourism and airlines.

Furthermore, a major factor in the growth of cross-border trade is the effectiveness, speed, and worldwide reach of the airline industry. It supports several industries, eases the flow of goods across international borders, and helps the world economy expand. Expanding fleets, rising fuel-efficient aircraft demand, ongoing technological advancements in airlines like the use of materials light carbon synthesis in aircraft construction, and a modest rise in air travelers all support domestic carriers. Major airlines have started modernizing their current production plant to guarantee planned delivery.

Furthermore, the manufacturing of airplanes is growing rapidly in emerging nations. As a result, these elements will increase the need for commercial airplanes. Furthermore, many nations have pledged to use domestic R&D or technology transfer initiatives to finance the purchase of new aircraft. Subsequently, these elements benefit the market, which in turn boosts the market.

Restraints

Increasing prices of fuels and government regulations

Several limitations impact the operations and competitiveness of the airline Industry. Government and airline regulators apply regulatory obstacles that establish safety standards, operational procedures, and flying patterns. These rules can restrict airlines’ ability to adjust to changing market conditions and frequently result in high compliance costs. Variations in the worldwide fuel market have a substantial effect on operating expenses. Oil prices fluctuate, which can have an impact on airlines’ revenues, particularly during periods of high fuel expenditures.

Additionally, the state of the economy has a significant impact on demand for air travel. Consumer spending tends to decline during economic downturns, which lowers demand for air travel and ticket sales. On the other hand, demand for travel is driven by economic growth, which thus necessitates cautious capacity management to prevent overstretching.

Additionally, airlines are under pressure to stand out from the competition in the market by their route networks, price policies, and quality of service. Particularly in crowded areas, this competition frequently results in low profit margins and price wars. In addition, major investments are needed to be competitive and meet evolving industry requirements due to technical advancements like digitization and innovation in airlines.

Opportunities

Rising disposal income and urbanization in developing countries can be an opportunity for the market

The airline industry, despite of its challenges, brings a lot of opportunities for businesses to grow. There is a noticeable increase in the demand for air travel, particularly in developing regions. Rising disposable incomes, urbanization, and an increase in business travel are the main causes of this increase.

Airlines have the chance to enhance consumer satisfaction, operational effectiveness, and safety due to technological advancements. Innovation can lower costs and streamline operations through the use of biometric boarding procedures and AI-powered predictive maintenance. Airlines have the chance to stand out from the competition and satisfy the increasing demand for eco-friendly travel options by implementing sustainability programs. In order to meet their environmental targets and draw in eco-aware passengers, airlines can make investments in fuel-efficient aircraft, carbon offset schemes, and alternative fuels.

Furthermore, alliances and partnerships help airlines broaden the scope of their networks and provide customers with a flawless travel experience. Enhancing connections and fostering client loyalty can be achieved through strategic partnerships with hotels, airlines, and other transportation companies.

Challenges

Increase in the price of Crude Oil

Crude oil price is one of the factors influencing the Airline Industry, and this determines whether the industry succeeds or fails. A significant risk that airlines faces is the fluctuation of crude oil prices. Moreover, growing crude oil prices raise downstream industry input costs, which raises the price of airline fuel. In addition, the airline industry’s operating costs dropped during the low-crude-oil period.

Reduced airfares and higher airline profitability are the results of low airline fuel prices. Therefore, in order to profit from changes in the price of crude oil, airlines must strike a balance between reduced airline fuel costs and expanded capacity. Consequently, the market is negatively impacted by these variables.

Latest Trends

Increasing adoption of Sustainable approaches in the industry

A number of significant trends are still influencing the aviation sector. As airlines purchase more fuel-efficient planes and investigate alternative fuels to lower emissions, sustainability is becoming highly significant. With the development of mobile apps, chatbots driven by AI, and customized services, digital transformation is completely changing the consumer experience.

The expansion of low-cost airlines is increasing competition and forcing established airlines to modernize and simplify their processes. Demand for distinctive in-flight experiences and destination-focused services has increased as experiential travel has become more popular. In addition, alliances and partnerships are growing; airlines are joining forces to enhance their services and broaden their worldwide reach through strategic alliances. In general, the future of aviation depends on sustainability, innovation, and adaptation.

Regional Analysis

In 2023, APAC held a dominant market position within the airline industry, capturing more than a 43% share of the global market. The demand for airline industry in APAC was valued at USD 778.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

This substantial market share can be attributed to several key factors that distinguish APAC from other regions. Primarily, the growth has been fueled by the increasing economic prosperity in major countries such as China and India, coupled with a growing middle-class population eager to travel both domestically and internationally. Additionally, the expansion of airport infrastructure and the rise of low-cost carriers have made air travel more accessible to a broader segment of the population in this region.

Government initiatives aimed at boosting tourism and improving air connectivity have also played a crucial role. For instance, policies favoring aviation infrastructure development, along with liberalization of air transport in several countries, have facilitated a higher volume of flight operations.

Several important countries in the region, including Japan, Singapore, the Philippines, Malaysia, Indonesia, Sri Lanka, and India, have governments that actively support the region financially and also enforce legislation that encourages the area. For instance, China intends to produce commercial airplanes domestically.

Thus, it is anticipated that domestic development will lead to the development of wide-body and narrow-body commercial aircraft as well as other types, which will exponentially accelerate the regional market’s growth rate. Furthermore, strategic alliances between regional airlines and international carriers have expanded global reach and operational efficiencies, driving further growth. These factors collectively underpin the leadership position of APAC in the global airline market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

There are numerous players present in the market. These players are striving to sustain in the market through new ventures, agreements, collaborations, partnerships and other. These approaches have helped businesses to stay ahead in the competition. Further businesses are also looking for new strategies formulations and innovations that can help the firm in offering new services to the customers.

The airline industry is highly competitive, with several major players vying for market share globally. These key players are often large, well-established airlines with extensive route networks and strong brand recognition. They have a significant market presence and leverage their resources and capabilities to attract passengers and generate revenue.

Some of the leading airlines in terms of market share include well-known names such as Delta Air Lines, American Airlines, United Airlines, and British Airways. These airlines have a substantial customer base, operate numerous flights to domestic and international destinations, and have a strong market position in their respective regions.

Top Key Players in the Market

- Air France KLM

- American Airlines Group

- ANA Holdings

- British Airways

- Delta Air Lines

- Deutsche Lufthansa

- Singapore Airlines

- Hainan Airlines

- Japan Airlines

- LATAM Airlines Group

- United Airlines Holdings, Inc.

- Ryanair DAC

- Other Key Players

Recent Developments

- In April 2024, Indigo’s Parent company, InterGlobe Enterprise signed a joint venture with Archer Aviation of the US to launch Electric Air Taxis in India.

- In November 2023, Air Transat and Porter Airlines collaborated through joint ventures to combine their networks and offer high benefits to their customers.

Report Scope

Report Features Description Market Value (2023) USD 647.7 Bn Forecast Revenue (2033) USD 1,193.2 Bn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Transport (Domestic, International), By Application (Passenger, Freight/Cargo) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Air France KLM, American Airlines Group, ANA Holdings, British Airways, Delta Air Lines, Deutsche Lufthansa, Singapore Airlines, Hainan Airlines, Japan Airlines, LATAM Airlines Group, United Airlines Holdings Inc., Ryanair DAC, Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Airline Industry?The airline industry comprises companies that provide air transport services for passengers and cargo. It includes both commercial airlines, which operate scheduled and charter flights, as well as cargo carriers.

How big is Airline Industry Market?The Global Airline Industry Market size is expected to be worth around USD 1,193.2 Billion by 2033, from USD 647.7 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Who are the main players in the Airline Industry?The airline industry is dominated by a few major players known as legacy carriers, such as Air France KLM, American Airlines Group, ANA Holdings, British Airways, Delta Air Lines, Deutsche Lufthansa, Singapore Airlines, Hainan Airlines, Japan Airlines, LATAM Airlines Group, United Airlines Holdings Inc., Ryanair DAC, Other Key Players,

What factors influence the Airline Industry Market?Factors influencing the airline industry include economic conditions, fuel prices, competition, technological advancements, government regulations, safety and security concerns, environmental regulations, and consumer preferences.

What are some challenges facing the Airline Industry?Challenges facing the airline industry include volatile fuel prices, intense competition, capacity management, labor relations, security threats, environmental concerns (such as carbon emissions), and regulatory changes impacting operations and costs.

What are some emerging trends in the Airline Industry?Emerging trends in the airline industry include the adoption of digital technologies for personalized passenger experiences, the growth of low-cost carriers and ultra-long-haul flights, increased focus on sustainability and eco-friendly practices, the use of data analytics for operational efficiency, and partnerships and alliances between airlines to expand route networks and improve connectivity.

Which region accounted for the highest share in the Airline Industry market?In 2023, APAC held a dominant market position within the airline industry, capturing more than a 43% share of the global market.

-

-

- Air France KLM

- American Airlines Group

- ANA Holdings

- British Airways

- Delta Air Lines

- Deutsche Lufthansa

- Singapore Airlines

- Hainan Airlines

- Japan Airlines

- LATAM Airlines Group

- United Airlines Holdings, Inc.

- Ryanair DAC

- Other Key Players